Professional Documents

Culture Documents

Solicitor's Accounts English

Uploaded by

Dananjaya RajapakshaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solicitor's Accounts English

Uploaded by

Dananjaya RajapakshaCopyright:

Available Formats

1|Page

11. Solicitor’s Accounts

Registered attorneys in Sri Lanka prepare these Solicitor’s Accounts and this is a process

somewhat outside the realm of accounting. But accounting rules and regulations are also used

here. Of particular note is that these accounts are most commonly used in legal settings.

Mainly two types of clients come along with lawyers.

1. Regular Clients - These are the ones who necessarily receive services from the law firm on a

regular basis for their needs at the same time. They pay at once.

2. Casual Clients - These are the clients who are not necessarily regular users of the services but

come to avail the services on occasion. They only pay a fee to the lawyer to represent their case

According to the Attorney Accounts Code, Solicitor’s Accounts must be maintained for regular

clients and casual clients.

1.Current Accounts

Lawyers Associations use two Current Accounts for regular clients and casual clients.

1. Client Current Account – For Regular Clients

2. Office Current Account – For casual clients

2. Allocations

Grant allocations are of two types.

1. Allocation of Fees of Regular Clients

2. Allocation of Fees of Casual Servants

Accounting And Ethics – Final KT Prabhashwara 0711336692

2|Page

3. Use of stamps

1. Using stamps for regular clients

2. Using stamps for casual clients

Let's find out what are the basic things we need to know in the question

1.In any case, the previous year's balance sheet is given to us to get the opening balances of this

year's accounts.

The following accounts will be prepared while preparing the lawyer's Accounts.

In any case, the previous year's balance sheet is given to us to get the opening balances of this

year's accounts.

A. Receipts and Payments Accounts (This is the Cash Book)

Office Client Office Client

B/F XXX XXX Accounts Payable XXX

Water XXX

Regular XXX Donations XXX

Casual XXX Drawings XXX

Fees Salaries XXX

AAA PVT LTD XXX Postage XXX

BBB PVT LTD XXX Telephone XXX

CCC PVT LTD XXX Office Rent XXX

Motor vehicle Running

Expenses XXX

Receipts Bank Loan Interest XXX

AAA PVT LTD XXX Purchase of Stamps XXX

BBB PVT LTD XXX Bank Charges XXX

CCC PVT LTD XXX Subscription Paid for the BAR XXX

Electricity XXX

Stamps Staff Insurance XXX

AAA PVT LTD XXX Consultancy Fee paid XXX

Accounting And Ethics – Final KT Prabhashwara 0711336692

3|Page

BBB PVT LTD XXX Stationary XXX

CCC PVT LTD XXX Travelling Expenses

Payment

AAA PVT LTD XXX

BBB PVT LTD XXX

CCC PVT LTD XXX

Balance C/D XXXX XXXX

XXXX XXXX XXXX XXXX

B. Stamp Account

Stamp

A/C

B/F xxx

Purchases of

Stamps xxx Stamps for Casual xxx

Clients

Regular Clients

(Stamps)

AAA PVT LTD xxx

BBB PVT LTD xxx

CCC PVT LTD xxx

B/C/D xxxx

xxxx xxxx

Accounting And Ethics – Final KT Prabhashwara 0711336692

4|Page

C.Regular Client’s Individual Accounts (Ledger Accounts)

Client ledger accounts are maintained separately for each regular client.

- These accounts are liability accounts (creditors accounts).

