Professional Documents

Culture Documents

Council Policy: Land Development

Uploaded by

senthilkumar kOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Council Policy: Land Development

Uploaded by

senthilkumar kCopyright:

Available Formats

Council Policy

Land Development

Program Impacted Land Development

Edmonton is developed to support growth and social, cultural, economic and

environmental well-being.

Financial Management

The City of Edmonton's resilient financial position enables both current and

long-term service delivery and growth.

Number C511A

Date of Approval April 25, 2023

Approval History July 13, 2005

Statement

The City of Edmonton, through its involvement in land development activities, is able to develop residential,

mixed-use, commercial and industrial lands to align with The City Plan, ConnectEdmonton and the

Community Energy Transition Strategy.

The City’s land development activities are financially self-sustaining and provide an alternate revenue stream

to the City through annual dividend payments.

The purpose of this policy is to provide clear guidelines for achieving the City’s land development objectives:

● generating revenue and paying a dividend to the corporation;

● creating environmentally sustainable, diverse and inclusive residential communities;

● balancing fiscal sustainability with city-building objectives;

● providing a diversity of housing choices for all Edmonontians; and

● attracting and supporting business and investment.

Program Objectives

1. Residential and mixed-use land development activities will:

a. Create a diverse mix of market rate housing types that encourages inclusive communities; and

Council Policy Number: 511A Page 1

b. Support achieving the City’s affordable housing targets in alignment with Policy C601 Affordable

Housing Investment Guidelines and Policy C437A City Land Assets for Non-Profit Affordable

Housing

2. Industrial land development activities will strive to ensure a continual supply of serviced industrial land

that moves forward the priorities of the City Plan.

3. Land development activities will strategically align with, and balance, the following City objectives:

a. Environmental sustainability and climate resilience;

b. Financial sustainability;

c. Innovative land development practices; and

d. Supporting other City projects that may be adjacent to land development projects where

practically and financially possible.

4. Land Enterprise will not acquire land in developing areas or future growth areas. The following

acquisitions are exceptions:

a. Land that may not be financially viable for the private sector to develop;

b. Opportunity purchases with other City departments where a portion of the site is required for

municipal use and the remainder of the site can provide land development opportunities.

c. Land adjacent to existing City holdings.

5. A minimum of 50% of greenfield, low density, residential lots will be sold directly to small builders and

members of the public. This objective only applies to the types of development described in 12.a and does

not apply to the types of development described in 12.b, 12.c, and 12.d.

6. Residential lot sales will not exceed 10% of Edmonton’s total single-family residential lot development

within a given year.

7. Explore partnerships with the private sector to creatively approach land development on City-owned

lands, redeveloping areas and priority growth areas, provided it generates a financial return for the City.

Financial Objectives

8. Land development activities will be funded solely by Land Enterprise Retained Earnings, including all

capital and operating expenses. Tax levy will not be used to fund land development activities.

9. Land Enterprise will operate as a self-sustaining enterprise with net income from operations directed to

Land Enterprise Retained Earnings.

10. Land Enterprise Retained Earnings shall only fund:

a. Land Development Activities (as defined below);

Council Policy Number: 511A Page 2

b. All expenses incurred in the delivery of the program;

c. Land exchanges where sale revenue equals or exceeds the acquisition costs;

d. Acquisition of existing titled roadways that are erroneously privately-owned; and

e. Provided the financial sustainability of Land Enterprise is not jeopardized,

i. Land development opportunities that achieve City Plan objectives and, in particular, may

remove barriers and advance development of nodes and corridors or other redeveloping

areas; and

ii. Servicing of lands for municipal use where they may be adjacent to, or in proximity of,

ongoing land development work.

11. Land Enterprise will pay an annual dividend to the City of Edmonton in the second quarter of each year

based on 2.5% of the year-end balance of Land Enterprise Retained Earnings for the previous year.

a. A dividend will not be paid if there is less than $30 million of Unappropriated Surplus Capital

available in Land Enterprise Retained Earnings.

Applicability

12. This policy will apply to the following types of land development activities carried out by Land Enterprise to

generate revenue:

a. Greenfield residential, mixed-use, commercial, and industrial land development projects;

b. Surplus residential, mixed-use, commercial, infill, and industrial land development projects;

c. City-owned Surplus School Sites that are not guided by another City Policy; and

d. Transformative redevelopment projects.

13. This policy does not apply to the following land development projects:

a. Blatchford;

b. Non-revenue generating land development projects; and

c. Affordable housing development projects.

