Professional Documents

Culture Documents

T2sch101-Fill-20e - Opening Balance Sheet Information

Uploaded by

nh nOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

T2sch101-Fill-20e - Opening Balance Sheet Information

Uploaded by

nh nCopyright:

Available Formats

Clear Data

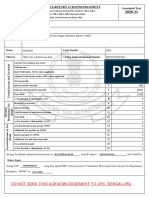

Schedule 101

Code 0803

Protected B

Opening Balance Sheet Information when completed

(1998 and later tax years)

Corporation's name Business number Tax Year End

Year Month Day

• Use this schedule to report the corporation's opening balance sheet information.

• For more information, see Guide RC4088, General Index of Financial Information (GIFI) and T4012, T2 Corporation – Income Tax Guide.

• If you need more space, attach additional schedules.

Assets Liabilities Shareholder equity

Field code Amount Field code Amount Field code Amount

* 3620

3640

Retained earnings

Field code Amount

* 2599 * 3499 * 3849

* This field code must be reported.

T2 SCH 101 E (20) (Ce formulaire est disponible en français.) Page 1 of 2

Clear Data

Commonly used fields codes

The following list contains some commonly used GIFI balance sheet field codes. You are not limited to using just these codes. For a complete listing of the

GIFI codes, please refer to Appendix A of Guide RC4088. You must complete the bolded field codes.

Current assets Current liabilities

Account description Field code Account description Field code

Cash and deposits 1000 Bank overdraft 2600

Cash 1001 Trade payables 2621

Accounts receivable 1060 Wages payable 2624

Trade accounts receivable 1062 Bonuses payable 2626

Taxes receivable 1066 Taxes payable 2680

Inventories 1120 Due to shareholder(s)/director(s) 2780

Short-term investments 1180 Current portion of long term liability 2920

Canadian term deposits 1181 Total current liabilities 3139

Prepaid expenses 1484

Total current assets 1599

Long-term liabilities

Capital assets Account description Field code

Account description Field code Long-term debt 3140

Future (deferred) income taxes 3240

Land 1600 Due to shareholder(s)/director(s) 3260

Buildings 1680 Due to related parties 3300

Accumulated amortization of buildings 1681 Total long-term liabilities 3450

Motor vehicles 1742 Total liabilities 3499

Accumulated amortization of motor vehicles 1743

Computer equipment/software 1774

Shareholder equity

Accumulated amortization of computer equipment/software 1775

Account description Field code

Furniture and fixtures 1787

Accumulated amortization of furniture and fixtures 1788 Common shares 3500

Leasehold improvements 1918 Preferred shares 3520

Accumulated amortization of leasehold improvements 1919 Contributed surplus 3541

Total tangible capital assets 2008 Retained earnings/deficit 3600

Total accumulated amortization of tangible capital assets 2009 Total shareholder equity 3620

Goodwill 2012 Total liabilities and shareholder equity 3640

Accumulated amortization of goodwill 2013

Incorporation costs 2018 Retained earnings

Accumulated amortization of incorporation costs 2019

Account description Field code

Long-term assets

Retained earnings/deficit – start 3660

Account description Field code Net income/loss 3680

Dividends declared 3700

Due from/investment in related parties 2240 Retained earnings/deficit – end 3849

Long-term investments 2300

Long-term loans 2360

Total long-term assets 2589

Total assets 2599

Page 2 of 2

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- T2sch100-Fill-20e - Balance Sheet InformationDocument2 pagesT2sch100-Fill-20e - Balance Sheet Informationnh nNo ratings yet

- T2sch125-Fill-23e - Income Statement InformationDocument4 pagesT2sch125-Fill-23e - Income Statement Informationnh nNo ratings yet

- Return Ali Raza 2022Document5 pagesReturn Ali Raza 2022hikamuddin38No ratings yet

- Acknowledgement Slip: Name: Address: CHAK NO. 39/141 P.O SAME Registration No Tax YearDocument4 pagesAcknowledgement Slip: Name: Address: CHAK NO. 39/141 P.O SAME Registration No Tax YearFairTax SolutionsNo ratings yet

- Additional Self-Test ProblemsDocument80 pagesAdditional Self-Test Problemsnsrivastav1No ratings yet

- PDF 928543220281220Document1 pagePDF 928543220281220Rajendra Prasad sahaNo ratings yet

- Statement of Cash Flows Lecture Questions and AnswersDocument9 pagesStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiNo ratings yet

- IT Return - FAST Builder - 2022Document3 pagesIT Return - FAST Builder - 2022Shakir MuhammadNo ratings yet

- 2020 10 13 16 14 03 443 - 1602585843443 - XXXPS4444X - Acknowledgement PDFDocument1 page2020 10 13 16 14 03 443 - 1602585843443 - XXXPS4444X - Acknowledgement PDFPradip ShindeNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradip ShindeNo ratings yet

- PDF 332384320310321 PDFDocument1 pagePDF 332384320310321 PDFSekharNo ratings yet

- House No. 43, Ghous Ul Azam Colony, Gulberg 2, Lahore Humna ShabirDocument5 pagesHouse No. 43, Ghous Ul Azam Colony, Gulberg 2, Lahore Humna ShabirAngrry BurdNo ratings yet

- 9 M - 28-Dec-2020 - 917355441Document1 page9 M - 28-Dec-2020 - 917355441Arihant SatpathyNo ratings yet

- Bài tập cá nhân chương 3 phần 1 - Quản trị tài chínhDocument5 pagesBài tập cá nhân chương 3 phần 1 - Quản trị tài chính211124022108No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusameer bakshiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearPrateeksha SharmaNo ratings yet

- t2sch125 08e 1Document4 pagest2sch125 08e 1denisgalNo ratings yet

- RACS Itr 2020-2021Document1 pageRACS Itr 2020-2021Lakshay SharmaNo ratings yet

- PDF 142704210080121Document1 pagePDF 142704210080121MugdhaNo ratings yet

- Ack Aqopk7926m 2022-23 794207320081122Document1 pageAck Aqopk7926m 2022-23 794207320081122ZAKIRNo ratings yet

- Ack Aaxpn5187e 2022-23 958380190240722Document1 pageAck Aaxpn5187e 2022-23 958380190240722jrgbcsputtasaraNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusachinkotadiyaaNo ratings yet

- Tutorial 8Document6 pagesTutorial 8WEI QUAN LEENo ratings yet

- Cash Flows Tutorial QuestionsDocument6 pagesCash Flows Tutorial Questionssmlingwa100% (1)

- MURALIDHARAN PILLAI - 10-Jan-2021 - 193247100Document1 pageMURALIDHARAN PILLAI - 10-Jan-2021 - 193247100raghav shettyNo ratings yet

- 2021 05 09 19 19 45 309 - 1620568185309 - XXXPK6024X - ItrvDocument1 page2021 05 09 19 19 45 309 - 1620568185309 - XXXPK6024X - ItrvRohan KapurNo ratings yet

- Itr2019 2022Document3 pagesItr2019 2022CHANDANNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- In Come Tax Return Form 2019Document48 pagesIn Come Tax Return Form 2019Mirza Naseer AbbasNo ratings yet

- PDF Class Note 1Document1 pagePDF Class Note 1Sachin KadamNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMohammad WaseemNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruChinmay BhattNo ratings yet

- FBR Tax FilingDocument48 pagesFBR Tax FilingMuhammad Waqas Hanif100% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAbhijeet NikamNo ratings yet

- Lapay Wali, Post Office Chawinda, Teshil PASRUR, Sialkot, Pasrur. Fiaz Ahmed BhattiDocument4 pagesLapay Wali, Post Office Chawinda, Teshil PASRUR, Sialkot, Pasrur. Fiaz Ahmed BhattiDAYYAN AHMED BHATTNo ratings yet

- 2018 Income TaxDocument4 pages2018 Income Taxmoxykho109No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRoshanjit ThakurNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAyush AgarwalNo ratings yet

- Income Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsDocument1 pageIncome Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsAik Luen LimNo ratings yet

- Suit For Mandatory InjunctionDocument5 pagesSuit For Mandatory InjunctionShahzad MirzaNo ratings yet

- 2020 11 28 13 48 32 813 - 1606551512813 - XXXPM2440X - AcknowledgementDocument1 page2020 11 28 13 48 32 813 - 1606551512813 - XXXPM2440X - AcknowledgementMadhu HarshithaNo ratings yet

- 15/219, GALI THEKEDARAN, HAJI PURA, Sialkot Sialkot Khawaja Zain AmirDocument4 pages15/219, GALI THEKEDARAN, HAJI PURA, Sialkot Sialkot Khawaja Zain AmirALI JAFFERNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurulokeshNo ratings yet

- 2020 09 13 10 56 29 221 - 1599974789221 - XXXPR9253X - AcknowledgementDocument1 page2020 09 13 10 56 29 221 - 1599974789221 - XXXPR9253X - Acknowledgementraoanagha27No ratings yet

- Ack Ejaps7559m 2022-23 763168490080722Document1 pageAck Ejaps7559m 2022-23 763168490080722Rashi SrivastavaNo ratings yet

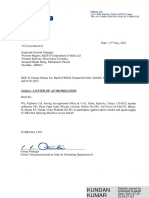

- Digitally Signed by Kundan Kumar Date: 2021.07.25 23:34:27 ISTDocument8 pagesDigitally Signed by Kundan Kumar Date: 2021.07.25 23:34:27 ISThimanshu pandaNo ratings yet

- Exercises JanuaryDocument3 pagesExercises JanuaryNameanxa AngelsNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVipin SaxenaNo ratings yet

- ARVINDDocument1 pageARVINDSourabh YadavNo ratings yet

- Alrpr6574n Itr VDocument1 pageAlrpr6574n Itr Vanon-511097100% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAbhishek SaxenaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalururrrrNo ratings yet

- Vikrant It RDocument1 pageVikrant It RShankar SagarNo ratings yet

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDocument1 page2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaNo ratings yet

