Professional Documents

Culture Documents

Lecture_7-8

Uploaded by

shadowlord468Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture_7-8

Uploaded by

shadowlord468Copyright:

Available Formats

Lecture #7.

HUMAN DEVELOPMENT INDEX

Human Development Index (HDI)

The HDI was created to emphasize that people and their capabilities should be the

ultimate criteria for assessing the development of a country, not economic growth

alone. The HDI can also be used to question national policy choices, asking how two

countries with the same level of GNI per capita can end up with different human

development outcomes. These contrasts can stimulate debate about government

policy priorities.

The Human Development Index (HDI) is a summary measure of average

achievement in key dimensions of human development: a long and healthy life,

being knowledgeable and have a decent standard of living. The HDI is the geometric

mean of normalized indices for each of the three dimensions.

The health dimension is assessed by life expectancy at birth, the education

dimension is measured by mean of years of schooling for adults aged 25 years and

more and expected years of schooling for children of school entering age. The

standard of living dimension is measured by gross national income per capita. The

HDI uses the logarithm of income, to reflect the diminishing importance of income

with increasing GNI. The scores for the three HDI dimension indices are then

aggregated into a composite index using geometric mean.

The HDI simplifies and captures only part of what human development entails. It

does not reflect on inequalities, poverty, human security, empowerment, etc. The

HDRO offers the other composite indices as broader proxy on some of the key issues

of human development, inequality, gender disparity and poverty.

A fuller picture of a country's level of human development requires analysis of other

indicators and information presented in the statistical annex of the report.

SOURCE: UNITED NATIONS DEVELOPMENT PROGRAMME (UNDP)

Lecture #8. BUSINESS CYCLEAND ECONOMIC GROWTH

Phases of Business Cycle

Any economy, whether local, national or international, follows the four phases of a

business cycle. The phases of a business cycle include:

1. Prosperity

2. Recession

3. Depression

4. Recovery

The time frame of each phase depends on various factors that affect an economy.

For instance, insufficient supply of oil leads to increase prices and eventually may lead to a

worse economic situation for importing countries. Also, the calamities hitting many

countries in the world are dragging down the economy to depression.

Circular flow of an Economic Activity

Economic model is a simplification of economic reality. It can be presented into the

following forms:

a. Mathematical equations

b. Set of diagrams

c. Scheme or flow charts

Macroeconomic models provide a systematic guide that permits the complexities of

the operations of the economy as a whole for understanding and interpretation.

Macroeconomic analysis aims to diagnose the reason for failure in achieving

economic goals and to point the way toward better performance in the future.

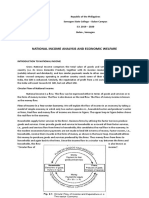

The economic model depicting the circular flow of goods and services (output) and

income is shown in the following diagram:

Figure 39. Circular flow of economic activity

reflecting the outflows and inflows

We see that the consumers provide economic resources to the business firms. These

economic resources or inputs of production are utilized to produce goods and services.

These will in turn be passed on to the consumers.

The flow of physical goods is accompanied by a flow of income. The consumers

deliver the economic resources to the producers with corresponding payments. These

payments are in the form of wages and salaries, interest and rent. On the other hand, the

goods and services produced by the firms will be passed on to the consumers thru payments

too, called consumption expenditures.

The incomes received by the consumers are spent for the purchase of goods and

services. If there is an equilibrium, that is the total demand of the consumers equals the

amount of goods and services produced by the business firms then everything is reverted

back into the system. However, the consumers do not always spend all the income they

received. A portion of the income is saved. This amount saved is not returned into the

system. Thus, savings have the effect of decreasing the level of economic activity in the

flow. Savings constitute the first outflow from the stream.

The existence of the government in the model shows that from the income derived

by the consumers, a portion of it goes to the government in the form of taxes. Taxes lessen

the disposable income of the consumers thereby decreasing the amount for spending. Taxes

therefore decrease the level of economic activity and constitute the second outflow.

When we import foreign goods and services, such amount paid flowed out of the

system. Hence, imports lessen the economic activity and constitute the third outflow.

