Professional Documents

Culture Documents

Journal Entries 23.3.2024

Uploaded by

vihanjangid2230 ratings0% found this document useful (0 votes)

3 views8 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views8 pagesJournal Entries 23.3.2024

Uploaded by

vihanjangid223Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

1.

Record the following transactions in the Journal and post them

into ledger and prepare a Trail Balance

Oct 1st Neel started business with a capital of 80,000

3rd Bought goods from Karl on credit 20,000

4th Sold goods to Tarl 25,000

5th Cash purchases 25,000

7th Cash sales 15,000

9th Goods retuned to Karl 2,000

10th Bought furniture for 15,000

11th Cash paid to Karl 12,000

12th Goods returned by Tarl 3,000

14th Goods taken by Neel for personal use 3,000

15th Cash received from Tarl 12,000

16th Took loan from Parl 30,000

17th Salary paid 5,000

18th Bought stationery for 1,000

19th Amount paid to Parl on loan account 18,000

20th Interest received 4,000

TRIAL BALANCE : BAL. SHEET : PROFIT & LOSS :

2. Enter the following transactions in the Journal and post them

into ledger and from the information obtained prepare a Trail

Balance.

Nov 10th : Mrs. Roy started business with 60,000

11th : Bought furniture from Modern Furniture for 10,000

12th : Purchased goods for cash 15,000

13th : Purchased goods from B. Sen & Co for 30,000

14th : Opened a bank account by depositing 16,000

16th : Sold goods for cash 15,000

17th : Purchased stationery for 1000 from Bharat Stationery Mart

18th : Sold goods to Zahir Khan for 10,000

19th : Bought machinery for 6,000 and payment made by cheque

20th : Goods returned by Zahir Khan for 2,000

21st : Payment to B.Sen & Co by cheque 5,000

22nd : Withdrew from bank for personal use 3,000

23rd : Interest paid through cheque 2,000

24th : Withdrew from bank for office expenses 10,000

26th : Cheque received from Zahir Khan 5,000

27th : Paid electricity bill for 100

29th : Cash sales for 6,000

30th : Commission received by cheque 5,000

TRIAL BALANCE : BAL. SHEET : PROFIT & LOSS :

3. Mr. Nirmal has the following transactions in the month of April.Write

Journal Entries for the transactions.

10th April : Commenced business with a capital of 1,00,000

11th April : Purchased goods from Veeru for 20,000

13th April : Purchased Goods for Cash 15,000

14th April : Purchased Goods from Abhiram for cash 9,000

16th April : Bought Goods from Shyam on credit 12,000

17th April : Sold goods worth 15,000 to Tarun

19th April : Sold goods for cash 20,000

20th April : Sold goods to Utsav for cash 6,000

21st April : Sold goods to Pranav on credit 17,000

22nd April : Returned goods to Veeru 3,000

23rd April : Goods returned from Tarun 1,000

25th April : Goods taken by the proprietor for personal use 1,000

26th April : Bought Land for 50,000

27th April : Purchased machinery for cash 45,000

28th April : Bought computer from Intel Computers for 25,000

28th April : Cash sales 15,000

29th April : Cash purchases 22,000

30th April : Bought furniture for proprietor's residence and paid cash 10,000

TRIAL BALANCE : BAL. SHEET : PROFIT & LOSS :

4. Journalise the following transactions in the books of Rama & Sons

3rd May : Cash deposited into bank 60,000

4th May : Loan given to Bhuvan 20,000

4th May : Paid cash to Veeru 20,000

5th May : Paid to Veeru by cheque 15,000

5th May : Cash received from Tarun 12,000

5th May : Took loan from Anush 15,000

6th May : Cheque received from Pranav 15,000

6th May : Paid to Intel Computers by cheque 17,000

6th May : Withdrew from bank 5,000

7th May : Withdrew from bank for office use 8,000

7th May : Cash received from Bhuvan on loan account 10,000

8th May : Withdrew from bank for personal use 1,000

8th May : Cash taken by proprietor for personal use 3,000

9th May : Bought furniture and paid by cheque 15,000

9th May : Paid to Anush by cheque on loan account 5,000

9th May : Brought additional capital of 25,000

TRIAL BALANCE : BAL. SHEET : PROFIT & LOSS :

5. Write journal entries in the books of Chikky & Bros.

10th June : Paid wages 12,000

11th June : paid rent by cheque 10,000

13th June : Paid salary to Mr. Charan 12,000

14th June : Purchased stationery from Kagaz & Co. and paid by cheque 5,000

15th June : Received interest 14,000

17th June : Received commission by cheque 6,000

18th June : Rent received from Mr. Mody 8,000

19th June : Interest received from Mr.Bijju by cheque 10,000

20th June : Carriage paid on purchase of goods 3,000

22nd June : Carriage paid on sale of goods 2,000

BAL. SHEET : P&L : Trial Bal.:

