Professional Documents

Culture Documents

Company Income Tax Returns (Itr14) - 488737522

Uploaded by

Tashy MalingaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Income Tax Returns (Itr14) - 488737522

Uploaded by

Tashy MalingaCopyright:

Available Formats

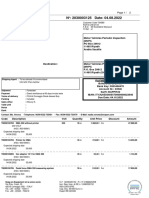

REMINDER

COMPANY INCOME TAX RETURNS (ITR14)

Enquiries should be addressed to SARS:

Contact Detail

SARS Contact Centre Tel: 0800 00 SARS (7277)

Alberton SARS online: www.sars.gov.za

MASIKIZE TRANSPORT LOGISTICS 1528

608 SILVERPLACE

SILVERTON

PRETORIA Details

GAUTENG Taxpayer Reference Number: 9187866265 Always quote this reference

0184 Case Number: 488737522

number when contacting SARS

Issue Date: 2024/02/23

Dear Taxpayer

REMINDER - COMPANY INCOME TAX RETURNS (ITR14)

SARS is aware that you will be submitting your Company Income Tax Return (ITR14) for the first time in 2024. This

letter is a friendly reminder that the ITR14 deadline is on 29 February 2024.

SARS requires companies to submit their income tax returns in the prescribed form (ITR14) twelve months after

their financial year-end. Our records show that your company is operating and has financial transactions or assets

linked to it.

In addition to the annual company income-tax returns, companies must also submit provisional tax returns (IRP6)

and pay by 29 February 2024. Companies must submit an IRP6 every six months after their financial year-end.

Provisional tax returns must include estimated figures of total income earned for that period, as well as taxes paid

on the income estimates for that period.

If your company does not submit its income-tax returns by 29 February 2024, then SARS may generate an

estimated assessment and penalty based on the information at our disposal.

Please ignore this message if you have already submitted all the required tax returns for the prescribed period.

More information

If you need help to complete your company income-tax return (ITR14):

Visit our YouTube channel, SARS TV (@sarstax), and watch the video, "How to Submit Your Income Tax Returns

for Companies (ITR14) on eFiling".

Book an appointment on the SARS website. Select the "Book an Appointment" icon on the homepage and choose

the "Company" option.

Send an SMS to SARS on 47277 to request an appointment at a branch. In your SMS, type Booking followed by a

space and your ID number/passport number/asylum-seeker number.

Visit your nearest SARS branch when your appointment has been confirmed.

Visit the SARS small-business webpage at https://www.sars.gov.za/businesses-and-employers/small-businesses-

taxpayers/.

Sincerely

ON BEHALF OF THE COMMISSIONER FOR THE SOUTH AFRICAN REVENUE SERVICE

MASIKIZE TRANSPO 4729343

9187866265 2024

WD01 : 01/01

WD01 WD01

2024-02-23 2016.01.00 SYSGENOUTLET_ROPP Page: 01/01

You might also like

- Reminder: Enquiries Should Be Addressed To SARSDocument2 pagesReminder: Enquiries Should Be Addressed To SARSHenry MeintjiesNo ratings yet

- GetLetter - 2023-02-22T134743.145 PDFDocument1 pageGetLetter - 2023-02-22T134743.145 PDFAbel MonchusiNo ratings yet

- Efiling Registration OutcomeDocument1 pageEfiling Registration Outcomemkhize.christian.21No ratings yet

- Get LetterDocument1 pageGet LetterLanganani Rollet MudauNo ratings yet

- SARS Income TaxDocument1 pageSARS Income TaxjamoneyzaNo ratings yet

- Value Added Tax RegistrationDocument1 pageValue Added Tax RegistrationFrancois GreeffNo ratings yet

- Malusi Sive PDFDocument1 pageMalusi Sive PDFAndile CeleNo ratings yet

- Income Tax: Notice of RegistrationDocument1 pageIncome Tax: Notice of RegistrationAndile CeleNo ratings yet

- Request For Relevant MaterialDocument1 pageRequest For Relevant MaterialEstherNo ratings yet

- Eurahel TCSDocument1 pageEurahel TCSMACPRAISE HOLDINGSNo ratings yet

- Efiling Registration: Request For Relevant MaterialDocument1 pageEfiling Registration: Request For Relevant Materialsebongilekotsedi406No ratings yet

- Request For Relevant MaterialDocument1 pageRequest For Relevant Materialsandra kivedoNo ratings yet

- Reminder To Submit Supporting Documents - 341337027Document1 pageReminder To Submit Supporting Documents - 341337027bra9tee9tiniNo ratings yet

- Efiling Registration OutcomeDocument1 pageEfiling Registration OutcomeJabu MtoloNo ratings yet

- Tax PIN - Lentala Tradings 2023Document1 pageTax PIN - Lentala Tradings 2023Khulekani ZuluNo ratings yet

- Get Letteruc 2Document1 pageGet Letteruc 2tesfayehussin263No ratings yet

- Request For Relevant MaterialDocument1 pageRequest For Relevant MaterialEsau KotsoaneNo ratings yet

- Enotice of RegistrationDocument1 pageEnotice of RegistrationsenwamadimmatshepoNo ratings yet

- Recurring Admin Penalty Imposed: Enquiries Should Be Addressed To SARSDocument1 pageRecurring Admin Penalty Imposed: Enquiries Should Be Addressed To SARSMxolisi Dumakude MaphangaNo ratings yet

- Efiling Registration: Request For Additional Relevant MaterialDocument1 pageEfiling Registration: Request For Additional Relevant Materialelmenda2008kiewietsNo ratings yet

- GetLetter PDFDocument1 pageGetLetter PDFMihkyle NabiNo ratings yet

- Tax Credit Certificate 2023 9553776791212Document2 pagesTax Credit Certificate 2023 9553776791212Mariana SurduNo ratings yet

- Comp 22 23Document2 pagesComp 22 23mexop31426No ratings yet

- Efiling Registration: Request For Relevant MaterialDocument1 pageEfiling Registration: Request For Relevant MaterialRose mpingaNo ratings yet

- WWF Taxation Order FOrmatDocument6 pagesWWF Taxation Order FOrmatSohaib ZafarNo ratings yet

- Eyabo TCS 2023Document1 pageEyabo TCS 2023MACPRAISE HOLDINGSNo ratings yet

- Get LetterDocument2 pagesGet LetterJo anne Jo anneNo ratings yet

- RSRM RiorexDocument2 pagesRSRM RiorexjwmemojstatNo ratings yet

- PIN IssuedDocument1 pagePIN IssuedMacPraise HoldingsNo ratings yet

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- Tax ClearanceDocument2 pagesTax ClearanceLee ArtsNo ratings yet

- Telephone: 18001034455 (Toll Free) or 080-46605200: Bengaluru-560500Document2 pagesTelephone: 18001034455 (Toll Free) or 080-46605200: Bengaluru-560500Siddharth SoporiNo ratings yet

- AQGxxxxx2Q G22 PDFDocument2 pagesAQGxxxxx2Q G22 PDFLatha YerurNo ratings yet

- SARS Confirmation LetterDocument1 pageSARS Confirmation Letterpmo41973No ratings yet

- GetLetter - 2023-11-10T092703.305Document1 pageGetLetter - 2023-11-10T092703.305thobani dludlaNo ratings yet

- Nsfas PDF PrintedDocument1 pageNsfas PDF PrintedMarco Luke NaidooNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- TBL - Sars Tax Pin - Aug 2022Document1 pageTBL - Sars Tax Pin - Aug 2022Alfred Nzo TourismNo ratings yet

- Terp Asia Construction Corp.: Statement of AccountDocument4 pagesTerp Asia Construction Corp.: Statement of AccountMark Israel DirectoNo ratings yet

- Get LetterDocument1 pageGet LettermajortradingzNo ratings yet

- SARS Tax ClearenceDocument1 pageSARS Tax ClearenceLelo MkhizeNo ratings yet

- Management PrinciplesDocument2 pagesManagement Principlesamon zuluNo ratings yet

- SNAPONDocument2 pagesSNAPONMaree AlShehriNo ratings yet

- Income Tax Acknowledgement: Receipt of Supporting DocumentsDocument1 pageIncome Tax Acknowledgement: Receipt of Supporting Documentsbra9tee9tiniNo ratings yet

- Mo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven StoresDocument4 pagesMo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven Storesbuwa moNo ratings yet

- Non-Domestic Rates Bill 2018/19: Please Quote On All EnquiriesDocument4 pagesNon-Domestic Rates Bill 2018/19: Please Quote On All Enquiriesautos osmanNo ratings yet

- Public Notice 91 of 2023 Automatic Issuance of The 2024 Tax Clearance Certificates To Up To Date TaxpayersDocument1 pagePublic Notice 91 of 2023 Automatic Issuance of The 2024 Tax Clearance Certificates To Up To Date Taxpayersisa kaziNo ratings yet

- Sdoc 07 21 SiDocument1 pageSdoc 07 21 SiLucienNo ratings yet

- Circular-ITR of Salaried Employees-Suspicious Claims..Document9 pagesCircular-ITR of Salaried Employees-Suspicious Claims..Damodar SurisettyNo ratings yet

- Archirodon Inv January 2024 (RTTS)Document11 pagesArchirodon Inv January 2024 (RTTS)SyedAsrarNo ratings yet

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasNo ratings yet

- Tax Invoice E76I/T2223/59 04/04/2022 12,213.00: Sharp Business Systems (I) PVT LTDDocument1 pageTax Invoice E76I/T2223/59 04/04/2022 12,213.00: Sharp Business Systems (I) PVT LTDDHIMAN BAURNo ratings yet

- Budget Guide 2024 - Consolidated 22022024Document42 pagesBudget Guide 2024 - Consolidated 22022024aubreyawaisNo ratings yet

- Notice of Reassessment 2021 08 16 06 14 40 172371Document4 pagesNotice of Reassessment 2021 08 16 06 14 40 172371api-676582318No ratings yet

- Yates Logistics BofA SepDocument7 pagesYates Logistics BofA SepJonathan Seagull LivingstonNo ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 847068Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318No ratings yet

- Welcome PDFDocument3 pagesWelcome PDFMsawakhe NxumaloNo ratings yet

- Tax Credit Certificate 2023 9552941697409 PDFDocument2 pagesTax Credit Certificate 2023 9552941697409 PDFCarlos ResendeNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- James Onley, "The Politics of Protection: The Gulf Rulers and The Pax Britannica in The Nineteenth Century" (2009)Document22 pagesJames Onley, "The Politics of Protection: The Gulf Rulers and The Pax Britannica in The Nineteenth Century" (2009)j.onley1684100% (1)

- Anthropology and Humanism - 2022 - Kefen Budji - Crossing Over An International Student S Experiences and Musings inDocument9 pagesAnthropology and Humanism - 2022 - Kefen Budji - Crossing Over An International Student S Experiences and Musings inJohanna MahabirNo ratings yet

- Final BA M3M Corner WalkDocument56 pagesFinal BA M3M Corner Walksushil aroraNo ratings yet

- 111 People v. Dela CruzDocument5 pages111 People v. Dela CruzCharles MagistradoNo ratings yet

- The Smithsonian's African American Museum - A Monument To Respectability Politics - Culture - The GuardianDocument8 pagesThe Smithsonian's African American Museum - A Monument To Respectability Politics - Culture - The GuardianFernanda_Pitta_5021No ratings yet

- Eden Integrated School Senior High SchoolDocument3 pagesEden Integrated School Senior High SchoolJamielor Balmediano100% (3)

- Job Description: General Affairs OfficerDocument16 pagesJob Description: General Affairs OfficerschakurtNo ratings yet

- Aff EmploymentDocument2 pagesAff EmploymentImee Atibula-PetillaNo ratings yet

- ABUJI - PResentationDocument13 pagesABUJI - PResentationSamuel HutabaratNo ratings yet

- Personal Assistant Hour Notification Form: Month - 20Document1 pagePersonal Assistant Hour Notification Form: Month - 20Shahnaz NawazNo ratings yet

- Rodriguez V Gloria Macapagal-Arroyo, Et Al. (G.R. No. 191805, April 16, 2013)Document8 pagesRodriguez V Gloria Macapagal-Arroyo, Et Al. (G.R. No. 191805, April 16, 2013)JM LumaguiNo ratings yet

- Republic vs. MangotaraDocument2 pagesRepublic vs. MangotaraVanityHugh100% (1)

- CH 03 Corpoate Social Responsibility MedinaDocument23 pagesCH 03 Corpoate Social Responsibility Medinavscolegit shoppeNo ratings yet

- 2 Interhandel Case (Ferrer) PDFDocument3 pages2 Interhandel Case (Ferrer) PDFMatt LedesmaNo ratings yet

- Constitution and by LawsDocument5 pagesConstitution and by LawsElla S. MatabalaoNo ratings yet

- 2019 Update On Labor LawDocument224 pages2019 Update On Labor LawHuey CalabinesNo ratings yet

- Rarest of Rare DoctrineDocument20 pagesRarest of Rare DoctrineSHEIK SHINY HANEEFANo ratings yet

- Samara Agro Industries: Approval Summary Sheet Seasonal Commission-2019/2020Document2 pagesSamara Agro Industries: Approval Summary Sheet Seasonal Commission-2019/2020Harunur RashidNo ratings yet

- IODC Crystal C3 250M EUR PGLDocument10 pagesIODC Crystal C3 250M EUR PGLcajoe1000No ratings yet

- Lease Agreement: Entered Into by and Between EBRAHIM MOHAMEDDocument7 pagesLease Agreement: Entered Into by and Between EBRAHIM MOHAMEDZiadSuttonNo ratings yet

- Republic of The Philippines Department of Social Welfare and DevelopmentDocument3 pagesRepublic of The Philippines Department of Social Welfare and DevelopmentRaison D'etreNo ratings yet

- Legaltech SurveyDocument5 pagesLegaltech SurveyJohnNo ratings yet

- Form 47Document2 pagesForm 47Dileep KumarNo ratings yet

- Chapter 2 Gov 'TDocument24 pagesChapter 2 Gov 'TYosef MitikuNo ratings yet

- BMRCL Recruitment 2022 For 144 AE, JE, Section Engineer and Engineering PostsDocument7 pagesBMRCL Recruitment 2022 For 144 AE, JE, Section Engineer and Engineering PostsRajesh K KumarNo ratings yet

- Chapter 4 TPDocument7 pagesChapter 4 TPEmerson Clores67% (3)

- Webquest For NapoleonDocument5 pagesWebquest For Napoleonapi-208815387No ratings yet

- Accounting For Business Combination PDFDocument13 pagesAccounting For Business Combination PDFSamuel FerolinoNo ratings yet

- GST Rewards To Complaint For Tax EvadersDocument5 pagesGST Rewards To Complaint For Tax EvadersSaheb ChadhaNo ratings yet

- Part 1 Requisites Nature and Effect of ObligationsDocument55 pagesPart 1 Requisites Nature and Effect of ObligationsVIA ROMINA SOFIA VILLA VELASCONo ratings yet