Professional Documents

Culture Documents

Assignment 2 Derivatives

Uploaded by

Mariam Mhamoud0 ratings0% found this document useful (0 votes)

2 views19 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views19 pagesAssignment 2 Derivatives

Uploaded by

Mariam MhamoudCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 19

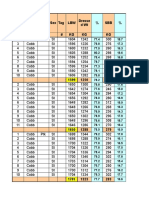

Selected call options

Code Name Category

1 N23 Gold 22-Feb-18 920 Call Options

2 N24 Gold 22-Feb-18 925 Call Options

3 N25 Gold 22-Feb-18 930 Call Options

4 N26 Gold 22-Feb-18 940 Call Options

5 N27 Gold 22-Feb-18 950 Call Options

6 N28 Gold 22-Feb-18 955 Call Options

7 N34 Copper 25-Jan-18 307 Call Options

8 N35 Copper 25-Jan-18 308 Call Options

9 N39 Copper 25-Jan-18 312 Call Options

10 N37 Copper 25-Jan-18 310 Call Options

11 N38 Copper 25-Jan-18 311 Call Options

12 N294 Silver 25-Jan-18 2725 Put Options

13 N295 Silver 25-Jan-18 2750 Put Options

14 N296 Silver 25-Jan-18 2775 Put Options

15 N297 Silver 22-Feb-18 2325 Put Options

16 N298 Silver 22-Feb-18 2350 Put Options

17 N402 Henry Hub Natural Gas (European) 23-Feb-18 10 Put Options

18 N403 Henry Hub Natural Gas (European) 23-Feb-18 10.25 Put Options

19 N404 Henry Hub Natural Gas (European) 23-Feb-18 10.5 Put Options

20 N405 Henry Hub Natural Gas (European) 23-Feb-18 10.75 Put Options

21 N406 Henry Hub Natural Gas (European) 23-Feb-18 11 Put Options

22 N407 Henry Hub Natural Gas (European) 23-Feb-18 11.25 Put Options

Exchange Option Type Underlying series EXERCISE PRICE

New York Mercantile Exchange (NYMEX) Call CMX-GOLD 100 OZ CONTINUOUS 919

New York Mercantile Exchange (NYMEX) Call CMX-GOLD 100 OZ CONTINUOUS 924

New York Mercantile Exchange (NYMEX) Call CMX-GOLD 100 OZ CONTINUOUS 929

New York Mercantile Exchange (NYMEX) Call CMX-GOLD 100 OZ CONTINUOUS 939

New York Mercantile Exchange (NYMEX) Call CMX-GOLD 100 OZ CONTINUOUS 949

New York Mercantile Exchange (NYMEX) Call CMX-GOLD 100 OZ CONTINUOUS 954

New York Mercantile Exchange (NYMEX) Call CMX-HIGH GRADE COPPER CONT. 306

New York Mercantile Exchange (NYMEX) Call CMX-HIGH GRADE COPPER CONT. 307

New York Mercantile Exchange (NYMEX) Call CMX-HIGH GRADE COPPER CONT. 311

New York Mercantile Exchange (NYMEX) Call CMX-HIGH GRADE COPPER CONT. 309

New York Mercantile Exchange (NYMEX) Call CMX-HIGH GRADE COPPER CONT. 310

New York Mercantile Exchange (NYMEX) Put CMX-SILVER 5000 OZ CONTINUOUS 2724

New York Mercantile Exchange (NYMEX) Put CMX-SILVER 5000 OZ CONTINUOUS 2749

New York Mercantile Exchange (NYMEX) Put CMX-SILVER 5000 OZ CONTINUOUS 2774

New York Mercantile Exchange (NYMEX) Put CMX-SILVER 5000 OZ CONTINUOUS 2324

New York Mercantile Exchange (NYMEX) Put CMX-SILVER 5000 OZ CONTINUOUS 2349

New York Mercantile Exchange (NYMEX) Put NYM-NATURAL GAS CONTINUOUS 9

New York Mercantile Exchange (NYMEX) Put NYM-NATURAL GAS CONTINUOUS 9.25

New York Mercantile Exchange (NYMEX) Put NYM-NATURAL GAS CONTINUOUS 9.5

New York Mercantile Exchange (NYMEX) Put NYM-NATURAL GAS CONTINUOUS 9.75

New York Mercantile Exchange (NYMEX) Put NYM-NATURAL GAS CONTINUOUS 10

New York Mercantile Exchange (NYMEX) Put NYM-NATURAL GAS CONTINUOUS 10.25

Hypothesized Option price 3-Jul 4-Jul 5-Jul 6-Jul 7-Jul

358 1219.2 1219.2 1221.7 1223.3 1209.7

354 1219.2 1219.2 1221.7 1223.3 1209.7

349 1219.2 1219.2 1221.7 1223.3 1209.7

338 1219.2 1219.2 1221.7 1223.3 1209.7

344 1219.2 1219.2 1221.7 1223.3 1209.7

328 1219.2 1219.2 1221.7 1223.3 1209.7

19 268.65 268.65 265.4 265.55 264.15

19 268.65 268.65 265.4 265.55 264.15

16 268.65 268.65 265.4 265.55 264.15

14 268.65 268.65 265.4 265.55 264.15

17 268.65 268.65 265.4 265.55 264.15

1022 1604 1604 1584.2 1592.7 1537.1

1048 1604 1604 1584.2 1592.7 1537.1

1073 1604 1604 1584.2 1592.7 1537.1

624 1604 1604 1584.2 1592.7 1537.1

648 1604 1604 1584.2 1592.7 1537.1

12 2.95 2.95 2.84 2.89 2.86

12 2.95 2.95 2.84 2.89 2.86

13 2.95 2.95 2.84 2.89 2.86

13 2.95 2.95 2.84 2.89 2.86

13 2.95 2.95 2.84 2.89 2.86

13 2.95 2.95 2.84 2.89 2.86

10-Jul 11-Jul 12-Jul 13-Jul 14-Jul 17-Jul 18-Jul

1213.2 1214.7 1219.1 1217.3 1227.5 1233.7 1241.9

1213.2 1214.7 1219.1 1217.3 1227.5 1233.7 1241.9

1213.2 1214.7 1219.1 1217.3 1227.5 1233.7 1241.9

1213.2 1214.7 1219.1 1217.3 1227.5 1233.7 1241.9

1213.2 1214.7 1219.1 1217.3 1227.5 1233.7 1241.9

1213.2 1214.7 1219.1 1217.3 1227.5 1233.7 1241.9

264.25 266.7 267.95 265.7 268.65 271.95 272.55

264.25 266.7 267.95 265.7 268.65 271.95 272.55

264.25 266.7 267.95 265.7 268.65 271.95 272.55

264.25 266.7 267.95 265.7 268.65 271.95 272.55

264.25 266.7 267.95 265.7 268.65 271.95 272.55

1557.7 1571.7 1585.9 1565.7 1589.9 1606.5 1623.7

1557.7 1571.7 1585.9 1565.7 1589.9 1606.5 1623.7

1557.7 1571.7 1585.9 1565.7 1589.9 1606.5 1623.7

1557.7 1571.7 1585.9 1565.7 1589.9 1606.5 1623.7

1557.7 1571.7 1585.9 1565.7 1589.9 1606.5 1623.7

2.93 3.05 2.98 2.96 2.98 3.02 3.09

2.93 3.05 2.98 2.96 2.98 3.02 3.09

2.93 3.05 2.98 2.96 2.98 3.02 3.09

2.93 3.05 2.98 2.96 2.98 3.02 3.09

2.93 3.05 2.98 2.96 2.98 3.02 3.09

2.93 3.05 2.98 2.96 2.98 3.02 3.09

19-Jul 20-Jul 21-Jul 24-Jul 25-Jul 26-Jul 27-Jul

1242 1245.5 1254.9 1254.3 1252.1 1249.4 1260

1242 1245.5 1254.9 1254.3 1252.1 1249.4 1260

1242 1245.5 1254.9 1254.3 1252.1 1249.4 1260

1242 1245.5 1254.9 1254.3 1252.1 1249.4 1260

1242 1245.5 1254.9 1254.3 1252.1 1249.4 1260

1242 1245.5 1254.9 1254.3 1252.1 1249.4 1260

270.6 271.15 271.8 273.15 284.25 286.95 287.4

270.6 271.15 271.8 273.15 284.25 286.95 287.4

270.6 271.15 271.8 273.15 284.25 286.95 287.4

270.6 271.15 271.8 273.15 284.25 286.95 287.4

270.6 271.15 271.8 273.15 284.25 286.95 287.4

1626.6 1631.4 1642.5 1641.1 1651 1642.8 1654.2

1626.6 1631.4 1642.5 1641.1 1651 1642.8 1654.2

1626.6 1631.4 1642.5 1641.1 1651 1642.8 1654.2

1626.6 1631.4 1642.5 1641.1 1651 1642.8 1654.2

1626.6 1631.4 1642.5 1641.1 1651 1642.8 1654.2

3.07 3.04 2.97 2.9 2.94 2.92 2.97

3.07 3.04 2.97 2.9 2.94 2.92 2.97

3.07 3.04 2.97 2.9 2.94 2.92 2.97

3.07 3.04 2.97 2.9 2.94 2.92 2.97

3.07 3.04 2.97 2.9 2.94 2.92 2.97

3.07 3.04 2.97 2.9 2.94 2.92 2.97

28-Jul 31-Jul 1-Aug 2-Aug 3-Aug 4-Aug 7-Aug

1268.4 1266.6 1275.2 1274.2 1270.2 1260.2 1260.2

1268.4 1266.6 1275.2 1274.2 1270.2 1260.2 1260.2

1268.4 1266.6 1275.2 1274.2 1270.2 1260.2 1260.2

1268.4 1266.6 1275.2 1274.2 1270.2 1260.2 1260.2

1268.4 1266.6 1275.2 1274.2 1270.2 1260.2 1260.2

1268.4 1266.6 1275.2 1274.2 1270.2 1260.2 1260.2

287.05 288.8 288.1 288.45 287.8 288.5 290.7

287.05 288.8 288.1 288.45 287.8 288.5 290.7

287.05 288.8 288.1 288.45 287.8 288.5 290.7

287.05 288.8 288.1 288.45 287.8 288.5 290.7

287.05 288.8 288.1 288.45 287.8 288.5 290.7

1666.4 1675 1676.4 1673.3 1663 1625.2 1625.1

1666.4 1675 1676.4 1673.3 1663 1625.2 1625.1

1666.4 1675 1676.4 1673.3 1663 1625.2 1625.1

1666.4 1675 1676.4 1673.3 1663 1625.2 1625.1

1666.4 1675 1676.4 1673.3 1663 1625.2 1625.1

2.94 2.79 2.82 2.81 2.8 2.77 2.8

2.94 2.79 2.82 2.81 2.8 2.77 2.8

2.94 2.79 2.82 2.81 2.8 2.77 2.8

2.94 2.79 2.82 2.81 2.8 2.77 2.8

2.94 2.79 2.82 2.81 2.8 2.77 2.8

2.94 2.79 2.82 2.81 2.8 2.77 2.8

8-Aug 9-Aug 10-Aug 11-Aug 14-Aug 15-Aug 16-Aug

1257.9 1274.6 1285.1 1289 1285.3 1274.7 1277.9

1257.9 1274.6 1285.1 1289 1285.3 1274.7 1277.9

1257.9 1274.6 1285.1 1289 1285.3 1274.7 1277.9

1257.9 1274.6 1285.1 1289 1285.3 1274.7 1277.9

1257.9 1274.6 1285.1 1289 1285.3 1274.7 1277.9

1257.9 1274.6 1285.1 1289 1285.3 1274.7 1277.9

294.25 292.7 290.3 291.2 290.45 288.3 295.35

294.25 292.7 290.3 291.2 290.45 288.3 295.35

294.25 292.7 290.3 291.2 290.45 288.3 295.35

294.25 292.7 290.3 291.2 290.45 288.3 295.35

294.25 292.7 290.3 291.2 290.45 288.3 295.35

1638.9 1686.3 1706.5 1707 1712.2 1671.4 1694

1638.9 1686.3 1706.5 1707 1712.2 1671.4 1694

1638.9 1686.3 1706.5 1707 1712.2 1671.4 1694

