Professional Documents

Culture Documents

New Microsoft Word Document

Uploaded by

R N MishraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Microsoft Word Document

Uploaded by

R N MishraCopyright:

Available Formats

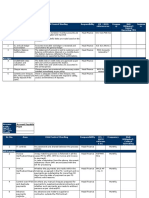

i Co-ordination, planning and overall management of the audit circle. ii.

To monitor maintenance of

Registered person’s master files and iii. To approve the desk review and audit plan, in respect of all the

small units, after ensuring that all the steps have been completed and forward a copy to JC/ ADC for

review. iv. To interact with registered persons at the time of audit in order to share major audit findings and

compliance issues. v. To approve and issue draft audit reports before placing the same in MCM meeting.

vi. As in-charge of Circle, to attend MCM and to represent the Circle in case of all DARs taken up for

discussion during MCM. vii. To issue final audit reports after approval in the MCM meeting. viii. To issue

show cause notices falling under his purview as per monetary limits fixed by CBIC from time to time both

under Section 73 and 74 of CGST Act. ix. To ensure timely preparation and forwarding of DSCNs along-

with relevant documents to the Audit Commissionerate, which are falling within the monetary limits for

SCN and adjudication by ADC/JC.

Audit plan in respect of Tiwari Warehousing Company Pvt. Ltd. (GSTIN-

19AADCT3802F1ZJ), has been submitted by the auditors of Group- 26. As per the letter of

allotment, the taxpayer belongs to Large Category. The audit will be conducted for the period

from 2017-18 to 2021-22[ 05 Years].

The desk review was done on the basis of examination of Annual Financial Statements

(Balance Sheet and Profit and Loss Accounts), and returns filed by the assesse from time to

time. Scrutiny of returns, genuineness of classification & valuation, verification of place of

supply, scrutiny of reverse charges, Risk parameters & verification of Non -GST/Zero

rated/Exempted Supplies have been incorporated in the audit plan. The auditors will examine

the risk parameters in detail and mention the actions taken by them in this regard in the audit

report.

ITC Ledger, Credit/Debit Note Ledger, Sales/Purchase Invoice, Bank Statements

to be verified with Returns and Annual Reports/ITR. Risk Parameter/Flags have been

identified by the Group.

Audit Plan (ANNEXURE-GSTAM-VII) along with Working Papers (ANNEXURE-

GSTAM-VIII) and Annexure-A are placed at Draft Tab/TOC for kind perusal and

approval please.

You might also like

- Compliance Checklist - PlantDocument36 pagesCompliance Checklist - Plantsaji kumarNo ratings yet

- CA Inter Audit Question BankDocument315 pagesCA Inter Audit Question BankKhushi SoniNo ratings yet

- Settlement of Audit ObjectionsDocument32 pagesSettlement of Audit ObjectionsFaizan Ch67% (6)

- Audit Manual CSDDocument74 pagesAudit Manual CSDdotpolkaNo ratings yet

- Audit Mannual - PPT FinalDocument25 pagesAudit Mannual - PPT FinalitelsindiaNo ratings yet

- Audit - Addl Ques-36-39Document4 pagesAudit - Addl Ques-36-39Dheeraj VermaNo ratings yet

- 55067bos44235p6 Iipc ADocument10 pages55067bos44235p6 Iipc AAshutosh KumarNo ratings yet

- Audit ManualDocument10 pagesAudit ManualSusan PascualNo ratings yet

- CA Inter Paper 6 Compiler 8-8-22Document316 pagesCA Inter Paper 6 Compiler 8-8-22KaviyaNo ratings yet

- Auditing Notes by Rehan Farhat ISA 300Document21 pagesAuditing Notes by Rehan Farhat ISA 300Omar SiddiquiNo ratings yet

- Terms of Reference Audit of Project Financial Statements (Project Name) I. BackgroundDocument5 pagesTerms of Reference Audit of Project Financial Statements (Project Name) I. BackgroundAbdullahi YusufNo ratings yet

- Inter-Paper-6-RTPs, MTPs and Past PapersDocument149 pagesInter-Paper-6-RTPs, MTPs and Past Paperssixipa1033No ratings yet

- Terms of Reference (TOR) : Bangladesh Standards On Auditing (BSA)Document28 pagesTerms of Reference (TOR) : Bangladesh Standards On Auditing (BSA)ronynoorNo ratings yet

- Audit of Debtors Loans and AdvancesDocument17 pagesAudit of Debtors Loans and Advanceseequals mcsquaredNo ratings yet

- National Thermal Power Corporation LimitedDocument74 pagesNational Thermal Power Corporation LimitedSamNo ratings yet

- Screenshot 2023-09-12 at 7.48.02 PMDocument149 pagesScreenshot 2023-09-12 at 7.48.02 PMDisha JainNo ratings yet

- EL Tax Audit Form 3CB IndividualDocument10 pagesEL Tax Audit Form 3CB IndividualNAYAN PATELNo ratings yet

- CGRE Asynchronous Assignment - 11Document5 pagesCGRE Asynchronous Assignment - 11Treesa JogiNo ratings yet

- Branch Auditor's Report: Raman Manoj& CoDocument25 pagesBranch Auditor's Report: Raman Manoj& CoDon bhaiNo ratings yet

- Greater Male WTE ADBDocument15 pagesGreater Male WTE ADBTamara RachimNo ratings yet