6. Name the two elements/accounts effected by the following

transactions. Also state the nature/kind/type of the elements

i. Paid cash to Ram 5,000

ii. Received cash from Shyam 3,000

iii. Wages Paid 750

iv. Rent Received 2,000

v. Cash taken by proprietor for his personal use 2,500

vi. Purchased stationery 300

vii. Received interest 800

TRIAL BALANCE : BAL. SHEET : PROFIT & LOSS :

8. Also state which element is to be debited and which element is

to be credited based on the principles of debit and credit.

i. Paid wages 4,000

ii. paid rent by cheque 6,000

iii. Paid salary to Mr. X 2,000

iv. Purchased stationery from KJ & Co. and paid by cheque 500

v. Received interest 5,000

vi. Received commission by cheque 3,000

vii. Rent received from Mr.LM 1,000

viii. Interest received from Mr.TJ by cheque 2,000

TRIAL BALANCE : BAL. SHEET : PROFIT & LOSS :

7. Identity the two elements effected by the following transactions.

Also state which element is to be debited and which element is to be credited

based on the principles of debit and credit.

1. Started business with cash 50, 000 in cash.

2. Bought goods from A & Co. for 10,000

3. Bought Goods for Cash 5,000

4. Bought Goods from B & Co. for cash 6,000

5. Purchased Goods from C & Co. on credit 8,000

6. Sold goods worth 8,000 to P

7. Sold goods for cash 10,000

8. Sold goods to Q for cash 4,000

9. Sold goods to R on credit 8,000

10. Returned goods to A & Co. 2,000

11. Goods returned from P 1,000

12. Goods taken by the proprietor for personal use 1,000

13. Bought furniture 10,000

14. Purchased machinery for cash 25,000

15. Bought computer from Intel & Co. 30,000

16. Cash sales 5,000

17. Cash purchases 6,000

TRIAL BALANCE : BAL. SHEET : PROFIT & LOSS :

9. Identity the two elements effected by the following transactions.

Also state which element is to be debited and which element is to be credited

based on the principles of debit and credit.

I. Cash paid into bank 50,000

II. Paid cash to A & Co. 10,000

III. Paid to A & Co. by cheque 5,000

IV. Cash received from P 8,000

V. Cheque received from Q 10,000

VI. Paid to Intel & Co. by cheque 10,000

VII. Withdrew from bank 2,000

VIII. Withdrew from bank for office use 3,000

IX. Withdrew from bank for personal use 2,000

X. Cash taken by proprietor for personal use 1,000

XI. Bought furniture and paid by cheque 5,000

TRIAL BALANCE : BAL. SHEET : PROFIT & LOSS :

10.Which two elements/accounts are effected by the following

transactions? Also state the nature/kind/type of the elements

i. Started business with capital 75,000

ii. Bought furniture 10,000

iii. Bought goods for cash 20,000

iv. Bought goods from Ram on Credit 10,000

v. Sold goods for cash 15,000

vi. Sold goods to Shyam on credit 5,000

vii. Returned goods to Ram 1,000

viii. Goods Returned from Shyam 500

ix. Goods taken by Proprietor for his personal use 1,000

TRIAL BALANCE : BAL. SHEET : PROFIT & LOSS :

11.What are the two elements/accounts effected by the following

transactions. Also state the nature/kind/type of the elements

i. Paid Cash into Bank 25,000

ii. Withdrawn from bank 5,000

iii. Paid to Ram by Cheque 3,500

iv. Received a cheque from Shyam 2,700

v. Purchased Machinery and paid by cheque 12,000

vi. Salary paid by cheque 4,500

vii. Commission received by Cheque 7,200

viii. Withdrawn from bank for office use 5,000

ix. Withdrawn from bank for personal use 3,000

x. Advertisement expenses paid by cheque 5,000

TRIAL BALANCE : BAL. SHEET : PROFIT & LOSS :

You might also like

- Angela Stark 3-21-10 Omar TRNSCRPTDocument15 pagesAngela Stark 3-21-10 Omar TRNSCRPTB-Nicole Williams100% (7)

- Secured Guaranties and Third Party Deeds of Trust 2010Document13 pagesSecured Guaranties and Third Party Deeds of Trust 2010mtandrewNo ratings yet

- Accounting Problems - 2018Document31 pagesAccounting Problems - 2018Albert Moreno100% (4)

