Professional Documents

Culture Documents

Iv. Completing The Accounting Cycle

Uploaded by

by ScribdOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Iv. Completing The Accounting Cycle

Uploaded by

by ScribdCopyright:

Available Formats

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

COMPLETING THE ACCOUNTING CYCLE

I. Using a Worksheet

A worksheet is a multiple-column form used in the adjustment process and in preparing financial

statements. It is a working tool, not a permanent accounting record. It is neither a journal nor a part of

the general ledger. The use of it is OPTIONAL.

The use of a worksheet is (1) to minimize errors in the records, (2) to simplify the end-of-period

procedures, and (3) to provide the financial statements to interested parties at an earlier date.

*Steps in preparing a worksheet*

1. Prepare a Trial Balance on the Worksheet

2. Enter the adjustments in the Adjustments Columns

3. Enter the adjusted balances in the adjusted trial balance columns

4. Extend the adjusted trial balance amounts to appropriate financial statement columns

5. Total the statement columns, compute the net income (or net loss), and complete the worksheet

II. Continuation of the Accounting Cycle

1. Closing Entries

After having adjusted the accounts at the end of the accounting period, the company makes

the accounts ready for the next period. This is called “closing the books”. Only temporary

accounts are closed at the end of the accounting period. Permanent accounts are not closed

from period to period rather, the balances of these accounts are carried forward into the next

accounting period.

TEMPORARY / NOMINAL ACCOUNT PERMANENT / REAL ACCOUNT

All Revenue Accounts All Asset Accounts

All Expense Accounts All Liability Accounts

Owner’s Drawing Owner’s Capital Account

Income Statement / Drawings Accounts Balance Sheet Accounts

Through closing entries, one transfers all temporary accounts to owner’s capital, a

permanent owner’s equity accounts. Therefore, at the end of an accounting period, all

temporary accounts must have zero balances.

Closing entries are usually done at the end of an ANNUAL accounting period.

a. Journalizing and Posting Closing Entries

1. Debit each revenue account for its balance, and credit Income Summary for total

revenues.

2. Debit Income Summary for total expenses, and credit each expense account for its

balance.

3. Debit Income Summary and credit Owner’s Capital for the amount of net income OR

debit Owner’s Capital and credit Income Summary for the amount of net loss.

4. Debit owner’s capital for the balance in the owner’s drawings account and credit owner’s

drawings for the same amount.

*Income Summary is a temporary account where all revenue and expense accounts are closed to.

b. Cautions in preparing closing entries

Avoid unintentionally doubling the revenue and expense balances rather than zeroing

them

Do not close Owner’s Drawings through Income Summary account. Owner’s Drawings is

not an expense, and it is not a factor in determining net income.

2. Post-Closing Trial Balance

After all closing entries have been journalized and posted, a post-closing trial balance is

prepared. The purpose of this trial balance is to prove the equality of the permanent

Accountancy Academic Organization Tutorials 2018 1

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

(statement of financial position) account balances that are carried forward into the next

accounting period.

III. Summary of the Accounting Cycle

Accounting Cycle Steps

1. Analyze business transactions

2. Journalize the transactions

3. Post to ledger accounts

4. Prepare a trial balance

5. Journalize and post adjusting entries: deferrals/accruals

6. Prepare an adjusted trial balance

7. Prepare financial statements: (1) Statement of Comprehensive Income; (2) Statement

of Changes in Owner’s Equity; (3) Statement of Financial Position

8. Journalize and post closing entries

9. Prepare a post-closing trial balance then back to step 1

**Steps 1-3 : may occur daily during the accounting period

4-7 : may occur on a periodic basis (monthly, quarterly,etc)

8-9 : takes place at the end of a company’s annual accounting period

Appendix A

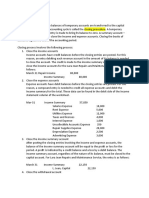

I. Reversing Entries (Optional Step) – exact opposite of the adjusting entry made in the previous period.

These are made at the beginning of the next accounting period. The purpose of these is to simplify the

recording of a subsequent transaction related to an adjusting entry.

Ex.

1. Oct 26 (initial salary entry): QueHorror Agency pays $4000 of salaries and wages earned between

Oct 15 and Oct 26

2. Oct 31 (adjusting entry): Salaries and wages earned between Oct 29 and Oct 31 are $1200. The

agency will pay these in the Nov 9 payroll.

3. Nov 9 (subsequent salary entry): Salaries and wages paid are $4000. Of this amount, $1200

applied to accrued salaries and wages payable and $2800 was earned between Nov 1 and Nov 9.

