Professional Documents

Culture Documents

AshrafCo Order2084

AshrafCo Order2084

Uploaded by

Your Advocate0 ratings0% found this document useful (0 votes)

5 views7 pagesOriginal Title

AshrafCo_Order2084

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views7 pagesAshrafCo Order2084

AshrafCo Order2084

Uploaded by

Your AdvocateCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

Qh

7

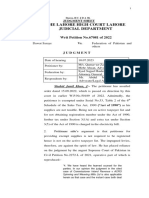

APPELLATE TRIBUNAL INLAND REVENUE OF PAKISTAN

KARACHI BENCH, KARACHI

Present: MR. TAUQEER ASLAM, CHAIRMAN

MR. MANZOOR ALI JOKHIO, A.M

ITA No.65/KB/2023

(Tax Year-2021)

U/S. 122(8A)

M/S. ASHRAF AND COMPANY, KARACHI.

NTN: 2236207

‘Appellant

Versus

The Commissioner-IR,

Audit-l, MTO, Karachi

Respondent

Appellantby : Mr. Irshad Alam, Advocate

Respondent by : Mr. Farhan Badar Solangi, D.R.

Date of hearing 24-08-2023

Dateoforder : 25-05-2023

ORDER

MANZOOR ALI JOKHIO, A.M: This listed appeal has been filed by

the appellant/taxpayer against the impugned order bearing Bar code

Noi100000137894766, dated 16-12-2022 passed by the Commissioner-IR

(Appéals-IV), Karachi. Through this order, the learned CIR(A) has

confirmed the order passed by the Additional Commissioner Inland

Revenue, Range-A, Audit-I, MTO, Karachi.

2. The taxpayer being aggrieved with the order of Learned CIR(A),

preferred appeal before this forum on the basis of grounds as set forth

in the memo of Appeal

3. The brief facts of the case as gathered from the available record

are that the Taxpayer is an AOP engaged in the business of

manufacturing of textiles. The Taxpayer has filed return of income for

tax year 2021 under section 114(4) of the Income Tax Ordinance, 2001

declaring income at Rs.8,873,118/- and tax chargeable at Rs. 1,388,872/-

which stands deemed assessed u/s 120 of the Income Tax Ordinance,

2001. After careful scrutiny of the taxpayer's return of income filed u/s

114(4) of the Income Tax Ordinance, 2001 for the tax year 2021, it was

found by the Additional Commissioner Inland Revenue that the

Page 1 of 6

taxpayer's deemed assessment u/s 120 of the Income Tax Ordinance,

2001 is erroneous in so far as prejudicial to the interest of revenue and

requires amendment as provided u/s 122(SA) of the Income Tax

Ordinance, 2001, on the grounds mentioned in Show Cause Notice

U/s.122(9) read with section 122(6A) of the Income Tax Ordinance 2001

issued by ADCIR to the taxpayer vide Bar code No.100000120340760,

dated 30-03-2022. The Officer issued various notices/reminders to

‘Taxpayer for submitting reply but the Taxpayer failed to comply with

any single notice. Resultantly, the Officer culminated its proceedings by

creating tax liability of Rs.71,948,449/- by passing order w/s.122(SA) of

the Income Tax Ordinance, 2001

4. On the date of hearing, Mr. Irshad Alam, Advocate appeared on

behalf of the Appellant/taxpayer while Mr. Farhan Badar Solangi, D.R

attended the case proceedings on behalf of the

Respondent/department.

8. During the course of court proceedings, the learned counsel of

the appellant/taxpayer argued that the CIR(A) confirmed the order of

the officer without touching the merit of the case, grounds taken by

appellant remained undecided in first stage of litigation i-e CIR(A), who

confirmed amended assessment order on the ground of non-

compliance of proceeding initiated by Additional Commissioner Inland

Revenue under section 122(SA) of Income Tax Ordinance 2001. He

further argued that the respondent has not bothered to adopt any other

mode of services. In this regard, he placed reliance on the judgement

reported as 2017 PTD 1839, relevant extract is as under;

“It may be further observed that in view of Article 10A of the

Constitution and Section 24-A of the General Clauses Act,

every public functionary, including the taxation Authorities,

are required to provide fair opportunity of being heard to

any person before taking an adverse action against him, or

passing any order of assessment or creating any additional

liability of tax, by confronting such person with the

proposed action in writing. The fair trial and right of hearing

is regarded as a cardinal principle of Natural justice, which

has to be read into very Statute, even if it may not be

specifically provided therein.”

Page 2 of 6

6. The learned AR of the appellant/taxpayer submitted that the

appellant sought extension for four week through IRIS on 06-06-2022.

