Professional Documents

Culture Documents

Harrison Fa11ege Inppt 03

Uploaded by

beyzakeklik0 ratings0% found this document useful (0 votes)

5 views56 pagesOriginal Title

harrison_fa11ege_inppt_03

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views56 pagesHarrison Fa11ege Inppt 03

Uploaded by

beyzakeklikCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 56

Financial Accounting

Eleventh Edition

Global Edition

Chapter 3

Accrual

Accounting

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objectives

3.1 Explain how accrual accounting differs from cash-basis

accounting

3.2 Apply the revenue and expense recognition principles

3.3 Adjust the accounts

3.4 Prepare updated financial statements

3.5 Close the books

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objective 3.1

Explain how accrual accounting differs from cash-basis

accounting

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Explain How Accrual Accounting Differs

From Cash-Basis Accounting (1 of 4)

Accrual Accounting

• Records impact of transactions when they occur

• Records:

– Income when earned

– Expenses when incurred

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Explain How Accrual Accounting Differs

From Cash-Basis Accounting (2 of 4)

Cash-Basis Accounting

• Records only cash transactions

– Cash receipts

– Cash payments

• Fails to capture the underlying economic phenomenon

• Results in incomplete financial statements

• Only used by businesses that do not follow accounting

standards

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Explain How Accrual Accounting Differs

From Cash-Basis Accounting (3 of 4)

• Accrual accounting records cash transactions, such as:

– Collecting cash from customers

– Receiving cash from interest earned

– Paying salaries, rent, and other expenses

– Borrowing money

– Paying off loans

– Issuing shares

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Explain How Accrual Accounting Differs

From Cash-Basis Accounting (4 of 4)

• The Time-Period Concept

– Accounting information is reported at regular intervals

– Basic accounting period is one year

– Companies also prepare financial statements for interim

periods

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objective 3.2

Apply the revenue and expense recognition principles

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Apply the Revenue and Expense

Recognition Principles (1 of 4)

The Revenue Principle

• Deals with two issues:

– When to record (recognize) revenue

– What amount of revenue to record

Revenue is recognized when:

– risks and rewards of ownership of the goods has transferred to

the buyer

– the entity retains neither continuing managerial involvement

usually associated with ownership nor effective control over

goods sold

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Apply the Revenue and Expense

Recognition Principles (2 of 4)

The Revenue Principle

Revenue is recognized when:

– the amount of revenue can be measured reliably

– it is probable that the economic benefits associated with the

transaction will flow to the entity

– the costs incurred or to be incurred in respect of the transaction

can be measured reliably

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Apply the Revenue and Expense

Recognition Principles (3 of 4)

The Expense Recognition Principle

• Includes two steps:

– Identify all expenses incurred during the period

– Measure the expenses and recognize them in the

same period in which any related revenues are earned

• To recognize an expense along with related revenues

means to subtract expenses from related revenues to

compute net income or net loss.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Apply the Revenue and Expense

Recognition Principles (4 of 4)

The Matching Concept explains the relationship between

expenses and revenues

Includes two steps:

– Identify all expenses incurred during the period

– Measure the expenses and recognize them in the

same period in which any related income is earned

• The change in assets and liabilities determines profit or

loss, not the application of a matching concept.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-2 The Matching Concept

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objective 3.3

Adjust the accounts

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-3 Unadjusted Trial Balance

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Categories of Adjusting Entries

• Deferrals

– An adjustment for payment of an item or receipt of cash

in advance.

• Accruals

– The opposite of a deferral.

