Professional Documents

Culture Documents

I. Adjusting Process

Uploaded by

by ScribdOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I. Adjusting Process

Uploaded by

by ScribdCopyright:

Available Formats

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

THE ADJUSTING PROCESS

I. Background Concepts

Companies naturally want to have regular reports as to the progress they have made. Thus,

accountants divide the economic life of a business into artificial time periods as a guide. This

assumption is known as the time period assumption.

A. Fiscal and Calendar Years

Accounting period that companies may adopt are:

Annual Periods

● Fiscal Year - The accounting time period of one year in length

● Calendar Year – Period of time equal in length to that of the year in the calendar conventionally

in use.

Interim periods

● Monthly time period

● Quarterly time period

B. Accrual- vs. Cash-basis Accounting

Accrual-basis accounting is all about recording transactions in the periods in which the

events occur. Revenues are recognized as services are performed. Expenses are recognized as these

are incurred.

Cash-basis accounting is all about recording transaction when cash is received or given

away. Revenues are recognized when cash is received. Expenses are recognized when cash is paid.

Cash-basis accounting is not in accordance with generally accepted accounting principles

(GAAP). It tend to produce misleading financial statements. It fails to record revenue when the

services were already performed but have yet to receive cash for them. As a result, expenses are not

properly matched with revenues.

.

C. Recognizing Revenues and Expenses

Time Period Assumption

Economic life of business can be divided

into artificial time periods

Revenue Recognition Principle Expense Recognition Principle

Recognize revenue in the accounting Match expenses with revenues in the

period in which the performance period when the company makes efforts

obligation is satisfied to generate those revenues

Revenue and Expense Recognition

Accountancy Academic Organization Tutorialswith

In accordance 2020generally accepted PAGE \*

accounting principles (GAAP) Arabic \*

MERGEFORMA

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

II. Nature

A. The Adjusting Process – is when entries are adjusted prior to the preparation of financial

statements to update certain accounts so that they reflect correct balances as of the

designated time.

Some accounts require updating for the following reasons:

1. Some expenses are not recorded daily.

2. Some revenues and expenses are incurred as time passes rather than as separate

transactions.

3. Some revenues and expenses may be unrecorded.

B. Types of Accounts Requiring Adjustments

Two main types of accounts requiring adjusting entries:

1. Accruals- in accounting, the term “accrual” (or to “accrue”/accumulate) means to

recognize an:

a. Income that is already earned but not yet collected (Accrued revenues);or

b. Expense that is already incurred but not yet paid (Accrued expenses).

- Accruals give rise to both income and receivable (or both expense and payable).

- In accruals, all adjusting entries involve at least one balance sheet account and

one income statement account.

- In accruals, all adjusting entries affect the profit or loss for the period.

2. Deferrals- in accounting this means to defer or to delay recognizing certain revenues or

expenses on the income statement until a later, more appropriate time. Deferrals are often

applied to:

a. Income- advanced collections of income may initially be recorded using either the

(1)liability method or (2) income method.

● Liability method- under this method, cash receipts from items of income are

initially credited to a liability account. At the end of the period, the earned

portion is recognized as income while the unearned portion remains as

liability.

● Income method- under this method, cash receipts from items of income are

initially credited to an income account. At the end of the period, the unearned

portion is recognized as liability while the earned portion remains as income.

b.Expenses- payments of expenses may initially be recorded using either the (1)asset

method or (2)income method

● Asset method- under this method, cash disbursements for items of expenses

are initially debited to an asset account. At the end of the period, the incurred

portion (‘used up’ or ‘expired’) is recognized as expense while the unused

portion remains as asset.

● Expense method- under this method, cash disbursements for items of

expenses are initially debited to an expense account. At the end of the period,

the unused portion (‘not yet incurred’ or ‘unexpired’) is recognized as asset

while the incurred portion remains as expense.

Accountancy Academic Organization Tutorials 2020 PAGE \*

Arabic \*

MERGEFORMA

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

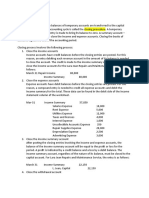

III. Recording Adjusting Entries – Illustrations

Case #1 Accrual of income- Interest income

ABC Co. received a 12%, 100,000, one-year, note receivable on April 1, 20x1. ABC uses a calendar

year period. The principal and interest on the note are due on April 1, 20x2.

