Professional Documents

Culture Documents

Calculate Your Federal Taxes

Calculate Your Federal Taxes

Uploaded by

api-719544021Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculate Your Federal Taxes

Calculate Your Federal Taxes

Uploaded by

api-719544021Copyright:

Available Formats

NGPF Activity Bank

Taxes

CALCULATE: Your Federal Taxes

In this activity, you will use sample W-2 and 1099 forms as well as information about deductions

and credits to calculate the taxes owed and refund of each individual.

Part I: Scenarios

To illustrate how different circumstances affect your tax return, we’ll explore the case of four

individuals. Assume all individuals are filing as single and not claimed as a dependant:

Name Employment Info W-2 Form Deductions Credits

Ashley Roslin ● Worked around ● Ashley made ● Ashley has

10 hours/week at a $50 no credits

Ashley’s

a local coffee donation to available

W-2

shop for $13/hour an animal

shelter

Melinda Flowers ● Worked ● As an ● Melinda

around 20 independent has $350

hours/week at contractor, in credits

a local ice Melinda was

Melinda’s

cream shop able to

W-2

● Worked deduct $645

irregularly as in business

Melinda’s

an related

1099

independent expenses

contractor for and $925 for

a landscaping vehicle use

company

Elyse ● Worked as a bus ● Elyse paid ● Elyse has

McPherson driver making $1,500 in $1,000 in

$32/hour plus state and credits

overtime pay local taxes

Elyse’s

and made

W-2

$5,000 in

charitable

contribution

s

Jameson ● Work as an Jameson’s ● Jameson ● Jameson

www.ngpf.org Last updated: 1/4/24

1

Michaels independent 1099 paid $16,000 has

contractor in mortgage $1,400 in

consulting for interest, credits

a tech firm $2,500 in

charitable

contribution

s

Part II: Taxable Income and Deductions

Before calculating taxes, you will sometimes be able to apply deductions, which reduce the

amount of your total income that will be taxed.

The deductions that will apply in this activity:

Personal Deductions

1) Take the standard deduction of $13,850 for single individuals in 2023. 90% of filers use this

option.

2) Itemize deductions if the total deductions will be more than the standard deduction. This

would include items like:

a) Interest on the first $750,000 of a mortgage

b) State and local taxes up to $10,000

c) Charitable contributions

Business Deductions

3) If you receive a 1099 for work as an independent contractor, you can deduct business

expenses on top of your personal deductions

Example

You made $30,000 last year as an independent contractor and are able to apply deductions of

$10,000 in personal expenses and $3,200 in business expenses. For personal expenses, it’s better

to take the standard deduction of $13,850. You will calculate your taxes owed on $30,000 - $13,850

- $3,200 = $12,950 of taxable income.

1. Consider each individual’s situation, then complete the table below by listing the

income reported on all W-2/1099 forms in column (a), total deductions in column (b)

and their taxable income after deductions in column (c).

Name Gross Income on Total Deductions Taxable Income after

W-2/1099 (b) Deductions

(a) (c)

Ashley $6,240.00 $50.00 $6,190.00

Melinda $21,151.00 $1,570.00 $19,581.00

www.ngpf.org Last updated: 1/4/24

2

Elyse $34,220.00 $6,500.00 $27,720.00

Jameson $66,500.00 $18,500.00 $48,000.00

Part III: Federal Income Taxes Owed

US Federal Income Taxes are a progressive tax system, which means that different portions of your

income are taxed at different rates. Here are the 2023 tax brackets for single individuals:

Example

If your taxable income is $57,500 after all deductions, we would calculate federal income taxes

owed like this:

Tax Bracket Taxable Income Remaining Taxes Owed

10% Bracket Total income remaining: The first $11,000 is taxed at

$57,500 10%:

$11,000 * .10 = $1,100 taxes

owed

12% Bracket Total Income remaining: This bracket covers the next

$57,500 - $11,000 = $46,500 $33,725 in taxable income.

You can find this by

subtracting the top of this

bracket from the top of the

previous bracket:

$44,725 - $11,000 = $33,725

www.ngpf.org Last updated: 1/4/24

3

$33,725 * .12 = $4,047 taxes

owed

22% Bracket Total income remaining = This bracket covers the next

$46,500 - $33,725 = $12,775 $50,650 in taxable income but

we only have $12,775 left:

$12,775 * .22 = $2,810.50 taxes

owed

Summary calculation

Total taxes owed = $1,100 + $4,047 + $2,810.50 = $7,957.50 total federal income taxes owed

2. Now it’s your turn! Calculate the total taxes owed for each individual.

a. First, transfer the Taxable Income after Deductions column (c) from part II into

column (c) below.

b. Next, calculate the amount owed for each bracket interval up to the individuals’

highest tax rate.

c. Finally, add these values together to find their overall taxes owed.