1638.9 1686.3 1706.5 1707 1712.2 1671.4 1694

1638.9 1686.3 1706.5 1707 1712.2 1671.4 1694

2.82 2.88 2.98 2.98 2.96 2.93 2.89

2.82 2.88 2.98 2.98 2.96 2.93 2.89

2.82 2.88 2.98 2.98 2.96 2.93 2.89

2.82 2.88 2.98 2.98 2.96 2.93 2.89

2.82 2.88 2.98 2.98 2.96 2.93 2.89

2.82 2.88 2.98 2.98 2.96 2.93 2.89

17-Aug 18-Aug 21-Aug 22-Aug 23-Aug 24-Aug 25-Aug

1287.3 1286.5 1291.5 1285.6 1289 1286.5 1292.6

1287.3 1286.5 1291.5 1285.6 1289 1286.5 1292.6

1287.3 1286.5 1291.5 1285.6 1289 1286.5 1292.6

1287.3 1286.5 1291.5 1285.6 1289 1286.5 1292.6

1287.3 1286.5 1291.5 1285.6 1289 1286.5 1292.6

1287.3 1286.5 1291.5 1285.6 1289 1286.5 1292.6

293.8 293.95 298.05 298.7 298.05 303.4 303

293.8 293.95 298.05 298.7 298.05 303.4 303

293.8 293.95 298.05 298.7 298.05 303.4 303

293.8 293.95 298.05 298.7 298.05 303.4 303

293.8 293.95 298.05 298.7 298.05 303.4 303

1705.3 1700 1701.5 1698.2 1704.6 1696.3 1705

1705.3 1700 1701.5 1698.2 1704.6 1696.3 1705

1705.3 1700 1701.5 1698.2 1704.6 1696.3 1705

1705.3 1700 1701.5 1698.2 1704.6 1696.3 1705

1705.3 1700 1701.5 1698.2 1704.6 1696.3 1705

2.93 2.89 2.96 2.94 2.93 2.95 2.89

2.93 2.89 2.96 2.94 2.93 2.95 2.89

2.93 2.89 2.96 2.94 2.93 2.95 2.89

2.93 2.89 2.96 2.94 2.93 2.95 2.89

2.93 2.89 2.96 2.94 2.93 2.95 2.89

2.93 2.89 2.96 2.94 2.93 2.95 2.89

28-Aug 29-Aug 30-Aug 31-Aug In the money or out of money

1309.8 1313.1 1308.1 1316.2 In the money

1309.8 1313.1 1308.1 1316.2 In the money

1309.8 1313.1 1308.1 1316.2 In the money

1309.8 1313.1 1308.1 1316.2 In the money

1309.8 1313.1 1308.1 1316.2 In the money

1309.8 1313.1 1308.1 1316.2 In the money

306.58 308 306 308 In the money

306.58 308 306 308 In the money

306.58 308 306 308 Out of money

306.58 308 306 308 Out of money

306.58 308 306 308 Out of money

1744 1743 1740 1748 In the money

1744 1743 1740 1748 In the money

1744 1743 1740 1748 In the money

1744 1743 1740 1748 In the money

1744 1743 1740 1748 In the money

2.92 2.96 2.94 3.04 In the money

2.92 2.96 2.94 3.04 In the money

2.92 2.96 2.94 3.04 In the money

2.92 2.96 2.94 3.04 In the money

2.92 2.96 2.94 3.04 In the money

2.92 2.96 2.94 3.04 In the money

Payoff long position Payoff short positionExcercise (Long position)

397.2 -397.2 Excercise

392.2 -392.2 Excercise

387.2 -387.2 Excercise

377.2 -377.2 Excercise

367.2 -367.2 Excercise

362.2 -362.2 Excercise

2 -2 Excercise

1 -1 Excercise

0 0 Not Excercise

0 0 Not Excercise

0 0 Not Excercise

976 -976 Excercise

1001 -1001 Excercise

1026 -1026 Excercise

576 -576 Excercise

601 -601 Excercise

5.96 -5.96 Excercise

6.21 -6.21 Excercise

6.46 -6.46 Excercise

6.71 -6.71 Excercise

6.96 -6.96 Excercise

7.21 -7.21 Excercise

Selected call options

Code Name Category

1 N23 Gold 22-Feb-18 920 Call Options

2 N24 Gold 22-Feb-18 925 Call Options

3 N25 Gold 22-Feb-18 930 Call Options

4 N26 Gold 22-Feb-18 940 Call Options

5 N27 Gold 22-Feb-18 950 Call Options

6 N28 Gold 22-Feb-18 955 Call Options

7 N34 Copper 25-Jan-18 307 Call Options

8 N35 Copper 25-Jan-18 308 Call Options

9 N39 Copper 25-Jan-18 312 Call Options

10 N37 Copper 25-Jan-18 310 Call Options

11 N38 Copper 25-Jan-18 311 Call Options

12 N294 Silver 25-Jan-18 2725 Put Options

13 N295 Silver 25-Jan-18 2750 Put Options

14 N296 Silver 25-Jan-18 2775 Put Options

15 N297 Silver 22-Feb-18 2325 Put Options

16 N298 Silver 22-Feb-18 2350 Put Options

17 N402 Henry Hub Natural Gas (European) 23-Feb-18 10 Put Options

18 N403 Henry Hub Natural Gas (European) 23-Feb-18 10.25 Put Options

19 N404 Henry Hub Natural Gas (European) 23-Feb-18 10.5 Put Options

20 N405 Henry Hub Natural Gas (European) 23-Feb-18 10.75 Put Options

21 N406 Henry Hub Natural Gas (European) 23-Feb-18 11 Put Options

22 N407 Henry Hub Natural Gas (European) 23-Feb-18 11.25 Put Options

Exchange Option Type Underlying seriesEXERCISE PRICEHypothesized Option price 3-Jul