- 242-Mb Govt. Superior Services Housing Society, Opposite Bahria Town, Canal Bank ROAD, LAHORE., Lahore Iqbal Town Abdul Qadeer KhanDocument4 pages242-Mb Govt. Superior Services Housing Society, Opposite Bahria Town, Canal Bank ROAD, LAHORE., Lahore Iqbal Town Abdul Qadeer KhanAbbas WazeerNo ratings yet

- ACCOUNTING P1 GR10 MEMO NOV2020 - EnglishDocument6 pagesACCOUNTING P1 GR10 MEMO NOV2020 - EnglishMolemo mabeleNo ratings yet

- Archith M 1623108 Rishab Mehta 1623135 Vishrut Shivkumar 1623149Document18 pagesArchith M 1623108 Rishab Mehta 1623135 Vishrut Shivkumar 1623149ARCHITH M 2127012No ratings yet

- Sek M Haniph 01042021 Till 31032022Document29 pagesSek M Haniph 01042021 Till 31032022Sujat KhanNo ratings yet

- Summer Internship 2013-14: Amity Business School, Amity University, Lucknow Campus 1Document10 pagesSummer Internship 2013-14: Amity Business School, Amity University, Lucknow Campus 1Deepak Singh NegiNo ratings yet

- Risk Management Solution Manual Chapter 03Document8 pagesRisk Management Solution Manual Chapter 03DanielLam71% (7)

- PDFDocument14 pagesPDFKamal RajNo ratings yet

- Introduction To Valuation: Case: Liston Mechanics CorporationDocument9 pagesIntroduction To Valuation: Case: Liston Mechanics CorporationKunal MehtaNo ratings yet

- Mercer-Capital Bank Valuation AKG PDFDocument60 pagesMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityRenieNo ratings yet

- Copia de Tian Kriek - Direction of Highest ProbabilityDocument24 pagesCopia de Tian Kriek - Direction of Highest ProbabilityJuan Carlos CruzNo ratings yet

- Intermediate Accounting Volume 2 Canadian 9th Edition Kieso Test BankDocument41 pagesIntermediate Accounting Volume 2 Canadian 9th Edition Kieso Test BankJenniferMartinezbisoa100% (14)

- Account STDocument1 pageAccount STSadiq PenahovNo ratings yet

- Elss Nfo JM Tax Gain FundDocument6 pagesElss Nfo JM Tax Gain FundDrashti InvestmentsNo ratings yet

- Gic LetterDocument1 pageGic Lettervikram toorNo ratings yet

- FULL Download Ebook PDF Issues in Financial Accounting 16th Edition PDF EbookDocument42 pagesFULL Download Ebook PDF Issues in Financial Accounting 16th Edition PDF Ebookanthony.mckinley50197% (36)

- Ifrs 6 Exploration For and Evaluation of Mineral ResourcesDocument2 pagesIfrs 6 Exploration For and Evaluation of Mineral Resourcesmusic niNo ratings yet

- SBR Notes by MR Rashid Hussain Marfat OnlineDocument34 pagesSBR Notes by MR Rashid Hussain Marfat Onlinehello jellybNo ratings yet

- Accounting 2Document4 pagesAccounting 2Jocelyn Delacruz50% (2)

- ACCOUNTANCY - (055) Periodic Test-1 Class - Xi Marks: 40M Time: 90 MinDocument5 pagesACCOUNTANCY - (055) Periodic Test-1 Class - Xi Marks: 40M Time: 90 MinvyshnaviNo ratings yet

- Cooperative Bank Internship ProjectDocument64 pagesCooperative Bank Internship ProjectPrashanth Gowda82% (57)

- Chapter 3 - Banking InstitutionsDocument37 pagesChapter 3 - Banking InstitutionsNur HazirahNo ratings yet

- Letter of Credit ReportDocument22 pagesLetter of Credit ReportMuhammad Waseem100% (4)

- SBS Instalment Plans at 0% MarkupDocument2 pagesSBS Instalment Plans at 0% MarkupAbdul Azeem SiddiquiNo ratings yet

- FAM MCQs Solved (Adnan UA)Document15 pagesFAM MCQs Solved (Adnan UA)arsalanssgNo ratings yet

- LP ExamplesDocument4 pagesLP ExamplesPinky PinkNo ratings yet

- Service Charges W.E.F 18.11.2022Document58 pagesService Charges W.E.F 18.11.2022anandNo ratings yet

- 1.1 Background of The StudyDocument18 pages1.1 Background of The StudyPrakash KhadkaNo ratings yet

- Banking & Economy PDF - March 2022 by AffairsCloud 1Document141 pagesBanking & Economy PDF - March 2022 by AffairsCloud 1ASHUTOSH KUMARNo ratings yet

- Indian Bank ChallanDocument1 pageIndian Bank Challanranga1231No ratings yet

- Savings AccountDocument1 pageSavings AccountMOS BLOGNo ratings yet

- Mock Exam ALCDocument18 pagesMock Exam ALCVenize Cheyseer Pelaez Abran100% (1)