0% found this document useful (0 votes)

218 views17 pagesFinancial Accounting Week 3

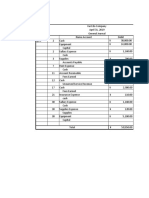

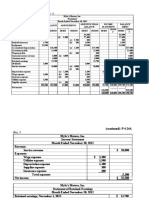

Minute Maid, a housecleaning firm, began operations on April 1, 2019. Throughout April, the company had various cash transactions including investing cash from the owner, paying rent for a van, borrowing from the bank, purchasing equipment, paying for supplies and advertisements, billing and collecting from customers, paying wages and expenses. The summary provides an overview of the company's cash flows and transactions during its first month in business.

Uploaded by

Siva PraveenCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

218 views17 pagesFinancial Accounting Week 3

Minute Maid, a housecleaning firm, began operations on April 1, 2019. Throughout April, the company had various cash transactions including investing cash from the owner, paying rent for a van, borrowing from the bank, purchasing equipment, paying for supplies and advertisements, billing and collecting from customers, paying wages and expenses. The summary provides an overview of the company's cash flows and transactions during its first month in business.

Uploaded by

Siva PraveenCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd