Professional Documents

Culture Documents

H P Cancer 27-09

Uploaded by

ABHISHEK SINGHOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

H P Cancer 27-09

Uploaded by

ABHISHEK SINGHCopyright:

Available Formats

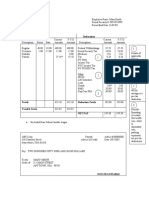

||OM SRI SHYAM DEVAY NAMAH:||

TAX INVOICE

ACECIA DRUG

RAJ-2 COMPLEX NEAR M B MOTORS |M/S H.P.CANCER HOSPITAL

BASARATPUR GORAKHPUR | GITA VATIKA GORAKHPUR Inv.No.:0000319

MOB NO;9696696977.9651049999 | State : 09 DATE : 27/09/2021

D.L.NO.GKP-2017/21B/000623 |GSTIN : 09AAATH3374C2ZU SUPPLY DATE:27/09/2021

GST:09AEQPJ5749B1Z8 |D.L.NO.DLA/67/20/2006

----------------------------------------------------------------------------------------------

HSN.|PRODUCT |PACK| QTY |FREE| RATE |GST|DISC.| AMOUNT|M.R.P | BATCH. |EXP |

----------------------------------------------------------------------------------------------

3004| 3004 SINUCAL CT |1*15| 63.0| | 124.80| 12| 0.00| 7862.40|195.00|STP-21058| 4/23|

3004| 3004 SINUCAL CT |1*15| 17.0| | 124.80| 12| 0.00| 2121.60|195.00|STP-21165| 6/23|

3004| 3004 SOLID TAB |1*4 | 50.0| | 93.44| 12| 0.00| 4672.00|146.00|210228 | 5/23|

3004| 3004 SUFATE-O SU|100M| 20.0| | 73.60| 12| 0.00| 1472.00|115.00|SP21564 | 5/23|

2106| 2106 TORVAC SOLU|200M| 50.0| | 151.25| 18| 0.00| 7562.50|250.00|MT283 | 9/22|

2106| 2106 LYCOL SOFT |1*15| 200| | 82.59| 18| 0.00|16518.00|136.50|421 |10/22|

HSN TAX% AMOUNT TAX QTY

3004 12.00 16128.00 1935.36 150

2106 18.00 24080.50 4334.50 250

GST->16128*6+6%=967.68SGST+967.68CGST,24080.5*9+9%=2167.25SGST+2167.25CGST,

------------------------------------------------------------------------------------------------

Note : |TOTAL 40208.5| ITEM

Terms @ conditions : |DEAL@DISC 0.00| 6

1.Please check exp.date before leaving our counter |ADD SGST 3134.93

2.On the assurance of the party that they have |ADD.CGST 3134.93

got their valid Drug Licence or he is R.M.P |Cr/Dr 0.00|

We are executing the indent.[SEC.18 DRUG ACT 1940] |NET AMT 46478.4|

|RND OFF 46478.0

Rs. Forty Six Thousand Four Hundred Seventy Eight Only

FOR ACECIA DRUG

OLD BAL:

Authorised signatory

Our GST Billing Software MARG Erp 9918124319,9918176444

You might also like

- CPA Exam REG - S-Corporation Taxation.Document2 pagesCPA Exam REG - S-Corporation Taxation.Manny MarroquinNo ratings yet

- Pay Stub Template 03 PDFDocument1 pagePay Stub Template 03 PDFchairgraveyardNo ratings yet

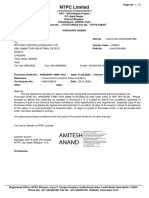

- NTPC Po - 4000236611Document10 pagesNTPC Po - 4000236611Haiti Shankar singhNo ratings yet

- OutDocument4 pagesOutramshere2003No ratings yet

- 85Document58 pages85damnrod23100% (1)

- ECLIPS - MS SSTP NmapDocument4 pagesECLIPS - MS SSTP NmapRich Arthur100% (3)

- Payslip - 2018 09 28 - ID 48027903 PDFDocument2 pagesPayslip - 2018 09 28 - ID 48027903 PDFMvans MnlstsNo ratings yet

- Payslip Balp407938201933002 PDFDocument1 pagePayslip Balp407938201933002 PDFnik omek100% (1)

- Tan Vs Del Rosario - Power of Taxation - CongressDocument2 pagesTan Vs Del Rosario - Power of Taxation - CongressprincessairellaNo ratings yet