Without Reversing Entries With Reversing Entry

Initial Salary Entry Initial Salary Entry

Oct 26 Salaries and Wages Expense $4000 Oct 26 Salaries and Wages Expense $4000

Cash $4000 Cash $4000

Adjusting Entry Adjusting Entry

Oct 31 Salaries and Wages Expense 1200 Oct 31 Salaries and Wages Expense 1200

Salaries and Wages Payable 1200 Salaries and Wages Payable 1200

Closing Entry Closing Entry

Oct 31 Income Summary 5200 Oct 31 Income Summary 5200

Salaries and Wages Expense 5200 Salaries and Wages Expense 5200

No Reversing Entry Reversing Entry

Nov 1 Salaries and Wages Payable 1200

Salaries and Wages Expense 1200

Subsequent Salary Entry Subsequent Salary Entry

Nov 9 Salaries and Wages Payable 1200 Nov 9 Salaries and Wages Expense 4000

Salaries and Wages Expense 2800 Cash 4000

Cash 4000

Accountancy Academic Organization Tutorials 2018 2

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

II. Correcting Entries (Avoidable Step) – entries that correct errors in previous entries. These must be

posted before closing entries.

Adjusting Entries Correcting Entries

1. Integral part of the accounting cycle 1. Unnecessary if the records are error-free

2. Journalized and posted only at the end of an 2. Made whenever an error is discovered

accounting period

3. May involve any combination of accounts

3. Always affect at least one statement of in need of correction

financial position account and one statement

of comprehensive income account

Case 1

Incorrect Entry (May 01) Correct Entry (May 01)

Cash xx Cash xx

Service Revenue xx Accounts Receivable xx

Correcting Entry

May 05 Service Revenue xx

Accounts Receivable xx

To record correcting

entry of May 01

Case 2

Incorrect Entry (May 03) Correct Entry (May 03)

Equipment 45 Equipment 450

Accounts Payable 45 Accounts Payable 450

Correcting Entry

May 07 Equipment 405

Accounts Payable 405

To record correcting

entry of May 03

Accountancy Academic Organization Tutorials 2018 3

You might also like

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Basic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)Document17 pagesBasic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)LiaNo ratings yet

- Accountng Cycle For A Service BusinessDocument12 pagesAccountng Cycle For A Service BusinessSharrymae Tumanguil MatoteNo ratings yet

- FABM 1 - Contextualized LAS - Quarter 2 - Week 1bDocument12 pagesFABM 1 - Contextualized LAS - Quarter 2 - Week 1bSheila Marie Ann Magcalas-GaluraNo ratings yet

- M8 Correcting Closing Reversing Entries and Financial StatementsDocument10 pagesM8 Correcting Closing Reversing Entries and Financial StatementsMicha AlcainNo ratings yet

- Module 5 Completion of The Accounting Process For ServiceDocument14 pagesModule 5 Completion of The Accounting Process For ServiceavimalditaNo ratings yet

- Accounting CycleDocument8 pagesAccounting CycleRescopin LorraineNo ratings yet

- Accounting Cycle: Recording, Posting Transactions & Trail BalanceDocument28 pagesAccounting Cycle: Recording, Posting Transactions & Trail BalanceMuskan binte RaisNo ratings yet

- Review Chapter 4 and Chapter 5Document17 pagesReview Chapter 4 and Chapter 5Khánh PhươngNo ratings yet

- Chapter 4 Review 11th EdDocument9 pagesChapter 4 Review 11th EdJoey AbrahamNo ratings yet

- The Accounting Cycle - Part6Document15 pagesThe Accounting Cycle - Part6RaaiinaNo ratings yet

- Accounting Cycle of A Service Provider: Closing Entries, Post-Closing Trial Balance and Reversing EntriesDocument7 pagesAccounting Cycle of A Service Provider: Closing Entries, Post-Closing Trial Balance and Reversing EntriesRio GardoceNo ratings yet

- Financial StatementsDocument65 pagesFinancial StatementsApollo Institute of Hospital AdministrationNo ratings yet

- FUNDAMENTALS OF ABM 1 Section 7Document13 pagesFUNDAMENTALS OF ABM 1 Section 7Allysa Kim RubisNo ratings yet

- Management PresentationDocument61 pagesManagement Presentationiffat.stu2018No ratings yet

- Ade T4 AmcDocument39 pagesAde T4 AmcproggerNo ratings yet

- The Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BDocument5 pagesThe Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BKenneth Christian WilburNo ratings yet

- Financial Statements 2Document65 pagesFinancial Statements 2srisrirockstarNo ratings yet

- Fabm1 Chapter 6 Closing EntriesDocument21 pagesFabm1 Chapter 6 Closing EntriesErikka Shanely LimpangugNo ratings yet