New York Mercantile Exchange (NYMEX)

Call

CMX-GOLD 100 OZ CONTINUOUS 919 358 1219.2

New York Mercantile Exchange (NYMEX)

Call

CMX-GOLD 100 OZ CONTINUOUS 924 354 1219.2

New York Mercantile Exchange (NYMEX)

Call

CMX-GOLD 100 OZ CONTINUOUS 929 349 1219.2

New York Mercantile Exchange (NYMEX)

Call

CMX-GOLD 100 OZ CONTINUOUS 939 338 1219.2

New York Mercantile Exchange (NYMEX)

Call

CMX-GOLD 100 OZ CONTINUOUS 949 344 1219.2

New York Mercantile Exchange (NYMEX)

Call

CMX-GOLD 100 OZ CONTINUOUS 954 328 1219.2

New York Mercantile Exchange (NYMEX)

Call

CMX-HIGH GRADE COPPER CONT. 306 19 268.65

New York Mercantile Exchange (NYMEX)

Call

CMX-HIGH GRADE COPPER CONT. 307 19 268.65

New York Mercantile Exchange (NYMEX)

Call

CMX-HIGH GRADE COPPER CONT. 311 16 268.65

New York Mercantile Exchange (NYMEX)

Call

CMX-HIGH GRADE COPPER CONT. 309 14 268.65

New York Mercantile Exchange (NYMEX)

Call

CMX-HIGH GRADE COPPER CONT. 310 17 268.65

New York Mercantile Exchange (NYMEX)

CMX-SILVER

Put 5000 OZ CONTINUOUS2724 1022 1604

New York Mercantile Exchange (NYMEX)

CMX-SILVER

Put 5000 OZ CONTINUOUS2749 1048 1604

New York Mercantile Exchange (NYMEX)

CMX-SILVER

Put 5000 OZ CONTINUOUS2774 1073 1604

New York Mercantile Exchange (NYMEX)

CMX-SILVER

Put 5000 OZ CONTINUOUS2324 624 1604

New York Mercantile Exchange (NYMEX)

CMX-SILVER

Put 5000 OZ CONTINUOUS2349 648 1604

New York Mercantile Exchange (NYMEX)

Put

NYM-NATURAL GAS CONTINUOUS 9 12 2.95

New York Mercantile Exchange (NYMEX)

Put

NYM-NATURAL GAS CONTINUOUS 9.25 12 2.95

New York Mercantile Exchange (NYMEX)

Put

NYM-NATURAL GAS CONTINUOUS 9.5 13 2.95

New York Mercantile Exchange (NYMEX)

Put

NYM-NATURAL GAS CONTINUOUS 9.75 13 2.95

New York Mercantile Exchange (NYMEX)

Put

NYM-NATURAL GAS CONTINUOUS 10 13 2.95

New York Mercantile Exchange (NYMEX)

