Professional Documents

Culture Documents

Assignment 1.2

Uploaded by

vihanjangid223Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1.2

Uploaded by

vihanjangid223Copyright:

Available Formats

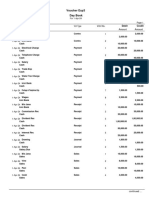

Chapter: -1.

2 Assignment

1. CREATE A COMPANY WITH YOUR NAME .NOW FROM THE BELOW

MENTIONED TRAIL BALANCE CREATE THE REQUIRED LEDGERS.

NOTE: AFTER CREATING TWO LEDGERS, CREATE REST OF THE LEDGER FROM

MULTI LEDGER CREATION WINDOW.

Opening Balance

Prticular Debit Credit

Share Capital 322000.00

General Reserve 80000.00

Vehicle 90500.00

Machinery 112000.00

Cash 16200.00

Petty cash 1000.00

Loan from Anil 16500.00

Loan from HDFC 115000.00

Furniture 110000.00

Corporation Bank (A/C No.- 257896752013458) 240000.00

Outstanding Electricity Bill 20600.00

Prepaid Rent 3500.00

Investment at IDBI 7800.00

Drawing 12000.00

Computer 25200.00

Profit & Loss A/C 64100.00

Grand total 618200.00 618200.00

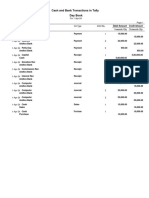

2. Now Create Another Ledger as Provisions for Depreciation with Opening Balance 9500.

3. Change the Ledger ‘Machinery’ As Plants & Machinery And ‘Furniture’ As ‘Furniture & Fixture.

4. Now Delete the Ledger ‘Provision for Depreciation’.

5. By Using Multi Ledger Alteration Change the Opening Balance of Plant & Machinery.

As ₹111000.00 And I nvestment As ₹ 8800.00.

6. Check the Trial Balance and Balance Sheet.

7 . Take Backup of Your Company In “D \your Name with pin code”.

REMEMBER POINTS

✓ WE NEVER CREATE CASH LEDGER AND PROFIT AND LOSS LEDGER BECAUSE IT IS ALREADY CREATED IN TALLY.

✓ IF WE WANT TO PUT THE OPENING BALANCE OF DEFAULT LEDGER THEN WE WILL GO TO ALTER & PUT THE

AMOUNT IN OPENING BALANCE.

✓ IF YOU WANT TO SHOW DETAIL VIEW OF TRIAL BALANCE PRESS ALT+F1

✓ ALSO IF YOU WANT TO SEE OPENING BALANCE IN TRIAL BALANCE WITH SPECIFIC COLUMN PRESS F12 THEN

ENABLE SHOW OPENING BALANCE(Y) ALSO WITH CLOSING BALANCE SHOW THERE IS OPTION.

You might also like

- Can Mers Foreclose or Assign MortgageDocument35 pagesCan Mers Foreclose or Assign Mortgagecfinley19100% (1)

- Bond SolutionDocument13 pagesBond Solution신동호100% (1)

- Tally ExerciseDocument16 pagesTally Exercisesbnikte73% (11)

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Velez Swing PDFDocument20 pagesVelez Swing PDFWilliam Amaral0% (2)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Essay QuestionsDocument16 pagesEssay QuestionssheldonNo ratings yet

- Questions On Trial Balance To StudentsDocument6 pagesQuestions On Trial Balance To Studentsveraji3735No ratings yet

- Stocks and BondsDocument40 pagesStocks and BondsCharlie Anne PadayaoNo ratings yet

- Day Trading With Pivot PointsDocument108 pagesDay Trading With Pivot PointsSadanand Mahato100% (2)

- ACC10007 Sample Exam 2Document9 pagesACC10007 Sample Exam 2dannielNo ratings yet

- Tally 9 AssignmentDocument49 pagesTally 9 AssignmentmayankNo ratings yet

- All Semesters Pages 47 65Document19 pagesAll Semesters Pages 47 65rpraveenkumarreddyNo ratings yet

- Financial Planning Black Book Final EditedDocument79 pagesFinancial Planning Black Book Final EditedDeep Shah83% (12)

- GemsrDocument20 pagesGemsrjohnnyz88No ratings yet

- Chapter 3. Financial Statements, Cash Flows, and Taxes: The Annual ReportDocument14 pagesChapter 3. Financial Statements, Cash Flows, and Taxes: The Annual ReportAsjad SandhuNo ratings yet

- Ranjith Complete ProjectDocument95 pagesRanjith Complete Projectarjunmba119624No ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- TALLY Suraj 1 1 1Document40 pagesTALLY Suraj 1 1 1Roopesh PandeNo ratings yet

- Financial ManagementDocument20 pagesFinancial Managementsanthanaaknal22No ratings yet

- PGDM (2021-23) Exercise On Final AccountsDocument9 pagesPGDM (2021-23) Exercise On Final Accountspriyanshu guptaNo ratings yet

- BBS - 1st - Financial Accounting and AnalysisDocument46 pagesBBS - 1st - Financial Accounting and AnalysisJALDIMAINo ratings yet

- Corporate Final Accounts With AdjustmentsDocument6 pagesCorporate Final Accounts With AdjustmentsNeelu AggrawalNo ratings yet

- Luqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsDocument5 pagesLuqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsQasim KhokharNo ratings yet

- Problem 1 2 3Document4 pagesProblem 1 2 3Ma Theresa MaguadNo ratings yet

- Excel Academy of CommerceDocument2 pagesExcel Academy of CommerceHassan Jameel SheikhNo ratings yet

- Ots 24 24009366 Annexure SialileaDocument17 pagesOts 24 24009366 Annexure Sialileaapi-3774915No ratings yet

- Financial Accounting-I Assignment 2: InstructionsDocument3 pagesFinancial Accounting-I Assignment 2: InstructionsMemes CreatorNo ratings yet

- CFS Class ProblemsDocument2 pagesCFS Class ProblemsPranav MishraNo ratings yet

- Duration: 1 Hour Max. Marks: 20Document2 pagesDuration: 1 Hour Max. Marks: 20Khushi TanejaNo ratings yet

- Solution - B124 - FTHE - V2 Summer 2020-2021 2 - V1Document13 pagesSolution - B124 - FTHE - V2 Summer 2020-2021 2 - V1AhmEd GhayasNo ratings yet

- Set No. A: Evaluation SheetDocument3 pagesSet No. A: Evaluation SheetaasthasoinnNo ratings yet

- CO517 - Financial AccountingDocument4 pagesCO517 - Financial Accountingmiciker416No ratings yet

- P3 Set 1-1Document5 pagesP3 Set 1-1Shingirayi MazingaizoNo ratings yet

- Profit After Tax: Revenue 25% Contribution Margin (% Change From Last y - 2%Document29 pagesProfit After Tax: Revenue 25% Contribution Margin (% Change From Last y - 2%Henry TranNo ratings yet

- 605701b41234414fbf70f2a0d6734ae1Document3 pages605701b41234414fbf70f2a0d6734ae1BabaNo ratings yet

- Adjustment Entry PrecticleDocument1 pageAdjustment Entry Precticlevihanjangid223No ratings yet

- Acc - Chapter 15 AmroDocument12 pagesAcc - Chapter 15 AmroWassim AlwanNo ratings yet

- TALLY Suraj 1 1 1 (1) 1Document31 pagesTALLY Suraj 1 1 1 (1) 1Roopesh PandeNo ratings yet

- CSEC Accounting Formats and TemplatesDocument15 pagesCSEC Accounting Formats and TemplatesRealGenius (Carl)No ratings yet

- F&AQPmidsem Summer22Document2 pagesF&AQPmidsem Summer22kanika thakurNo ratings yet

- Instructions: Amazon Seller Buys Printer Supplies For $29 With CashDocument1 pageInstructions: Amazon Seller Buys Printer Supplies For $29 With CashJorge FloresNo ratings yet

- Accounting and Law - NotesDocument11 pagesAccounting and Law - NotesCrystal ApinesNo ratings yet

- Working Notes Profit and Loss Adjustment AccountDocument11 pagesWorking Notes Profit and Loss Adjustment Accountkvrajan6No ratings yet

