Professional Documents

Culture Documents

Statement of Financial Position Statement of Profit or Loss: AS AT JUNE 30, 2023 For The Year Ended June 30, 2023

Uploaded by

Saljook AslamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement of Financial Position Statement of Profit or Loss: AS AT JUNE 30, 2023 For The Year Ended June 30, 2023

Uploaded by

Saljook AslamCopyright:

Available Formats

68 | Berger Paints Pakistan Limited - Annual Report 2023

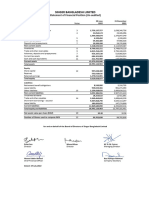

STATEMENT OF FINANCIAL POSITION

AS AT JUNE 30, 2023

2023 2022

ASSETS Note (Rupees in thousand)

NON-CURRENT ASSETS

Property, plant and equipment 7 2,306,831 1,628,161

Intangible assets 8 - 23

Long term investments 9 78,479 70,915

Long term loans 10 37,261 38,632

Long term deposits 11 22,218 38,138

2,444,789 1,775,869

CURRENT ASSETS

Stores, spare parts and loose tools 13 30,341 22,735

Stock in trade 14 1,437,793 1,625,411

Trade debts - unsecured 15 1,907,525 1,628,302

Loans and advances 16 277,322 221,950

Trade deposits and short term prepayments 17 31,864 26,821

Other receivables 18 62,053 113,633

Tax refund due from government 19 182,994 207,054

Short term investment 20 191,000 140,000

Cash and bank balances 21 47,078 223,671

4,167,970 4,209,577

TOTAL ASSETS 6,612,759 5,985,446

EQUITY AND LIABILITIES

SHARE CAPITAL AND RESERVES

Authorised share capital 250,000 250,000

Issued, subscribed and paid-up share capital 22 245,516 204,597

Capital reserves

Revaluation surplus on property, plant and equipment 23.3 1,495,613 830,273

Other reserves 23 56,205 58,017

1,551,818 888,290

Revenue reserves

General reserve 23 285,000 285,000

Accumulated profits 23 1,113,469 967,825

1,398,469 1,252,825

3,195,803 2,345,712

NON-CURRENT LIABILITIES

Long term financing - secured 24 94,221 183,222

Long term diminishing musharaka 25 333,333 16,000

Deferred grant 26 21,672 2,251

Long term employee benefits 27 144,748 144,012

Deferred taxation - net 12 104,645 8,379

698,619 353,864

CURRENT LIABILITIES

Trade and other payables 28 2,020,366 1,790,697

Current portion of long term financing 29 228,098 69,110

Unclaimed dividend 13,106 6,826

Accrued markup 30 31,459 45,298

Short term borrowings - secured 31 425,308 1,373,939

2,718,337 3,285,870

TOTAL LIABILITIES 3,416,956 3,639,734

TOTAL EQUITY AND LIABILITIES 6,612,759 5,985,446

CONTINGENCIES AND COMMITMENTS 32

The annexed notes from 1 to 58 form an integral part of these financial statements.

Chief Financial Officer Chief Executive Director

BERGER PAINTS | 69

Trusted Worldwide

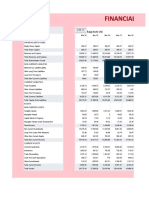

STATEMENT OF PROFIT OR LOSS

FOR THE YEAR ENDED JUNE 30, 2023

2023 2022

Note (Rupees in thousand)

Revenue from contract with customers - net 33 7,341,165 7,105,233

Cost of sales 34 (5,858,052) (5,883,486)

Gross profit 1,483,113 1,221,747

Selling and distribution expenses 35 (582,571) (677,395)

Administrative and general expenses 36 (208,993) (191,950)

Impairment loss (charged) / reversed during the year 15.3 & 11 (73,084) 3,074

Other operating expenses 37 (101,414) (19,386)

(966,062) (885,657)

Profit from operations 517,051 336,090

Other income 38 97,691 74,405

614,742 410,495

Finance cost 39 (283,545) (163,477)

Profit before taxation 331,197 247,018

Taxation 40 (91,136) (45,132)

Profit after taxation 240,061 201,886

Earnings per share - basic and diluted (Rupees) 41 9.78 8.22

The annexed notes from 1 to 58 form an integral part of these financial statements.

