Professional Documents

Culture Documents

COVER PAGE-final-1 T

Uploaded by

quyenb22065880 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

COVER PAGE-final-1 tờ

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageCOVER PAGE-final-1 T

Uploaded by

quyenb2206588Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

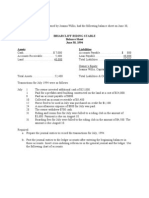

GROUP: ....... NAME: .................................................... STUDENT’S CODE:..........................

No. Debits No. Credits

101 Cash $ 4,880 154 Accumulated $ 1,500

112 Accounts receivable 3,520 201 Accounts Payable 3,400

126 Supplies 2,000 209 Unearned Service Revenue 1,400

153 Store equipment 15,000 212 Salaries Payable 500

301 J. Rand, Capital 18,600

` 25,400 24,400

During November the following summary transactions were completed

Sept. 8 Paid $1,400 for salaries due employees, of which $900 is for September.

10 Received $1,200 cash from customers on account.

12 Received $3,400 cash for services performed in November.

15 Purchased store equipment on account $3,000.

17 Purchased supplies on account $1,200.

20 Paid creditors $4,500 on account.

22 Paid November rent $500.

25 Paid salaries $1,250.

27 Performed services on account and billed customers for services provided $1,500.

29 Received $650 from customers for future service.

Adjustment data consist of:

1. Supplies on hand $1,200

2. Accrued salaries payable $400

3. Depreciation is $100 per month

4. Unearned service revenue of $1,450 is earned

Instructions

(a) Enter the September 1 balances in the ledger accounts.

(b) Joumalize the September transactions.

(c) Post to the ledger accounts. Use J1 for the posting reference. Use the following additional

accounts: No. 407 Service Revenue, No. 615 Depreciation Expense, No. 651 Supplies Expense,

No. 726 Salaries Expense, and No. 729 Rent Expense.

(d) Prepare a trial balance at September 30.

(e) Joumalize and post adjusting entries.

(t) Prepare an adjusted trial balance.

(g) Prepare an income statement and an owner's equity statement for September and a balance sheet

at September 30 on the next page.

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- At.3004-Nature and Type of Audit EvidenceDocument6 pagesAt.3004-Nature and Type of Audit EvidenceSadAccountantNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- AIQS - APC Q&A Workshop - RameshDocument16 pagesAIQS - APC Q&A Workshop - RameshDhanushka WijesekaraNo ratings yet

- CH 2 ExercisesDocument4 pagesCH 2 ExercisesAnonymous Jf9PYY2E80% (1)

- Cover PageDocument1 pageCover PagePhat NguyenNo ratings yet

- Latihan Ap1Document3 pagesLatihan Ap1debora yosikaNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Chapter 3new BOOK QuestionsDocument5 pagesChapter 3new BOOK Questionsgameppass22No ratings yet

- An-Najah N. University Faculty of Eng. & IT (MIS Dept.) Final Assignment Principle of Accounting and Finance 17/5/2020 9 - 11 AmDocument4 pagesAn-Najah N. University Faculty of Eng. & IT (MIS Dept.) Final Assignment Principle of Accounting and Finance 17/5/2020 9 - 11 AmHiba ShalbeNo ratings yet

- Problems: Set C: InstructionsDocument4 pagesProblems: Set C: InstructionsRabie HarounNo ratings yet

- Accounting Process HandoutsDocument6 pagesAccounting Process HandoutsMichael BongalontaNo ratings yet

- Chapter 4 4 4 4 4Document7 pagesChapter 4 4 4 4 4Rabie HarounNo ratings yet

- Journalizing - ExercisesDocument6 pagesJournalizing - ExercisesSophia Criciel GumatayNo ratings yet

- Acn201 (Ques) ..Assign-1Document1 pageAcn201 (Ques) ..Assign-1tafeem kamalNo ratings yet

- Arid Agriculture University, Rawalpindi: Final Exam / FALL-2020 (Paper Duration 24 Hours) To Be Filled by TeacherDocument6 pagesArid Agriculture University, Rawalpindi: Final Exam / FALL-2020 (Paper Duration 24 Hours) To Be Filled by TeachernabeelNo ratings yet

- Review Questions: Chart of AccountsDocument4 pagesReview Questions: Chart of AccountsHasan NajiNo ratings yet

