Professional Documents

Culture Documents

GEP Jan 2024 Regional Highlights ECA

Uploaded by

aoerdannyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GEP Jan 2024 Regional Highlights ECA

Uploaded by

aoerdannyCopyright:

Available Formats

Global Economic Prospects: Europe and Central Asia

January 2024

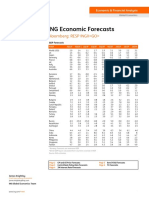

Recent developments: In 2023, growth in Europe and Central Asia (ECA) picked up to 2.7 percent, from

1.2 percent in 2022. This acceleration in growth was driven by strengthened domestic demand, backed by

additional fiscal support, robust labor market conditions, and the resumption of growth in the Russian

Federation and Ukraine.

However, if these countries and Türkiye are excluded, ECA witnessed a notable slowdown in growth in

2023, estimated at 1.8 percent. This deceleration was widespread, impacting 78 percent of the region’s

economies. The impact of weak external demand from the euro area was particularly pronounced in Central

Europe, where growth was subdued at 0.7 percent— the lowest among the subregions— and in the

Western Balkans. Growth also slowed in South Caucasus but accelerated in Central Asia. Remittance flows

played an important role in supporting demand in Armenia, Kyrgyz Republic, and Tajikistan. In Eastern

Europe, growth returned to positive territory, with Ukraine experiencing a growth rate of 4.8 percent. Despite

this positive trend, Ukraine's output in 2023 remained 30 percent below its pre-invasion level.

Headline inflation in the region has decelerated, alongside easing energy and food price pressures, but

remains above target in most countries. With subdued activity and easing inflation, policy interest rates

have likely reached their peak in many economies, prompting several central banks to start lowering rates.

However, both Türkiye and Russia have embarked on a tightening cycle.

Outlook: Growth in ECA is projected to moderate to 2.4 percent in 2024 and then firm to 2.7 percent in

2025. The main drivers of this growth include private consumption, which is supported by reduced

inflationary pressures, and exports, which are boosted by a gradual recovery in the euro area. However,

uncertainty surrounding the evolution of Russia’s invasion of Ukraine plays an important role in shaping the

regional outlook. Excluding these two economies, growth in the region is expected to accelerate to 3.1

percent this year and to 3.7 percent in 2025. Most ECA countries are likely to continue easing monetary

policy, as inflation is projected to decline. However, projected fiscal consolidation dampens the outlook.

Regional growth is expected to remain below its pre-pandemic trend due to the lingering effects of the

pandemic and Russia’s invasion of Ukraine. The pace of income per capita convergence in ECA is expected

to remain sluggish, with average income per capita reaching only 24 percent of the EU level in 2025.

Risks: Risks to the regional outlook remain tilted to the downside. An escalation of the conflict in the Middle

East could increase energy prices, tighten financial conditions, and negatively affect confidence.

Geopolitical risks in the region, including an escalation of the Russian Federation’s invasion of Ukraine, are

elevated and could materialize, worsening already heavy human and economic losses. Higher-than-

anticipated inflation could keep monetary policies tighter for longer. A weaker-than-expected recovery in

the euro area, the region’s main trading partner, would also negatively impact regional activity. Additionally,

a more significant slowdown in China or a sharper-than-expected reduction in remittances from Russia

would represent external headwinds to Central Asia and the South Caucasus. Further delays in the

disbursement of EU funds pose another downside risk for Central Europe, as do delays in reforms tied to

EU accession in the Western Balkans.

Download Global Economic Prospects: https://www.worldbank.org/gep

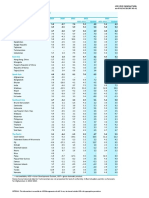

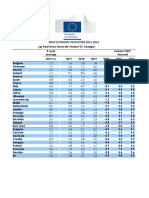

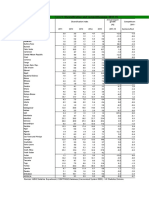

Europe and Central Asia Country Forecasts

(Annual percent change unless indicated otherwise)

2021 2022 2023e 2024f 2025f

GDP at market prices (average 2010-19 US$)