Adjusting Journal Entry:

December Interest Receivable 9,000

31, 20x1 Interest Income 9,000

Notes:

● The adjusting entry is dated as at the end of the reporting period (i.e December 31, 20x1).

● “Interest receivable” is debited because the interest is yet to be collected in the future (i.e. on

April 1, 20x2).

● In 20x1, interest income is recognized only for the expired period (time passed) of April 1 to

December 31, 20x1. Interest converting the remaining 33 months of January 1 to March 31,

20x2 will be recognized in the next accounting period. This is an application of the time

period concept.

In the next accounting period, the collection of the interest is recorded as follows:

April 1, Cash 12,000

20x2 Interest Income 3,000

Interest Receivable 9,000

Case #2 Accrual of Expense- Interest expense

ABC Co. issued a 12%, 100,000, one-year, note payable on October 1, 20x1. The principal and

interest are due on October 1, 20x2.

Adjusting Journal Entry:

December Interest Expense 3,000

31, 20x1 Interest payable 3,000

Notes:

● Interest payable is credited because the interest is yet to be paid in the future (i.e., Oct. 1

20x2).

● In 20x1, interest expense is recognized only for the expired period (time passed) – October 1

to December 31, 20x1. Interest covering the remaining 9 months of January 1 to October 31,

20x2 will be recognized in the next accounting period.

In the next accounting period, the collection of the interest is recorded as follows:

April 1, Interest payable 3,000

20x2 Interest expense 9,000

Cash 12,000

Case #3 Deferrals of Income- Liability vs Income method

A business rents out its building to various tenants. On April 1, 20x1, the business received one-year

rent in advance of 120,000 from one of its tenants. Rent per month is 10,000.

Accountancy Academic Organization Tutorials 2020 PAGE \*

Arabic \*

MERGEFORMA

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

The receipt of the advance rent is recorded as follows:

Liability method Income method

April 1, 20x1 April 1, 20x1

Cash 120,000 Cash 120,000

Unearned Rent 120,000 Rent Income 120,000

The adjusting entries on December 31, 20x1 are as follows:

Liability method Income method

December 31, 20x1 December 31, 20x1

Unearned Rent 90,000 Rent income 30,000

Rent Income 90,000 Unearned Rent 30,000

Case #4 Deferrals of Expense- Asset vs. Expense method

A business prepays one-year insurance for 120,000 on October 1, 20x1.

The receipt of the advance rent is recorded as follows:

Asset method Expense method

October 1, 20x1 October 1, 20x1

Prepaid insurance 120,000 Insurance Expense 120,000

Cash 120,000 Cash 120,000

The adjusting entries on December 31, 20x1 are as follows:

Asset method Expense method

December 31, 20x1 December 31, 20x1

Insurance expense 30,000 Prepaid Insurance 90,000

Prepaid insurance 30,000 Insurance Expense 90,000

Summary on Accruals and deferrals:

Accrual Deferral

● To recognize income that is already ● To postpone the income recognition of an

earned but not yet collected. advance collection. The advance

collection is treated as liability until

earned.

● To recognize expense that is already ● To postpone the expense recognition of a

incurred but not yet paid. prepayment. The prepayment is treated

as asset until incurred.

Accountancy Academic Organization Tutorials 2020 PAGE \*

Arabic \*

MERGEFORMA

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Case #5 Depreciation

A building with an estimated useful life of 30 years finished construction on June 1, 20x1. The cost

of the building is 4.8 million pesos with an estimated salvage value of P300,000.

Adjusting Journal Entry:

December Depreciation Expense 87,500

31, 20x1 Accumulated Depreciation- Building 87,500

● In 20x1, depreciation expense is recognized only for the expired period (time passed) – June

1 to December 31, 20x1.

● The accumulated depreciation account is credited because it is a contra asset account. Thus, it

will be deducted from its related asset.

