Professional Documents

Culture Documents

Fauji Food 30 June 2023

Uploaded by

mrordinaryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fauji Food 30 June 2023

Uploaded by

mrordinaryCopyright:

Available Formats

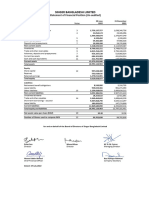

CONDENSED INTERIM STATEMENT

OF FINANCIAL POSITION

As at 30 June 2023

Un-audited Audited Un-audited Audited

30 June 31 December 30 June 31 December

Note 2023 2022 Note 2023 2022

Rupees Rupees Rupees Rupees

EQUITY AND LIABILITIES ASSETS

Share capital and reserves Non-current assets

Authorized share capital Property, plant and equipment 10 8,367,159,622 8,138,695,696

2,800,000,000 (31 December 2022: 2,800,000,000) Intangible assets 11 9,489,882 5,929,326

ordinary shares of Rs 10 each 28,000,000,000 28,000,000,000 Security deposits 9,929,465 9,539,947

8,386,578,969 8,154,164,969

Issued, subscribed and paid up share capital 4 25,199,631,390 15,840,881,590

Capital reserves

Share deposit money 4 2,350,000,001 2,708,749,801 Current assets

Share premium 1,801,082,303 1,835,148,153 Stores, spares and loose tools 270,631,395 185,095,995

Surplus on revaluation of property, plant Stock-in-trade 12 2,408,613,622 1,239,691,594

and equipment - net of tax 2,061,177,591 2,131,898,795 Trade debts 1,013,355,196 557,499,467

Loans and advances 362,861,260 149,550,153

Revenue reserve Deposits, prepayments and other receivables 187,317,904 198,461,867

Accumulated loss (18,545,820,152) (18,469,229,527) Accrued interest 40,466,298 40,973,562

12,866,071,133 4,047,448,812 Sales tax refundable - net 1,496,651,080 1,275,508,594

Non-current liabilities Income tax recoverable 1,164,758,704 1,269,852,300

Long term loans 5 – 5,482,593,723 Cash and cash equivalents 13 727,497,411 1,145,482,229

Lease liabilities 222,350,034 53,570,131 7,672,152,870 6,062,115,761

Deferred liabilities 34,216,986 30,795,946

256,567,020 5,566,959,800

Current liabilities

Short term borrowings 6 – 1,705,540,931

Current portion of long term liabilities 107,541,688 579,001,285

Trade and other payables 7 2,151,590,281 1,576,465,618

Contract liabilities 513,844,446 178,556,370

Unclaimed dividend 965,752 965,752

Accrued finance cost 8 35,212,332 402,289,522

Provision for taxation 126,939,187 159,052,640

2,936,093,686 4,601,872,118

Contingencies and commitments 9

16,058,731,839 14,216,280,730 16,058,731,839 14,216,280,730

The annexed notes from 1 to 23 form an integral part of these condensed interim financial statements.

Chairman Chief Executive Director Chief Financial Officer Chairman Chief Executive Director Chief Financial Officer

10 Half Year ended 30 June 2023 11

CONDENSED INTERIM STATEMENT CONDENSED INTERIM STATEMENT OF

OF PROFIT OR LOSS (UN-AUDITED) COMPREHENSIVE INCOME (UN-AUDITED)

For the six months ended 30 June 2023 For the six months ended 30 June 2023

Half Year Ended Quarter Ended Half Year Ended Quarter Ended

30 June 30 June 30 June 30 June

Note 2023 2022 2023 2022 2023 2022 2023 2022

Rupees Rupees Rupees Rupees Rupees Rupees Rupees Rupees

Revenue from contracts with Profit / (Loss) for the period (147,311,829) (1,253,473,085) 22,271,186 (754,291,120)

customers - Net 14 9,837,736,143 4,796,600,579 4,668,667,870 2,393,602,964

Cost of revenue 15 (8,607,136,063) (4,617,830,795) (4,098,740,110) (2,384,060,336) Other comprehensive income for