Albania 8.9 4.8 3.6 3.2 3.2

Armenia 5.8 12.6 7.1 4.7 4.5

Azerbaijan 5.6 4.6 1.5 2.4 2.5

Belarus 2.4 -4.7 3.0 0.8 0.8

Bosnia and Herzegovina a 7.4 3.9 2.2 2.8 3.4

Bulgaria 7.7 3.9 1.7 2.4 3.3

Croatia 13.8 6.3 2.5 2.7 3.0

Georgia 10.5 10.4 6.5 4.8 4.5

Kazakhstan 4.3 3.2 4.5 4.3 4.5

Kosovo 10.7 5.2 3.2 3.9 4.0

Kyrgyz Republic 5.5 6.3 3.5 4.0 4.0

Moldova 13.9 -5.0 1.8 4.2 4.1

Montenegro 13.0 6.4 4.8 3.2 3.1

North Macedonia 4.5 2.2 1.8 2.5 2.9

Poland 6.9 5.1 0.5 2.6 3.4

Romania 5.7 4.6 1.8 3.3 3.8

Russian Federation 5.6 -2.1 2.6 1.3 0.9

Serbia 7.7 2.5 2.0 3.0 3.8

Tajikistan 9.4 8.0 7.5 5.5 4.5

Türkiye 11.4 5.5 4.2 3.1 3.9

Ukraine 3.5 -29.1 4.8 3.2 6.5

Uzbekistan 7.4 5.7 5.5 5.5 5.5

Source: World Bank.

Note: e = estimate; f = forecast. World Bank forecasts are frequently updated based on new

information and changing (global) circumstances. Consequently, projections presented here may

differ from those contained in other Bank documents, even if basic assessments of countries’

prospects do not significantly differ at any given moment in time. The World Bank is currently not

publishing economic output, income, or growth data for Turkmenistan owing to a lack of reliable data

of adequate quality. Turkmenistan is excluded from cross-country macroeconomic aggregates.

a. GDP growth rate at constant prices is based on production approach.

You might also like

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Global Economic Prospects: Europe and Central Asia: June 2020Document2 pagesGlobal Economic Prospects: Europe and Central Asia: June 2020michel mboueNo ratings yet

- Regional Economic Prospects: A Cold Winter Ahead?Document34 pagesRegional Economic Prospects: A Cold Winter Ahead?LEKH021No ratings yet

- Rep 0523Document36 pagesRep 0523Aswin Aras ShunmugathasonNo ratings yet

- Izvještaj EBRD-a Za Svibanj 2020.Document23 pagesIzvještaj EBRD-a Za Svibanj 2020.Index.hrNo ratings yet

- EBRDDocument1 pageEBRDDennik SME100% (1)

- GEP Jan 2024 Regional Highlights SSADocument4 pagesGEP Jan 2024 Regional Highlights SSAaoerdannyNo ratings yet

- ADOU 2022 - A1-GDP GrowthDocument1 pageADOU 2022 - A1-GDP GrowthKarl LabagalaNo ratings yet

- ADO - GDP Growth 2022Document1 pageADO - GDP Growth 2022Rizky Aditya Muhammad Al-fathNo ratings yet

- Global Economic Prospects Sub-Saharan Africa: June 2021Document3 pagesGlobal Economic Prospects Sub-Saharan Africa: June 2021Greisy EsquivelNo ratings yet

- 1 InflationDocument1 page1 Inflationramshah tajammalNo ratings yet

- Global Economic Prospects: Sub-Saharan Africa: June 2020Document4 pagesGlobal Economic Prospects: Sub-Saharan Africa: June 2020michel mboueNo ratings yet

- ADB ADO 2022 - InflationDocument9 pagesADB ADO 2022 - InflationKm TrinidadNo ratings yet

- CREDIT SUISSE ECONOMICS - Global Economics Quarterly - The Worst Is Yet To Come (28sep2022)Document45 pagesCREDIT SUISSE ECONOMICS - Global Economics Quarterly - The Worst Is Yet To Come (28sep2022)ikaNo ratings yet

- Chapter 01Document117 pagesChapter 01Sadi SonmezNo ratings yet

- World Advanced Economies: (Percent Change From Previous Year)Document33 pagesWorld Advanced Economies: (Percent Change From Previous Year)harshad bhirudNo ratings yet

- Real GDP: World Advanced EconomiesDocument27 pagesReal GDP: World Advanced EconomiesPaul TambunanNo ratings yet