Put

NYM-NATURAL GAS CONTINUOUS 10.25 13 2.95

4-Jul 5-Jul 6-Jul 7-Jul 10-Jul 11-Jul 12-Jul

1219.2 1221.7 1223.3 1209.7 1213.2 1214.7 1219.1

1219.2 1221.7 1223.3 1209.7 1213.2 1214.7 1219.1

1219.2 1221.7 1223.3 1209.7 1213.2 1214.7 1219.1

1219.2 1221.7 1223.3 1209.7 1213.2 1214.7 1219.1

1219.2 1221.7 1223.3 1209.7 1213.2 1214.7 1219.1

1219.2 1221.7 1223.3 1209.7 1213.2 1214.7 1219.1

268.65 265.4 265.55 264.15 264.25 266.7 267.95

268.65 265.4 265.55 264.15 264.25 266.7 267.95

268.65 265.4 265.55 264.15 264.25 266.7 267.95

268.65 265.4 265.55 264.15 264.25 266.7 267.95

268.65 265.4 265.55 264.15 264.25 266.7 267.95

1604 1584.2 1592.7 1537.1 1557.7 1571.7 1585.9

1604 1584.2 1592.7 1537.1 1557.7 1571.7 1585.9

1604 1584.2 1592.7 1537.1 1557.7 1571.7 1585.9

1604 1584.2 1592.7 1537.1 1557.7 1571.7 1585.9

1604 1584.2 1592.7 1537.1 1557.7 1571.7 1585.9

2.95 2.84 2.89 2.86 2.93 3.05 2.98

2.95 2.84 2.89 2.86 2.93 3.05 2.98

2.95 2.84 2.89 2.86 2.93 3.05 2.98

2.95 2.84 2.89 2.86 2.93 3.05 2.98

2.95 2.84 2.89 2.86 2.93 3.05 2.98

2.95 2.84 2.89 2.86 2.93 3.05 2.98

13-Jul 14-Jul 17-Jul 18-Jul 19-Jul 20-Jul 21-Jul

1217.3 1227.5 1233.7 1241.9 1242 1245.5 1254.9

1217.3 1227.5 1233.7 1241.9 1242 1245.5 1254.9

1217.3 1227.5 1233.7 1241.9 1242 1245.5 1254.9

1217.3 1227.5 1233.7 1241.9 1242 1245.5 1254.9

1217.3 1227.5 1233.7 1241.9 1242 1245.5 1254.9

1217.3 1227.5 1233.7 1241.9 1242 1245.5 1254.9

265.7 268.65 271.95 272.55 270.6 271.15 271.8

265.7 268.65 271.95 272.55 270.6 271.15 271.8

265.7 268.65 271.95 272.55 270.6 271.15 271.8

265.7 268.65 271.95 272.55 270.6 271.15 271.8

265.7 268.65 271.95 272.55 270.6 271.15 271.8

1565.7 1589.9 1606.5 1623.7 1626.6 1631.4 1642.5

1565.7 1589.9 1606.5 1623.7 1626.6 1631.4 1642.5

1565.7 1589.9 1606.5 1623.7 1626.6 1631.4 1642.5

1565.7 1589.9 1606.5 1623.7 1626.6 1631.4 1642.5

1565.7 1589.9 1606.5 1623.7 1626.6 1631.4 1642.5

2.96 2.98 3.02 3.09 3.07 3.04 2.97

2.96 2.98 3.02 3.09 3.07 3.04 2.97

2.96 2.98 3.02 3.09 3.07 3.04 2.97

2.96 2.98 3.02 3.09 3.07 3.04 2.97

2.96 2.98 3.02 3.09 3.07 3.04 2.97

2.96 2.98 3.02 3.09 3.07 3.04 2.97

24-Jul 25-Jul 26-Jul 27-Jul 28-Jul 31-Jul 1-Aug

1254.3 1252.1 1249.4 1260 1268.4 1266.6 1275.2

1254.3 1252.1 1249.4 1260 1268.4 1266.6 1275.2

1254.3 1252.1 1249.4 1260 1268.4 1266.6 1275.2

1254.3 1252.1 1249.4 1260 1268.4 1266.6 1275.2

1254.3 1252.1 1249.4 1260 1268.4 1266.6 1275.2

1254.3 1252.1 1249.4 1260 1268.4 1266.6 1275.2

273.15 284.25 286.95 287.4 287.05 288.8 288.1

273.15 284.25 286.95 287.4 287.05 288.8 288.1

273.15 284.25 286.95 287.4 287.05 288.8 288.1

273.15 284.25 286.95 287.4 287.05 288.8 288.1

273.15 284.25 286.95 287.4 287.05 288.8 288.1

1641.1 1651 1642.8 1654.2 1666.4 1675 1676.4

1641.1 1651 1642.8 1654.2 1666.4 1675 1676.4

1641.1 1651 1642.8 1654.2 1666.4 1675 1676.4

1641.1 1651 1642.8 1654.2 1666.4 1675 1676.4

1641.1 1651 1642.8 1654.2 1666.4 1675 1676.4

2.9 2.94 2.92 2.97 2.94 2.79 2.82

2.9 2.94 2.92 2.97 2.94 2.79 2.82

2.9 2.94 2.92 2.97 2.94 2.79 2.82

2.9 2.94 2.92 2.97 2.94 2.79 2.82

2.9 2.94 2.92 2.97 2.94 2.79 2.82

2.9 2.94 2.92 2.97 2.94 2.79 2.82

2-Aug 3-Aug 4-Aug 7-Aug 8-Aug 9-Aug 10-Aug

1274.2 1270.2 1260.2 1260.2 1257.9 1274.6 1285.1

1274.2 1270.2 1260.2 1260.2 1257.9 1274.6 1285.1

1274.2 1270.2 1260.2 1260.2 1257.9 1274.6 1285.1

1274.2 1270.2 1260.2 1260.2 1257.9 1274.6 1285.1

1274.2 1270.2 1260.2 1260.2 1257.9 1274.6 1285.1

1274.2 1270.2 1260.2 1260.2 1257.9 1274.6 1285.1

288.45 287.8 288.5 290.7 294.25 292.7 290.3

288.45 287.8 288.5 290.7 294.25 292.7 290.3

288.45 287.8 288.5 290.7 294.25 292.7 290.3

288.45 287.8 288.5 290.7 294.25 292.7 290.3

288.45 287.8 288.5 290.7 294.25 292.7 290.3

1673.3 1663 1625.2 1625.1 1638.9 1686.3 1706.5

1673.3 1663 1625.2 1625.1 1638.9 1686.3 1706.5

1673.3 1663 1625.2 1625.1 1638.9 1686.3 1706.5

1673.3 1663 1625.2 1625.1 1638.9 1686.3 1706.5

1673.3 1663 1625.2 1625.1 1638.9 1686.3 1706.5

2.81 2.8 2.77 2.8 2.82 2.88 2.98

2.81 2.8 2.77 2.8 2.82 2.88 2.98

2.81 2.8 2.77 2.8 2.82 2.88 2.98

2.81 2.8 2.77 2.8 2.82 2.88 2.98

2.81 2.8 2.77 2.8 2.82 2.88 2.98

2.81 2.8 2.77 2.8 2.82 2.88 2.98

11-Aug 14-Aug 15-Aug 16-Aug 17-Aug 18-Aug 21-Aug

