Professional Documents

Culture Documents

Indus Motor Company Ltd. Financial Statement Analysis

Uploaded by

Taha AfzalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indus Motor Company Ltd. Financial Statement Analysis

Uploaded by

Taha AfzalCopyright:

Available Formats

Indus Motor Company Ltd.

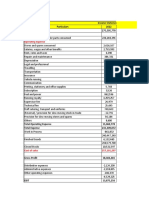

Statement of Financial Position

As at June 30, 2022

Note 2022 2021

--------(Rupees in ‘000)---------

ASSETS

Non-Current Assets

Property, plant and equipment 4 15,040,490 15,769,862

Intangible assets 4 145,092 39,784

Long-term loans and advances 5 15,983 16,857

Long-term deposits 6 10,020 10,020

Long-term investments 7 7,794,310 3,127,175

Deferred taxation - net 8 827,869 230,553

23,833,764 19,194,251

Current Assets

Stores and spares 9 513,440 420,105

Stock-in-trade 10 26,454,435 22,288,961

Trade debts - unsecured 11 3,090,713 517,138

Loans and advances 12 9,218,637 6,263,003

Short-term prepayments 13 49,611 36,999

Accrued return 14 341,268 109,996

Other receivables 15 2,737,584 983,119

Short-term investments 16 140,932,118 82,052,447

Cash and bank balances 17 6,793,784 2,039,797

190,131,590 114,711,565

TOTAL ASSETS 213,965,354 133,905,816

EQUITY

Share Capital

Authorised capital

500,000,000 (2021: 500,000,000) ordinary shares of Rs 10 each 5,000,000 5,000,000

Issued, subscribed and paid-up capital 18 786,000 786,000

Reserves 19 53,225,076 47,415,465

54,011,076 48,201,465

LIABILITIES

Non-Current Liabilities

Long term loan 20 279,878 589,837

Deferred Revenue 959 -

Deferred Government grant 21 - 6,023

Gas Infrastructure Development Cess Payable - 149,573

280,837 745,433

Current Liabilities

Current portion of long term loan 20 319,955 373,303

Current portion of deferred revenue 103 3,799

Current portion of deferred Government grant 21 6,023 34,680

Current portion of Gas Infrastructure Development Cess Payable 27,127 41,522

Unpaid / unclaimed dividend 1,426,545 330,370

Trade payables, other payables and provisions 22 40,480,546 30,288,196

Advances from customers and dealers 23 111,989,837 51,266,776

Taxation - net 24 5,423,305 2,620,272

159,673,441 84,958,918

159,954,278 85,704,351

TOTAL EQUITY AND LIABILITIES 213,965,354 133,905,816

CONTINGENCIES AND COMMITMENTS 27

The annexed notes 1 to 49 form an integral part of these financial statements.

Mohammad Ibadullah Ali Asghar Jamali Shinji Yanagi

Chief Financial Officer Chief Executive Vice Chairman & Director

Annual Report 2022 113

Statement of Profit or Loss

For the year ended June 30, 2022

Note 2022 2021

--------(Rupees in ‘000)---------

Revenue from contracts with customers 28 275,505,778 179,161,727

Cost of sales 29 (257,101,297) (162,508,017)

Gross profit 18,404,481 16,653,710

Distribution expenses 30 (2,124,200) (1,618,863)

Administrative expenses 31 (2,218,655) (1,464,888)

Other operating expenses 32 (186,370) (76,342)

(4,529,225) (3,160,093)

13,875,256 13,493,617

Workers’ Profit Participation Fund and Workers’ Welfare Fund 33 (1,244,092) (740,193)

12,631,164 12,753,424

Other income 34 12,935,711 5,579,339

25,566,875 18,332,763

Finance cost 35 (114,299) (133,570)

Profit before taxation 25,452,576 18,199,193

Taxation 36 (9,650,728) (5,370,601)

Profit after taxation 15,801,848 12,828,592

------------(Rupees )----------

Earnings per share - basic and diluted 37 201.04 163.21

The annexed notes 1 to 49 form an integral part of these financial statements.

Mohammad Ibadullah Ali Asghar Jamali Shinji Yanagi

Chief Financial Officer Chief Executive Vice Chairman & Director

114 Indus Motor Company Ltd.

Indus Motor Company Ltd.