- Real GDP: World Advanced EconomiesDocument27 pagesReal GDP: World Advanced Economiesmichel mboueNo ratings yet

- GEP Jan 2024 Regional Highlights MENADocument2 pagesGEP Jan 2024 Regional Highlights MENAaoerdannyNo ratings yet

- Ip183 - en - Statistical AnnexDocument3 pagesIp183 - en - Statistical AnnexPeter DerdakNo ratings yet

- World Advanced Economies: (Percent Change From Previous Year)Document33 pagesWorld Advanced Economies: (Percent Change From Previous Year)Saira BalochNo ratings yet

- Pensión Funds-in-Figures-2021Document6 pagesPensión Funds-in-Figures-2021elena huertaNo ratings yet

- We o July 2023 UpdateDocument13 pagesWe o July 2023 UpdateStella GárnicaNo ratings yet

- Global Economic Prospects Jan 2018 GDPgrowthdataDocument5 pagesGlobal Economic Prospects Jan 2018 GDPgrowthdataNeil PalaciosNo ratings yet

- Forecast Tables EN PDFDocument2 pagesForecast Tables EN PDFSyed Maratab AliNo ratings yet

- Statistical Tables: Table 1. Growth Rate of GDPDocument8 pagesStatistical Tables: Table 1. Growth Rate of GDPazile_071386No ratings yet

- Note On Stock of Liabilities of Trade Credits and AdvancesDocument2 pagesNote On Stock of Liabilities of Trade Credits and Advancesathanasios_syrakisNo ratings yet

- October 2022 INGF 3Document7 pagesOctober 2022 INGF 3Daniel SbizzaroNo ratings yet

- ADO 2020 - GDP GrowthDocument4 pagesADO 2020 - GDP GrowthStevanusChandraNo ratings yet

- Global Economic Prospects: East Asia and Pacific: June 2020Document2 pagesGlobal Economic Prospects: East Asia and Pacific: June 2020michel mboueNo ratings yet

- WEOJanuary 2022 UpdateDocument57 pagesWEOJanuary 2022 UpdateBILLY 102013286No ratings yet

- RT 01Document18 pagesRT 01Quyền Nguyễn Khánh HàNo ratings yet

- OECD Economic Outlook Presentation Data May 2021Document75 pagesOECD Economic Outlook Presentation Data May 2021fedpelaNo ratings yet

- Regression StatisticsDocument5 pagesRegression StatisticsIsmayaCahyaningPutriNo ratings yet

- We o Jan 2021 UpdateDocument14 pagesWe o Jan 2021 UpdateNavendu TripathiNo ratings yet

- World Output Grouth Since 1991Document1 pageWorld Output Grouth Since 1991hellbustNo ratings yet

- GEP June 2023 GDP Growth DataDocument27 pagesGEP June 2023 GDP Growth DataKong CreedNo ratings yet

- Table 1: Health Expenditure in OECD Countries, 2000 To 2006Document8 pagesTable 1: Health Expenditure in OECD Countries, 2000 To 2006snamicampaniaNo ratings yet

- Table 1.1. Overview of The World Economic Outlook Projections (Percent Change, Unless Noted Otherwise)Document2 pagesTable 1.1. Overview of The World Economic Outlook Projections (Percent Change, Unless Noted Otherwise)sy yusufNo ratings yet

- Ecfin Forecast Spring 2020 Overview en 0Document6 pagesEcfin Forecast Spring 2020 Overview en 0Gordon FreenmanNo ratings yet

- Global Economic Prospects January 2017 Regional Overview LACDocument2 pagesGlobal Economic Prospects January 2017 Regional Overview LACOscar Eduardo CasillaNo ratings yet

- Ae8c39ec enDocument22 pagesAe8c39ec enStathis MetsovitisNo ratings yet

- QET 2022Q4 ReportDocument21 pagesQET 2022Q4 ReportSNamNo ratings yet

- Laju Pertumbuhan Produk Domestik Bruto Per Kapita Beberapa Negara Menurut Harga Konstan (Persen), 2000-2015Document4 pagesLaju Pertumbuhan Produk Domestik Bruto Per Kapita Beberapa Negara Menurut Harga Konstan (Persen), 2000-2015Rahayu SetianingsihNo ratings yet

