Professional Documents

Culture Documents

Statement of Financial Position Statement of Profit or Loss: As at 30 June 2021 For The Year Ended 30 June 2021

Uploaded by

Saljook Aslam0 ratings0% found this document useful (0 votes)

5 views3 pagesOriginal Title

2021

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pagesStatement of Financial Position Statement of Profit or Loss: As at 30 June 2021 For The Year Ended 30 June 2021

Uploaded by

Saljook AslamCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

68 | BERGER PAINTS Trusted Worldwide

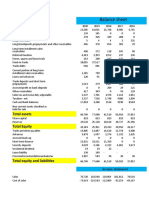

Statement of Financial Position

As at 30 June 2021

Rupees in thousand Note 2021 2020

ASSETS

Non-current assets

Property, plant and equipment 6 1,634,795 1,638,058

Intangibles 7 211 25,516

Investments 8 52,505 52,037

Loan to related party - secured 9 - 40,000

Long term loans 10 34,147 23,974

Long term deposits and prepayments 11 36,419 17,875

Deferred taxation 12 29,093 -

1,787,170 1,797,460

Current assets

Stores, spare parts and loose tools 18,491 13,593

Stock-in-trade 13 1,225,895 1,085,933

Trade debts - unsecured 14 1,219,678 1,039,773

Loans and advances 15 277,245 156,048

Trade deposits and short term prepayments 16 31,676 34,038

Other receivables 17 184,323 104,579

Tax refund due from Government 192,661 250,706

Short term investment 18 30,000 32,195

Cash and bank balances 19 44,476 40,635

3,224,445 2,757,500

5,011,615 4,554,960

EQUITY AND LIABILITIES

Authorised share capital 250,000 250,000

Share capital and reserves

Issued, subscribed and paid-up capital 20 204,597 204,597

Reserves

Capital reserves

Share premium and other reserves 45,304 40,543

Revaluation surplus on property, plant and machinery 849,056 877,100

Revenue reserves 21 894,360 917,643

General reserve 285,000 285,000

Accumulated profits 841,416 647,783

21 1,126,416 932,783

Total equity 2,225,373 2,055,023

Non-current liabilities

Long term financing - secured 22 152,498 120,122

Deferred income 23 1,155 2,077

Staff retirement and other long term benefits 24 75,589 138,527

Deferred taxation - 15,453

229,242 276,179

Current liabilities

Trade and other payables 25 1,569,174 900,926

Current portion of deferred income 2,407 1,662

Current maturity of long term financing 107,884 227,759

Unclaimed dividend 7,551 6,687

Accrued markup 26 22,479 35,173

Short term borrowings - secured 27 847,505 1,051,551

2,557,000 2,223,758

2,786,242 2,499,937

Contingencies and commitments 28

5,011,615 4,554,960

The annexed notes 1 to 52 form an integral part of these financial statements.

Chief Financial Officer Chief Executive Director

Berger Paints Pakistan Limited - Annual Report 2021 | 69

Statement of Profit or Loss

For the year ended 30 June 2021

Rupees in thousand Note 2021 2020

Revenue 29 5,602,160 4,177,951

Cost of sales 30 (4,485,600) (3,301,617)

Gross profit 1,116,560 876,334

Selling and distribution costs 31 (538,891) (479,685)

Administrative and general expenses 32 (172,057) (167,647)

Impairment loss on trade debts and other receivables (61,923) -

Other income 33 91,580 84,041

Other expenses 34 (50,465) (8,461)

(731,756) (571,752)

Profit from operations 384,804 304,582

Finance cost 35 (117,758) (190,050)

Profit before taxation 267,046 114,532

Taxation 36 (71,825) (40,224)

Profit after taxation 195,221 74,308

Rupees Rupees

Earnings per share - basic and diluted 37 9.54 3.63

The annexed notes 1 to 52 form an integral part of these financial statements.

Chief Financial Officer Chief Executive Director

Berger Paints Pakistan Limited - Annual Report 2021 | 71

Statement of Cash Flows

For the year ended 30 June 2021

Rupees in thousand Note 2021 2020

Cash flows from operating activities

Profit before taxation 267,046 114,532

Adjustments for non-cash and other items:

Depreciation on property, plant and equipment 134,793 78,183

Amortization on computer software 1,305 1,745

Gain on disposal of property, plant and equipment (4,640) (6,288)

Provision charged against slow moving stock - net 28,227 6,557

Insurance claim - (20,347)

Revaluation deficit - 15,241

Impairment loss on trade debts and other receivables 61,923 47,908

Provision for staff retirement and other long term benefits 20,107 12,395

Provision for trade deposits and short term prepayments - 495

Provision for doubtful deposits - 381

Finance cost 117,758 190,050

Impairment on investment in associate 4,293 -

Impairment on goodwill 24,000 -

Amortization of deferred grant (6,595) -

Mark-up on term deposit receipts (11,581) (13,703)

