Professional Documents

Culture Documents

Nationalization of Banks in India - Shrikrishna A. Pandit (1973)

Uploaded by

Abhinav Singh0 ratings0% found this document useful (0 votes)

2 views6 pagesOriginal Title

Nationalization of Banks in India -- Shrikrishna a. Pandit (1973)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views6 pagesNationalization of Banks in India - Shrikrishna A. Pandit (1973)

Uploaded by

Abhinav SinghCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

Shrikrishna A.

Pandit

The author outlines the principal

objectives of the nationalization

of major commercial banks

in India, discusses its progress

Nationalization

of Banks

to date and the various

supporting steps, and visualizes

the economic and political

implications of this important

socialistic measure. in India

32

©International Monetary Fund. Not for Redistribution

o n July 19, 1969, the Government of nationalized was discriminatory and, there- per annum and/or 30-year securities at

India nationalized 14 large commercial fore, unconstitutional. The Court also de- 5Y2 per cent. Two banks chose to receive

banks. This was not the first nationalization clared invalid the principle and method the payment in cash, and the others partly

measure aimed at the banking system or prescribed for compensation payment to in cash and partly in securities. The entire

the financial institutions of India, for in the nationalized banks, namely, a sum compensation has already been paid, and

1949 the partly private and partly govern- equal to the total assets of each banking it totaled about Rs 0.87 billion, equivalent

ment-owned. Reserve Bank was fully na- company minus its total liabilities. Follow- to slightly more than three times their

tionalized, followed by the nationalization ing this decision, however, the Government aggregate paid-up capital of Rs 0.28 bil-

in July 1955 of the Imperial Bank, the enacted a new Nationalization Law without lion. The ratios of compensation payments

largest commercial bank in India, and of the previous clauses which the Court had to the paid-up capital of the 14 banks

245 life insurance companies in September found objectionable. The new law per- varied from 154 per cent to 510 per cent.

1956. Certain other sectors of the economy mitted the former banking companies con- The compensation was paid to the banks

had also been nationalized, such as railway cerned to engage in new banking business and not directly to the individual share-

transport, air transport, and intercity bus again, and instead of laying down any new holders of each bank.

transport in many States. compensation formula prescribed specific

The nationalization of the 14 banks in compensation payments to each of the

1969 was, however, far more important nationalized banks. OBJECTIVES AND PROGRESS

than any previous acts of nationalization

in that it has had considerable sociopolitical Banks Covered by the Act The avowed objectives of the bank

consequences and signaled a definite turn The 14 banks that were nationalized nationalization legislation were to "control

in the Government's economic policies. were selected on the basis that each of the heights of the economy and to meet

This is primarily because, unlike the Re- them had a total deposit business in ex- progressively, and serve better, the needs

serve Bank and the former Imperial Bank cess of Rs 500 million (i.e., about US$67 of development of the economy in con-

that were partly state-owned prior to their million, at the then prevailing exchange formity with national policy and objec-

full nationalization, the newly nationalized rate of US$1 = Rs 7.5) as of the last tives." These objectives did not in them-

banks were formerly fully privately owned, Friday of June 1969; the largest of these selves represent any new radicalism in the

and there was a long-standing public de- banks had a deposit business of Rs 4.33 Government's thinking in this field, for,

mand for their nationalization; the ruling billion. Their aggregate volume of deposits toward the end of 1967, the Government

political party in India had for many years on the eve of nationalization totaled had already introduced a more or less

been promising action in this field. Con- Rs 26.26 billion, which was equivalent to similarly motivated scheme of social con-

sequently, when these banks were finally 56 per cent of the total deposit business of trol over the banks which was later given

nationalized, the move was widely ac- all the commercial banks in India. Together a legal framework under the Banking

claimed as offering convincing proof to the with the previously nationalized Imperial Laws Amendment Act, 1968. That scheme

people of the Government's commitment Bank, renamed the State Bank of India, envisaged a purposive distribution of avail-

to its pledge of following a socialistic pro- which with its seven subsidiaries had a able credit and more effective mobilization

gram of economic development. Keeping network of 2,509 bank offices and total of savings. For this purpose, a high-level

to this pledge, in May 1971 the Govern- deposits of Rs 12.48 billion, these 14 body, the National Credit Council, was

ment nationalized the general insurance banks accounted for about 85 per cent set up in February 1968 to assess the

business and a part of the import trade, of the commercial bank deposit business demand for bank credit and determine pri-

and since then the copper industry and in the country. The banks that still re- orities in its allocations, and to coordinate

one of the two largest iron and steel mained in the private sector numbered 76 the lending and investment policies of the

enterprises in the country. Further, the with total deposits of Rs 8.09 billion, in- commercial banks with those of other

Finance Minister of India has announced cluding 15 foreign banks with a business financial institutions. Further, under the

that before long several key industries in of Rs 4.82 billion and 61 Indian banks amended Bank Law, the Boards of Direc-

India will also be added to the public with a business of Rs 3.27 billion. The tors of various banks were reconstituted

sector. In particular, in July 1972, the foreign banks were not nationalized on so as to improve the efficiency of bank