Definitions

● Affordable Housing Housing that requires subsidization to be affordable for its residents, often with rents

or payments below average market cost, and is targeted for long-term occupancy by households who earn

less than the median income for their household size.

● Greenfield Land that has not been previously developed for residential or non-residential land uses,

other than for agricultural purposes. The City Plan identifies these areas as the developing area and future

growth area. Greenfield developments can be developed as residential, mixed-use, commercial or

industrial uses.

● Land Development Activities The acquisition, planning, engineering, public engagement, servicing,

marketing and disposal of city-owned land to generate revenue and achieve the Land Enterprise

objectives, as outlined above.

Council Policy Number: 511A Page 3

● Land Enterprise Land Enterprise is recognized as a self-funded enterprise. Land Enterprises activities are

entirely funded by Land Enterprise Retained Earnings and do not receive tax levy funding.

● Land Enterprise Retained Earnings A constrained funding source used and reported on by Land

Enterprise. It provides all the funding for land development work, as outlined in this policy. It is the

accumulation of relevant annual surpluses and deficits from operations.

● Unappropriated Surplus Capital The portion of Land Enterprise Retained Earnings that is not designated

for specific purposes and is therefore available to fund future Land Development Activities.

Council Policy Number: 511A Page 4

You might also like

- City Policy: Policy Number: C511 Reference: Adopted byDocument2 pagesCity Policy: Policy Number: C511 Reference: Adopted byWahid Rahman RahmaniNo ratings yet

- 2018 Adopted TIF PoliciesDocument9 pages2018 Adopted TIF PoliciesSean BakerNo ratings yet

- Soccer Development Deal For Council-2Document17 pagesSoccer Development Deal For Council-2petersoe0No ratings yet

- Foster/Edens TIF Redevelopment PlanDocument60 pagesFoster/Edens TIF Redevelopment PlanDNAinfo ChicagoNo ratings yet

- Sample Text For DTA 1!: Read The Passage and Identify The Main Idea!Document3 pagesSample Text For DTA 1!: Read The Passage and Identify The Main Idea!Ankur SuryavanshiNo ratings yet

- Project Proposal For G+7 Mixed Use BuildingDocument24 pagesProject Proposal For G+7 Mixed Use BuildingJoey MW95% (60)

- GFS Strategic Investment PlanDocument9 pagesGFS Strategic Investment PlanWCTV Digital TeamNo ratings yet

- Guidelines On The Direct Developmental Loan For The Pambansang Pabahay para Sa Pilipino (4PH) ProgramDocument10 pagesGuidelines On The Direct Developmental Loan For The Pambansang Pabahay para Sa Pilipino (4PH) ProgramabdullahNo ratings yet

- T: F: S: D: B:: O ROM Ubject ATE AckgroundDocument17 pagesT: F: S: D: B:: O ROM Ubject ATE AckgroundNicoleNo ratings yet

- Development Agreement: Former Macy's HQDocument10 pagesDevelopment Agreement: Former Macy's HQWVXU NewsNo ratings yet

- International Finance in Development of Integrated Township in IndiaDocument34 pagesInternational Finance in Development of Integrated Township in Indialazzyfn100% (1)

- Eventfile 30102019031001Document50 pagesEventfile 30102019031001Rishikesh AnandNo ratings yet

- Bre217 L6Document39 pagesBre217 L6winniechan037No ratings yet

- Mixxed Use BLDDocument25 pagesMixxed Use BLDMelese FirdisaNo ratings yet

- Authority Levers For Implementing The CLUPDocument10 pagesAuthority Levers For Implementing The CLUPErnie Gultiano100% (1)

- Dec. 13 2021 Grand Forks Olive Ann Second ProposalDocument3 pagesDec. 13 2021 Grand Forks Olive Ann Second ProposalJoe BowenNo ratings yet

- Urban Development and Housing Act (Udha) : Notes OnDocument5 pagesUrban Development and Housing Act (Udha) : Notes OnTDNo ratings yet

- Comp Plan Chapter 2Document17 pagesComp Plan Chapter 2winfieldwvNo ratings yet

- OCM00503 Reimagine Services Update Council ReportDocument14 pagesOCM00503 Reimagine Services Update Council ReportEmily MertzNo ratings yet

- Module 1 Real Estate Development & Land ManagementDocument40 pagesModule 1 Real Estate Development & Land Managementmalik_king2010No ratings yet

