Professional Documents

Culture Documents

Eia1001 - Discussion 3 - Equation and Transactions

Uploaded by

MUHAMMAD ZAIM ILYASA KASIMOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eia1001 - Discussion 3 - Equation and Transactions

Uploaded by

MUHAMMAD ZAIM ILYASA KASIMCopyright:

Available Formats

DISCUSSION FOR SEMINAR 3 & 4

ANALYSING BUSINESS TRANSACTIONS

1- For each of the following events, assume the events are in order:

a) Owner invested $50,000 cash into the business.

b) Purchased $400 of supplies on account.

c) Purchased equipment for $1,600 on account.

d) Earned $1000 of revenue by performing a service for cash.

e) Received utilities bill for $500, to be paid in the following period.

f) Performed services for a customer valued at $3000 on account.

g) Paid salaries to employees of $5,000.

h) Purchased equipment for $5,000 cash.

i) Collected $1,500 from a customer on an account receivable.

i- indicate the amount by which total assets increased or decreased;

ii- indicate effect on other accounts;

iii- show journal entries and prepare a trial balance for the transactions.

2- For each of the following events, assume the events are in order:

a) Owner invested cash of $25,000 and equipment valued at $10,500 into the business.

b) Purchased $600 of supplies on account.

c) Borrowed $10,000 from the bank, issuing a note payable.

d) Performed a service for $1,500 and immediately collected the cash.

e) Paid the employee salaries of $1,200.

f) Purchased equipment for $550 cash.

g) Received monthly rent bill of $1,300, to be paid in the following period.

h) Performed a service on account for $2,300.

i. indicate the amount by which liabilities increased or decreased;

ii. indicate effect on other accounts;

iii. show journal entries and prepare a trial balance for the transactions.

3- State the effect on the accounting equation of each transaction below for Mac's

Garage and prepare a trial balance after attending to the events.

a) George McGuire invests $20,000 cash into a business known as Mac's Garage.

b) George purchases auto supplies on account for $500.

c) George purchases auto repair equipment for $6,500 cash.

d) George receives and pays the garage’s utilities bill amounting to $425.

e) Garage revenue for the current period amounts to $3,500, cash.

PRINCIPLES OF ACCOUNTING/DR HASLIDA ABU HASAN/ DISCUSSION 3/ Page 1 of 4

4. Following is a list of events for Pools Unlimited for the month of June. Show the effects of these events

on the accounting equation by completing the table below.

June 1 Owner invested $50,000 cash and equipment valued at $25,000 into the business.

3 Purchased $5,500 of equipment on account.

5 Purchased $400 of supplies for cash.

10 Bought a truck, paying $4,000 in cash and signing a note for $11,000.

14 Performed services for a customer for $1,850 cash.

15 Paid employee wages of $1,200.

18 Paid $2,000 on the equipment purchased on June 3.

24 Performed services for a customer on account, $2,500.

27 Collected $500 from the customer of June 24.

30 Owner withdrew $900 for personal use.

Date Cash A/R Supp. Equip. Truck A/P N/P Capital

June 1

3

5

10

14

15

18

24

27

30

Total

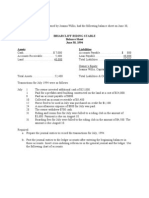

5. Unique Realtors prepared the following random list of assets, liabilities, revenues, and expenses from

their December 31, 20X7, accounting records. The beginning capital as of January 1, 19X7, was $33,200

and the owner, Quite Unique, withdrew $11,600 cash for personal use during the year.

Accounts receivable $13,600

Service revenue 45,800

Interest expense 1,400

Cash 5,200

Supplies 4,900

Note payable 15,000

Furniture 16,500

Account payable 3,500

Salary expense 18,300

Utilities expense 4,900

Interest payable 600

Rent expense 9,400

Salary payable 1,200

Automobile 13,500

Prepare a statement of owner's equity for the year ended December 31, 20X7.

