Professional Documents

Culture Documents

FC 101634

Uploaded by

Parth BeriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FC 101634

Uploaded by

Parth BeriCopyright:

Available Formats

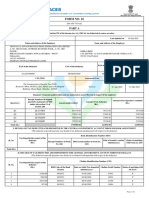

[ATSIPL^FC^101634^MAR^2022^DEFAULT2]

TECH DATA ADVANCED SOLUTIONS (INDIA) PRIVATE LIMITED TAX FORECASTING FOR MARCH 2022

TAX REGIME OPTED:OLD DOB:17/08/1972

EMPLOYEE:(101634) DHIRAJ BERI BRANCH:DELHI GENDER:M PAN:AENPB5077R DOJ:19/11/2018 DOS:08/03/2022

-------------------------------------------------------------------------------------------------------------------------------------------------

---------------------------------------------------------Actual---------------------------------------------------------|

PARTICULARS APRIL MAY JUNE JULY AUGUST SEPTEMBER OCTOBER NOVEMBER DECEMBER JANUARY FEBRUARY MARCH TOTAL

-------------------------------------------------------------------------------------------------------------------------------------------------

EARNED BASIC 38236 38236 38236 38236 38236 38236 38236 38236 38236 38236 38236 9867 430463

HOUSE RENT ALLO 19118 19118 19118 19118 19118 19118 19118 19118 19118 19118 19118 4934 215232

SPECIAL ALLOWAN 67400 67400 67400 67400 67400 67400 67400 67400 67400 67400 67400 17394 758794

MISC. EARNINGS 0 0 0 0 0 0 0 2907 0 0 0 0 2907

NOTICE PAY 0 0 0 0 0 0 0 0 0 0 0 101963 101963

EX-GRATIA 0 0 0 0 0 0 0 0 0 0 0 254909 254909

LEAVE ENCASHMEN 0 0 0 0 0 0 0 0 0 0 0 107062 107062

INCENTIVE 0 38776 146313 0 0 76200 0 0 163870 0 0 0 425159

UNCLAIM CAR ALL 0 0 0 0 0 0 0 0 0 0 0 0 0

UNCLAIM DRIVER 0 0 0 0 0 0 0 0 0 0 0 0 0

CAR REIMBURSEME 0 0 0 0 0 10800 0 0 5400 0 0 4065 20265*

DRIVER REIMBURS 0 0 0 0 0 0 0 0 8100 0 0 2032 10132*

-------------------------------------------------------------------------------------------------------------------------------------------------

TOTAL EARNING 124754 163530 271067 124754 124754 211754 124754 127661 302124 124754 124754 502226 2326886

-------------------------------------------------------------------------------------------------------------------------------------------------

P.F. 4588 4588 4588 4588 4588 4588 4588 4588 4588 4588 4588 1184 51652

INCOME TAX DEDU 8685 16750 51973 8685 8685 32459 8685 9591 59812 24696 26466 143397 399884

-------------------------------------------------------------------------------------------------------------------------------------------------

TAX CALCULATIONS NEW REGIME OLD REGIME|DEDUCTION U/S 10/17..........................|CALCULATION OF HRA REBATE......................

================ ========== ==========|HRA REBATE 172181 | RENT FROM TO

TOTAL EARNING 2326886 2326886| | 30000 01/04/2021 08/03/2022 - HRA

LESS: *REIMBURSEMENTS 30397 30397|INVESTMENTS U/S 80C..........................|

ADD : PERKS & OTHERS 0 0|PF-DED 51652 |A. HOUSE RENT ALLOWANCE 215232

TOTAL GROSS 2296489 2296489|Life Insurance Premium 13646 |B. TOTAL RENT 337742

|School Fee 77336 | LESS 10% OF BASIC SALARY (43046) 294696

LESS: DEDUCTION U/S 10/17 0 172181|TOTAL 142634 |C. 40% OF BASIC SALARY 172181

LESS: PROFESSION TAX 0 0| | HRA REBATE (LEAST OF A,B,C) 172181

LESS: STANDARD DEDUCTION 0 50000|INVESTMENTS U/S 80(OTH)......................|

NET SALARY 2296489 2074308|MEDICLAIM 28506 |

| |TAX CALCULATION ON TAXABLE INCOME....RS.1906674

LESS: HOUSING LOAN INTEREST 0 0|---------------------------------------------| 0- 250000: 250000 x 0% = 0.00

LESS: INVEST. U/S 80C 0 142634|PROOFS RECEIVED..............................| 250000- 500000: 250000 x 5% = 12500.00

LESS: INVESTMENTS U/S 80(OTH) 0 25000|Life Insurance Premium 13646 | 500000- 1000000: 500000 x 20% = 100000.00