Statement of Comprehensive Income

For the year ended June 30, 2022

Note 2022 2021

-------(Rupees in ‘000)-------

Profit after taxation 15,801,848 12,828,592

Other comprehensive income

Items that will not be reclassified to profit or loss

Remeasurement (loss) / gain on net defined benefit obligation 25.4 (14,980) 28,003

Related deferred tax thereon 4,943 (8,121)

(10,037) 19,882

Total comprehensive income for the year 15,791,811 12,848,474

The annexed notes 1 to 49 form an integral part of these financial statements.

Mohammad Ibadullah Ali Asghar Jamali Shinji Yanagi

Chief Financial Officer Chief Executive Vice Chairman & Director

Annual Report 2022 115

Statement of Cash Flows

For the year ended June 30, 2022

Note 2022 2021

---------(Rupees in ‘000)---------

CASH FLOWS FROM OPERATING ACTIVITIES

Cash generated from operations 38 78,650,196 51,925,832

Net decrease / (increase) in long-term loans and advances 874 (4,218)

Compensation paid on advances received from customers (1,308,657) (461,017)

Increase / (decrease) in deferred revenue 959 (3,799)

Payment to Workers’ Profit Participation Fund (1,350,000) (715,000)

Payment to Workers’ Welfare Fund (300,395) (110,003)

Interest paid on long term loan (18,477) (16,879)

Income tax paid (7,440,067) (2,793,787)

Net cash inflow from operating activities 68,234,433 47,821,129

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property, plant and equipment and intangible assets (2,827,583) (2,454,354)

Proceeds from disposals of property, plant and equipment 189,029 125,837

Interest received on bank deposits and Term Deposit Receipts 1,731,771 1,016,304

Gain on sale of Pakistan Investment Bonds 944,844 175,977

Interest received on Pakistan Investment Bonds 898,720 117,072

Investment in Pakistan Investment Bonds (8,878,024) (2,627,129)

Investment in listed mutual fund units (40,000,457) (22,400,145)

Dividend income received from listed mutual fund units 709,574 539,677

Proceeds from redemption of listed mutual fund units 33,621,998 9,802,373

Interest received on Market Treasury Bills 3,572,485 -

Investment in Market Treasury Bills (65,257,588) (21,663,415)

Proceeds from sale of Market Treasury Bills 37,264,556 24,589,923

Net cash outflow on investing activities (38,030,675) (12,777,880)

CASH FLOWS FROM FINANCING ACTIVITIES

Long term loan received - 539,797

Long term loan repaid (397,987) (128,705)

Dividend paid (8,886,025) (5,843,096)

Net cash outflow on financing activities (9,284,012) (5,432,004)

Net increase in cash and cash equivalents during the year 20,919,746 29,611,245

Cash and cash equivalents at beginning of the year 71,477,141 41,865,896

Cash and cash equivalents at end of the year 39 92,396,887 71,477,141

The annexed notes 1 to 49 form an integral part of these financial statements.

Mohammad Ibadullah Ali Asghar Jamali Shinji Yanagi

Chief Financial Officer Chief Executive Vice Chairman & Director

116 Indus Motor Company Ltd.

You might also like

- Lofty Credit Primary TradelinesDocument1 pageLofty Credit Primary Tradelinesmyfaithwalk1343100% (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- IU Student Bank StatementDocument1 pageIU Student Bank StatementHasnain AliNo ratings yet

- Milk Powder ProductionDocument28 pagesMilk Powder Productionabel_kayel100% (2)

- Microsoft Business Strategy 101Document17 pagesMicrosoft Business Strategy 101Chinmay Chauhan50% (2)

- Rental Agreement Format ChennaiDocument4 pagesRental Agreement Format Chennaisundarji sundararajuluNo ratings yet

- FINANCIAL POSITION AND PROFITDocument2 pagesFINANCIAL POSITION AND PROFITMuhammad Noman MehboobNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Saljook AslamNo ratings yet

- Financial Statements 2021Document6 pagesFinancial Statements 2021Shehzad QureshiNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at 30 June 2021 For The Year Ended 30 June 2021Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at 30 June 2021 For The Year Ended 30 June 2021Saljook AslamNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at June 30, 2022 For The Year Ended June 30, 2022Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at June 30, 2022 For The Year Ended June 30, 2022Saljook AslamNo ratings yet