PRINCIPLES OF ACCOUNTING/DR HASLIDA ABU HASAN/ DISCUSSION 3/ Page 2 of 4

PRINCIPLES OF ACCOUNTING/DR HASLIDA ABU HASAN/ DISCUSSION 3/ Page 3 of 4

PRINCIPLES OF ACCOUNTING/DR HASLIDA ABU HASAN/ DISCUSSION 3/ Page 4 of 4

You might also like

- Phonics Stage 1 PDFDocument50 pagesPhonics Stage 1 PDFMehwish Azmat83% (6)

- CH 2 ExercisesDocument4 pagesCH 2 ExercisesAnonymous Jf9PYY2E80% (1)

- MIDTERM LESSON 1 Accounting EquationDocument2 pagesMIDTERM LESSON 1 Accounting EquationJomar Villena100% (3)

- SMDM Project Report - Shubham Bakshi - 07.05.2023Document23 pagesSMDM Project Report - Shubham Bakshi - 07.05.2023Abhishek Arya0% (1)

- Accounting Assignment 04A 207Document10 pagesAccounting Assignment 04A 207Aniyah's RanticsNo ratings yet

- Analyze Financial StatementsDocument2 pagesAnalyze Financial StatementsRabie HarounNo ratings yet

- Group Work FA 1Document5 pagesGroup Work FA 1Phan Đỗ QuỳnhNo ratings yet

- Greaves Brewery Bottle Replenishment ForecastingDocument5 pagesGreaves Brewery Bottle Replenishment Forecastingshadynader50% (2)

- Data Driven Facebook Ads Checklist-Fillable-1 PDFDocument29 pagesData Driven Facebook Ads Checklist-Fillable-1 PDFSergiu Alexandru VlasceanuNo ratings yet

- Forum Discussion - Thibasri VasuDocument2 pagesForum Discussion - Thibasri VasuLokanayaki SubramaniamNo ratings yet

- Train With Bain 2 HandoutDocument7 pagesTrain With Bain 2 HandoutAnn100% (1)

- Marketing Strategy of Samsung Mobile Sector in BangladeshDocument22 pagesMarketing Strategy of Samsung Mobile Sector in BangladeshAtanu MojumderNo ratings yet

- Saudi Aramco Port and Terminal Booklet 2020 PDFDocument384 pagesSaudi Aramco Port and Terminal Booklet 2020 PDFmersail100% (1)

- An-Najah N. University Faculty of Eng. & IT (MIS Dept.) Final Assignment Principle of Accounting and Finance 17/5/2020 9 - 11 AmDocument4 pagesAn-Najah N. University Faculty of Eng. & IT (MIS Dept.) Final Assignment Principle of Accounting and Finance 17/5/2020 9 - 11 AmHiba ShalbeNo ratings yet

- Mini Golf and Driving Range TransactionsDocument4 pagesMini Golf and Driving Range TransactionsRabie HarounNo ratings yet

- FRA Class ProblemsDocument4 pagesFRA Class Problemskaisarimam96No ratings yet

- Revision 1&2Document7 pagesRevision 1&2YousefNo ratings yet

- CH 02Document4 pagesCH 02flrnciairnNo ratings yet

- CH 01Document2 pagesCH 01flrnciairnNo ratings yet

- FA Work BookDocument59 pagesFA Work BookUnais AhmedNo ratings yet

- Mr. Sam's new consulting company transactionsDocument7 pagesMr. Sam's new consulting company transactionsMoni TafechNo ratings yet

- Adjusting Entries & Adjusted Trial Balance-1 - 94Document9 pagesAdjusting Entries & Adjusted Trial Balance-1 - 94Zubair Jutt100% (1)

- Fundamental - I WorksheetDocument3 pagesFundamental - I WorksheetuuuNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Financial Accounting Week 3Document17 pagesFinancial Accounting Week 3Siva PraveenNo ratings yet

- Chapter 1 Acctg Equation JournalizingDocument4 pagesChapter 1 Acctg Equation JournalizingNicole Marie Pontay BajadeNo ratings yet

- Unity University Group Accounting AssignmentDocument2 pagesUnity University Group Accounting AssignmenttotiNo ratings yet

- ch01 PDFDocument2 pagesch01 PDFDanish BaigNo ratings yet

- COVER PAGE-final-1 tờDocument1 pageCOVER PAGE-final-1 tờquyenb2206588No ratings yet

- Accounting Analysis of TransactionsDocument14 pagesAccounting Analysis of TransactionscamilleNo ratings yet