1289 1285.3 1274.7 1277.9 1287.3 1286.5 1291.5

1289 1285.3 1274.7 1277.9 1287.3 1286.5 1291.5

1289 1285.3 1274.7 1277.9 1287.3 1286.5 1291.5

1289 1285.3 1274.7 1277.9 1287.3 1286.5 1291.5

1289 1285.3 1274.7 1277.9 1287.3 1286.5 1291.5

1289 1285.3 1274.7 1277.9 1287.3 1286.5 1291.5

291.2 290.45 288.3 295.35 293.8 293.95 298.05

291.2 290.45 288.3 295.35 293.8 293.95 298.05

291.2 290.45 288.3 295.35 293.8 293.95 298.05

291.2 290.45 288.3 295.35 293.8 293.95 298.05

291.2 290.45 288.3 295.35 293.8 293.95 298.05

1707 1712.2 1671.4 1694 1705.3 1700 1701.5

1707 1712.2 1671.4 1694 1705.3 1700 1701.5

1707 1712.2 1671.4 1694 1705.3 1700 1701.5

1707 1712.2 1671.4 1694 1705.3 1700 1701.5

1707 1712.2 1671.4 1694 1705.3 1700 1701.5

2.98 2.96 2.93 2.89 2.93 2.89 2.96

2.98 2.96 2.93 2.89 2.93 2.89 2.96

2.98 2.96 2.93 2.89 2.93 2.89 2.96

2.98 2.96 2.93 2.89 2.93 2.89 2.96

2.98 2.96 2.93 2.89 2.93 2.89 2.96

2.98 2.96 2.93 2.89 2.93 2.89 2.96

22-Aug 23-Aug 24-Aug 25-Aug 28-Aug 29-Aug 30-Aug

1285.6 1289 1286.5 1292.6 1309.8 1313.1 1308.1

1285.6 1289 1286.5 1292.6 1309.8 1313.1 1308.1

1285.6 1289 1286.5 1292.6 1309.8 1313.1 1308.1

1285.6 1289 1286.5 1292.6 1309.8 1313.1 1308.1

1285.6 1289 1286.5 1292.6 1309.8 1313.1 1308.1

1285.6 1289 1286.5 1292.6 1309.8 1313.1 1308.1

298.7 298.05 303.4 303 306.58 308 306

298.7 298.05 303.4 303 306.58 308 306

298.7 298.05 303.4 303 306.58 308 306

298.7 298.05 303.4 303 306.58 308 306

298.7 298.05 303.4 303 306.58 308 306

1698.2 1704.6 1696.3 1705 1744 1743 1740

1698.2 1704.6 1696.3 1705 1744 1743 1740

1698.2 1704.6 1696.3 1705 1744 1743 1740

1698.2 1704.6 1696.3 1705 1744 1743 1740

1698.2 1704.6 1696.3 1705 1744 1743 1740

2.94 2.93 2.95 2.89 2.92 2.96 2.94

2.94 2.93 2.95 2.89 2.92 2.96 2.94

2.94 2.93 2.95 2.89 2.92 2.96 2.94

2.94 2.93 2.95 2.89 2.92 2.96 2.94

2.94 2.93 2.95 2.89 2.92 2.96 2.94

2.94 2.93 2.95 2.89 2.92 2.96 2.94

31-Aug Profit or loss Profit (Long) Profit (Short) Excercise (Long position)

1316.2 Profit 39.2 -39.2 Exercise

1316.2 Profit 38.2 -38.2 Exercise

1316.2 Profit 38.2 -38.2 Exercise

1316.2 Profit 39.2 -39.2 Exercise

1316.2 Profit 23.2 -23.2 Exercise

1316.2 Profit 34.2 -34.2 Exercise

308 Loss -17 17 Exercise

308 Loss -18 18 Exercise

308 Loss -19 19 Not Exercise

308 Loss -15 15 Not Exercise

308 Loss -19 19 Not Exercise

1748 Loss -46 46 Exercise

1748 Loss -47 47 Exercise

1748 Loss -47 47 Exercise

1748 Loss -48 48 Exercise

1748 Loss -47 47 Exercise

3.04 Loss -6.04 6.04 Exercise

3.04 Loss -5.79 5.79 Exercise

3.04 Loss -6.54 6.54 Exercise

3.04 Loss -6.29 6.29 Exercise

3.04 Loss -6.04 6.04 Exercise

3.04 Loss -5.79 5.79 Exercise

You might also like

- S Wave 09 OD 11 F O1 (Atoll)Document7 pagesS Wave 09 OD 11 F O1 (Atoll)NOKIAXL CJNo ratings yet

- Katalog Hijab Motif Flose HijabDocument16 pagesKatalog Hijab Motif Flose HijabAyu Aditya SafiraNo ratings yet

- J 005Document29 pagesJ 005Gonzalo MNo ratings yet

- ER HasnainDocument24 pagesER HasnainArslan Ahmed SoomroNo ratings yet

- Data Botou RandiDocument73 pagesData Botou RandiMEILAN BAMUNo ratings yet

- Torque vs. Angular Deformation CurveDocument56 pagesTorque vs. Angular Deformation CurveAdnan Shahariar AnikNo ratings yet

- Design Considerations and Important NotesDocument32 pagesDesign Considerations and Important NotesSougata DasNo ratings yet

- K.P. No. Date S.P. No. Adtiya Lot S Lot SPBGSSPWTDocument50 pagesK.P. No. Date S.P. No. Adtiya Lot S Lot SPBGSSPWTSunil DeshmukhNo ratings yet

- SteelDocument147 pagesSteelAbhilashPadmanabhanNo ratings yet

- 4 PONTON 5 MDocument44 pages4 PONTON 5 Mjayrsa-1No ratings yet

- ELPLA ListAAAAAAAAAAAAAAAADocument2 pagesELPLA ListAAAAAAAAAAAAAAAAJosé Luis González HerreraNo ratings yet

- Task N1Document25 pagesTask N1Giorgi KvetenadzeNo ratings yet

- QC 00000657Document358 pagesQC 00000657Rogelio ArdilesNo ratings yet

- TEProduct ListJuly15 FinalDocument70 pagesTEProduct ListJuly15 FinalbabuNo ratings yet

- BMS1 SPMFDocument1,059 pagesBMS1 SPMFSyed Asgar AhmedNo ratings yet

- Planilha Financeiro NovDocument36 pagesPlanilha Financeiro Novuriel.santos.educacaoNo ratings yet

- Junio 24 Al 28 18 BaseDocument21 pagesJunio 24 Al 28 18 BaseFrank Montilla PérezNo ratings yet