- CHAPTER 3 Bai TapDocument19 pagesCHAPTER 3 Bai TapPhuong Anh HoangNo ratings yet

- Asignment Sec 2Document2 pagesAsignment Sec 2suhayb abdiNo ratings yet

- AccountingPrinciples Group08Document12 pagesAccountingPrinciples Group08Truong Ngoc Tho B2206548No ratings yet

- Accounting CycleDocument6 pagesAccounting CycleElla Acosta0% (1)

- Chapter 01 Transaction AnalysisDocument28 pagesChapter 01 Transaction Analysistanvir ahmedNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- Accounting Exercises PDFDocument7 pagesAccounting Exercises PDFMoni TafechNo ratings yet

- Make-Up AssignmentDocument5 pagesMake-Up AssignmentRileyNo ratings yet

- ACCT1100 PA1 AssignmentSolutionManual 1Document6 pagesACCT1100 PA1 AssignmentSolutionManual 1Chi IuvianamoNo ratings yet

- Fundamentals of Accounting-I WorksheetDocument7 pagesFundamentals of Accounting-I WorksheetLee HailuNo ratings yet

- Question April-2010Document51 pagesQuestion April-2010zia4000100% (1)

- Yardstick International College: Masters of Business Administration (2013)Document7 pagesYardstick International College: Masters of Business Administration (2013)Dani Azmi AwokeNo ratings yet

- Tahir Qarayev Accounting Imtahan SuallariDocument6 pagesTahir Qarayev Accounting Imtahan SuallariEli HüseynovNo ratings yet

- Accounting Assignment 04A 207Document10 pagesAccounting Assignment 04A 207Aniyah's RanticsNo ratings yet

- Tan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMDocument6 pagesTan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMvanessaNo ratings yet

- 4 6026199395324659830Document30 pages4 6026199395324659830Beka Asra100% (1)

- Eia1001 - Discussion 3 - Equation and TransactionsDocument4 pagesEia1001 - Discussion 3 - Equation and TransactionsMUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Sample Midterm Exam With SolutionDocument17 pagesSample Midterm Exam With Solutionq mNo ratings yet

- Accounting Analysis of TransactionsDocument14 pagesAccounting Analysis of TransactionscamilleNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A SolutionsDocument17 pagesChapter 4 - Complete The Accounting Cycle Practice Set A SolutionsNguyễn Minh ĐứcNo ratings yet

- CH 3Document10 pagesCH 3Mohammed mostafaNo ratings yet

- Spjimr - PGDM - 2021 - Financial Accounting and AnalysisDocument2 pagesSpjimr - PGDM - 2021 - Financial Accounting and AnalysisRishabh ChawlaNo ratings yet

- ACCT 1005 - Worksheet - 2Document12 pagesACCT 1005 - Worksheet - 2Rick SimmsNo ratings yet

- Third QuizDocument6 pagesThird Quizibrahim haniNo ratings yet

- CH 3 HomeworkDocument6 pagesCH 3 HomeworkAxel OngNo ratings yet

- Paf 3023 - Adjusting Entries Exercise SkemaDocument6 pagesPaf 3023 - Adjusting Entries Exercise SkemaLIM LEE THONGNo ratings yet

- Pilot TestDocument6 pagesPilot TestNguyễn Thị Ngọc AnhNo ratings yet

- Far ExercisesDocument34 pagesFar ExercisesTrisha Mae CorpuzNo ratings yet

- Assignment 1Document6 pagesAssignment 1Haider Chelsea KhanNo ratings yet

- PART B - SET A (Odd Groups - 1,3,5,7,9)Document4 pagesPART B - SET A (Odd Groups - 1,3,5,7,9)ngocanhhlee.11No ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- Quis Seb UASDocument5 pagesQuis Seb UASHafiz FadhlanNo ratings yet

- Chapter 2 ExercisesDocument8 pagesChapter 2 ExercisesChoco PieNo ratings yet

- Sheger College MBA Program Group Assignment For The Course Financial and Managerial AccountingDocument2 pagesSheger College MBA Program Group Assignment For The Course Financial and Managerial AccountingTiny GechNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- ACCT - Ch2 Accounting ProblemsDocument3 pagesACCT - Ch2 Accounting ProblemsshigekaNo ratings yet