- Seatwork 5: Application A. Owner's EquityDocument7 pagesSeatwork 5: Application A. Owner's EquityAngela GarciaNo ratings yet

- Peachtree Accounting ProjectDocument12 pagesPeachtree Accounting ProjectTahir DestaNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- B. (Basis of Findings Is The Missallocation of Payment From Zebra Computers)Document6 pagesB. (Basis of Findings Is The Missallocation of Payment From Zebra Computers)Kathlyn Joyce SumangNo ratings yet

- Suggestion CorrectedDocument2 pagesSuggestion CorrectedMd Chamok ShuvoNo ratings yet

- Exercise 1Document11 pagesExercise 1girmayadane7No ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- Hassan ZaibDocument3 pagesHassan ZaibHaris YaminNo ratings yet

- Model Project: News / Events Project ProfileDocument1 pageModel Project: News / Events Project ProfileHarshadaNo ratings yet

- BC 502 Management Accounting 908088840Document8 pagesBC 502 Management Accounting 908088840Saibal SandhirNo ratings yet

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Final Accounts: Problem SheetDocument2 pagesFinal Accounts: Problem SheetSaransh MaheshwariNo ratings yet

- Income Statement Balance Sheet For The Year Ended 31 July 2012 As at 31 July 2012 Sales Non Current AssetsDocument1 pageIncome Statement Balance Sheet For The Year Ended 31 July 2012 As at 31 July 2012 Sales Non Current Assetshananiqbal1999No ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- Advanced AccountingDocument12 pagesAdvanced AccountingmayuriNo ratings yet

- Course Review Exercise 2Document5 pagesCourse Review Exercise 2Carolina MerinoNo ratings yet

- Capital Budgeting - 2021Document7 pagesCapital Budgeting - 2021Mohamed ZaitoonNo ratings yet

- Financial Statement 1st PaperDocument24 pagesFinancial Statement 1st PaperMtNo ratings yet

- Cases Chapter 5Document2 pagesCases Chapter 5Rifqi FarhanNo ratings yet

- Adowa Peachtree Class ExcerciseDocument4 pagesAdowa Peachtree Class ExcerciseAbel Hailu100% (1)

- Homework Ch5-Second Week 1Document19 pagesHomework Ch5-Second Week 1api-557133689No ratings yet

- Financial Statement2 (Work Sheet)Document6 pagesFinancial Statement2 (Work Sheet)Arham RajpootNo ratings yet

- Chaithanya Info SystemsDocument5 pagesChaithanya Info SystemsMichael WellsNo ratings yet

- Trial BalDocument1 pageTrial Balvihanjangid223No ratings yet

- Journal Entries 23.3.2024Document8 pagesJournal Entries 23.3.2024vihanjangid223No ratings yet

- Tally Prime Assignment No.2Document1 pageTally Prime Assignment No.2vihanjangid223No ratings yet

- Xlookup 10 ExaDocument18 pagesXlookup 10 Exavihanjangid223No ratings yet

- Final DashboardDocument84 pagesFinal Dashboardvihanjangid223No ratings yet

- Pand LDocument1 pagePand Lvihanjangid223No ratings yet

- Day BookDocument2 pagesDay Bookvihanjangid223No ratings yet

- BSheetDocument1 pageBSheetvihanjangid223No ratings yet

- BSheetDocument1 pageBSheetvihanjangid223No ratings yet

- B 3 Voucher Example 8.4.2024Document2 pagesB 3 Voucher Example 8.4.2024vihanjangid223No ratings yet

- Day BookDocument1 pageDay Bookvihanjangid223No ratings yet

- Bank Reconislation in Tally PrimeDocument7 pagesBank Reconislation in Tally Primevihanjangid223No ratings yet

- Bank Reconciliation StatementDocument2 pagesBank Reconciliation Statementvihanjangid223No ratings yet

- BSheetDocument1 pageBSheetvihanjangid223No ratings yet

- GRP SumDocument1 pageGRP Sumvihanjangid223No ratings yet

- Datafeb 22 2021Document3 pagesDatafeb 22 2021vihanjangid223No ratings yet

- Inventory Sum 2Document3 pagesInventory Sum 2vihanjangid223No ratings yet

- INVENTORY SUM 1 QuestionDocument2 pagesINVENTORY SUM 1 Questionvihanjangid223No ratings yet