Case #6 Doubtful Accounts

Accounts Receivable shows a balance of P100,000. It is estimated that 8% of this is uncollectible.

Give the adjusting journal entry on December 31, 20x1 for the provision of the estimated

uncollectible account.

Adjusting Journal Entry:

December Bad Debts Expense 8,000

31, 20x1 Allowance for Bad Debts 8,000

● The allowance for bad debts account is credited because it is a contra asset account. Thus, it

will be deducted from its related receivable.

IV. Recording Adjusting Entries – Practice Problems

a. Prepaid Expenses

The December 31, 2014, unadjusted trial balance of Liverpool Co. indicates a balance in the supplies

account of $1,900. In addition, the prepaid insurance account has a balance of $3,600.

Assume that on December 31 the amount of supplies on hand is $450 and that the debit balance of

$3,600 in Liverpool Co’ prepaid insurance account represents a December 1 prepayment of insurance

for 12 months.

b. Unearned Revenues

The December 31, 2014, unadjusted trial balance of Boston Inc. indicates a balance in the unearned

rent account of $510. This balance represents the receipt of three months’ rent on December 1 for

December, January and February. Show the adjusting entry at the end of December.

c. Accrued Revenues

Assume that EsurientZita. signed an agreement with Reteche Co. on December 15. The agreement

provides that EsurientZita will answer computer questions and render assistance to Reteche Co.’s

employees. The services will be billed to Reteche Co. on the fifteenth of each month at a rate of $20

per hour. As of December 31, EsurientZita had provided 25 hours of assistance to Reteche Co.

d. Accrued Expenses

Accountancy Academic Organization Tutorials 2020 PAGE \*

Arabic \*

MERGEFORMA

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

GreatGatsby pays its employees biweekly. During December, GreatGatsby paid wages of $950 on

December 13 and $1,200 on December 27. As of December 31, GreatGatsby owes $250 of wages for

Monday and Tuesday, December 30 and 31.

December

Sun Mon Tue Wed Thu Fri Sat

1 2 3 4 5 6 7

8 9 10 11 12 13 14

15 16 17 18 19 20 21

22 23 24 25 26 27 28

29 30 31

e. Depreciation Expense

The estimated amount of depreciation on equipment for the current year is $120. Journalize.

**Key notes on Depreciation:

● Depreciation is the process of allocating the cost of an asset to expense over its useful life.

● Depreciation is an allocation concept, not a valuation one. It allocates an asset’s cost to the

periods in which it is used. Depreciation does not attempt to report the actual change in the

value of the asset.

● Accumulated Depreciation is a contra asset account that keeps track of the total amount of

depreciation expense taken over the life of the asset

**Formulas :

Cost - Salvage Value_

Useful Life Depreciable cost – Accumulated Depreciation = Book Value

IV. Summary of Adjustment Process

Asset Method

a. Prepaid Expenses

Expense xx

Asset xx

b. Unearned Revenues

Liability xx

Revenue xx

c. Accrued Revenues

Asset xx

Revenue xx

d. Accrued Expenses

Expense xx

Liability xx

e. Depreciation

Expense xx

Contra Asset xx

Expense Method

a. Prepaid Expenses

Accountancy Academic Organization Tutorials 2020 PAGE \*

Arabic \*

MERGEFORMA

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Asset xx

Expenses xx

b. Unearned Revenues

Revenue xx

Liability xx

**No expense methods for accruals as no entries occur before companies make these types of

adjusting entries

V. Adjusted Trial Balance - prepared after all adjusting entries have been journalized and posted.

It shows the balances of all accounts at the end of the accounting period and the effects of all

financial events that have occurred during the period. It proves the equality of the total debit and

credit balances in the ledger after all adjustments have been made. Financial statements can be

prepared directly from the adjusted trial balance.

