Professional Documents

Culture Documents

Ch8 Income Statement Worksheet Answers

Uploaded by

salma RamadanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch8 Income Statement Worksheet Answers

Uploaded by

salma RamadanCopyright:

Available Formats

Cambridge IGCSE and O Level Accounting

Worksheet 3.1 answers

1 Trading section Profit and loss section

Revenue ✓

Purchases ✓

Sales returns ✓

Purchases returns ✓

Wages and salaries ✓

Rent and rates ✓

General expenses ✓

Opening inventory ✓

Closing inventory ✓

2

Tebogo

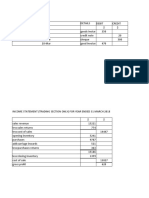

Income statement (trading section) for the year ended 31 January 20–8

$ $ $

Revenue 38 000

1

Less sales returns 1 860 36 140

Less Cost of sales

Opening inventory 2 040

Purchases 26 500

Less Purchases returns 540

25 960

Less Goods for own use 365

25 595

Carriage inwards 1 310 26 905

28 945

Less Closing inventory 1 570 27 375

Gross profit 8 765

3 Cost of sales = Opening inventory + Purchases – Closing inventory

Revenue – Cost of sales = Gross profit

Profit for the year = Gross profit – Expenses

© Cambridge University Press 2018

Cambridge IGCSE and O Level Accounting

4

Angi

Income statement for the year ended 30 April 20-6

$ $ $

Revenue 54 000

Less Sales returns 1 620 52 380

Less Cost of sales

Opening inventory 2 970

Purchases 28 500

Less Purchases returns 520

27 980

Less Goods for own use 635

27 345

Carriage inwards 1 210 28 555

31 525

Less Closing inventory 1 480 30 045

Gross profit 22 335

Less Wages 8 300

2

Rent 8 600

Motor expenses 3 125

General expenses 1 150 21 175

Profit for the year 1 160

5 Goods taken for personal use reduce the goods available for sale and

must be deducted from the purchases. These goods should not be

deducted from the closing inventory as that represents the value of

the goods in stock on that particular date.

© Cambridge University Press 2018

You might also like

- 8905 Corporate Liquidation Answers PDFDocument14 pages8905 Corporate Liquidation Answers PDFYADAO, EloisaNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Amadeus RefundsDocument10 pagesAmadeus RefundsAHMED ALRADAEENo ratings yet

- Coursebook Chapter 8 AnswersDocument4 pagesCoursebook Chapter 8 AnswersAhmed Zeeshan100% (9)

- Partnership Formation - : Individuals With NO Existing Business Formed A PartnershipDocument16 pagesPartnership Formation - : Individuals With NO Existing Business Formed A PartnershipFrancis SantosNo ratings yet

- Chap14 The Calculation & Interpretation of Accounting RatiosDocument6 pagesChap14 The Calculation & Interpretation of Accounting RatiosSaiful AliNo ratings yet

- NMIMS Sem 1 Assignment Solution April 2022 Call 9025810064Document7 pagesNMIMS Sem 1 Assignment Solution April 2022 Call 9025810064Annamalai MBA Assignment Help 2018-20190% (1)

- Business Case TemplateDocument4 pagesBusiness Case TemplatealuanuNo ratings yet

- Dominos ReportDocument20 pagesDominos Reportkuntaljariwala100% (1)

- The Trading and Profit and Loss Account Is Divided IntoDocument4 pagesThe Trading and Profit and Loss Account Is Divided IntoTaviah BrownNo ratings yet

- 2208 IS and Balance SheetDocument8 pages2208 IS and Balance SheetHAHAHANo ratings yet

- Income StatementDocument2 pagesIncome StatementClemyNo ratings yet

- MT1 Ch10Document16 pagesMT1 Ch10api-3725162No ratings yet

- Financial Statements - Part ADocument36 pagesFinancial Statements - Part AHussain AhmedNo ratings yet

- Answers To Quick Tests: Unit 3.1: Income StatementsDocument7 pagesAnswers To Quick Tests: Unit 3.1: Income StatementsJaved MushtaqNo ratings yet

- 2019 Unit 3 Outcome 2 Solution BookDocument10 pages2019 Unit 3 Outcome 2 Solution BookLachlan McFarlandNo ratings yet

- ACCT2511 Topic 2 Tutorial Solutions STUDENTDocument8 pagesACCT2511 Topic 2 Tutorial Solutions STUDENTKJSAdNo ratings yet