- PVD Dan H Initial LJ4Document307 pagesPVD Dan H Initial LJ4ayukuncaravitaNo ratings yet

- Case#2 TrainingDocument25 pagesCase#2 TrainingReza RamadhanNo ratings yet

- 0 ContactsDocument13 pages0 ContactsSékou TouréNo ratings yet

- qc00150205 Bellav. LoretDocument139 pagesqc00150205 Bellav. Loretneilsc sosaNo ratings yet

- Other Payables 2018Document19 pagesOther Payables 2018jaymark camachoNo ratings yet

- Horse Head PDFDocument8 pagesHorse Head PDFMatija VučićNo ratings yet

- Anexo9 Priv Aut Apos Eq Plena 60 DiasDocument16 pagesAnexo9 Priv Aut Apos Eq Plena 60 DiasMarcelo HeineNo ratings yet

- LighthouseDocument472 pagesLighthousemihaid_5No ratings yet

- Decay Chart 7416Document1 pageDecay Chart 7416Steve TayoneNo ratings yet

- System Transfer ListDocument6 pagesSystem Transfer ListJolanta RadzyńskaNo ratings yet

- Price HourDocument2 pagesPrice HourJohn ReyanNo ratings yet

- TOO Brix Relative DensityDocument2 pagesTOO Brix Relative DensityHatem ZedanNo ratings yet

- BC Session 4Document53 pagesBC Session 4Amit DharkarNo ratings yet

- LAUSD List of AB 300 BuildingsDocument21 pagesLAUSD List of AB 300 BuildingsDennis RomeroNo ratings yet

- Installation ManualspeedometerDocument21 pagesInstallation ManualspeedometerAndre VPNo ratings yet

- Civil & Interior BOQ Shorlisted From DSR - Civil SOR & BPWDDocument379 pagesCivil & Interior BOQ Shorlisted From DSR - Civil SOR & BPWDSridhar SanNo ratings yet

- CurvesDocument49 pagesCurvesSAMBHAVNo ratings yet

- Massas Nova Ford CustomDocument69 pagesMassas Nova Ford CustomPedroCosta87No ratings yet

- Fuel Dan Populasi UnitDocument8 pagesFuel Dan Populasi Unitdwi haryantoNo ratings yet

- Data Pemakaian Air Gapura VistaDocument11 pagesData Pemakaian Air Gapura VistaParlin SimangunsongNo ratings yet

- AIPGEE - 1 Explanations Master Key: (Errata - Marked Red in Color)Document30 pagesAIPGEE - 1 Explanations Master Key: (Errata - Marked Red in Color)shejintjNo ratings yet

- RELIABLE SUPPLIER. BUY QUALITY SSD CHEMICAL SOLUTION +27780171131 Rustenburg, Polokwane Durban/east London, Pretoria, Johannesburg, Mpumalanga.Document9 pagesRELIABLE SUPPLIER. BUY QUALITY SSD CHEMICAL SOLUTION +27780171131 Rustenburg, Polokwane Durban/east London, Pretoria, Johannesburg, Mpumalanga.maama zamaNo ratings yet

- $ MONEY TALKS AND MONEY IS LIFE JOIN ILLUMINATE in Kampala Uganda ..U.K.+27788676511, HOW 2 JOIN ILLUMINATI SOCIETY IN UGANDA TOWNS NOW +27788676511Document9 pages$ MONEY TALKS AND MONEY IS LIFE JOIN ILLUMINATE in Kampala Uganda ..U.K.+27788676511, HOW 2 JOIN ILLUMINATI SOCIETY IN UGANDA TOWNS NOW +27788676511maama zamaNo ratings yet

- <GET> RICH,+27780171131 HOW 2 JOIN ILLUMINATI SOCIETY IN UGANDA NOW, FOR MONEY,FAME AND POWER in Uganda, kampala join Illuminati +27780171131 GET RICH, HOW 2 JOIN ILLUMINATI SOCIETY IN UGANDA NOW, FOR MONEY,FAME AND POWER in Singapore, join Illuminati +27780171131Document9 pages<GET> RICH,+27780171131 HOW 2 JOIN ILLUMINATI SOCIETY IN UGANDA NOW, FOR MONEY,FAME AND POWER in Uganda, kampala join Illuminati +27780171131 GET RICH, HOW 2 JOIN ILLUMINATI SOCIETY IN UGANDA NOW, FOR MONEY,FAME AND POWER in Singapore, join Illuminati +27780171131maama zama0% (1)

- TABLE: Element Forces - Frames Frame PDocument7 pagesTABLE: Element Forces - Frames Frame Pmoshi3824No ratings yet

- Assignment BuildingDocument20 pagesAssignment BuildingSagar JhaNo ratings yet

- ReportDocument723 pagesReportBittu GhoshNo ratings yet

- DB CH+DB CH: Ok Ok Ok .. Ok .. .. Ok Ok Ok .-. .-. OK OK OK .-. OK OK OK .-. Ok OK Ok Ok Ok OkDocument349 pagesDB CH+DB CH: Ok Ok Ok .. Ok .. .. Ok Ok Ok .-. .-. OK OK OK .-. OK OK OK .-. Ok OK Ok Ok Ok OkhellohhhhhNo ratings yet

- Packing List - P932: Item Cant Description Hoja #72 72 72Document11 pagesPacking List - P932: Item Cant Description Hoja #72 72 72Anonymous CpWhwdC7sNo ratings yet

- QC 00000255Document264 pagesQC 00000255Abigail CcastroNo ratings yet

- Mine/Countermine OperationsDocument185 pagesMine/Countermine OperationsBox VoxNo ratings yet

- Different Weight Range Own FarmDocument17 pagesDifferent Weight Range Own FarmFidahussainNo ratings yet

- DataDocument27 pagesDataIntawich EakpiyakulNo ratings yet

- Flute Length Overall Length ShankDocument10 pagesFlute Length Overall Length ShanknateNo ratings yet