Minister for Foreign Trade said that within the grounds that they were engaged in the operations and reduce the power exercised

two years the entire jute trade and about specialized business of facilitating foreign by the directors representing large trading

95 per cent of the import trade would be trade and tourism, and constituted a part and industrial interests in formulating bank

nationalized. of international banking facilities, and that policies.

their nationalization could have created The social control scheme was, how-

Legal Challenge an unfavorable climate for the continued ever, judged by the authorities to be inade-

inflow of the much needed foreign capital quate to achieve the desired results with

Unlike the previous nationalization (loans and investments) into India. sufficient promptitude. The Government

measures, the nationalization of the major came to the conclusion that, in the words

commercial banks in 1969 did not have a Compensation to Nationalized of Indian Prime Minister, Indira Gandhi,

smooth passage in its early stages. Thus, Banks "it is widely recognized that the operations

within six months after the nationalization, of the banking system should be informed

The bank nationalization law required

the Supreme Court of India declared the that the compensation to each bank be by a larger social purpose and be subject

Nationalization Act unconstitutional on paid within two months of the date the to close public regulation . . . (and) that

two grounds. First, the Court held that the banking company asked for it. The com- the desired regulation and rate of progress

prohibition imposed by the act on the panies were given a choice of receiving the (of banking business) consistent with the

former owners of the nationalized banks Compensation either fully in cash, or partly urgency iof our problems could be secured

from engaging in banking business but not in cash and partly in 10-year central gov- only through nationalization." The notion

on the banking companies that were not ernment securities at 4J/2 per cent interest of a "larger social purpose" injected in the

33

©International Monetary Fund. Not for Redistribution

motivation for bank nationalization was Concerning the objective of promoting and banking in the country could best be

aimed principally at ensuring that the a wider dispersal of credit, the banks, achieved by taking into account the differ-

banks would play an increasingly impor- both in the public sector and the private ing local conditions in various parts of the

tant role in promoting productive activities sector, were especially instructed to cater country. That study group, under the

on the part of vast masses of the people to the needs of the so-called priority sec- chairmanship of the late Professor D. R.

that would be conducive to a substantial tors that had been generally neglected: Gadgil, a former Deputy Chairman of

growth of employment opportunities. This agriculture, small industries, retail trade India's Planning Commission and an emi-

is very important in view of the gravity of and small businessmen, small local road nent economist with keen insight into

India's unemployment and underemploy- transport operators, professional and self- India's rural economic problems, urged an

ment situation. The "social purpose" also employed persons, and persons desirous "area approach" in this context, with the

involved preventing excessive channeling of receiving higher education. The appre- further suggestion that the administrative

of bank funds to large borrowers and the ciable success achieved in realizing this unit "district" be taken as the nucleus of

possible use of credit for speculative and goal is evidenced by the growth of about this approach, especially since most sta-

other unproductive purposes. 138 per cent in public sector bank credit tistical data in India were collected on

The Government intends to achieve the to these priority sectors during the 3-year a district basis. After a further examina-

broad aims of bank nationalization through period ended June 1972, compared with tion of these proposals and similar recom-

a two-pronged approach: one, expanding an expansion of 54 per cent in total bank mendations of a special committee of

the banking network in all parts of the credit (Table B). As a result, the share of bankers, the Reserve Bank formulated the

country with special emphasis on setting credit to the priority sectors in total bank LBS. Under this scheme, all the adminis-

up adequate banking facilities in the hith- credit rose from 15 per cent to 23 per cent trative districts in India (335), excluding

erto unbanked or underbanked areas; and during this period. only such urban centers as Bombay, Delhi,

two, making bank credit available to all Calcutta, Madras, Chandigarh, and Goa,

segments of the economy and regions of have been allotted for banking develop-

SUPPORTING MEASURES ment to the State Bank group (89 dis-

the country. It is, of course, too early as

yet to evaluate the success achieved in both tricts), 14 other nationalized banks (250

these respects. However, it is clear that The success of the banking system in districts), and three private banks (9 dis-

considerable progress has already been India during the past three years in ex- tricts). The banking development in cer-

made. Thus, in the three-year period ended panding the branch network and in effect- tain districts has been entrusted to two

June 1972, the newly nationalized banks ing a wider dispersion of credit activities Lead Banks working together. In allotting

set up 3056 new bank offices (Table A). could not have been achieved by mere these districts, the size and existing re-

In addition, the State Bank group and the nationalization of the major banks in the gional orientation of each bank was taken

nonnationalized banks have also opened absence of several concerted and purpose- into account. Also, care was taken to

during the same period a large number of ful supporting steps taken by the Govern- ensure that banking development in every

offices, primarily at the urging of the ment and the Reserve Bank. In a sense the state of India would be entrusted to more