- FAUJI FOOD 30 JUNE 2023Document3 pagesFAUJI FOOD 30 JUNE 2023mrordinaryNo ratings yet

- Shell Pakistan Limited Financial Statements For The Year Ended December 31, 2010Document60 pagesShell Pakistan Limited Financial Statements For The Year Ended December 31, 2010popatiaNo ratings yet

- Annual 2014-15 Bestway Cements Accounts PDFDocument49 pagesAnnual 2014-15 Bestway Cements Accounts PDFjamalNo ratings yet

- Kel Annual AccountsDocument14 pagesKel Annual AccountsmrordinaryNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: AS AT JUNE 30, 2023 For The Year Ended June 30, 2023Document3 pagesStatement of Financial Position Statement of Profit or Loss: AS AT JUNE 30, 2023 For The Year Ended June 30, 2023Saljook AslamNo ratings yet

- Financial Results For The 2 Quarter Ended 30 June 2021Document6 pagesFinancial Results For The 2 Quarter Ended 30 June 2021asadnawazNo ratings yet

- March 2021 Nine Month Orion PharmaDocument26 pagesMarch 2021 Nine Month Orion PharmaAfia Begum ChowdhuryNo ratings yet

- Cherat Cement's Financial Health in 2020Document4 pagesCherat Cement's Financial Health in 2020Asad RehmanNo ratings yet

- September 2020 Orion PharmaDocument28 pagesSeptember 2020 Orion PharmaAfia Begum ChowdhuryNo ratings yet

- Al Noor 2021Document1 pageAl Noor 2021Afan QayumNo ratings yet

- Orion Pharma Q3 2022 Condensed Financial StatementsDocument26 pagesOrion Pharma Q3 2022 Condensed Financial StatementsAfia Begum ChowdhuryNo ratings yet

- Corporate Finance AssigmentDocument15 pagesCorporate Finance Assigmentesmailkarimi456No ratings yet

- Byco Data PDFDocument32 pagesByco Data PDFMuiz SaddozaiNo ratings yet

- CIB Separate Financial Statements Mar 2022 EnglishDocument29 pagesCIB Separate Financial Statements Mar 2022 EnglishPT l Pardox TechNo ratings yet

- Audited Financial Statements of NKR Engineering (Private) LimitedDocument19 pagesAudited Financial Statements of NKR Engineering (Private) LimitedMustafa hadiNo ratings yet

- HBL Financial Statements for the nine months ended September 30, 2022Document69 pagesHBL Financial Statements for the nine months ended September 30, 2022Irfan MasoodNo ratings yet

- Shell Pakistan Limited Balance Sheet As at December 31, 2009Document39 pagesShell Pakistan Limited Balance Sheet As at December 31, 2009Saadia Anwar AliNo ratings yet

- Redco Textiles Q1 2022 ReportDocument11 pagesRedco Textiles Q1 2022 ReportTutii FarutiNo ratings yet

- Balance SheetDocument1 pageBalance SheetAmmar YasinNo ratings yet

- UBL Annual Consolidated Financial Statments 2022Document92 pagesUBL Annual Consolidated Financial Statments 2022abdullahazaim55No ratings yet

- Mi Annual Report 2022 - 230529 - 154403Document11 pagesMi Annual Report 2022 - 230529 - 154403Jia YiNo ratings yet

- United Bank 2021 Financial ResultsDocument91 pagesUnited Bank 2021 Financial ResultsAftab JamilNo ratings yet

- Ar-18 8Document5 pagesAr-18 8jawad anwarNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- SOFPDocument1 pageSOFPSaad SalmanNo ratings yet

- HUBCO Financial Statements Analysis 2015-2020Document97 pagesHUBCO Financial Statements Analysis 2015-2020Omer CrestianiNo ratings yet

- Final Title 2019-20Document3 pagesFinal Title 2019-20Ahmad KhalidNo ratings yet

- Beximco Pharmaceuticals Limited Statement of Financial PositionDocument55 pagesBeximco Pharmaceuticals Limited Statement of Financial Positionrimon dasNo ratings yet