- Proposed Philippine Agrarian REIT 5Document6 pagesProposed Philippine Agrarian REIT 5Federico CuervoNo ratings yet

- Project Proposal For The Construction ofDocument26 pagesProject Proposal For The Construction ofMeaza MadaNo ratings yet

- Master planning-WPS OfficeDocument7 pagesMaster planning-WPS OfficeCivil services prepatory schoolNo ratings yet

- Downtown Bennington Area Wide Plan ApplicationDocument27 pagesDowntown Bennington Area Wide Plan ApplicationJoey KulkinNo ratings yet

- KEBERDocument19 pagesKEBERgemechu100% (2)

- What Is A: Land Use Plan?Document16 pagesWhat Is A: Land Use Plan?shalini agarwalNo ratings yet

- Ra 7279 - Lina Law (Udha) Urban Development and Housing ActDocument2 pagesRa 7279 - Lina Law (Udha) Urban Development and Housing ActJoan Marie Uy-QuiambaoNo ratings yet

- Comprehension of NMT in Delhi Master PlaDocument7 pagesComprehension of NMT in Delhi Master PlaFeng YuNo ratings yet

- Union Budget 2011 12 Infra&SEZDocument9 pagesUnion Budget 2011 12 Infra&SEZKarthikeyan RaguramNo ratings yet

- Property DevelopmentDocument19 pagesProperty Developmentxrosan100% (2)

- Documents/ 563/week13.doc/ 9/29/2008/ 8:40:05 AM 1 of 13Document13 pagesDocuments/ 563/week13.doc/ 9/29/2008/ 8:40:05 AM 1 of 13VictoriaNo ratings yet

- Rift Valley University Bishoftuu Campus Department of Accounting and Finance Project Analysis and EvaluationDocument15 pagesRift Valley University Bishoftuu Campus Department of Accounting and Finance Project Analysis and EvaluationDereje AberaNo ratings yet

- Mirtama Agricultural Investment Project ProposalDocument45 pagesMirtama Agricultural Investment Project Proposalkassahun mesele90% (51)

- PHL Iloilo Es1Document12 pagesPHL Iloilo Es1VillarojoJhomariNo ratings yet

- Chapter 4 - Redevelopment PDFDocument13 pagesChapter 4 - Redevelopment PDFMahima SalujaNo ratings yet

- Strategic Investment Program: For Projects Up To $5,000,000Document11 pagesStrategic Investment Program: For Projects Up To $5,000,000jerricc8100% (2)

- Attachment Summary PPPDocument9 pagesAttachment Summary PPPdevesh chaudharyNo ratings yet

- Housing Development AddDocument18 pagesHousing Development AddBenyam SemunigusNo ratings yet

- Assignment: "Construction Finance Management & Cost Accounting" (PGCM - 24)Document17 pagesAssignment: "Construction Finance Management & Cost Accounting" (PGCM - 24)Nilesh SondigalaNo ratings yet

- Answer Key - 230529 - 213341Document19 pagesAnswer Key - 230529 - 213341Nithiss ANo ratings yet

- 4th Regional & Urban DevelopmentDocument7 pages4th Regional & Urban DevelopmentGhotna ChatterjeeNo ratings yet

- Housing Module 5Document13 pagesHousing Module 5Kyla TiangcoNo ratings yet

- FDI ReportDocument4 pagesFDI ReportFire burnNo ratings yet

- ACFrOgA4qYAQuXXYc9BobZbGxyIWA49aFJy8ddB5 U8mZZ3oH2EJQ a9I5OLT5z5K r0MD52eEaDxremcREmf8K97uBF317G7BbAJsS - 2fKKMgfR7R-rug2bw7vEjOQ5qLBRNiPewrkoohA153xDocument12 pagesACFrOgA4qYAQuXXYc9BobZbGxyIWA49aFJy8ddB5 U8mZZ3oH2EJQ a9I5OLT5z5K r0MD52eEaDxremcREmf8K97uBF317G7BbAJsS - 2fKKMgfR7R-rug2bw7vEjOQ5qLBRNiPewrkoohA153xNaimur RahamanNo ratings yet

- Damo Dalacha PensionDocument30 pagesDamo Dalacha Pensionalemayehu tariku100% (1)

- Part One: Kronenwetter Economic Development Plan DraftDocument75 pagesPart One: Kronenwetter Economic Development Plan Draftfoody_kathleenNo ratings yet

