Professional Documents

Culture Documents

Et-Sw 1 - 04.02.24

Uploaded by

Roland jamesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Et-Sw 1 - 04.02.24

Uploaded by

Roland jamesCopyright:

Available Formats

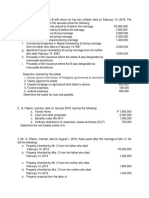

Business and Transfer Taxes Seatwork #1 April 2, 2024

Problem 1 – Gross estate, tangibles and intangibles, life insurance, claims against insolvent persons, reciprocity

Mr. Mabuhay died on June 1, 20A1 with the following properties, rights and claims at the time of his death:

Real property

Zonal value P50,000,000

Fair market value per RPT declaration 45,000,000

Shares of stock (domestic shares)

Abaca Company, 10,000 common shares (listed in the PSE)

Par value 4,000,000

Book value 5,000,000

Begonia Company, 100,000 common shares (unlisted shares)

Par value 3,000,000

Book value 4,000,000

If sold at the time of death 3,200,000

Begonia Company, 10,000 preferred shares (unlisted shares)

Par value 3,000,000

Par value plus dividend in arrears 3,500,000

If sold at the time of death 3,300,000

Shares of stock (foreign shares)

Camilla Corporation, 1,000 shares (unlisted)

Par value 1,000,000

Book value 1,200,000

If sold at the time of death 1,500,000

Jewelry

Acquisition cost several years ago 2,000,000

Present pawn value 600,000

Receivables under life insurance policies

Domestic insurance company 1,000,000

Singaporean insurance company 2,000,000

Receivable from Ms. Masaya who has no properties 300,000

Cash in banks

Philippine National Bank, Singapore Branch 2,000,000

Bank of Singapore, Singapore Head Office 5,000,000

The following are the additional information:

a. Abaca Company’s common shares were traded on June 1 at the highest price of P620 and lowest price of P580.

b. Begonia Company owned real properties with book value of P100,000,000 and fair market value of P125,000,000. It had

revaluation surplus of P5,000,000 recorded in its books. It had 1,000,000 issued and outstanding common shares.

c. For jewelry, the practice of pawnshops is to give a pawn value equal to 1/3 of the fair market value of any property

pawned.

Required:

1. Determine the gross estate of Mr. Mabuhay if at the time of his death, he was a citizen of the Philippines.

2. Determine the gross estate of Mr. Mabuhay if at the time of his death, he was neither a citizen nor a resident of the

Philippines.

3. Determine the gross estate of Mr. Mabuhay if at the time of his death, he was neither a citizen nor a resident of the

Philippines. Assume that the country where Mr. Mabuhay resided does not impose death or estate tax.

Problem 2 – Gross estate, various properties, transfers in contemplation of death, life insurance, other transfers

Mr. Segundo, widower, died on October 15, 20A1 with the following properties, rights and claims at the time of her death:

Real property in Bohol, fair market value P60,000,000

House in Quezon City, used as residence (mortgaged to Masaya Banking

Corporation for P3,500,000), fair market value 10,000,000

House and lot in Krabi, Thailand, used as vacation house

(mortgaged to Sawadee Banking Corporation, Thai bank, for 20,000,000

P12,000,000)

Furniture and fixtures in residential house 680,000

Transfers in contemplation of death:

Sale of real properties in the Philippines

Consideration received 2,000,000

Fair market value at the time of transfer 19,900,000

Fair market value at the time of death 20,800,000

Donation of real properties in Bangkok, Thailand

Fair market value at the time of transfer 9,000,000

Fair market value at the time of death 9,400,000

Sale of personal properties in the Philippines but outside the Philippines

at the time of death

Consideration received 100,000

Fair market value at the time of transfer 1,400,000

Fair market value at the time of death 1,100,000

Sale of personal properties outside the Philippines but within the

Philippines at the time of death

Consideration received 200,000

Fair market value at the time of transfer 400,000

Fair market value at the time of death 1,000,000

Sale of personal properties in the Philippines and within the Philippines at

the time death

Consideration received 900,000

Fair market value at the time of transfer 900,000

Fair market value at the time of death 1,500,000

Insurance proceeds receivables

Life insurance policies taken out by Mr. Segundo on his own life

Policy 1000: Beneficiary was his estate, with power of revocation not

exercised before his death 1,500,000

Policy 3000: Beneficiary was his son, with power to change the

beneficiary 1,000,000

Policy 5000: Beneficiary was his son, with irrevocable designation of

beneficiary 2,000,000

Group life insurance taken out by the employer with estate of decedent

as revocable beneficiary 500,000

Accident insurance for injury sustained while still alive 100,000

Property insurance 200,000

Accounts receivables

Ms. Masaya against whom insolvency proceedings is pending in court.

Ratio of properties to her liabilities is 1:2. 500,000

Mr. Maputi, a Korean residing in Japan with obligation maturing on

December 20A1 1,000,000

Mr. Matangkad, a Korean in South Korea, admittedly insolvent 1,500,000

Shares of stock:

Domestic corporation, certificates deposited in Thai Bank, fair market value 500,000

Foreign corporation, certificates deposited in Thai Bank, fair market value 200,000

Required:

1. Determine the gross estate of Mr. Segundo if at the time of his death, he was a citizen of the Philippines.

2. Determine the gross estate of Mr. Segundo if at the time of his death, he was neither a citizen nor a resident of the

Philippines.

3. Determine the gross estate of Mr. Segundo if at the time of his death, he was neither a citizen nor a resident of the

Philippines. Assume that the country where Mr. Segundo resides provides tax exemption from donor’s tax and estate tax

to Filipinos on transfers of intangible properties.

Problem 3 – Gross estate, exclusions and exemptions

Ms. Masaya, a resident of the Philippines, died on February 1, 20A1. She left the following properties and rights:

Commercial property, fair market value P50,000,000

Residential house and lot, fair market value 18,000,000

Jewelry, fair market value 2,500,000

Agricultural lot in Cebu, fair market value 10,000,000

Agricultural lot in Negros Oriental, fair market value 12,000,000

Agricultural lot in Negros Occidental, fair market value 15,000,000

Agricultural lot in Samar, fair market value 8,000,000

Various personal properties donated to a charitable institution 3,000,000

Accounts receivables 3,500,000

Death benefits from SSS 5,000,000

Retirement benefits from employer 6,800,000

Life insurance proceeds with her sister as revocable beneficiary 7,000,000

The following are the additional information:

a. The residential house and lot was mortgaged for P5,000,000.

b. The agricultural lot in Cebu was originally owned by Ms. Maganda. When Ms. Maganda died, she left the usufruct of the

said property to Ms. Masaya while the naked title to Ms. Matalino. The said lot was subjected to estate tax when Ms.

Maganda died.

c. The agricultural lot in Negros Oriental was originally owned by Ms. Matiwasay. When Ms. Matiwasay died, she left the

property to Ms. Masaya with a condition that if Ms. Malaki gets married, Ms. Masaya must give the property to Ms.

Malaki. Estate tax was paid when Ms. Matiwasay died.

d. The agricultural lot in Negros Occidental was inherited by Ms. Maganda from her mother. However, Ms. Maganda will own

the property for five years with the obligation to preserve said property. After five years, 60% must be given to Ms.

Masaya’s daughter while Ms. Masaya will retain the remaining 40%. Estate tax was paid when Ms. Maganda inherited the

property four years ago.

e. The agricultural lot in Samar was purchased five years ago for donation to the local government unit as provided in the

last will and testament.

f. The accounts receivables pertain to receivables from Ms. Masaya’s friends. One of them was insolvent. Receivable from

said person amounted to P50,000.

Required: Determine the gross estate of Ms. Masaya.