Chief Financial Officer Chief Executive Director

BERGER PAINTS | 71

Trusted Worldwide

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED JUNE 30, 2023

2023 2022

Note (Rupees in thousand)

CASH FLOWS FROM OPERATING ACTIVITIES

Net cash flows from operating activities before working capital

changes 43 872,347 550,521

(Increase) / decrease in current assets:

Stores, spare parts and loose tools 13 (7,606) (4,244)

Stock-in-trade 14 199,364 (382,030)

Trade debts - unsecured 15 (279,223) (408,624)

Loans and advances 16 (45,217) 53,537

Trade deposits and short term prepayments 17 (5,043) 4,056

Other receivables 18 51,580 72,130

(86,145) (665,175)

Increase in current liabilities:

Trade and other payables 28 209,144 191,021

Cash generated from operations 995,346 76,367

Finance cost paid (296,440) (140,298)

Taxation - net 19.1 (87,189) (2,934)

Long term employee benefit paid (31,600) (21,227)

Funds transferred to the Company from the Gratuity fund - 55,000

Worker's Profit Participation Fund paid (13,248) (13,470)

Workers' Welfare Fund paid (4,137) -

Long term loans received/(disbursed) - net 3,457 (2,124)

Long term deposits realised 3,678 2,109

(425,479) (122,944)

Net cash generated from /(used in) operating activities 569,867 (46,577)

CASH FLOWS FROM INVESTING ACTIVITIES

Capital expenditure incurred (25,655) (128,201)

Proceeds from disposal of property, plant and equipment 14,408 6,809

Mark-up received on term deposit and long term loan 23,708 9,753

Short term investments made during the year (81,000) -

Right shares purchased during the year (29,399) -

Net cash used in investing activities (97,938) (111,639)

CASH FLOWS FROM FINANCING ACTIVITIES

Repayment of long term financing - net (108,332) (12,459)

Proceeds from long term diminishing musharaka 484,000 16,000

Dividend paid (75,559) (82,564)

(Repayments)/proceeds of/from short term borrowings - net (255,552) 194,852

Net cash generated from financing activities 44,557 115,829

Net increase / (decrease) in cash and cash equivalents 516,486 (42,387)

Cash and cash equivalents at beginning of the year (784,716) (742,329)

Cash and cash equivalents at end of the year 42 (268,230) (784,716)

The annexed notes from 1 to 58 form an integral part of these financial statements.

Chief Financial Officer Chief Executive Director

You might also like

- Percentage Worksheet2Document5 pagesPercentage Worksheet2Hao WeiNo ratings yet

- Murray Stahl Discusses Value Investing Approach and Top Stock IdeasDocument10 pagesMurray Stahl Discusses Value Investing Approach and Top Stock IdeaskdwcapitalNo ratings yet

- Elite Signals Free Trading CourseDocument13 pagesElite Signals Free Trading CourseRavinder Singh Rajput100% (1)

- Chapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsDocument45 pagesChapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsAchmad RizalNo ratings yet

- Unit 2Document52 pagesUnit 2RajasekaranArunaNo ratings yet

- FINANCIAL POSITION AND PROFITDocument2 pagesFINANCIAL POSITION AND PROFITMuhammad Noman MehboobNo ratings yet

- Balance SheetDocument1 pageBalance Sheetarslan.ahmed8179No ratings yet

- Financial Statements 2021Document6 pagesFinancial Statements 2021Shehzad QureshiNo ratings yet

- Indus Motor Company Ltd. Financial Statement AnalysisDocument4 pagesIndus Motor Company Ltd. Financial Statement AnalysisTaha AfzalNo ratings yet

- FAUJI FOOD 30 JUNE 2023Document3 pagesFAUJI FOOD 30 JUNE 2023mrordinaryNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at June 30, 2022 For The Year Ended June 30, 2022Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at June 30, 2022 For The Year Ended June 30, 2022Saljook AslamNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at 30 June 2021 For The Year Ended 30 June 2021Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at 30 June 2021 For The Year Ended 30 June 2021Saljook AslamNo ratings yet

- Ecopack Limited Financial StatementsDocument84 pagesEcopack Limited Financial StatementspolodeNo ratings yet

- Orion Pharma Q3 2022 Condensed Financial StatementsDocument26 pagesOrion Pharma Q3 2022 Condensed Financial StatementsAfia Begum ChowdhuryNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Saljook AslamNo ratings yet

- Audited Financial Statements of NKR Engineering (Private) LimitedDocument19 pagesAudited Financial Statements of NKR Engineering (Private) LimitedMustafa hadiNo ratings yet

- Eum Edgenta Sofp & Sopl 2020Document4 pagesEum Edgenta Sofp & Sopl 2020ariash mohdNo ratings yet

- Shell Pakistan Limited Balance Sheet As at December 31, 2009Document39 pagesShell Pakistan Limited Balance Sheet As at December 31, 2009Saadia Anwar AliNo ratings yet

- Mari Gas Annual Report 2005Document32 pagesMari Gas Annual Report 2005Nauman IqbalNo ratings yet

- March 2021 Nine Month Orion PharmaDocument26 pagesMarch 2021 Nine Month Orion PharmaAfia Begum ChowdhuryNo ratings yet