Government, in different parts of the coun- objectives of bank nationalization could be than one Lead Bank, and that every Lead

try. The total number of new bank offices said to have made the introduction of Bank would operate in more than one

opened by all banks during the three years these steps (described below) imperative. state. The Lead Bank does not have a

ended June 1972 was 5,358, compared monopoly over banking business in the

Lead Bank Scheme districts allotted to it. However, it acts as

with only about 4,000 offices established

in the 22 years prior to bank nationaliza- One of the most important supporting the leader of all the other banks in those

tion. Of the total number of new bank measures was the introduction of a Lead districts, works closely with them and the

offices, as many as 3,416 have been located Bank Scheme (LBS) by the Reserve Bank other financial institutions in the area and

in December 1969. This was a sequel to area government authorities, and jointly

in previously unbanked areas, so that by

now only a few areas with populations in the recommendation by a study group sponsors the banking development of those

excess of 10,000 remain without any bank- appointed by the National Credit Council districts so as to help in their overall eco-

ing facilities. Further, as a result of the to the effect that the development of credit nomic development. In connection with

deliberate policy of spreading the banking

facilities to the rural areas, the ratio of

bank offices in such areas to the total num-

ber of offices in the whole country rose

from 22 per cent in June 1969 to 39 per

cent in June 1972. The expansion in the

banking network resulted in a sharp reduc-

tion, during the three-year period under re-

view, in the ratio of population served by

the banks from one bank office per 65,000

persons to one office per 40,000 persons.

Further, in addition to the new regular Shrikrishna A. Panditit.

bank offices opened, many banks, mainly who is a Ph.D. of Bombay University, joined the

the newly nationalized banks, have orga- staff of the Fund in 1949 and is now in the

nized a large number of mobile banking Asian Department.

units to serve mainly the rural areas, and

set up banking facilities in various fac-

tories, offices, schools, and colleges to help

spread the banking habit.

34

©International Monetary Fund. Not for Redistribution

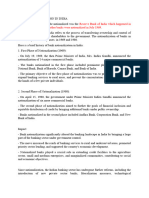

the latter objective, the Lead Bank, in

cooperation with other institutions and Table a.

local authorities, is required to integrate Growth of Bank Brandies Since July 1969

the credit business in each district with

oher economic activities in that district, Number of Bank Offices Increases During

such as production and marketing. One as of July 1969-

of the immediate tasks given to all the June 1969 June 1972 June 1972

Lead Banks was to make initial surveys

of the credit needs and potential of the Scheduled banks 8,045 13.515 5.470

14 newly nationalized banks 4,1. 7.189 3.505

districts allotted to them. At the same State Bank group 2,462 9.358 1.496

time, however, the Lead Banks were also Other banks 1,4. 2.368 9188

to be active from the very beginning in Nonscheduled banks 217 105 918-112

Total 8,262 13.620 5.3538

their other assignments, especially in estab-

lishing new bank offices. The success of Of which:

the LBS can be seen from the completion in rural centers 1,8. 5.267 3.435

semiurban centers 3,322 4.351 1.02999

of the initial credit surveys in some 260 urban areas 1,4. 1.916. 469.4

districts by the end of June 1972 and by metropolitan/port towns 1,6. 2.0866 4255

the large number of new bank offices

established and the wider credit distribu- table B.

tion achieved, as mentioned above. ' Growft of Public ^tor tank Credit Since July 1969

Credit Guarantee for Small Loans Outstanding Amount Percentage Increase

(billions of rupees) as of During

While the authorities instructed the June 1969 June 1972 July 1969- June 1972

banks to step up credit extension to bor-

rowers in the hitherto neglected sectors, Credit to priority sectors 4.3 10.47 138

they realized that such activities involved Agriculture 1.7 3.80 122

considerable credit risks which the banks

Small-scale industries 2.3 5.23 119

Other priority sectors 0.2 1.44 397

could not readily undertake without seri- Credit to otter sectors 25.. 34.99 39

ous financial implications. The national- Total bank credit 29.54 45.46 54

ized banks as well as the banks left in the

Source: Reserve Bank of India, Annual Report and Trend and Progress of Banking in

private sector had therefore to be provided »«««, 1971 MNfcflttHk.

adequate cover against such credit risks.

For bank credit to small-scale industries,

a guarantee scheme providing some cover

had already been initiated as far back as New Guidelines for the Banks needs of the hitherto neglected areas and

July 1960, and the Reserve Bank, desig- In order to facilitate the implementa- sectors and actively to solicit credit de-

nated as the "Guarantee Organization," tion by the commercial banks, particularly mand from them, and, second, to shift

had been operating this scheme as the the public sector banks, of the principal the emphasis in bank lending from pri-

agent of the Government of India. Fol- objectives of the nationalization of banks, marily the creditworthiness of the bor-

lowing the nationalization of banks; this the Government and the Reserve Bank rowers to the creditworthiness of the proj-

scheme was amended and enlarged effec- have, after a careful study, prescribed for ects for which credit is sought. Previously

tive February 1, 1970. the banks several useful guidelines for under the pattern evolved over several