You might also like

- MR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheDocument3 pagesMR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheSharjaaah100% (2)

- LifeInsur E311 2022 10 9EDDocument312 pagesLifeInsur E311 2022 10 9EDEldho GeorgeNo ratings yet

- HO4 Pre TestDocument4 pagesHO4 Pre TestJason Saberon Quiño0% (2)

- Exercises On Estate TaxDocument6 pagesExercises On Estate TaxPaulo VillarinNo ratings yet

- PROBLEMDocument5 pagesPROBLEMgaler LedesmaNo ratings yet

- Checklist - Worker's Compensation ClaimsDocument6 pagesChecklist - Worker's Compensation Claimscxz4321No ratings yet

- Financial Institutions Management A Risk Management Approach 8th Edition Saunders Solutions Manual 1Document17 pagesFinancial Institutions Management A Risk Management Approach 8th Edition Saunders Solutions Manual 1iva100% (35)

- Ic 26 Practice Test 1 PDFDocument33 pagesIc 26 Practice Test 1 PDFLaxminarayana Madavi0% (1)

- Ias 37 PDFDocument27 pagesIas 37 PDFmohedNo ratings yet

- Composition of The Gross Estate of A DecedentDocument16 pagesComposition of The Gross Estate of A DecedentBill BreisNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax QJaypee Verzo SaltaNo ratings yet

- Estate Tax Pre TestDocument7 pagesEstate Tax Pre TestAldrin ZolinaNo ratings yet

- Gross Estate Board WorkDocument5 pagesGross Estate Board Worksharon5lotinoNo ratings yet

- A Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsDocument1 pageA Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsAmie Jane MirandaNo ratings yet

- Estate Tax Exercises On Gross EstateDocument5 pagesEstate Tax Exercises On Gross EstateGileah ZuasolaNo ratings yet

- Estate Tax HW8Document12 pagesEstate Tax HW8ALYZA ANGELA ORNEDONo ratings yet

- TX2 101Document3 pagesTX2 101Pau SantosNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax Qrick owensNo ratings yet

- Estate Taxation - Discussions...............Document5 pagesEstate Taxation - Discussions...............jangjangNo ratings yet

- Gross EstateDocument13 pagesGross EstateLadybellereyann A TeguihanonNo ratings yet

- Prelim TaskDocument4 pagesPrelim TaskJohn Francis RosasNo ratings yet

- Estate TaxDocument1 pageEstate TaxMelisa Joy MalenabNo ratings yet

- ProblemsDocument12 pagesProblemsJohn Carlo J. DominoNo ratings yet

- Transfer Tax Prelim ExamDocument4 pagesTransfer Tax Prelim ExamSalma AbdullahNo ratings yet

- Transfer and Business Taxation - Exercises SolutionDocument40 pagesTransfer and Business Taxation - Exercises SolutionMa. BeatriceNo ratings yet

- 1st Semester Transfer Taxation - Long Quiz 01Document6 pages1st Semester Transfer Taxation - Long Quiz 01Nah HamzaNo ratings yet

- Tandem Activity GE Allowable DeductionsDocument6 pagesTandem Activity GE Allowable DeductionsErin CruzNo ratings yet

- Solutions For Module 3 IllustrationDocument22 pagesSolutions For Module 3 IllustrationColeen GaliciaNo ratings yet

- Princess Elaine Esperat - Tax 2 - Activity 2 FinalDocument3 pagesPrincess Elaine Esperat - Tax 2 - Activity 2 FinalPrincess Elaine EsperatNo ratings yet

- Exercise - Estate Tax 2Document2 pagesExercise - Estate Tax 2Mark Edgar De GuzmanNo ratings yet

- Problems 1Document11 pagesProblems 1Kenneth Bryan Tegerero Tegio100% (1)

- Estate Tax Problems Quizzer 1104Document10 pagesEstate Tax Problems Quizzer 1104Fate Serrano100% (1)

- Test Bank 1 UpdatedDocument5 pagesTest Bank 1 UpdatedSumanting GarnethNo ratings yet

