Professional Documents

Culture Documents

Cma FND RPT & SFB Ts 4 Acc Sa

Uploaded by

sindevaishnavi1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cma FND RPT & SFB Ts 4 Acc Sa

Uploaded by

sindevaishnavi1Copyright:

Available Formats

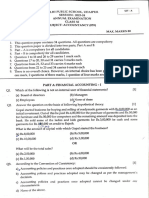

TEST SERIES

CMA – FOUNDATION (RPT & SF(B) - FEB’2024

PAPER 2 : FUNDAMENTALS OF FINANCIAL AND COST ACCOUNTING

TEST SERIES – 4

SUGGESTED ANSWERS

Date: 12th April 2024 Marks : 50 Duration : 30 Min.

Syllabus: Rectification of Errors, Depreciation, Bank Reconciliation Statement

Choose the correct options: 25Q*2M = 50M

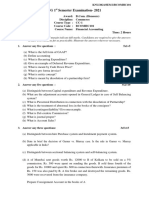

1. The payments side of the cash book is under cast by Rs.200. When overdraft as per pass book is the

starting point, to get the overdraft as per cash book.

(d) Rs.200 will be deducted (b) Rs.200 will be added

(c) Rs.400 will be added (d) Rs.400 will be deducted

2. A Company, which closes its books each year on 31st March December, bought on 1st Jan., 2000, a

second hand machine for Rs.23,000 and spent Rs 2,000 on its overhaul. The expected life is 5 years

of 2,000 hours each. During 2000 and 2001 it worked for 1,500 and 1,000 hours respectively.

Calculate the total amount of depreciation for the two years under SLM:

(d) 10,000 (b) 6,250 (c) 2,250 (d) 12,500

3. The total of sales book has been under cast by Rs. 200. For rectifying this error:

(d) Purchase book should be debited by the Rs. 200

(b) Sales a/c should be credited by Rs. 200

(c) Sales book should be debited by Rs. 200

(d) Sales book should be credited by Rs. 400

4. The bank pass book shows Rs.3,260 but the Cash book gives a different figure. The differences are

found to be a cheque for Rs.34 sent to a creditor but wrongly entered in the cash book as Rs.142; an

error by the bank, Rs.324 paid in has not been credited by them to the customer. The cash book

showed:

(d) Rs.2,828 (b) Rs.3,044 (c) Rs.3,476 (d) Rs.3,692

5. Original cost of asset Rs.5,00,000 ; Discount offered Rs.20,000; Life time of asset 5 years;

Estimated scrap value Rs.40,000; Depreciation method is Sinking fund method; Sinking fund table

reference; 0.180975. The annual Depreciation is Rs. :

(d) 90,487.5 (b) 86,868 (c) 79,629 (d) 83,248.5

6. What is the rectified entry when sales book is cast short?

(d) Dr. Bank a/c & Cr. Sales a/c (b) Dr. Sales a/c & Cr. Bank a/c

(c) Dr. Suspense a/c & Cr. Sales a/c (d) Dr. Sales a/c & Cr. Suspense a/c

7. When Overdraft Balance as per cash book is 20,000. Interest on Overdraft by Bank is Rs. 2,000 is not

recorded in cash book then the Overdraft Balance as per Pass Book will be _________

(d) 22,000 (b) 24,000 (c) 18,000 (d) 21,000

8. What is the rectified entry when the cash received from A has been credited to B a/c?

(d) Dr. Bank a/c & Cr. B a/c (b) Dr. A a/c & Cr. B a/c

(c) Dr. Bank a/c & Cr. A a/c (d) Dr. B a/c & Cr. A a/c

9. A credit purchase of Rs.30,000 was recorded in the sales book posted to the credit of supplier. The

difference in the Trial Balance will be

www.isfs.edu.in LBN | KKP | SBD | HTN | SRN | WGL 9849222244 1

TEST SERIES

(d) Debit side higher by Rs.30,000 (b) Credit side higher by Rs.30,000

(c) Debit side higher by Rs.60,000 (d) Credit side higher by Rs.60,000

10. The cash book showed an overdraft of Rs. 1,500 as cash at bank, but the pass book made up to

the same date showed that cheques of Rs. 100, Rs. 50 and Rs. 125 respectively had not been

presented for payments; and the cheque of Rs. 400 paid into account had not been cleared. “The

balance as per pass book will be”

(d) Rs. 1,100. (b) Rs. 2,175. (c) Rs. 1,625. (d) Rs. 1,375.

11. Amit Ltd. purchased a machine on 01.01.2003 for Rs.1,20,000. Installation expenses were

Rs.10,000. Residual value after 5 years Rs.5,000. On 01.07.2003, expenses for repairs were

incurred to the extent of Rs.2,000. Depreciation is provided under straight line method. Annual

Depreciation will be.

(d) Rs.13,000 (b) Rs.17,000 (c) Rs.21,000 (d) Rs.25,000

12. Furniture which stood in the books of Rs.500 was sold for Rs.275 in part exchange of new furniture

costing Rs.875 and the net invoice of Rs.600 was passed through the purchases book. The

rectification of this error would result in:

(d) increase in the profit by Rs.375 (b) decrease in the profit by Rs.375

(c) decrease in the profit by Rs.225 (d) increase in the profit by Rs.600

13. Historical cost Rs.8,00,000 ; Estimated Scrap value Rs.50,000; Depreciation method applied is WDV

method @ 10% per annum. What is written down value at the end of 4th year?

(d) 5,42,880 (b) 5,24,880 (c) 5,82,480 (d) 5,48,280

14. Goods sold under credit terms Rs.16,900 to Mohan were recorded properly in the Sales Book but

were debited to his account as Rs.19,600 and carriage outward freight paid Rs.700 chargeable

from him were posted to Sales Expenses Account. To rectify this,

(d) credit Mohan a/c with Rs.2,700 (b) credit Mohan a/c with Rs.2,000

(c) debit Mohan a/c with Rs.700 (d) debit Mohan a/c with Rs.2,700

15. What is the rectified entry when drawings made by proprietor is debited to expense a/c?

(d) Dr. Expense a/c & Cr. Drawings (b) Dr. Drawings a/c & Cr. Expense a/c

(c) Dr. Expense a/c & Cr. Bank (d) Dr. Drawings a/c & Cr. Bank a/c

16. Balance in Bank column of the cash book of X & Co. on 31.03.2007 is Rs.5,500. Cheques issued

but not presented for payment till 31.03.2007 are Rs.250 and cheques deposited but not cleared

are Rs.350. Balance as per Bank pass book is

(d) Rs.5,400 (b) Rs.6,100 (c) Rs.4,900 (d) Rs.5,850

17. What is the rectified entry when a cheque received from A is dishonoured and posted to sales

return a/c?

(d) Dr. A a/c & Cr. Sales a/c (b) Dr. Sales a/c & Cr. A a/c

(c) Dr. Sale a/c & Cr. Sales return a/c (d) Dr. A a/c & Cr. Sales return a/c

18. What entry would the customer pass when he rejects the goods purchased on approval basis?

(d) Dr. Supplier a/c & Cr.Purchase a/c

(b) Dr. Supplier a/c & Cr.Purchase on approval basis a/c

(c) Dr. Supplier a/c & Cr. Suspense a/c

(d) No entry

19. Sale of old machinery of Rs.5,000 has been treated as sale of goods. To rectify this error give the

journal entry, after preparing the trial balance.

www.isfs.edu.in LBN | KKP | SBD | HTN | SRN | WGL 9849222244 2

TEST SERIES

(d) Machinery account Dr. 5,000

To Sales account 5,000

(b) Purchases account Dr. 5,000

To Machinery account 5000

(c) Sales account Dr. 5,000

To Machinery account 5,000

(d) Sales account Dr. 5,000

To Purchases account 5,000

20. Debit balance in plant account on 1.1.04 is Rs.80,000; Scrap value Rs.20,000 Depreciation method

applied up to 31.12.2003 is SLM method @ 15% per annum. Find out the original cost of the plant

if it was purchased on 1.1.2000 :

(d) 2,00,000 (b) 2,40,000 (c) 4,20,000 (d) 2,04,000

21. A Company, which closes its books each year on 31st December, bought on 1st Jan, 2000, a

second hand machine for Rs.23,000 and spent Rs.2,000 on its overhaul. The expected life is

5 years of 2,000 hours each. During 2000 and 2001 it worked for 1,500 and 1,000 hours respectively.

Calculate the total amount of depreciation for the two years :

(d) 10,000 (b) 6,250 (c) 2,650 (d) 12,500

22. A mine estimated to contain 1,00,000 tonnes of minerals is leased at a cost of Rs.15,00,000 and was

expected to be worked for 10 years. During the first year, production was 6,000 tonnes. State the

amount of the depreciation :

(d) 1,50,000 (b) 51,000 (c) 19,000 (d) 90,000

23. What is the rate of depreciation, as per SLM when cost of machine is Rs.1,05,000,residual value

Rs.5,000 & useful life is 10 years?

(d) 9% (b) 9.5% (c) 10% (d) 10.5%

24. Ram Ltd. purchased a machine on 01.01.2003 for Rs.1,20,000. Installation expenses were

Rs.10,000. Residual value after 5 years Rs.5,000. On 01.07.2003, expenses for repairs were

incurred to the extent of Rs.2,000. Depreciation is provided under straight line method.

Depreciation rate is 10%. Annual Depreciation will be.

(d) Rs.13,000 (b) Rs.17,000 (c) Rs.21,000 (d) Rs.25,000

25. H Ltd. purchased a machinery on April 01, 2000 for Rs. 3,00,000. It is estimated that the machinery

will have a useful life of 5 years after which it will have no salvage value. If the company follows

sum-of-the-years-digits method of depreciation, the amount of depreciation charged during the

year 2004-05 was

(d) Rs. 1,00,000 (b) Rs. 80,000 (c) Rs. 60,000 (d) Rs. 20,000.

www.isfs.edu.in LBN | KKP | SBD | HTN | SRN | WGL 9849222244 3

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Massey Ferguson MF7600 Technician Workshop ManualDocument798 pagesMassey Ferguson MF7600 Technician Workshop Manualgavcin100% (5)

- Account MCQ Notes PDFDocument26 pagesAccount MCQ Notes PDFShakib AnsariNo ratings yet

- CA-idms Ads Alive User Guide 15.0Document142 pagesCA-idms Ads Alive User Guide 15.0svdonthaNo ratings yet

- Hazop Close Out ReportDocument6 pagesHazop Close Out ReportKailash PandeyNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Multiple Choice Quetions - Financial AccountingDocument4 pagesMultiple Choice Quetions - Financial Accountingshabukr100% (4)

- BZY Series Tension Meter ManualDocument29 pagesBZY Series Tension Meter ManualJORGE SANTANDER0% (1)

- Practice Quiz Reflection Project Initiation and Key ComponentsDocument3 pagesPractice Quiz Reflection Project Initiation and Key ComponentsFalastin Tanani67% (3)

- CA CPT June 2014 Paper With SolutionsDocument19 pagesCA CPT June 2014 Paper With SolutionsAnweshaBose100% (2)

- CA CPT June 2014 Solved PaperDocument18 pagesCA CPT June 2014 Solved PaperAnweshaBose50% (4)

- 11th Accounts Full Test MVPDocument17 pages11th Accounts Full Test MVPnandiniladdha16No ratings yet

- Disclaimer: Vidya Sagar InstituteDocument38 pagesDisclaimer: Vidya Sagar InstituteAkashdeep MukherjeeNo ratings yet

- 11 AccountancyDocument10 pages11 AccountancyIndrajitNo ratings yet

- CA - CPT Question Paper (June 2012) - RevisedDocument21 pagesCA - CPT Question Paper (June 2012) - RevisedgyansmrutiNo ratings yet

- CPT Answer Key With Question Paper June 2016Document17 pagesCPT Answer Key With Question Paper June 2016Gomathi SankarNo ratings yet

- Revision Accountancy XI Term II 8.12.2022 FinalDocument15 pagesRevision Accountancy XI Term II 8.12.2022 FinalNIRMALA COMMERCE DEPTNo ratings yet

- Model Test PaperDocument112 pagesModel Test PaperTanya Hughes100% (1)

- CPT Sample Question PaperDocument41 pagesCPT Sample Question PaperAshraf ValappilNo ratings yet

- 11 Accountancy First Term Set BDocument6 pages11 Accountancy First Term Set Bmcsworkshop777No ratings yet

- Acct Practice PaperDocument11 pagesAcct Practice PaperKrish BajajNo ratings yet

- Ty Bcom PDF Sample QuiestionsDocument49 pagesTy Bcom PDF Sample QuiestionsAniket VyasNo ratings yet

- MCQs Financial AccountingDocument12 pagesMCQs Financial AccountingPervaiz ShahidNo ratings yet

- SET A Class 11th Accountancy WPT - I 2Document5 pagesSET A Class 11th Accountancy WPT - I 2Shakshi ShudhNo ratings yet

- RKG Accounts (XI) CH 9 To 16Document3 pagesRKG Accounts (XI) CH 9 To 16arorayug90No ratings yet

- XI Account Questions PDFFDocument9 pagesXI Account Questions PDFFnazwaniiharshNo ratings yet

- Ac Test 80 M (1) - Watermark - WatermarkDocument5 pagesAc Test 80 M (1) - Watermark - Watermarkanikeshyadav0700No ratings yet

- Mock Full Book 02 BookDocument3 pagesMock Full Book 02 Bookgoharmahmood203No ratings yet

- 11 Accountancy Practice PaperDocument9 pages11 Accountancy Practice PaperPlayer dude65No ratings yet

- CPT Mock Test Minor Test 3 (15.5.2019)Document35 pagesCPT Mock Test Minor Test 3 (15.5.2019)polad72No ratings yet

- 11 Accountancy First Term Set ADocument6 pages11 Accountancy First Term Set Amcsworkshop777No ratings yet

- Sample Paper AccountsDocument7 pagesSample Paper AccountsmenekyakiaNo ratings yet

- CPT Mock Question PaperDocument40 pagesCPT Mock Question PaperbaburamNo ratings yet

- Accountancy PaperDocument7 pagesAccountancy PaperPritika Ghai XI-Humanities RNNo ratings yet

- ElementsBookKeepingAccountancy SQPDocument6 pagesElementsBookKeepingAccountancy SQPMohd JamaluddinNo ratings yet

- Depreciation AccountingDocument14 pagesDepreciation AccountingsheebaNo ratings yet

- AccountancyDocument8 pagesAccountancyvanitasharmap0124No ratings yet

- Mock Test 1 Accounts QuestionsDocument10 pagesMock Test 1 Accounts Questionss.Praveen kumarNo ratings yet

- 11th Accountancy DraftDocument8 pages11th Accountancy Draftmohit pandeyNo ratings yet

- ElementsBookKeepingAccountancy SQPDocument7 pagesElementsBookKeepingAccountancy SQPKanya PrakashNo ratings yet

- Xi Pre Final AccountsDocument7 pagesXi Pre Final AccountsDrishti ChauhanNo ratings yet

- CPT Model Papers 1Document418 pagesCPT Model Papers 1Kalyan SagarNo ratings yet

- 202AF13A Financial AccountingDocument14 pages202AF13A Financial AccountingkalpanaNo ratings yet

- Accountancy Class 11 PaperDocument14 pagesAccountancy Class 11 Paperjimoochaudhary0% (1)

- 21936mtp Cptvolu1 Part4Document404 pages21936mtp Cptvolu1 Part4Arun KCNo ratings yet

- CA CPT Question Paper 2018Document31 pagesCA CPT Question Paper 2018Gaurav JainNo ratings yet

- 13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Document15 pages13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Rakesh MaliNo ratings yet

- ElugabaechariDocument12 pagesElugabaecharihitaNo ratings yet

- I M.com Accounting For Managerial DecisionDocument10 pagesI M.com Accounting For Managerial DecisionVISHAGAN MNo ratings yet

- CBSE Grade 11 Accounts Practice Paper 234521Document8 pagesCBSE Grade 11 Accounts Practice Paper 234521The DealerNo ratings yet

- Test ID Max Marks: 200 CA CPT December 2014 (Memory Based Paper)Document21 pagesTest ID Max Marks: 200 CA CPT December 2014 (Memory Based Paper)Icaii InfotechNo ratings yet

- Session Ending Examination 2019Document7 pagesSession Ending Examination 2019madhudevi06435No ratings yet

- Nulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021Document2 pagesNulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021Shyamal dasNo ratings yet

- 21935mtp Cptvolu1 Part3 PDFDocument224 pages21935mtp Cptvolu1 Part3 PDFArun KCNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- 25 Question PaperDocument4 pages25 Question PaperPacific Tiger0% (1)

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- Accounts: Common Proficiency Test - CPT Innova Sample PaperDocument19 pagesAccounts: Common Proficiency Test - CPT Innova Sample PapercptinnovaNo ratings yet

- CPT Scanner (Paper1) June+Dec 09Document19 pagesCPT Scanner (Paper1) June+Dec 09Ankit GadaNo ratings yet

