Professional Documents

Culture Documents

Survey Questionnai

Uploaded by

Pinky Dela Cruz AballeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Survey Questionnai

Uploaded by

Pinky Dela Cruz AballeCopyright:

Available Formats

I.

Respondent’s Demographic Profile

Name: (optional)_____________________

Sex: ⬜ Male ⬜ Female

Age: ________

Strand/Section: ______________

INSTRUCTIONS:

Please use the rating scale

5- Strongly Agree 4- Agree 3- Neutral 2- disagree 1-Strongly Disagree

Direction: Put a check mark inside the box that corresponds to your answer. Using a scale of 1 to

5 where 5= strongly agree, 4 = agree, 3= neutral , 2 = disagree, and 1 = strongly disagree.

Financial Attitude 5 4 3 2 1

1. It isR$

19. Imagine Joseph inherits important

10000.00totoday

control

andmonthly expenses.

Peter inherits R$ 10000.00 in three

years. According to the time value of money, who is going totargets

2. It is important to establish financial for the future

be wealthier?

⬜ Joseph Peter 3. It is important to save money on a monthly basis.

⬜ They are equally as 4.

wealthy

The way I manage my money today will affect my future

⬜ Do not know 5. It is important to have and follow a monthly expense plan

6. It is important to stay within a budget.

Financial Behavior

7. I worry about how best to manage my money.

8. I take notes and control my personal expenses(e.g., expense and revenue spreadsheet).

Advanced Financial Knowledge

9. I follow a weekly or monthly plan for expenses.

20. Which statement is10.

correct?

I am satisfied with the way I control my finances.

⬜ Once investing in investment refunds, it is not possible to take the money out in the first

12. I save monthly.

year

13. Ibesave

⬜ Investment refunds can so I can

invested buy something

in many expensive

assets, such as shares(e.g.,

and car,brand

securities new textbooks,smartphone).

14. Iassured

⬜ Investment refunds pay compare prices

return when

rates thatbuying

dependsomething.

on past behavior

⬜ None of them 15. I analyze my financial situation before a major purchase.

⬜ Do not know 16. I buy on impulse

21. When an investor diversifies,

17. I preferhis investments

to buy areproduct

a financial dividedtoamong different

save money to assets.

buy in The

cash

risk of losing money:

⬜ Increases

⬜ Decreases Basic Financial Knowledge

⬜ Remains the same

⬜ Do not know 18. Imagine you have R$ 100.00 in the savings account and the tax rate is 10% a year. After

5 years, how much money will you have in this account?

⬜ More than R$ 150.00

⬜ Exactly R$ 150.00

⬜ Less than R$ 150.00

You might also like

- Summary of Rubén Villahermosa's Trading and Investing for BeginnersFrom EverandSummary of Rubén Villahermosa's Trading and Investing for BeginnersNo ratings yet

- The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical CounselFrom EverandThe Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical CounselNo ratings yet

- Grow MoneyDocument81 pagesGrow MoneybeingviswaNo ratings yet

- Survey Questionnaire Dear Respondents,: Check Mark On The Space Provided That Corresponds To Your ResponseDocument12 pagesSurvey Questionnaire Dear Respondents,: Check Mark On The Space Provided That Corresponds To Your ResponseJeffrey R. Abad100% (3)

- Draft 2 Financial Literacy Survey Questionnaire NewDocument2 pagesDraft 2 Financial Literacy Survey Questionnaire NewCuestas Jelou100% (17)

- Reviewed QUESTIONNAIRE ON THE FINANCIAL MANAGEMENT BEHAVIOR AND FINANCIAL WELLDocument3 pagesReviewed QUESTIONNAIRE ON THE FINANCIAL MANAGEMENT BEHAVIOR AND FINANCIAL WELLJenalyn Miranda Cayanan - Marayag100% (1)

- 14 AppendixDocument8 pages14 Appendixgouravkumar700488No ratings yet

- Investement AvenuesDocument82 pagesInvestement AvenuesSunil RawatNo ratings yet

- FinanceDocument4 pagesFinanceGODINA PONCE MIRSA YARILNo ratings yet

- BUSINESS FINANCE Las Week 5 and 6Document9 pagesBUSINESS FINANCE Las Week 5 and 6ggonegvftNo ratings yet

- Cordero, Kristian Charles - Business FinanceDocument4 pagesCordero, Kristian Charles - Business FinanceThea Mitzi ElveñaNo ratings yet

- The Millionaire in You PDFDocument9 pagesThe Millionaire in You PDFPomija0% (1)

