Professional Documents

Culture Documents

Ma. Faith R. Tan: Payable To A Revocable Beneficiary."

Uploaded by

Faith Reyna TanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ma. Faith R. Tan: Payable To A Revocable Beneficiary."

Uploaded by

Faith Reyna TanCopyright:

Available Formats

Ma. Faith R.

Tan April 4, 2021

BSA-2A | AEC10

Activity no.2

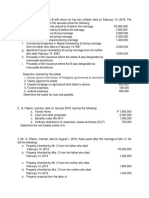

1. Whether the following properties are includable in the estate of decedent or not:

a) Includable d) Includable g) Includable

b) Includable e) Includable h) Includable

c) Includable f) Includable i) Includable

2. Cathay’s employer owed Cathay ₱ 5 000 on salary that had not been paid at the time of death.

a) Yes, Cathy’s right to that ₱ 5 000 salary is includable to her gross estate.

b) Yes, in such situation the amount ₱ 5 000 as a benefit to Cathay’s employment until retirement or

death, such that her death had come first, said amount is includable in the gross estate, classified as an

intangible personal property.

3. Sue Tek insured his life for ₱ 450 000. In policy, he designated his wife as the revocable beneficiary.

a) Yes, in such case that death has be fallen upon Sue Tek, the proceeds of his life insurance shall become

a part of his estate under the decedent’s interest, which includes the “proceeds of life insurance policy

payable to a revocable beneficiary.”

b) No, the proceeds of life insurance covering the life of the insured are includable in the estate except

when the beneficiary appointed in the policy is not the estate of the deceased, his executor or

administrator and the person designated as beneficiary is irrevocable. In which case, Sue Teks’s wife is

a revocable beneficiary.

4. Sigurista sold to Tagapagmana a real property valued at ₱ 650 000 for ₱ 300 000 only. The sale contains a

reserved power to revoke the same while Sigurista is alive, which she failed to exercise until his death.

When Sigurista died, the property had a value of ₱ 750 000.

a) ₱ 300 000 should be included in the gross estate of Sigurista, the difference between ₱ 650 000, the

real property value, and the price sold with, which amounts to ₱ 350 000 is subject to gift tax.

b) ₱ 750 000, If the transfer of the decedent is proven fictitious, the total value of the property at the time

of death shall be included in the gross estate.

5. Yolly took a life insurance policy upon her own life. The face value is ₱ 400 000. When she died the

insurance company paid her only daughter, Marietta, the proceeds of the insurance. Marietta did not

include the ₱ 400 000 in the computation of the gross estate. Upon assessment, the BIR official contends

that there is deficiency tax having failed to the insurance proceeds in the gross estate. Is the tax official

correct?

Answer: Yes, life proceeds are to be included in the gross estate. The entire value of the proceeds must

be included in the insured's gross estate even if the insured possessed no incident of ownership in the

policy, and paid none of the premiums. Proceeds are includable in an insured's gross estate if they are

receivable by or for the benefit of the insured's estate.

6. Ara Nina, 85 years old and aware of her serious illness, sold a property with a value of ₱ 800 000 for a

consideration of ₱ 300 000 to Dina Ngona. After a month, she died leaving a net estate after the deducting

of estate tax of ₱ 3 000 0000. How much is the net distributable estate of Ara Nina if the property sold to

Dina Ngona had a value of ₱ 840 000 at the time of death?

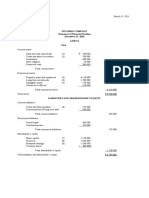

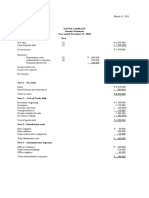

Answer:

Gross Estate ₱ 3 840 000

Less: (exception) ( 250 000)

Net Distributable Estate at time of Death ₱ 3 590 000

7. Bonador donated to Atacador a parcel of land in 2010. Bonador made the deed of donation entitled

“Donation Inter Vivos” in a public instrument and Atacador accepted the donation in the same document. I

was provided in the deed that the land donated shall be immediately delivered to Atacador and Atacador

shall have right to enjoy the fruits fully. The deed also provided that Bonador was reserving the right to

dispose of said land during his lifetime, and that Atacador shall not register the deed of donation until

Bonador’s death. Upon Bonador’s death, Curiadora, Bonador’s widow and sole heir, filed an action for the

recover of the donated land, contending that the donation made by Bonador is a donation mortis causa ad

not donation inter vivos. Will said action prosper?

Answer: Yes, Donation Inter Vivos is a contract which takes place by mutual consent, whilst Donation

Mortis Causa is a gift anticipation of death. In which the case provided has explicitly been told that upon

the death of Bonador that Atacador shall only and only register the deed of donation upon the death of

Bonador, as the deceased has conditioned.

You might also like

- AEC10 Activity No. 2Document1 pageAEC10 Activity No. 2Faith Reyna TanNo ratings yet

- 3-1. Discussion Questions / ProblemsDocument4 pages3-1. Discussion Questions / Problemscoleen paraynoNo ratings yet

- Deductions: Philippines Gross Estate World Gross Estate Deductible LITDocument3 pagesDeductions: Philippines Gross Estate World Gross Estate Deductible LITMaria LopezNo ratings yet

- Estate TaxDocument4 pagesEstate TaxLovely Jane Raut CabiltoNo ratings yet

- Gross EstateDocument13 pagesGross EstateLadybellereyann A TeguihanonNo ratings yet

- Introduction to transfer taxes and succession conceptsDocument12 pagesIntroduction to transfer taxes and succession conceptsErica XaoNo ratings yet

- Estate TaxDocument8 pagesEstate TaxIELTSNo ratings yet

- Transfer Tax QuizDocument3 pagesTransfer Tax QuizMary Grace SalcedoNo ratings yet

- HO4 Pre TestDocument4 pagesHO4 Pre TestJason Saberon Quiño0% (2)

- Exercise No. 1-Estate TaxationDocument4 pagesExercise No. 1-Estate TaxationRed Velvet100% (1)

- M3 - Gross Estate - Common Rules Students'Document43 pagesM3 - Gross Estate - Common Rules Students'micaella pasionNo ratings yet

- Estate Tax QuizzerDocument10 pagesEstate Tax QuizzerMakoy BixenmanNo ratings yet

- Taxn03b Pexam QuestionnaireDocument2 pagesTaxn03b Pexam Questionnairesmosaldana.cvtNo ratings yet

- Module12 Gross EstateDocument12 pagesModule12 Gross EstateKenNo ratings yet

- ACAE 18 - Deduction From Gross EstateDocument4 pagesACAE 18 - Deduction From Gross Estatechen dalitNo ratings yet

- Activity__No.2_Primo_JehanFranz.docxDocument4 pagesActivity__No.2_Primo_JehanFranz.docxlexfred55No ratings yet

- 12Document12 pages12mariyha Palanggana0% (2)

- Estate Tax Practice Set With AnswersDocument6 pagesEstate Tax Practice Set With AnswersXin ZhaoNo ratings yet

- Estate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaDocument38 pagesEstate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaRaymundo EirahNo ratings yet

- Quiz2_chapter2Document3 pagesQuiz2_chapter2argene.malubayNo ratings yet

- TX2 101Document3 pagesTX2 101Pau SantosNo ratings yet

- Final Tax ExamDocument10 pagesFinal Tax ExamGerald RojasNo ratings yet

- Cagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IDocument3 pagesCagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IJenelyn BeltranNo ratings yet

- Estate Tax Post Quiz Answer KeyDocument8 pagesEstate Tax Post Quiz Answer KeyMichael AquinoNo ratings yet

- Transfer Estate Tax Chapter 1Document33 pagesTransfer Estate Tax Chapter 1cmaepitoc21No ratings yet

- Business and Transfer Taxation Gross Estate (Students' Handouts)Document2 pagesBusiness and Transfer Taxation Gross Estate (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Filipino Estate Tax Calculation for Married IndividualDocument3 pagesFilipino Estate Tax Calculation for Married IndividualSharjaaah100% (2)

- ACT26 Ch05 Net-Taxable-EstateDocument7 pagesACT26 Ch05 Net-Taxable-EstateMark BajacanNo ratings yet

- Chapter 23 QUESTIONS ANSWERSDocument18 pagesChapter 23 QUESTIONS ANSWERSDizon Ropalito P.No ratings yet