- Swisstek (Ceylon) PLC Swisstek (Ceylon) PLCDocument7 pagesSwisstek (Ceylon) PLC Swisstek (Ceylon) PLCkasun witharanaNo ratings yet

- Balance SheetDocument1 pageBalance SheetJack DawsonNo ratings yet

- Balance SheetDocument1 pageBalance Sheetarslan.ahmed8179No ratings yet

- Htpadu bs2022Document2 pagesHtpadu bs2022shuhada shuhaimiNo ratings yet

- 15 Balance Sheet - 2Document1 page15 Balance Sheet - 2amer_mrd87No ratings yet

- Annex A 1 FCGI and Subsidiary Proforma Consolidated FS June 30 2021 2020 2019 1Document81 pagesAnnex A 1 FCGI and Subsidiary Proforma Consolidated FS June 30 2021 2020 2019 1psevangelioNo ratings yet

- Ecopack Limited Financial StatementsDocument84 pagesEcopack Limited Financial StatementspolodeNo ratings yet

- Udenna Corpation and Subsidiaries - 2017 Conso AFSDocument133 pagesUdenna Corpation and Subsidiaries - 2017 Conso AFSRappler100% (4)

- Orion Pharma Q3 2020 Financial ResultsDocument13 pagesOrion Pharma Q3 2020 Financial ResultsAfia Begum ChowdhuryNo ratings yet

- FMDocument8 pagesFMesmailkarimi456No ratings yet

- Dec 22 Management ConsolidatedDocument23 pagesDec 22 Management ConsolidatedKhalid KhanNo ratings yet

- Robi Stat Interim FS Q2 21 FV 003Document26 pagesRobi Stat Interim FS Q2 21 FV 003Niamul HasanNo ratings yet

- Balance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022Document1 pageBalance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022burhan mattooNo ratings yet

- Balance SheetDocument2 pagesBalance SheetMuazzam AliNo ratings yet

- Mari Gas Annual Report 2005Document32 pagesMari Gas Annual Report 2005Nauman IqbalNo ratings yet

- AGTL - 2009 Al Ghazi Tractors Limited OpenDoors - PKDocument30 pagesAGTL - 2009 Al Ghazi Tractors Limited OpenDoors - PKMubashar TNo ratings yet

- Gul Ahmed Quiz 2 QuesDocument5 pagesGul Ahmed Quiz 2 QuesTehreem SirajNo ratings yet

- UBL Interim Financial Statements March 2023 ConsolidatedDocument37 pagesUBL Interim Financial Statements March 2023 Consolidatedabdullahazaim55No ratings yet

- BRAC Bank Audited Financial Statements 2022Document125 pagesBRAC Bank Audited Financial Statements 2022barmanjhuma77No ratings yet

- Q2 2019 Interim Financial Statements Brick Brewing CoDocument12 pagesQ2 2019 Interim Financial Statements Brick Brewing CoyanaNo ratings yet

- Condensed Interim Financial Information For The Three Months Ended March 31Document15 pagesCondensed Interim Financial Information For The Three Months Ended March 31AJWAD AIRFNo ratings yet

- 11.4 Case Atlas Honda Full - Activity 07112022Document6 pages11.4 Case Atlas Honda Full - Activity 07112022Areeba RaoNo ratings yet

- Taliworks Corporation Berhad Q4 2019 Financial ReportDocument28 pagesTaliworks Corporation Berhad Q4 2019 Financial ReportGan ZhiHanNo ratings yet

- Pakistan Petroleum LTDDocument43 pagesPakistan Petroleum LTDMuheeb AhmadNo ratings yet

- Taliworks - Q4FY23Document31 pagesTaliworks - Q4FY23seeme55runNo ratings yet

- Impact of COVID-19 Pandemic On Micro, Small, and Medium-Sizedenterprises Operating in PakistanDocument14 pagesImpact of COVID-19 Pandemic On Micro, Small, and Medium-Sizedenterprises Operating in PakistanSohail AkramNo ratings yet

- Principles of Management Term Project - in Pursuit of HappynessDocument9 pagesPrinciples of Management Term Project - in Pursuit of HappynessTaha AfzalNo ratings yet

- Indus Motors - Term ProjectDocument17 pagesIndus Motors - Term ProjectTaha AfzalNo ratings yet

- The Law of UnpredictabilityDocument6 pagesThe Law of UnpredictabilityTaha AfzalNo ratings yet