Gross profit 1,230,600,080 178,769,784 569,927,760 9,542,628 the period

Marketing and distribution

expenses (695,961,895) (677,842,757) (349,239,894) (341,636,315) Other comprehensive income that

Administrative expenses (344,165,484) (209,373,196) (157,427,445) (98,378,453) may be reclassified to profit or loss

Profit / (Loss) from operations 190,472,701 (708,446,169) 63,260,421 (430,472,140) in subsequent periods (net of tax) – – – –

Other income 126,686,626 81,663,532 56,866,382 39,554,409

Other operating expense (2,162,240) – (1,694,448) – Other comprehensive income that will

Finance costs 16 (335,369,729) (565,363,055) (35,591,493) (332,738,094) not be reclassified to profit or loss

Profit / (Loss) before taxation (20,372,642) (1,192,145,692) 82,840,862 (723,655,825) in subsequent periods (net of tax) – – – –

Income tax expense 17 (126,939,187) (61,327,393) (60,569,676) (30,635,295)

Profit / (Loss) after taxation for Total comprehensive income / (loss)

the period (147,311,829) (1,253,473,085) 22,271,186 (754,291,120) for the period (147,311,829) (1,253,473,085) 22,271,186 (754,291,120)

(Loss) / Earnings per share -

basic and diluted 18 (0.07) (0.79) 0.01 (0.48) The annexed notes from 1 to 23 form an integral part of these condensed interim financial statements.

The annexed notes from 1 to 23 form an integral part of these condensed interim financial statements.

Chairman Chief Executive Director Chief Financial Officer Chairman Chief Executive Director Chief Financial Officer

12 Half Year ended 30 June 2023 13

CONDENSED INTERIM STATEMENT CONDENSED INTERIM STATEMENT

OF CHANGES IN EQUITY (UN-AUDITED) OF CASH FLOWS (UN-AUDITED)

For the six months ended 30 June 2023 For the six months ended 30 June 2023

Capital Reserve

Revenue Half Year Ended

reserves

30 June 30 June

Share Surplus on

Total Note 2023 2022

capital revaluation of

Share Share deposit Accumulated

premium money

property, plant

loss

Rupees Rupees

and equipment

- net of tax Cash flow from operating activities

Rupees Loss before taxation (20,372,642) (1,192,145,692)

Adjustments to reconcile loss before tax to net cash flows:

Balance as at 01 January 2022 (audited) 15,840,881,590 1,854,498,097 – 2,225,644,056 (16,395,504,505) 3,525,519,238 Depreciation on property, plant and equipment 10 257,521,294 243,899,862

Loss after taxation for the period – – – – (1,253,473,085) (1,253,473,085) Amortization of intangible assets 440,644 32

Gain on disposal of property, plant and equipment (4,767,822) (931,749)

Other comprehensive income – – – – – –

Profit on bank saving accounts and Term Deposit Receipts (TDRs) (117,057,861) (69,220,357)

Total comprehensive loss for the period – – – – (1,253,473,085) (1,253,473,085) Provision for employee retirement benefits 13,218,780 14,105,548

Share issuance cost – (2,849,343) – – – (2,849,343) Finance cost 335,369,729 565,363,055

Operating profit / (loss) before working capital changes 464,352,124 (438,929,301)

Incremental depreciation relating to surplus

Working capital adjustments:

on revaluation - net of tax – – – (46,872,630) 46,872,630 – (Increase) / decrease in current assets:

Balance as at 30 June 2022 (un-audited) 15,840,881,590 1,851,648,754 – 2,178,771,426 (17,602,104,960) 2,269,196,810 Stores, spares and loose tools (85,535,400) (36,112,221)

Stock-in-trade (1,168,922,028) 5,426,401

Trade debts (455,855,729) (42,208,987)

Balance as at 01 January 2023 (audited) 15,840,881,590 1,835,148,153 2,708,749,801 2,131,898,795 (18,469,229,527) 4,047,448,812 Loans and advances (213,311,107) 50,270,266

Loss after taxation for the period – – – – (147,311,829) (147,311,829) Deposits, prepayments and other receivables 10,754,445 (4,918,120)

Sales tax refundable (221,142,486) (81,740,756)