- G N A L: Uidance Ote On Udit of IabilitiesDocument22 pagesG N A L: Uidance Ote On Udit of IabilitiesPaula MerrilesNo ratings yet

- AARS Solution Class Test 1 FinalDocument3 pagesAARS Solution Class Test 1 FinalWaseim KhanNo ratings yet

- A Hand Book On Statutory Bank Branch Audit - Rajkumar S. AdukiaDocument6 pagesA Hand Book On Statutory Bank Branch Audit - Rajkumar S. AdukiaCA Lokesh MaheshwariNo ratings yet

- I Audit Objectives: Finance & Risk ManagementDocument9 pagesI Audit Objectives: Finance & Risk ManagementChinh Le DinhNo ratings yet

- GN 23Document17 pagesGN 23Uddeshya KumarNo ratings yet

- Advanced Auditing and Professional Ethics-3 ADocument26 pagesAdvanced Auditing and Professional Ethics-3 ACAtestseriesNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaAlok TiwariNo ratings yet

- Final Set A SolutionsDocument8 pagesFinal Set A SolutionsAARCHI JAINNo ratings yet

- Audit Procedure Rap / IapDocument53 pagesAudit Procedure Rap / IapBeing HumaneNo ratings yet

- At at 1st Preboard Oct08Document12 pagesAt at 1st Preboard Oct08Czarina CasallaNo ratings yet

- Accept Affects The Sample Size Required. The Lower The Risk The Auditor Is Willing To Accept, The Greater The Sample Size Will Need To BeDocument11 pagesAccept Affects The Sample Size Required. The Lower The Risk The Auditor Is Willing To Accept, The Greater The Sample Size Will Need To BeGao YungNo ratings yet

- October 2008Document17 pagesOctober 2008Deex AgueronNo ratings yet

- Taxguru - In-Checklist For Statutory Audit of Bank Branch Audit An OverviewDocument8 pagesTaxguru - In-Checklist For Statutory Audit of Bank Branch Audit An OverviewBhavani GirineniNo ratings yet

- Audit GKJDocument24 pagesAudit GKJtutuaman603No ratings yet

- Suggested Solution Mock Exam With Marking Scheme and Source of QDocument18 pagesSuggested Solution Mock Exam With Marking Scheme and Source of QHuma BashirNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument10 pages© The Institute of Chartered Accountants of IndiaSanjay SahuNo ratings yet

- Instruction Circular No.: 2608 Department Running No.: 351Document4 pagesInstruction Circular No.: 2608 Department Running No.: 351sanjog patnaikNo ratings yet

- Paper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Document15 pagesPaper - 3: Advanced Auditing and Professional Ethics: (5 Marks)ritz meshNo ratings yet

- Paper 6 Ipcc Auditing and Assurance Solution Nov 2015Document13 pagesPaper 6 Ipcc Auditing and Assurance Solution Nov 2015ßãbÿ Ðøll ßəʌʋtɣ QʋɘɘŋNo ratings yet

- Chapter 20 - Answer PDFDocument10 pagesChapter 20 - Answer PDFjhienellNo ratings yet

- Class Notes 6-8Document11 pagesClass Notes 6-8Omnia HassanNo ratings yet

- SAI-LGAS MDLSGDDocument6 pagesSAI-LGAS MDLSGDlovellev.ev3No ratings yet

- Extracted Chapter 1Document103 pagesExtracted Chapter 1PalisthaNo ratings yet

- Loreto Executive Summary 2014Document5 pagesLoreto Executive Summary 2014Justine CastilloNo ratings yet

- 06-DFA2022 Part1-Auditor's ReportDocument5 pages06-DFA2022 Part1-Auditor's ReportjoevincentgrisolaNo ratings yet

- Audit ProgrammeDocument12 pagesAudit ProgrammeCA Nagendranadh TadikondaNo ratings yet

- Audit Nov 20Document18 pagesAudit Nov 20ritz meshNo ratings yet

- Settlement of Audit ObjectionsDocument32 pagesSettlement of Audit ObjectionsMillat AfridiNo ratings yet

- 57060aasb46101 8Document20 pages57060aasb46101 8Wubneh AlemuNo ratings yet

- Terms of Reference (TOR) : Bangladesh Standards On Auditing (BSA)Document28 pagesTerms of Reference (TOR) : Bangladesh Standards On Auditing (BSA)Shohel RanaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument11 pages© The Institute of Chartered Accountants of IndiaGJ ELASHREEVALLINo ratings yet

- CA Final Audit A MTP 2 Nov23 Castudynotes ComDocument10 pagesCA Final Audit A MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- CA Inter Audit Q MTP 1 May 23Document7 pagesCA Inter Audit Q MTP 1 May 23Drake DDNo ratings yet

- Published MaharastraDocument4 pagesPublished MaharastraCA Nagendranadh TadikondaNo ratings yet

- Alegria Executive Summary 2019Document6 pagesAlegria Executive Summary 2019Ronel CadelinoNo ratings yet

- 26 Final Notes Surbhi BansalDocument148 pages26 Final Notes Surbhi Bansalav_meshramNo ratings yet

- Part 2 - 456Document5 pagesPart 2 - 456Nguyễn Hương QuỳnhNo ratings yet

- Audit Report Template Final Pub 70121 Clean - 0Document19 pagesAudit Report Template Final Pub 70121 Clean - 0Bhavana CMNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet