Professional Documents

Culture Documents

AEC10 Activity No. 2

Uploaded by

Faith Reyna TanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AEC10 Activity No. 2

Uploaded by

Faith Reyna TanCopyright:

Available Formats

AEC10

ACTIVITY NO. 2

1. whether the following properties are includible in the estate of the decedent or not:

a. Salary from September 1 to 15 if the decedent died on September 16 of the current year.

He made a five (5) days cash advance prior to his death;

b. Rent income of apartment for the month of August which have not yet been collected;

c. Accrued interest on a savings account which have not yet been withdrawn;

d. Dividends on shares stock. The decedent died before the date of record;

e. Partial interest in a co-ownership;

f. A parcel of land inherited from an uncle who died a week ago. He was not yet taken

possession over the property;

g. Insurance on his life. His child is designated as the revocable beneficiary under such policy.

h. Jewelry worth a hundred thousand pesos received as donation from his paramour.

i. A brand new Isuzu Sportivo donated by a public works contractor to the Regional Director

of the PWDH in connection with the request to favor the former in the awarding of multi-

millionaire pesos contract.

2. Cathay’s employer owed Cathay P5, 000 on salary that had not been paid at the time of death.

a. Is Cathay’s right to that amount includible in her gross estate?

b. What if the P5, 000 is a benefit that Cathay’s employer agreed to pay to Cathay or her estate

only if she continued to work from the employer until her death or retirement, and Cathay

worked until the day she died?

3. Sue Tek insured his life for P450,000. In the policy, he designated his wife as the revocable

beneficiary.

a. In case of death of Sue Tek, will the proceeds of the life insurance become part of his estate?

b. How about if the designation to his beneficiary wife is irrevocable?

4. Sigurista sold to Tagapagmana a real property valued at P650, 000 for P300, 000 only. The

sale contains a reserved power to revoke the same while Sigurista is alive, which she failed to

exercise until his death. When Sigurista died, the property had a value of P750, 000.

a. How much should be included in the gross estate of Sigurista?

b. How about if it is discovered that the sale is fictitious?

5. Yolly took a life insurance policy upon her own life. The face value is P400, 000. When she died,

the insurance company paid her only daughter, Marietta, the proceeds of the insurance.

Marietta did not include the P400, 000 in the computation of the gross estate. Upon assessment,

the BIR official contends that there is deficiency tax having failed to include the insurance

proceeds in the gross estate. Is the tax official correct?

6. Ara Nina, 85 years old and aware of her serious illness, sold a property with a value of P800,

000 for a consideration of P300, 000 to Dina Ngona. After a month, she died leaving a net estate

after the deducting the estate tax of P3, 000, 000. How much is the net distributable estate of

Ara Nina if the Property sold to Dina Ngona Had a value of P840, 000 at the time of death?

7. Bonador donated to Atacador a parcel of land in 2010. Bonador made the deed of donation

entitled “Donation Inter Vivos” in a publc instrument and Atacador accepted the donation in the

same document. It was provided in the deed that the land donated shall be immediately

delivered to Atacador and Atacador shall have right to enjoy the fruits fully. The deed also

provided that Bonador was reserving the right to dispose of said land during his (Bonador’s)

lifetime, and that Atacador shall not register the deed of donation until Bonador’s death. Upon

Bonador’s death, Curiadora, Bonador’s widow and sole heir, filed an action for the recovery of

the donated land, contending that the donation made by Bonador is a donation mortis causa

and not donation inter vivos. Will said action prosper?

- End -

You might also like

- Estate Tax Post Quiz Answer KeyDocument8 pagesEstate Tax Post Quiz Answer KeyMichael AquinoNo ratings yet

- Raising CapitalDocument43 pagesRaising CapitalMuhammad AsifNo ratings yet

- Intangible Assets PDFDocument9 pagesIntangible Assets PDFFery AnnNo ratings yet

- Tray Play Ebook PDFDocument60 pagesTray Play Ebook PDFkaren megsanNo ratings yet

- How To Write SpecificationsDocument9 pagesHow To Write SpecificationsLeilani ManalaysayNo ratings yet

- Chapter 03 Gross EstateDocument16 pagesChapter 03 Gross EstateNikki Bucatcat0% (1)

- History of Sultan KudaratDocument9 pagesHistory of Sultan Kudaratjimmy_andangNo ratings yet

- Sample Activity ReportDocument2 pagesSample Activity ReportKatrina CalacatNo ratings yet

- Final Tax ExamDocument10 pagesFinal Tax ExamGerald RojasNo ratings yet

- Snail Production Techniques in Nigeria (Extension No. 108, Forestry Series No. 12) BulletinDocument23 pagesSnail Production Techniques in Nigeria (Extension No. 108, Forestry Series No. 12) BulletinGbenga AgunbiadeNo ratings yet

- Kaulachara (Written by Guruji and Posted 11/3/10)Document4 pagesKaulachara (Written by Guruji and Posted 11/3/10)Matt Huish100% (1)

- Ia 1 Setc Finalexam No AnswerDocument10 pagesIa 1 Setc Finalexam No Answerjulia4razo100% (1)

- Creative Writers and Daydreaming by Sigmund Freud To Print.Document7 pagesCreative Writers and Daydreaming by Sigmund Freud To Print.Robinhood Pandey82% (11)

- NewsWriting HizonDocument18 pagesNewsWriting HizonCrisvelle AlajeñoNo ratings yet

- Based On The 1979 Standards of Professional Practice/ SPPDocument10 pagesBased On The 1979 Standards of Professional Practice/ SPPOwns DialaNo ratings yet

- The List of the Korean Companies in the UAE: Company Name 이름 Off. Tel Off. Fax P.O.BoxDocument34 pagesThe List of the Korean Companies in the UAE: Company Name 이름 Off. Tel Off. Fax P.O.Boxnguyen phuong anh100% (1)

- CH1 HbotbDocument7 pagesCH1 HbotbJela OasinNo ratings yet

- Farparcor 2 Chapter 1 Exercises Problem AnswersDocument10 pagesFarparcor 2 Chapter 1 Exercises Problem AnswersWillnie Shane LabaroNo ratings yet

- Cost Accounting Quiz Bee EasyDocument9 pagesCost Accounting Quiz Bee EasyJinx Cyrus RodilloNo ratings yet

- Inventories ATs Garcia CristineJoy G BSA-1BDocument4 pagesInventories ATs Garcia CristineJoy G BSA-1BCj GarciaNo ratings yet

- Audit of InventoryDocument9 pagesAudit of InventoryEliyah JhonsonNo ratings yet

- Fringe Benefits ScenariosDocument2 pagesFringe Benefits ScenariosKatherine BorjaNo ratings yet

- Presumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateDocument5 pagesPresumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateLala AlalNo ratings yet

- JPIA CA5101 MerchxManuf Reviewer PDFDocument7 pagesJPIA CA5101 MerchxManuf Reviewer PDFmei angelaNo ratings yet

- Long QuizDocument4 pagesLong QuizJoshua Rey Sapuras0% (1)

- Group 3 Feasibility Study Chapters 1 2 3Document55 pagesGroup 3 Feasibility Study Chapters 1 2 3KRISTAN JOHN M. SALASNo ratings yet

- Early Philippine IndustrializationDocument2 pagesEarly Philippine IndustrializationsppNo ratings yet

- AP.3406 Audit of InvestmentsDocument5 pagesAP.3406 Audit of InvestmentsMonica GarciaNo ratings yet

- ACC12 - Auditing and Assurance Concepts and Applications 1 Midterm ExaminationDocument2 pagesACC12 - Auditing and Assurance Concepts and Applications 1 Midterm ExaminationUn knownNo ratings yet

- Far JpiaDocument14 pagesFar JpiaJNo ratings yet

- Mathematics For FinanceDocument15 pagesMathematics For Financekirsten chingNo ratings yet

- ROMERO BSMA1E Standard Costing ExerciseDocument4 pagesROMERO BSMA1E Standard Costing ExerciseAliah Romero100% (1)

- Chapter OneDocument5 pagesChapter OneHazraphine LinsoNo ratings yet

- Current Liabilities and ProvisionsDocument12 pagesCurrent Liabilities and ProvisionsRinkashizu TokimimotakuNo ratings yet

- 02 Fundamentals of Assurance ServicesDocument5 pages02 Fundamentals of Assurance ServicesKristine TiuNo ratings yet

- PPE HandoutsDocument12 pagesPPE HandoutsChristine Joy PamaNo ratings yet

- Revaluation-Accounting CompressDocument13 pagesRevaluation-Accounting CompressEunice Buenaventura100% (1)

- Use The Following Information For The Next Two Questions.: Act1108 Financial Management Inventory Management - ExercisesDocument1 pageUse The Following Information For The Next Two Questions.: Act1108 Financial Management Inventory Management - ExercisesMaryrose SumulongNo ratings yet

- Scope: Financial Accounting and Reporting - Property, Plant and Equipment Property, Plant and EquipmentDocument12 pagesScope: Financial Accounting and Reporting - Property, Plant and Equipment Property, Plant and EquipmentEngel QuimsonNo ratings yet

- Foreign Currency Transactions2019Document6 pagesForeign Currency Transactions2019Jeann MuycoNo ratings yet

- This Study Resource Was: Saint Paul School of Business and LawDocument4 pagesThis Study Resource Was: Saint Paul School of Business and LawKim FloresNo ratings yet

- CONCEPTUAL FRAMEWORK HandoutDocument6 pagesCONCEPTUAL FRAMEWORK HandoutRuby RomeroNo ratings yet

- EXAM About INTANGIBLE ASSETS 2Document3 pagesEXAM About INTANGIBLE ASSETS 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- M36 - Quizzer 1 PDFDocument8 pagesM36 - Quizzer 1 PDFJoshua DaarolNo ratings yet

- BPS Quiz Intangibles PRINTDocument3 pagesBPS Quiz Intangibles PRINTSheena CalderonNo ratings yet

- PAS 28 Does Not Require The Equity Method To Be Applied To Which of The Following InstanceDocument2 pagesPAS 28 Does Not Require The Equity Method To Be Applied To Which of The Following InstanceAngeline RamirezNo ratings yet

- MAS-02 Cost Terms, Concepts and BehaviorDocument4 pagesMAS-02 Cost Terms, Concepts and BehaviorMichael BaguyoNo ratings yet

- Chapter 16 - Consol. Fs Part 1Document17 pagesChapter 16 - Consol. Fs Part 1PutmehudgJasdNo ratings yet

- IA Prelim ExamDocument6 pagesIA Prelim ExamJanella PazcoguinNo ratings yet

- Intermediate Accounting SolmanDocument14 pagesIntermediate Accounting SolmanAlarich CatayocNo ratings yet

- SCRC 3 CorporationDocument18 pagesSCRC 3 CorporationChristine Yedda Marie AlbaNo ratings yet

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- Question: Austral & Company Has A Debt Ratio of 0.5, A Total Assets Turnover Ratio of 0.25, and A Pro ..Document3 pagesQuestion: Austral & Company Has A Debt Ratio of 0.5, A Total Assets Turnover Ratio of 0.25, and A Pro ..Malik AsadNo ratings yet

- AFAR 1 Flexible Learning Module Midterm Topic 2 ABC and Variable Costing.Document11 pagesAFAR 1 Flexible Learning Module Midterm Topic 2 ABC and Variable Costing.Jessica IslaNo ratings yet

- Problem 4Document2 pagesProblem 4mhikeedelantarNo ratings yet

- 5 6255862442081910859Document29 pages5 6255862442081910859Christine PedronanNo ratings yet

- HW 2. Problems Cash and Cash Equivalents - StudentDocument2 pagesHW 2. Problems Cash and Cash Equivalents - StudentAngelo TipaneroNo ratings yet

- An Examination of Factors Affecting The Passing Rates of The CPA ExaminationDocument20 pagesAn Examination of Factors Affecting The Passing Rates of The CPA ExaminationKimberly BanuelosNo ratings yet

- MS03 09 Capital Budgeting Part 2 EncryptedDocument6 pagesMS03 09 Capital Budgeting Part 2 EncryptedKate Crystel reyesNo ratings yet