|School Fee 77336 |1000000- 1906674: 906674 x 30% = 272002.20

TAXABLE INCOME 2296489 1906674|Mediclaim 28506 |TOTAL (Rounded) = 384503.00

|Rent 30000 |EDUCATION CESS @ 4% on 384503 = 15381.00

TOTAL TAX 443505 399884| |TOTAL TAX = 399884.00

---------------------------------------------------| |

TAX APPLIED AS PER OLD REGIME 399884 | |

---------------------------------------------------| |

LESS: TAX DEDUCTED AT SOURCE 399884 | |

| |

BALANCE TAX PAYABLE 0 | |

BALANCE NUMBER OF MONTHS 0 | |

MONTHLY TAX 0 | |

You might also like

- Mohd Naim FNF STDocument2 pagesMohd Naim FNF STMohd NaimNo ratings yet

- Rep ShowDocument1 pageRep Showprabu sNo ratings yet

- Engine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryFrom EverandEngine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryNo ratings yet

- 06005965 (8)Document1 page06005965 (8)surisam.rNo ratings yet

- 882668Document1 page882668chandan singhaniyaNo ratings yet

- 20220707164304Document2 pages20220707164304yesid lozanoNo ratings yet

- Hdfcergo Pay Slip 25297 Sep 2023Document1 pageHdfcergo Pay Slip 25297 Sep 2023bunnyakg14No ratings yet

- Hdfcergo 9920 Aug 2022 Payslip 9920Document1 pageHdfcergo 9920 Aug 2022 Payslip 9920Pramila TyagiNo ratings yet

- PFSSPL Pay Slip 50002019 Aug 2022Document1 pagePFSSPL Pay Slip 50002019 Aug 2022Satyam MishraNo ratings yet

- Hdfcergo 9920 Jan 2022 Payslip 9920Document1 pageHdfcergo 9920 Jan 2022 Payslip 9920Pramila DeviNo ratings yet

- MCL2125Document3 pagesMCL2125srinivasNo ratings yet

- ReportDocument1 pageReportPriyanka DodkeNo ratings yet

- Common Recruitment Process For RRBs (RRBs - CRP-VII) For Recruitment of Group A-Officers (Scale-II & III) TaxDocument1 pageCommon Recruitment Process For RRBs (RRBs - CRP-VII) For Recruitment of Group A-Officers (Scale-II & III) TaxAnurag SaxenaNo ratings yet

- Bajaj AllianzDocument1 pageBajaj AllianzKolkata Jyote MotorsNo ratings yet

- Rnlic Pay Slip 70648381 Oct 2023Document1 pageRnlic Pay Slip 70648381 Oct 2023Neeraj BhardwajNo ratings yet

- Payslip Feb 2022Document1 pagePayslip Feb 2022PRASHANT BANDAWARNo ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctJoshua GarrettNo ratings yet

- BalantaDocument2 pagesBalantaTania BențaNo ratings yet

- January 2023Document1 pageJanuary 2023biplab chowdhuryNo ratings yet

- Earnings Deductions: Mth./Yr Code Pay Items INS Hrs/Dy ASO Rs - P Mth./Yr Code Pay Items INS Hrs/Dy ASO Rs - PDocument1 pageEarnings Deductions: Mth./Yr Code Pay Items INS Hrs/Dy ASO Rs - P Mth./Yr Code Pay Items INS Hrs/Dy ASO Rs - PRishav JhaNo ratings yet

- Hdfcergo Pay Slip 22652 Nov 2022Document1 pageHdfcergo Pay Slip 22652 Nov 2022Rahul RampalNo ratings yet

- S 0azSgdYnY5feko3q2ZBs5 TJQ9fyV-ecQ4YUGIDocument1 pageS 0azSgdYnY5feko3q2ZBs5 TJQ9fyV-ecQ4YUGIRishav JhaNo ratings yet

- TrialDocument3 pagesTriallincoinforexandtravelNo ratings yet

- Payslip - 2018 09 28 - ID 48027903 PDFDocument2 pagesPayslip - 2018 09 28 - ID 48027903 PDFMvans MnlstsNo ratings yet

- Results 1Document2 pagesResults 1shaheenghazeerNo ratings yet

- GeneratePdftax AspxDocument2 pagesGeneratePdftax AspxShiva KumarNo ratings yet

- DGSL - PAY - SLIP - 162781 - APRIL - 2023 DDFDocument1 pageDGSL - PAY - SLIP - 162781 - APRIL - 2023 DDFVarun GunjalNo ratings yet

- ReportDocument1 pageReportAishwarya KoreNo ratings yet

- November 2016Document1 pageNovember 2016vasssssssSNo ratings yet

- DGSL - PAY - SLIP - 162781 - FEB - 2023 DDFDocument1 pageDGSL - PAY - SLIP - 162781 - FEB - 2023 DDFVarun GunjalNo ratings yet

- Item No Particulars Qty Rate Disc TaxableDocument2 pagesItem No Particulars Qty Rate Disc TaxableSrinivasa YashwanthNo ratings yet

- 85Document58 pages85damnrod23100% (1)

- Dar CementDocument1 pageDar Cementatifah3322No ratings yet

- (CaseSt1) Trial Balance PBDocument2 pages(CaseSt1) Trial Balance PBtitu patriciuNo ratings yet

- Adisoft - 2014Document22 pagesAdisoft - 2014Sridhar GandikotaNo ratings yet

- April Sathish Pay SlipDocument1 pageApril Sathish Pay Slipmsathish7428No ratings yet

- H P Cancer 27-09Document1 pageH P Cancer 27-09ABHISHEK SINGHNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument9 pages1 2 3 4 5 6 7 8 Mergedvikas guptaNo ratings yet

- Tax Cal - 2020 - 21 MalayDocument8 pagesTax Cal - 2020 - 21 MalayGaming PlazaNo ratings yet

- DAIRFLOWDocument2 pagesDAIRFLOWtkhan2001No ratings yet

- Wipro Technologies Sal Slip AprDocument1 pageWipro Technologies Sal Slip AprRohit KumarNo ratings yet

- Tabela Binomial Normal T Student Qui-QuadradoDocument7 pagesTabela Binomial Normal T Student Qui-QuadradoJORGE LUCAS PAZ DA SILVANo ratings yet

- HeatLoad Aiport Trichy - TowerDocument16 pagesHeatLoad Aiport Trichy - TowerRaja SekarNo ratings yet

- ROOPRANGFAB OutstndngDocument5 pagesROOPRANGFAB Outstndnginfo.kanhapackagingNo ratings yet

- Expences Sheet July 2016 To June 2017Document2 pagesExpences Sheet July 2016 To June 2017Abdul RaqeebNo ratings yet

- Ag PDFDocument3 pagesAg PDFAmar GuptaNo ratings yet

- Webcrche 2019Document2 pagesWebcrche 2019DANKOIRE HMNo ratings yet

- Calcium 01Document1 pageCalcium 01Ramesh KumarNo ratings yet

- ENBIL4 Dec 19Document3,239 pagesENBIL4 Dec 19galicruNo ratings yet

- 00104269 (26)Document2 pages00104269 (26)James ParkerNo ratings yet

- 202112eerDocument3 pages202112eerSSEPWIC DOINo ratings yet

- SSB 4575Document1 pageSSB 4575Ramesh KumarNo ratings yet

- Keshab Kaukhik Dutta ITDocument23 pagesKeshab Kaukhik Dutta ITAnup SahaNo ratings yet

- Pay Slip Oct 10Document1 pagePay Slip Oct 10vshet43% (7)