Other comprehensive income – – – – – –

Increase / (decrease) in current liabilities:

Total comprehensive loss for the period – – – – (147,311,829) (147,311,829) Trade and other payables 575,124,663 570,317,049

Issue of share capital 9,358,749,800 – (708,749,800) – – 8,650,000,000 Contract liabilities 335,288,076 (1,681,847)

(1,223,599,566) 459,351,785

Share issuance cost – (34,065,850) – – – (34,065,850)

Cash (used in) / generated from operations (759,247,442) 20,422,484

Share deposit money received – – 350,000,000 – – 350,000,000 Income tax paid (53,959,044) (30,045,039)

Revaluation surplus realized through disposal Employee benefits paid (9,797,740) (11,092,648)

Net cash used in operating activities (823,004,226) (20,715,203)

of operating fixed assets – – – (31,660,679) 31,660,679 –

Cash flow from investing activities

Incremental depreciation relating to surplus Acquisition of property, plant and equipment (315,353,975) (38,784,561)

on revaluation - net of tax – – – (39,060,525) 39,060,525 – Acquisition of intangible assets (4,001,200) –

Sale proceeds from disposal of property, plant and equipment 80,914,486 2,584,448

Balance as at 30 June 2023 (un-audited) 25,199,631,390 1,801,082,303 2,350,000,001 2,061,177,591 (18,545,820,152) 12,866,071,133

Profit on saving accounts 51,938,275 69,220,357

Profit on TDRs 65,626,849 –

The annexed notes from 1 to 23 form an integral part of these condensed interim financial statements. Net cash (Used in) / generated from investing activities (120,875,565) 33,020,244

Cash flow from financing activities

Proceeds from short term borrowings - net – 18,841

Share deposit money received from Fauji Foundation 350,000,000 –

Finance cost paid (702,446,920) (604,571,628)

Proceeds received against issuance of shares 8,650,000,000 –

Repayment of long term loans (5,988,149,277) (25,228,912)

Repayment of principal portion of lease liabilities (43,902,050) (31,375,629)

Share issuance cost (34,065,850) (2,849,343)

Net cash generated from / (used in) financing activities 2,231,435,903 (664,006,671)

Net increase / (decrease) in cash and cash equivalents 1,287,556,113 (651,701,630)

Cash and cash equivalents - at beginning of the period (560,058,702) 169,082,593

Cash and cash equivalents - at end of the period 727,497,411 (482,619,037)

Cash and cash equivalents comprise of the following:

- Cash and bank balances 13 727,497,411 1,220,952,442

- Running finances 6 – (1,703,571,479)

727,497,411 (482,619,037)

Significant non-cash transactions

Addition in right of use assets 246,777,910 –

Issue of shares against accrued mark-up 708,749,800 –

The annexed notes from 1 to 23 form an integral part of these condensed interim financial statements.

Chairman Chief Executive Director Chief Financial Officer Chairman Chief Executive Director Chief Financial Officer

14 Half Year ended 30 June 2023 15

You might also like

- Financial Results For The 2 Quarter Ended 30 June 2021Document6 pagesFinancial Results For The 2 Quarter Ended 30 June 2021asadnawazNo ratings yet

- March 2022 Nine Month Orion PharmaDocument26 pagesMarch 2022 Nine Month Orion PharmaAfia Begum ChowdhuryNo ratings yet

- Beximco Pharmaceuticals Limited Statement of Financial PositionDocument55 pagesBeximco Pharmaceuticals Limited Statement of Financial Positionrimon dasNo ratings yet

- Swisstek (Ceylon) PLC Swisstek (Ceylon) PLCDocument7 pagesSwisstek (Ceylon) PLC Swisstek (Ceylon) PLCkasun witharanaNo ratings yet

- Indus Statements 2022 - 2021Document4 pagesIndus Statements 2022 - 2021Taha AfzalNo ratings yet

- March 2020 Nine MonthDocument13 pagesMarch 2020 Nine MonthAfia Begum ChowdhuryNo ratings yet

- Robi Stat Interim FS Q2 21 FV 003Document26 pagesRobi Stat Interim FS Q2 21 FV 003Niamul HasanNo ratings yet