If there is a continuous outflow in the economy, recession sets in and eventually led

to depression. Siphoning back the lost funds can offset this situation. When consumers save,

normally in banks, such amount can be reverted back to the system if the banks will invest

such funds. Banks can lend the said funds to the business sectors so that the latter will have

money to produce goods and services. If investment is equal to savings, it offsets the

outflow caused by the savings of consumers.

When the government collects taxes, these are used to defray expenses such as

infrastructure, social services, education, etc. In doing so, the amounts are spent back into

the system and offset the outflow in the form of taxes.

When the Philippines imports goods, it expects that other countries reciprocate by

buying our goods. When these countries buy our goods, funds flow back into the system.

Hence, export offsets import.

Equilibrium condition: Outflows = Inflows

Leakages = Injections

S + T + M = I + G + X

When the outflow equals the inflow, the level of economic activity is maintained.

An excess inflow over the outflow results to expansionary. A contracting economy follows

if the outflow exceeds the inflow. Manipulating the outflow and inflow can affect the level

of economic activity. However, the outflows are difficult to control because they are

dependent on income. When income increases, savings, taxes and imports tend to increase

too. In contrast, inflows are easier to manipulate. Therefore, proper government policy can

encourage exports and investments.

In order to manipulate the inflows and outflows, various policies can be

implemented. Monetary policy can affect savings and investment. Fiscal policy can control

taxes and government expenditures. While, trade policy can affect the country’s exports and

imports.

Economic Growth and Business Cycles

No economy can sustain growth and development over a long period of time. This

is because every business is affected by various factors classified as:

1. Exogenous – These are forces outside the economic system like natural

calamities, political crisis, wars or technological changes. No economy can

sustain development if natural calamities, war or any exogenous factors hits the

country.

2. Endogenous – These are forces within the economic system like multiplier,

accelerator, monetary policies or innovations.

The Human Development Index (HDI) is a composite measurement introduced by Pakistani

Economist Mahub Ul-Haq in 1990 that quantifies the average well-being of people in a

given country. It consists of three dimensions: Life expectancy at birth, Expected years of

schooling for children and mean years of schooling for adults, and Gross National Income

per capita. These dimensions provide a comprehensive assessment of human development

beyond economic measures like gross domestic product per capita. The HDI helps analyze

the relationship between financial and social progress, identifies areas that need attention,

and provides quantitative evidence for discussions on social justice.

You might also like

- Republic of The PhilippinesDocument9 pagesRepublic of The PhilippinesRay PopNo ratings yet

- Mb1102 Me - U IV - Dr.r.arunDocument24 pagesMb1102 Me - U IV - Dr.r.arunDr. R. ArunNo ratings yet

- Economic Growth & GDPDocument5 pagesEconomic Growth & GDPDhruv ThakkarNo ratings yet

- Note 5Document4 pagesNote 5nobelynalimondaNo ratings yet

- Eco 316Document36 pagesEco 316Amarin MdNo ratings yet

- Economic Development PDFDocument12 pagesEconomic Development PDFSharib KhanNo ratings yet

- Online Quiz 1Document2 pagesOnline Quiz 1Mary Antonette LastimosaNo ratings yet

- Economic GrowthDocument5 pagesEconomic GrowthMay Fleur MayaoNo ratings yet

- PAKISTAN Gross Domestic ProductDocument34 pagesPAKISTAN Gross Domestic ProductAsad MuhammadNo ratings yet

- Umer Mid EcoDocument4 pagesUmer Mid EcoMalik NoraizNo ratings yet

- ECODocument5 pagesECOMasum Kaijar BiswasNo ratings yet

- Macro Economics AssignmentDocument20 pagesMacro Economics AssignmentSWAPNIL GUPTANo ratings yet

- Income WelfareDocument14 pagesIncome WelfareAie GeraldinoNo ratings yet

- Untitled DocumentDocument9 pagesUntitled DocumentBuilt DifferentNo ratings yet

- What Is Capital FormationDocument13 pagesWhat Is Capital FormationWanderer leeNo ratings yet

- BE2 Economic Environment V1.2Document98 pagesBE2 Economic Environment V1.2Mrutyunjay SaramandalNo ratings yet