‘The assessing officer passed order within prescribed period envisaged

under section 122(9) of the Income Tax Ordinance 2001, whereas

adjournment sought by the appellant, excluded from limitation period

defined under the law, thus assessing officer had sufficient time to offer

another opportunity of hearing before passing ex-parte amended

assessment order. He further submitted that the learned officer was not

justified to pass ex-parte assessment on 22-07-2022 which was not a

date fixed for hearing (compliance date of notice u/s 122(9) of the

Income Tax Ordinance 2001 was 06-07-2022). Thus passing of order on

a date which was not fixed for hearing was illegal. In this regard, he

placed rreliance upon reported judgment as 1975 PTD 58 (LHC), 1995

PTD (Trib) 1159, 2012 PTD (Trib) 202 and 2009 PTD (Trib) 1641

According to him, the appellant’s total audit under section 177(1) of the

Income Tax Ordinance 2001, was already conducted by the

Commissioner Inland Revenue, bearing barcode number

100000126602218 dated 30-06-2022 and transpired reason / risk area

for audit which is same issues as confronted by the ADCIR. The CIR is

higher in hierarchy as per law, who superseded the proceeding of

ADCIR and same issue was adjudicated by the two different officers

which leads to multiplicity of orders. In coneciton with the same, he

placed reliance on reported judgment 2011 PTD (Trib) 1824 wherein the

Honourable ATIR held that “order passed by DCIR is legal and within

lawful authority as the order passed by DCIR is considered to have

been passed by the Commissioner u/s 211(1)”

7. The learned counsel of the appellant/taxpayer contended that the

Honourable apex court and Tribunal has already decided the plethora

of cases regarding jurisdiction of section 122(5A) of the Income Tax

Ordinance, 2001 and held that erroneousness and prejudicial to interest

of revenue must exist simultaneously in the show cause notice and not

based on fishing inquiries, assumption and surmises. He placed

reliance on the following reported judgments:

2010 PTD (trib) 111

2012 PTD (Trib) 1593

2010 PTD (Trib) 111

2014 PTD (Trib) 2085

Page 3 of 6

8. The learned AR of the Taxpayer further contended that the ADCIR

passed amended assessment order confronted different issues on the

basis of non-compliance and passed amended assessment order under

section 122(SA) of Income Tax Ordinance 2001, issue wise grounds are

as under;

“Minimum Tax u/s 113

Through routine audit selected under section 177(1) of the Income

tax Ordinance 2001, the DCIR already confront this issue under

section (122(9) bearing barcode umber 100000136514920 dated

28.11.2022, (Annexure “I”), reply submitted to DCIR hence ex.

parte order for charging minimum tax u/s 133 liable to delete from

impugned order, Let the findings comes from total audit conducted

by commissioner IR,

Exempt /Other Revenue

1. Exempt or other revenue was charged by the ADCIR under

section 18 without mentioning subsection of section 18 of the

Income tax Ordinance 2001, further stated that assessing officer

failed to mention any particular section in show cause notice.

2, That the appellant counsel while filling return erroneously

declared exempt income Rs.38,864,370/, this value pertains to

tax deduction u/s 153 by the buyer of appellant, erroneously

shown as exempt other revenue, no effect of this exempt income

transfer in books of account neither reflect in balance sheet nor

any partner claimed share of exempt income.

3. That the DCIR issued audit observation bearing barcode number

100000130925457 dated 04.11.2022 (Annexure “J”), wherein

point no.6 confront the same issue, appellant replied along with

supporting document and same was drop/settled by the DCIR in

included this issue in show cause notice bearing No.

100000136514920 dated 28.11.2022. (Annexure”K”),

Additional u/s 111 (1)(4) (Point No. 3&4)

1. That the Difference of CPRN u/s 153(1)(a) 183(1)(b) of the

ITO,2001 added as un-explained income amounting to Rs,

12,6241,893/- and Rs. 65,030,922/-, officer failed to confront

CPRN details, the appellant is quite assure that all taxes was

deducted by those buyers whose sales declared in Sales tax

Return and accordingly total sales and revenue declared in

income tax return and accordingly total sales and revenue

declared in income tax return, it is general practice of buyers

that they do not furnished all tax payment challan to the

supplier, appellant declared deduction of tax u/s 153 well in

available challan.

2. That the same issued was confront by the Honourable CIR for

selection of audit u/s of the ITO 2001, point number 7 of the

notice bearing no. 100000126602218 dated 30.06.2022 after

Page 4 of 6

submission of relevant documents DCIR satisfy and excluded

this issue in audit observation as well in show cause notice.

3. That the additional under section 111(1)(d) of the Income tax

Ordinance 2001, required enquiry and explanation not

permitted under section 122(SA) reliance is placed on report

judgement reproduced hereunder ;

2013-PTD-1557 122(5) vs. 122(5A)

10.. ..We also find force in the

assertion of AR that section 111(1)(d) pertains to concealment

or furnishing of inaccurate particulars of income therefore it

has a nexus to the provisions of section 122(1) read with

subsection (5) and (8) of section 122. The A.R. has explained

that the FBR itself in its explanatory Circular No. 7 of 201!

dated 1.7.2011 clarified that by virtue of in section of 111(1)(d)

in the Ordinance by Finance Act, 2011 any production sale or

any amount chargeable to tax and suppression of any iter

or receipt liable to tax in whole or in part has to be treated

as “concealed income” whereas section 122(5) deals with

the orders which are found erroneous and prejudicial to

the_interest_of revenue but the orders involving

concealment in our view have to be dealt with under

section 122(1) read with 122(5)(8) therefore action of the

additional Commissioner to invoke provisions of section

111()(@)_in_his order under section 122(5A)_is_ not

sustainable in the eyes of law.

