Professional Documents

Culture Documents

Jadhao MH

Uploaded by

sarojdubey01070 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

jadhao mh

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageJadhao MH

Uploaded by

sarojdubey0107Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

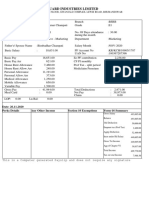

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Name : MOHAN HANJARI JADHAO DESG/ESG : Addl Exe Engineer

Empl ID : 10612 Birth Date :05.04.1966 PG/EG : Grade A Employee

CPF No./UAN: 02036207 / 100229581835 Retire Due :30.04.2024 LAP Avl/Bal: 0 / 249

PAN No. : ABFPJ8733M Due Incr Dt :22.07.2024 SCL Avl/Bal: 0 / 48

Pay Period : 01.03.2024 - 31.03.2024 Basic Rate :122,410.00 HAP Avl/Bal: 0 / 351

Bank Ac No : 30978221844 Emp.Status :Active Comm Avl : 0

Bank Name : STATE BANK OF INDIA Seniority No: 1 ADD EXE ENG-DIP EOL Avl : 0

Pay Scale : MG17 - 81695-3145-97420-3570-175960 Absent(C/P): 0 / 0

PSA/PBC : TPS KORADI

Earnings Deductions Loan Balances

Basic Salary 122,410.00 Ee PF contribution 21,446.00

Dearness Allow 56,309.00 Er Pension contribution 1,250.00

Special Compen Allow 500.00 Prof Tax - split period 200.00

Elec. Charges Allow 600.00 Income Tax 36,940.00

Convey Allow 13 Liter 1,300.00 Staff Welfare Fund 10.00

Fringe Benefit - Field 1,400.00 Mediclaim-Ee Contributio 1,238.00

Tech J A / Book Allow 880.00 Emp Dep Wel T Fund 30.00

Entertainment Allow 670.00 Engineer CCSoc Nagpur 1,050.00

House Rent Allow 11,017.00 Deductions not taken in the month

Ar. Night Shift Allowanc 1,320.00

Emp Wel Fund-Reward 10,000.00

Adjustments 0.00

Total 206,406.00 Total 60,914.00 Take Home Pay 145,492.00

Perks/Exemption Other Income/Deduction Form 16 summary Form 16 summary

Ann Reg Incom 2,253,773.00 Balance 2,282,141.00

Ann Irr Incom 42,260.00 Std Deduction 50,000.00

Prev Yr Incom 13,892.00- Incm under Hd Salary 2,232,141.00

Gross Salary 2,282,141.00 Gross Tot Income 2,232,141.00

Balance 2,282,141.00 Total Income 2,232,141.00

Tax on total Income 369,642.30

Tax payable and surcharg 384,428.00

Tax payable by Ee. 384,428.00

Tax deducted so far 347,488.00

Income Tax 36,940.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

You are due for retirement on 30.04.2024 Please submit CPF, Pension Form & postal address, personal mobile, email for communication

You are due for retirement on 30.04.2024 Please submit CPF, Pension Form & postal address, personal mobile, email for communication

Date:29.03.2024

You might also like

- Salary Slip XLXDocument2 pagesSalary Slip XLXDeepak50% (4)

- Form (12) Payslip For JNR ExDocument1 pageForm (12) Payslip For JNR Exnikhil kumarNo ratings yet

- Thank You For Being A Liberty Mutual Renters Customer Since 2014!Document29 pagesThank You For Being A Liberty Mutual Renters Customer Since 2014!RewaNo ratings yet

- SalarySlip 5564050 AprDocument1 pageSalarySlip 5564050 AprsayanNo ratings yet

- Paystub 02.28.2019 PDFDocument1 pagePaystub 02.28.2019 PDFAnonymous dDiu2yq2KNo ratings yet

- Mania Ki Photo PDFDocument1 pageMania Ki Photo PDFThapliyal PrakashNo ratings yet

- Indiabulls Securities LimitedDocument1 pageIndiabulls Securities Limitedraj200224No ratings yet

- Highest Efficiencies For Various Industrial Applications: PumpsDocument8 pagesHighest Efficiencies For Various Industrial Applications: Pumpsahmed MareiNo ratings yet