Accountancy Academic Organization Tutorials 2020 PAGE \*

Arabic \*

MERGEFORMA

You might also like

- Cancel A Citation Within 72 HrsDocument7 pagesCancel A Citation Within 72 HrsJason Henry100% (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Aircraft Hourly Operating Cost CalculatorDocument33 pagesAircraft Hourly Operating Cost CalculatorhenryNo ratings yet

- Adjusting EntryDocument48 pagesAdjusting EntryKentoy Serezo Villanura100% (1)

- Adjusting EntriesDocument19 pagesAdjusting EntriesMasood Ahmad AadamNo ratings yet

- Sample Letter of IntentDocument4 pagesSample Letter of IntentKaloyana Georgieva100% (2)

- Unit 8 Adjusting EntriesDocument8 pagesUnit 8 Adjusting EntriesRey ViloriaNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesMs VampireNo ratings yet

- Adjusting EntriesDocument7 pagesAdjusting EntriesJon PangilinanNo ratings yet

- Inancial CCTG: Adjusting The AccountsDocument28 pagesInancial CCTG: Adjusting The AccountsLj BesaNo ratings yet

- Scantlings Rev01 ISO125Document3 pagesScantlings Rev01 ISO125Jesse Garcia OlmosNo ratings yet

- Simulation Hybrid Cooling SystemDocument8 pagesSimulation Hybrid Cooling SystemAniruddha Gupta100% (1)

- Adjusting EntriesDocument35 pagesAdjusting EntriesEliyah CalucagNo ratings yet

- Accounting Adjusting EntryDocument20 pagesAccounting Adjusting EntryClemencia Masiba100% (1)

- Cat Ladder Details3Document36 pagesCat Ladder Details3Shoaib KhanNo ratings yet

- Adjusting Process ValixDocument28 pagesAdjusting Process ValixjepsyutNo ratings yet

- AUX101Document98 pagesAUX101Ammar Baig100% (2)

- Adj. EntriesDocument41 pagesAdj. EntriesElizabeth Espinosa Manilag100% (2)

- Adjusting The Book of AccountsDocument33 pagesAdjusting The Book of Accountsjoshua zabala100% (1)

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Document9 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Tumamudtamud, JenaNo ratings yet

- Spa For ScribdDocument3 pagesSpa For ScribdMarcus GilmoreNo ratings yet

- Fundamentals of ABM1 Q4 Week 1 2Document24 pagesFundamentals of ABM1 Q4 Week 1 2randy magbudhi100% (4)

- (FABM1) Module 2 Accounting Concepts and PrinciplesDocument8 pages(FABM1) Module 2 Accounting Concepts and PrinciplesYvonne Alyanna LunaNo ratings yet

- Senior High School Department: Quarter 3 - Module 12: Adjusting Journal EntriesDocument14 pagesSenior High School Department: Quarter 3 - Module 12: Adjusting Journal EntriesJaye Ruanto100% (2)

- Module 7 - The Need For Adjusting Journal Entries, Part IDocument12 pagesModule 7 - The Need For Adjusting Journal Entries, Part INina AlexineNo ratings yet

- Iii. The Adjusting ProcessDocument4 pagesIii. The Adjusting Processby ScribdNo ratings yet

- Adjusting EntriesDocument18 pagesAdjusting EntriesAmie Jane MirandaNo ratings yet

- Acct 2021 CH 2 Completion of The WorksheetDocument20 pagesAcct 2021 CH 2 Completion of The WorksheetAlemu BelayNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service BusinessDocument8 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service BusinessNinia Cresil Ann JalagatNo ratings yet

- The Accounting Process (Part 2) : Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument47 pagesThe Accounting Process (Part 2) : Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenNo ratings yet

- Adjusting EntriesDocument27 pagesAdjusting EntriesquintosjeryNo ratings yet

- The Adjusting Process PDFDocument3 pagesThe Adjusting Process PDFMaria Cristina ArcillaNo ratings yet

- 1 The Basics of Adjusting EntriesDocument9 pages1 The Basics of Adjusting Entriescyrize mae fajardoNo ratings yet

- Module 8 - The Need For Adjusting Journal Entries, Part IIDocument8 pagesModule 8 - The Need For Adjusting Journal Entries, Part IINina AlexineNo ratings yet

- BAM 103 - Week 3 - DOUBLE ENTRY SYSTEM - PART 2Document26 pagesBAM 103 - Week 3 - DOUBLE ENTRY SYSTEM - PART 2Trixy013No ratings yet