- Corporate Finance AssigmentDocument15 pagesCorporate Finance Assigmentesmailkarimi456No ratings yet

- FMDocument8 pagesFMesmailkarimi456No ratings yet

- Final Title 2019-20Document3 pagesFinal Title 2019-20Ahmad KhalidNo ratings yet

- Shell Pakistan Limited Financial Statements For The Year Ended December 31, 2010Document60 pagesShell Pakistan Limited Financial Statements For The Year Ended December 31, 2010popatiaNo ratings yet

- Cherat Cement's Financial Health in 2020Document4 pagesCherat Cement's Financial Health in 2020Asad RehmanNo ratings yet

- Annual 2014-15 Bestway Cements Accounts PDFDocument49 pagesAnnual 2014-15 Bestway Cements Accounts PDFjamalNo ratings yet

- September 2020 Orion PharmaDocument28 pagesSeptember 2020 Orion PharmaAfia Begum ChowdhuryNo ratings yet

- Bkash Limited - For The Period Ended On June 30, 2018Document15 pagesBkash Limited - For The Period Ended On June 30, 2018Mashrur WasekNo ratings yet

- Condensed Interim Financial Information For The Three Months Ended March 31Document15 pagesCondensed Interim Financial Information For The Three Months Ended March 31AJWAD AIRFNo ratings yet

- UBL Interim Financial Statements March 2023 ConsolidatedDocument37 pagesUBL Interim Financial Statements March 2023 Consolidatedabdullahazaim55No ratings yet

- Htpadu bs2022Document2 pagesHtpadu bs2022shuhada shuhaimiNo ratings yet

- Orion Pharma Q3 2020 Financial ResultsDocument13 pagesOrion Pharma Q3 2020 Financial ResultsAfia Begum ChowdhuryNo ratings yet

- 17Q DMPL FS Q3 Fy22Document90 pages17Q DMPL FS Q3 Fy22mac macNo ratings yet

- Redco Textiles Q1 2022 ReportDocument11 pagesRedco Textiles Q1 2022 ReportTutii FarutiNo ratings yet

- DMPL 3qfy2022 FsDocument58 pagesDMPL 3qfy2022 FsRj ArevadoNo ratings yet

- Udenna Corpation and Subsidiaries - 2017 Conso AFSDocument133 pagesUdenna Corpation and Subsidiaries - 2017 Conso AFSRappler100% (4)

- Beximco Pharmaceuticals Limited Statement of Financial PositionDocument55 pagesBeximco Pharmaceuticals Limited Statement of Financial Positionrimon dasNo ratings yet

- Balance SheetDocument1 pageBalance SheetJack DawsonNo ratings yet

- Dec 22 Management ConsolidatedDocument23 pagesDec 22 Management ConsolidatedKhalid KhanNo ratings yet

- Financial Results For The 2 Quarter Ended 30 June 2021Document6 pagesFinancial Results For The 2 Quarter Ended 30 June 2021asadnawazNo ratings yet

- SOFPDocument1 pageSOFPSaad SalmanNo ratings yet

- Swisstek (Ceylon) PLC Swisstek (Ceylon) PLCDocument7 pagesSwisstek (Ceylon) PLC Swisstek (Ceylon) PLCkasun witharanaNo ratings yet

- CIB Financial StatementsDocument64 pagesCIB Financial StatementsLingua IntlNo ratings yet

- fr2018 PDFDocument84 pagesfr2018 PDFHamza HanifNo ratings yet

- PSO StatementDocument1 pagePSO StatementNaseeb Ullah TareenNo ratings yet

- Kel Annual AccountsDocument14 pagesKel Annual AccountsmrordinaryNo ratings yet

- CR-July-Aug-2022Document6 pagesCR-July-Aug-2022banglauserNo ratings yet

- Company 1Document5 pagesCompany 1purvimahajan027No ratings yet

- Aci Limited q1 Fs - 2022 23 - 13 11 2022Document20 pagesAci Limited q1 Fs - 2022 23 - 13 11 2022israt.reefaNo ratings yet

- Balance SheetDocument1 pageBalance SheetAmmar YasinNo ratings yet

- Golden Harvest Agro Industries Limited: Statement of Financial Position As at June 30, 2012Document8 pagesGolden Harvest Agro Industries Limited: Statement of Financial Position As at June 30, 2012khurshid topuNo ratings yet

- Reckitt Benckiser Bangladesh Annual Report 2009Document4 pagesReckitt Benckiser Bangladesh Annual Report 2009dbjhtNo ratings yet

- Balance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022Document1 pageBalance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022burhan mattooNo ratings yet

- 1st Qtr.2021 ReportDocument31 pages1st Qtr.2021 ReportMurad HasanNo ratings yet

