Professional Documents

Culture Documents

Vande Bharat Exp Chair Car (CC)

Uploaded by

jordanrai183Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vande Bharat Exp Chair Car (CC)

Uploaded by

jordanrai183Copyright:

Available Formats

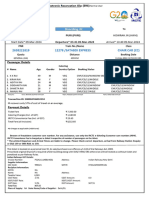

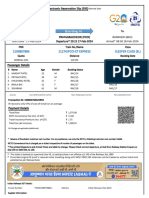

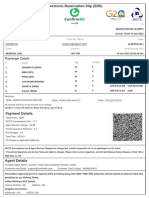

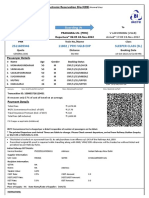

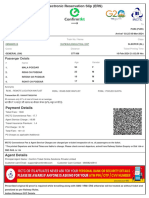

Electronic Reservation Slip (ERS)-Normal User

Booked From To

PURI (PURI) PURI (PURI) HOWRAH JN (HWH)

Start Date* 09-Mar-2024 Departure* 13:50 08-Mar-2024 Arrival* 20:30 09-Mar-2024

PNR Train No./Name Class

8613025710 22896 / VANDE BHARAT EXP CHAIR CAR (CC)

Quota Distance Booking Date

GENERAL (GN) 499 KM 11-Feb-2024 10:59:28 HRS

Passenger Details

Catering

# Name Age Gender Service Option Booking Status Current Status

1. K K RAI 49 M VEG CNF/C3/10/WINDOW SIDE CNF /C3/10/WINDOW SIDE

2. KIRAN RAI 46 F VEG CNF/C3/11/MIDDLE CNF /C3/11/MIDDLE

3. ADITYA RAI 24 M VEG CNF/C3/12/ASILE CNF/C3/12/ASILE

4. SIDDHARTH RAI 21 M VEG CNF/C3/15/WINDOW CNF/C3/15/WINDOW

5. SHWETA RAI 26 F VEG CNF/C3/16/MIDDLE CNF/C3/16/MIDDLE

6. MANJU RAI 58 F VEG CNF/C3/17/AISLE CNF/C3/17/AISLE

Acronyms: RLWL: REMOTE LOCATION WAITLIST PQWL: POOLED QUOTA WAITLIST RSWL: ROAD-SIDE WAITLIST

Transaction ID: 100004748410110

IR recovers only 57% of cost of travel on an average.

Payment Details

Ticket Fare ₹ 7,031.00

Catering Charges (Incl. of GST) ₹ 1452.00

IRCTC Convenience Fee (Incl. of GST) ₹ 23.60

Total Fare (all inclusive) ₹ 8,506.60

PG Charges as applicable (Additional)

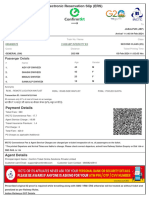

Beware of fraudulent customer care number. For any assistance, use only the IRCTC e-ticketing Customer care number:14646.

IRCTC Convenience Fee is charged per e-ticket irrespective of number of passengers on the ticket.

* The printed Departure and Arrival Times are liable to change. Please Check correct departure, arrival from Railway Station Enquiry

or Dial 139 or SMS RAIL to 139.

This ticket is booked on a personal User ID, its sale/purchase is an offence u/s 143 of the Railways Act,1989.

Prescribed original ID proof is required while travelling along with SMS/ VRM/ ERS otherwise will be treated as without ticket and

penalized as per Railway Rules.

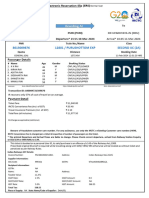

Indian Railways GST Details:

Invoice Number: PS24211146814691 Address: Indian Railways New Delhi

Supplier Information:

SAC Code: 996421 GSTIN: 07AAAGM0289C1ZL

Recipient Information:

GSTIN: NA

Name: NA Address:

Taxable Value: 7,031

CGST Rate: 2.5% CGST Amount: 0.0

SGST/UGST Rate: SGST/UGST Amount:

IGST Rate: 5.0% IGST Amount: 351.55

Total Tax: 351.55

Place of Supply: Uttar Pradesh(9) State Name/Code of Supplier: Delhi/DL

You might also like

- Statement 05-APR-23 AC 20312789 07043628 PDFDocument4 pagesStatement 05-APR-23 AC 20312789 07043628 PDFBakhter Jabarkhil0% (1)

- 一卡通賬戶月結單 All-In-One Card Account StatementDocument2 pages一卡通賬戶月結單 All-In-One Card Account StatementMolecular Trader0% (1)

- satabdi Express Chair Car (CC)Document2 pagessatabdi Express Chair Car (CC)jordanrai183No ratings yet

- vande Bharat Express Chair Car (CC)Document2 pagesvande Bharat Express Chair Car (CC)jordanrai183No ratings yet

- Purushottom Exp Second Ac (2A)Document1 pagePurushottom Exp Second Ac (2A)jordanrai183No ratings yet

- HPT Src1alamDocument1 pageHPT Src1alamAlamgir MollaNo ratings yet

- SMVB MRDW Exp Sleeper Class (SL) : Electronic Reserva On Slip (ERS)Document1 pageSMVB MRDW Exp Sleeper Class (SL) : Electronic Reserva On Slip (ERS)headcsirfpiNo ratings yet

- TicketsDocument1 pageTicketsYuvraj SinghNo ratings yet

- Pragati Express Second Sitting (2S) : WL WLDocument2 pagesPragati Express Second Sitting (2S) : WL WLgadhaveanosh77No ratings yet

- 14316/intercity Exp Chair Car (CC)Document2 pages14316/intercity Exp Chair Car (CC)harshitsingh.79835No ratings yet

- TicketsDocument2 pagesTicketsvvsrkkamalesh2003No ratings yet

- 12183/Bpl PBH SF Exp Sleeper Class (SL)Document3 pages12183/Bpl PBH SF Exp Sleeper Class (SL)tarujain1120No ratings yet

- 12795/lpi Intercity Second Sitting (2S)Document2 pages12795/lpi Intercity Second Sitting (2S)RAJ KUMAR MADDANo ratings yet

- TicketDocument2 pagesTicketRonit PatilNo ratings yet

- 22449/porvotr S Krnti Sleeper Class (SL)Document3 pages22449/porvotr S Krnti Sleeper Class (SL)Khaja KhanNo ratings yet

- Return TicketDocument3 pagesReturn Ticketchoudharyankush731No ratings yet

- 01440/ami Pune Special Sleeper Class (SL)Document3 pages01440/ami Pune Special Sleeper Class (SL)823. JadhavNo ratings yet

- 12421/ned Asr SF Exp Third Ac (3A)Document2 pages12421/ned Asr SF Exp Third Ac (3A)Jyoti TahalramaniNo ratings yet

- Vizag UpDocument2 pagesVizag UpLoke RajpavanNo ratings yet

- 22912/shipra Express Third Ac (3A)Document2 pages22912/shipra Express Third Ac (3A)Priya joshiNo ratings yet

- TNL To VSKP 2Document1 pageTNL To VSKP 2Sri VamsiNo ratings yet

- Hubbali To SCDocument2 pagesHubbali To SC20H51A04P3-PEDAPUDI SHAKTHI GANESH B.Tech ECE (2020-24)No ratings yet

- 12368/vikramshila Exp Sleeper Class (SL)Document3 pages12368/vikramshila Exp Sleeper Class (SL)Rahul GuptaNo ratings yet

- 17415/haripriya Exp Sleeper Class (SL)Document2 pages17415/haripriya Exp Sleeper Class (SL)sahiltulaskar47No ratings yet

- Ticket TK440733380J69Document3 pagesTicket TK440733380J69sankalpdwivedi303No ratings yet

- HW LTT Ac Exp Third Ac (3A) : Electronic Reserva On Slip (ERS)Document2 pagesHW LTT Ac Exp Third Ac (3A) : Electronic Reserva On Slip (ERS)shahisonal02No ratings yet

- 11274/pcoi Et Express Sleeper Class (SL)Document3 pages11274/pcoi Et Express Sleeper Class (SL)patelchhotupatel8No ratings yet