- 13 Accounting Cycle of A Service Business 2Document28 pages13 Accounting Cycle of A Service Business 2Ashley Judd Mallonga Beran60% (5)

- Fabm1 & 2 - ReviewDocument77 pagesFabm1 & 2 - ReviewBernice Jayne MondingNo ratings yet

- MODULE 7 and 8 ACCDocument3 pagesMODULE 7 and 8 ACCnorie jane pacisNo ratings yet

- 7-Completing The Accounting CycleDocument12 pages7-Completing The Accounting Cyclechobiipiggy26No ratings yet

- Financial Statements - II: 360 AccountancyDocument65 pagesFinancial Statements - II: 360 AccountancyshantX100% (1)

- Accounting Principles: Second Canadian EditionDocument75 pagesAccounting Principles: Second Canadian EditionMuhammad AfzalNo ratings yet

- POA WK 7 LECT 2 VER 1 28032021 115402am 17112022 110442am 06052023 101809amDocument65 pagesPOA WK 7 LECT 2 VER 1 28032021 115402am 17112022 110442am 06052023 101809ammuhammad atifNo ratings yet

- Rac 101 - The Trial BalanceDocument12 pagesRac 101 - The Trial BalanceKevin TamboNo ratings yet

- Dr. M. D. Chase Long Beach State University Accounting 300A-10A The Operating Cycle: Worksheet/Closing EntriesDocument20 pagesDr. M. D. Chase Long Beach State University Accounting 300A-10A The Operating Cycle: Worksheet/Closing EntriesDanilo QuinsayNo ratings yet

- Accounting Chapter 5Document24 pagesAccounting Chapter 5Will TrầnNo ratings yet

- Class 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIDocument70 pagesClass 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIPathan KausarNo ratings yet

- Accounting Principles - Chapter 4Document8 pagesAccounting Principles - Chapter 4Duoth ChuolNo ratings yet

- Posting and Preparation of Trial BalanceDocument15 pagesPosting and Preparation of Trial Balance愛結No ratings yet

- Grade11 Fabm1 Q2 Week6Document19 pagesGrade11 Fabm1 Q2 Week6Mickaela MonterolaNo ratings yet

- Adjusting The AccountsDocument79 pagesAdjusting The AccountsaccpackmlbbNo ratings yet

- ACCY901 Accounting Foundations For Professionals: Topic 3 Accrual Accounting and Adjusting EntriesDocument35 pagesACCY901 Accounting Foundations For Professionals: Topic 3 Accrual Accounting and Adjusting Entriesvenkatachalam radhakrishnan100% (1)

- Week 5 Lecture Notes (1 Slide)Document67 pagesWeek 5 Lecture Notes (1 Slide)MEIWEI LINo ratings yet

- Chapter 3 - The Adjusting ProcessDocument60 pagesChapter 3 - The Adjusting ProcessAzrielNo ratings yet

- CHAPTER 6 - PPTDocument42 pagesCHAPTER 6 - PPTmeahangela.labadan.23No ratings yet

- Cba Financial StatementsDocument27 pagesCba Financial Statementsreagan blaireNo ratings yet

- PPT2-Adjusting The Accounts and Completing The Accounting CycleDocument46 pagesPPT2-Adjusting The Accounts and Completing The Accounting CycleGriselda Aurelie100% (1)

- Financial Statements - II: 372 AccountancyDocument65 pagesFinancial Statements - II: 372 AccountancyBhartiNo ratings yet

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Document14 pagesACTBAS1 - Lecture 11 (Completion of Acctg Cycle)AA Del Rosario AlipioNo ratings yet

- Handouts Chapter 4 56 7 CombinedDocument21 pagesHandouts Chapter 4 56 7 CombinedShane Khezia Abriol BaclayonNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Document9 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Tumamudtamud, JenaNo ratings yet

- Q3 Module 1Document15 pagesQ3 Module 1shamrockjusayNo ratings yet

- AE21 Lesson 6: Review of The Accounting Cycle: Worksheet and Adjusting EntriesDocument6 pagesAE21 Lesson 6: Review of The Accounting Cycle: Worksheet and Adjusting EntriesGlenda LinatocNo ratings yet

- SamenvattingDocument16 pagesSamenvattingDanaosNo ratings yet

- Quizzes Chapter 9 Acctg Cycle of A Service BusinessDocument26 pagesQuizzes Chapter 9 Acctg Cycle of A Service BusinessJames CastañedaNo ratings yet

- Chapter 2 QuestionsDocument23 pagesChapter 2 QuestionsSaleh AlzahraniNo ratings yet