Name Taxable 10% Bracket 12% Bracket 22% Bracket Total Taxes

Income after (d) (e) (f) Owed

Deductions (g)

(c)

Ashley $6,190.00 $11,000 $619.00

Melinda $19,581.00 $11,000/ 1029.72 $2,129.72

$1,100

Elyse $27,720.00 $11,000/ $16,720.00/ $3,106.40

$1,100 $2,006.40

Jameson $48,000.00 $11,000/ $33,725.00/ $3,275.00/ $5,867.50

$1,100 $4,047.00 $720.50

www.ngpf.org Last updated: 1/4/24

4

Part IV: Credits

Credits are a reduction in your Total Taxes Owed AFTER your taxes are calculated. There are a lot

of different credits for things like child care, education, health care, and adoption.

There are some credits that are refundable, which means that you will be paid if they cause a

refund in total taxes owed. However, most credits are non-refundable, which means that they will

reduce your total taxable income to $0 but will not give you a refund.

All of the credits in this activity are non-refundable credits.

Example

You calculated that you owe $4700 in taxes and have a $500 tax credit. Your new taxes owed after

credits would be $4,700 - $500 = $4,200 in taxes owed after credits.

3. Transfer the Total taxes owed column (g) from part III into column (g) below. The

amount of each individual’s total credits is listed in Part I and can be brought down to

column (h) below. Use this information to complete column (i) of the table.

Name Total Taxes Owed Total Eligible Credits Taxes Owed after Credits

(g) (h) (i)

Ashley $619.00 $0.00 $619.00

Melinda $2,129.72 $350.00 $1,779.72

Elyse $3,106.40 $1,000.00 $2,106.40

Jameson $5,867.50 $1,400.00 $4,467.50

Part V: Summary

To wrap things up, let’s calculate and compare each individual’s marginal and effective tax rate.

We will also check to see if each individual will owe money in taxes or receive a refund.

● Your marginal tax rate is the highest tax bracket in which you owe taxes.

● If you divide your taxes owed after all deductions and credits by your total taxable income

after deductions, then multiply by 100, you will calculate your effective tax rate.

Example

Total income: $70,050.00

Total taxable income after deductions: $57,500.00

Total taxes owed: $8,387.60 total federal taxes owed

● Your marginal tax rate is 22% because that is the highest tax bracket that your money is

taxed in

● Your effective tax rate will be

www.ngpf.org Last updated: 1/4/24

5

You can calculate whether you will get a refund or owe additional taxes by subtracting your total

taxes owed and the amount that is already withheld on your W-2 or 1099.

Example

You owe $8,367.60 and you had $9,250.60 federal income tax withheld from your paycheck on box

2 of your W-2.

$8,367.60 - $9,250.60 = -$883.00. Because you paid more than you owed, you will receive an

$883 refund!

4. Transfer column (i) from Part IV above into column (i) below. Use the above example to

complete the table below to summarize each individual’s taxes.

Name Taxes Owed Marginal Tax Effective Tax Federal Taxes Refund/

after Credits Rate Rate Withheld on Owed Taxes

(i) ( j) (k) W-2/1099 (m)

(l)

Ashley $619.00 $196.25 $422.75

Melinda $1,779.72 $534.96 $1,245.00

Elyse $2,106.40 $3,947.30 -$1,840.90

Jameson $4,467.50 $0.00 $4,467.50

www.ngpf.org Last updated: 1/4/24

6

You might also like

- CALCULATE - Completing A 1040Document3 pagesCALCULATE - Completing A 1040Giselle Ubieta Salas50% (8)

- Case Chapter 3 - Accounting IntermediateDocument2 pagesCase Chapter 3 - Accounting IntermediateIndra Aminudin100% (3)

- IFMA FMP v3 LSDocument177 pagesIFMA FMP v3 LSNabil Sharafaldin100% (6)

- The Role of Agile LeadershipDocument21 pagesThe Role of Agile LeadershipSherin Khodier0% (1)

- Solved Marcy Tucker Received The Following Items This Year Determine ToDocument1 pageSolved Marcy Tucker Received The Following Items This Year Determine ToAnbu jaromiaNo ratings yet