- Estate Ni JonaDocument2 pagesEstate Ni Jonalov3m350% (2)

- Chapter 3 ExercisesDocument5 pagesChapter 3 Exercisesdennilyn recaldeNo ratings yet

- Illustrations PDFDocument3 pagesIllustrations PDFCharrey Leigh FormaranNo ratings yet

- Comprehensive Problem Estate TaxDocument2 pagesComprehensive Problem Estate Taxmarch0% (1)

- 01TaskPerformance1 BussinessTaxDocument3 pages01TaskPerformance1 BussinessTaxSnapShop by AJNo ratings yet

- Tax Without ChoicesDocument6 pagesTax Without ChoicesEdwinJugadoNo ratings yet

- 01 Task Performance 1 (8) Business TaxationDocument2 pages01 Task Performance 1 (8) Business TaxationAries Christian S PadillaNo ratings yet

- Quiz 2 Tax 2 Answer KeyDocument10 pagesQuiz 2 Tax 2 Answer KeyJamaica DavidNo ratings yet

- Quiz On Estate TaxDocument4 pagesQuiz On Estate TaxRenz CastroNo ratings yet

- Exercise No. 1-Estate TaxationDocument4 pagesExercise No. 1-Estate TaxationRed Velvet100% (1)

- Ma. Faith R. Tan: Payable To A Revocable Beneficiary."Document1 pageMa. Faith R. Tan: Payable To A Revocable Beneficiary."Faith Reyna TanNo ratings yet

- Activity #2: Assignment On Computation of Gross Estate Group Activity InstructionsDocument3 pagesActivity #2: Assignment On Computation of Gross Estate Group Activity InstructionsjayNo ratings yet

- Prelim TaskDocument8 pagesPrelim TaskHeidi KaterineNo ratings yet

- Business and Transfer Taxation Gross Estate (Students' Handouts)Document2 pagesBusiness and Transfer Taxation Gross Estate (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Estate and Donor'S TaxDocument10 pagesEstate and Donor'S TaxJoseph MangahasNo ratings yet

- Agriculture-Biological Assets - 2Document9 pagesAgriculture-Biological Assets - 2let me live in peaceNo ratings yet

- 7106 - Biological AssetDocument2 pages7106 - Biological AssetGerardo YadawonNo ratings yet

- Gross Estate Activity PDFDocument5 pagesGross Estate Activity PDFJaypee Verzo SaltaNo ratings yet

- 1st Semester Transfer Taxation Long Quiz No. 01 (2nd Set)Document5 pages1st Semester Transfer Taxation Long Quiz No. 01 (2nd Set)James ScoldNo ratings yet

- Property Regime For Married IndividualsDocument35 pagesProperty Regime For Married IndividualsbetariceNo ratings yet

- BT Bank AnswersDocument5 pagesBT Bank AnswersKereen Ruie LingcoNo ratings yet

- EncodedDocument8 pagesEncodedMary Benedict AbraganNo ratings yet

- Ordinary DeductionsDocument10 pagesOrdinary DeductionsJULIUS BORDON100% (1)

- Self-Assessment Quiz - 3 - Attempt ReviewDocument6 pagesSelf-Assessment Quiz - 3 - Attempt ReviewbiggoboziNo ratings yet

- 16Document11 pages16Sheie WiseNo ratings yet

- Midterm - Taxation2 - Module - Estate TaxDocument18 pagesMidterm - Taxation2 - Module - Estate TaxEJ HipolitoNo ratings yet

- 6966 - Biological AssetDocument2 pages6966 - Biological Assetjohn paulNo ratings yet

- And Profit and Loss Account and Balance Sheet On 31st December, 2019Document2 pagesAnd Profit and Loss Account and Balance Sheet On 31st December, 2019Prabhleen KaurNo ratings yet

- De La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentDocument2 pagesDe La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentGurong MNo ratings yet