- Assignment 1Document6 pagesAssignment 1Haider Chelsea KhanNo ratings yet

- KTQTE_BT NHÓM_HK1Document3 pagesKTQTE_BT NHÓM_HK1Dung Nguyen Tran ThanhNo ratings yet

- CHAPTER-3-Bai-tap (1)Document19 pagesCHAPTER-3-Bai-tap (1)Phuong Anh HoangNo ratings yet

- 11 Accounts Sample Paper 2Document15 pages11 Accounts Sample Paper 2Techy ParasNo ratings yet

- 13 Single Entry and Incomplete Records Additional ExercisesDocument5 pages13 Single Entry and Incomplete Records Additional ExercisesAditya Hemani100% (1)

- Accounting For Finance: Eric Cauvin Exercises 2Document6 pagesAccounting For Finance: Eric Cauvin Exercises 2ddd huangNo ratings yet

- Orie 3150 HW1 Fa17Document5 pagesOrie 3150 HW1 Fa17Carl WeinfieldNo ratings yet

- Accounting VacationDocument28 pagesAccounting VacationPro NdebeleNo ratings yet

- Fundamentals of Accounting-I WorksheetDocument7 pagesFundamentals of Accounting-I WorksheetLee HailuNo ratings yet

- Practice Final Acct 1Document12 pagesPractice Final Acct 1hannahkellum08No ratings yet

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- Chapter 4 4 4 4 4Document7 pagesChapter 4 4 4 4 4Rabie HarounNo ratings yet

- Accounting Principles Pilot TestDocument6 pagesAccounting Principles Pilot TestNguyễn Thị Ngọc AnhNo ratings yet

- 2021 - Basic Acctg ReviewDocument4 pages2021 - Basic Acctg ReviewAbegail DelacruzNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- Karthik Single EntryDocument4 pagesKarthik Single EntryAMIN BUHARI ABDUL KHADERNo ratings yet

- Accounts Paper 1 June 2001Document11 pagesAccounts Paper 1 June 2001BRANDON TINASHENo ratings yet

- Module 2 - Caragan, Adriane Ronn B. (CORRESPONDENCE)Document6 pagesModule 2 - Caragan, Adriane Ronn B. (CORRESPONDENCE)WonnNo ratings yet

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Financial Accounting 1 Final Exam QuestionsDocument4 pagesFinancial Accounting 1 Final Exam QuestionsMuhammad Abdullah SaniNo ratings yet

- Third Quiz Accounting ProcessDocument6 pagesThird Quiz Accounting Processibrahim haniNo ratings yet

- Problems For Accounting Equation: Mandy ArnoldDocument4 pagesProblems For Accounting Equation: Mandy ArnoldDipika tasfannum salamNo ratings yet

- Fundamentals of Financial AccountingDocument9 pagesFundamentals of Financial AccountingEmon EftakarNo ratings yet

- Accounting Problem SetDocument22 pagesAccounting Problem SetJill SolisNo ratings yet

- Journalizing - ExercisesDocument6 pagesJournalizing - ExercisesSophia Criciel GumatayNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- Whatever - Ciclo ContableDocument6 pagesWhatever - Ciclo ContablemillionextupNo ratings yet

- BASIC ACCOUNTING PRINCIPLESDocument28 pagesBASIC ACCOUNTING PRINCIPLEStanvir ahmedNo ratings yet

- Review QuestionsDocument9 pagesReview QuestionsGamaya EmmanuelNo ratings yet

- Final Exam Review PPTDocument14 pagesFinal Exam Review PPTJackie JacquelineNo ratings yet

- Working Paper-Chapters 1-4 Naser AbdelkarimDocument5 pagesWorking Paper-Chapters 1-4 Naser AbdelkarimHasan NajiNo ratings yet

- Chapter 4 Review QuestionsDocument11 pagesChapter 4 Review QuestionsUyenNo ratings yet