- Shell Pakistan Limited Balance Sheet As at December 31, 2009Document39 pagesShell Pakistan Limited Balance Sheet As at December 31, 2009Saadia Anwar AliNo ratings yet

- September 2020 Orion PharmaDocument28 pagesSeptember 2020 Orion PharmaAfia Begum ChowdhuryNo ratings yet

- Unaudited Q3 23 Financial StatementDocument24 pagesUnaudited Q3 23 Financial StatementMd. Imran HossainNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: AS AT JUNE 30, 2023 For The Year Ended June 30, 2023Document3 pagesStatement of Financial Position Statement of Profit or Loss: AS AT JUNE 30, 2023 For The Year Ended June 30, 2023Saljook AslamNo ratings yet

- 2020 - GATI - Gatron Industries Limited-55-56Document2 pages2020 - GATI - Gatron Industries Limited-55-56Muhammad Noman MehboobNo ratings yet

- Annual-Accounts-2021 (2) - Pages-DeletedDocument6 pagesAnnual-Accounts-2021 (2) - Pages-DeletedShehzad QureshiNo ratings yet

- Interim Financial Statements - English q2Document12 pagesInterim Financial Statements - English q2yanaNo ratings yet

- Quarterly Report As at 31 March 2022Document11 pagesQuarterly Report As at 31 March 2022Tutii FarutiNo ratings yet

- Singer Q2 2021-2022Document13 pagesSinger Q2 2021-2022syfizajiNo ratings yet

- Royal Ceramics Lanka PLC: Interim Financial Statements For The Period Ended 30Th September 2022Document12 pagesRoyal Ceramics Lanka PLC: Interim Financial Statements For The Period Ended 30Th September 2022kasun witharanaNo ratings yet

- Balance SheetDocument1 pageBalance Sheetarslan.ahmed8179No ratings yet

- 195879Document69 pages195879Irfan MasoodNo ratings yet

- 2nd Quarter Financial Statements 2020Document15 pages2nd Quarter Financial Statements 2020Ahm FerdousNo ratings yet

- Consolidated Statement of Financial Position: Beximco Pharmaceuticals Limited and Its Subsidiaries As at June 30, 2019Document4 pagesConsolidated Statement of Financial Position: Beximco Pharmaceuticals Limited and Its Subsidiaries As at June 30, 2019palashndcNo ratings yet

- Case Study: Non-Current AssetsDocument4 pagesCase Study: Non-Current AssetsAsad RehmanNo ratings yet

- September 2019 Orion PharmaDocument13 pagesSeptember 2019 Orion PharmaAfia Begum ChowdhuryNo ratings yet

- Numinus FS Q1 Nov 30, 2022 FINALDocument26 pagesNuminus FS Q1 Nov 30, 2022 FINALNdjfncnNo ratings yet

- Singer 2021 Financial Statements Q2Document13 pagesSinger 2021 Financial Statements Q2Rally RockNo ratings yet

- Sss 2021 Audited FsDocument181 pagesSss 2021 Audited FsJohn Paul BiraquitNo ratings yet

- March 2021 Nine Month Orion PharmaDocument26 pagesMarch 2021 Nine Month Orion PharmaAfia Begum ChowdhuryNo ratings yet

- Kel Annual AccountsDocument14 pagesKel Annual AccountsmrordinaryNo ratings yet

- Ecopack Limited: Financial StatementsDocument84 pagesEcopack Limited: Financial StatementspolodeNo ratings yet

- Corporate Finance AssigmentDocument15 pagesCorporate Finance Assigmentesmailkarimi456No ratings yet

- Half Yearly Financial Statements June 2022Document34 pagesHalf Yearly Financial Statements June 2022Ctg TalkNo ratings yet

- BRAC Bank Audited Financial Statements 2022Document125 pagesBRAC Bank Audited Financial Statements 2022barmanjhuma77No ratings yet

- BRD - 20230208074925 - BRD IFRS December 2022 ENDocument3 pagesBRD - 20230208074925 - BRD IFRS December 2022 ENteoxysNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Saljook AslamNo ratings yet

- Resus Energy PLC: Interim Report 01st Quarter 2022-2023Document13 pagesResus Energy PLC: Interim Report 01st Quarter 2022-2023w.chathura nuwan ranasingheNo ratings yet

- Byco Data PDFDocument32 pagesByco Data PDFMuiz SaddozaiNo ratings yet

- SCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022Document13 pagesSCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022kimNo ratings yet

- Condensed Quarterly Accounts (Un-Audited)Document10 pagesCondensed Quarterly Accounts (Un-Audited)Perah ShaikhNo ratings yet

- CR-July-Aug-2022Document6 pagesCR-July-Aug-2022banglauserNo ratings yet

- Shell Pakistan Limited Financial Statements For The Year Ended December 31, 2010Document60 pagesShell Pakistan Limited Financial Statements For The Year Ended December 31, 2010popatiaNo ratings yet

- NKR Engineering (Private) Limited - June 2020Document19 pagesNKR Engineering (Private) Limited - June 2020Mustafa hadiNo ratings yet

- Pakistan Petroleum LTDDocument43 pagesPakistan Petroleum LTDMuheeb AhmadNo ratings yet

- Dec 2023 Financials UpdatedDocument102 pagesDec 2023 Financials Updatedpraveenramesh058No ratings yet

- Greenko - Investment - Company - Audited - Combined - Financial - Statements - FY 2018 - 19Document102 pagesGreenko - Investment - Company - Audited - Combined - Financial - Statements - FY 2018 - 19hNo ratings yet

- Weekly Statement of Position of All Scheduled Banks As at Close of Business On September 18, 2020Document1 pageWeekly Statement of Position of All Scheduled Banks As at Close of Business On September 18, 2020sm_1234567No ratings yet

- 1609913324.QCI Financials FY 2019-20 Final SignedDocument14 pages1609913324.QCI Financials FY 2019-20 Final SignedHari OmNo ratings yet

- Gma FSDocument13 pagesGma FSMark Angelo BustosNo ratings yet

- Bkash Limited - For The Period Ended On June 30, 2018Document15 pagesBkash Limited - For The Period Ended On June 30, 2018Mashrur WasekNo ratings yet

- Q319 Un-Audited Financial Statements For IRDocument26 pagesQ319 Un-Audited Financial Statements For IRMehedi KhanNo ratings yet

- Final Title 2019-20Document3 pagesFinal Title 2019-20Ahmad KhalidNo ratings yet

- LWL Dec2021Document7 pagesLWL Dec2021Shabry SamoonNo ratings yet

- Dialog Axiata PLCDocument15 pagesDialog Axiata PLCgirihellNo ratings yet

- MPCLDocument4 pagesMPCLRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Con Solo Dated Financial Statement AsperUS GAAP 2009 10Document8 pagesCon Solo Dated Financial Statement AsperUS GAAP 2009 10Nitin VatsNo ratings yet

- Lanka Walltiles PLC: Provisional Financial Statements For The Six Months Ended 30th September 2022Document7 pagesLanka Walltiles PLC: Provisional Financial Statements For The Six Months Ended 30th September 2022kasun witharanaNo ratings yet

- BRD - Groupe Société Générale S.A.: Interim Financial ReportDocument20 pagesBRD - Groupe Société Générale S.A.: Interim Financial Reporthemant19801No ratings yet

- Dec 22 Management ConsolidatedDocument23 pagesDec 22 Management ConsolidatedKhalid KhanNo ratings yet

- Udenna Corpation and Subsidiaries - 2017 Conso AFSDocument133 pagesUdenna Corpation and Subsidiaries - 2017 Conso AFSRappler100% (4)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- ACC 108 P3 Quiz 1 Ans KeyDocument6 pagesACC 108 P3 Quiz 1 Ans Keyrago.cachero.auNo ratings yet

- 13 Capital Structure (Slides) by Zubair Arshad PDFDocument34 pages13 Capital Structure (Slides) by Zubair Arshad PDFZubair ArshadNo ratings yet

- 25885110Document21 pages25885110Llyana paula SuyuNo ratings yet

- How To Get What The US Government Owes You!Document4 pagesHow To Get What The US Government Owes You!creativemarcoNo ratings yet

- Mercury Action Athletic Synergies & AssumptionsDocument10 pagesMercury Action Athletic Synergies & AssumptionsSimón SegoviaNo ratings yet

- Governement Grants PDFDocument3 pagesGovernement Grants PDFVillaruz Shereen MaeNo ratings yet

- Retained EarningsDocument8 pagesRetained Earningsjelai anselmoNo ratings yet

- Exercise 1. Choose The Correct Alternative To Complete Each SentenceDocument8 pagesExercise 1. Choose The Correct Alternative To Complete Each SentenceGliqeria PlasariNo ratings yet

- Earnings Con Call-Q4 Fy 17 18Document24 pagesEarnings Con Call-Q4 Fy 17 18Sourav DuttaNo ratings yet

- 26 Accounting Policies Estimates and Errors s19Document53 pages26 Accounting Policies Estimates and Errors s19sibiyazukiswa27No ratings yet

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document20 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Pdf FilesNo ratings yet

- Itr Form 2019-20Document10 pagesItr Form 2019-20AartiNo ratings yet

- Business Studies: Paper 7115/11 Short Answer/Structured ResponseDocument13 pagesBusiness Studies: Paper 7115/11 Short Answer/Structured ResponseBurhanNo ratings yet

- Tutorial 2 Traditional OverheadsDocument3 pagesTutorial 2 Traditional OverheadsSyafiqNo ratings yet

- Fin623 Midterm 9 Papers Solved by Laiba ButtDocument79 pagesFin623 Midterm 9 Papers Solved by Laiba ButtSunitaNo ratings yet

- The Financial Statement Analysis of PepsiCoDocument9 pagesThe Financial Statement Analysis of PepsiCoJaveedali MjNo ratings yet

- Chapter 11 Provision and Contingent Liabilities - ZasDocument39 pagesChapter 11 Provision and Contingent Liabilities - Zasying huiNo ratings yet

- PMliabilities InputDocument13 pagesPMliabilities InputAbigail Ann PasiliaoNo ratings yet

- Vertical and Horizontal AnalysisDocument4 pagesVertical and Horizontal AnalysisKaren CastroNo ratings yet

- Indigent Offerings Pamphlets EnglishDocument2 pagesIndigent Offerings Pamphlets EnglishGiovanni RossiNo ratings yet

- PT Hexindo Adiperkasa TBK.: Summary of Financial StatementDocument2 pagesPT Hexindo Adiperkasa TBK.: Summary of Financial StatementMaradewiNo ratings yet

- MHRM-706 MEDIA - GENERAL - AND - THE - BALANCED - SCORECARD - (A) - Case - Study - 3 PDFDocument18 pagesMHRM-706 MEDIA - GENERAL - AND - THE - BALANCED - SCORECARD - (A) - Case - Study - 3 PDFDi VineNo ratings yet

- Tutorial Test 3Document2 pagesTutorial Test 3Hải NhưNo ratings yet

- IFT CFA Level I Facts and Formula Sheet 2021 - v1.0Document12 pagesIFT CFA Level I Facts and Formula Sheet 2021 - v1.0Tsaone Fox100% (1)

- MCQs Test 2Document25 pagesMCQs Test 2khankhan1No ratings yet

- E7 25Document2 pagesE7 25Muhammad Syafiq RamadhanNo ratings yet

- ACC 107: QUIZ #1: Use The Following Information For The Next Nine QuestionsDocument3 pagesACC 107: QUIZ #1: Use The Following Information For The Next Nine QuestionsJomar RabiaNo ratings yet

- Chapter 11 - Capital Budgeting Cash Flows PDFDocument32 pagesChapter 11 - Capital Budgeting Cash Flows PDFMaisha Tanzim RahmanNo ratings yet

- GA55Document7 pagesGA55Aasefa BanoNo ratings yet

- Manufacturing Account Worked Example Question 4Document5 pagesManufacturing Account Worked Example Question 4Roshan RamkhalawonNo ratings yet