- (Mike Medici) How To Effectively Spend Money in Your 20s (Pre-Millionaire Lifestyle)Document6 pages(Mike Medici) How To Effectively Spend Money in Your 20s (Pre-Millionaire Lifestyle)João PereiraNo ratings yet

- 9.entrep ActivityDocument9 pages9.entrep ActivityMark Anthony Telan PitogoNo ratings yet

- 7 1/2 Lies That Keep You From Being Rich: Beau HendersonDocument25 pages7 1/2 Lies That Keep You From Being Rich: Beau HendersonMonu25584No ratings yet

- Wealth ManagementDocument67 pagesWealth ManagementShera BhaiNo ratings yet

- Perfin JournalDocument14 pagesPerfin JournalMagen Leann ParkerNo ratings yet

- Mod 1 Fundamentals of Personal FinanceDocument15 pagesMod 1 Fundamentals of Personal FinanceShruti b ahujaNo ratings yet

- Draft 2 Financial Literacy Survey Questionnaire NewDocument2 pagesDraft 2 Financial Literacy Survey Questionnaire NewEarvin John Medina86% (49)

- A Personal Finance Self Evaluation Checklist: Act I: PreparationDocument3 pagesA Personal Finance Self Evaluation Checklist: Act I: PreparationPower of Stock MarketNo ratings yet

- Lesson 5 - Creating WealthDocument8 pagesLesson 5 - Creating WealthMarc Loui RiveroNo ratings yet

- Topic 10 Achieving Entrepreneurs Personal Financial DreamsDocument31 pagesTopic 10 Achieving Entrepreneurs Personal Financial DreamsTalk 2meNo ratings yet

- Financial Planning and Wealth ManagementDocument58 pagesFinancial Planning and Wealth ManagementsohanlNo ratings yet

- How to Secure Your Future: Why Real Estate is the Key to Wealth Building: Why Real Estate Investing is the Key to Wealth BuildingFrom EverandHow to Secure Your Future: Why Real Estate is the Key to Wealth Building: Why Real Estate Investing is the Key to Wealth BuildingNo ratings yet

- Quickstart Guide TO: InvestingDocument21 pagesQuickstart Guide TO: InvestingAmir Syazwan Bin MohamadNo ratings yet

- Flame I - Jaideep FinalDocument23 pagesFlame I - Jaideep FinalShreya TalujaNo ratings yet

- Myworth Mindset WorkookDocument21 pagesMyworth Mindset WorkookmikeyizanainvincibleNo ratings yet

- "Oh Shit, I Wish I Had Realized This Earlier": 1. Present Financial Fitness and ConditionDocument2 pages"Oh Shit, I Wish I Had Realized This Earlier": 1. Present Financial Fitness and ConditionammarNo ratings yet

- Business Finance Q2 Week 3Document8 pagesBusiness Finance Q2 Week 3JustineNo ratings yet

- Prosper!, Chapter6: Financial CapitalDocument28 pagesProsper!, Chapter6: Financial CapitalAdam Taggart33% (12)

- Prosper Chapter6v2 PDFDocument28 pagesProsper Chapter6v2 PDFAdam Taggart100% (2)

- Behavioural Finance: Submitted To: DR - Divya VermaDocument13 pagesBehavioural Finance: Submitted To: DR - Divya Vermathulli06No ratings yet

- Final Assignment Part A Evan TraasdahlDocument13 pagesFinal Assignment Part A Evan Traasdahlapi-303166922No ratings yet

- Written Final Part ADocument12 pagesWritten Final Part Aapi-291725624No ratings yet

- Rule 1 Cheat SheetDocument10 pagesRule 1 Cheat SheetPramodh RobbiNo ratings yet

- Money FeesDocument10 pagesMoney Feesvipgaming fourthNo ratings yet

- 12 Abm B Survey QuestionnairesDocument2 pages12 Abm B Survey QuestionnairesPinky Dela Cruz AballeNo ratings yet

- Module 1Document26 pagesModule 1Ankit JajalNo ratings yet

- Personal FinanceDocument24 pagesPersonal FinanceKirosTeklehaimanotNo ratings yet

- Metrobank Moneybility First Edition (2023.03)Document154 pagesMetrobank Moneybility First Edition (2023.03)Kri SaNo ratings yet

- Business Finance (Soft Copy of Chapter 7 Managing Personal Finance)Document7 pagesBusiness Finance (Soft Copy of Chapter 7 Managing Personal Finance)KOUJI N. MARQUEZNo ratings yet

- Lesson 1Document28 pagesLesson 1June Ann OberezNo ratings yet

- Acceptable and Unacceptable AssetDocument3 pagesAcceptable and Unacceptable AssetDenicelle BucoyNo ratings yet

- Rich Dad Poor DadDocument26 pagesRich Dad Poor Dadchaand33100% (17)

- Simple and Compound InterestDocument51 pagesSimple and Compound InterestYōsukeNo ratings yet

- Online Trading and Stock Investing for Beginners: The Easy Way to Start Trading and Getting Rich in the Stock MarketFrom EverandOnline Trading and Stock Investing for Beginners: The Easy Way to Start Trading and Getting Rich in the Stock MarketRating: 5 out of 5 stars5/5 (1)

- Survey QuestionnaidocxABMDocument1 pageSurvey QuestionnaidocxABMPinky Dela Cruz AballeNo ratings yet

- 02.time Value of Money III and Risk and Return IDocument4 pages02.time Value of Money III and Risk and Return IMaithri Vidana Kariyakaranage100% (1)

- BIFFPP-Step 4 CPA BermudaDocument6 pagesBIFFPP-Step 4 CPA BermudaRG-eviewerNo ratings yet

- Secrets To Positive CashflowDocument15 pagesSecrets To Positive CashflowSleepy Chinita100% (4)

- Account-Opening-Individual - Meezan Sahulat Sarmayakari Account FinalDocument7 pagesAccount-Opening-Individual - Meezan Sahulat Sarmayakari Account FinalSalman ArshadNo ratings yet

- Survey-Questionnai HelpDocument1 pageSurvey-Questionnai HelpPinky Dela Cruz AballeNo ratings yet

- Finance - Unit 9 - Using MoneyDocument29 pagesFinance - Unit 9 - Using MoneyToàn NguyễnNo ratings yet

- Managing Family Finances in Difficult Times by Obinna B. OnwukaDocument6 pagesManaging Family Finances in Difficult Times by Obinna B. OnwukaObinna OnwukaNo ratings yet

- 4894 C Ferique Giff Guide An Final WebDocument4 pages4894 C Ferique Giff Guide An Final WebhenrychavezhNo ratings yet

- In The Philippine ContextDocument1 pageIn The Philippine ContextPinky Dela Cruz AballeNo ratings yet

- Reading and Writing Skills-Aballe-Abm BDocument10 pagesReading and Writing Skills-Aballe-Abm BPinky Dela Cruz AballeNo ratings yet

- Exothermic and EndothermicDocument8 pagesExothermic and EndothermicPinky Dela Cruz AballeNo ratings yet

- Grade 12 2nd Sem Source All in by RamoncabansaganDocument512 pagesGrade 12 2nd Sem Source All in by RamoncabansaganJofanie MeridaNo ratings yet

- Chemical ReactionDocument3 pagesChemical ReactionPinky Dela Cruz AballeNo ratings yet

- CertainlyDocument3 pagesCertainlyPinky Dela Cruz AballeNo ratings yet

- Survey QuestionnaiDocument2 pagesSurvey QuestionnaiPinky Dela Cruz AballeNo ratings yet

- Research Final Defense ChecklistDocument2 pagesResearch Final Defense ChecklistPinky Dela Cruz AballeNo ratings yet

- Research Proposal of Group 1Document23 pagesResearch Proposal of Group 1Pinky Dela Cruz AballeNo ratings yet

- Princess - PhilosophyDocument3 pagesPrincess - PhilosophyPinky Dela Cruz AballeNo ratings yet

- Group 1 ABM B FiduciaryDocument11 pagesGroup 1 ABM B FiduciaryPinky Dela Cruz AballeNo ratings yet

- Supreme Student Council: Guidelines For "BAND ERA"Document3 pagesSupreme Student Council: Guidelines For "BAND ERA"Pinky Dela Cruz AballeNo ratings yet

- Exothermic and EndothermicDocument8 pagesExothermic and EndothermicPinky Dela Cruz AballeNo ratings yet

- Chapter 1-3Document30 pagesChapter 1-3Pinky Dela Cruz AballeNo ratings yet

- Research PaperDocument4 pagesResearch PaperPinky Dela Cruz AballeNo ratings yet

- Exothermic and EndothermicDocument8 pagesExothermic and EndothermicPinky Dela Cruz AballeNo ratings yet

- Research Proposal of Group 1Document23 pagesResearch Proposal of Group 1Pinky Dela Cruz AballeNo ratings yet

- JAPET Business PlanDocument8 pagesJAPET Business PlanPinky Dela Cruz AballeNo ratings yet