- Chapter 3 PresentationDocument48 pagesChapter 3 Presentationhosie.oqbeNo ratings yet

- Financial Accounting Chapter 3: The Adjusting Process: The Accrual Basis of Accounting vs. The Cash Basis of AccountingDocument2 pagesFinancial Accounting Chapter 3: The Adjusting Process: The Accrual Basis of Accounting vs. The Cash Basis of AccountingMardhiah RamlanNo ratings yet

- Accounting 5 - Closing EntriesDocument13 pagesAccounting 5 - Closing EntriesOanh NguyenNo ratings yet

- Accounting Cycle: From Filipino Accounting Tutorial (YT)Document10 pagesAccounting Cycle: From Filipino Accounting Tutorial (YT)Gesther Djeane M. SorianoNo ratings yet

- ChapterDocument47 pagesChapteralfyomar79No ratings yet

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocument16 pagesFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNo ratings yet

- Course: Principles of Accounting and Economics Chapter 3: Accounting CycleDocument23 pagesCourse: Principles of Accounting and Economics Chapter 3: Accounting CyclemoallimNo ratings yet

- Adjusting EntriesDocument21 pagesAdjusting EntriesshielaNo ratings yet

- The Conceptual Framework of AccountingDocument34 pagesThe Conceptual Framework of AccountingSuzanne Paderna100% (1)

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- Global Financial SystemDocument16 pagesGlobal Financial Systemby ScribdNo ratings yet

- Easy Round 1 Point Each Theory - 10 Seconds Problem - 15 SecondsDocument8 pagesEasy Round 1 Point Each Theory - 10 Seconds Problem - 15 Secondsby ScribdNo ratings yet

- RFBTDocument9 pagesRFBTby ScribdNo ratings yet

- I. Nature of Business and Accounting Module (Aao Tutorials 2018)Document6 pagesI. Nature of Business and Accounting Module (Aao Tutorials 2018)by ScribdNo ratings yet

- Module 1Document45 pagesModule 1by ScribdNo ratings yet

- Adjusting EntriesDocument49 pagesAdjusting Entriesby ScribdNo ratings yet

- Basic AccountingDocument36 pagesBasic Accountingby ScribdNo ratings yet

- Bsac II - A ScheduleDocument1 pageBsac II - A Scheduleby ScribdNo ratings yet

- MODULE 3 AutosavedDocument24 pagesMODULE 3 Autosavedby ScribdNo ratings yet

- Acclaw 3 NotesDocument32 pagesAcclaw 3 Notesby ScribdNo ratings yet

- Chapter 4 Enterprise Risk Management and Related Topics (Test Bank)Document8 pagesChapter 4 Enterprise Risk Management and Related Topics (Test Bank)by ScribdNo ratings yet

- Statement of Cash Flows Final Term - 240325 - 221434Document20 pagesStatement of Cash Flows Final Term - 240325 - 221434by ScribdNo ratings yet

- Vii. The Accounting CycleDocument6 pagesVii. The Accounting Cycleby ScribdNo ratings yet

- I. Adjusting ProcessDocument7 pagesI. Adjusting Processby ScribdNo ratings yet

- G6 Morality As Human ReasonablenessDocument2 pagesG6 Morality As Human Reasonablenessby ScribdNo ratings yet

- Reo atDocument18 pagesReo atby ScribdNo ratings yet

- Reo RFBTDocument14 pagesReo RFBTby ScribdNo ratings yet

- ADZU POWER BI - Assignment Per StudentDocument4 pagesADZU POWER BI - Assignment Per Studentby ScribdNo ratings yet

- CONWOR InstructionsDocument2 pagesCONWOR Instructionsby ScribdNo ratings yet

- Updated Problem ConconDocument2 pagesUpdated Problem Conconby ScribdNo ratings yet

- A Lecture7 10 21 22Document36 pagesA Lecture7 10 21 22by ScribdNo ratings yet

- Finacc3 LQ1Document4 pagesFinacc3 LQ1by ScribdNo ratings yet

- 1 Lecture Financial Statements Is and BSDocument60 pages1 Lecture Financial Statements Is and BSby Scribd100% (1)

- Loona Space Presentation TemplateDocument12 pagesLoona Space Presentation Templateby ScribdNo ratings yet

- HTTPS://WWW - Youtube.com/watch?v A1Xfy8fl Qg&embeds Euri HTTPS://WWW - Wakacoffee.com/&feature Emb Imp WoytDocument1 pageHTTPS://WWW - Youtube.com/watch?v A1Xfy8fl Qg&embeds Euri HTTPS://WWW - Wakacoffee.com/&feature Emb Imp Woytby ScribdNo ratings yet

- A Lecture8 Acc Cycle Step 6 10 11-11-22Document36 pagesA Lecture8 Acc Cycle Step 6 10 11-11-22by ScribdNo ratings yet

- G5 Practical Reason and Art of ContemplationDocument2 pagesG5 Practical Reason and Art of Contemplationby ScribdNo ratings yet

- A Lecture6 9 29 22Document46 pagesA Lecture6 9 29 22by ScribdNo ratings yet

- 1 Lecture Corporation p.2Document31 pages1 Lecture Corporation p.2by ScribdNo ratings yet

- Fin. Acc. Chapter-2 Tabular AnalysisDocument2 pagesFin. Acc. Chapter-2 Tabular AnalysisFayez AmanNo ratings yet

- Messay TilayeDocument70 pagesMessay TilayechuchuNo ratings yet

- T Q C 1: C C A: EST Uestions For Hapter Omparable Ompanies NalysisDocument14 pagesT Q C 1: C C A: EST Uestions For Hapter Omparable Ompanies NalysisHe HaoNo ratings yet

- Manila MAY 5, 2022 Preweek Material: Management Advisory ServicesDocument25 pagesManila MAY 5, 2022 Preweek Material: Management Advisory ServicesJoris YapNo ratings yet

- Residential StatusDocument11 pagesResidential StatusSaurav MedhiNo ratings yet

- Dwi Suci Indah S - 472026 - W5 Easy ProblemDocument5 pagesDwi Suci Indah S - 472026 - W5 Easy ProblemucyNo ratings yet

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document4 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Jehan CodanteNo ratings yet

- Assignment 1Document12 pagesAssignment 1Ravi KumarNo ratings yet

- Ch01. Intro. To Financial ManagementDocument16 pagesCh01. Intro. To Financial ManagementSHAFA SAJIDANo ratings yet

- Tibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRDocument33 pagesTibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRjoshuaNo ratings yet

- P2Document18 pagesP2YusufNo ratings yet

- Foundation FA S1Document18 pagesFoundation FA S1narmadaNo ratings yet

- 2.roshan Kumar-Payslip - Jun-2022Document1 page2.roshan Kumar-Payslip - Jun-2022Burning to ShineNo ratings yet

- Taxation I Lesson 1 and 2 Introduction TDocument13 pagesTaxation I Lesson 1 and 2 Introduction TApex LionheartNo ratings yet

- Managerial Accounting BudgetingDocument3 pagesManagerial Accounting BudgetingJoelyn Grace MontajesNo ratings yet

- Social Media InfluencerDocument15 pagesSocial Media InfluencerKate Hazzle JandaNo ratings yet

- Script AuditingReportDocument3 pagesScript AuditingReportElaine Joyce GarciaNo ratings yet

- ACC Cement Ratio AnalysisDocument5 pagesACC Cement Ratio Analysisgaurav_sharma_19900No ratings yet

- Form16 2018 2019Document10 pagesForm16 2018 2019LogeshwaranNo ratings yet

- Chapter 10 ForecastingDocument2 pagesChapter 10 ForecastingElizabethNo ratings yet

- Governmental Accounting: Accountability: Term Used by GASB To Describe A Government's Duty To Justify The Raising andDocument14 pagesGovernmental Accounting: Accountability: Term Used by GASB To Describe A Government's Duty To Justify The Raising andAbdul Hakim MambuayNo ratings yet

- Degree of Financial Leverage Formula Excel TemplateDocument4 pagesDegree of Financial Leverage Formula Excel TemplateSyed Mursaleen ShahNo ratings yet

- CH 01Document54 pagesCH 01Ngân Hà ĐỗNo ratings yet

- Poverty in The PhilippinesDocument23 pagesPoverty in The PhilippinesDejabGuinMajaNo ratings yet

- Journal EntriesDocument3 pagesJournal EntrieskatNo ratings yet

- Bafinmax CM7Document22 pagesBafinmax CM7Marvin AndresNo ratings yet

- Fit - Tax Table 2Document4 pagesFit - Tax Table 2zipaganermy15No ratings yet

- Accounting For Managers-Assignment MaterialsDocument4 pagesAccounting For Managers-Assignment MaterialsYehualashet TeklemariamNo ratings yet

- Notes Rental BusinessDocument3 pagesNotes Rental Businessdaniel bwireNo ratings yet

- Income Tax: Full PFRS, Prfs For Smes & Pfrs For SesDocument15 pagesIncome Tax: Full PFRS, Prfs For Smes & Pfrs For SesChara etangNo ratings yet