• Depreciation

– Allocates the cost of Property, Plant and Equipment

(PPE) to expense over the asset’s useful life.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Adjust the Accounts (1 of 6)

Prepaid Expenses

An expense paid in advance. Prepaid expenses are assets

because they provide a future benefit for the owner.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Prepaid Expenses (1 of 4)

Prepaid Rent: Suppose RedLotus’ Travel Inc., prepays three

months’ store rent ($3,000) on June 1.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Prepaid Expenses (2 of 4)

Prepaid Rent. Throughout June, Prepaid Rent carries the balance

of $3,000. At June 30, an adjusting entry is required to transfer

$1,000 ($3,000 ÷ 3) from Prepaid Rent to Rent Expense.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Prepaid Expenses (3 of 4)

Supplies. On June 2, RedLotus paid cash of $700 for cleaning

supplies.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Prepaid Expenses (4 of 4)

Supplies. A count at June 30 indicates that $400 of supplies

remain on hand.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Adjust the Accounts (2 of 6)

Unearned Service Revenue

• Receipt of cash before earning the revenue creates a

liability

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Unearned Service Revenue (1 of 2)

Suppose another hotel chain engages RedLotus Travel, paying

them commissions in advance to make 10 bookings within 30

days. Assume RedLotus collects $400 on June 15.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Unearned Service Revenue (2 of 2)

During the last 15 days of the month, RedLotus books five clients

into the hotel to earn ½ of the $400.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Adjust the Accounts (3 of 6)

Accrued Expenses

• A liability that arises from an expense that has not yet been

paid

• Not recorded daily or weekly, but rather at the end of the

period as an adjusting entry

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Accrued Expenses (1 of 4)

Accrued Salary Expense. Suppose RedLotus Travel, Inc. pays

its employee a monthly salary of $1,800, half on the 15th and half

on the last day of the month. The following calendar for June has

the paydays circled:

Assume that if a payday falls on a Sunday, RedLotus’ pays the

employee on the following Monday.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Accrued Expenses (1 of 3)

During June, RedLotus Travel paid its employee the first half-

month salary of $900.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Accrued Expenses (2 of 3)

The second half-month amount of $900 will be paid on Monday,

July 1. At June 30, therefore, RedLotus Travel makes the

adjusting entry.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Adjust the Accounts (4 of 6)

Accrued Revenues

• A revenue that has been earned but not yet collected.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Accrued Revenues (3 of 3)

Assume that on June 15 a hotel agrees to pay RedLotus a

commission of $30 per booking into its hotel over the next 30

days. RedLotus books 10 clients in June and earns $300, for work

done in June.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-4 Prepaid and Accrual

Adjustments

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Adjust the Accounts (5 of 6)

Depreciation of Property, Plant and Equipment

• Plant assets are long-lived tangible assets, such as land,

buildings, furniture, and equipment.

• Depreciation is the process of allocating cost to expense

for a long-term plant asset.

– Decline in usefulness

– Spread the cost of the plant asset over its useful life

– Exception: Land – does not decline in usefulness

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Depreciation of Plant Assets (1 of 4)

Equipment. Suppose that on June 2 RedLotus purchased

equipment on account for $24,000

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Depreciation of Plant Assets (2 of 4)

Straight-line depreciation method:

• Divide cost of the asset by its useful life

• RedLotus Travel Inc. Equipment:

Cost: $24,000

Useful life: 5 years

24,000

Annual depreciation = year = 4,800 per year

5

4,800

Monthly depreciation = months = 400 per year

12

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Depreciation of Plant Assets (3 of 4)

Depreciation expense for June is recorded as follows:

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Depreciation of Plant Assets (4 of 4)

Accumulated Depreciation

• Shows the sum of all depreciation expense

• The balance increases over the asset’s life

• Contra asset account, a normal credit balance.

• A contra account has two distinguishing characteristics:

– Always has a companion account

– Normal balance is opposite that of the companion

account

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-4 Plant Assets on the

Balance Sheet of Alladin Travel

Book Value: Cost of the plant asset minus accumulated

depreciation

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Income Tax Accrual

RedLotus Travel, Inc. would make an additional adjusting

entry to accrue income tax expense of $600 and the related

income tax payable as the final adjusting entry of the period.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Summary of the Adjusting Process

• Two purposes of the adjusting process are to

– measure income, and

– update the balance sheet.

• Therefore, every adjusting entry affects both of the

following:

– Revenue or expense—to measure income

– Asset or liability—to update the balance sheet

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-7 Summary of Adjusting

Entries

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-8 The Adjusting Process of

RedLotus Travel, Inc. (1 of 2)

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-8 The Adjusting Process of

RedLotus Travel, Inc. (2 of 2)

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Adjust the Accounts (6 of 6)

The Adjusted Trial Balance

Summarizes all accounts and their final balances after all

adjusting entries have been journalized and posted

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-9 Adjusted Trial Balance

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objective 3.4

Prepare updated financial statements

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Construct the Financial Statements

The June financial statements of RedLotus Travel, Inc. can

be prepared from the adjusted trial balance.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-10 Income Statement

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-11 Statement of Changes in

Equity

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-12 Balance Sheet

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objective 3.5

Close the books

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Close the Books (1 of 3)

• Prepares the accounts for the next period

• Close temporary accounts: accounts related to a limited

period of time

– Income

– Expenses

– Dividends

• Do NOT close permanent accounts

– Assets

– Liabilities

– Shareholders’ equity

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Close the Books (2 of 3)

Steps to close the books:

1. Debit each income for the amount of its credit balance.

Credit Retained Earnings for the sum of all revenues.

2. Credit each expense account for the amount of its debit

balance. Debit Retained Earnings for the sum of all

expenses.

3. Credit the Dividends account for the amount of its debit

balance. Debit Retained Earnings for the same amount.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-13 Journalizing and Posting

the Closing Entries (1 of 2)

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 3-13 Journalizing and Posting

the Closing Entries (2 of 2)

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Close the Books (3 of 3)

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

You might also like

- Lecture 3 PDFDocument64 pagesLecture 3 PDFRachel TamNo ratings yet

- The Adjusting ProcessDocument69 pagesThe Adjusting ProcessDonnie SalazarNo ratings yet

- 03 The Adjusting ProcessDocument68 pages03 The Adjusting Processalice paronNo ratings yet

- Chapter 2 PPT (To Students)Document64 pagesChapter 2 PPT (To Students)歩美桜井No ratings yet

- Financial Accounting: Recording Business TransactionsDocument64 pagesFinancial Accounting: Recording Business Transactionsirma makharoblidzeNo ratings yet

- Financial Accounting: Cash FlowsDocument61 pagesFinancial Accounting: Cash FlowsMaggie ShekNo ratings yet

- Financial Accounting: Cash FlowsDocument69 pagesFinancial Accounting: Cash FlowsRachel TamNo ratings yet

- Chapter 3Document50 pagesChapter 3Galata NugusaNo ratings yet

- Financial Accounting: Conceptual FrameworkDocument50 pagesFinancial Accounting: Conceptual Frameworkirma makharoblidzeNo ratings yet

- Financial Accounting: LiabilitiesDocument90 pagesFinancial Accounting: Liabilitiesirma makharoblidzeNo ratings yet

- Fa PPT CH 3 - 7eDocument69 pagesFa PPT CH 3 - 7eMaria GomezNo ratings yet

- Chapter 7Document49 pagesChapter 7Dr. Menna KadryNo ratings yet

- Nobles Finmgr6 PPT 04 RevisedDocument64 pagesNobles Finmgr6 PPT 04 RevisedzezegallyNo ratings yet

- 1.business EnviironmentDocument48 pages1.business EnviironmentAbdelmajid JamaneNo ratings yet

- Financial Accounting: LiabilitiesDocument46 pagesFinancial Accounting: LiabilitiesRachel TamNo ratings yet

- Financial Accounting: PPE and IntangiblesDocument49 pagesFinancial Accounting: PPE and IntangiblesMalak RabieNo ratings yet

- Hhfa10 ch03 Student PPTDocument91 pagesHhfa10 ch03 Student PPTnoblevermaNo ratings yet

- Chapter 5 PPT (To Students)Document48 pagesChapter 5 PPT (To Students)Heidi ChanNo ratings yet

- The Adjusting Process: © 2016 Pearson Education, LTDDocument53 pagesThe Adjusting Process: © 2016 Pearson Education, LTDEce BarlasNo ratings yet

- Goals and Governance of The Corporation Goals and Governance of The Corporation Accounting and FinanceDocument32 pagesGoals and Governance of The Corporation Goals and Governance of The Corporation Accounting and FinanceAbdullah BugshanNo ratings yet

- Time Value of Money 2Document77 pagesTime Value of Money 2ChinChiaYuanNo ratings yet

- The Adjusting Process: Income MeasurementDocument9 pagesThe Adjusting Process: Income MeasurementJerhoNo ratings yet

- CH 03Document60 pagesCH 03Dr. Murad SalehNo ratings yet

- Day-6 Cash FlowsDocument47 pagesDay-6 Cash FlowsRajsri RaajarrathinamNo ratings yet

- Lecture 4 PDFDocument60 pagesLecture 4 PDFRachel TamNo ratings yet

- Murphy ContemporaryLogistics 12e PPT Ch03Document33 pagesMurphy ContemporaryLogistics 12e PPT Ch03Ege GoksuzogluNo ratings yet

- Topic 3 Accounting For ManagersDocument47 pagesTopic 3 Accounting For ManagersJack BlackNo ratings yet

- Lesson 2 Adjusting The Accounts Service TypeDocument33 pagesLesson 2 Adjusting The Accounts Service TypeSofia Naraine OnilongoNo ratings yet

- Fa Unit 3Document11 pagesFa Unit 3VTNo ratings yet

- Financial Accounting: Internal Control, Cash, and ReceivablesDocument70 pagesFinancial Accounting: Internal Control, Cash, and ReceivablesRachel TamNo ratings yet

- Financial Accounting: Inventory and Merchandising OperationsDocument62 pagesFinancial Accounting: Inventory and Merchandising OperationsRachel TamNo ratings yet

- Chapter2 Recording+Business+Transactions 2022Document24 pagesChapter2 Recording+Business+Transactions 2022gjemiljesyla1No ratings yet

- Financial Accounting - Information For Decisions - Session 5 - Chapter 7 PPT gFWXdxUqrsDocument55 pagesFinancial Accounting - Information For Decisions - Session 5 - Chapter 7 PPT gFWXdxUqrsmukul3087_305865623No ratings yet

- Financial Reporting: Othm Level 5 Diploma in Accounting and BusinessDocument33 pagesFinancial Reporting: Othm Level 5 Diploma in Accounting and BusinessDime PierrowNo ratings yet

- Titman - PPT - CH06Document77 pagesTitman - PPT - CH06Shubham KhuranaNo ratings yet

- IFRS 2, Share-Based Payment - DipIFR - Students - ACCA - ACCA GlobalDocument8 pagesIFRS 2, Share-Based Payment - DipIFR - Students - ACCA - ACCA Globalvivsubs18No ratings yet

- Cash Flow and Financial PlanningDocument64 pagesCash Flow and Financial PlanningAmjad J AliNo ratings yet

- CHP 1 Slides - Financial Accounting 27eDocument62 pagesCHP 1 Slides - Financial Accounting 27eWaliyahNo ratings yet

- Advanced Accounting: Business CombinationsDocument43 pagesAdvanced Accounting: Business CombinationsSin TungNo ratings yet

- Adjusting EntriesDocument69 pagesAdjusting EntriesMadia Mujib100% (1)

- Financial Accounting: 1-1 ReservedDocument51 pagesFinancial Accounting: 1-1 ReservedOsiris HernandezNo ratings yet

- Task 3Document7 pagesTask 3Yashmi BhanderiNo ratings yet

- Adjusting EntriesDocument4 pagesAdjusting EntriesNoj WerdnaNo ratings yet

- Chapter 4 PPT (To Students)Document43 pagesChapter 4 PPT (To Students)歩美桜井No ratings yet

- The Adjusting ProcessDocument51 pagesThe Adjusting ProcessM.Sobhan KasaeiNo ratings yet

- Session 1Document37 pagesSession 1vidyadhar16No ratings yet

- Financial Management:: Stock ValuationDocument57 pagesFinancial Management:: Stock ValuationSarah SaluquenNo ratings yet

- Part 4 AdjustingDocument31 pagesPart 4 AdjustingDONALD GUTIERREZNo ratings yet

- Adjusting Entries Chapter $Document56 pagesAdjusting Entries Chapter $Arzan AliNo ratings yet