- Cooking in The Forex: © Proact Traders LLC 2006 1Document30 pagesCooking in The Forex: © Proact Traders LLC 2006 1trans29100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- XyzDocument8 pagesXyzRaghav KanoongoNo ratings yet

- Tally Practice ProblemsDocument4 pagesTally Practice Problemskumarbcomca83% (6)

- Assignment No-3Document9 pagesAssignment No-3Ronit gawade100% (1)

- General Measurement Aptitude TestDocument207 pagesGeneral Measurement Aptitude TestEDUCATED MIND100% (1)

- Accounting ProblemsDocument7 pagesAccounting Problemspammy313100% (1)

- Accounting Equation Exercises PDFDocument1 pageAccounting Equation Exercises PDFAdelle Bert DiazNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Ca F Chapter 2 CompletelyDocument14 pagesCa F Chapter 2 CompletelyG. DhanyaNo ratings yet

- The Accounting EquationDocument10 pagesThe Accounting EquationMylene Salvador100% (1)

- Assignment No.2 (Journal Entries, Ledger and Trial Balance)Document1 pageAssignment No.2 (Journal Entries, Ledger and Trial Balance)Muhammad Arsalan33% (3)

- Exercises On Journalizing (Debit and Credit)Document2 pagesExercises On Journalizing (Debit and Credit)kim100% (4)

- What Is VolumeDocument9 pagesWhat Is VolumeRahul Chaturvedi100% (1)

- Accounting ADocument6 pagesAccounting AMar Jinita37% (19)

- Assignment Journal and LedgersDocument5 pagesAssignment Journal and LedgersAdil Khan LodhiNo ratings yet

- Extra Journal QuestionsDocument3 pagesExtra Journal QuestionsMba BNo ratings yet

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument5 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsNoorNo ratings yet

- Accounting JournalDocument12 pagesAccounting JournalHarmanjeet SinghNo ratings yet

- Accountancy QPDocument3 pagesAccountancy QPpammy313No ratings yet

- Jeyaseeli Is A Sole Proprietor Having A Provisions StoreDocument17 pagesJeyaseeli Is A Sole Proprietor Having A Provisions StoreJahanzaib ButtNo ratings yet

- Ledger QuestionsDocument2 pagesLedger QuestionsAlefiya BurhaniNo ratings yet

- Asset, Liability, Owner 'S Equity, Revenue, or Expense Asset Liability Asset Asset Expense: Revenue Revenue Expense LiabilityDocument7 pagesAsset, Liability, Owner 'S Equity, Revenue, or Expense Asset Liability Asset Asset Expense: Revenue Revenue Expense LiabilityabhiNo ratings yet

- Problem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalDocument2 pagesProblem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalMadeeha KhanNo ratings yet

- Assignment No. 01 FAPDocument4 pagesAssignment No. 01 FAPUmar FaridNo ratings yet

- Accounting Bs 1st New Practice QuestionsDocument14 pagesAccounting Bs 1st New Practice QuestionsJahanzaib ButtNo ratings yet

- ST RD TH TH TH TH TH TH TH TH TH TH TH TH TH THDocument2 pagesST RD TH TH TH TH TH TH TH TH TH TH TH TH TH THTarun KatariaNo ratings yet

- Accounts - Journal EntriesDocument3 pagesAccounts - Journal Entriessjjjsjs0% (1)

- Lab Practical Question in Computerised AccountingDocument2 pagesLab Practical Question in Computerised Accountingnani11k3No ratings yet

- 9 CI Accounting Holiday HWDocument4 pages9 CI Accounting Holiday HWmeena malikNo ratings yet

- Learning Task 3 and 4Document3 pagesLearning Task 3 and 4Alyana NoraNo ratings yet

- Accounting Terms and ConceptsDocument4 pagesAccounting Terms and ConceptsNirajNo ratings yet

- Question Bank For AccountsDocument12 pagesQuestion Bank For AccountsSwati DubeyNo ratings yet

- Assignment 2 ShyamDocument6 pagesAssignment 2 Shyamjennifersunny007No ratings yet

- Assignment 1Document3 pagesAssignment 1Syed Muhammad Abdullah ShahNo ratings yet

- Journal Ledger Trial BalanceDocument8 pagesJournal Ledger Trial BalancejessNo ratings yet

- RD TH TH TH TH TH TH TH TH TH TH TH TH TH TH THDocument1 pageRD TH TH TH TH TH TH TH TH TH TH TH TH TH TH THsimranarora2007No ratings yet