- CONTROL & SHUTDOWN PHI R.B - Comment PDFDocument14 pagesCONTROL & SHUTDOWN PHI R.B - Comment PDFmzqaqila100% (1)

- Heat Transfer Lab AssignmentDocument5 pagesHeat Transfer Lab AssignmentChristyNo ratings yet

- Rabade PayDocument1 pageRabade Paysarojdubey0107No ratings yet

- Paystub 202109Document1 pagePaystub 202109Ankush BarheNo ratings yet

- 1 Apr 17Document1 page1 Apr 17pravin_3781No ratings yet

- Payslip PDFDocument1 pagePayslip PDFASHWINI KHANGARNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Date:29 03 2023Document1 pageDate:29 03 2023tanmay awareNo ratings yet

- PayslipSalary Slips - 9-2020 PDFDocument1 pagePayslipSalary Slips - 9-2020 PDFSukant ChampatiNo ratings yet

- Amit JiDocument1 pageAmit JiRohit RajNo ratings yet

- PayslipSalary Slips - 11-2020-1 PDFDocument1 pagePayslipSalary Slips - 11-2020-1 PDFSukant ChampatiNo ratings yet

- Payslip For Nov-16 PDFDocument1 pagePayslip For Nov-16 PDFManoj KumarNo ratings yet

- Payslip April 2021 State Bank of India: AIOPP6062HDocument1 pagePayslip April 2021 State Bank of India: AIOPP6062HsayanNo ratings yet

- Telangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruDocument2 pagesTelangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruSuresh DoosaNo ratings yet

- Nov 10Document1 pageNov 10Kaushik GhoshNo ratings yet

- 1109021 (1)Document1 page1109021 (1)Cms Stl CmsNo ratings yet

- PayslipSalary Slips - 10-2020 PDFDocument1 pagePayslipSalary Slips - 10-2020 PDFSukant ChampatiNo ratings yet

- Form PDFDocument2 pagesForm PDFSuresh DoosaNo ratings yet

- SalarySlip 6774210Document1 pageSalarySlip 6774210GANINo ratings yet

- PayslipDocument6 pagesPayslipmohamed arabathNo ratings yet

- SalarySlip 8484236Document1 pageSalarySlip 8484236Vikram MaanNo ratings yet

- Form 1Document1 pageForm 1Ganesh DasaraNo ratings yet

- UnknownDocument1 pageUnknownFiroz ShaikhNo ratings yet

- Payslip A64eed675b869b 2023-08Document1 pagePayslip A64eed675b869b 2023-08lavatev95No ratings yet

- Ranjan KumarDocument2 pagesRanjan KumarRanjan KumarNo ratings yet

- Payslip May 2021 State Bank of India: DMIPK3947MDocument1 pagePayslip May 2021 State Bank of India: DMIPK3947MArjun KumarNo ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- Documents To Print PDFDocument44 pagesDocuments To Print PDFrajeevtyagiNo ratings yet

- C001 SP RMC3720 202106Document1 pageC001 SP RMC3720 202106suprakash samantaNo ratings yet

- UnknownDocument2 pagesUnknownSudip MondalNo ratings yet

- UnknownDocument1 pageUnknownNISHCHAL AGARWALNo ratings yet

- $valueseptDocument1 page$valueseptashok sahooNo ratings yet

- Payslip 2018 2019 1 100000000421201 IGSLDocument1 pagePayslip 2018 2019 1 100000000421201 IGSLArivu AkilNo ratings yet

- A Government of West Bengal EnterpriseDocument1 pageA Government of West Bengal EnterprisetanmoyNo ratings yet

- March 2024Document1 pageMarch 2024irshadahmed563No ratings yet

- 1109277 (21)Document1 page1109277 (21)armvideos001No ratings yet

- February 2023Document1 pageFebruary 2023Pradeep Kumar malikNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- Fiserv December SalaryDocument1 pageFiserv December SalarySiddharthNo ratings yet

- Salary Slip - Quess)Document1 pageSalary Slip - Quess)gamersingh098123No ratings yet

- A Government of West Bengal EnterpriseDocument1 pageA Government of West Bengal EnterprisetanmoyNo ratings yet