369,590 312,617

Operating profit before working capital changes 636,636 427,149

Working capital changes

(Increase) / decrease in current assets:

Stores, spare parts and loose tools (4,898) 3,313

Stock-in-trade (168,189) (175,122)

Trade debts - unsecured (231,784) 382,146

Loans and advances (89,512) (57,262)

Trade deposits and short term prepayments 2,362 6,673

Other receivables (87,955) (79,340)

(579,976) 80,408

Decrease / (increase) in current liabilities:

Trade and other payables 692,006 (289,925)

Cash generated from operations 748,666 217,632

Finance cost paid (125,589) (194,309)

Taxes paid - net (82,478) (2,782)

Staff retirement and other long term benefits paid (92,217) (24,919)

Long term loans - net (19,524) 20,654

Long term deposits - net (878) 2,949

(320,686) (198,407)

Net cash generated from operating activities 427,980 19,225

Cash flows from investing activities

Capital expenditure incurred (133,349) (93,471)

Proceeds from disposal of property, plant and equipment 8,585 17,349

Mark-up received on term deposit and long term loan 9,748 13,889

Short term investments - net 2,195 -

Net cash used in investing activities (112,821) (62,233)

Cash flows from financing activities

Long term financing - net (87,676) 179,967

Dividend paid (19,596) (19,753)

Short term borrowings - net (81,276) 41,976

Net cash (used in) / generated from financing activities (188,548) 202,190

Net increase in cash and cash equivalents 126,611 159,182

Cash and cash equivalents at beginning of the year (868,940) (1,028,122)

Cash and cash equivalents at end of the year 38 (742,329) (868,940)

The annexed notes 1 to 52 form an integral part of these financial statements.

Chief Financial Officer Chief Executive Director

You might also like

- Entrepreneurship - Quarter 2 Week 9Document8 pagesEntrepreneurship - Quarter 2 Week 9SHEEN ALUBANo ratings yet

- TAX Withholding TaxesDocument6 pagesTAX Withholding TaxesRae WorksNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at June 30, 2022 For The Year Ended June 30, 2022Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at June 30, 2022 For The Year Ended June 30, 2022Saljook AslamNo ratings yet

- FINANCIAL POSITION AND PROFITDocument2 pagesFINANCIAL POSITION AND PROFITMuhammad Noman MehboobNo ratings yet

- Indus Motor Company Ltd. Financial Statement AnalysisDocument4 pagesIndus Motor Company Ltd. Financial Statement AnalysisTaha AfzalNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Saljook AslamNo ratings yet

- Financial Statements 2021Document6 pagesFinancial Statements 2021Shehzad QureshiNo ratings yet

- Kel Annual AccountsDocument14 pagesKel Annual AccountsmrordinaryNo ratings yet

- Al Noor 2021Document1 pageAl Noor 2021Afan QayumNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: AS AT JUNE 30, 2023 For The Year Ended June 30, 2023Document3 pagesStatement of Financial Position Statement of Profit or Loss: AS AT JUNE 30, 2023 For The Year Ended June 30, 2023Saljook AslamNo ratings yet

- Annual 2014-15 Bestway Cements Accounts PDFDocument49 pagesAnnual 2014-15 Bestway Cements Accounts PDFjamalNo ratings yet

- Shell Pakistan Limited Financial Statements For The Year Ended December 31, 2010Document60 pagesShell Pakistan Limited Financial Statements For The Year Ended December 31, 2010popatiaNo ratings yet

- FMDocument8 pagesFMesmailkarimi456No ratings yet

- Corporate Finance AssigmentDocument15 pagesCorporate Finance Assigmentesmailkarimi456No ratings yet

- FAUJI FOOD 30 JUNE 2023Document3 pagesFAUJI FOOD 30 JUNE 2023mrordinaryNo ratings yet

- Financial Results For The 2 Quarter Ended 30 June 2021Document6 pagesFinancial Results For The 2 Quarter Ended 30 June 2021asadnawazNo ratings yet

- UBL Annual Consolidated Financial Statments 2022Document92 pagesUBL Annual Consolidated Financial Statments 2022abdullahazaim55No ratings yet

- Balance SheetDocument1 pageBalance SheetJack DawsonNo ratings yet

- SOFPDocument1 pageSOFPSaad SalmanNo ratings yet

- Condensed Interim Financial Information For The Three Months Ended March 31Document15 pagesCondensed Interim Financial Information For The Three Months Ended March 31AJWAD AIRFNo ratings yet

- Shell Pakistan Limited Balance Sheet As at December 31, 2009Document39 pagesShell Pakistan Limited Balance Sheet As at December 31, 2009Saadia Anwar AliNo ratings yet