- Unit IVDocument148 pagesUnit IVanilakash442No ratings yet

- Full Download Financial Managerial Accounting 6th Edition Horngren Solutions ManualDocument35 pagesFull Download Financial Managerial Accounting 6th Edition Horngren Solutions Manualezranewood100% (27)

- Recognition of Share-Based Payment Equity Settled Transactions Performance Conditions Cash Settled Transactions Deferred Tax Implications DisclosureDocument4 pagesRecognition of Share-Based Payment Equity Settled Transactions Performance Conditions Cash Settled Transactions Deferred Tax Implications Disclosureyung kenNo ratings yet

- Chapter 2 - Measuring Income To Assess PerformanceDocument4 pagesChapter 2 - Measuring Income To Assess PerformanceArmanNo ratings yet

- Bovee Bia8 Inppt 17Document40 pagesBovee Bia8 Inppt 17Usman AliAsifNo ratings yet

- Power Point For Dividend PolicyDocument51 pagesPower Point For Dividend PolicyAnonymous DStKlFbQ1B100% (1)

- 07.2022 Real Estate Finance and Economics For Appraisers HandoutDocument23 pages07.2022 Real Estate Finance and Economics For Appraisers HandoutJohnny Castillo SerapionNo ratings yet

- Financial Management AssignmentDocument53 pagesFinancial Management Assignmentmuleta100% (1)

- Chapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlDocument42 pagesChapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlAbel100% (1)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Efficient Diversification: Bodie, Kane, and Marcus Eleventh EditionDocument39 pagesEfficient Diversification: Bodie, Kane, and Marcus Eleventh Editionirma makharoblidzeNo ratings yet

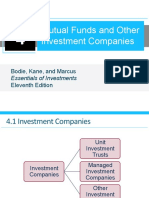

- Mutual Funds and Other Investment Companies: Bodie, Kane, and Marcus Eleventh EditionDocument23 pagesMutual Funds and Other Investment Companies: Bodie, Kane, and Marcus Eleventh Editionirma makharoblidzeNo ratings yet

- 279 - Fin Management 8 NPV and InvestmentDocument17 pages279 - Fin Management 8 NPV and Investmentirma makharoblidzeNo ratings yet

- 5.1 Rates of Return: Holding-Period Return (HPR)Document31 pages5.1 Rates of Return: Holding-Period Return (HPR)irma makharoblidzeNo ratings yet

- Accounts Receivable and Inventory ManagementDocument54 pagesAccounts Receivable and Inventory Managementirma makharoblidzeNo ratings yet

- 137 - Avoidance of Double TaxationDocument7 pages137 - Avoidance of Double Taxationirma makharoblidzeNo ratings yet

- 137 - Gatt, Gats, TripsDocument6 pages137 - Gatt, Gats, Tripsirma makharoblidze100% (1)

- 150 Harrison FAIFRS11e Inppt 04Document43 pages150 Harrison FAIFRS11e Inppt 04irma makharoblidzeNo ratings yet

- Financial Accounting: Conceptual FrameworkDocument50 pagesFinancial Accounting: Conceptual Frameworkirma makharoblidzeNo ratings yet

- Treaty of GiorgievskDocument1 pageTreaty of Giorgievskirma makharoblidzeNo ratings yet

- Financial Accounting: LiabilitiesDocument90 pagesFinancial Accounting: Liabilitiesirma makharoblidzeNo ratings yet

- Financial Accounting: Internal Control, Cash, and ReceivablesDocument75 pagesFinancial Accounting: Internal Control, Cash, and Receivablesirma makharoblidzeNo ratings yet

- 150 Harrison FAIFRS11e Inppt 04Document43 pages150 Harrison FAIFRS11e Inppt 04irma makharoblidzeNo ratings yet

- Daftar Kalibrasi Peralatan MedisDocument34 pagesDaftar Kalibrasi Peralatan Medisdiklat rssnNo ratings yet

- Pipes On DeckDocument34 pagesPipes On DeckNataly Janataly100% (1)

- Ch08 Project SchedulingDocument51 pagesCh08 Project SchedulingTimothy Jones100% (1)