- RedpDocument11 pagesRedpShubhi SharmaNo ratings yet

- Unit 03Document27 pagesUnit 03Ashafali KNo ratings yet

- Financing Local Resilience Actions Investment Programming For ResiliencyDocument29 pagesFinancing Local Resilience Actions Investment Programming For ResiliencyLPPDA DILG LGCDDNo ratings yet

- Assignment of Hafiz Sir For FinalDocument17 pagesAssignment of Hafiz Sir For FinalShuhan ChowdhuryNo ratings yet

- 7 HOUSING FINANCE 1 MergedDocument192 pages7 HOUSING FINANCE 1 MergedKristien GuanzonNo ratings yet

- Balanced Development Priorities RubricDocument4 pagesBalanced Development Priorities RubricWVXU NewsNo ratings yet

- Project ProposalDocument23 pagesProject ProposalMohan.rNo ratings yet

- Real Estate & IndiaDocument5 pagesReal Estate & IndiaDeb TumbinNo ratings yet

- Annual Report 2011 September FinalDocument6 pagesAnnual Report 2011 September FinallocalonNo ratings yet

- Assignment 4 - PGCM 24Document20 pagesAssignment 4 - PGCM 24Nilesh SondigalaNo ratings yet

- Taxpayer's Review Comments On The Chesterfield County Comprehensive PlanDocument26 pagesTaxpayer's Review Comments On The Chesterfield County Comprehensive PlanchesterfieldtaxpayerNo ratings yet

- Construction of Public Market Building Project Proposal San Ricardo-To Be PresentedDocument4 pagesConstruction of Public Market Building Project Proposal San Ricardo-To Be PresentedJoel80% (5)

- Land to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesFrom EverandLand to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesNo ratings yet

- Jäœehl Ä C G Â K W G ®KHD¡ FHF Èäbl : Ä F LZ UójDocument1 pageJäœehl Ä C G Â K W G ®KHD¡ FHF Èäbl : Ä F LZ Uójsenthilkumar kNo ratings yet

- SSPB EPD Imbalance 20230525 ENDocument20 pagesSSPB EPD Imbalance 20230525 ENsenthilkumar kNo ratings yet

- eCoPRDocument2 pageseCoPRsenthilkumar kNo ratings yet

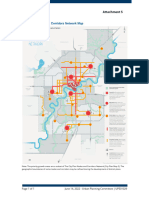

- UPE01029 Attachment 5 City Plan Nodes and Corridors Network MapDocument1 pageUPE01029 Attachment 5 City Plan Nodes and Corridors Network Mapsenthilkumar kNo ratings yet

- Sodapdf SplitDocument1 pageSodapdf Splitsenthilkumar kNo ratings yet

- July Stock StatementDocument1 pageJuly Stock Statementsenthilkumar kNo ratings yet

- Tamilnadu Generation and Distribution Corporation: I. Security Deposit DetailsDocument1 pageTamilnadu Generation and Distribution Corporation: I. Security Deposit DetailsVjdSivakumarNo ratings yet

- Chennai Foodies MenuDocument4 pagesChennai Foodies Menusenthilkumar kNo ratings yet

- Tamilnadu Generation and Distribution Corporation: I. Security Deposit DetailsDocument1 pageTamilnadu Generation and Distribution Corporation: I. Security Deposit DetailsVjdSivakumarNo ratings yet

- Establishment of Hydroponic & Mushroom Production PlantDocument17 pagesEstablishment of Hydroponic & Mushroom Production Plantsenthilkumar kNo ratings yet

- No. of Persons: No. of Laddus:: Special Entry Darshan Receipt ( .300/-)Document1 pageNo. of Persons: No. of Laddus:: Special Entry Darshan Receipt ( .300/-)senthilkumar kNo ratings yet

- LAF PamphletDocument1 pageLAF Pamphletsenthilkumar kNo ratings yet

- 029300000018554Document1 page029300000018554senthilkumar kNo ratings yet

- New Doc 2018-09-07 17.11.15Document1 pageNew Doc 2018-09-07 17.11.15senthilkumar kNo ratings yet

- Digital Customer Form Silver Health 8408Document2 pagesDigital Customer Form Silver Health 8408senthilkumar kNo ratings yet

- 029300000018554Document1 page029300000018554senthilkumar kNo ratings yet

- LRS Check List-1Document1 pageLRS Check List-1Ramana ReddyNo ratings yet

- Ch1 IMDocument14 pagesCh1 IMEmmanuel MwandamaNo ratings yet

- Lesson Plan - Recycling - Advantages and Good Working Habit (Part 2)Document6 pagesLesson Plan - Recycling - Advantages and Good Working Habit (Part 2)Marynell ValenzuelaNo ratings yet