- Folha..: 1 SIGA /ATI305/v.12 Acumulado de Visitas de 01/06/19 A 01/06/20 DT - Ref.: 03/09/20 Hora... : 16:41:52 - Grupo de Empresa: A.T.I.BRASIL / Filial: FORTALEZA Emissão: 03/09/20Document26 pagesFolha..: 1 SIGA /ATI305/v.12 Acumulado de Visitas de 01/06/19 A 01/06/20 DT - Ref.: 03/09/20 Hora... : 16:41:52 - Grupo de Empresa: A.T.I.BRASIL / Filial: FORTALEZA Emissão: 03/09/20clecio felixNo ratings yet

- Apache Service BillDocument2 pagesApache Service Billgowthamkanagaraj123No ratings yet

- Payslip March 2023Document1 pagePayslip March 2023Abdul Khadar Jilani ShaikNo ratings yet

- BinomialDocument4 pagesBinomiallgcosta01No ratings yet

- Project ItineraryDocument1 pageProject ItineraryParth BeriNo ratings yet

- Jan Pay SlipDocument1 pageJan Pay SlipParth BeriNo ratings yet

- Offer Dhiraj Beri Delhi Regional HeadDocument2 pagesOffer Dhiraj Beri Delhi Regional HeadParth BeriNo ratings yet

- The Last Lesson WorksheetDocument1 pageThe Last Lesson WorksheetParth BeriNo ratings yet

- Nov PayslipDocument1 pageNov PayslipParth BeriNo ratings yet

- CTC TDDocument1 pageCTC TDParth BeriNo ratings yet

- New Joiner DetailsDocument7 pagesNew Joiner DetailsParth BeriNo ratings yet

- B.ST 12th 22-23Document16 pagesB.ST 12th 22-23Parth BeriNo ratings yet

- CBSE Examination Online ClassesDocument1 pageCBSE Examination Online ClassesParth BeriNo ratings yet

- Circular and Datesheet of Weekly TestDocument1 pageCircular and Datesheet of Weekly TestParth BeriNo ratings yet

- Resume Dhiraj BeriDocument4 pagesResume Dhiraj BeriParth BeriNo ratings yet

- Form 16 2020-2021Document2 pagesForm 16 2020-2021Parth BeriNo ratings yet

- Resume Dhiraj BeriDocument4 pagesResume Dhiraj BeriParth BeriNo ratings yet

- Enterprenuership 22-23 Class 12Document15 pagesEnterprenuership 22-23 Class 12Parth BeriNo ratings yet

- Principles of ManagementDocument22 pagesPrinciples of ManagementParth BeriNo ratings yet

- End Course Submission - Design Drawing Course - B.des, Divya BatraDocument43 pagesEnd Course Submission - Design Drawing Course - B.des, Divya BatraParth BeriNo ratings yet

- SR Bus Routes 1Document20 pagesSR Bus Routes 1Parth BeriNo ratings yet

- Har Ghar TirangaDocument1 pageHar Ghar TirangaParth BeriNo ratings yet

- HHWXII 202223 CommerceDocument9 pagesHHWXII 202223 CommerceParth BeriNo ratings yet

- End Course Submission - Design Drawing Course - B.des, Divya BatraDocument43 pagesEnd Course Submission - Design Drawing Course - B.des, Divya BatraParth BeriNo ratings yet

- Adobe Scan 16-Jul-2022Document1 pageAdobe Scan 16-Jul-2022Parth BeriNo ratings yet

- Datesheet IX To XII Half Yearly ExaminationDocument2 pagesDatesheet IX To XII Half Yearly ExaminationParth BeriNo ratings yet

- Retiement & DeathDocument19 pagesRetiement & DeathParth BeriNo ratings yet

- ClassXIICOMMERCE SepHYDocument3 pagesClassXIICOMMERCE SepHYParth BeriNo ratings yet

- Investing in 20sDocument3 pagesInvesting in 20sParth BeriNo ratings yet

- Furniture Catalog For IDAp ProjectsDocument13 pagesFurniture Catalog For IDAp ProjectsSheik HassanNo ratings yet

- KX072867 Invoice/Credit: Miss Margarita Pantelidou (200073769) Pooley 21I Pooley House Westfield Way London E1 4PUDocument1 pageKX072867 Invoice/Credit: Miss Margarita Pantelidou (200073769) Pooley 21I Pooley House Westfield Way London E1 4PUMarita PantelNo ratings yet

