Professional Documents

Culture Documents

Desiree Smith - Assignment 2 1

Uploaded by

Des Smith0 ratings0% found this document useful (0 votes)

1 views3 pagesOriginal Title

Desiree Smith- Assignment 2 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views3 pagesDesiree Smith - Assignment 2 1

Uploaded by

Des SmithCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Desiree Smith

ASSIGNMENT 2

1. Complete 2 on page 137 (Direct Method)

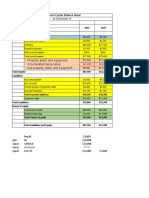

Midland Manufacturing Corporation

Statement of Cash Flow

For the Year Ended December 31, 2016

Cash Flow from Operating Activities:

Net Income 10,000

Depreciation Expense 5,000

Accounts Receivable (1500)

Inventory (1500)

Accounts Payable 1000

Accruals 1000

Deferred Federal Income Tax 2000

Net Cash Flows from Operating Activities 16,000

Cash Flows from Investing Activities:

Fixed Assets- Purchase of equipment (12,000)

Fixed Assets- Retired equipment 2000

Net Cash Flows from Investing Activities (10,000)

Cash Flows from Financing Activities:

Long Term Debt (4,000)

Dividends (5,000)

Proceeds from sale of new stock 2000

Net Cash Flows from Financing Activities (7000)

Net Decrease in Cash- Ending Cash Balance -1000

Desiree Smith

2. Complete ST1 on page 179

a. 1,000 (1+0.08/1^5)

1,000 (1.08^5)

= $1,469.33

b. 1,000(1+0.08/4^4x5)

1,000(1.02^20)

=$1,485.95

Complete 1,3,4, 7 on page 180

1. 3 years = $1191.02

5 years= $1338.23

10 years= $1790.85

3. FVAN=PMT(FVIFA)(1.09)

= $20000(11.028) (1.09)

= $240,410.40

4. a. PVAND = PMT(PVIFA )(1.08)

= 1200(7.536)(1.08)

=$ 9,766.66

b. Seeing that its $10,000 at present value, I prefer condition

1 (solution to 4-a) @ $9,766.66 which is less.

7. 4% (annually)= 800(1.04^8)= $584.53

8%(annually)= 800/(1.08^8)= $432.22

20% (quarterly)= 20/4=5% = 800/(1.05^8x4)= $167.89

0% ((annually)= 800/(1.0^8)= $800

Complete 11, on page 181

Desiree Smith

5%= (Present value annuity factor of 5% for 25years x$70)+

(1000/1.05^25)

= (70x14.0939) + (1000/3.386)

= 986.57+295.30

= $1,281.87

7%= (Present value annuity factor of 7% for 25years x$70)+

(1000/1.07^25)

= (70x11.6536) + (1000/5.4274)

= 815.75+184.23

= $1,000.00

12%= (Present value annuity factor of 12% for 25years x$70)+

(1000/1.12^25)

= (70x7.8431) + (1000/17.0001)

= 549.02+58.82

= $607.84

You might also like

- Chapter 05 Test BankDocument73 pagesChapter 05 Test BankBrandon LeeNo ratings yet

- Qualifying Exam Review Financial Accounting & ReportingDocument21 pagesQualifying Exam Review Financial Accounting & ReportingClene DoconteNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Cash Flow Problems - Group 1Document7 pagesCash Flow Problems - Group 1TrixieNo ratings yet

- CH 17Document6 pagesCH 17Rabie HarounNo ratings yet

- Assign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020Document5 pagesAssign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020mhikeedelantar100% (1)

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Document7 pagesCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Tugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Alya Sufi Ikrima0% (1)

- Financial Management - Capital Budgeting Answer KeyDocument5 pagesFinancial Management - Capital Budgeting Answer KeyRed Velvet100% (1)

- Activity 3 CAMINGAWAN BSMA 2B PDFDocument7 pagesActivity 3 CAMINGAWAN BSMA 2B PDFMiconNo ratings yet

- Lab Pengantar AkuntansiDocument6 pagesLab Pengantar Akuntansirahadatul aishyNo ratings yet

- Final F09 SolutionDocument5 pagesFinal F09 SolutionWyatt Niblett-wilsonNo ratings yet

- Income Summary 3500 Balance (Prepayment) 1000: November 2009 Paper 11 Rent ReceivedDocument2 pagesIncome Summary 3500 Balance (Prepayment) 1000: November 2009 Paper 11 Rent Receivedzahid_mahmood3811No ratings yet

- A) 1-Adjustment 1: Closing InventoryDocument12 pagesA) 1-Adjustment 1: Closing InventoryTuba AkbarNo ratings yet

- DUAZO - 6th EXAM SIM ANSWERSDocument7 pagesDUAZO - 6th EXAM SIM ANSWERSJeric TorionNo ratings yet

- Tutorial 17.5Document4 pagesTutorial 17.5نور عفيفهNo ratings yet

- Practice Exam Chapters 1-5 (1) Solutions: Problem IDocument5 pagesPractice Exam Chapters 1-5 (1) Solutions: Problem IAtif RehmanNo ratings yet

- Answer To The Question NoDocument4 pagesAnswer To The Question NoFahim Faisal 1620560630No ratings yet

- Answers To Questions Chapter 06.part IIDocument19 pagesAnswers To Questions Chapter 06.part IIDaniel TadejaNo ratings yet

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument16 pagesSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamNo ratings yet

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFDocument38 pagesFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (10)

- Fernandez - SIM Activity - HyperinflationDocument5 pagesFernandez - SIM Activity - HyperinflationJeric TorionNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- Financial Reporting Week 1 Class 1 Important!Document18 pagesFinancial Reporting Week 1 Class 1 Important!Lin SongNo ratings yet

- Consolidation Q76Document4 pagesConsolidation Q76johny SahaNo ratings yet

- Question 2Document11 pagesQuestion 2NindyElsheraRenataNo ratings yet

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Document8 pagesMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630No ratings yet

- Chapter 23Document8 pagesChapter 23Matahari PagiNo ratings yet

- 06 Notes Receivable Sec 2 MCPDocument3 pages06 Notes Receivable Sec 2 MCPkyle mandaresioNo ratings yet

- Reporting & Interpreting Investments in Other CorporationsDocument12 pagesReporting & Interpreting Investments in Other CorporationslelydiNo ratings yet

- Cababahay - 6th Exam Topic - SIM ANSWERSDocument7 pagesCababahay - 6th Exam Topic - SIM ANSWERSJeric TorionNo ratings yet

- Assignment - CASH FLOWDocument6 pagesAssignment - CASH FLOWFariha tamannaNo ratings yet

- Solution Aassignments CH 12Document7 pagesSolution Aassignments CH 12RuturajPatilNo ratings yet

- Solutions For Notes and Loans ReceivableDocument4 pagesSolutions For Notes and Loans ReceivableKenaniah SanchezNo ratings yet

- Acc Tut 12 Final JTDocument21 pagesAcc Tut 12 Final JTxhayyyzNo ratings yet

- Last Assignment (Najeeb)Document7 pagesLast Assignment (Najeeb)Najeeb KhanNo ratings yet

- Exercise Chapter 14Document9 pagesExercise Chapter 14hassah fahadNo ratings yet

- Exercise Chapter 14Document9 pagesExercise Chapter 14hassah fahadNo ratings yet

- FIN-AW4 AnswersDocument14 pagesFIN-AW4 AnswersRameesh DeNo ratings yet

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Tugas Cash Flow (Kel 4) KelarDocument23 pagesTugas Cash Flow (Kel 4) KelarRamaNo ratings yet

- Accounting and Financial Management-ProjectDocument8 pagesAccounting and Financial Management-ProjectMelokuhle MhlongoNo ratings yet

- Kelompok 5 - Cash Flow - ALKDocument16 pagesKelompok 5 - Cash Flow - ALKSiti Ruhmana SiregarNo ratings yet

- Intermediate Accounting Exam 3 SolutionsDocument7 pagesIntermediate Accounting Exam 3 SolutionsAlex SchuldinerNo ratings yet

- Hanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4Document3 pagesHanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- Hanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4Document3 pagesHanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- Yohanes Bosko Arya B - 041711333195 - AKM E23.11, P23.4Document3 pagesYohanes Bosko Arya B - 041711333195 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- Kelompok: Achmad Bahari Ilmi (041711333127) Yohanes Bosko Arya Bima (041711333195)Document3 pagesKelompok: Achmad Bahari Ilmi (041711333127) Yohanes Bosko Arya Bima (041711333195)ulil alfarisyNo ratings yet

- Chapter 12 ProblemsDocument40 pagesChapter 12 ProblemsInciaNo ratings yet

- Ch23 StatementofCashFlowExamples Zeke and ZoeDocument4 pagesCh23 StatementofCashFlowExamples Zeke and ZoeHossein ParvardehNo ratings yet

- VELLORE, CHENNAI-632 002: Answer The Following QuestionsDocument5 pagesVELLORE, CHENNAI-632 002: Answer The Following QuestionsJayanthiNo ratings yet

- Revenue Grants (Income) : J-EntriesDocument6 pagesRevenue Grants (Income) : J-EntriesRamin AminNo ratings yet

- Soha Balance SheeDocument7 pagesSoha Balance SheeMohamed ZaitoonNo ratings yet

- S 5.8-5.13 Limited CompaniesDocument11 pagesS 5.8-5.13 Limited CompaniesIlovejjcNo ratings yet

- Akm 2 Week 11Document3 pagesAkm 2 Week 11Ahsan FirdausNo ratings yet

- Assignment 1-11 ManAccDocument13 pagesAssignment 1-11 ManAccMay Grethel Joy PeranteNo ratings yet

- Unit 3 BBC SlidesDocument12 pagesUnit 3 BBC SlidesKatrina EustaceNo ratings yet

- Case 1 - Tutor GuideDocument3 pagesCase 1 - Tutor GuideKAR ENG QUAHNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- Desiree Smith - Assignment 6 2Document4 pagesDesiree Smith - Assignment 6 2Des SmithNo ratings yet

- Desiree Smith - Assignment 5Document5 pagesDesiree Smith - Assignment 5Des SmithNo ratings yet

- Desiree Smith - Assignment 1 2Document2 pagesDesiree Smith - Assignment 1 2Des SmithNo ratings yet

- Desiree Smith - Assignment 3 1Document3 pagesDesiree Smith - Assignment 3 1Des SmithNo ratings yet

- Desiree Smith - Case Analysis - A Breakdown in CommunicationDocument7 pagesDesiree Smith - Case Analysis - A Breakdown in CommunicationDes SmithNo ratings yet

- Desiree Smith - Case Analysis - The New Plant ManagerDocument6 pagesDesiree Smith - Case Analysis - The New Plant ManagerDes SmithNo ratings yet

- Cracker Barrell - DS CommentsDocument15 pagesCracker Barrell - DS CommentsDes SmithNo ratings yet

- Desiree Smith - Cracker BarrellDocument1 pageDesiree Smith - Cracker BarrellDes SmithNo ratings yet

- Annuitization and The DARA HypothesisDocument29 pagesAnnuitization and The DARA HypothesisTomás Valenzuela TormNo ratings yet

- FormsDocument21 pagesFormsKushal BhatiaNo ratings yet

- LIC S Jeevan Akshay VII Sales BrochureDocument16 pagesLIC S Jeevan Akshay VII Sales BrochureKALIA PRADHANNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 523799420050920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 523799420050920 Assessment Year: 2020-21Sushant MishraNo ratings yet

- CM1A - September23 - Clean ProofDocument6 pagesCM1A - September23 - Clean ProofVaibhav SharmaNo ratings yet

- BSC StatisticsDocument40 pagesBSC StatisticsVishnupriyaNo ratings yet

- Merged Excel Prac QuestionDocument26 pagesMerged Excel Prac QuestionhibaNo ratings yet

- Advanced Demo DescriptionDocument34 pagesAdvanced Demo DescriptionAlex GNo ratings yet

- Momentum Divorce - OrderDocument11 pagesMomentum Divorce - OrderHumbulani VhuthuhaweNo ratings yet

- Public DebtDocument3 pagesPublic DebtMohamed AzmyNo ratings yet

- Actuarial Mathematics II: Notre Dame University - LouaizeDocument54 pagesActuarial Mathematics II: Notre Dame University - LouaizeMarie BtaichNo ratings yet

- QUANTITATIVE METHODS FOR BUSINESS - 1 NOTES-1st-semDocument33 pagesQUANTITATIVE METHODS FOR BUSINESS - 1 NOTES-1st-semSeenaNo ratings yet

- FormsDocument16 pagesFormsSujeet kumarNo ratings yet

- LIC S New Jeevan Shanti Sales BrochureDocument16 pagesLIC S New Jeevan Shanti Sales BrochureAkshay ChaudhryNo ratings yet

- Uj 35520+SOURCE1+SOURCE1.1Document14 pagesUj 35520+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- TAX3247N 3226N May 2024 Assignment Question PaperDocument10 pagesTAX3247N 3226N May 2024 Assignment Question PaperfortuinpdNo ratings yet

- EDS522 - Week 8Document21 pagesEDS522 - Week 8William OketamiNo ratings yet

- The Penguin Dictionary of EconomicsDocument420 pagesThe Penguin Dictionary of EconomicsHarshitNo ratings yet

- LICs Jeevan Dhara-II - Policy Document - With LogoDocument23 pagesLICs Jeevan Dhara-II - Policy Document - With Logopave.scgroupNo ratings yet

- National Pension System (NPS) : SR - No ParticularDocument9 pagesNational Pension System (NPS) : SR - No ParticularsantoshkumarNo ratings yet

- ICICI Pru Guaranteed Pension Plan Flexi Annexure V Benefit Enhancer 24june2022Document8 pagesICICI Pru Guaranteed Pension Plan Flexi Annexure V Benefit Enhancer 24june2022Prashant A UNo ratings yet

- IAI CM1 Syllabus 2024Document7 pagesIAI CM1 Syllabus 2024agnivodeystat1068No ratings yet

- AF7 2022-23 Practice Test 3 (July 2020 EG) PDFDocument26 pagesAF7 2022-23 Practice Test 3 (July 2020 EG) PDFAnan Guidel AnanNo ratings yet

- Lic PPTDocument21 pagesLic PPTvsharma0091No ratings yet

- Quantitative Methods For Business - 1 NotesDocument34 pagesQuantitative Methods For Business - 1 NotesSOLOMON GHUNNEYNo ratings yet

- HDFC Life Smart Pension Plan BrochureDocument17 pagesHDFC Life Smart Pension Plan BrochureSatyajeet AnandNo ratings yet

- Learner Guide 242597Document28 pagesLearner Guide 242597palmalynchwatersNo ratings yet

- Kotak Lifetime Income V13Document11 pagesKotak Lifetime Income V13skverma3108No ratings yet

- FinaMan Final TermDocument15 pagesFinaMan Final TermHANNAH ROSS BAELNo ratings yet