- Research Proposal of Group 1Document23 pagesResearch Proposal of Group 1Pinky Dela Cruz AballeNo ratings yet

- JAPET Business PlanDocument8 pagesJAPET Business PlanPinky Dela Cruz AballeNo ratings yet

- ObjectiveDocument1 pageObjectivePinky Dela Cruz AballeNo ratings yet

- 1st Business PlanDocument7 pages1st Business PlanPinky Dela Cruz AballeNo ratings yet

- Five Steps To Effective Corporate GovernanceDocument7 pagesFive Steps To Effective Corporate Governanceneamma0% (1)

- NetmedsDocument1 pageNetmedsdisha vNo ratings yet

- New Issue MarketDocument39 pagesNew Issue Marketsachuvsudevnair100% (3)

- 50+ Chrome Extensions For Recruiters by Laxminarayana BupathiDocument45 pages50+ Chrome Extensions For Recruiters by Laxminarayana Bupathiaadipudi.rohithsandeepNo ratings yet

- Danielle Simpson ResumeDocument1 pageDanielle Simpson Resumeapi-413439815No ratings yet

- Fabm ExamDocument3 pagesFabm ExamRonald AlmagroNo ratings yet

- Pre-Event Networking Preparation - Making The Most From Networking EventsDocument10 pagesPre-Event Networking Preparation - Making The Most From Networking EventsRob BrownNo ratings yet

- Acceptable and Unacceptable AssetDocument3 pagesAcceptable and Unacceptable AssetDenicelle BucoyNo ratings yet

- RTB BAsicDocument9 pagesRTB BAsicLuis Vicente100% (7)

- 11 Quality Management - FDocument15 pages11 Quality Management - FdumNo ratings yet

- MS 900T01 Microsoft 365 Fundamentals MCT PDFDocument158 pagesMS 900T01 Microsoft 365 Fundamentals MCT PDFhernan100% (1)

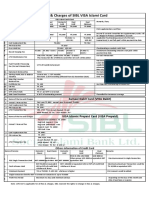

- Fees and Charges of SIBL Islami CardDocument1 pageFees and Charges of SIBL Islami CardMd YusufNo ratings yet

- ConceptualizingDocument8 pagesConceptualizingHyacinth'Faith Espesor IIINo ratings yet

- Module 2a - AR RecapDocument10 pagesModule 2a - AR RecapChen HaoNo ratings yet

- Algorithmic Trading Directory 2010Document100 pagesAlgorithmic Trading Directory 201017524100% (4)

- Practice Problem 1Document1 pagePractice Problem 1Desree Gale0% (2)

- Goal Programming PDFDocument26 pagesGoal Programming PDFkumar satyamNo ratings yet

- Computing Profits LessonDocument22 pagesComputing Profits LessonMYRRH TRAINNo ratings yet

- Simulation of The Preparation of The Work Unit (Satker) Financial StatementsDocument23 pagesSimulation of The Preparation of The Work Unit (Satker) Financial StatementskarismaNo ratings yet

- PERI Study On Minumum WageDocument33 pagesPERI Study On Minumum WageJim KinneyNo ratings yet

- The Rise and Rise of The B2B Brand: Rick Wise and Jana ZednickovaDocument10 pagesThe Rise and Rise of The B2B Brand: Rick Wise and Jana Zednickovasobti_mailmeNo ratings yet

- Solartronics IncDocument5 pagesSolartronics Incraman2303100% (2)

- Kellison Exercises Chapter 9 IR SensitivityDocument11 pagesKellison Exercises Chapter 9 IR SensitivityAlondra ZamudioNo ratings yet

- Sarthee Consultancy - Corporate PresentationDocument11 pagesSarthee Consultancy - Corporate PresentationSarthee ConsultancyNo ratings yet

- Setting Up and Management of Merchant BankingDocument8 pagesSetting Up and Management of Merchant BankingRajeswari Kuttimalu100% (1)

- Professional Development Portfolio GuidanceDocument10 pagesProfessional Development Portfolio GuidancehoheinheimNo ratings yet

- Your Business Your Growth Game Your Business Your Growth GameDocument10 pagesYour Business Your Growth Game Your Business Your Growth Gamehitesh100% (1)

- Application For PromotionDocument2 pagesApplication For PromotionCarol AbelardeNo ratings yet

- Logical DWDesignDocument5 pagesLogical DWDesignbvishwanathrNo ratings yet

- Decision Making (Indian Ethos) 26!1!2021Document73 pagesDecision Making (Indian Ethos) 26!1!2021addeNo ratings yet