- Haleeb Rejuvenating The Market Leader of The PastDocument11 pagesHaleeb Rejuvenating The Market Leader of The PastTaha AfzalNo ratings yet

- Flavoured BreadDocument39 pagesFlavoured BreadTaha AfzalNo ratings yet

- Daraz - PK Online Marketplace'SValue Chain by - M. Shakeel S. Jajja1 Mohsin N. Jat1 Presented To - Sir Asif IqbalDocument19 pagesDaraz - PK Online Marketplace'SValue Chain by - M. Shakeel S. Jajja1 Mohsin N. Jat1 Presented To - Sir Asif IqbalTaha AfzalNo ratings yet

- Chapter 4 SolutionsDocument80 pagesChapter 4 SolutionssurpluslemonNo ratings yet

- Assignment 3Document3 pagesAssignment 3Nurul FitriNo ratings yet

- First Draft 001Document44 pagesFirst Draft 001robbymalcolm18No ratings yet

- The Virgin Group: An Innovative Corporate StructureDocument25 pagesThe Virgin Group: An Innovative Corporate Structurerohanag25% (4)

- Intermediate Accounting 1 - InventoriesDocument9 pagesIntermediate Accounting 1 - InventoriesLien LaurethNo ratings yet

- ANSWER KEY ON PARTNERSHIP MOCK TESTxDocument6 pagesANSWER KEY ON PARTNERSHIP MOCK TESTxzhyrus macasilNo ratings yet

- PS - Project Finance Concepts and ApplicationsDocument283 pagesPS - Project Finance Concepts and ApplicationsLahinNo ratings yet

- Case Evidence and Details LebowitzLPR 2 3 PDFDocument19 pagesCase Evidence and Details LebowitzLPR 2 3 PDFAnonymous xm0nAXZNo ratings yet

- Balance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of AccountsDocument27 pagesBalance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of Accountsrisc1No ratings yet

- SPRING 2018 BUS 498 EXIT ASSESSMENT TEST Questions - NSUDocument8 pagesSPRING 2018 BUS 498 EXIT ASSESSMENT TEST Questions - NSURafina Aziz 1331264630No ratings yet

- The Alchemist - Edition 8 FinalDocument53 pagesThe Alchemist - Edition 8 FinalPikinisoNo ratings yet

- Executive Summary of the Office of the President 2020 Annual ReportDocument5 pagesExecutive Summary of the Office of the President 2020 Annual ReportJohn Francis SegarraNo ratings yet

- Short AnswerDocument5 pagesShort AnswerblueberryNo ratings yet

- FIN301 Final QuestionDocument5 pagesFIN301 Final QuestionJunaidNo ratings yet

- Traders EdgeDocument5 pagesTraders Edgeartus14100% (1)

- Fina 385class NotesDocument119 pagesFina 385class NotesNazimBenNo ratings yet

- Lee Mei Peng No 33 Jalan Delima 4A/Ks6 Bandar Parkland Pendamar 41200 KLANGDocument4 pagesLee Mei Peng No 33 Jalan Delima 4A/Ks6 Bandar Parkland Pendamar 41200 KLANGappleNo ratings yet

- Variable and Absorption Income StatementDocument29 pagesVariable and Absorption Income Statementits4krishna3776No ratings yet

- John Neff 22 Sep 2020 1116Document5 pagesJohn Neff 22 Sep 2020 1116Debashish Priyanka SinhaNo ratings yet

- Generic Ic Disc PresentationDocument55 pagesGeneric Ic Disc PresentationInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasMHILET BasanNo ratings yet

- Major and Minor Programmes 2022-23Document11 pagesMajor and Minor Programmes 2022-23Kelly lamNo ratings yet

- LandBank - Cash Card FormDocument2 pagesLandBank - Cash Card FormPete Rahon94% (16)

- Shareholders' Equity: PROBLEM 1: Prepare Journal Entries To Record Each of The FollowingDocument14 pagesShareholders' Equity: PROBLEM 1: Prepare Journal Entries To Record Each of The FollowingAccounting LayfNo ratings yet

- Dissolution - Changes in OwnershipDocument57 pagesDissolution - Changes in OwnershipJean Rae RemiasNo ratings yet