- Vii. The Accounting CycleDocument6 pagesVii. The Accounting Cycleby ScribdNo ratings yet

- Unit 8 Adjusting EntriesDocument8 pagesUnit 8 Adjusting EntriesRey ViloriaNo ratings yet

- Adjusting EntriesDocument37 pagesAdjusting Entriesallijah100% (1)

- Adjusting EntriesDocument5 pagesAdjusting EntriesDyenNo ratings yet

- Acctg11e - SM - CH03 For 25 - 29 Sept 2017Document114 pagesAcctg11e - SM - CH03 For 25 - 29 Sept 2017Dylan Rabin Pereira100% (1)

- Castellano Fa1 Midterm Module Ba1 ABC LeganesDocument28 pagesCastellano Fa1 Midterm Module Ba1 ABC Leganesma. tricia soberanoNo ratings yet

- Lesson 3: Basic Accounting: Completing The Accounting Cycle Adjusting The AccountsDocument18 pagesLesson 3: Basic Accounting: Completing The Accounting Cycle Adjusting The AccountsAra ArinqueNo ratings yet

- Module 4 - Adjusting The Accounts Accrual Basis of AccountingDocument20 pagesModule 4 - Adjusting The Accounts Accrual Basis of AccountingShaneNo ratings yet

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocument16 pagesFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNo ratings yet

- Module 6Document13 pagesModule 6kohi jellyNo ratings yet

- Adjusting Entries (PART 2)Document34 pagesAdjusting Entries (PART 2)MARY ANN PALAPAN100% (1)

- FABM 1 - Contextualized LAS - Quarter 2 - Week 1aDocument15 pagesFABM 1 - Contextualized LAS - Quarter 2 - Week 1aSheila Marie Ann Magcalas-GaluraNo ratings yet

- Q3 Module 1Document15 pagesQ3 Module 1shamrockjusayNo ratings yet

- Subject Overview: (MODULE 4 - The Adjusting Process)Document40 pagesSubject Overview: (MODULE 4 - The Adjusting Process)Samuel John GustiloNo ratings yet

- Handouts ACCOUNTING-2Document39 pagesHandouts ACCOUNTING-2Marc John IlanoNo ratings yet

- Adjusting EntryDocument24 pagesAdjusting EntryHypa100% (1)

- Chapter 3 (Part 1 - Introduction and Deferrals)Document11 pagesChapter 3 (Part 1 - Introduction and Deferrals)Qais KhaledNo ratings yet

- BEACTG 03 REVISED MODULE 2 Business Transaction & Acctg EquationDocument25 pagesBEACTG 03 REVISED MODULE 2 Business Transaction & Acctg EquationChristiandale Delos ReyesNo ratings yet

- Prepaid Expenses & Accrual IncomeDocument11 pagesPrepaid Expenses & Accrual IncomeAdvertising Alaska HolidayNo ratings yet

- Adjusting Entries1Document20 pagesAdjusting Entries1Timothy CaragNo ratings yet

- Day 4 Income Statement and Statement of Cash FlowDocument31 pagesDay 4 Income Statement and Statement of Cash FlowSue-Allen Mardenborough100% (1)

- Adjusting EntriesDocument69 pagesAdjusting EntriesMadia Mujib100% (1)

- Adjusting Journal EntriesDocument34 pagesAdjusting Journal Entriesロザリーロザレス ロザリー・マキルNo ratings yet

- MODULE 7 and 8 ACCDocument3 pagesMODULE 7 and 8 ACCnorie jane pacisNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 FourthDocument4 pagesFundamentals of Accountancy Business and Management 1 11 FourthPaulo Amposta CarpioNo ratings yet

- Lesson 2 Adjusting The Accounts Service TypeDocument33 pagesLesson 2 Adjusting The Accounts Service TypeSofia Naraine OnilongoNo ratings yet

- Fundamentals of Accounting (Accounting Equation and Accounting Process)Document17 pagesFundamentals of Accounting (Accounting Equation and Accounting Process)Charlene ViceralNo ratings yet