2013 PTD 900

We are of the considered view that addition under section

111(1)(b) cannot be made without making inquiry. Firstly the

assessing Officer will have to ask the taxpayer to submit

explanation regarding nature and source of the amount and

after considering the explanation, than addition under section

111()(b) will be made. Asking for explanation means

conducting of inquiry which is beyond the scope of section

122(5A). Hence, additions under section 111(1)(b) for tax

years 2006 and 2007 are ordered to be deleted.”

9. On the other hand, the learned D.R vehemently opposed the

contentions of learned AR of the appellant/taxpayer and stated that both

the orders of below officers are well within the framework of law and

carry no illegality and infirmity, and prayed that both order of CIR(A)

may be confirmed.

10. We have heard the arguments of learned representatives from

both sides and perused the available record of the case including two

order of below authorities. We have observed that the two officers

below ignored cardinal principle of audi alteram partem and Section

24-A of the General Clauses Act. The learned CIR(A) confirmed the

Page 5 of 6

order of the assessing officer without touching the merits of the case and

the grounds taken by appellant, which remained undecided in first

stage of litigation i-e CIR(A), who confirmed amended assessment

order on the ground of non-compliance of proceeding initiated by

Additional Commissioner Inland Revenue under section 122(8A) of

Income Tax Ordinance 2001. In view of the reported judgment as 2017

PTD 1839, we deem it appropriate to remand back the case to the

department with the directions to decide the matter afresh after

providing adequate opportunity of being heard to the taxpayer and the

taxpayer is also directed to provide all relevant documentary evidences

to the Officer for concluding the matter in instant appeal.

11. The appeal filed by the taxpayer is disposed of in the manner

discussed supra.

Sa/-

(MANZOOR ALI JOKHIO)

ACCOUNTANT MEMBER

Sa/-

(TAUQEER ASLAM)

CHAIRMAN

Younus/SPS*

Page 6 of 6

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- ATIR ORDER Withholding, Tax Monitoring & ThresholdDocument15 pagesATIR ORDER Withholding, Tax Monitoring & ThresholdYour AdvocateNo ratings yet

- NTDC ATIR Judgment On Turnover Tax 113Document9 pagesNTDC ATIR Judgment On Turnover Tax 113Your AdvocateNo ratings yet

- 2023 PTD 541 161BDocument8 pages2023 PTD 541 161BYour AdvocateNo ratings yet

- Special Sales Tax Reference Application No.542 of 2020Document2 pagesSpecial Sales Tax Reference Application No.542 of 2020Your AdvocateNo ratings yet

- Order Sheet in The Islamabad High Court, Islamabad. Judicial DepartmentDocument16 pagesOrder Sheet in The Islamabad High Court, Islamabad. Judicial DepartmentYour AdvocateNo ratings yet

- 2023LHC5827Document6 pages2023LHC5827Your AdvocateNo ratings yet

- Ammendments in The Constitution of PakistanDocument15 pagesAmmendments in The Constitution of PakistanYour AdvocateNo ratings yet

- 2023 LHC 4338Document4 pages2023 LHC 4338Your AdvocateNo ratings yet

- Important Data For PHDDocument46 pagesImportant Data For PHDYour AdvocateNo ratings yet

- Income Tax Ordinance ConceptDocument6 pagesIncome Tax Ordinance ConceptYour AdvocateNo ratings yet

- Important Legal Decisions in History of PakistanDocument4 pagesImportant Legal Decisions in History of PakistanYour AdvocateNo ratings yet

- 3 November Emergency Proclamation CaseqwerqwerqwerDocument3 pages3 November Emergency Proclamation CaseqwerqwerqwerYour AdvocateNo ratings yet

- Haji Saifullah Vs Federation of PakistanDocument1 pageHaji Saifullah Vs Federation of PakistanYour Advocate33% (3)

- Haji Saifullah Vs Federation of PakistanDocument1 pageHaji Saifullah Vs Federation of PakistanYour AdvocateNo ratings yet

- Constituion of Mosque 1Document9 pagesConstituion of Mosque 1Your AdvocateNo ratings yet

- Form C and Patner Ship DeedDocument7 pagesForm C and Patner Ship DeedYour AdvocateNo ratings yet

- Sheikh Law Associates: SubjectDocument5 pagesSheikh Law Associates: SubjectYour AdvocateNo ratings yet