- Wanoi General StoreDocument1 pageWanoi General Storeatifah3322No ratings yet

- Dar CementDocument1 pageDar Cementatifah3322No ratings yet

- Calcium 01Document1 pageCalcium 01Ramesh KumarNo ratings yet

- TEW210420509738RPOSDocument3 pagesTEW210420509738RPOSALI RAZANo ratings yet

- 20220707164304Document2 pages20220707164304yesid lozanoNo ratings yet

- 0310000100113329ffd - PSP (1) .RPTDocument4 pages0310000100113329ffd - PSP (1) .RPTrahulNo ratings yet

- The - Mumbai - Bazar 22Document2 pagesThe - Mumbai - Bazar 22Sanjeev RanjanNo ratings yet

- FC 101634Document1 pageFC 101634Parth BeriNo ratings yet

- 1 24012024152606Document4 pages1 24012024152606sathishrvgNo ratings yet

- Mane No 709190009Document12 pagesMane No 709190009st376213No ratings yet

- SSB 4575Document1 pageSSB 4575Ramesh KumarNo ratings yet

- January 2018Document1 pageJanuary 2018NellyUSANo ratings yet

- Ds Vtu Repeated QuestionsDocument2 pagesDs Vtu Repeated QuestionsAfreen ZohraNo ratings yet

- JioMart Invoice 16491388400103662ADocument2 pagesJioMart Invoice 16491388400103662ADobariya Poonam Dobariya PoonamNo ratings yet

- QaswaDocument1 pageQaswaatifah3322No ratings yet

- JioMart Invoice 1712767759386Document2 pagesJioMart Invoice 1712767759386Madhu ManiNo ratings yet

- DjrvphvegzDocument1 pageDjrvphvegzaadeemdNo ratings yet

- CFTC Commitments of Traders Report - CME (Futures Only) 06082013Document10 pagesCFTC Commitments of Traders Report - CME (Futures Only) 06082013Md YusofNo ratings yet

- Toy StoryDocument2 pagesToy StoryOm SharmaNo ratings yet

- Darshan TradingDocument61 pagesDarshan TradingShobha SinghNo ratings yet

- JioMart Invoice 1695448703457Document3 pagesJioMart Invoice 1695448703457praveenrajendraaNo ratings yet

- JioMart Invoice 16904277690032932ADocument2 pagesJioMart Invoice 16904277690032932AYash RathiNo ratings yet

- 582912020511776rpos PDFDocument3 pages582912020511776rpos PDFKarthik sankarNo ratings yet

- 1274 PDFDocument1 page1274 PDFAbhilashKrishnanNo ratings yet

- 1274 PDFDocument1 page1274 PDFAbhilashKrishnanNo ratings yet

- Panasonic Ac BillDocument3 pagesPanasonic Ac BillKaushik GajeraNo ratings yet

- BataClub Receipt 123455522546Document4 pagesBataClub Receipt 123455522546babupradhan452No ratings yet

- UntitledDocument2 pagesUntitledPMG Bhuswal ProjectNo ratings yet

- Igo 788 358 - Ccu@09jan2020Document70 pagesIgo 788 358 - Ccu@09jan2020Siddhartha VishwakarmaNo ratings yet

- 16971205440287977M 01Document2 pages16971205440287977M 01checkmyphone1995No ratings yet

- CFTC Commitments of Traders Report - CMX (Futures Only 21 Avril 2021)Document2 pagesCFTC Commitments of Traders Report - CMX (Futures Only 21 Avril 2021)Pirlo TottiNo ratings yet

- JioMart Invoice 1691924455801Document2 pagesJioMart Invoice 1691924455801krahul39896666No ratings yet

- Vijaya PharmacyDocument1 pageVijaya PharmacyGanesh KrishnanNo ratings yet

- NET InstalationDocument4 pagesNET Instalationtushar kastureNo ratings yet

- January 2023Document1 pageJanuary 2023biplab chowdhuryNo ratings yet

- JioMart Invoice 16622748220112317ADocument2 pagesJioMart Invoice 16622748220112317Asanjay prasadNo ratings yet

- TU6610221501274RPOSDocument2 pagesTU6610221501274RPOSArtistshweta SonkusareNo ratings yet

- JioMart Invoice 16652220730178443ADocument2 pagesJioMart Invoice 16652220730178443ASujit Kumar MallikNo ratings yet

- Naqsh Automation - VFDDocument1 pageNaqsh Automation - VFDKrishNo ratings yet

- Thq310122512710rpos 1Document3 pagesThq310122512710rpos 1TANISHQA PANDANo ratings yet

- JioMart Invoice 16885587420176684ADocument2 pagesJioMart Invoice 16885587420176684AYash RathiNo ratings yet

- Signed AL MSTC LKO 23-24 2848Document3 pagesSigned AL MSTC LKO 23-24 2848AshwaniSinghNo ratings yet

- Aggregate Turnover - 10 CRDocument2 pagesAggregate Turnover - 10 CRSpeciality GeochemNo ratings yet