- Abm 1-W6.M3.T1.L3Document21 pagesAbm 1-W6.M3.T1.L3mbiloloNo ratings yet

- Accounting LM3Document6 pagesAccounting LM3Nathan Kurt LeeNo ratings yet

- 10 Alternative Recording of DeferralsDocument3 pages10 Alternative Recording of DeferralsTrisha Mae BrazaNo ratings yet

- Adjusting Theaccounts Studyobjectives After Studying This Chapter, You Should Be Able ToDocument5 pagesAdjusting Theaccounts Studyobjectives After Studying This Chapter, You Should Be Able ToAbdiraxman MaxamedNo ratings yet

- Module 4 Packet: AE 111 - Financial Accounting & ReportingDocument28 pagesModule 4 Packet: AE 111 - Financial Accounting & ReportingHelloNo ratings yet

- Financial Accounting Chapter 3: The Adjusting Process: The Accrual Basis of Accounting vs. The Cash Basis of AccountingDocument2 pagesFinancial Accounting Chapter 3: The Adjusting Process: The Accrual Basis of Accounting vs. The Cash Basis of AccountingMardhiah RamlanNo ratings yet

- RFBTDocument9 pagesRFBTby ScribdNo ratings yet

- MODULE 3 AutosavedDocument24 pagesMODULE 3 Autosavedby ScribdNo ratings yet

- Basic AccountingDocument36 pagesBasic Accountingby ScribdNo ratings yet

- Easy Round 1 Point Each Theory - 10 Seconds Problem - 15 SecondsDocument8 pagesEasy Round 1 Point Each Theory - 10 Seconds Problem - 15 Secondsby ScribdNo ratings yet

- Global Financial SystemDocument16 pagesGlobal Financial Systemby ScribdNo ratings yet

- Adjusting EntriesDocument49 pagesAdjusting Entriesby ScribdNo ratings yet

- Vii. The Accounting CycleDocument6 pagesVii. The Accounting Cycleby ScribdNo ratings yet

- Bsac II - A ScheduleDocument1 pageBsac II - A Scheduleby ScribdNo ratings yet

- Module 1Document45 pagesModule 1by ScribdNo ratings yet

- I. Nature of Business and Accounting Module (Aao Tutorials 2018)Document6 pagesI. Nature of Business and Accounting Module (Aao Tutorials 2018)by ScribdNo ratings yet

- Acclaw 3 NotesDocument32 pagesAcclaw 3 Notesby ScribdNo ratings yet

- Chapter 4 Enterprise Risk Management and Related Topics (Test Bank)Document8 pagesChapter 4 Enterprise Risk Management and Related Topics (Test Bank)by ScribdNo ratings yet

- Statement of Cash Flows Final Term - 240325 - 221434Document20 pagesStatement of Cash Flows Final Term - 240325 - 221434by ScribdNo ratings yet

- G5 Practical Reason and Art of ContemplationDocument2 pagesG5 Practical Reason and Art of Contemplationby ScribdNo ratings yet

- ADZU POWER BI - Assignment Per StudentDocument4 pagesADZU POWER BI - Assignment Per Studentby ScribdNo ratings yet

- Reo RFBTDocument14 pagesReo RFBTby ScribdNo ratings yet

- Updated Problem ConconDocument2 pagesUpdated Problem Conconby ScribdNo ratings yet

- CONWOR InstructionsDocument2 pagesCONWOR Instructionsby ScribdNo ratings yet

- G6 Morality As Human ReasonablenessDocument2 pagesG6 Morality As Human Reasonablenessby ScribdNo ratings yet

- Finacc3 LQ1Document4 pagesFinacc3 LQ1by ScribdNo ratings yet

- Reo atDocument18 pagesReo atby ScribdNo ratings yet

- LP2 Preliminary Notion On EthicsDocument2 pagesLP2 Preliminary Notion On Ethicsby ScribdNo ratings yet

- HTTPS://WWW - Youtube.com/watch?v A1Xfy8fl Qg&embeds Euri HTTPS://WWW - Wakacoffee.com/&feature Emb Imp WoytDocument1 pageHTTPS://WWW - Youtube.com/watch?v A1Xfy8fl Qg&embeds Euri HTTPS://WWW - Wakacoffee.com/&feature Emb Imp Woytby ScribdNo ratings yet