- Exercises On Estate Tax Additional ProblemsDocument8 pagesExercises On Estate Tax Additional ProblemsMidas Troy VictorNo ratings yet

- CM1A - September23 - Clean ProofDocument6 pagesCM1A - September23 - Clean ProofVaibhav SharmaNo ratings yet

- Profit and Loss Ibps S K RajuDocument14 pagesProfit and Loss Ibps S K RajuAmit VyasNo ratings yet

- Dec 1st WeekDocument23 pagesDec 1st WeekGaurav PrajapatNo ratings yet

- Tata AIG Motor Policy Schedule - 3184 - 6201884780-00Document4 pagesTata AIG Motor Policy Schedule - 3184 - 6201884780-00Điwakar MudhirajNo ratings yet

- Shift Work Is Hell Part 6Document25 pagesShift Work Is Hell Part 6contrax8No ratings yet

- Tax Prelim Exam ReviewerDocument20 pagesTax Prelim Exam ReviewerWawi Dela RosaNo ratings yet

- List of Finance Companies of IndiaDocument2 pagesList of Finance Companies of IndiaSurinder TanwarNo ratings yet

- Para-Banking ActivitiesDocument14 pagesPara-Banking Activitiesneeteesh_nautiyalNo ratings yet

- Ey Ifrs17 Implications For European InsurersDocument32 pagesEy Ifrs17 Implications For European InsurersmarhadiNo ratings yet

- Shubham Gumber - ReportDocument28 pagesShubham Gumber - ReportJill RoseNo ratings yet

- FCCB AccountingDocument20 pagesFCCB AccountingManoj NambiarNo ratings yet

- 2024 National Cherry Festival Agreement 3-5 RedlineDocument7 pages2024 National Cherry Festival Agreement 3-5 RedlineBrandon ChewNo ratings yet

- Market Driven Product Development SrategyDocument25 pagesMarket Driven Product Development SrategyGerry FerdiansyahNo ratings yet

- Jan. 8, 2024, Presentation To Caddo School Board's Insurance and Finance CommitteeDocument26 pagesJan. 8, 2024, Presentation To Caddo School Board's Insurance and Finance CommitteeCurtis HeyenNo ratings yet

- Financial Accounting & Reporting 2: PX - Set SolutionDocument15 pagesFinancial Accounting & Reporting 2: PX - Set SolutionGabrielle Marie Rivera33% (3)

- XL Alumni Insurance Topup Plan Announcement 2021 0504Document3 pagesXL Alumni Insurance Topup Plan Announcement 2021 0504Adil HussainNo ratings yet

- Law Firm Registration FormDocument51 pagesLaw Firm Registration FormAlize MendozaNo ratings yet

- Visa ChecklistDocument1 pageVisa ChecklistRitika SudanNo ratings yet

- Contribution AgreementDocument43 pagesContribution AgreementCharan SehgalNo ratings yet

- Cidb Standard Form of Contract 2000Document127 pagesCidb Standard Form of Contract 2000SzeJinTan100% (2)

- LBP No. 8 (Statement of Fund Operation) (2013) Gen&EcoDocument6 pagesLBP No. 8 (Statement of Fund Operation) (2013) Gen&EcoBar2012No ratings yet

- Insurance Awareness Policy 2020Document6 pagesInsurance Awareness Policy 2020Siddhi ShelarNo ratings yet

- Adjusting - Merchandising BusinessDocument3 pagesAdjusting - Merchandising BusinessJekoe25% (4)

- Accounting and Reporting For Buyback in India: 11.. IinnttrroodduuccttiioonnDocument8 pagesAccounting and Reporting For Buyback in India: 11.. IinnttrroodduuccttiioonnThéotime HabinezaNo ratings yet

- S Ramachandra-Marketers Dont Build Brands Consumers DoDocument10 pagesS Ramachandra-Marketers Dont Build Brands Consumers Domaheshwari_pallavNo ratings yet