- PAYSLIPDocument1 pagePAYSLIPsandeepNo ratings yet

- April - 20223Document1 pageApril - 20223Gadhavi JitudanNo ratings yet

- SalaryDocument1 pageSalarypankajNo ratings yet

- Bal Fvakozg PDFDocument1 pageBal Fvakozg PDFThapliyal PrakashNo ratings yet

- FormDocument1 pageFormPatel NiravNo ratings yet

- JuneDocument2 pagesJuneMaddydon123No ratings yet

- Payslip For: FEB-2022: Louis Berger SASDocument1 pagePayslip For: FEB-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- Employee Salary Slip For August, 2022: Lucky Cement LimitedDocument124 pagesEmployee Salary Slip For August, 2022: Lucky Cement LimitedAdeen MohsinNo ratings yet

- UnknownDocument1 pageUnknownAjit KumarNo ratings yet

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- Nava Bharat Ventures Limited: Net Pay 12,106.00 in Words: Rupees Twelve Thousand One Hundred Six OnlyDocument1 pageNava Bharat Ventures Limited: Net Pay 12,106.00 in Words: Rupees Twelve Thousand One Hundred Six OnlyAbinash ChikunNo ratings yet

- 137326Document2 pages137326nsmankr1No ratings yet

- May 2023Document1 pageMay 2023Gadhavi JitudanNo ratings yet

- Tan Koon Aik PayslipDocument3 pagesTan Koon Aik PayslipDaniel GuanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- User-Manual BIS v3 23-12-2021Document7 pagesUser-Manual BIS v3 23-12-2021sarojdubey0107No ratings yet

- Hindu Calendar 2023Document25 pagesHindu Calendar 2023Abhishek KumawatNo ratings yet

- tentativeBoilerCleanUp 230509 112910Document2 pagestentativeBoilerCleanUp 230509 112910sarojdubey0107No ratings yet

- Employers - Hire A Young Person - Intray ExerciseDocument2 pagesEmployers - Hire A Young Person - Intray Exercisesarojdubey0107No ratings yet

- Asm 73431 231002 161404Document4 pagesAsm 73431 231002 161404sarojdubey0107No ratings yet

- Asm 73443 231002 161150Document3 pagesAsm 73443 231002 161150sarojdubey0107No ratings yet

- 2016 Accounting Period Calendar 4 4 5Document1 page2016 Accounting Period Calendar 4 4 5sarojdubey0107No ratings yet

- U-9 Shutdown DefectsDocument5 pagesU-9 Shutdown Defectssarojdubey0107No ratings yet

- SOP Cleaup With HPH Blow ProcessDocument2 pagesSOP Cleaup With HPH Blow Processsarojdubey0107No ratings yet

- 24.09.2017 Aoh-ReportDocument1 page24.09.2017 Aoh-Reportsarojdubey0107No ratings yet

- 28.09.2017 Aoh-ReportDocument1 page28.09.2017 Aoh-Reportsarojdubey0107No ratings yet

- Updated PERMITDocument16 pagesUpdated PERMITsarojdubey0107No ratings yet

- 27.09.2017 Aoh-ReportDocument1 page27.09.2017 Aoh-Reportsarojdubey0107No ratings yet

- SOP Cleaup With HPH Blow ProcessDocument2 pagesSOP Cleaup With HPH Blow Processsarojdubey0107No ratings yet

- Updated PERMITDocument16 pagesUpdated PERMITsarojdubey0107No ratings yet

- Writeup On APSDocument49 pagesWriteup On APSsarojdubey0107No ratings yet

- 4 CorrosionDocument1 page4 Corrosionsarojdubey0107No ratings yet

- Non Tripping Event Analysis FormatDocument1 pageNon Tripping Event Analysis Formatsarojdubey0107No ratings yet

- 1a.supercritical FluidDocument1 page1a.supercritical Fluidsarojdubey0107No ratings yet

- HR - 1677135504 Joined Before 01.09.2014Document20 pagesHR - 1677135504 Joined Before 01.09.2014sarojdubey0107No ratings yet

- K.golden Flower MeditationDocument6 pagesK.golden Flower Meditationamjr1001No ratings yet