- Macro Presentation: Jazira CapitalDocument8 pagesMacro Presentation: Jazira CapitalMohamed FahmyNo ratings yet

- Economic Survey 2002-03Document240 pagesEconomic Survey 2002-03raza9871No ratings yet

- ADO 2020 - Inflation (Corrigendum)Document4 pagesADO 2020 - Inflation (Corrigendum)Contemporary WorldNo ratings yet

- Table 8. Diversification and Competitiveness, 2011-15Document2 pagesTable 8. Diversification and Competitiveness, 2011-15Zainal WafaNo ratings yet

- Total Fertility Rate by Region and Country: 1990-2050Document7 pagesTotal Fertility Rate by Region and Country: 1990-2050emiliobalboNo ratings yet

- Real GDP: World 3.0 2.3 - 4.3 4.0 3.8 0.9 - 0.2 Advanced Economies 2.2 1.6 - 5.4 3.3 3.5 1.6 - 0.6Document19 pagesReal GDP: World 3.0 2.3 - 4.3 4.0 3.8 0.9 - 0.2 Advanced Economies 2.2 1.6 - 5.4 3.3 3.5 1.6 - 0.6Suhe EndraNo ratings yet

- GDPDocument12 pagesGDPgaelainnNo ratings yet

- Seasonally Adjusted Unemployment, Totals:: Data Not Available January 2021Document6 pagesSeasonally Adjusted Unemployment, Totals:: Data Not Available January 2021Robert SzymańskiNo ratings yet

- Real and Projection GDP World GrowthDocument35 pagesReal and Projection GDP World GrowthArviza AzharNo ratings yet

- CPI 2009 Regional Highlights EU WE en - Corruption Perceptions Index 2009 - Regional Highlights For The European Union and Western EuropeDocument2 pagesCPI 2009 Regional Highlights EU WE en - Corruption Perceptions Index 2009 - Regional Highlights For The European Union and Western EuropeJon C.No ratings yet

- Table A1. Summary of World Output: (Annual Percent Change)Document30 pagesTable A1. Summary of World Output: (Annual Percent Change)Eimy NavasNo ratings yet

- March 2019 Crude Steel Production TableDocument1 pageMarch 2019 Crude Steel Production TablePoolNo ratings yet

- Final Version Rsmea Newsletter Overview of The Kenya Finance Bill 2023Document35 pagesFinal Version Rsmea Newsletter Overview of The Kenya Finance Bill 2023Daniel MuriithiNo ratings yet

- Global Economy - Website - Aug 9 2022Document3 pagesGlobal Economy - Website - Aug 9 2022vinay jodNo ratings yet

- Table 53: Taxes On Capital As % of GDP - TotalDocument30 pagesTable 53: Taxes On Capital As % of GDP - TotalRalwkwtza NykoNo ratings yet

- Global Competitiveness Index: Quality of Roads, 2001 - 2014: A) B) B) C) C) C)Document4 pagesGlobal Competitiveness Index: Quality of Roads, 2001 - 2014: A) B) B) C) C) C)Elvandri P GumilangNo ratings yet

- BMBS Chapter 2 Short NotesDocument8 pagesBMBS Chapter 2 Short NotesMasood AliNo ratings yet

- BSECO - 18 (The Lucas Imperfect-Information Model)Document32 pagesBSECO - 18 (The Lucas Imperfect-Information Model)Paris AliNo ratings yet

- ACCA F9 Lecture 3Document20 pagesACCA F9 Lecture 3Fathimath Azmath Ali100% (1)

- FINC600 Homework Template Week 3 Jan2013Document16 pagesFINC600 Homework Template Week 3 Jan2013joeNo ratings yet

- Cost Inflation Index Chart of INDIADocument3 pagesCost Inflation Index Chart of INDIAhusankar2103No ratings yet

- Briefings Rs F House BubblesDocument4 pagesBriefings Rs F House BubblesmyjustynaNo ratings yet

- Merton. (2003) - Thoughts On The Future of Investment ManagementDocument8 pagesMerton. (2003) - Thoughts On The Future of Investment ManagementCamilo Prieto LopezNo ratings yet

- Analysis of Real Estate Investment at Navasari - BBA Finance Summer Training Project ReportDocument60 pagesAnalysis of Real Estate Investment at Navasari - BBA Finance Summer Training Project ReportPrafull shekhar RojekarNo ratings yet