- Question BankDocument21 pagesQuestion BankIan ChanNo ratings yet

- CH6-7 Home QuizDocument5 pagesCH6-7 Home QuizAngel MenodiadoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Macro1 - Essay - Muhammad Zaim Ilyasa Bin KasimDocument2 pagesMacro1 - Essay - Muhammad Zaim Ilyasa Bin KasimMUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- Occ2-Muhammad Zaim Ilyasa Bin Kasim-22004425Document9 pagesOcc2-Muhammad Zaim Ilyasa Bin Kasim-22004425MUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- Exercise 1 SolutionDocument3 pagesExercise 1 SolutionMUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- Exercise 7 - SolutionDocument3 pagesExercise 7 - SolutionMUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- Exercise 2 - SolutionDocument4 pagesExercise 2 - SolutionMUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- Contextual Clues For Word Meanings FILL IN THE BLANKSDocument1 pageContextual Clues For Word Meanings FILL IN THE BLANKSMUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- CH06 - PPT 2Document48 pagesCH06 - PPT 2MUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- Discussion For Adjustment Entries - QuestionsDocument6 pagesDiscussion For Adjustment Entries - QuestionsMUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- Cont Assessment - Indv AssignmentDocument3 pagesCont Assessment - Indv AssignmentMUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- Bussiness Ethics Responsibility of StakeholdersDocument34 pagesBussiness Ethics Responsibility of StakeholdersNalin GuptaNo ratings yet

- OTO-25-42-00300-General ArrangemnetDocument1 pageOTO-25-42-00300-General ArrangemnetHarry Ccayascca FloresNo ratings yet

- Note On House Rent AllowanceDocument5 pagesNote On House Rent AllowanceAbhisek SarkarNo ratings yet

- Letter of Enquiry and Response EditedDocument5 pagesLetter of Enquiry and Response EditedMugdhaNo ratings yet

- Xaerus Product CatalogueDocument4 pagesXaerus Product CatalogueBurhan AdnanNo ratings yet

- Gei Portal Training Revamp d15!8!16 16Document22 pagesGei Portal Training Revamp d15!8!16 16Rahul SharmaNo ratings yet

- Swift 2017stantardsforum Tec3 SwiftgpiDocument30 pagesSwift 2017stantardsforum Tec3 SwiftgpisunetravbNo ratings yet

- TG Calling Data Excel FileDocument6 pagesTG Calling Data Excel FileVISHAL WARULENo ratings yet

- Full Download Advanced Accounting 6th Edition Jeter Test BankDocument35 pagesFull Download Advanced Accounting 6th Edition Jeter Test Bankjacksongubmor100% (40)

- S. Venkatesan: ProfileDocument2 pagesS. Venkatesan: ProfileSudu SalianNo ratings yet

- Effect of Organizational Ethics On Employee Performance in Airline Industry: A Nigerian PerspectiveDocument12 pagesEffect of Organizational Ethics On Employee Performance in Airline Industry: A Nigerian PerspectiveabbeyNo ratings yet

- Corporate Governance Models ExplainedDocument34 pagesCorporate Governance Models ExplainedAprajita Sharma0% (1)

- 2008 - APOL - APOL - Annual Report - 2008Document182 pages2008 - APOL - APOL - Annual Report - 2008Daniel ManuNo ratings yet

- Business Ethics Q4 Mod4 Introduction To The Notion of Social Enterprise-V3Document29 pagesBusiness Ethics Q4 Mod4 Introduction To The Notion of Social Enterprise-V3Charmian100% (1)

- NDBT Feb 2022Document5 pagesNDBT Feb 2022shamim0008No ratings yet

- Jurnal Analogi Hukum Prosedur Dan Akibat PKPUDocument5 pagesJurnal Analogi Hukum Prosedur Dan Akibat PKPUanindita putriNo ratings yet

- Exclusive License Dispute Over Zinc Coated Metal SheetsDocument7 pagesExclusive License Dispute Over Zinc Coated Metal SheetsChristopher ArellanoNo ratings yet

- EconDocument12 pagesEconfranz justin kyle syNo ratings yet

- Tinywow - Unit 1 Assignment 2 Exploring Businesses - 6114684Document54 pagesTinywow - Unit 1 Assignment 2 Exploring Businesses - 6114684ali MuradNo ratings yet

- Nakama Special PolvoronDocument9 pagesNakama Special PolvoronAlmayda AndrewNo ratings yet

- Final Project IhrmDocument22 pagesFinal Project IhrmPooja MuruganNo ratings yet

- Pricing Issues and Post-Transaction Issues: Chapter Learning ObjectivesDocument11 pagesPricing Issues and Post-Transaction Issues: Chapter Learning ObjectivesDINEO PRUDENCE NONGNo ratings yet