- Assignment MS ExcelDocument26 pagesAssignment MS Excelvihanjangid223No ratings yet

- Project 1 Profit & Loss A/c: 1-Apr-2022 To 31-May-2023 1-Apr-2022 To 31-May-2023 1-Apr-2022 To 31-May-2023Document1 pageProject 1 Profit & Loss A/c: 1-Apr-2022 To 31-May-2023 1-Apr-2022 To 31-May-2023 1-Apr-2022 To 31-May-2023vihanjangid223No ratings yet

- Tds (Tax Deducted at Source) Using Tallyerp9: 1. Enabling Tds in Tally - Erp9Document10 pagesTds (Tax Deducted at Source) Using Tallyerp9: 1. Enabling Tds in Tally - Erp9vihanjangid223No ratings yet

- Excise Tril Bal 8Document6 pagesExcise Tril Bal 8vihanjangid223No ratings yet

- BSheetDocument1 pageBSheetvihanjangid223No ratings yet

- Excise Tril Bal 1-15Document15 pagesExcise Tril Bal 1-15vihanjangid223No ratings yet

- Transaction Excise in Tally 22.3.2024Document3 pagesTransaction Excise in Tally 22.3.2024vihanjangid223No ratings yet

- Tata Chemicals by KotakDocument9 pagesTata Chemicals by KotakAshish KudalNo ratings yet

- Unit 19 Reconciliation of Cost and Financial Accounts: StructureDocument20 pagesUnit 19 Reconciliation of Cost and Financial Accounts: StructureAttay SabNo ratings yet

- 3q21 Earnings ReleaseDocument5 pages3q21 Earnings ReleaseBruno EnriqueNo ratings yet

- A Conversation With Benjamin GrahamDocument4 pagesA Conversation With Benjamin GrahamKevin SmithNo ratings yet

- Chapter 10 Audit of The Financing CycleDocument17 pagesChapter 10 Audit of The Financing CycleCASTILLO, MA. CHEESA D.No ratings yet

- Idap Io Whitepaper PDFDocument46 pagesIdap Io Whitepaper PDFamin jamilNo ratings yet

- 3rd Amended Complaint Against Former Stanford EmployeesDocument58 pages3rd Amended Complaint Against Former Stanford EmployeesAllenStanford100% (1)

- MCI Capital Structure TheoryDocument13 pagesMCI Capital Structure TheoryEfri DwiyantoNo ratings yet

- Wa0003Document81 pagesWa0003irfanNo ratings yet

- 06 - 2pm - Hedge - Fund - Presentation - BourlandDocument20 pages06 - 2pm - Hedge - Fund - Presentation - BourlandHimanshu GondNo ratings yet

- Ration Analysis of M&SDocument72 pagesRation Analysis of M&SRashid JalalNo ratings yet

- Present Values, The Objectives of The Firm, and Corporate GovernanceDocument31 pagesPresent Values, The Objectives of The Firm, and Corporate GovernanceTanvi KatariaNo ratings yet

- Fin Mid Fall 2020Document2 pagesFin Mid Fall 2020Shafiqul Islam Sowrov 1921344630No ratings yet

- Pfizer Exam Solution ManualDocument25 pagesPfizer Exam Solution ManualDiego AguirreNo ratings yet

- NRI Investments in IndiaDocument3 pagesNRI Investments in IndiaRahul BediNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementLevina DiazNo ratings yet

- Assignment Comparative Ratio Analysis ofDocument16 pagesAssignment Comparative Ratio Analysis ofAbhishekDey162b BBANo ratings yet

- Ies2 Edited Pero Di Ko Sure 2Document4 pagesIes2 Edited Pero Di Ko Sure 2Lyn AbudaNo ratings yet

- BillCatchesPips Course - xPAKOZZxDocument8 pagesBillCatchesPips Course - xPAKOZZxTonderai ChihambakweNo ratings yet

- Mark Suster: A Primer On ExitsDocument22 pagesMark Suster: A Primer On Exitsapi-204718852100% (2)

- Rogger Septrya P2Document10 pagesRogger Septrya P2Lydia limNo ratings yet