- Owners Manual NCSP3CM (En)Document47 pagesOwners Manual NCSP3CM (En)yurii volNo ratings yet

- Daily 500 Maximum 2500 Minimum 1000 Lead Time 15 Days EOQ 1200 Emergency Lead Time 3 DaysDocument5 pagesDaily 500 Maximum 2500 Minimum 1000 Lead Time 15 Days EOQ 1200 Emergency Lead Time 3 DaysM Noaman AkbarNo ratings yet

- References: ProblemsDocument14 pagesReferences: ProblemsDiego AlejandroNo ratings yet

- Pay Slip SampleDocument3 pagesPay Slip SampleJoseph ClaveriaNo ratings yet

- Weigh Bridge Miscellaneous Items DetailsDocument1 pageWeigh Bridge Miscellaneous Items DetailsChandan RayNo ratings yet

- ISO 9001 Required DocumentationDocument3 pagesISO 9001 Required Documentationdnmule100% (1)

- API 16C ErrataDocument1 pageAPI 16C ErrataDinesh KumarNo ratings yet

- IFAD Vietnam RIMS Training Workshop 2011 (1 of 7)Document18 pagesIFAD Vietnam RIMS Training Workshop 2011 (1 of 7)IFAD VietnamNo ratings yet

- Machine Design II: Prof. K.Gopinath & Prof. M.M.MayuramDocument4 pagesMachine Design II: Prof. K.Gopinath & Prof. M.M.Mayurampredrag10No ratings yet

- Jurnal Kasus Etikolegal Dalam Praktik KebidananDocument13 pagesJurnal Kasus Etikolegal Dalam Praktik KebidananErni AnggieNo ratings yet

- Conference Proceedings: Inhaled Nitric Oxide: Delivery Systems and MonitoringDocument27 pagesConference Proceedings: Inhaled Nitric Oxide: Delivery Systems and MonitoringPhanNo ratings yet

- Acalculous Cholecystitis CaseDocument35 pagesAcalculous Cholecystitis CaseSaada Enok MedtamakNo ratings yet

- 06 - Flexible Operation of Thermal Power Plants - OEM Perspective and Experiences PDFDocument22 pages06 - Flexible Operation of Thermal Power Plants - OEM Perspective and Experiences PDFRavishankarNo ratings yet

- Lesson 5: Prejudice and StereotypesDocument31 pagesLesson 5: Prejudice and StereotypesZeynep SulaimankulovaNo ratings yet

- Production of AcetaldehydeDocument124 pagesProduction of AcetaldehydeAdilaAnbreen80% (5)

- Juri Ferrer - Ws - WeatherDocument4 pagesJuri Ferrer - Ws - WeathersJIqsNo ratings yet

- Healing and Keeping Prayer (2013)Document2 pagesHealing and Keeping Prayer (2013)Kylie DanielsNo ratings yet

- VW Golf 8 Variant WD EngDocument664 pagesVW Golf 8 Variant WD EngLakhdar BouchenakNo ratings yet

- All Electricity Worksheets For Midterm 22Document22 pagesAll Electricity Worksheets For Midterm 22Maryam AlkaabiNo ratings yet

- Magicad Heating&Piping and Ventilation Version 2011.11: User'S GuideDocument285 pagesMagicad Heating&Piping and Ventilation Version 2011.11: User'S GuideCalin CalinNo ratings yet

- Premium Connections Catalogue ENGDocument134 pagesPremium Connections Catalogue ENGsubzwarijNo ratings yet

- MUMMY'S KITCHEN NEW FinalDocument44 pagesMUMMY'S KITCHEN NEW Finalanon_602671575100% (4)

- GS Module 3 ConcessionDocument3 pagesGS Module 3 ConcessionManolacheNo ratings yet

- Ducted Exhaust Ventilation Fans: Low Noise, High Performance Air and Moisture ExtractionDocument4 pagesDucted Exhaust Ventilation Fans: Low Noise, High Performance Air and Moisture ExtractionNicolas BaquedanoNo ratings yet

- Jurnal Aquaponik Jada BahrinDocument36 pagesJurnal Aquaponik Jada BahrinbrentozNo ratings yet