- CPT Mock Test Minor Test 2 (15.5.2019)Document37 pagesCPT Mock Test Minor Test 2 (15.5.2019)polad72No ratings yet

- Question Paper Financial Accounting (MB131) : January 2005Document32 pagesQuestion Paper Financial Accounting (MB131) : January 2005Ujwalsagar SagarNo ratings yet

- Practice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsDocument4 pagesPractice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsSNPS BhadraNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Final Lab Manual Main Ars 200280705008Document6 pagesFinal Lab Manual Main Ars 200280705008shalini pathakNo ratings yet

- Intermediate Programming (Java) 1: Course Title: Getting Started With Java LanguageDocument11 pagesIntermediate Programming (Java) 1: Course Title: Getting Started With Java LanguageRickCy Perucho PccbsitNo ratings yet

- H I Ôn Thi Aptis & Vstep - Tài Liệu - Anna MaiDocument4 pagesH I Ôn Thi Aptis & Vstep - Tài Liệu - Anna Maihanh.mt2022No ratings yet

- SRM 7 EHP 4 Release Notes PDFDocument18 pagesSRM 7 EHP 4 Release Notes PDFMOHAMMED SHEHBAAZNo ratings yet

- Maryam Ejaz Sec-A Marketing Assignment (CHP #15)Document3 pagesMaryam Ejaz Sec-A Marketing Assignment (CHP #15)MaryamNo ratings yet

- (IGC 2024) 2nd Circular - 0630Document43 pages(IGC 2024) 2nd Circular - 0630VictoriaNo ratings yet

- Certain Application of Photovo PDFDocument235 pagesCertain Application of Photovo PDFaun_nustNo ratings yet

- Bill - AKIJDocument3 pagesBill - AKIJm.tanjil2005No ratings yet

- Cross System Create Supplier ProcessDocument14 pagesCross System Create Supplier ProcesssakthiroboticNo ratings yet

- Ijrpr2741 Study On Investor Perception Towards Stock Market InvestmentDocument19 pagesIjrpr2741 Study On Investor Perception Towards Stock Market InvestmentAbhay RanaNo ratings yet

- Epidemiological Triad of HIV/AIDS: AgentDocument8 pagesEpidemiological Triad of HIV/AIDS: AgentRakib HossainNo ratings yet

- Cyrille MATH INVESTIGATION Part2Document18 pagesCyrille MATH INVESTIGATION Part2Jessie jorgeNo ratings yet

- Keira Knightley: Jump To Navigation Jump To SearchDocument12 pagesKeira Knightley: Jump To Navigation Jump To SearchCrina LupuNo ratings yet

- Light Dimmer CircuitsDocument14 pagesLight Dimmer CircuitskapilasriNo ratings yet

- Probecom 11.3M Antenna System Datasheet 2Document2 pagesProbecom 11.3M Antenna System Datasheet 2Hugo MateoNo ratings yet

- Lecture 08Document32 pagesLecture 08SusovanNo ratings yet

- Introductions and Basic Personal Information (In/Formal Communication)Document6 pagesIntroductions and Basic Personal Information (In/Formal Communication)juan morenoNo ratings yet

- Why You MeDocument18 pagesWhy You MeFira tubeNo ratings yet

- List of Famous Cities On River Banks in The WorldDocument2 pagesList of Famous Cities On River Banks in The WorldDiptangshu DeNo ratings yet

- Summary of The Pilot ProjectDocument46 pagesSummary of The Pilot ProjectSrinivasan JeganNo ratings yet

- Pu3-Mo A1 MoversDocument40 pagesPu3-Mo A1 MoversMiss María José SalasNo ratings yet

- English Assignment - October 6, 2020 - Group AssignmentDocument3 pagesEnglish Assignment - October 6, 2020 - Group AssignmentDaffa RaihanNo ratings yet

- Loch ChildrenDocument4 pagesLoch ChildrenLauro De Jesus FernandesNo ratings yet

- Part 1. Question 1-7. Complete The Notes Below. Write NO MORE THAN THREE WORDS AND/OR A NUMBER For Each AnswerDocument13 pagesPart 1. Question 1-7. Complete The Notes Below. Write NO MORE THAN THREE WORDS AND/OR A NUMBER For Each Answerahmad amdaNo ratings yet

- AC MachinesDocument32 pagesAC Machinesjoeney guardiarioNo ratings yet