While the need for guaranteeing the conducting their activities. In connection decades, only the economically better-off

credits extended to small-scale industries with one of these objectives, namely, the and well-organized trading and industrial

had thus been met, it was considered nec- expansion and wide diffusion of the bank- interests in urban areas, especially metro-

essary to initiate a separate guarantee ing network, the guidelines have consisted politan centers, in relatively more pros-

scheme for credits of even smaller individ- primarily of the setting up of annual tar- perous regions of the country had secured

ual denominations to be given to borrow- gets for the establishment of new branch the bulk of bank credit, which was also in

ers in the hitherto neglected sectors. For bank offices and their distribution by excess of their share in total deposit busi-

this purpose, the Government set up a regions and according to an economic ness of the banks. The new guidelines are

new public limited company, the Credit geographical scatter pattern (rural, semi- aimed at bringing about an almost revolu-

Guarantee Corporation of India, Ltd., with urban, urban, etc., and banked, centers and tionary change in this pattern, though in

an authorized capital of Rs 100 million, underbanked or unbanked centers). With a well-regulated manner. Hence, the main

of which Rs 20 million has already been regard to the banks' credit activities, the thrust of these guidelines was to ask the

paid up (60 per cent by the Reserve Bank, guidelines have been more important and banks to provide credit for all activities

and the rest by the scheduled banks in more numerous, and also in many cases with considerable employment potential

both the public and private sectors). This quite specific. Most of these relate to the regardless of the meager collateral that the

scheme, which came into operation on more active role that the banks are now would-be borrowers wanting to undertake

April 1, 1971, covers small loans and required to play in supplying credit to the such activities could put up.

other credit facilities extended by the Among the more specific guidelines,

hitherto neglected geographical areas and those spelled out in considerable detail

scheduled commercial banks to transport

operators, retail traders, dealers in fer- economic sectors. relate to the credit for agriculture. The

tilizers, professional and self-employed The two most important guidelines in banks have been asked to consider that

persons, other business enterprises, and this connection are that the banks have their main objective in lending to agricul-

farmers. been asked, first, to estimate the credit ture should be to encourage the farmers

35

©International Monetary Fund. Not for Redistribution

to adopt improved farming practices and to look after various interests. These spe- ber of bank branches throughout the

"thus to move to a higher technological cial Committees and the Custodians are country and the sizable increase in credit

plane of activity." They have also been expected to be replaced soon by new to various hitherto neglected sectors of

instructed to make adequate amounts of boards under a scheme that was enacted the economy indicate that appreciable

credit available to the cultivators at the in December 1970. The scheme provides progress has been made in implementing

right time, to keep in close touch with the for a 15-member Board of Directors, to the main objectives of the nationalization

borrowers in order to facilitate loan recov- consist of two full-time directors to be of the major banks in India, despite some

ery and to inculcate in them the habit of appointed by the Government, one of important constitutional obstacles in the

making timely debt repayment, and to whom will be the Managing Director, and initial stages, and without impairing the

promote savings habits among the bor- 13 part-time members including two rep- financial efficiency of the banks. These

rowers through developing a mechanism resentatives of bank employees, one repre- achievements are a reflection of the de-

linking credit given to the farmers with sentative each of the Government of India termination of the authorities to pursue

their deposits with the banks. Finally, the and the Reserve Bank, one director each steadfastly the objectives of bank nation-

banks have been urged to move into some to represent the interests of agriculturists, alization, and of the several supporting

of the even more remote rural areas, the working class, artisans, and bank measures that have been adopted.

although there may be few or no appropri- depositors, and five other members, with The success achieved so far by the

ate intermediaries in those areas on which specialized knowledge in the banking field. nationalized banks and the good prospects

the banks could lean. for further progress will have some impor-

Financial Position tant economic and social implications. In

Management The nationalization of the major banks the first place, there is expected to develop

In the initial stages, the Boards of Direc- has not apparently had any adverse im- a close coordination at many different

tors of the 14 nationalized banks were pact on their financial efficiency as some levels between the public sector banks and

abolished and in their place the Govern- critics had feared. In fact, during 1970 the other credit and financial institutions

ment appointed new Custodians of the and 1971, the financial position of the in the country which is so important for

banks who, incidentally, in all instances banks showed some improvement despite the success of overall credit planning in

were the former Chairmen of those Boards. the heavy initial expenses involved in the India. Second, bank branch expansion

These Custodians were, however, in- opening of numerous new bank offices should help considerably in mobilizing

structed by the Government to follow and the substantial increase in credit to savings, compensating to some extent for

strictly the guidelines laid down by the the small sectors. Aggregate net profits of the relatively low rates of interest on sav-

Government and/or the Reserve Bank for these banks in 1970 and 1971 were Rs ings deposits in India. It is also likely to

conducting their operations. Subsequently, 69 million and Rs 85 million—appreciably help expedite the monetization of the still

in July 1970, in addition to the Custo- higher than the 1969 figure of Rs 58 mil- nonmonetized segments of the economy,

dians, the Government appointed special lion. and reduce the present heavy dependence

Management Committees for all these of these sectors on the moneylenders in

banks composed of the nominees of the Concluding Observations the unorganized money market. Further,

Reserve Bank, and several other directors The substantial expansion in the num- the increasing flow of substantial amounts

of credits to borrowers in the hitherto neg-

lected small sectors is expected to boost

production; this, in turn, will have a con-

siderable impact on the employment prob-

lem, since it is generally recognized that

the productive activities in the small sec-

tors have a large employment potential

while their individual capital needs are rel-

atively small. As a large proportion of this

employment-creating new productive activ-

ity is likely to be located in areas other

than those of heavy urban concentration,

there will probably be some check on the

excessively rapid pace of urbanization with

all its attendant evils. Credit extension to

small borrowers should also help promote

initiative, confidence, and entrepreneurship

among a growing number of people in all

parts of the country, which is so essential

for the success of the development plans.

Finally, the very fact that, at the express

instructions of the Government, the public

sector banks will be extending the banking

facilities all over the country and advanc-

ing credit to even the small man will help

forge a closer bond between the people

and the Government, which would be an

Papier mache worker: "credit extension to neglected small centers will have a added factor promoting political and social

considerable impact on the employment problem." stability. ED

36

©International Monetary Fund. Not for Redistribution

DILEMMAS OF will be the need for evolution in inter-

national relations—including trade, for-

framework of national development stra-

tegies or programs, providing such strate-

THE DEVELOPING eign investment, international develop- gies and programs are realistically designed

COUNTRIES: ment assistance, and so forth. For

example, more international assistance

and implemented.

Another clear lesson to be drawn from

THE SWORD may be given to projects which create experience is that the advocacy of interna-

OF DAMOCLES employment, improve the income of the

poorest groups, or which ameliorate

tional development assistance must be

based on the realities of the development

(continued from page 15)

urban conditions. process and conditions in the developing

criteria in investment decisions. Without countries. We cannot expect that develop-

this acceptability, investments which To many these suggestions will sound

ment successes will bring with them social

might be attractive on other grounds like counsels of perfection, but they are

harmony or political stability. We cannot

(e.g., the usual cost/benefit grounds) based on actual conditions and the urgent

expect that all or even most judgments

run the risk of being pursued either need for solutions. Our generation has

on development will prove with hindsight

poorly or not at all. Similarly, certain already achieved many things which a

to be the optimal ones. By recognizing

projects are hard to interrupt because generation ago would have been regarded

these facts we can avoid future disillu-

of the large investments involved and as unreal and romantic. Indeed, there are

sionment with current activities and loss of

the resulting loss of substantial sunken signs already that countries, if only out of

credibility in efforts being made. We can

capital if not completed. Governments sheer necessity, are moving in the direction

promise to do most of what we set out to

must, of course, be free to make some advocated herein. We can reduce the num-

do, because experience has indicated that

changes in public expenditures, but too ber and magnitude of future problems by a

development decisions can be implemented

much flexibility can be costly to the willingness to be bold in bringing quali-

effectively. We can point to repeated suc-

development process. tative factors into our decision-making

5. International positions and pros- process, combined with an eagerness to cesses and promise success in the future if

pects must also be clearly understood assess past decisions objectively and take such promises are made with full recogni-

and be reflected in the development new paths as quickly as possible when old tion that success does not mean the elimi-

strategy. Thus, side by side with the decisions prove to be faulty. This requires nation of problems or the achievement of

evolution of new approaches to domestic mechanisms for constantly reviewing de- stability, but rather the generation of new

problems suited to changing conditions, cision. This can take place within the problems requiring new solutions. HD

INCOME DISTRIBUTION less severe income inequalities and more

uniform distribution.

project. From that stage on, the socio-

economic rate of return or benefit-cost

CRITERIA FOR The weights based on the first two meas- ratio can be obtained in the usual way.

THE ANALYSIS OF ures increase as one goes down the income

scale and the weights based on the third

It can be deduced from my discussion of

weighting procedures for developing coun-

DEVELOPMENT and fourth increase the further a country tries that the number of projects to which

PROJECTS departs from the uniform income distribu-

tion. Without understating the complexity

the method suggested in this paper can be

applied will depend on the circumstances

(continued from page 19) of the task, I should assume that it is of the country and the nature of the proj-

down the income scale, because we attach possible to obtain a set of weights that can ect itself. The method is suitable for test-

highest priority (weighting) to improving be applicable to projects in most of the ing the sensitivity of the project to alter-

the incomes of the poor. Other possible developing countries. Furthermore, these native locations in accordance with re-

measures of income inequality on which income-based weights can be modified to gional policies. It is also suitable for test-

a weighting procedure could be based are: take into account other social circum- ing the sensitivity of public expenditure

• The income level below which vari- stances such as regional differences which programs to various degrees of emphasis

ous percentages of a country's agricul- may not be reflected in income disparities. in response to certain' social problems. In

tural families are to be found. The defect of these regional or income- the first case, for most agricultural and

• The share of a country's gross domes- based weights is that they assume con- irrigation projects which have clearly iden-

tic product going to various groups of stant levels of percentage income shares tifiable groups of beneficiaries the method

the population. throughout the life of the project. This is easily applicable. With respect to public