- KogyiDocument5 pagesKogyiDr.NayNo ratings yet

- MACROECONOMICS: KEY ISSUESDocument71 pagesMACROECONOMICS: KEY ISSUESBhavani venkatesanNo ratings yet

- Urban PLanning NotesDocument22 pagesUrban PLanning NotesCarlo CapiliNo ratings yet

- Comparison of Emerging Economy Through Macro Economy IndicatorsDocument29 pagesComparison of Emerging Economy Through Macro Economy Indicatorssarangk87No ratings yet

- The Circular Flow of Economic Activities (Bulayo and Galanta)Document7 pagesThe Circular Flow of Economic Activities (Bulayo and Galanta)bulayoashleyNo ratings yet

- My Lecture NotesDocument67 pagesMy Lecture NotesAnil Naraine0% (1)

- BE2 Economic Environment V1.2Document96 pagesBE2 Economic Environment V1.2Husain BohraNo ratings yet

- ADBI4201.420032_044325158(2)Document5 pagesADBI4201.420032_044325158(2)Muhammad IzzaibNo ratings yet

- What is Capital Formation and How Does it Impact Economic GrowthDocument13 pagesWhat is Capital Formation and How Does it Impact Economic GrowthWanderer leeNo ratings yet

- Macroeconomics (106) ExplainedDocument30 pagesMacroeconomics (106) ExplainedSahil RajputNo ratings yet

- What Is Suppressed InflationDocument4 pagesWhat Is Suppressed InflationDrRishikesh KumarNo ratings yet

- Economic Growth & Development StructureDocument33 pagesEconomic Growth & Development Structuremusinguzi francisNo ratings yet

- Economic GrowthDocument7 pagesEconomic GrowthZunaira SafdarNo ratings yet

- FOB AssignmentDocument7 pagesFOB AssignmentOtoshi AhmedNo ratings yet

- Macroeconomics-I final Eddited handout-1Document109 pagesMacroeconomics-I final Eddited handout-1lemma4aNo ratings yet

- Unit 2Document14 pagesUnit 2sonika7No ratings yet

- A Assignment ON "Trade Off Between Inflation & Unemployment"Document9 pagesA Assignment ON "Trade Off Between Inflation & Unemployment"parikharistNo ratings yet

- Macroeconomics and Micro EconomicsDocument8 pagesMacroeconomics and Micro EconomicsDeepanshi PNo ratings yet

- Economic Growth: Economic Growth Is A Term Used To Indicate The Increase of Per Capita Gross Domestic ProductDocument3 pagesEconomic Growth: Economic Growth Is A Term Used To Indicate The Increase of Per Capita Gross Domestic Productram1986_ramdasNo ratings yet

- INFOLINK COLLEGE (Public Finance)Document138 pagesINFOLINK COLLEGE (Public Finance)arsen lupin100% (1)

- Chapter-One Overview of Public Finance & TaxationDocument211 pagesChapter-One Overview of Public Finance & Taxationarsen lupinNo ratings yet

- BCM 221 - Macroeconomic I (Notes)Document214 pagesBCM 221 - Macroeconomic I (Notes)Anonymous UybMZYTNo ratings yet

- Macroeconomics Assignment #1: Name EnrollmentDocument5 pagesMacroeconomics Assignment #1: Name EnrollmentSajida HussainNo ratings yet

- Hitesh Tandon Bitm Macroeconomics NotesDocument15 pagesHitesh Tandon Bitm Macroeconomics Notesshubham chatterjeeNo ratings yet

- Macroeconomic PrinciplesDocument128 pagesMacroeconomic PrinciplesTsitsi Abigail100% (2)

- Backup of Economic Readings SummaryDocument21 pagesBackup of Economic Readings Summarybenicebronzwaer0No ratings yet

- Indian Economy NotesDocument10 pagesIndian Economy NotesAbhishek Verma93% (14)

- National IncomeDocument129 pagesNational IncomeBabli PattanaikNo ratings yet

- SummaryDocument59 pagesSummaryNefta BaptisteNo ratings yet

- Introduction to Macroeconomics: Understanding Aggregates and the Economy (ECON605Document58 pagesIntroduction to Macroeconomics: Understanding Aggregates and the Economy (ECON605Divyankar VarmaNo ratings yet