- Icb 1Document9 pagesIcb 1Diana GallardoNo ratings yet

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- Ap.m-1401-Correction of ErrorsDocument12 pagesAp.m-1401-Correction of Errorsjulie anne mae mendozaNo ratings yet

- Profit Loss Account TemplateDocument4 pagesProfit Loss Account TemplatesnehaNo ratings yet

- COA - C2004 006 ReceiptsDocument5 pagesCOA - C2004 006 Receiptslou annNo ratings yet

- Completing The Cost Cycle and Accounting For Production and LossesDocument31 pagesCompleting The Cost Cycle and Accounting For Production and LossesAllysa OleaNo ratings yet

- Nfjpiar3 1718 21st-RMYC Sponsorship-LetterDocument4 pagesNfjpiar3 1718 21st-RMYC Sponsorship-LetterDarelle Hannah MarquezNo ratings yet

- Mainfreight DraftDocument5 pagesMainfreight Draft秦雪岭No ratings yet

- 1004 DDocument2 pages1004 DMohd EsmaielNo ratings yet

- Revenue Bulletin No. 01-03Document4 pagesRevenue Bulletin No. 01-03MMNo ratings yet

- Annual Report 2001-2002: Corporate GovernanceDocument2 pagesAnnual Report 2001-2002: Corporate GovernanceRaakze MoviNo ratings yet

- Assessment Task - Assignment On L2Document4 pagesAssessment Task - Assignment On L2linkin soyNo ratings yet

- UK Salary GuideDocument24 pagesUK Salary GuideForense OrlandoNo ratings yet

- RR 16-86Document2 pagesRR 16-86matinikki100% (1)

- Dipto Ready File BBA 2020Document45 pagesDipto Ready File BBA 2020Fahimul Hoque ChowdhuryNo ratings yet

- USJR JPIA Unveils Sweet Surprises For The 2nd SemesterDocument1 pageUSJR JPIA Unveils Sweet Surprises For The 2nd SemesterJess EchavezNo ratings yet

- An Internship Report On Kandel S. & Associates: by Puja Bogati Roll No: 19032387 P.U Registration No: 2018-2-03-2135Document25 pagesAn Internship Report On Kandel S. & Associates: by Puja Bogati Roll No: 19032387 P.U Registration No: 2018-2-03-2135Santosh ThapaliyaNo ratings yet

- E 09 GP 005 Contractor Health and Safety Plan AssessmentDocument9 pagesE 09 GP 005 Contractor Health and Safety Plan AssessmentJohn KalvinNo ratings yet

- How To Handle Letter of Authority To Examine Cooperatives: Rhodora Garcia-IcaranomDocument42 pagesHow To Handle Letter of Authority To Examine Cooperatives: Rhodora Garcia-IcaranomJeanette LampitocNo ratings yet

- Ccrhpwa Bye-LowDocument11 pagesCcrhpwa Bye-Lowapi-294979872No ratings yet

- Andy's Cannabis Financial StatementsDocument3 pagesAndy's Cannabis Financial Statementsnickstevens24No ratings yet

- Draft - Well Developed Planning ProcessDocument36 pagesDraft - Well Developed Planning ProcessJason UnNo ratings yet

- Prepared by Reviewed & Approved By: Signatory Designation Food Technologist Production Manager DateDocument3 pagesPrepared by Reviewed & Approved By: Signatory Designation Food Technologist Production Manager DatenasuhaNo ratings yet

- Job Order CostingDocument4 pagesJob Order CostingKaye Angelie UsogNo ratings yet

- Accounting 101Document17 pagesAccounting 101Jenne Santiago BabantoNo ratings yet

- Majid CVDocument2 pagesMajid CVMuhammadMajidSomroNo ratings yet

- PMD 913 - Module 3-A3 Cost Variance Analysis ExampleDocument2 pagesPMD 913 - Module 3-A3 Cost Variance Analysis ExampleAbdallah HabeebNo ratings yet

- Auditing NotesDocument65 pagesAuditing NotesTushar GaurNo ratings yet

- Auditor's Report Definition: 1. SimplicityDocument2 pagesAuditor's Report Definition: 1. Simplicitysameerkhan855No ratings yet

- Cover LetterDocument2 pagesCover LetterRojim OtadoyNo ratings yet

- Auditing Principles and Procedures PDFDocument580 pagesAuditing Principles and Procedures PDFRuqia KhanNo ratings yet