- Chapter 06 - SamplesDocument3 pagesChapter 06 - SamplesJessica ZhangNo ratings yet

- Solved The Kane Corporation Is An Accrual Basis Taxpayer State LawDocument1 pageSolved The Kane Corporation Is An Accrual Basis Taxpayer State LawAnbu jaromiaNo ratings yet

- ACC 430 Chapter 17Document13 pagesACC 430 Chapter 17vikkiNo ratings yet

- 02 F6 LRP Questions FA2009 PDFDocument44 pages02 F6 LRP Questions FA2009 PDFJino JoseNo ratings yet

- A Case Study of Ratio Analysis of Garima Bikas Bank LimitedDocument31 pagesA Case Study of Ratio Analysis of Garima Bikas Bank LimitedThe onion factory67% (3)

- Calculate Your Federal TaxesDocument4 pagesCalculate Your Federal Taxesapi-718873824No ratings yet

- Solved Ms Reid Borrowed 50 000 From A Broker To Purchase LeroDocument1 pageSolved Ms Reid Borrowed 50 000 From A Broker To Purchase LeroAnbu jaromiaNo ratings yet

- Introduction To Accounting EXE 1Document6 pagesIntroduction To Accounting EXE 1ntxthuy04No ratings yet

- TaxreturnprojectDocument6 pagesTaxreturnprojectapi-312756385No ratings yet

- Acc Chapter 2Document4 pagesAcc Chapter 2WissalNo ratings yet

- KW Macro CH 07 End of Chapter ProblemsDocument10 pagesKW Macro CH 07 End of Chapter ProblemsAnirvan SenNo ratings yet

- Tax Return Project Situation - Cohen Tax Year 2015 - Fall 2016Document5 pagesTax Return Project Situation - Cohen Tax Year 2015 - Fall 2016Shivani Jani0% (3)

- Solved Simon Is Single and A Stockbroker For A Large InvestmentDocument1 pageSolved Simon Is Single and A Stockbroker For A Large InvestmentAnbu jaromiaNo ratings yet

- M4 Transaction Analysis JEDocument7 pagesM4 Transaction Analysis JEJohn Benedict Capiral TehNo ratings yet

- Chapter 17 PDFDocument17 pagesChapter 17 PDFJay BrockNo ratings yet

- Accounting Tutorial 1Document2 pagesAccounting Tutorial 1AmalinaIsaNo ratings yet

- Solved in January Ms NW Projects That Her Employer Will WithholdDocument1 pageSolved in January Ms NW Projects That Her Employer Will WithholdAnbu jaromiaNo ratings yet

- Basic Accounting IDocument24 pagesBasic Accounting IAlpha HoNo ratings yet

- Solved Minnie Owns A Qualified Annuity That Cost 78 000 The AnnuityDocument1 pageSolved Minnie Owns A Qualified Annuity That Cost 78 000 The AnnuityAnbu jaromiaNo ratings yet

- AssignmentDocument4 pagesAssignmentPatrick Bryan NugrahaNo ratings yet

- Cash Flow Calculator CFO SelectionsDocument12 pagesCash Flow Calculator CFO Selections202040336No ratings yet

- Think Pair ShareforLecture23Winter2024Document6 pagesThink Pair ShareforLecture23Winter2024小田菜小林No ratings yet

- Solved MR Alm Earned A 61 850 Salary and Recognized A 5 600Document1 pageSolved MR Alm Earned A 61 850 Salary and Recognized A 5 600Anbu jaromiaNo ratings yet

- Bankruptcy Problems MirzaDocument3 pagesBankruptcy Problems MirzaKesarapu Venkata ApparaoNo ratings yet

- Solved A What Requirements Must Be Met in Order For A PDFDocument1 pageSolved A What Requirements Must Be Met in Order For A PDFAnbu jaromiaNo ratings yet

- Jane Kent Is A Licensed Cpa During The First Month PDFDocument1 pageJane Kent Is A Licensed Cpa During The First Month PDFAnbu jaromia0% (1)

- Irrecoverable DebtsDocument21 pagesIrrecoverable DebtsjsxlinaNo ratings yet

- Osborne.2022 RPTDocument10 pagesOsborne.2022 RPTThomas JonesNo ratings yet

- Cases CH 3Document2 pagesCases CH 3ejaaejoNo ratings yet

- South Western Federal Taxation 2017 Comprehensive 40Th Edition Hoffman Solutions Manual Full Chapter PDFDocument36 pagesSouth Western Federal Taxation 2017 Comprehensive 40Th Edition Hoffman Solutions Manual Full Chapter PDFfred.henderson352100% (10)