- Im ProblemsDocument6 pagesIm Problemsbushra asad khanNo ratings yet

- Employee Mileage Log Excel TemplateDocument3 pagesEmployee Mileage Log Excel TemplateRoosy RoosyNo ratings yet

- Commerical License 2022-2023Document2 pagesCommerical License 2022-2023Majdi HalikNo ratings yet

- LESSON 1.wealth CreationDocument6 pagesLESSON 1.wealth CreationGRAVES JAKENo ratings yet

- STUCO Project Planning PacketDocument13 pagesSTUCO Project Planning Packetkevin elchicoNo ratings yet

- 3 Column Cash BookDocument4 pages3 Column Cash BookMuketoi AlexNo ratings yet

- 1 Fundamentals of EconomicsDocument17 pages1 Fundamentals of EconomicsRod100% (6)

- CPWD Guest HouseDocument10 pagesCPWD Guest HouseAmit Kumar100% (1)

- Update Faculty Based Bank Written Math-2019 by Yousuf AliDocument23 pagesUpdate Faculty Based Bank Written Math-2019 by Yousuf AliAlex MoonNo ratings yet

- Cost and Management Accounting II.Document19 pagesCost and Management Accounting II.Bahar aliyiNo ratings yet

- 12 - Republic Vs MeralcoDocument1 page12 - Republic Vs MeralcoSealtiel VillarealNo ratings yet

- AccountancyDocument4 pagesAccountancyAbhijan Carter BiswasNo ratings yet

- Return On Invested Capital (ROIC)Document4 pagesReturn On Invested Capital (ROIC)VinodSinghNo ratings yet

- Introduction To Meeting PresentationDocument20 pagesIntroduction To Meeting PresentationNazmul HasanNo ratings yet

- 1.3 Vicious Circles of PovertyDocument3 pages1.3 Vicious Circles of PovertySheldon JosephNo ratings yet

- Tubes - Analisa Laporan Keuangan - M Revivo Andrea Vadsya - 1202194122 - Si4307Document8 pagesTubes - Analisa Laporan Keuangan - M Revivo Andrea Vadsya - 1202194122 - Si4307M REVIVO ANDREA VADSYANo ratings yet

- Carroll 1991 PDFDocument10 pagesCarroll 1991 PDFRahman AnshariNo ratings yet

- Practice Problem Set 2 SolutionsDocument4 pagesPractice Problem Set 2 SolutionsHemabhimanyu MaddineniNo ratings yet

- Balanced Scorecard and Performance Management in The U.S. Postal ServiceDocument24 pagesBalanced Scorecard and Performance Management in The U.S. Postal ServiceAlexandreVazVelosoNo ratings yet

- Rent Ageeement-Baccha KacchaDocument3 pagesRent Ageeement-Baccha KacchaSyed TajNo ratings yet

- Compound Interest 2Document7 pagesCompound Interest 2JORENCE PHILIPP ENCARNACIONNo ratings yet

- Global Politics, Governance, and The GlobalizationDocument21 pagesGlobal Politics, Governance, and The GlobalizationMark Anthony LegaspiNo ratings yet

- Eta Halfen Hbs 05-11-21 enDocument26 pagesEta Halfen Hbs 05-11-21 enAhmad MalekianNo ratings yet

- Open Top PE TankDocument4 pagesOpen Top PE TanklaweenceNo ratings yet

- Survey of Accounting 7th Edition Warren Solutions ManualDocument35 pagesSurvey of Accounting 7th Edition Warren Solutions Manualandrefloresxudd100% (25)

- IC3 Starter Audio ScriptDocument6 pagesIC3 Starter Audio ScriptCarola M. GonzalezNo ratings yet

- RBI Monetary Policy MrunalDocument13 pagesRBI Monetary Policy MrunalAHMAT JAVIDNo ratings yet

- Tugas 2 Pengantar Ekonomi Makro - Wati AndayaniDocument4 pagesTugas 2 Pengantar Ekonomi Makro - Wati AndayaniWati AndayaniNo ratings yet