- Estate Tax HW8Document12 pagesEstate Tax HW8ALYZA ANGELA ORNEDONo ratings yet

- CPAR Estate-TaxationDocument18 pagesCPAR Estate-Taxationwendygilbuela2022No ratings yet

- Enhancement Estate Tax2Document35 pagesEnhancement Estate Tax2Kathleen Tabasa ManuelNo ratings yet

- TAX 2 Deductions From The Gross Estate 1PPT.Document24 pagesTAX 2 Deductions From The Gross Estate 1PPT.Franz Ana Marie CuaNo ratings yet

- Transfer Taxes Tax 2Document45 pagesTransfer Taxes Tax 2Nat PantsNo ratings yet

- Determining Gross Estate for Estate Tax PurposesDocument5 pagesDetermining Gross Estate for Estate Tax PurposesLou Anthony A. Calibo0% (1)

- Cpa Reviewer in TaxationDocument34 pagesCpa Reviewer in TaxationMika MolinaNo ratings yet

- Tax Lecture Estate Tax Part 2Document7 pagesTax Lecture Estate Tax Part 2Kathreen Aya ExcondeNo ratings yet

- TRANSFER TAXES.... Tax 2Document45 pagesTRANSFER TAXES.... Tax 2atenionc100% (1)

- Calculate Vanishing DeductionDocument32 pagesCalculate Vanishing DeductionJayvee Felipe100% (1)

- Rules Gross Estate Taxation PhilippinesDocument4 pagesRules Gross Estate Taxation PhilippinesMarie Tes LocsinNo ratings yet

- Evaluate 1 - Estate Taxation Answer KeyDocument3 pagesEvaluate 1 - Estate Taxation Answer KeyNicolas AlonsoNo ratings yet

- CPAR Estate Tax (Batch 89) HandoutDocument18 pagesCPAR Estate Tax (Batch 89) HandoutlllllNo ratings yet

- Business Tax 4Document24 pagesBusiness Tax 4Cheska AtienzaNo ratings yet

- CEBU ROOSEVELT MEMORIAL COLLEGES PRELIMINARY EXAMINATIONDocument5 pagesCEBU ROOSEVELT MEMORIAL COLLEGES PRELIMINARY EXAMINATIONjhell dela cruzNo ratings yet

- Estate Taxation BasicsDocument11 pagesEstate Taxation BasicsPrincess EngresoNo ratings yet

- Estate-Taxation QAsDocument9 pagesEstate-Taxation QAsTeresaNo ratings yet

- ESTATE AND DONOR'S TAX GUIDEDocument10 pagesESTATE AND DONOR'S TAX GUIDEJoseph MangahasNo ratings yet

- 1.2.1 MC - Exercises On Property RelationsDocument3 pages1.2.1 MC - Exercises On Property RelationsJem ValmonteNo ratings yet

- Tax - 001Document3 pagesTax - 001HURLY BALANCAR0% (1)

- ESTATE TAX PROBLEMSDocument6 pagesESTATE TAX PROBLEMSZerjo CantalejoNo ratings yet

- Estate TaxDocument21 pagesEstate TaxPatrick ArazoNo ratings yet

- Estate Tax (Exercises)Document3 pagesEstate Tax (Exercises)dimpy dNo ratings yet

- Estate Tax-MCQDocument8 pagesEstate Tax-MCQAngela Miles DizonNo ratings yet

- Estate Tax Exam Multiple Choice QuestionsDocument8 pagesEstate Tax Exam Multiple Choice Questionsrey mark hamacNo ratings yet

- Estate Tax - Is The Tax On The Right To Transmit Property at Death and On Certain Transfers Which Are Made by Law The Equivalent ofDocument4 pagesEstate Tax - Is The Tax On The Right To Transmit Property at Death and On Certain Transfers Which Are Made by Law The Equivalent ofAlliah SomidoNo ratings yet

- 89 05 Estate and Trust Taxation PDF FreeDocument3 pages89 05 Estate and Trust Taxation PDF Freefrostysimbamagi meowNo ratings yet

- Estate Tax NotesDocument11 pagesEstate Tax NotesClaire Araneta AlcozeroNo ratings yet

- Material 11 Estate TaxDocument20 pagesMaterial 11 Estate Taxnodnel salonNo ratings yet