- Mosquito RacquetDocument1 pageMosquito Racquetsawantarwani12No ratings yet

- 1829000400100863ffd PSP - RPTDocument9 pages1829000400100863ffd PSP - RPTASIFA FARHADNo ratings yet

- JioMart Invoice 16798974620090885ADocument2 pagesJioMart Invoice 16798974620090885AMarc GuptaNo ratings yet

- STMT 011613046000001Document13 pagesSTMT 011613046000001Srinivas ReddyNo ratings yet

- UntitledDocument1,024 pagesUntitledHarry DavisNo ratings yet

- Laptop Invoice - GujaratDocument2 pagesLaptop Invoice - GujaratTuShAr DaVENo ratings yet

- UntitledDocument3 pagesUntitledDolos HecterNo ratings yet

- 198911520507085RPOSDocument2 pages198911520507085RPOSRayani VardhanNo ratings yet

- Aggregate Turnover - 20 CRDocument2 pagesAggregate Turnover - 20 CRSpeciality GeochemNo ratings yet

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- ADIT Syllabus 2017Document70 pagesADIT Syllabus 2017hariinshrNo ratings yet

- RMC No 28-2018Document1 pageRMC No 28-2018Lom Ow TenesseeNo ratings yet

- 3 Piece Men SuitDocument1 page3 Piece Men Suitmdasifkhan2013No ratings yet

- ViewPDF Aspx PDFDocument1 pageViewPDF Aspx PDFSIBAPRASAD BHUNIANo ratings yet

- INTGR TAX 023 Donor's TaxationDocument7 pagesINTGR TAX 023 Donor's TaxationJohn Paul SiodacalNo ratings yet

- Income Taxation 2015 Edition Solman PDFDocument53 pagesIncome Taxation 2015 Edition Solman PDFPrincess AlqueroNo ratings yet

- Taxation Homework 1 PDFDocument4 pagesTaxation Homework 1 PDFKNVS Siva KumarNo ratings yet

- 2012 Taxpayer Advocate Report To Congress - Volume 1Document756 pages2012 Taxpayer Advocate Report To Congress - Volume 1Brian BergquistNo ratings yet

- Assignment Public Finance and Taxation - 2022-ExtensionDocument3 pagesAssignment Public Finance and Taxation - 2022-ExtensionMesfin YohannesNo ratings yet

- Chapter 18 Homework: Award: 10.00 PointsDocument4 pagesChapter 18 Homework: Award: 10.00 PointsBreann MorrisNo ratings yet

- Lesson 4 and 5Document7 pagesLesson 4 and 5Fatima Elsan OrillanNo ratings yet

- Inter Ca Syllabus 1Document5 pagesInter Ca Syllabus 1SamirNo ratings yet

- PayslipDocument2 pagesPayslipAbdul JabarNo ratings yet

- 0055450928Document1 page0055450928chandramouliyadavNo ratings yet

- Payslip For The Month of January 2023: CRM Services India Private LimitedDocument1 pagePayslip For The Month of January 2023: CRM Services India Private Limitednaman porwalNo ratings yet

- 132 Preet PDFDocument1 page132 Preet PDFUdhav RohiraNo ratings yet

- Steve and Beth Compton Are Married and Have One ChildDocument2 pagesSteve and Beth Compton Are Married and Have One Childtrilocksp SinghNo ratings yet

- MyGlamm Invoice 1679797507-80-1Document1 pageMyGlamm Invoice 1679797507-80-1Pragya SonkarNo ratings yet

- Desai Brothers LTD 104 20-09-2021Document1 pageDesai Brothers LTD 104 20-09-2021Pragnesh PrajapatiNo ratings yet

- Vision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Document1 pageVision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Pravin KhopadeNo ratings yet

- Telangana Budget Analysis 2022-23Document7 pagesTelangana Budget Analysis 2022-23AN NETNo ratings yet

- 0665 Your Tax Invoice Explained FlyerDocument3 pages0665 Your Tax Invoice Explained FlyerTung TruongNo ratings yet

- Education Benefits Self-Study Course: (2 Tax Law CE Hours)Document34 pagesEducation Benefits Self-Study Course: (2 Tax Law CE Hours)John MikeNo ratings yet

- DGWooo004661050000r06053073276621 2Document1 pageDGWooo004661050000r06053073276621 2Janssen PerezNo ratings yet

- ITAD BIR Ruling No. 007-16 Dated March 4, 2016 - Business ProfitsDocument11 pagesITAD BIR Ruling No. 007-16 Dated March 4, 2016 - Business ProfitsKriszanFrancoManiponNo ratings yet

- Tax Profile ExampleDocument2 pagesTax Profile ExampleZakaria AliNo ratings yet