• The "concentration coefficient" (an problem can be taken care of by further expenditure programs, these are usually

index based on the Pareto formula or modification of the weights. allocated to various regions on the basis

its derivative, the Lorenz curve) which of unspecified criteria. The method sug-

measures the extent of departure of Formulation gested here can form a basis for deciding

actual income distribution from an egali- The next step is to multiply the set of the amounts of public expenditure pro-

tarian income distribution. weights by the set of (allocated) costs and grams to be allocated to various regions or

• The extent of dualism in the country, benefits (the highest weights against the sectors depending on the income groups

ranging from a largely agrarian econ- costs and benefits allocated to the lowest largely represented in that region or sector.

omy with an almost negligible monetary income groups). The result is a measure HD

sector to one with a large modern wage of the income distributional effect or In a future article the author proposes

economy. Various intermediate levels equity costs/benefits of the project. This to illustrate the application of the method

can be identified. Countries with a pre- is then added to the other stream of outlined in this article to a study on the

dominantly modern sector tend to have (unweighted) costs and benefits of the location of a major international airport.

37

©International Monetary Fund. Not for Redistribution

You might also like

- A Study On Credit Appraisal Process On Lotak Mahindra Bank (Draft)Document54 pagesA Study On Credit Appraisal Process On Lotak Mahindra Bank (Draft)Rhea SrivastavaNo ratings yet

- Organizational Structure, Development of Banks in IndiaDocument54 pagesOrganizational Structure, Development of Banks in Indiaanand_lamani100% (1)

- Thesis Report of 5 BankDocument180 pagesThesis Report of 5 BankMd KamruzzamanNo ratings yet

- Indian Banking SystemDocument88 pagesIndian Banking SystemAmit ChaudhariNo ratings yet

- Free Credit Score & Free Credit Reports With Monitoring - Credit KarmaDocument18 pagesFree Credit Score & Free Credit Reports With Monitoring - Credit KarmaERVIN CATALANNo ratings yet

- Infographic FIN346 Chapter 5Document2 pagesInfographic FIN346 Chapter 5AmaninaYusri100% (2)

- CBM FinalDocument37 pagesCBM FinalSaili SarmalkarNo ratings yet

- Bank NationalizationDocument16 pagesBank NationalizationIshita DongreNo ratings yet

- 11 - Chapter 4Document34 pages11 - Chapter 4BEPF 32 Sharma RohitNo ratings yet

- Banking Sector ReformsDocument16 pagesBanking Sector ReformsbabuNo ratings yet

- Banking Sector in IndiaDocument99 pagesBanking Sector in IndiaRajesh SaharanNo ratings yet

- Commercial Banking Team ProjectDocument12 pagesCommercial Banking Team ProjectShadab HasanNo ratings yet

- Nationalisation of Banks in IndiaDocument5 pagesNationalisation of Banks in IndiaPravish Lionel DcostaNo ratings yet

- And Long Term" Which Is Accomplished During The Training Bank of Baroda, SME LOANDocument246 pagesAnd Long Term" Which Is Accomplished During The Training Bank of Baroda, SME LOANkanchanmbmNo ratings yet

- Finance in India: Bank of Bengal Bank of Bombay Bank of MadrasDocument14 pagesFinance in India: Bank of Bengal Bank of Bombay Bank of MadrasRohan KhattarNo ratings yet

- 9 Nationalisation of Banks Pros & ConsDocument6 pages9 Nationalisation of Banks Pros & ConsAastha PrakashNo ratings yet

- 12 - Chapter 2 PDFDocument32 pages12 - Chapter 2 PDFManali ShahNo ratings yet

- Banking Final BibliographyDocument93 pagesBanking Final BibliographyDipen AshwaniNo ratings yet

- Commercial Banking System Role of RBI AM ST NcjhaiDocument9 pagesCommercial Banking System Role of RBI AM ST NcjhaiAlimo shaikhNo ratings yet

- Chapter On Banking SectorDocument19 pagesChapter On Banking Sectorvikas jainNo ratings yet

- A Brief History & Development of Banking in India and Its FutureDocument12 pagesA Brief History & Development of Banking in India and Its FutureMani KrishNo ratings yet

- Nationalisation of BanksDocument6 pagesNationalisation of BanksRishit12340% (1)

- 1.bank NationalisationDocument5 pages1.bank Nationalisationsanamja1No ratings yet

- Chapter-1 Introduction 1.1 Introduction About The SectorDocument60 pagesChapter-1 Introduction 1.1 Introduction About The SectorGaurav Goyal100% (2)

- Reform in Banking SectorDocument59 pagesReform in Banking SectorRaKesh KuMarNo ratings yet

- Jemtec School of Law: Role of The Nationalised Banks in Promoting Growth in The Indian EconomyDocument19 pagesJemtec School of Law: Role of The Nationalised Banks in Promoting Growth in The Indian Economynikita jainNo ratings yet

- Bangladesh University of Business and Technology: Assignment On Overview of Banking Sector of BangladeshDocument27 pagesBangladesh University of Business and Technology: Assignment On Overview of Banking Sector of BangladeshRahat KhanNo ratings yet

- Nationalization and PrivirizationDocument5 pagesNationalization and PrivirizationKhawar Hussain100% (1)

- Regulatory Framework For Islamic BankingDocument68 pagesRegulatory Framework For Islamic BankingAllauddinaghaNo ratings yet

- Banking LawDocument75 pagesBanking LawAnchalNo ratings yet

- Agricultural LoanDocument62 pagesAgricultural Loanprasad pawleNo ratings yet

- 10 - Chapter 4Document18 pages10 - Chapter 4Akansha SinghNo ratings yet

- 1.2 An Introduction To Deposit Mobilization Deposit MobilizationDocument3 pages1.2 An Introduction To Deposit Mobilization Deposit MobilizationsahilNo ratings yet

- Banking Sector in India - A ReviewDocument8 pagesBanking Sector in India - A ReviewHarshvardhan SurekaNo ratings yet

- Banking Sector in India - A ReviewDocument8 pagesBanking Sector in India - A ReviewSandeep Singh BhandariNo ratings yet

- Banking Sector in India - A ReviewDocument8 pagesBanking Sector in India - A ReviewSandeep Singh BhandariNo ratings yet

- Bank Nationalisation NewDocument3 pagesBank Nationalisation NewYamuna ViswamNo ratings yet

- Indian Banking Sector ReviewDocument42 pagesIndian Banking Sector Reviewranbir751No ratings yet

- Industry Profile: Indian Banking SystemDocument74 pagesIndustry Profile: Indian Banking SystemSwapnil BalanNo ratings yet

- Industry Profile: Priority Sector Lending & Analysis On Housing FinanceDocument52 pagesIndustry Profile: Priority Sector Lending & Analysis On Housing FinanceManjunath ManjuNo ratings yet

- 4cb2indian Banking SystemDocument12 pages4cb2indian Banking SystemAnkit GodreNo ratings yet

- The Banking SectorDocument76 pagesThe Banking SectorMinal AgrawalNo ratings yet

- Introduction To Banking IndustryDocument35 pagesIntroduction To Banking IndustrySindhuja SridharNo ratings yet

- Law of Banking & NI ActDocument14 pagesLaw of Banking & NI Actikram4qaNo ratings yet

- Project On Credit Scheme Offered by State Bank of India and HDFC Bank in Coimbatore CityDocument63 pagesProject On Credit Scheme Offered by State Bank of India and HDFC Bank in Coimbatore Cityprakalya100% (1)

- Islamic Banking Around The World Islamic Banking in Pakistan Strategy For Eliminating Interest From The EconomyDocument29 pagesIslamic Banking Around The World Islamic Banking in Pakistan Strategy For Eliminating Interest From The EconomyMayra NiharNo ratings yet

- Consolidation in The Indian Financial Sector Shri V. LeeladharDocument17 pagesConsolidation in The Indian Financial Sector Shri V. LeeladharMahalaxmi KrishnanNo ratings yet

- History: Before IndependenceDocument14 pagesHistory: Before IndependenceRI ShawonNo ratings yet

- History of Banking in India: 1) Pre-Nationalization EraDocument7 pagesHistory of Banking in India: 1) Pre-Nationalization EraKoshyNo ratings yet

- BanksDocument120 pagesBankskoshycjNo ratings yet

- Comparative Analysis On Non Performing Assets of Private and Public Sector BanksDocument50 pagesComparative Analysis On Non Performing Assets of Private and Public Sector BanksAvinash AndyNo ratings yet

- Q. 4 There Are Three Different Phases in The History of Banking in India.Document4 pagesQ. 4 There Are Three Different Phases in The History of Banking in India.MAHENDRA SHIVAJI DHENAKNo ratings yet

- Law of BankingDocument68 pagesLaw of BankingSuôn Ly BùiNo ratings yet

- History of Commercial Banking in India: DividendsDocument24 pagesHistory of Commercial Banking in India: DividendsMohan KumarNo ratings yet

- Chapter No .1-Introduction: K.K.H.A. Art S.M.G.L Commerce S.T.H.J. Science Senior College ChandwadDocument43 pagesChapter No .1-Introduction: K.K.H.A. Art S.M.G.L Commerce S.T.H.J. Science Senior College ChandwadganeshNo ratings yet

- Banking Law Unit-III Law of Banking Regulations: Banking Regulation ActDocument7 pagesBanking Law Unit-III Law of Banking Regulations: Banking Regulation ActRishi exportsNo ratings yet

- CSR FinalDocument44 pagesCSR FinalrohanNo ratings yet

- The Indian Banking IndustryDocument28 pagesThe Indian Banking Industrymkesh_k4uNo ratings yet

- Indian Banking HistoryDocument13 pagesIndian Banking Historyraj7670No ratings yet

- 3935cstudy Material On Banking Law 1Document9 pages3935cstudy Material On Banking Law 1NancygirdherNo ratings yet