- Book 2Document379 pagesBook 2Vikas kumar singhNo ratings yet

- BCH Crane Duty Motors-Technical Data SheetDocument1 pageBCH Crane Duty Motors-Technical Data SheetNaveen GuptaNo ratings yet

- Canal Frequency EGSM900 GSM900 GSM1800Document1 pageCanal Frequency EGSM900 GSM900 GSM1800dddNo ratings yet

- Ada 634x638xcf Edin DiscontinuedDocument13 pagesAda 634x638xcf Edin DiscontinuedRaghavendran BalakumarNo ratings yet

- Aasiya TradersDocument11 pagesAasiya Traderssunglassanbarasu91No ratings yet

- Fecha Dias Etapa Etp (Mm/dia) KC Eto (Mm/dia)Document10 pagesFecha Dias Etapa Etp (Mm/dia) KC Eto (Mm/dia)Jheyzon PalmaNo ratings yet

- 2585 Zoning-By-Law Consolidation RemediatedDocument536 pages2585 Zoning-By-Law Consolidation RemediateddarwingcamachoNo ratings yet

- Pract 1Document10 pagesPract 1Nino NatradzeNo ratings yet

- Designing and Analysis of Hydrogen Power VehicleDocument11 pagesDesigning and Analysis of Hydrogen Power VehicleAblaqNo ratings yet

- Investor Update: Pushing BoundariesDocument18 pagesInvestor Update: Pushing BoundariesAnurag RayNo ratings yet

- Petroleum MCQs-1Document19 pagesPetroleum MCQs-1Hikmatullah khanNo ratings yet

- Reservoir Drive MechanismsDocument10 pagesReservoir Drive MechanismsSri Varshini PrathaNo ratings yet

- C8GCh3 Mineral Power ResourcesDocument50 pagesC8GCh3 Mineral Power ResourcesPieNo ratings yet

- Compressor Tech 04 2015 PDFDocument92 pagesCompressor Tech 04 2015 PDFHoang Bao Son100% (1)

- Inward Material Dimension Inspection ReportDocument1 pageInward Material Dimension Inspection ReportPrathamesh OmtechNo ratings yet

- Ethane Steam CrackingDocument13 pagesEthane Steam CrackingarmanNo ratings yet

- Resignation LetterDocument1 pageResignation LetterPawan ChaturvediNo ratings yet

- Sr. No. Oisd Standard/GDN/RP No Standard Name Current Edition in VogueDocument6 pagesSr. No. Oisd Standard/GDN/RP No Standard Name Current Edition in Voguehcsharma1967No ratings yet

- Modernization of Two-Phase Oil and Gas SeparatorDocument7 pagesModernization of Two-Phase Oil and Gas Separatorn.hartonoNo ratings yet

- CNG Refuelling - English Final 100504Document8 pagesCNG Refuelling - English Final 100504Worldwide Equipment SolutionsNo ratings yet

- Oil & Gas Fields RajasthanDocument2 pagesOil & Gas Fields RajasthanShailenderNo ratings yet

- Literature Review On Oil and Gas IndustryDocument7 pagesLiterature Review On Oil and Gas Industryaflshxeid100% (1)

- GREET LCA Approach-ElgowainyDocument25 pagesGREET LCA Approach-ElgowainyAhmad SyauqiNo ratings yet

- Alert For TCI Rsi Buy 15 MIN ChartinkDocument31 pagesAlert For TCI Rsi Buy 15 MIN ChartinksaiNo ratings yet

- Bukubelum SiapDocument16 pagesBukubelum SiapVicky FerdianNo ratings yet

- Questions - Worksheet - 8th - Science - 2022-11-03T17 - 48Document2 pagesQuestions - Worksheet - 8th - Science - 2022-11-03T17 - 48Gurbir Kaur RandhawaNo ratings yet

- Boring Log: PLTMH Taman Sar - Malang - Jawa TimurDocument1 pageBoring Log: PLTMH Taman Sar - Malang - Jawa TimurEdied DoublebanksNo ratings yet

- Curriculum Vitae: Personal IdentificationDocument3 pagesCurriculum Vitae: Personal Identificationrio HENRYNo ratings yet

- Resilient Qatar's Natural Gas Development Policy and Energy Situation Under Its CrisisDocument4 pagesResilient Qatar's Natural Gas Development Policy and Energy Situation Under Its Crisisعلي حميد زغير صحنNo ratings yet

- Liquified Natural Gas: C2 - C5 CryogenicDocument22 pagesLiquified Natural Gas: C2 - C5 CryogenicNicolaNo ratings yet

- New Offshore ProjectDocument74 pagesNew Offshore Projecthari6622No ratings yet

- Northern Michigan Is A Likely Hotspot For Natural GasDocument3 pagesNorthern Michigan Is A Likely Hotspot For Natural Gasskuell80No ratings yet

- Webinar Getting Biogas To The RNG Market Carbotech PSADocument69 pagesWebinar Getting Biogas To The RNG Market Carbotech PSAMarcela FragozoNo ratings yet

- WP - Natural Gas Leak Detection White Paper-2021Document5 pagesWP - Natural Gas Leak Detection White Paper-2021Jose BrionNo ratings yet

- Neway Trunnion Ball Valves FPDDocument20 pagesNeway Trunnion Ball Valves FPDmario sigchoNo ratings yet

- Flushing and Cleaning Procedure: Gta Hub / Terminal - FacilitiesDocument27 pagesFlushing and Cleaning Procedure: Gta Hub / Terminal - FacilitiesSuci Nur HidayahNo ratings yet

- Gabarito Conhecimento Instrumentação - Petrobras 2023Document1 pageGabarito Conhecimento Instrumentação - Petrobras 2023Leandro Camara DavidNo ratings yet

- API Gravity PDFDocument225 pagesAPI Gravity PDFAnurag RayNo ratings yet