- Finding the number of regular clients (this is given under current liabilities in last year's balance

sheet)

AAA Ltd

Office Client Office Client

Fee xxx B/F xxx

Fee xxx

Payment xxx Receipt xxx

Stamp xxx Stamp xxx

B/C/D xxxx

xxxx xxxx xxxx xxxx

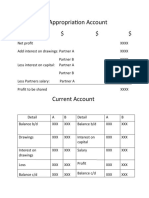

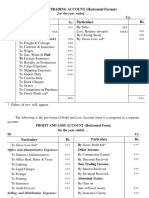

D. Income Statement

Income Statement

Payment Income

Salaries XXX Fee – Casual XXX

Office Rent XXX Fee – Regular Clients

Vehicle running Cost XXX AAA PVT LTD XXX

Postage XXX BBB PVT LTD XXX

Telephone XXX CCC PVT LTD XXX

Electricity XXX

Bank Charges XXX

Depreciation – Motor vehicle XXX

Accounting And Ethics – Final KT Prabhashwara 0711336692

5|Page

Depreciation – building XXX

Depreciation – Machines XXX

Travelling Expenses XXX

Casual Clients – Stamps XXX

Bank Loan Interest XXX

Consultancy Fee Paid XXX

Stationary XXX

Staff Insurance XXX

B/C/D XXXX

XXXX XXXX

E. Balance Sheet (Financial Position Statement)

Balance Sheet

Net

Capital and Liability Assets Cost Value

Capital xxx Non-Current Assets

Profit XXX PPE XXX

Office Equipment XXX

Drawing (xxx) Computers XXX

Motor Vehicles XXX

Current Assets

Non-Current Liability

Cash XXX

Bank Loan XXX Receivable from Debtors XXX

Other Long-term Loans XXX Prepaid Expenses XXX

Other Receivables XXX

Accounting And Ethics – Final KT Prabhashwara 0711336692

6|Page

Current Liability Stock of Stamps xxx

Creditors xxx Bank Balance

Electricity Payable XXX Office xxx

Insurance Payable XXX Clients xxx

Water Payable XXX

Regular Clients

AAA pvt ltd xxx

BBB pvt ltd xxx

CCC pvt ltd xxx

Total Equity and Liability xxxx Total Assets xxxx

If you have the adjustments as below you have to write down the double entries as follows

1. Balance caried Forward

Receipts and payment A/C – Bank Balance (Office balance should be put to the office column

and client balance should be put to the client column)

Stamps A/C – balance of stock of stamps in the balance sheet

Client ledger A/C – balances should be put into the client’s ledger A/Cs In credit side from the

balance sheet. In the balance sheet the balances of clients have been put under Current

Liabilities.

2. Fees - regular Clients

This has 4 entries.

1. Receipts and Payment AC dr

2. Client Ledger AC s dr

3. Income statement cr

4. Client Ledger AC s cr

3. Fees – Casual Clients

Receipts and payment Ac dr

Income statement cr

Accounting And Ethics – Final KT Prabhashwara 0711336692

7|Page

4. Receipts – Casual Client

Receipts and Payment AC dr

Client Ledger AC s cr

5. Stamps – regular clients

This has 4 entries.

Receipts and Payment AC dr

Client Ledger AC s dr

Client Ledger AC s cr

Stamp Ac cr

6. Payments – regular clients

Client Ledger AC s dr

Receipts and Payment AC cr

Please refer the above structures of the Accounts.

Accounting And Ethics – Final KT Prabhashwara 0711336692

You might also like

- Powers of AppointmentDocument5 pagesPowers of Appointmentscartoneros_1100% (1)

- (Mdv4y King) Stevens, Mark - Stevens, Carol Bloom - King Icahn - The Biography of A Renegade Capitalist-Dutton (1993)Document332 pages(Mdv4y King) Stevens, Mark - Stevens, Carol Bloom - King Icahn - The Biography of A Renegade Capitalist-Dutton (1993)Lin LexNo ratings yet

- 12 Important Documents To Check Before Buying A New PropertyDocument26 pages12 Important Documents To Check Before Buying A New Propertysrinath1234No ratings yet

- Bond Scandal AllDocument59 pagesBond Scandal Allapi-241253495No ratings yet

- Palm Oil BusinessDocument8 pagesPalm Oil BusinessAzike NnamdiNo ratings yet

- Capital Account - OdpDocument15 pagesCapital Account - OdpRakhfan JimshafNo ratings yet