- Chapter - 6 JournalDocument4 pagesChapter - 6 JournalRitaNo ratings yet

- Day Books FA1Document3 pagesDay Books FA1amirNo ratings yet

- Accountancy For Lawyers - Practice QuestionsDocument3 pagesAccountancy For Lawyers - Practice QuestionsNantege ProssielyNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- Acc 31: Quiz 2Document1 pageAcc 31: Quiz 2Felimar CalaNo ratings yet

- Accounting EquationDocument2 pagesAccounting Equationsyed ali raza kazmi100% (1)

- Class Exercise Session 1,2Document7 pagesClass Exercise Session 1,2sheheryar50% (4)

- Accounting Process HW1Document1 pageAccounting Process HW1satya100% (1)

- General JournalDocument5 pagesGeneral Journalmuhammad.16032.acNo ratings yet

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument6 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsMuhammad Haris100% (1)

- Cash BookDocument4 pagesCash BookSuneet SaxenaNo ratings yet

- BBA AccountingDocument2 pagesBBA AccountingAnonymous UKybnj9Otd50% (2)

- 11 Accountancy Notes Ch03 Recording of Transactions 02Document20 pages11 Accountancy Notes Ch03 Recording of Transactions 02Subodh Saxena100% (1)

- Basic Accounting Complete TheoryDocument10 pagesBasic Accounting Complete TheoryKamlesh KumarNo ratings yet

- Accounting Equation Exercise 1Document3 pagesAccounting Equation Exercise 1Abife AmatongNo ratings yet

- Exercise Cash BookDocument3 pagesExercise Cash BookAjay Kumar Sharma33% (3)

- Practice Question JournalDocument2 pagesPractice Question JournalHoorain AsadNo ratings yet

- Accounting Equation and General JournalDocument3 pagesAccounting Equation and General JournalWaqar AhmadNo ratings yet

- Financial Accounting HWDocument5 pagesFinancial Accounting HWSheila Gelato-Girl50% (2)

- Afm Assignment 1Document3 pagesAfm Assignment 1ನಂದನ್ ಎಂ ಗೌಡNo ratings yet

- Questions On Journal Entry For StudentsDocument8 pagesQuestions On Journal Entry For Studentsveraji3735No ratings yet

- Problem Assignment - 01Document5 pagesProblem Assignment - 01Anand BabarNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- Question Bank-Accountancy 11thDocument26 pagesQuestion Bank-Accountancy 11thshaurya goyalNo ratings yet

- Final DashboardDocument84 pagesFinal Dashboardvihanjangid223No ratings yet

- Pand LDocument1 pagePand Lvihanjangid223No ratings yet

- BSheetDocument1 pageBSheetvihanjangid223No ratings yet

- Tally Prime Assignment No.2Document1 pageTally Prime Assignment No.2vihanjangid223No ratings yet

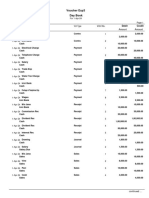

- Trial BalDocument1 pageTrial Balvihanjangid223No ratings yet

- Xlookup 10 ExaDocument18 pagesXlookup 10 Exavihanjangid223No ratings yet

- B 3 Voucher Example 8.4.2024Document2 pagesB 3 Voucher Example 8.4.2024vihanjangid223No ratings yet

- Day BookDocument2 pagesDay Bookvihanjangid223No ratings yet

- BSheetDocument1 pageBSheetvihanjangid223No ratings yet

- Day BookDocument1 pageDay Bookvihanjangid223No ratings yet

- BSheetDocument1 pageBSheetvihanjangid223No ratings yet

- Assignment 1.2Document3 pagesAssignment 1.2vihanjangid223No ratings yet

- GRP SumDocument1 pageGRP Sumvihanjangid223No ratings yet

- INVENTORY SUM 1 QuestionDocument2 pagesINVENTORY SUM 1 Questionvihanjangid223No ratings yet

- Assignment MS ExcelDocument26 pagesAssignment MS Excelvihanjangid223No ratings yet

- Bank Reconciliation StatementDocument2 pagesBank Reconciliation Statementvihanjangid223No ratings yet

- Datafeb 22 2021Document3 pagesDatafeb 22 2021vihanjangid223No ratings yet

- BSheetDocument1 pageBSheetvihanjangid223No ratings yet

- Tds (Tax Deducted at Source) Using Tallyerp9: 1. Enabling Tds in Tally - Erp9Document10 pagesTds (Tax Deducted at Source) Using Tallyerp9: 1. Enabling Tds in Tally - Erp9vihanjangid223No ratings yet