- Chapter 1 - Public FinanceDocument7 pagesChapter 1 - Public FinancePeter DundeeNo ratings yet

- National Income: Understanding a Country's WealthDocument25 pagesNational Income: Understanding a Country's WealthSivaramkrishnanNo ratings yet

- Aggregate Demand vs Supply: Fiscal vs Monetary PoliciesDocument3 pagesAggregate Demand vs Supply: Fiscal vs Monetary PoliciesKumaingking Daniell AnthoineNo ratings yet

- Q. 1 Construct A Simplified Model of An Economic System and Explain The Circular Flow of Income. AnsDocument17 pagesQ. 1 Construct A Simplified Model of An Economic System and Explain The Circular Flow of Income. AnsMuhammad NomanNo ratings yet

- MDI GWPI Prep - Monetrix ChapterDocument22 pagesMDI GWPI Prep - Monetrix ChapterAnand1832No ratings yet

- Indicators of Economic Growth LEEBDocument12 pagesIndicators of Economic Growth LEEBNischay RathiNo ratings yet

- Introduction To Macroeconomics Basic Concepts and Scope of Macroeconomic Analysis What Is Macroeconomics?Document53 pagesIntroduction To Macroeconomics Basic Concepts and Scope of Macroeconomic Analysis What Is Macroeconomics?ZAKAYO NJONYNo ratings yet

- Backup of Backup of Economics Lesson 23Document66 pagesBackup of Backup of Economics Lesson 23benicebronzwaer0No ratings yet

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

- Unit 5me (New)Document6 pagesUnit 5me (New)Anuj YadavNo ratings yet

- Week 2 - Scientific ApproachDocument37 pagesWeek 2 - Scientific ApproachChristopher DacatimbanNo ratings yet

- 3 1 The Level of Economic ActivityDocument75 pages3 1 The Level of Economic ActivityMohammad Farhan NewazNo ratings yet

- Circular Flow of IncomeDocument32 pagesCircular Flow of IncomeTarun SukhijaNo ratings yet

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- FINMAN NOTES MIDTERMDocument20 pagesFINMAN NOTES MIDTERMshadowlord468No ratings yet

- Dsa 102 Lesson 4Document29 pagesDsa 102 Lesson 4shadowlord468No ratings yet

- Dsa 102 Lesson 3Document12 pagesDsa 102 Lesson 3shadowlord468No ratings yet

- Lecture 9Document7 pagesLecture 9Shawn PeridoNo ratings yet

- Corporate Governance, Business Ethics, Risk Management and Internal ControlDocument18 pagesCorporate Governance, Business Ethics, Risk Management and Internal ControlArnel John Mabalot NayraNo ratings yet

- GBRICK NOTESDocument25 pagesGBRICK NOTESshadowlord468No ratings yet

- GBRICK NOTEDocument13 pagesGBRICK NOTEshadowlord468No ratings yet

- Ite Lesson 1Document25 pagesIte Lesson 1shadowlord468No ratings yet

- Lesson 5 ActivitiesDocument1 pageLesson 5 Activitiesshadowlord468No ratings yet

- LESSON7Document9 pagesLESSON7Ira Charisse BurlaosNo ratings yet

- A Study of Factors Influencing Maladaptive Behaviour Among High School StudentsDocument13 pagesA Study of Factors Influencing Maladaptive Behaviour Among High School StudentsNovitha LatumahinaNo ratings yet

- Curriculum Map - Math 6 q3Document3 pagesCurriculum Map - Math 6 q3Dhevy LibanNo ratings yet

- MC BabbiDocument1 pageMC BabbiKiran BogamNo ratings yet

- Organisational Development Intervention Selection and DesignDocument13 pagesOrganisational Development Intervention Selection and DesignvkavijithNo ratings yet

- Civil Engineer resume with structural design experienceDocument6 pagesCivil Engineer resume with structural design experiencePalencia CharlesNo ratings yet

- Random WordsDocument3 pagesRandom WordsRezzonico Dal Canton TicinoNo ratings yet

- Childhood and Adolescence DisordersDocument28 pagesChildhood and Adolescence DisordersFfahima M Khann100% (1)

- 476-Article Text-1973-2-10-20201024Document13 pages476-Article Text-1973-2-10-20201024MUTIARA ARIANINo ratings yet

- Rizal Family Childhood EducationDocument27 pagesRizal Family Childhood EducationPb CunananNo ratings yet

- LESSON PLAN FOR ROOMS AND PARTS OF THE HOUSEDocument8 pagesLESSON PLAN FOR ROOMS AND PARTS OF THE HOUSEJohn RamirezNo ratings yet

- Algorithms Abstractions and Iterations Teaching Computational Thinking Using Protein Synthesis TranslationDocument9 pagesAlgorithms Abstractions and Iterations Teaching Computational Thinking Using Protein Synthesis TranslationGülbin KiyiciNo ratings yet

- Judy Lever-Duffy and Jean McDonald - Teaching and Learning With Technology (What's New in Instructional Technology) - Pearson (2017)Document9 pagesJudy Lever-Duffy and Jean McDonald - Teaching and Learning With Technology (What's New in Instructional Technology) - Pearson (2017)SILVIANANo ratings yet

- Your Order Receipt: We Have Received Your Order. Order Date: Oct 22, 2019 Order Number: WEB70000018405360Document1 pageYour Order Receipt: We Have Received Your Order. Order Date: Oct 22, 2019 Order Number: WEB70000018405360maxgospel1983No ratings yet

- Infants Toddlers and Caregivers A Curriculum of Respectful Responsive Relationship Based Care and Education 11th Edition Gonzalez Mena Test BankDocument16 pagesInfants Toddlers and Caregivers A Curriculum of Respectful Responsive Relationship Based Care and Education 11th Edition Gonzalez Mena Test Bankdonalddodsondmtyacjins100% (38)

- Qualitative and Quantitative Analysis: Spotlight OnDocument1 pageQualitative and Quantitative Analysis: Spotlight OnSachitNo ratings yet

- Mother Tongue - 3 PagesDocument4 pagesMother Tongue - 3 PagesLyn D BreezyNo ratings yet

- BIOL240W SyllabusDocument7 pagesBIOL240W Syllabusmittal8003804No ratings yet

- Essay Comparison - IELTS 8.0 vs. 9.0Document2 pagesEssay Comparison - IELTS 8.0 vs. 9.0Emad MerganNo ratings yet

- Long Answer Questions (With Solutions) - The Road Not Taken Class 9 NotesDocument7 pagesLong Answer Questions (With Solutions) - The Road Not Taken Class 9 NotesDeb Kumar SarkarNo ratings yet

- Daily Lesson Plan on Thesis StatementsDocument4 pagesDaily Lesson Plan on Thesis StatementsKanon NakanoNo ratings yet

- Mahamat: Parin, Jana Cloydine M. 20190119336Document11 pagesMahamat: Parin, Jana Cloydine M. 20190119336alliyah dale tayactacNo ratings yet

- Classroom Management PhilosophyDocument4 pagesClassroom Management Philosophyapi-530667949No ratings yet

- Cambridge Primary Science 6 (TR Resource)Document66 pagesCambridge Primary Science 6 (TR Resource)Mie Nge71% (7)

- Selçuk University 2020 - 2021 Academic Year International Student Admission (SÜYÖS-2020) Additional Placement Application GuideDocument21 pagesSelçuk University 2020 - 2021 Academic Year International Student Admission (SÜYÖS-2020) Additional Placement Application GuideDeni PanduNo ratings yet

- BGC FormDocument12 pagesBGC FormHoly ReaperNo ratings yet

- Approaches of Educational TechnologyDocument7 pagesApproaches of Educational TechnologySalma Jan100% (1)

- Fsa Lesson Plan-Kelly and AmeliaDocument5 pagesFsa Lesson Plan-Kelly and Ameliaapi-574938315No ratings yet

- WEEK 15 Legal Bases of MTBMLE PDFDocument8 pagesWEEK 15 Legal Bases of MTBMLE PDFJM PascualNo ratings yet

- Brochure Of64th Course - FinalDocument4 pagesBrochure Of64th Course - FinalJyoti Arvind PathakNo ratings yet

- Biology WaecDocument37 pagesBiology WaecPascal JohnsonNo ratings yet