- Tax Review Q and A Quiz 1 and 2 FinalsDocument19 pagesTax Review Q and A Quiz 1 and 2 FinalsAngel Xavier CalejaNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Linear Programming Models: Graphical and Computer MethodsDocument91 pagesLinear Programming Models: Graphical and Computer MethodsFaith Reyna TanNo ratings yet

- Chart of Accounts: Grp. 5 To GRP 1 AnalysisDocument1 pageChart of Accounts: Grp. 5 To GRP 1 AnalysisFaith Reyna TanNo ratings yet

- Chapter 3 (Problem Solving)Document19 pagesChapter 3 (Problem Solving)Faith Reyna Tan100% (1)

- Chart of Accounts: Grp. 5 To GRP 1 AnalysisDocument1 pageChart of Accounts: Grp. 5 To GRP 1 AnalysisFaith Reyna TanNo ratings yet

- AEC12 Chapter 4Document7 pagesAEC12 Chapter 4Faith Reyna TanNo ratings yet

- Exercise No.5 (Acctg 7) - TanDocument3 pagesExercise No.5 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Exercise No.6 (Acctg 7) - TanDocument1 pageExercise No.6 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Youth Company Income Statement 2020Document1 pageYouth Company Income Statement 2020Faith Reyna TanNo ratings yet

- Calculating gross estates under Philippine tax lawDocument2 pagesCalculating gross estates under Philippine tax lawFaith Reyna TanNo ratings yet

- FSAQ1Document1 pageFSAQ1Faith Reyna TanNo ratings yet

- Revenue Cycle TestsDocument3 pagesRevenue Cycle TestsFaith Reyna TanNo ratings yet

- Chapter Test - Production CycleDocument3 pagesChapter Test - Production CycleFaith Reyna TanNo ratings yet

- Chapter Test - HRM&Payroll CycleDocument3 pagesChapter Test - HRM&Payroll CycleFaith Reyna TanNo ratings yet

- Chapter Test - Expenditure CycleDocument4 pagesChapter Test - Expenditure CycleFaith Reyna TanNo ratings yet

- Chapter Test - Gen Ledger & RPTG CycleDocument3 pagesChapter Test - Gen Ledger & RPTG CycleFaith Reyna TanNo ratings yet

- ProblemsDocument1 pageProblemsFaith Reyna TanNo ratings yet

- Activity 10.1Document1 pageActivity 10.1Faith Reyna TanNo ratings yet

- Ma. Faith R. Tan: Payable To A Revocable Beneficiary."Document1 pageMa. Faith R. Tan: Payable To A Revocable Beneficiary."Faith Reyna TanNo ratings yet

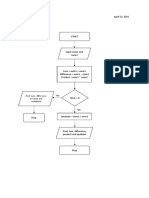

- TanMa FaithAEC9FlowchartDocument1 pageTanMa FaithAEC9FlowchartFaith Reyna TanNo ratings yet

- Chapter02 Assignment (AnswerSheet)Document13 pagesChapter02 Assignment (AnswerSheet)Faith Reyna TanNo ratings yet

- AEC10 Activity No.1 TanDocument1 pageAEC10 Activity No.1 TanFaith Reyna TanNo ratings yet

- Activity 11.1Document2 pagesActivity 11.1Faith Reyna TanNo ratings yet

- Data, Information, Cycles & DocumentationDocument11 pagesData, Information, Cycles & DocumentationFaith Reyna TanNo ratings yet

- Activity 10.1Document1 pageActivity 10.1Faith Reyna TanNo ratings yet

- Revenue Cycle TestsDocument3 pagesRevenue Cycle TestsFaith Reyna TanNo ratings yet

- Activity 11.1Document1 pageActivity 11.1Faith Reyna TanNo ratings yet

- Chapter Test - Production CycleDocument3 pagesChapter Test - Production CycleFaith Reyna TanNo ratings yet

- Chapter Test - Gen Ledger & RPTG CycleDocument3 pagesChapter Test - Gen Ledger & RPTG CycleFaith Reyna TanNo ratings yet

- Chapter Test - HRM&Payroll CycleDocument3 pagesChapter Test - HRM&Payroll CycleFaith Reyna TanNo ratings yet

- Mercantile Law: Topics PagesDocument7 pagesMercantile Law: Topics PagesAngel Eilise0% (1)