- Capstone Project PGDM 2992 f3Document12 pagesCapstone Project PGDM 2992 f3pinka02No ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Major Scams in India Since 1947 - A Brief SketchDocument39 pagesMajor Scams in India Since 1947 - A Brief SketchAbhinav SinghNo ratings yet

- Ground Water Resources of Punjab (As On 31st March, 2020)Document111 pagesGround Water Resources of Punjab (As On 31st March, 2020)Abhinav SinghNo ratings yet

- The Substitution of Labour For Capital in Kenyan Manufacturing - Howard Pack (1976)Document14 pagesThe Substitution of Labour For Capital in Kenyan Manufacturing - Howard Pack (1976)Abhinav SinghNo ratings yet

- Transactions Costs Through TimeDocument10 pagesTransactions Costs Through TimeAbhinav SinghNo ratings yet

- Lesson 1 - CFA InstituteDocument14 pagesLesson 1 - CFA InstituteAhadd ViraneNo ratings yet

- Letter of Credit ExplainedDocument6 pagesLetter of Credit ExplainedChux Elumeze0% (1)

- RBL Annexure UpdatedDocument2 pagesRBL Annexure UpdatedAFFII MARKETINGNo ratings yet

- Capital Float (India) New Pitch DeckDocument21 pagesCapital Float (India) New Pitch Deckpushkar royNo ratings yet

- AL - ADALAH: Jurnal Syariah Dan Hukum Islam e-ISSN: 2503-1473 Hal. 73-80 Vol. 1, No. 3, November 2016Document8 pagesAL - ADALAH: Jurnal Syariah Dan Hukum Islam e-ISSN: 2503-1473 Hal. 73-80 Vol. 1, No. 3, November 2016DINDA NUR HALIZANo ratings yet

- Final Internship Report - Amber DasDocument19 pagesFinal Internship Report - Amber DasAmber DasNo ratings yet

- Data Privacy Act NotesDocument6 pagesData Privacy Act NotesRyDNo ratings yet

- TNC Dial For CashDocument3 pagesTNC Dial For CashChaitanya MedipallyNo ratings yet

- தனி வட்டிDocument41 pagesதனி வட்டிAnbuNo ratings yet

- GBL-cases - My DigestDocument14 pagesGBL-cases - My DigestPatricia BautistaNo ratings yet

- Fi&m Chapter 4Document21 pagesFi&m Chapter 4samuel debebeNo ratings yet

- Services For Credit Card: Your DetailsDocument3 pagesServices For Credit Card: Your DetailsMartin GohNo ratings yet

- Report On " Analyzing Financial Status of Three Pharmaceutical Companies"Document26 pagesReport On " Analyzing Financial Status of Three Pharmaceutical Companies"Rahi MunNo ratings yet

- NF 902 PDFDocument5 pagesNF 902 PDFG.C chandrahasreddy0% (1)

- Volume 1, Issue 1 of International Journal of Research in Computer Application & ManagementDocument162 pagesVolume 1, Issue 1 of International Journal of Research in Computer Application & ManagementAnonymous mErRz7noNo ratings yet

- Present and Future Value Project Math 1090Document11 pagesPresent and Future Value Project Math 1090api-260807594No ratings yet

- Study On Efficacy of PSB Loan in 59 MinutesDocument33 pagesStudy On Efficacy of PSB Loan in 59 MinutesNeeraj kumar75% (4)

- R56 Fundamentals of Credit AnalysisDocument23 pagesR56 Fundamentals of Credit AnalysisDiegoNo ratings yet

- Guidance Note On Audit of Banks 2020 PDFDocument732 pagesGuidance Note On Audit of Banks 2020 PDFFinadwisery FinNo ratings yet

- AU 2 I COMPARE Select A Financial Account or ProductDocument5 pagesAU 2 I COMPARE Select A Financial Account or ProductMaria SalinasNo ratings yet

- Financial Management Cia 1 Divyang Agarwal 2023291Document9 pagesFinancial Management Cia 1 Divyang Agarwal 2023291Raj AgarwalNo ratings yet

- Background History of The Development of Credit in The Philippines How Credit Instruments Are NegotiatedDocument33 pagesBackground History of The Development of Credit in The Philippines How Credit Instruments Are Negotiatedelizabeth bernalesNo ratings yet

- Ebrd Risk AppetiteDocument16 pagesEbrd Risk AppetiteleonciongNo ratings yet

- Building Credit From ScratchDocument2 pagesBuilding Credit From ScratchCarolNo ratings yet

- Petition For Writ of Praecipe Against JudgeDocument12 pagesPetition For Writ of Praecipe Against Judgetexrees100% (3)

- LSB2605 Assignment 2 762303 FINALDocument2 pagesLSB2605 Assignment 2 762303 FINALGift MatoaseNo ratings yet

- SBS Rating ForamtDocument1 pageSBS Rating ForamtShubham ChoudharyNo ratings yet

- Funds Transfer & Standing Orders: Click To Edit Master Text Styles Second Level Third LevelDocument154 pagesFunds Transfer & Standing Orders: Click To Edit Master Text Styles Second Level Third Levelhuongdt100% (1)