- Byco Data PDFDocument32 pagesByco Data PDFMuiz SaddozaiNo ratings yet

- 17Q DMPL FS Q1 Fy22Document73 pages17Q DMPL FS Q1 Fy22PaulNo ratings yet

- Mi Annual Report 2022 - 230529 - 154403Document11 pagesMi Annual Report 2022 - 230529 - 154403Jia YiNo ratings yet

- Balance Sheet: Share Capital and ReservesDocument42 pagesBalance Sheet: Share Capital and ReservesaaliaccaNo ratings yet

- Annual-Report-FML-30-June-2020 Vol 1Document1 pageAnnual-Report-FML-30-June-2020 Vol 1Bluish FlameNo ratings yet

- AGTL - 2009 Al Ghazi Tractors Limited OpenDoors - PKDocument30 pagesAGTL - 2009 Al Ghazi Tractors Limited OpenDoors - PKMubashar TNo ratings yet

- Singer Q2 2021-2022Document13 pagesSinger Q2 2021-2022syfizajiNo ratings yet

- Half Yearly Financial Statements June 2022Document34 pagesHalf Yearly Financial Statements June 2022Ctg TalkNo ratings yet

- Statement of Financial Position SummaryDocument1 pageStatement of Financial Position SummarySaad SalmanNo ratings yet

- 3rd Quarter Report 2021 2022Document12 pages3rd Quarter Report 2021 2022শ্রাবনী দেবনাথNo ratings yet

- Financial Management 4Document41 pagesFinancial Management 4geachew mihiretu0% (1)

- Types of Investment RiskDocument2 pagesTypes of Investment RiskChandan GupttaNo ratings yet

- Cayman Lakeside Estate Investment Guide - Cayman Islands - DSR Asset Management LTDDocument12 pagesCayman Lakeside Estate Investment Guide - Cayman Islands - DSR Asset Management LTDProperty Cayman IslandsNo ratings yet

- Financial Analysis Using Financial Performance MetricsDocument27 pagesFinancial Analysis Using Financial Performance MetricsNishant_Gupta_8770No ratings yet

- Applied Optoelectronics (AAOI) - LONG RecommendationDocument3 pagesApplied Optoelectronics (AAOI) - LONG RecommendationJulia LaskowskaNo ratings yet

- Assignment 1Document2 pagesAssignment 1georgeNo ratings yet

- Questions - Business Valuation, Capital Structure and Risk ManagementDocument5 pagesQuestions - Business Valuation, Capital Structure and Risk Managementpercy mapetereNo ratings yet

- Module 2 Notes SapmDocument6 pagesModule 2 Notes SapmEsha BafnaNo ratings yet

- Cost of Capital ProblemsDocument5 pagesCost of Capital ProblemsYusairah Benito DomatoNo ratings yet

- Stochastic Processes For FinanceDocument74 pagesStochastic Processes For FinanceEmilioNo ratings yet

- RelianceDocument9 pagesRelianceIshpreet SinghNo ratings yet

- Chapter One: Book Building Method Problems and Its Implementation - 1Document18 pagesChapter One: Book Building Method Problems and Its Implementation - 1Zubayer HussainNo ratings yet

- Capital Gains Section 54 ChartDocument6 pagesCapital Gains Section 54 ChartYamuna GNo ratings yet

- Financial Accounting GlossaryDocument5 pagesFinancial Accounting GlossaryDheeraj SunthaNo ratings yet

- Selected QuestionsDocument5 pagesSelected QuestionsMazhar AliNo ratings yet

- Financial Markets and InstitutionsDocument21 pagesFinancial Markets and InstitutionsanilaNo ratings yet

- Price/Sales Ratio For High Growth FirmDocument8 pagesPrice/Sales Ratio For High Growth FirmTatiana BuruianaNo ratings yet

- Final Project Report - Excel SheetDocument24 pagesFinal Project Report - Excel SheetrajeshNo ratings yet

- CPA Review School Philippines Capital AssetsDocument8 pagesCPA Review School Philippines Capital AssetsJuan Miguel UngsodNo ratings yet

- CRR, SLR: Dr.S.C.BihariDocument16 pagesCRR, SLR: Dr.S.C.BihariAbhi2636100% (1)

- Financial Market and Banking OperationsDocument9 pagesFinancial Market and Banking OperationsShreya JoriNo ratings yet

- Bonds Payable QuizDocument7 pagesBonds Payable QuizChristine Jean MajestradoNo ratings yet

- Investment BankingDocument61 pagesInvestment BankingAbbas Taher PocketwalaNo ratings yet

- Week 8 Class ExercisesDocument3 pagesWeek 8 Class ExercisesChinhoong Ong100% (1)

- The Jalandhar Central Cooperative Bank Ltd.Document63 pagesThe Jalandhar Central Cooperative Bank Ltd.Tutorial ki Badi DuniyaNo ratings yet