- Ratio AnalysisDocument11 pagesRatio AnalysisAna Marie EscoridoNo ratings yet

- NlktaDocument9 pagesNlktaYến Hoàng HảiNo ratings yet

- Accounts (Trading Profit and Loss Account)Document3 pagesAccounts (Trading Profit and Loss Account)Tianah PoloNo ratings yet

- Book 2Document2 pagesBook 2Ada heeseungNo ratings yet

- Answers To Review Questions Volume 1Document2 pagesAnswers To Review Questions Volume 1YelenochkaNo ratings yet

- The Final Accounts of Sole Trader (Financial Statements) : Topic 5Document32 pagesThe Final Accounts of Sole Trader (Financial Statements) : Topic 5vickramravi16No ratings yet

- Trading and Profit and Loss Accounts: Further ConsiderationsDocument3 pagesTrading and Profit and Loss Accounts: Further ConsiderationsCynNo ratings yet

- File 11Document1 pageFile 11Anubhav DobhalNo ratings yet

- Chapter 7 Trading and Profit and Loss Accounts For Sole Traders Q1 HadleeDocument1 pageChapter 7 Trading and Profit and Loss Accounts For Sole Traders Q1 HadleeAmyNo ratings yet

- BDFA1103Document5 pagesBDFA1103Yukie LimNo ratings yet

- Case F&B: Income StatementDocument3 pagesCase F&B: Income StatementDIPESH KUNWARNo ratings yet

- FMA AnswersDocument9 pagesFMA AnswersPriyadarshini PandaNo ratings yet

- Week 2 - One Direction SolutionDocument2 pagesWeek 2 - One Direction SolutionrahimNo ratings yet

- Teddy BearDocument3 pagesTeddy BearKrisha Joy MercadoNo ratings yet

- Individual Assignment 3 Part 2Document13 pagesIndividual Assignment 3 Part 2211124022108No ratings yet

- Goodwill CompanyDocument13 pagesGoodwill CompanyFiel Marie SateraNo ratings yet

- Kunci Jawaban ICAEW Part 2Document4 pagesKunci Jawaban ICAEW Part 2Dendi RiskiNo ratings yet

- FABM2 - QuizDocument4 pagesFABM2 - QuizlabayanjoshuaNo ratings yet

- Merchant Center Income Statement For The Year Ended, DECEMBER 31, 2018Document7 pagesMerchant Center Income Statement For The Year Ended, DECEMBER 31, 2018Melissa RaboNo ratings yet

- CJL TPL Lessons 2022Document3 pagesCJL TPL Lessons 2022Kerine Williams FigaroNo ratings yet

- Topic 2 - Assets, Equities and LiabilitiesDocument29 pagesTopic 2 - Assets, Equities and Liabilitiesahmadamsyar083No ratings yet

- Financial Statements Year Ended December 31, 20X5: ABC CompanyDocument11 pagesFinancial Statements Year Ended December 31, 20X5: ABC CompanysaraNo ratings yet

- Saleem Provided Following Trial Balance On December 31, 2015Document17 pagesSaleem Provided Following Trial Balance On December 31, 2015S Jawad Ul HasanNo ratings yet

- Fact Sheet - Financial Statements For Sole TradersDocument5 pagesFact Sheet - Financial Statements For Sole TradersTeresa ManNo ratings yet

- End Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying AbilityDocument4 pagesEnd Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying Abilityawaischeema100% (1)

- Financial Ratios Activity Answer KeyDocument8 pagesFinancial Ratios Activity Answer KeyMarienell YuNo ratings yet

- Management Accounting - I: - Dr. Sandeep GoelDocument109 pagesManagement Accounting - I: - Dr. Sandeep GoelRajat Jawa100% (1)

- RUE Hread TD: Ompany AckgroundDocument3 pagesRUE Hread TD: Ompany AckgroundAthulya SanthoshNo ratings yet

- The Profit and Loss AccountDocument19 pagesThe Profit and Loss AccountDenmark SantosNo ratings yet

- MT1 Ch08Document5 pagesMT1 Ch08api-3725162No ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- Financial Statements SolutionsDocument6 pagesFinancial Statements SolutionsSyed HaseebNo ratings yet

- Financial Statement ExerciseDocument7 pagesFinancial Statement ExerciseĐạt PhạmNo ratings yet

- BLD 416 Budgeting and Financial Control 1 Lecture Note 2Document9 pagesBLD 416 Budgeting and Financial Control 1 Lecture Note 2Oluwayomi MalomoNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive IncomeVeronica BaileyNo ratings yet

- Financial Statements Handout - SADocument12 pagesFinancial Statements Handout - SAShafiulFahim100% (1)