- Solved Refer To The Preceding Problem and Assume That Mrs NunnDocument1 pageSolved Refer To The Preceding Problem and Assume That Mrs NunnAnbu jaromiaNo ratings yet

- Advanced Tax (Acct 407) Chapter 17, 2, 3, 4, and 5Document14 pagesAdvanced Tax (Acct 407) Chapter 17, 2, 3, 4, and 5barlie3824No ratings yet

- Turkan's Balance Sheet Transactions - PDF (Annotated) .77793749.1614201946655Document2 pagesTurkan's Balance Sheet Transactions - PDF (Annotated) .77793749.1614201946655Turkan AmirovaNo ratings yet

- Problem 12Document2 pagesProblem 12Fria Mae Aycardo AbellanoNo ratings yet

- South Western Federal Taxation 2016 Individual Income Taxes 39Th Edition Hoffman Solutions Manual Full Chapter PDFDocument36 pagesSouth Western Federal Taxation 2016 Individual Income Taxes 39Th Edition Hoffman Solutions Manual Full Chapter PDFfred.henderson352100% (11)

- South-Western Federal Taxation 2016 Individual Income Taxes 39th Edition Hoffman Solutions Manual 1Document26 pagesSouth-Western Federal Taxation 2016 Individual Income Taxes 39th Edition Hoffman Solutions Manual 1alisha100% (48)

- Quiz 5 - CHAPTERS 12 13 14: Tax Drill - Refundable and Nonrefundable CreditsDocument9 pagesQuiz 5 - CHAPTERS 12 13 14: Tax Drill - Refundable and Nonrefundable CreditsJoel Christian MascariñaNo ratings yet

- Chapter+7 Part+I Before+class+notes+ PDFDocument10 pagesChapter+7 Part+I Before+class+notes+ PDFhr4hzz79kdNo ratings yet

- Case Study 1Document5 pagesCase Study 18142301001No ratings yet

- Ir 194Document15 pagesIr 194samsujNo ratings yet

- Chap 03 Double EntryDocument6 pagesChap 03 Double Entry465jgbgcvfNo ratings yet

- Solved MR and Mrs PJ Celebrated The Birth of Their ThirdDocument1 pageSolved MR and Mrs PJ Celebrated The Birth of Their ThirdAnbu jaromiaNo ratings yet

- On April 1 Flint Hills Travel Agency Inc Was EstablishedDocument1 pageOn April 1 Flint Hills Travel Agency Inc Was EstablishedM Bilal SaleemNo ratings yet

- Solution Manual For Corporate Financial Accounting 14th Edition by Warren ISBN 130565353X 9781305653535Document36 pagesSolution Manual For Corporate Financial Accounting 14th Edition by Warren ISBN 130565353X 9781305653535kevinhopkinsjqoxycnbsp100% (26)

- Beams10e Ch07 Intercompany Profit Transactions BondsDocument25 pagesBeams10e Ch07 Intercompany Profit Transactions BondsIrma RismayantiNo ratings yet

- Income Must Be Money or Convertible Into Money Nature of Trade)Document6 pagesIncome Must Be Money or Convertible Into Money Nature of Trade)HD DNo ratings yet

- BRRRR v2Document5 pagesBRRRR v2SujitKGoudarNo ratings yet

- Exam 2 QuestionsDocument17 pagesExam 2 QuestionsAntonio Salas ChavezNo ratings yet

- Eia1001 - Discussion 3 - Equation and TransactionsDocument4 pagesEia1001 - Discussion 3 - Equation and TransactionsMUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- Solution E13-22 E 13-23Document2 pagesSolution E13-22 E 13-23Ziyad Imad AyadNo ratings yet

- ACC - ACF1200 Topic 7 SOLUTIONS To Questions For Self-StudyDocument2 pagesACC - ACF1200 Topic 7 SOLUTIONS To Questions For Self-StudyChuangjia MaNo ratings yet

- Solved MR and Mrs Janus Operate A Restaurant Business As ADocument1 pageSolved MR and Mrs Janus Operate A Restaurant Business As AAnbu jaromiaNo ratings yet

- Solved On January 1 2014 Leo Paid 15 000 For 5 PercentDocument1 pageSolved On January 1 2014 Leo Paid 15 000 For 5 PercentAnbu jaromiaNo ratings yet

- Income and ExpensesDocument4 pagesIncome and ExpensesVeronica BaileyNo ratings yet

- MCQ Nov11 OlevelDocument2 pagesMCQ Nov11 OlevelAbid faisal AhmedNo ratings yet

- CH 5 Problem Session Exercise - StudentDocument5 pagesCH 5 Problem Session Exercise - StudenthannahNo ratings yet

- Case Study 1 (Assignment)Document14 pagesCase Study 1 (Assignment)AprajitaNo ratings yet

- EconometricsDocument7 pagesEconometricsmehrin.morshed1230No ratings yet

- RA 7942 (Small Scale Mining)Document2 pagesRA 7942 (Small Scale Mining)Kit ChampNo ratings yet

- Evaluating Excavation Equipment Productivity Constant For Construction ProjectDocument10 pagesEvaluating Excavation Equipment Productivity Constant For Construction Projectdhan singhNo ratings yet

- CSR Initiatives Worldwide (2008) 2. CSR Initiatives in IndiaDocument30 pagesCSR Initiatives Worldwide (2008) 2. CSR Initiatives in Indiarikitagujral100% (1)

- Human Resource Management: Cec - 5 Employee Relation and Collective BargainingDocument8 pagesHuman Resource Management: Cec - 5 Employee Relation and Collective BargainingMOHD SHARIQUE ZAMANo ratings yet

- HPC Maam ChingDocument4 pagesHPC Maam Chingmelanie concejaNo ratings yet

- DIALOG2014 FinancialDocument141 pagesDIALOG2014 FinancialFarah ismailNo ratings yet

- 637be4d838045 - DOC 20221119 WA0028.Document5 pages637be4d838045 - DOC 20221119 WA0028.Balla AhmedNo ratings yet

- Property OutlineDocument85 pagesProperty OutlineCarmen DesmondNo ratings yet

- Marketing Management: Channel Design DecisionsDocument46 pagesMarketing Management: Channel Design DecisionsMeenakshi AnilNo ratings yet

- Pas 2 Common AssignmentDocument4 pagesPas 2 Common AssignmentTimothy james PalermoNo ratings yet

- Annexure 1 Godrej & Boyce Mfg. Co. Ltd.Document1 pageAnnexure 1 Godrej & Boyce Mfg. Co. Ltd.Rajiv PhilipNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Devan ShahNo ratings yet

- Disney HRMDocument12 pagesDisney HRMOanhNo ratings yet

- Course Title: Macroeconomics I: Chapter 1 of Heijdra (2 Lectures 3 Hours)Document2 pagesCourse Title: Macroeconomics I: Chapter 1 of Heijdra (2 Lectures 3 Hours)Tanuj SinghNo ratings yet

- UNIT-II - International Parity Conditions, TheoriesDocument34 pagesUNIT-II - International Parity Conditions, TheoriesSarath kumar CNo ratings yet

- Advantages and Disadvantages of Outsourcing: Open AccessDocument3 pagesAdvantages and Disadvantages of Outsourcing: Open Accesskemedoro haderaNo ratings yet

- Case Study About EvaluationDocument10 pagesCase Study About EvaluationMary Lyn DuarteNo ratings yet

- Anylogic:: Multi-Method Simulation ModelingDocument12 pagesAnylogic:: Multi-Method Simulation ModelingPaulo Jorge MachadoNo ratings yet

- Elphinstone CollegeDocument2 pagesElphinstone CollegeNaina ShrivastavaNo ratings yet

- Labour ProductivityDocument2 pagesLabour Productivityabdul WahabNo ratings yet

- My Life History: Sub By: Junko E. Cayton, BSBA 1 Sub To: Mrs. Divina RosalesDocument7 pagesMy Life History: Sub By: Junko E. Cayton, BSBA 1 Sub To: Mrs. Divina RosalesJunko CaytonNo ratings yet

- MDSAP Audit ApproachDocument226 pagesMDSAP Audit ApproachFelipe BertolinoNo ratings yet

- Work Personality Results: Here Is The FREE Summary ofDocument6 pagesWork Personality Results: Here Is The FREE Summary ofRaskolnikovNo ratings yet

- Deepa Raj D b1826092Document72 pagesDeepa Raj D b1826092vinayNo ratings yet

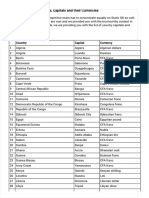

- Important List of Countries, Capitals and Their CurrenciesDocument7 pagesImportant List of Countries, Capitals and Their CurrenciesShiva KumarNo ratings yet