- AG Securities V VaughanDocument41 pagesAG Securities V VaughanharrycheunggggNo ratings yet

- Norma IEC-479-1Document70 pagesNorma IEC-479-1vicgarofalo22100% (2)

- 07192022103337.906 82864976 EoiDocument2 pages07192022103337.906 82864976 Eoidhananjay prahladkaNo ratings yet

- Synopsis: Contract of Bailment, Rights and Duties of Bailor and Bailee, License, SaleDocument2 pagesSynopsis: Contract of Bailment, Rights and Duties of Bailor and Bailee, License, SaleZohaib RazaNo ratings yet

- Third party beneficiary rightsDocument2 pagesThird party beneficiary rightsBP RosiesunflowerandlilliesNo ratings yet

- Perfam Syllabus - Part4Document11 pagesPerfam Syllabus - Part4Russell Stanley Que GeronimoNo ratings yet

- 2Document11 pages2Christopher Gutierrez Calamiong100% (1)

- International Convention On The Rights of Persons With Disabilities (CRPD)Document15 pagesInternational Convention On The Rights of Persons With Disabilities (CRPD)MrAlbusNo ratings yet

- Essential Elements of The Contract ofDocument12 pagesEssential Elements of The Contract ofjanicetorredaNo ratings yet

- Consti 2 Review - Montejo LecturesDocument108 pagesConsti 2 Review - Montejo LecturesLaura Brewer100% (1)

- Lanuza V. de Leon 20 SCRA 369 (1967)Document2 pagesLanuza V. de Leon 20 SCRA 369 (1967)CAJNo ratings yet

- Lease Subordination AgreementDocument2 pagesLease Subordination AgreementRocketLawyer100% (1)

- Raval v. PeraltaDocument3 pagesRaval v. PeraltaJasper Magbanua Bergantinos0% (2)

- Contracts, 7th (Hornbook Series - Joseph PerilloDocument1,506 pagesContracts, 7th (Hornbook Series - Joseph PerilloAntonio100% (17)

- Non-Corporate BodiesDocument7 pagesNon-Corporate BodiesYwani Ayowe KasilaNo ratings yet

- Law of Agency - Chapter FourDocument12 pagesLaw of Agency - Chapter FourAllan OcheroNo ratings yet

- Complaint For Partition and AccountingDocument3 pagesComplaint For Partition and AccountingJuris DoctorNo ratings yet

- The Relationship Between Contract Law and Property LawDocument25 pagesThe Relationship Between Contract Law and Property Lawsiska sembiringNo ratings yet

- Achitects in Bni Chapters in MumbaiDocument19 pagesAchitects in Bni Chapters in MumbaiSachin KampaniNo ratings yet

- VI SEM TPA-Unit IV-Law Relating To Transfer of Intangible Properties PDFDocument10 pagesVI SEM TPA-Unit IV-Law Relating To Transfer of Intangible Properties PDFSakshi MehraNo ratings yet

- 1.cruz V de Leon (1912)Document4 pages1.cruz V de Leon (1912)MJ Decolongon100% (1)

- Utopia-Law On Sales Reviewer by X.B.K. BataanDocument68 pagesUtopia-Law On Sales Reviewer by X.B.K. BataanXavier BataanNo ratings yet

- Accounting for PartnershipsDocument36 pagesAccounting for Partnershipsedo100% (2)

- Remedies Available Under Specific Relief Act, 1963Document14 pagesRemedies Available Under Specific Relief Act, 1963SIIB SURATNo ratings yet

- Easement LawDocument14 pagesEasement LawSanchit ShastriNo ratings yet

- JIS K6741-2016 - e - Ed10 - I4-Hitachi - ENDocument38 pagesJIS K6741-2016 - e - Ed10 - I4-Hitachi - ENvan binh NguyenNo ratings yet

- PNB v. Sta MariaDocument5 pagesPNB v. Sta MariaPea ChubNo ratings yet

- Sales - Credit Transactions - Agency.notes - OutlineDocument39 pagesSales - Credit Transactions - Agency.notes - OutlineFernando III PerezNo ratings yet

- Freehold Covenants PQ Solving (Property Law)Document13 pagesFreehold Covenants PQ Solving (Property Law)Mahdi Bin MamunNo ratings yet