- 30+ Questions From NCERTs in Prelims 2022Document11 pages30+ Questions From NCERTs in Prelims 2022Shivam MauryaNo ratings yet

- Financial Markets and Institutions 8th Edition Mishkin Eakins Test Bank PDFDocument14 pagesFinancial Markets and Institutions 8th Edition Mishkin Eakins Test Bank PDFari61333% (3)

- Dividends For RetirementDocument2 pagesDividends For RetirementThad MalleyNo ratings yet

- Perform Financial CalculationsDocument46 pagesPerform Financial Calculationsnigus89% (9)

- D0683ECO BQP QR (2021) .pdf-1-21Document21 pagesD0683ECO BQP QR (2021) .pdf-1-21Tanya SinghNo ratings yet

- Quantity Theory of Money PDFDocument3 pagesQuantity Theory of Money PDFRenee KaulNo ratings yet

- Economic Survey Volume I Complete PDFDocument226 pagesEconomic Survey Volume I Complete PDFBaldev ChoyalNo ratings yet

- AP MACRO ECONOMICS Notes Unit 1Document11 pagesAP MACRO ECONOMICS Notes Unit 1pyoon1No ratings yet

- The Anatomy of Power: ChallengeDocument9 pagesThe Anatomy of Power: ChallengeMauricio Fernández GioinoNo ratings yet

- How Is The Exchange Rate Defined?: T E R K D CDocument16 pagesHow Is The Exchange Rate Defined?: T E R K D CNherwin OstiaNo ratings yet

- Federal Deficit by Fiscal Year 26nov2021Document6 pagesFederal Deficit by Fiscal Year 26nov2021Jeren SteppNo ratings yet

- Chap 12 Cost of Capital - EditedDocument17 pagesChap 12 Cost of Capital - EditedJanine LerumNo ratings yet

- Measures To Control Inflation - RecessionDocument10 pagesMeasures To Control Inflation - Recessionprof_akvchary100% (2)

- Mag BudgetDocument120 pagesMag BudgetPriya SinghNo ratings yet

- Macro CourseDocument4 pagesMacro CourseKAMRAN ASHRAFNo ratings yet

- L1 - JN - Equity 2024 V1Document39 pagesL1 - JN - Equity 2024 V1Rohan ShekarNo ratings yet

- Banker Et Al. (2000)Document29 pagesBanker Et Al. (2000)Lucas AalbersNo ratings yet

- 2021 Cfa Liii Mockexam-Pm-NewDocument25 pages2021 Cfa Liii Mockexam-Pm-NewHoang Thi Phuong ThuyNo ratings yet

- Global Investment OutlookDocument82 pagesGlobal Investment OutlookAnte MaricNo ratings yet

- Purchasing Power ParityDocument17 pagesPurchasing Power ParitySwati Dhoot100% (1)

- CORRECTED TRANSCRIPT - The Coca-Cola Co. (KO-US), Q4 2022 Earnings Call, 14-February-2023 8 - 30 AM ETDocument19 pagesCORRECTED TRANSCRIPT - The Coca-Cola Co. (KO-US), Q4 2022 Earnings Call, 14-February-2023 8 - 30 AM ETindierlianti3010No ratings yet

- Dfi 306 Public FinanceDocument134 pagesDfi 306 Public FinanceElizabeth MulukiNo ratings yet

- From Cold War To Hot Peace: An American Ambassador in Putin's RussiaFrom EverandFrom Cold War To Hot Peace: An American Ambassador in Putin's RussiaRating: 4 out of 5 stars4/5 (23)

- Heretic: Why Islam Needs a Reformation NowFrom EverandHeretic: Why Islam Needs a Reformation NowRating: 4 out of 5 stars4/5 (57)

- Age of Revolutions: Progress and Backlash from 1600 to the PresentFrom EverandAge of Revolutions: Progress and Backlash from 1600 to the PresentRating: 4.5 out of 5 stars4.5/5 (9)

- No Mission Is Impossible: The Death-Defying Missions of the Israeli Special ForcesFrom EverandNo Mission Is Impossible: The Death-Defying Missions of the Israeli Special ForcesRating: 4.5 out of 5 stars4.5/5 (7)

- Hunting Eichmann: How a Band of Survivors and a Young Spy Agency Chased Down the World's Most Notorious NaziFrom EverandHunting Eichmann: How a Band of Survivors and a Young Spy Agency Chased Down the World's Most Notorious NaziRating: 4 out of 5 stars4/5 (157)

- The Hundred Years' War on Palestine: A History of Settler Colonialism and Resistance, 1917–2017From EverandThe Hundred Years' War on Palestine: A History of Settler Colonialism and Resistance, 1917–2017Rating: 4.5 out of 5 stars4.5/5 (130)

- Kilo: Inside the Deadliest Cocaine Cartels—From the Jungles to the StreetsFrom EverandKilo: Inside the Deadliest Cocaine Cartels—From the Jungles to the StreetsRating: 4.5 out of 5 stars4.5/5 (2)

- My Promised Land: the triumph and tragedy of IsraelFrom EverandMy Promised Land: the triumph and tragedy of IsraelRating: 4 out of 5 stars4/5 (149)

- Iran Rising: The Survival and Future of the Islamic RepublicFrom EverandIran Rising: The Survival and Future of the Islamic RepublicRating: 4 out of 5 stars4/5 (55)

- North Korea Confidential: Private Markets, Fashion Trends, Prison Camps, Dissenters and DefectorsFrom EverandNorth Korea Confidential: Private Markets, Fashion Trends, Prison Camps, Dissenters and DefectorsRating: 4 out of 5 stars4/5 (107)

- Plans For Your Good: A Prime Minister's Testimony of God's FaithfulnessFrom EverandPlans For Your Good: A Prime Minister's Testimony of God's FaithfulnessNo ratings yet

- The Israel Lobby and U.S. Foreign PolicyFrom EverandThe Israel Lobby and U.S. Foreign PolicyRating: 4 out of 5 stars4/5 (13)

- Palestinian-Israeli Conflict: A Very Short IntroductionFrom EverandPalestinian-Israeli Conflict: A Very Short IntroductionRating: 4.5 out of 5 stars4.5/5 (29)

- How to Stand Up to a Dictator: The Fight for Our FutureFrom EverandHow to Stand Up to a Dictator: The Fight for Our FutureRating: 4 out of 5 stars4/5 (18)

- The Showman: Inside the Invasion That Shook the World and Made a Leader of Volodymyr ZelenskyFrom EverandThe Showman: Inside the Invasion That Shook the World and Made a Leader of Volodymyr ZelenskyRating: 4.5 out of 5 stars4.5/5 (6)

- A Day in the Life of Abed Salama: Anatomy of a Jerusalem TragedyFrom EverandA Day in the Life of Abed Salama: Anatomy of a Jerusalem TragedyRating: 4.5 out of 5 stars4.5/5 (19)

- Understanding Iran: Everything You Need to Know, From Persia to the Islamic Republic, From Cyrus to KhameneiFrom EverandUnderstanding Iran: Everything You Need to Know, From Persia to the Islamic Republic, From Cyrus to KhameneiRating: 4.5 out of 5 stars4.5/5 (14)

- Unholy Alliance: The Agenda Iran, Russia, and Jihadists Share for Conquering the WorldFrom EverandUnholy Alliance: The Agenda Iran, Russia, and Jihadists Share for Conquering the WorldRating: 3.5 out of 5 stars3.5/5 (17)

- Overreach: The Inside Story of Putin’s War Against UkraineFrom EverandOverreach: The Inside Story of Putin’s War Against UkraineRating: 4.5 out of 5 stars4.5/5 (29)

- The Hundred Years' War on Palestine: A History of Settler Colonialism and Resistance, 1917–2017From EverandThe Hundred Years' War on Palestine: A History of Settler Colonialism and Resistance, 1917–2017Rating: 4 out of 5 stars4/5 (63)

- Birth of a Dream Weaver: A Writer's AwakeningFrom EverandBirth of a Dream Weaver: A Writer's AwakeningRating: 5 out of 5 stars5/5 (1)

- The Chile Project: The Story of the Chicago Boys and the Downfall of NeoliberalismFrom EverandThe Chile Project: The Story of the Chicago Boys and the Downfall of NeoliberalismRating: 4.5 out of 5 stars4.5/5 (3)