- Project 1 Profit & Loss A/c: 1-Apr-2022 To 31-May-2023 1-Apr-2022 To 31-May-2023 1-Apr-2022 To 31-May-2023Document1 pageProject 1 Profit & Loss A/c: 1-Apr-2022 To 31-May-2023 1-Apr-2022 To 31-May-2023 1-Apr-2022 To 31-May-2023vihanjangid223No ratings yet

- Excise Tril Bal 8Document6 pagesExcise Tril Bal 8vihanjangid223No ratings yet

- Inventory Sum 2Document3 pagesInventory Sum 2vihanjangid223No ratings yet

- Bank Reconislation in Tally PrimeDocument7 pagesBank Reconislation in Tally Primevihanjangid223No ratings yet

- Excise Tril Bal 1-15Document15 pagesExcise Tril Bal 1-15vihanjangid223No ratings yet

- Transaction Excise in Tally 22.3.2024Document3 pagesTransaction Excise in Tally 22.3.2024vihanjangid223No ratings yet

- Financial InstitutionsDocument2 pagesFinancial InstitutionsWilsonNo ratings yet

- Mrunal Updates - Money - Banking - Mrunal PDFDocument39 pagesMrunal Updates - Money - Banking - Mrunal PDFShivangi ChoudharyNo ratings yet

- Ae Campus Alberta Grant FundingDocument3 pagesAe Campus Alberta Grant FundingedmontonjournalNo ratings yet

- T6int 2009 Jun QDocument9 pagesT6int 2009 Jun QRana KAshif GulzarNo ratings yet

- Intro ERP Using GBI GBI Slides en v2.20Document15 pagesIntro ERP Using GBI GBI Slides en v2.20Jayashree ChatterjeeNo ratings yet

- NPP 2020 Final Web PDFDocument216 pagesNPP 2020 Final Web PDFMawuli AhorlumegahNo ratings yet

- Cir v. Bank of Commerce G.R. 149636Document14 pagesCir v. Bank of Commerce G.R. 149636ATTYSMDGNo ratings yet

- SSRN Id1889147Document5 pagesSSRN Id1889147A.K. MarsNo ratings yet

- Internship Proposal Learning AgreementDocument4 pagesInternship Proposal Learning AgreementAshish SoinNo ratings yet

- MCQ - Unit 2Document15 pagesMCQ - Unit 2Niraj PandeyNo ratings yet

- Definition of 'Debt Funds': What Is A Mutual Fund?Document5 pagesDefinition of 'Debt Funds': What Is A Mutual Fund?Girish SahareNo ratings yet

- BGS Micro NotesDocument1 pageBGS Micro NotesAvinash JhaNo ratings yet

- Accounts ManipulationDocument5 pagesAccounts ManipulationomarahpNo ratings yet

- STAT 3820 Homework 1: 1 + It If T 1Document2 pagesSTAT 3820 Homework 1: 1 + It If T 1estarianNo ratings yet

- IC38 Concise-1Document30 pagesIC38 Concise-1Swanand VlogsNo ratings yet

- Title of Business Plan Food Industry Business PlanDocument26 pagesTitle of Business Plan Food Industry Business PlanIsmail AzhariNo ratings yet

- Palkka Mepv2022k12a1t36702c0 09.12.2022Document3 pagesPalkka Mepv2022k12a1t36702c0 09.12.2022CesarNo ratings yet

- Dubai Economic Report 2018 Full Report PDFDocument220 pagesDubai Economic Report 2018 Full Report PDFHugo RidaoNo ratings yet

- Managing Option Positions: Download This in PDF FormatDocument11 pagesManaging Option Positions: Download This in PDF FormatpkkothariNo ratings yet

- GSLC 12 December (Statement of Cash Flow)Document4 pagesGSLC 12 December (Statement of Cash Flow)Anindya ZahraNo ratings yet

- Prelim Exam - LUNADocument17 pagesPrelim Exam - LUNAJoyce LunaNo ratings yet

- INDIAN BANK - Taking Banking Technology To The Common ManDocument1 pageINDIAN BANK - Taking Banking Technology To The Common Mannellai kumarNo ratings yet

- AFFIDAVIT OF FINANCIAL SUPPORT - Parents - DebashishDocument6 pagesAFFIDAVIT OF FINANCIAL SUPPORT - Parents - DebashishImdad KhanNo ratings yet

- Accounting For Management: Acca - Applied KnowledgeDocument9 pagesAccounting For Management: Acca - Applied KnowledgeTrà My ĐoànNo ratings yet

- Research Nepal BankDocument61 pagesResearch Nepal Bankbadaladhikari12345No ratings yet