- Using Accounting Information in DecisionDocument15 pagesUsing Accounting Information in DecisionMarj AgustinNo ratings yet

- Mas Drills Weeks 1 5Document28 pagesMas Drills Weeks 1 5Hermz ComzNo ratings yet

- Management Advisory Services - FinalDocument8 pagesManagement Advisory Services - FinalFrancis MateosNo ratings yet

- 5share OptionsDocument21 pages5share OptionsnengNo ratings yet

- Module Far1 Unit-1 Part-1bDocument5 pagesModule Far1 Unit-1 Part-1bHazel Jane EsclamadaNo ratings yet

- Law 3Document3 pagesLaw 3Amethyst JordanNo ratings yet

- MAS-42E (Budgeting With Probability Analysis)Document10 pagesMAS-42E (Budgeting With Probability Analysis)Fella GultianoNo ratings yet

- AFAR - 4 Construction Accounting and Franchise AccountingDocument3 pagesAFAR - 4 Construction Accounting and Franchise AccountingalyssaNo ratings yet

- Topacio Rizza C. Activity 6-1Document12 pagesTopacio Rizza C. Activity 6-1santosashleymay7No ratings yet

- WEEK3to4 (AKTIVITY 2.rizalDocument3 pagesWEEK3to4 (AKTIVITY 2.rizalErwil AgbonNo ratings yet

- Module 4 Post TaskDocument9 pagesModule 4 Post TaskTHEA BEATRICE GARCIA100% (1)

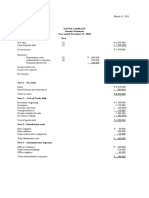

- Ma. Faith R. Tan: Payable To A Revocable Beneficiary."Document1 pageMa. Faith R. Tan: Payable To A Revocable Beneficiary."Faith Reyna TanNo ratings yet

- Linear Programming Models: Graphical and Computer MethodsDocument91 pagesLinear Programming Models: Graphical and Computer MethodsFaith Reyna TanNo ratings yet

- Exercise No.4 (Acctg 7) - TanDocument1 pageExercise No.4 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- AEC12 Chapter 4Document7 pagesAEC12 Chapter 4Faith Reyna TanNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Exercise No.6 (Acctg 7) - TanDocument1 pageExercise No.6 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Chart of Accounts: Grp. 5 To GRP 1 AnalysisDocument1 pageChart of Accounts: Grp. 5 To GRP 1 AnalysisFaith Reyna TanNo ratings yet

- Chapter 3 (Problem Solving)Document19 pagesChapter 3 (Problem Solving)Faith Reyna Tan100% (1)

- Chart of Accounts: Grp. 5 To GRP 1 AnalysisDocument1 pageChart of Accounts: Grp. 5 To GRP 1 AnalysisFaith Reyna TanNo ratings yet

- Exercise No.5 (Acctg 7) - TanDocument3 pagesExercise No.5 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Chapter Test - HRM&Payroll CycleDocument3 pagesChapter Test - HRM&Payroll CycleFaith Reyna TanNo ratings yet

- Chapter Test - Revenue CycleDocument3 pagesChapter Test - Revenue CycleFaith Reyna TanNo ratings yet

- AEC10 Activity No.3 TanDocument2 pagesAEC10 Activity No.3 TanFaith Reyna TanNo ratings yet

- FSAQ1Document1 pageFSAQ1Faith Reyna TanNo ratings yet

- Chapter Test - Production CycleDocument3 pagesChapter Test - Production CycleFaith Reyna TanNo ratings yet

- Chapter Test - Expenditure CycleDocument4 pagesChapter Test - Expenditure CycleFaith Reyna TanNo ratings yet

- Chapter Test - Gen Ledger & RPTG CycleDocument3 pagesChapter Test - Gen Ledger & RPTG CycleFaith Reyna TanNo ratings yet

- Chapter02 Assignment (AnswerSheet)Document13 pagesChapter02 Assignment (AnswerSheet)Faith Reyna TanNo ratings yet

- Notebook in Acctg8Document11 pagesNotebook in Acctg8Faith Reyna TanNo ratings yet

- Activity 10.1Document1 pageActivity 10.1Faith Reyna TanNo ratings yet

- Ma. Faith R. Tan: Payable To A Revocable Beneficiary."Document1 pageMa. Faith R. Tan: Payable To A Revocable Beneficiary."Faith Reyna TanNo ratings yet

- ProblemsDocument1 pageProblemsFaith Reyna TanNo ratings yet

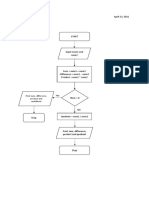

- TanMa FaithAEC9FlowchartDocument1 pageTanMa FaithAEC9FlowchartFaith Reyna TanNo ratings yet

- AEC10 Activity No.1 TanDocument1 pageAEC10 Activity No.1 TanFaith Reyna TanNo ratings yet

- Activity 10.1Document1 pageActivity 10.1Faith Reyna TanNo ratings yet

- Chapter Test - HRM&Payroll CycleDocument3 pagesChapter Test - HRM&Payroll CycleFaith Reyna TanNo ratings yet

- Chapter Test - Revenue CycleDocument3 pagesChapter Test - Revenue CycleFaith Reyna TanNo ratings yet

- Activity 11.1Document2 pagesActivity 11.1Faith Reyna TanNo ratings yet

- Activity 11.1Document1 pageActivity 11.1Faith Reyna TanNo ratings yet

- Chapter Test - Gen Ledger & RPTG CycleDocument3 pagesChapter Test - Gen Ledger & RPTG CycleFaith Reyna TanNo ratings yet

- Chapter Test - Production CycleDocument3 pagesChapter Test - Production CycleFaith Reyna TanNo ratings yet

- Sci ReportDocument8 pagesSci ReportAna LuisaNo ratings yet

- Arnold Böcklin Was Born in Basel, Switzerland inDocument6 pagesArnold Böcklin Was Born in Basel, Switzerland inDragos PlopNo ratings yet

- Masculine Ideal in The Old Man and The SeaDocument5 pagesMasculine Ideal in The Old Man and The Seaapi-295869808No ratings yet

- Mision de Amistad Correspondence, 1986-1988Document9 pagesMision de Amistad Correspondence, 1986-1988david_phsNo ratings yet

- Proposal For Pitch An IdeaDocument2 pagesProposal For Pitch An Ideaaaron mathewsNo ratings yet

- Lirik KoreaDocument6 pagesLirik KoreaSabrina Winyard ChrisNo ratings yet

- Operating BudgetDocument38 pagesOperating BudgetRidwan O'connerNo ratings yet

- PEXAM - 1attempt ReviewDocument4 pagesPEXAM - 1attempt ReviewBibi CaliBenitoNo ratings yet

- Email 1Document4 pagesEmail 1Ali AmarNo ratings yet

- SCAM (Muet)Document6 pagesSCAM (Muet)Muhammad FahmiNo ratings yet

- Kentucky National Guard MemorialDocument60 pagesKentucky National Guard MemorialCourier JournalNo ratings yet

- Rizal Module 2 Concept of A HeroDocument11 pagesRizal Module 2 Concept of A HeropinkgirljojiNo ratings yet

- 6A E21 Addendum 1 PDFDocument9 pages6A E21 Addendum 1 PDFAndres FCTNo ratings yet

- The Achaeans (Also Called The "Argives" or "Danaans")Document3 pagesThe Achaeans (Also Called The "Argives" or "Danaans")Gian Paul JavierNo ratings yet

- Of Delhi in Criminal Appeal No. - of 2018)Document18 pagesOf Delhi in Criminal Appeal No. - of 2018)AnukritiNo ratings yet

- 2021 Community ReportDocument28 pages2021 Community Reportapi-309161587No ratings yet

- Novena To ST JudeDocument2 pagesNovena To ST JudeBeatrice Mae ChuaNo ratings yet

- Resolution No. 1433Document2 pagesResolution No. 1433MA. DIVINA LAPURANo ratings yet

- Ganendra Art House: 8 Lorong 16/7B, 46350 Petaling Jaya, Selangor, MalaysiaDocument25 pagesGanendra Art House: 8 Lorong 16/7B, 46350 Petaling Jaya, Selangor, MalaysiaFiorela Estrella VentocillaNo ratings yet