- POA FormatsDocument7 pagesPOA FormatsWilliNo ratings yet

- Product Costing - Cost Estimation in SAPDocument12 pagesProduct Costing - Cost Estimation in SAPlakhbir60% (5)

- Module - 1 Principles and Practice of Life InsuranceDocument252 pagesModule - 1 Principles and Practice of Life InsuranceJai100% (1)

- Fdic Complaint FormDocument3 pagesFdic Complaint Formnujahm1639100% (1)

- Accounts For Clubs and SocietiesDocument4 pagesAccounts For Clubs and SocietiesSimba Muhonde100% (2)

- Proforma of Trading PL and Balance SheetDocument2 pagesProforma of Trading PL and Balance SheetPranay Sai Garepally100% (3)

- Accounts of Clubs and SocietiesDocument5 pagesAccounts of Clubs and SocietiesJunaid Islam100% (1)

- Accounting-Formats For Cambridge IGCSEDocument11 pagesAccounting-Formats For Cambridge IGCSEmuhtasim kabir100% (9)

- Accenture Innovation in Houston Final Report-VF3Document65 pagesAccenture Innovation in Houston Final Report-VF3Lydia DePillis100% (3)

- SYJCBKLMRDocument33 pagesSYJCBKLMRghostinhouse223No ratings yet

- Company Financials - Cash FlowDocument17 pagesCompany Financials - Cash FlowJack SangNo ratings yet

- S.Y.J.C. (Commerce) Book-Kkeping & Accoutancy Partnership Final Accounts Compiled By: Prof. Bosco FernandesDocument11 pagesS.Y.J.C. (Commerce) Book-Kkeping & Accoutancy Partnership Final Accounts Compiled By: Prof. Bosco FernandesDheer BhanushaliNo ratings yet

- CHAPTER 16 PartnershipDocument22 pagesCHAPTER 16 PartnershipbabarNo ratings yet

- Remote Desktop Redirected PrinterDocument1 pageRemote Desktop Redirected Printeramit chavariaNo ratings yet

- Accounting FormatsDocument21 pagesAccounting FormatsAsima ZubairNo ratings yet

- Beginners - Guide - Credit Cards - A4 LINKEDDocument8 pagesBeginners - Guide - Credit Cards - A4 LINKEDvikasNo ratings yet

- Form One NotesDocument2 pagesForm One NotesSalim Abdulrahim Bafadhil50% (2)

- Accounting For PartershipDocument7 pagesAccounting For Partershipwairimuesther506No ratings yet

- Accounting WorkDocument6 pagesAccounting WorkHarpreet singhNo ratings yet

- Partnership Final Accounts PDFDocument97 pagesPartnership Final Accounts PDFKaushik Patel75% (4)

- INCOMPLETE RECORDS O LevelDocument5 pagesINCOMPLETE RECORDS O LevelRECALL JIRIVENGWA100% (1)

- General Format For Final AccountsDocument2 pagesGeneral Format For Final AccountsGokulCj GroveNo ratings yet

- Current and Deferred Tax AssignmentsDocument12 pagesCurrent and Deferred Tax AssignmentsAftab AliNo ratings yet

- An Income Statement and A Statement of Financial Position For LawyersDocument5 pagesAn Income Statement and A Statement of Financial Position For Lawyerstapiwa mafunduNo ratings yet

- Sharing Session - Accounting 13.11.23Document5 pagesSharing Session - Accounting 13.11.23marlina elisabethNo ratings yet

- Partnership AccountsDocument19 pagesPartnership AccountsJovy IvyNo ratings yet

- Microsoft PowerPoint - PL & BS (Compatibility Mode)Document30 pagesMicrosoft PowerPoint - PL & BS (Compatibility Mode)Riyasat khanNo ratings yet

- Ch-01: Accounting For Partnership Firms - Fundamental: Maintenance of Partners Capital AlcDocument70 pagesCh-01: Accounting For Partnership Firms - Fundamental: Maintenance of Partners Capital AlcPawan TalrejaNo ratings yet

- Chapter Five BP2020Document8 pagesChapter Five BP2020Nelson OmondiNo ratings yet

- Tally Ledger and Trail Balance SumsDocument13 pagesTally Ledger and Trail Balance Sumssuresh kumar10No ratings yet

- Financial Statement of Sole Trader LHADocument2 pagesFinancial Statement of Sole Trader LHASameer AliNo ratings yet

- Partnership Lecture Handout With IllustrationDocument23 pagesPartnership Lecture Handout With IllustrationMichael Asiedu100% (3)

- 4 General Accounts of Partnership FirmDocument16 pages4 General Accounts of Partnership FirmNisarga T DaryaNo ratings yet

- Manufacturing A/c For The Year Ended .31.03.2016: XXX XXXDocument2 pagesManufacturing A/c For The Year Ended .31.03.2016: XXX XXXsubhash dalviNo ratings yet

- Financial Accounting Topic FiveDocument14 pagesFinancial Accounting Topic FiveGABRIEL KAMAU KUNG'UNo ratings yet

- Mepa Unit 5Document18 pagesMepa Unit 5Tharaka RoopeshNo ratings yet

- Notes in Partnerships.Document4 pagesNotes in Partnerships.Jkuat MSc. P & LNo ratings yet

- Final - Accounts Format PDFDocument13 pagesFinal - Accounts Format PDFajaychatta100% (1)

- Final - Accounts Format 234 PDFDocument13 pagesFinal - Accounts Format 234 PDFajaychattaNo ratings yet

- Preparation of Financial Statements-PartnershipsDocument7 pagesPreparation of Financial Statements-PartnershipsHeavens MupedzisaNo ratings yet

- Clause 44-Working NotesDocument3 pagesClause 44-Working NotesFaizan AhmedNo ratings yet

- Accounts Receivable: Practical Accounting 1 1Document6 pagesAccounts Receivable: Practical Accounting 1 1Bryan ReyesNo ratings yet

- Final AccountsDocument13 pagesFinal AccountsRahul NegiNo ratings yet

- WS / HW / / RS / 194: 2021 - 2022: TERM: I / II: Revaluation of Asset and LiabilitiesDocument7 pagesWS / HW / / RS / 194: 2021 - 2022: TERM: I / II: Revaluation of Asset and LiabilitiesLavanya SharmaNo ratings yet

- Departmental TradingDocument1 pageDepartmental Tradingmeelas123No ratings yet

- Intercompany Charging Transactions TemplateDocument31 pagesIntercompany Charging Transactions TemplateNorberto CercadoNo ratings yet

- Final AccountsDocument8 pagesFinal AccountsDananjaya RajapakshaNo ratings yet

- Adjusting Entries Notes: DepreciationDocument3 pagesAdjusting Entries Notes: DepreciationMichael RegalaNo ratings yet

- Sharing Session - Accounting 14.11.23Document6 pagesSharing Session - Accounting 14.11.23marlina elisabethNo ratings yet

- Financial Accounting 2Document89 pagesFinancial Accounting 2Colince johnson0% (1)

- Form Akt DSR 1Document14 pagesForm Akt DSR 1Andrew SamuelNo ratings yet

- Kendriya Vidyalaya Sangathan Jaipur Region: Last Minutes Revision Material Subject: AccountancyDocument20 pagesKendriya Vidyalaya Sangathan Jaipur Region: Last Minutes Revision Material Subject: AccountancyMohd AyazNo ratings yet

- Template Profit MethodDocument1 pageTemplate Profit MethodadmfrdsNo ratings yet

- 02 Partnership Final AccountsDocument43 pages02 Partnership Final AccountsroyNo ratings yet

- Final Account of Sole TradersDocument16 pagesFinal Account of Sole Tradersheena mohnaniNo ratings yet

- True or FalseDocument6 pagesTrue or FalseRainnel james AntaranNo ratings yet

- Accounting Standards and The Conceptual FrameworkDocument11 pagesAccounting Standards and The Conceptual FrameworkmeekyeohNo ratings yet