- ADIB Consalidated Condensed Dec 2022Document109 pagesADIB Consalidated Condensed Dec 2022Youssef NabilNo ratings yet

- Redco Textiles Q1 2022 ReportDocument11 pagesRedco Textiles Q1 2022 ReportTutii FarutiNo ratings yet

- Balance SheetDocument1 pageBalance Sheetarslan.ahmed8179No ratings yet

- Pakistan Refinery Limited (Annual Report 2008)Document84 pagesPakistan Refinery Limited (Annual Report 2008)Monis Ali100% (1)

- United Bank 2021 Financial ResultsDocument91 pagesUnited Bank 2021 Financial ResultsAftab JamilNo ratings yet

- Packages Annualreport2002Document66 pagesPackages Annualreport2002omairNo ratings yet

- IbfDocument9 pagesIbfMinhal-KukdaNo ratings yet

- Crescent Steel and Allied Products LTD.: Balance SheetDocument14 pagesCrescent Steel and Allied Products LTD.: Balance SheetAsadvirkNo ratings yet

- Dec 22 Management ConsolidatedDocument23 pagesDec 22 Management ConsolidatedKhalid KhanNo ratings yet

- Ecopack Limited Financial StatementsDocument84 pagesEcopack Limited Financial StatementspolodeNo ratings yet

- CIB Separate Financial Statements Mar 2022 EnglishDocument29 pagesCIB Separate Financial Statements Mar 2022 EnglishPT l Pardox TechNo ratings yet

- Pak Elektron Limited: Condensed Interim Consolidated Balance Sheet AS AT MARCH 31, 2017Document9 pagesPak Elektron Limited: Condensed Interim Consolidated Balance Sheet AS AT MARCH 31, 2017Imran Abdul AzizNo ratings yet

- Ar-18 8Document5 pagesAr-18 8jawad anwarNo ratings yet

- Balance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022Document1 pageBalance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022burhan mattooNo ratings yet

- Numinus FS Q1 Nov 30, 2022 FINALDocument26 pagesNuminus FS Q1 Nov 30, 2022 FINALNdjfncnNo ratings yet

- Accounting Information System HomeWork 1 Jazan UniversityDocument7 pagesAccounting Information System HomeWork 1 Jazan Universityabdullah.masmaliNo ratings yet

- Mi Annual Report 2022 - 230529 - 154403Document11 pagesMi Annual Report 2022 - 230529 - 154403Jia YiNo ratings yet

- March 2021 Nine Month Orion PharmaDocument26 pagesMarch 2021 Nine Month Orion PharmaAfia Begum ChowdhuryNo ratings yet

- Balance SheetDocument1 pageBalance SheetAmmar YasinNo ratings yet

- BRAC Bank Audited Financial Statements 2022Document125 pagesBRAC Bank Audited Financial Statements 2022barmanjhuma77No ratings yet

- Orion Pharma Q3 2022 Condensed Financial StatementsDocument26 pagesOrion Pharma Q3 2022 Condensed Financial StatementsAfia Begum ChowdhuryNo ratings yet

- Mari Gas Annual Report 2005Document32 pagesMari Gas Annual Report 2005Nauman IqbalNo ratings yet

- Pakistan Telecommunication Company Ltd. (PTCL) Connecting The Nation Since 1947Document12 pagesPakistan Telecommunication Company Ltd. (PTCL) Connecting The Nation Since 1947M Bilal KNo ratings yet

- Reports SampleDocument20 pagesReports SampleChristian Jade Lumasag NavaNo ratings yet

- Beximco Pharmaceuticals Limited Statement of Financial PositionDocument55 pagesBeximco Pharmaceuticals Limited Statement of Financial Positionrimon dasNo ratings yet

- Half Yearly Financial Statements June 2022Document34 pagesHalf Yearly Financial Statements June 2022Ctg TalkNo ratings yet

- 2006 BafDocument3 pages2006 BafGulraiz HanifNo ratings yet

- HUBCO Financial Statements Analysis 2015-2020Document97 pagesHUBCO Financial Statements Analysis 2015-2020Omer CrestianiNo ratings yet

- Balance Sheet: Share Capital and ReservesDocument42 pagesBalance Sheet: Share Capital and ReservesaaliaccaNo ratings yet

- Htpadu bs2022Document2 pagesHtpadu bs2022shuhada shuhaimiNo ratings yet

- DSML Mar 07Document1 pageDSML Mar 07usman_dhilloNo ratings yet

- HOndaDocument8 pagesHOndaRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- HBL Financial Statements for the nine months ended September 30, 2022Document69 pagesHBL Financial Statements for the nine months ended September 30, 2022Irfan MasoodNo ratings yet

- AGTL - 2009 Al Ghazi Tractors Limited OpenDoors - PKDocument30 pagesAGTL - 2009 Al Ghazi Tractors Limited OpenDoors - PKMubashar TNo ratings yet