- Vizag To BorraDocument3 pagesVizag To BorraLoke RajpavanNo ratings yet

- TicketsDocument3 pagesTicketsBurhanuddin IndorewalaNo ratings yet

- TicketDocument3 pagesTicketAarish AcharyaNo ratings yet

- Ticket TK375535669R22Document3 pagesTicket TK375535669R22Rinky KapoorNo ratings yet

- Mumbai To Satara 2 Dt26.03.24 Darshstck1 AKDocument1 pageMumbai To Satara 2 Dt26.03.24 Darshstck1 AKItsMe BunnyNo ratings yet

- Mookambika - Train - Going TicketDocument2 pagesMookambika - Train - Going TicketSreejith KSNo ratings yet

- To Eluru 01Document4 pagesTo Eluru 01aravind GannamaniNo ratings yet

- 20805/AP EXPRESS Sleeper Class (SL)Document3 pages20805/AP EXPRESS Sleeper Class (SL)Jitendra AsoleNo ratings yet

- Bui To NdlsDocument2 pagesBui To NdlsGolu BhaiNo ratings yet

- Jagannath Exp Sleeper Class (SL)Document1 pageJagannath Exp Sleeper Class (SL)sanguNo ratings yet

- Ticket TK325453518R82Document2 pagesTicket TK325453518R82Deepak SinghNo ratings yet

- IoekDocument3 pagesIoekwhyb24816No ratings yet

- Vijaywada To ChennaiDocument1 pageVijaywada To Chennaikhan khanNo ratings yet

- Thivim To Goa For 5 PassangersDocument2 pagesThivim To Goa For 5 PassangersNikhil MhatreNo ratings yet

- NGP2Document3 pagesNGP2sagarNo ratings yet

- HWH RDocument3 pagesHWH RKuleshwar SahuNo ratings yet

- 22nd NotesDocument2 pages22nd NotesnareshNo ratings yet

- Pryj VGLB Exp Sleeper Class (SL)Document2 pagesPryj VGLB Exp Sleeper Class (SL)suresh muthuramanNo ratings yet

- 15231/bju Gondia Exp Sleeper Class (SL)Document3 pages15231/bju Gondia Exp Sleeper Class (SL)Sanjeet KumarNo ratings yet

- Numbar 3690Document2 pagesNumbar 3690Chanaykya BrahmaNo ratings yet

- Sleeper Class (SL) 13146/RDP KOAA EXPDocument3 pagesSleeper Class (SL) 13146/RDP KOAA EXPrajukanuaNo ratings yet

- All KnowledgeDocument3 pagesAll Knowledgesomnathghosh0619No ratings yet

- TNL To VSKP 1Document1 pageTNL To VSKP 1Sri VamsiNo ratings yet

- Neelanchal Exp Sleeper Class (SL)Document3 pagesNeelanchal Exp Sleeper Class (SL)yashpalsinhchauhan06No ratings yet

- 16127/Ms Guruvayur Ex Sleeper Class (SL)Document2 pages16127/Ms Guruvayur Ex Sleeper Class (SL)Gayathri kNo ratings yet

- 22718/rajkot SF Exp Sleeper Class (SL)Document3 pages22718/rajkot SF Exp Sleeper Class (SL)Pruthviraj JuniNo ratings yet

- Jhansi Spe To HydDocument3 pagesJhansi Spe To HydA Surya TejaNo ratings yet

- Print - HOWRAH JN (HWH) - RAMPUR HAT (RPH) - 6734214772Document1 pagePrint - HOWRAH JN (HWH) - RAMPUR HAT (RPH) - 6734214772thispcmsNo ratings yet

- Null 5Document3 pagesNull 50477.07No ratings yet

- 17412/mahalaxmi Exp Sleeper Class (SL)Document2 pages17412/mahalaxmi Exp Sleeper Class (SL)sahiltulaskar47No ratings yet

- 15076/TRIVENI EXP Sleeper Class (SL)Document3 pages15076/TRIVENI EXP Sleeper Class (SL)jitendrachahal10No ratings yet