- Reading of Ledger AccountDocument18 pagesReading of Ledger Accountneeru79200050% (2)

- FABM FORMAT STATEMENT (Final)Document6 pagesFABM FORMAT STATEMENT (Final)RishiiieeeznNo ratings yet

- 2023 - 02 - 28 07 - 23 Office Lens PDFDocument9 pages2023 - 02 - 28 07 - 23 Office Lens PDFRoy AnkiNo ratings yet

- Utility Bill Template 25Document6 pagesUtility Bill Template 25衡治洲No ratings yet

- Control Accounts English BW ClassDocument6 pagesControl Accounts English BW ClassDananjaya RajapakshaNo ratings yet

- Bank Reconciliation Statements - BW ClassDocument5 pagesBank Reconciliation Statements - BW ClassDananjaya RajapakshaNo ratings yet

- Human AnatomyDocument8 pagesHuman AnatomyDananjaya RajapakshaNo ratings yet

- Process of Food DigestionDocument14 pagesProcess of Food DigestionDananjaya RajapakshaNo ratings yet

- Sasresultpart2 (OB)Document20 pagesSasresultpart2 (OB)mohitangirashNo ratings yet

- Click Here For Shipping WaiverDocument2 pagesClick Here For Shipping WaiverIvan Joseph LimNo ratings yet

- GyanSys India Employees Project Bonus GuidelinesDocument3 pagesGyanSys India Employees Project Bonus GuidelinesdarapuNo ratings yet

- CH 11Document51 pagesCH 11Bayley_NavarroNo ratings yet

- What Is Efficient FrontierDocument17 pagesWhat Is Efficient FrontierGames destroyerNo ratings yet

- Process Costing-WIPDocument3 pagesProcess Costing-WIPSigei LeonardNo ratings yet

- Finance: Finance Is A Field That Is Concerned With The Allocation (Investment)Document3 pagesFinance: Finance Is A Field That Is Concerned With The Allocation (Investment)nidayousafzaiNo ratings yet

- Job WorkDocument2 pagesJob WorkPragasNo ratings yet

- TH4457CDDocument131 pagesTH4457CDSharad AcharyaNo ratings yet

- Sensata Technologies Holland B.V: InvoiceDocument2 pagesSensata Technologies Holland B.V: InvoiceDayana IvanovaNo ratings yet

- Chapter 3.5: Calculating The Lifetime Value of A CustomerDocument24 pagesChapter 3.5: Calculating The Lifetime Value of A CustomerT HawkNo ratings yet

- Mastering Your Money - A Guide To Financial FreedomDocument9 pagesMastering Your Money - A Guide To Financial FreedomDavid EliasNo ratings yet

- Experiential MarketingDocument22 pagesExperiential Marketingjatin_met1No ratings yet

- Candente Resource Corportaion PDFDocument46 pagesCandente Resource Corportaion PDFRicardo Daniel ArandaNo ratings yet

- What Is A Bank Reconciliation StatementDocument4 pagesWhat Is A Bank Reconciliation StatementHsin Wua ChiNo ratings yet

- ფინტექიDocument14 pagesფინტექიnanuka nanukaNo ratings yet

- SME Development Challenges and Opportunities in Bangladesh: A Case Study On Poultry Hatcheries by Triple Triangle Framework (TTF)Document20 pagesSME Development Challenges and Opportunities in Bangladesh: A Case Study On Poultry Hatcheries by Triple Triangle Framework (TTF)meftahul arnobNo ratings yet

- Assigment 2Document14 pagesAssigment 2Felipe PinedaNo ratings yet

- How To Start A Business Enterprise PDFDocument22 pagesHow To Start A Business Enterprise PDFDhana RedNo ratings yet

- Veloso Case Digests For ObliconDocument10 pagesVeloso Case Digests For ObliconRalph VelosoNo ratings yet

- Garrison Lecture Chapter 11Document57 pagesGarrison Lecture Chapter 11sofikhdyNo ratings yet