- Mini Cement Plant: Jaslin Singh Gyanvendra Singh Anurag AgrawalDocument14 pagesMini Cement Plant: Jaslin Singh Gyanvendra Singh Anurag AgrawalJaslin SinghNo ratings yet

- Chapter On Public Sector Strategies BDocument10 pagesChapter On Public Sector Strategies BKey OnNo ratings yet

- Consumer BehaviourDocument10 pagesConsumer BehaviourPranayNo ratings yet

- CHAPTER 1 IntroductionDocument22 pagesCHAPTER 1 IntroductionCarissa May Maloloy-on100% (1)

- My Answers.Document2 pagesMy Answers.cris addunNo ratings yet

- CSR Midterm ReviewerDocument23 pagesCSR Midterm ReviewerCriza Riene SualogNo ratings yet

- EcoVadis CSR Methodology Overview and PrinciplesDocument15 pagesEcoVadis CSR Methodology Overview and PrinciplesPam Landi100% (1)

- Environmental Protection in The Production of FootballsDocument4 pagesEnvironmental Protection in The Production of FootballsclampcnNo ratings yet

- Effects of Restaurant Green Practices Which PractiDocument24 pagesEffects of Restaurant Green Practices Which PractiKabir GandhiNo ratings yet

- GD On Ehtics or Profit: ControversiesDocument2 pagesGD On Ehtics or Profit: ControversiesSahil RaiNo ratings yet

- Distribution Strategy: Case Study: Abhishek Tuli Ajay Kaushik Ankit Karir Ankit Garg Md. SalmanDocument10 pagesDistribution Strategy: Case Study: Abhishek Tuli Ajay Kaushik Ankit Karir Ankit Garg Md. SalmanAjay KaushikNo ratings yet

- Influence of Green Marketing On Customers Buying BehaviourDocument8 pagesInfluence of Green Marketing On Customers Buying BehaviourVu Tung LinhNo ratings yet

- Pengaruh Corporate Social Responsibility (CSR) Terhadap Citra Perusahaan Pt. Bank Danamon Indonesia TBKDocument9 pagesPengaruh Corporate Social Responsibility (CSR) Terhadap Citra Perusahaan Pt. Bank Danamon Indonesia TBKAnthon AqNo ratings yet

- Introduction To HSE PTPDocument19 pagesIntroduction To HSE PTPSung MuhamadNo ratings yet

- Waterproofing WorkDocument10 pagesWaterproofing WorkNisanth ThulasidasNo ratings yet

- Desigo CC A Building Management System That Is Writing HistoryDocument8 pagesDesigo CC A Building Management System That Is Writing HistoryelhbabacarNo ratings yet

- Malaysia Plastics Sustainability Roadmap 2021 - 2030Document53 pagesMalaysia Plastics Sustainability Roadmap 2021 - 2030Khairulina Mohd KamaruddinNo ratings yet

- IndianOil AR 2022-23 Spread 30 07 23Document242 pagesIndianOil AR 2022-23 Spread 30 07 23ebook ebookNo ratings yet

- Case Study ManagementDocument16 pagesCase Study ManagementMaryam AzeemNo ratings yet

- Project Brief-Fire PRevention MonthDocument2 pagesProject Brief-Fire PRevention MonthJomidy MidtanggalNo ratings yet

- Final CSR Project of Tata CapitalDocument56 pagesFinal CSR Project of Tata CapitalPayal PatelNo ratings yet

- A Building Sustainability Assessment System (BSAS) For Least DevDocument9 pagesA Building Sustainability Assessment System (BSAS) For Least DevGibidaws HapNo ratings yet

- EnergyNext Vol 05 Issue 12 Oct 2015Document84 pagesEnergyNext Vol 05 Issue 12 Oct 2015IndiaNextNo ratings yet

- MOCK TEST 1-17 Sep 2021: A. LISTENING (50 Points)Document17 pagesMOCK TEST 1-17 Sep 2021: A. LISTENING (50 Points)minhNo ratings yet

- Mesfin Kora TeleDocument74 pagesMesfin Kora TeleYared GaredewNo ratings yet

- OD ch#05Document23 pagesOD ch#05Ruhma ZainabNo ratings yet

- HSE Manager & Supervisor CV - Niranjan 30-04-2021Document4 pagesHSE Manager & Supervisor CV - Niranjan 30-04-2021NiraNo ratings yet