- BF2207 Exercise 6 - Dorchester LimitedDocument2 pagesBF2207 Exercise 6 - Dorchester LimitedEvelyn TeoNo ratings yet

- Balanced Scorecard Approach ReportDocument8 pagesBalanced Scorecard Approach ReportGeryes E. Haddad100% (1)

- Winter 2016 QP3 Spreadsheet QuestionDocument2 pagesWinter 2016 QP3 Spreadsheet Questioneegeekeek eieoieeNo ratings yet

- Cold Rolled CoilDocument23 pagesCold Rolled Coilmametcool100% (1)

- Ebook Principles of Corporate Finance PDF Full Chapter PDFDocument67 pagesEbook Principles of Corporate Finance PDF Full Chapter PDFmichelle.haas303100% (28)

- Argumentative E-WPS OfficeDocument6 pagesArgumentative E-WPS OfficeoneNo ratings yet

- Corality ModelOff Sample Answer Hard TimesDocument81 pagesCorality ModelOff Sample Answer Hard TimesserpepeNo ratings yet

- Autodesk Inventor Practice Part DrawingsDocument25 pagesAutodesk Inventor Practice Part DrawingsCiprian Fratila100% (1)

- Test Help StatDocument18 pagesTest Help Statthenderson22603No ratings yet

- Vocabulary List Year 6 Unit 10Document2 pagesVocabulary List Year 6 Unit 10Nyat Heng NhkNo ratings yet

- Muscovy DucksDocument27 pagesMuscovy DucksStephenNo ratings yet

- The Passport: Gate Valve TYPE: "SCH 160"Document25 pagesThe Passport: Gate Valve TYPE: "SCH 160"CE CERTIFICATENo ratings yet

- Session 2 - 01 (Energy Efficiency Potential Assessment of Chandrapura TPS, DVC)Document52 pagesSession 2 - 01 (Energy Efficiency Potential Assessment of Chandrapura TPS, DVC)pkumarNo ratings yet

- Technical Schedule World BankDocument249 pagesTechnical Schedule World BankPramod ShastryNo ratings yet

- ACCA P5 GTG Question Bank - 2011Document180 pagesACCA P5 GTG Question Bank - 2011raqifiluz86% (22)

- Woman Magazine Who Was Changing Jobs To Be The Editor Of: Family Circle AdweekDocument11 pagesWoman Magazine Who Was Changing Jobs To Be The Editor Of: Family Circle AdweekManish RanaNo ratings yet

- Talk - Data Quality FrameworkDocument30 pagesTalk - Data Quality FrameworkMatthew LawlerNo ratings yet

- 2 SpecificationDocument20 pages2 Specificationprithvi614710No ratings yet

- Arti ResearchDocument10 pagesArti Researcharti nongbetNo ratings yet

- Robert Plank's Super SixDocument35 pagesRobert Plank's Super SixkoyworkzNo ratings yet

- PSA Technology-More Than A Hydrogen Purifier: TOBIAS KELLER and GOUTAM SHAHANI, Linde EngineeringDocument2 pagesPSA Technology-More Than A Hydrogen Purifier: TOBIAS KELLER and GOUTAM SHAHANI, Linde EngineeringChem.EnggNo ratings yet

- Vandex CrystallineDocument12 pagesVandex CrystallineJoseph ChenNo ratings yet

- Standard Operating Procedure Template - Single PageDocument1 pageStandard Operating Procedure Template - Single PagetesNo ratings yet

- PF2579EN00EMDocument2 pagesPF2579EN00EMVinoth KumarNo ratings yet

- L - HRF22B0301 - Hose & Pulley Block (ZM, METRIC)Document5 pagesL - HRF22B0301 - Hose & Pulley Block (ZM, METRIC)Gustavo RodriguezNo ratings yet

- Daily Activities List - TCF3 (Safety Aramco) : Work Description Date LocationDocument2 pagesDaily Activities List - TCF3 (Safety Aramco) : Work Description Date LocationSheri DiĺlNo ratings yet

- Bonus 6 - Mastering ASP - NET Core SecurityDocument147 pagesBonus 6 - Mastering ASP - NET Core SecurityDark Shadow100% (1)