Professional Documents

Culture Documents

NTDC ATIR Judgment On Turnover Tax 113

NTDC ATIR Judgment On Turnover Tax 113

Uploaded by

Your Advocate0 ratings0% found this document useful (0 votes)

19 views9 pagesOriginal Title

NTDC ATIR Judgment on Turnover Tax 113

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views9 pagesNTDC ATIR Judgment On Turnover Tax 113

NTDC ATIR Judgment On Turnover Tax 113

Uploaded by

Your AdvocateCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 9

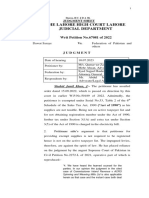

PPELLATE TRIBUNAL INLAI

LAHORE

ITA No.6346/LB/2022

(Tax Year 2014)

M/s. National Transmission & Dispatch _...Appellant

Company, Limited, Lahore.

Versus

The CIR, LTO, Lahore. «Respondent

Appellant by: Mr. Ageel Ahmad Sheikh, Advocate

Respondent by: Mr. Husnain Shamim, DCIR A/w

Mr. Amir Yasin, DCIR, DRS

06.06.2023

09.06.2023

ORDER

appeal has been filed by the appellant-taxpayer against the

order dated 27.12.2022 passed by the learned Commissioner

Inland Revenue (Appeals-I), Lahore("CIR(A)") for the Tax Year

2014 on the grounds set forth in the memo of appeal.

2. The facts in brief leading to the present appeal are that the

appellant-taxpayer, a public limited company, is engaged in

purchase and supply/ transmission of electricity to the

Distribution Companies (DISCOs) by using its transmission

network, under the license bearing No.TL/01/2002 dated

31.12.2002 issued in pursuance to section 17 of the Regulation +

of Generation, Transmission and Distribution of Electric Power

‘Act, 1997 (XL of 1997). It may not be out of place to mention

here that the supply of electric power is legally prohibited

without a license of distribution and determination of tariff rates

by NEPRA under the said Act.

3. The appellant filed its income tax return for the tax year

2014 on 15.08.2015 and claimed refund of (Rs. 690,112,821).

The return of income filed by the appellant-taxpayer was

treated, as deemed assessment under section 120(1) of the

Income Tax Ordinance, 2001("the Ordinance 2001”) by

Scanned with CamScanner

a anossnazas

operation of law. On observing that the sald deemed assessment

u/s 120 was erroneous as well as prejudicial to the interest of

revenue, the concerned Additional Commissioner Inland Revenue

(“AACIR") initiated amendment of assessment proceedings u/s

122(5A) of the Ordinance 2001 by issuing show-cause notice u/s

122(9) of the Ordinance ibid. The said proceedings culminated in

passing the order u/s 122(5A) dated 16.12.2020, creating

income tax demand of Rs.8,189,206,628/- on a single issue of

charging minimum tax u/s 113 of the Ordinance 2001 on the

,

declared business turnover of appellant-taxpayer as was

fainable from the audited final accounts appended with the

4. In the first round of appeal proceedings against theorder of

the CIR(A), this learned Tribunal remanded the case back to the

CIR(A) vide order dated 23.09.2022 in ITA No.3891/LB/2021,

with the directions to decide the appeal on merits. The CIR(A),

took up the matter again, and disposed of the appeal vide his

order dated 27.12.2022, rejecting the appeal of the appellant-

taxpayer while holding as under:

“In view of the discussion made hereinabove, I am of the

considered view that the treatment accorded by the

AGCIR, charging tax u/s 113 on total turnover, is legally

and factually correct and valid. Therefore, the impugned

order for tax year 2014 passed u/s 122(5A) dated

16.12.2020 is endorsed and hereby confirmed.”

5. Aggrieved yet again, the appellant has filed instant appeal

before this Tribunal, in the second round of proceedings.

6. Mr. Ageel Ahmad Sheikh, Advocate appeared on behalf of

the appellant-taxpayer as Authorized Representative ("AR"). The

respondent-department was represented by Mr. Husnain

Shamim, DCIR and Mr. Amir Yasin, DCIR as the Departmental

Representatives.

Scanned with CamScanner

a amass

7. The learned AR vehemently argued that the learned AdCIR

was not justified in charging minimum tax u/s 113 of the

Ordinance 2001 because the “declared turnover” adopted by the

AACIR does not pertain to/belong to the appellant-taxpayer.

While highlighting the relevant provisions of Regulation of

Generation, Transmission and Distribution of Electric Power Act,

1997 (XL of 1997) and the license issued to the appellant-

taxpayer in pursuance to the Act 1997 ibid, the learned AR

contended that the appellant-taxpayer is not legally entitled to

urchase and sell electricity. He argued that the whole domain of

siness activities of the appellant-taxpayer is confined to

revenues from “transmission charges”, which revenue

be to the appellant-taxpayer and, therefore, the appellant

hasVoluntarily paid minimum u/s 113 of the Ordinance 2001 on

‘such transmission charges. The AR continued that the appellant-

taxpayer only acts as a conduit between the power generation

companies i.e. Generation Companies (GENCOs) & Independent

Power Producers (IPPs) on the one hand and the Distribution ,

Companies (DISCOs) on the other, As per the learned AR, no

profit margin is earned by the appellant-taxpayer on the

transactions for which it only acts as a conduit. In view of the

above arrangements, which is contended to be supported by the

relevant law and business license issued to the appellant-

taxpayer under section 17 of the Regulation of Generation,

Transmission and Distribution of Electric Power Act, 1997 (XL of

1997), charging minimum tax u/s 113 is absolutely unjustified

and against the law. The AR fervidly stated that the assessing

officer as well as the CIR(A) have completely ignored the fact

that the appellant-taxpayer had disclosed the cost/sale of

electricity as its turnover in its financial statements for reporting

purpose only. He went on to quote judgment of the honorable

Supreme Court of Pakistan cited as PLD 1985 SC 109 in

support of his argument that mere fact that the taxpayer has

himself categorized a certain type of activity in a certain manner

in his financial statements Is not enough to treat it in the manner

in the accounts without looking into the actual

declared

substance of the transactions. In view of these averments, the

Scanned with CamScanner

‘ sanasusnanors

learned AR emphasized that charging of minimum tax on

turnover is against the law and facts of the case, therefore, the

same is liable to be deleted.

8. Both the learned DRs opposed the contentions of the

counsel of the appellant-taxpayer. They informed that, as is

clearly evident from the copies of the audited final accounts, the

taxpayer itself has treated the revenue from sale of electricity as

its own revenue. They further apprised the court that the

appellant-taxpayer has filed sales tax returns for the period

under reference as well as for the preceding and succeeding tax

periods wherein sale and purchase of electricity has been shown

.e appellant-taxpayer. It is an admitted position of fact that

eneration companies issue invoice in the name of the

-taxpayer who in turn sells electricity to the DISCOs

raises necessary sale tax invoices in this regard. The

irther informed that the declared turnover from sale of

clectricity, under the Identical circumstances, was previously

exempt from payment of minimum tax under section 113 of the

Ordinance 2001 in view of clause (5) of Part-III of Second

Schedule to the Ordinance 2001, which clause was subsequently

omitted from the statutes by the Finance Act, 2013 with effect

m 01.07.2013. The DRs underscored that the appellant

clause

fror

taxpayer was mentioned by name in the sald exemption

which leaves no room for doubt that that appellant was engaged

in the sale and purchase of electricity. The DR's main argument

was built on the premise that the said omission of clause (5) ibid

took away the benefit earlier available to the appellant-taxpayer

for computation of its tumover chargeable u/s 113 of the

ordinance 2001.The DRs continued that the exemption clause

itself is a final and irrefutable proof that the taxpayer is engaged

in purchase and sale of electricity and the turnover from sale of

electricity declared by the appellant-taxpayer belongs to it.

‘Therefore, the theory of being a mere conduit for transmission of

electricity from power generation companies to distribution

companies is only an after-thought and the same is of neither

any consequence nor of any benefit to the appellant-taxpayer.

Scanned with CamScanner

5 sanosusnanon

The learned DRs vehemently argued that had the appellant-

taxpayer not been the owner of turnover representing sale of

electricity, there would not have been any need to the legislature

to grant exemption from payment of minimum tax u/s 113 by

Inserting specific clause to this effect In the Second Schedule to

the Ordinance 2001.

9. Arguments advanced by both the parties have been heard

and record has been perused with the able assistance of the

learned AR of the appellant and the DRs.

10. It is observed that one of the line of reasoning of the

tellant-taxpayer at the lower forums was that the learned

a was not competent to invoke the provisions of section

2A8HA) of the Ordinance 2001 under the powers delegated by

efgAcommissioner Inland Revenue. Since this issue has attained

finality in view of the honorable Supreme Court of Pakistan

judgment dated 23.05.2023 in C.P. No, 6-L of 2023 (Allied

Bank Limited vs. The Commissioner of Income Tax, Lahore

etc.), this issue was not pressed by the learned AR of the

appellant-taxpayer. Similarly, the argument of the learned AR

that the AdCIR passing impugned order u/s 122(5A) did not

have proper jurisdiction is found to be without any merits

because, the learned AR’s reference to the jurisdiction order

dated 12.03.2011 is misplaced. The ACIR Is found to have been

delegated with the powers u/s 122(5A) by the CIR’s jurisdiction

order dated 11.08.2020.

41. It is further seen that a similar Issue has already been

decided by this learned Tribunal In favour of the department in

the cases CIT, Legal Division, LTU Lahore vs. M/s. Total

Parco Pakistan Limited (ITA Nos. 668 to 670/LB/2007) &

M/s. Total Parco Pakistan Limited vs. CIT, Legal Division,

LTU Lahore (ITA Nos. 2136/LB/2007, 129 to

131/LB/2007 and 609 to 611/LB/2007), wherein It has

been held that minimum tax Is to be pald on turnover and not

the profit margin.

Scanned with CamScanner

anesuensraons

A 12. Another case came up for consideration by this court which

a is cited as 1991 SCMR 1447. The matter in this case was that a

Person named Dalima had paid advance tax on behalf of Eruck

Maneckj

Nawroz Maneckji and Pakistan Progressive Cement

Industries Limited. The concerned officer rejected such claim by

observing that the advance tax paid by Dalima was on account

of its own business income. Another relevant fact of the said

case was that it was accepted by the department itself while

Passing the assessment order in the case of another taxpayer.

jalima was carrying on business on behalf of above said

Ns and no declaration regarding this business income was

sd to be made by Mr. Dalima. The Hon'ble Court decided in

f department. In the instant case, neither the appellant-

taxpayer has claimed that it has paid minimum tax on behalf of

Distribution Companies, nor Distribution Companies have made

any such claim. Hence, the facts of the cited case are not at all

four with the facts of the case of appellant-taxpayer.

13. Perusal of the written arguments and documents annexed

therewith further shows that the learned counsel for the

appellant-taxpayer has also paced reliance on the following

cases.

2004 PTD 174 (Trib.)

2003 PTD 869 (Trib.)

1994 PTD 758 (Trib.)

iv. 2015 PTD 1926(Trib.)

v. 1993 SCMR 287

vi. 1997 PLD 582

‘A careful analyses of these cases have revealed that, in the case

cited a 2004 PTD 174 (Trib.), the Tribunal had held that the

assessing authorities could not establish that the Lahore

Development Authority (LDA) was engaged in any business.

Since minimum tax under section 80D of the repealed Income

Tax Ordinance, 1979 was payable on the declared “business

turnover", therefore, minimum tax charged under that provision

was deleted because of want of evidence regarding conduct of

business by-the.LDA.-As. the fact_of sale_and_purchase of

Scanned with CamScanner

mena

electricity stands established In the case of the appellant, benefit

of this case cannot be extended to the appellant. The cases.

reported as 2003 PTD 869 (Trib.), 1994 PTD 758 (Trib.)

and 2015 PTD 1926(Trib.) have been decided by the Tribunal

on the principle that there was a clear-cut distribution

agreement between the principal companies with the agents

(principal-agent relationship), and the agents were merely

selling the products at the behest of and under the Instructions

of the principal companies at the prices given by the principals.

all these cases, it was established that the agents were

jing only commission/margin and all sale activity of the

\cts belonged to the principal companies and not the

Tax Ordinance, 1979 or corresponding provisions of section 113

of the Income Tax Ordinance, 2001 was directed to be levied on

commission in these cases. The facts of these cases are

distinguishable from the facts of this appellant because no

principal-agent relationship exists between the generation

‘companies (GENCOs)/Independent Power Producers (IPPs) and

the appellant-taxpayer. Therefore, the cases cited as precedent

are of no avail to the appellant. Lastly the cases relled upon by

the learned AR, 1993 SCMR 287 (SC) and 1997 PLD 582

(SC) are also of no help to the appellant because the case cited

as 1993 SCMR 287 (SC) holds that, "Y think that, properly

considered, income tax Is a tax on a person in relation to his

income. The tax {s not imposed on income generally; it is

imposed on the income of a person. “The appellant-taxpayer has

failed to establish that at factual level It Is not engaged In

purchase and sale of electricity as a necessary part of Its own

business, The case cited as 1997 PLD 582 (SC)exhaustively

dealt with the definition of the word Income and ultimately held

that “business turnover” can been deemed as “Income” by the

legislature for levy of minimum tax under section 80D of the

Repealed Income Tax Ordinance, 1979.

14. Perusal of the licensing arrangement of the appellant

taxpayer shows that NEPRA has Issued license to NTDC

Scanned with CamScanner

a .

(eppeliant-taxpayer) for procurement, supply, and transmission

of electricity as nobody can deal in generation, Purchase, sales

or transmission electricity without taking license from NEPRA as

Per sections 14B,16, 20, 22, 23C of the Regulation of

Generation, Transmission and Distribution of Electric Power Act,

1997, This Is just like any other regulated regime in Pakistan, for

anosenanons

Instance none can sell medicine in Pakistan without obtaining

license from Drug Regulatory Authority of Pakistan (DRAP) under

BXrovisions of the Drug Act,1976. The same is situation for

% oil &petroleum products

Btion, import and sales of gas,

3 regulated by the OGRA under the Oil & Gas Regulatory

Yonce, 2002. Therefore, the argument that the appeliant-

xpayer is not involved in sale and Purchase of electricity is far

from convincing even in view of the licensing arrangement relied

upon by the appellant,

15. Further, it would be advantageous to reproduce clause (5)

Of Part-III of Second Schedule to the Ordinance 2001 here,

ready reference:

iWhere the corporatized entities of Pakistan Water and

Power Development Authority (DISCOs) and National

7ransmission and Dispatch Company(NTDC), are required

to Pay minimum tax u/s 113, the purchase price of

electricity shall be excluded from the turnover liable to

minimum tax up to the tax year 2013.”

for

‘The above quoted omitted clause makes it crystal clear that as a,

matter of a special concession granted by the legislature, the

“purchase price of electricity’ was to be excluded from the

turnover on account of sale of electricity llable to minimum tax

till the tax year 2013.After the omission of clause (5) of Part-II

Of Second Schedule to the Ordinance 2001, appellant-taxpayer

cannot take cover of an Article out of its license to avoid

Payment of minimum tax on its declared turnover,

inclusive of

electricity price, in respect of tax year 2014 and onwards,

16. It seems relevant to mention here that the external

auditors of the appellant-taxpayer who had audited the final’

accounts of the appellant-taxpayer were “KPMG Taseer Hadi &

Co." and they had given an opinion on the audited accounts for

Scanned with CamScanner

. ne snesnasn0nd

tx year 2014 while highlighting fallure of the appellant-taxpayer +

to comply with the provisions of section 113 of the Ordinance

2001. Clause (c) of Para3 of the Auditor's Opinion Is reproduced

hereunder for reference:

“() as explained In note 28.1 of the accompanying

financial statements, the Company was granted exemption

by Federal Government vide SRO171(1/2008) dated 21

February 2008 to exclude purchase price of electricity from

oss turnover for the purpose of charging minimum tax

Ner section113 of Income Tax Ordinance, 2001 till tax

\ 2013. The exemption period, expired, and the

a any has not made, provision for tax In the financial

dments based on minimum tax chargeable on gross

over Including purchase price of electricity. The *

-afpellant-company only considers use of system charges

for calculation of minimum tax. Had the provision of

minimum tax based on gross turnover been made in the

financial statements, tax provision and current tax expense

for the year would have been higher by Rs. 7,686.44

million and profit after tax and accumulated profits would

have been lowered by Rs. 7,686.44 million.”

It seems that the appellant was well aware of the legal position

as to mandatory payment of minimum tax, however, it had

deliberately avolded to make due payment of minimum tax on

the declared business turnover including sale of electricity.

17. In view of what has been discussed above, we do not have

any doubt in our minds that the appeal filed by the appellant-

taxpayer is devold of any merits, hence, liable to be dismissed.

We order accordingly.

oh

(CH. MUHAMMAD TARIQUE)

oA Accountant Member

(MONIM SULTAN)

Judicial Member

lad

De pcle tb fr

4%

Assle tr

Widisha even

sontthgitirlona

BITHE GIR, eomensorntraat

Scanned with CamScanner

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Haji Saifullah Vs Federation of PakistanDocument1 pageHaji Saifullah Vs Federation of PakistanYour AdvocateNo ratings yet

- tax evasion PHCDocument22 pagestax evasion PHCYour AdvocateNo ratings yet

- Tax Evasion Important ATIRDocument10 pagesTax Evasion Important ATIRYour AdvocateNo ratings yet

- Order Sheet in The Islamabad High Court, Islamabad. Judicial DepartmentDocument16 pagesOrder Sheet in The Islamabad High Court, Islamabad. Judicial DepartmentYour AdvocateNo ratings yet

- Special Sales Tax Reference Application No.542 of 2020Document2 pagesSpecial Sales Tax Reference Application No.542 of 2020Your AdvocateNo ratings yet

- AshrafCo Order2084Document7 pagesAshrafCo Order2084Your AdvocateNo ratings yet

- ATIR ORDER Withholding, Tax Monitoring & ThresholdDocument15 pagesATIR ORDER Withholding, Tax Monitoring & ThresholdYour AdvocateNo ratings yet

- 2023 PTD 541 161BDocument8 pages2023 PTD 541 161BYour AdvocateNo ratings yet

- Important Data For PHDDocument46 pagesImportant Data For PHDYour AdvocateNo ratings yet

- 2023 LHC 4338Document4 pages2023 LHC 4338Your AdvocateNo ratings yet

- 2023LHC5827Document6 pages2023LHC5827Your AdvocateNo ratings yet

- Ammendments in The Constitution of PakistanDocument15 pagesAmmendments in The Constitution of PakistanYour AdvocateNo ratings yet

- Haji Saifullah Vs Federation of PakistanDocument1 pageHaji Saifullah Vs Federation of PakistanYour Advocate33% (3)

- 3 November Emergency Proclamation CaseqwerqwerqwerDocument3 pages3 November Emergency Proclamation CaseqwerqwerqwerYour AdvocateNo ratings yet

- Important Legal Decisions in History of PakistanDocument4 pagesImportant Legal Decisions in History of PakistanYour AdvocateNo ratings yet

- Income Tax Ordinance ConceptDocument6 pagesIncome Tax Ordinance ConceptYour AdvocateNo ratings yet

- Constituion of Mosque 1Document9 pagesConstituion of Mosque 1Your AdvocateNo ratings yet

- Sheikh Law Associates: SubjectDocument5 pagesSheikh Law Associates: SubjectYour AdvocateNo ratings yet

- Form C and Patner Ship DeedDocument7 pagesForm C and Patner Ship DeedYour AdvocateNo ratings yet