- Learning Contract ETHICSDocument2 pagesLearning Contract ETHICSby ScribdNo ratings yet

- A Lecture6 9 29 22Document46 pagesA Lecture6 9 29 22by ScribdNo ratings yet

- Proposed Revisions To ETHICS Learning ContractDocument2 pagesProposed Revisions To ETHICS Learning Contractby ScribdNo ratings yet

- Loona Space Presentation TemplateDocument12 pagesLoona Space Presentation Templateby ScribdNo ratings yet

- A Lecture7 10 21 22Document36 pagesA Lecture7 10 21 22by ScribdNo ratings yet

- History: Masskara FestivalDocument5 pagesHistory: Masskara FestivalNORMA SABIONo ratings yet

- Fishbone Diagram PresentationDocument47 pagesFishbone Diagram PresentationSangram KendreNo ratings yet

- 41 Commandments Inside The ScilabDocument3 pages41 Commandments Inside The ScilabAlexie AlmohallasNo ratings yet

- Professionalization of Pre-Service Teachers Through University-School PartnershipsDocument13 pagesProfessionalization of Pre-Service Teachers Through University-School Partnershipsurban7653No ratings yet

- Legal Document - 2021-12/27/212703 - State of Morocco Fiduciare Al Malik Ben BeyDocument2 pagesLegal Document - 2021-12/27/212703 - State of Morocco Fiduciare Al Malik Ben Beyal malik ben beyNo ratings yet

- Codigos para Drag and Drop Recreacion para TodosDocument14 pagesCodigos para Drag and Drop Recreacion para TodosGuadalupe NovaNo ratings yet

- PUN Hlaing, Hsu Yadanar AungDocument2 pagesPUN Hlaing, Hsu Yadanar AungHsu Yadanar AungNo ratings yet

- Hotel. How May I Help You?Document2 pagesHotel. How May I Help You?putu kasparinataNo ratings yet

- Accounting Practice Set (Journal Ledger Trial Balance)Document13 pagesAccounting Practice Set (Journal Ledger Trial Balance)Yasmien Mae ValdesconaNo ratings yet

- AF33-5 Reverse InhibitDocument4 pagesAF33-5 Reverse InhibitgabotoyoNo ratings yet

- Steam Jet Refrigeration SystemDocument3 pagesSteam Jet Refrigeration Systematulyajyoti123100% (1)

- Progress Test 2Document13 pagesProgress Test 2Enrique GarciaNo ratings yet

- Quality Control Reqmts For Using CRMBDocument6 pagesQuality Control Reqmts For Using CRMBAbhinay KumarNo ratings yet

- Codal Practices For RCC Design Part A General by VKMehtaDocument22 pagesCodal Practices For RCC Design Part A General by VKMehtavijaymehta3450% (1)

- Haramaya Coa Assigment 2022Document16 pagesHaramaya Coa Assigment 2022wubie derebeNo ratings yet

- Time Manegment 4Document2 pagesTime Manegment 4Osman ElmaradnyNo ratings yet

- MS 221 Volunteer AllowancesDocument8 pagesMS 221 Volunteer AllowancesAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- ISGLT en IC - Inicio Temprano para Beneficios RapidosDocument10 pagesISGLT en IC - Inicio Temprano para Beneficios RapidosAnonymous envUOdVNo ratings yet

- Cricket RulesDocument14 pagesCricket Rulesitmefrom2007No ratings yet

- Easy Way To Determine R, S ConfigurationDocument11 pagesEasy Way To Determine R, S ConfigurationHimNo ratings yet

- GPS System Limitations: Known Geographic & Weather Related LimitationsDocument1 pageGPS System Limitations: Known Geographic & Weather Related LimitationsVaibhav PooniaNo ratings yet

- Notice: Human Drugs: Prescription Drug User Fee Cover Sheet (FDA Form 3397) and User Fee Payment Identification Number Electronic AvailabilityDocument1 pageNotice: Human Drugs: Prescription Drug User Fee Cover Sheet (FDA Form 3397) and User Fee Payment Identification Number Electronic AvailabilityJustia.comNo ratings yet