- Train 2Document3 pagesTrain 2rajeev_kumar365No ratings yet

- Ticket 25octDocument3 pagesTicket 25octAbhinav SinghNo ratings yet

- Shirdi TicketDocument2 pagesShirdi TicketPOORVA GURAVNo ratings yet

- TAX Lecture 0 - Exam TechniqueDocument12 pagesTAX Lecture 0 - Exam TechniqueHuma BashirNo ratings yet

- Cash BookDocument33 pagesCash BookShaloom TVNo ratings yet

- Swift MT700Document4 pagesSwift MT700FTU.CS2 Lê Phương ThảoNo ratings yet

- Tax Invoice: Sno. Particulars Stay Date Sell Rate Inclusion Discount Sub Total CGST SGST TotalDocument2 pagesTax Invoice: Sno. Particulars Stay Date Sell Rate Inclusion Discount Sub Total CGST SGST TotalSimran MehrotraNo ratings yet

- ST2023062601012473724Document1 pageST2023062601012473724alikhanmusa302No ratings yet

- Specimen of Indemnity BondDocument3 pagesSpecimen of Indemnity BondRahul Kumar100% (1)

- Your Accounts at A Glance: Premier BankingDocument6 pagesYour Accounts at A Glance: Premier BankingSuzanne MurphyNo ratings yet

- Deductions On Gross IncomeDocument6 pagesDeductions On Gross IncomeJamaica DavidNo ratings yet

- GeM SERVICE PROPOSALDocument2 pagesGeM SERVICE PROPOSALKartik RajputNo ratings yet

- Ategory: Details of Possible Complaints Relating To The AccountDocument50 pagesAtegory: Details of Possible Complaints Relating To The Accounteferem67% (6)

- Apollo Shoes Comparative Balance Sheet at Dec. 31, 2014 and Dec. 31, 2013Document3 pagesApollo Shoes Comparative Balance Sheet at Dec. 31, 2014 and Dec. 31, 2013Richard HanselNo ratings yet

- Cards Schedule ChargesDocument3 pagesCards Schedule ChargesVR MNo ratings yet

- Lembar Jawaban Paket 3 UKK (JUrnal Khusus)Document20 pagesLembar Jawaban Paket 3 UKK (JUrnal Khusus)Sri WidharaniPNo ratings yet

- CheatsheetDocument2 pagesCheatsheetSafi NurulNo ratings yet

- Tax Remedies QuizDocument5 pagesTax Remedies QuizAnonymous 03JIPKRkNo ratings yet

- Computation 22-23Document2 pagesComputation 22-23Raj DelhiNo ratings yet

- CIR V Placer DomeDocument3 pagesCIR V Placer DomeAsia WyNo ratings yet

- Wella Koleston 20220114.20Document4 pagesWella Koleston 20220114.20Be HeroSmartNo ratings yet

- 5821 11327 1 SMDocument17 pages5821 11327 1 SMRidho MuhammadNo ratings yet

- Saadiq SOCDocument31 pagesSaadiq SOCjoshmalikNo ratings yet

- All About ChecksDocument5 pagesAll About ChecksCzarina JaneNo ratings yet

- ListDocument4 pagesListNathy FrometaNo ratings yet

- Digital Currency Whitepaper: Bitcoin White PaperDocument2 pagesDigital Currency Whitepaper: Bitcoin White Paperalehegn manayeNo ratings yet

- Invoice - GC - 16-17 - 140-1474629364Document1 pageInvoice - GC - 16-17 - 140-1474629364Kapil CRNo ratings yet

- Proposed Millionaire Tax To Massachusetts Constitution (RULED UNCONSTITUTIONAL 6/18/2018)Document2 pagesProposed Millionaire Tax To Massachusetts Constitution (RULED UNCONSTITUTIONAL 6/18/2018)ChrisWhittleNo ratings yet

- 2020 IRR of RA 11256Document4 pages2020 IRR of RA 11256Karla Elaine UmaliNo ratings yet

- Tax - Midterm NTC 2017Document12 pagesTax - Midterm NTC 2017Red YuNo ratings yet

- August Salary SlipDocument1 pageAugust Salary SlipVipul TyagiNo ratings yet