- Cherat Cement's Financial Health in 2020Document4 pagesCherat Cement's Financial Health in 2020Asad RehmanNo ratings yet

- Libro 1Document1 pageLibro 1Constanta CobusceanNo ratings yet

- Balance Sheet: Total Assets Total EquityDocument6 pagesBalance Sheet: Total Assets Total EquityDeepak MatlaniNo ratings yet

- Unaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Document7 pagesUnaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Fuaad DodooNo ratings yet

- Audited Financial Statements of NKR Engineering (Private) LimitedDocument19 pagesAudited Financial Statements of NKR Engineering (Private) LimitedMustafa hadiNo ratings yet

- Robi Stat Interim FS Q2 21 FV 003Document26 pagesRobi Stat Interim FS Q2 21 FV 003Niamul HasanNo ratings yet

- Chapter 3Document53 pagesChapter 3Josceline JoscelineNo ratings yet

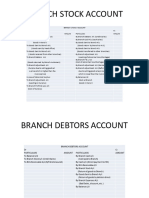

- Whittington 22e Solutions Manual Ch14Document14 pagesWhittington 22e Solutions Manual Ch14潘妍伶No ratings yet

- ASSIGNMENT AnidaDocument14 pagesASSIGNMENT AnidaAnida BgdNo ratings yet

- ProspectusDocument595 pagesProspectusAdlan IzamNo ratings yet

- A Comparative Study Between Free Cash Flows and ManagementDocument7 pagesA Comparative Study Between Free Cash Flows and ManagementCatharinaNo ratings yet

- Receivables Chapter SummaryDocument62 pagesReceivables Chapter SummaryTan IrisNo ratings yet

- Intermediate Financial Management 13th Edition Brigham Solutions ManualDocument33 pagesIntermediate Financial Management 13th Edition Brigham Solutions Manualcuongamandan4c100% (37)

- Catalogo de Cuentas Cargable ContpaqDocument1 pageCatalogo de Cuentas Cargable ContpaqSergei ItzruyenerNo ratings yet

- Partnership FormationDocument13 pagesPartnership Formationceasar compayNo ratings yet

- FIN 401 AssignmentDocument20 pagesFIN 401 AssignmentAnika NawarNo ratings yet

- 67 6 3 AccountancyDocument19 pages67 6 3 Accountancypoonam KanuajiyaNo ratings yet

- Lesson 7 Mergers and AcquisitionsDocument11 pagesLesson 7 Mergers and AcquisitionsfloryvicliwacatNo ratings yet

- Practice Competency 2021-2022 Final Edited-Format 1Document8 pagesPractice Competency 2021-2022 Final Edited-Format 1CATUGAL, LANCE ALECNo ratings yet

- Accountancy PPT 1Document22 pagesAccountancy PPT 1sakshamNo ratings yet

- CAF 05 FAR 1 Past Paper SC E Learning 1 PDFDocument223 pagesCAF 05 FAR 1 Past Paper SC E Learning 1 PDFaeman0% (1)

- NPV EgDocument4 pagesNPV EgSanjay MehrotraNo ratings yet

- BDB Annual Report 2021 - Part - 4Document111 pagesBDB Annual Report 2021 - Part - 42023149467No ratings yet

- FINM 272 Work Program 2024Document5 pagesFINM 272 Work Program 2024NkatekoNo ratings yet

- Fin 133 Practice Final ExamDocument8 pagesFin 133 Practice Final ExamFierryl MenisNo ratings yet

- Stock & Debtors System FormatsDocument9 pagesStock & Debtors System Formatsvani jainNo ratings yet

- Signed FS Inocycle Technology Group TBK 2018 PDFDocument74 pagesSigned FS Inocycle Technology Group TBK 2018 PDFmichele hazelNo ratings yet

- BNBR - Final Report Billingual December 31 2022 PDFDocument135 pagesBNBR - Final Report Billingual December 31 2022 PDFVal IntanNo ratings yet

- 1styr 1stMT Financial Accounting and Reporting 2324Document31 pages1styr 1stMT Financial Accounting and Reporting 2324MaryNo ratings yet

- Shell Financial Data BloombergDocument48 pagesShell Financial Data BloombergShardul MudeNo ratings yet

- Inventory - Gross Profit - Retail MethodDocument6 pagesInventory - Gross Profit - Retail MethodaleywaleyNo ratings yet

- Kotak Mahindra INC FY23Document22 pagesKotak Mahindra INC FY23Kaneez FatimaNo ratings yet

- 3 D Enterprises LedgerDocument1 page3 D Enterprises Ledgerzubair.afuNo ratings yet

- Q12 KeyDocument3 pagesQ12 KeyMuhammad AbdullahNo ratings yet