- Accounting Exercise Chap 13Document10 pagesAccounting Exercise Chap 13Zi Yan HoonNo ratings yet

- 2) Integrating Statements PDFDocument8 pages2) Integrating Statements PDFAkshit SoniNo ratings yet

- 01a Financial Statements - Income Statement - ch14pr01 - SoluDocument2 pages01a Financial Statements - Income Statement - ch14pr01 - SolumalvikatanejaNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1Puteri Noor SyahiraNo ratings yet

- MMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsDocument7 pagesMMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsSerena100% (1)

- Financial StatementDocument3 pagesFinancial StatementrosemaeannmalinaoNo ratings yet

- MARCH 2020 AnswerDocument16 pagesMARCH 2020 AnswerXianFa WongNo ratings yet

- L.O.V.E: Can You Feel OurDocument23 pagesL.O.V.E: Can You Feel OurshahidjappaNo ratings yet

- DocumentDocument3 pagesDocumentPhantom LancerNo ratings yet

- 3 FINANCIAL STATEMENT - FinalDocument3 pages3 FINANCIAL STATEMENT - FinalAaliyah Joize LegaspiNo ratings yet

- 2019 Mid-Semester Mock Exam SolutionDocument11 pages2019 Mid-Semester Mock Exam SolutionMichael BobNo ratings yet

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- Annual Financial Statements 2020 WebDocument42 pagesAnnual Financial Statements 2020 WebNiyati TiwariNo ratings yet

- 9.2 Investment in AssociateDocument6 pages9.2 Investment in AssociateJorufel PapasinNo ratings yet

- PI Industries 20 05 2023 MotiDocument12 pagesPI Industries 20 05 2023 MotiAbhishek Dutt IntolerantNo ratings yet

- Partnership and Non-For-Profit OrganisationsDocument4 pagesPartnership and Non-For-Profit OrganisationsJoshi DrcpNo ratings yet

- FRS 10Document14 pagesFRS 10Sara JunioNo ratings yet

- MTP I AnswersDocument16 pagesMTP I AnswersEediko ConsultingNo ratings yet

- Equity Valuation Methods - Types - Balance Sheet, DCF, Earnings MultiplierDocument1 pageEquity Valuation Methods - Types - Balance Sheet, DCF, Earnings MultiplierSandeep SinghNo ratings yet

- Shreeji Kosh Overseas Pte. Ltd. FS 31 March 23Document19 pagesShreeji Kosh Overseas Pte. Ltd. FS 31 March 23primestuff09No ratings yet

- Presentation Financial Analysis MMBDocument88 pagesPresentation Financial Analysis MMBSamir Raihan ChowdhuryNo ratings yet

- Integprac1 Quiz 1Document2 pagesIntegprac1 Quiz 1AMARO, BABY LIZ ANDESNo ratings yet

- At 1 January 2020Document6 pagesAt 1 January 2020Carl Yry BitzNo ratings yet

- NCPAR Sample Review QuestionsDocument7 pagesNCPAR Sample Review QuestionsJonathan Tumamao FernandezNo ratings yet

- Cost of CapitalDocument2 pagesCost of CapitalShota ChenebresNo ratings yet

- Accounting-Standards 8490251 PowerpointDocument10 pagesAccounting-Standards 8490251 PowerpointArsénio Leonardo MataNo ratings yet

- Financial Accounting 09 PDFDocument48 pagesFinancial Accounting 09 PDFGoutham BaskerNo ratings yet

- Kasneb June ResultsDocument980 pagesKasneb June Resultskenlics50% (4)

- 1Document3 pages1Stook01701No ratings yet

- Case Study 2013Document2 pagesCase Study 2013weichieh1986No ratings yet

- C13 Gitman Leverage and CapitalDocument53 pagesC13 Gitman Leverage and CapitalPhước Nguyễn100% (1)

- BUS020 Chapter 1 (Outline - Libby Libby)Document5 pagesBUS020 Chapter 1 (Outline - Libby Libby)Amanda RodriguezNo ratings yet

- Company Analysis Report (Raymond)Document33 pagesCompany Analysis Report (Raymond)balaji bysani100% (2)

- Form FIN - 1: Historical Financial PerformanceDocument1 pageForm FIN - 1: Historical Financial PerformanceRameshNo ratings yet

- Home Assignment Ch.1Document6 pagesHome Assignment Ch.1Sausan SaniaNo ratings yet

- AFM Course Outline PDFDocument4 pagesAFM Course Outline PDFPrateek saxenaNo ratings yet

- QV Answer Key PDFDocument6 pagesQV Answer Key PDFKyla DizonNo ratings yet