Professional Documents

Culture Documents

McShane EarlyMoverAdvantages 2012

Uploaded by

3081245716Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

McShane EarlyMoverAdvantages 2012

Uploaded by

3081245716Copyright:

Available Formats

Early Mover Advantages: Evidence From the Long-Term Care Insurance Market

Author(s): Michael K. McShane, Larry A. Cox and Yanling Ge

Source: The Journal of Risk and Insurance , December 2012, Vol. 79, No. 4 (December

2012), pp. 1115-1141

Published by: American Risk and Insurance Association

Stable URL: https://www.jstor.org/stable/23354960

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

American Risk and Insurance Association is collaborating with JSTOR to digitize, preserve and

extend access to The Journal of Risk and Insurance

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

© The Journal of Risk and Insurance, 2012, Vol. 79, No. 4,1115-1141

DOI: 10.1111 /).1539-6975.2011,01449.x

Early Mover Advantages: Evidence From

the Long-Term Care Insurance Market

Michael K. McShane

Larry A. Cox

Yanling Ge

Abstract

Researchers frequently question whether financial firms benefit by devel

oping new products because barriers to entry common to other industries

generally do not exist. Studies of early mover advantages for new finan

cial products provide mixed evidence at best. We find evidence of early

mover advantages in the relatively young market for long-term care insur

ance (LTCI) using data that allow broad testing of financial performance.

Product differentiation, individual lines exposure, firm size, and traditional

health insurance experience also affect financial performance.

Introduction

The extant literature contains a wealth of conceptual and theoretical analyses of

financial market innovation, but relatively little empirical evidence (Frame and White,

2004). The core issue of whether financial firms actually gain from innovation is

particularly intriguing because these firms generally do not benefit from the barriers to

entry that can make such behavior profitable in nonfinancial industries. For instance, a

pharmaceutical or technology firm can develop a profitable new product that cannot

be imitated for many years because of patent laws. Other potential barriers can

stem from switching costs, proprietary learning, and economies of scale and scope

(Rumelt, 1987). Financial firms are not as sheltered as others because entry into the

industry is relatively easy, patents typically are not available, and public disclosure

of new product structures and terms generally is required by regulators (Tufano,

1989; Berger and Dick, 2007). Despite these barrier-reducing factors, financial firms

continue to develop new products, services, production processes, and organizational

forms (see, e.g., Frame and White, 2004).

While theoretical researchers continue to develop rationales for innovation by finan

cial firms when imitation by competitors is so easy and inexpensive, relatively few

Michael K. McShane is at the College of Business and Public Administration, Old Dominion

University. Larry A. Cox is at the School of Business Administration, University of Mississippi.

Yanling Ge is at FNC, Inc. The authors can be connected via e-mail: mmcshane@odu.edu,

lcox@bus.olemiss.edu, and ymayer@fncinc.com, respectively.

1115

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

1116 The Journal of Risk and Insurance

empirical researchers have explored whether early movers gain competitive advan

tages in new product markets. Further, the evidence that does exist is mixed at best.

Some researchers find that early movers into new financial products gain greater

market share, at least in the short run, and suggest that they may benefit from lower

costs because of economies of scale or proprietary information. Lower costs for new

financial products have been implied, rather than directly observed, in these stud

ies, however. Some researchers also find evidence that financial innovators are able

to charge relatively high prices, but others claim that imitators are able to leverage

favorable reputations to mitigate any early mover advantages. Researchers have not

been able to verify higher market or book returns to financial firms that innovate with

new products, however.

Our study fits within this vein of empirical research into financial product innova

tion as we empirically examine whether insurers have benefited by moving relatively

rapidly into the market for long-term care insurance (LTCI) that emerged in recent

decades. Product-specific data unique to LTCI allow rigorous examination of mar

ket share, profits, and pricing that is not possible for other financial products. We

first analyze innovations introduced in LTCI products. Then we empirically exam

ine potential early-mover advantages using our unique set of financial performance

measures and price estimates.

We find that early movers in the LTCI market gained relatively greater market share

than later entrants, which is consistent with prior research. This evidence is not

enough to demonstrate early mover advantage because insurers potentially could

"buy" market share merely by operating unprofitably. We therefore explore LTCI

profitability and pricing. We find that early movers into the LTCI line generally are

more profitable but are not charging higher premiums for LTCI policies. Although

like previous researchers we cannot observe product-specific costs, we argue that

early movers into LTCI have cost advantages because of their larger market shares

and profits in the face of apparently competitive pricing. Other explanations are

possible, such as a superior product mix and quality that increases revenues but are

not directly observed. In an effort to account for these other possibilities, we control

for the number of products offered, year in which specific policies were first offered,

and policy comprehensiveness.

Because our tests reveal no evidence of economies of scale or consumer lock-in,

we surmise that proprietary learning by early movers into LTCI products is the

likely source of reduced costs. An alternative explanation is that early movers have

established a reputation that allows them to charger higher premiums, and thus

increase profits. We argue that the reputation alternative is accounted for to some

extent by other variables that we include in the regressions, such as firm size, firm

age, and capital adequacy. Additionally our pricing model results provide no evidence

that early movers charge higher prices.

Additional empirical findings include a strong positive relation between product dif

ferentiation, firm size, and strength in traditional health insurance lines with both

LTCI market share and profitability. Our results also suggest that insurers issuing

relatively more individual, rather than group, policies are able to charge higher

prices and extract greater profits. This is consistent with the idea that group buy

ers have lower switching costs and therefore are less prone to consumer lock-in. Our

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

Early Mover Advantages 1117

profitability results also imply strong initial underwriting effects for LTCI policies,

which disappears after 2 years.

Literature Review

Researchers have long recognized the importance of technical innovation for eco

nomic growth (Schumpeter, 1911; Solow, 1956; Romer, 1986) and theorized about the

importance of first- or early-mover advantages that provide an incentive to innovate.

In industrial markets, the costly entry barriers imposed by research and development

costs and patent protection have allowed first movers to realize advantages such as

lower production costs, larger market shares, higher survival rates, and greater profits

(see, e.g., Mueller, 1986,1997).

In financial markets, patent protection generally does not apply, so information on

the structure and pricing of new products or processes can be appropriated and imi

tated (Finnerty, 1988; Berger and Dick, 2007). In U.S. security markets, full disclosure

rules promulgated by the Securities and Exchange Commission facilitate imitation.

Similar rules apply to U.S. insurance markets because insurers issuing new products

must fully and publicly disclose contractual provisions and prices to state regulators.

Despite apparently fewer incentives to innovate, financial firms continue to introduce

new products, however (see, e.g., Allen and Gale, 1994; Lerner, 2002, 2006).

Financial Product Innovation and Early Mover Advantages

Some researchers have explored product innovations in investment banking markets

to determine whether first or early movers gain comparative advantages. Tufano

(1989) investigates 58 financial products introduced during the period 1974-1986.

His strictly univariate tests suggest that first movers generally realize greater market

shares, but not higher prices. He conjectures that early movers must realize lower

costs, while admitting that data limitations prevent direct testing.

Carow (1999a) explores 64 bonds and preferred stocks that he classifies as innova

tive and were introduced during the 1974 though 1988 period. He extends Tufano's

study by controlling for the impact of specific attributes of the products and the

reputations of the underwriting firms on prices. He also creates variables that dis

tinguish between first movers, or "pioneers," and early movers. Carow's results

indicate that while product pioneers do not realize any pricing advantages, prices

decline as imitators enter new product markets. These results generally imply early

mover advantages. Additional results indicate lower prices for larger, more reputable

underwriters, which he attributes to economies of scale.

Carow (1999b) next conducts a more intensive study of reputation effects based upon

a subset of the 43 new bond and preferred stock innovations examined in his previous

study. He finds that investment banks entering a new product market generally offer

lower spreads, but this effect is mitigated for banks with stronger reputations. He

concludes that reputational capital therefore poses a barrier to entry in the markets

for financial innovations.

Charupat and Prisman (2004) investigate pricing in the market for installment receipts,

which securitize the installment purchase of underlying securities. Their test sample

contains data for 29 initial public offerings during the period 1991-2000. They find that

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

1118 The Journal of Risk and Insurance

the premium on underwriting spreads exceeds implicit costs, in particular the costs of

buyer default. They claim that this finding supports Van Horn's (1985) hypothesis that

financial innovation must significantly reduce market friction costs to be successful.

Schroth (2006) examines demand for new offerings of 50 types of equity-linked and

derivative securities issued during the period 1985-2001. His proxy for demand is

the ratio of market share for the innovative security underwritten to market share for

all equity securities underwritten during the same period. He finds that early movers

benefit from greater demand than imitators initially although this advantage declines

over time. Schroth attributes these differences to informational advantages gained by

innovators. He argues that imitators must surmount barriers posed by the private

information obtained by early movers and this takes time.

Schroth's findings imply that the source of first-mover advantages is differentiation

both within product types and across generations of similar products. He suggests

that investment banks differentiate by using innovative ability, engineering skills,

and placement capacity.

Berger and Dick (2007) investigate early mover advantage in the banking industry

and find that banks entering a market earlier gain and maintain a larger market share

relative to later entrants. One key to holding onto the market share advantage appears

to be the strategic use of branch networks. Like previous early mover research, their

data set did not allow them to investigate early mover advantage in terms of profit

and price.

Determinants of Financial Product Innovation

Two recent studies explore a variety of factors that can affect the propensity of financial

firm managers to introduce product innovations. Akhavein, Frame, and White (2005)

investigate 99 large retail banks that introduced credit scoring for small business

loans. They specifically examine effects of market, firm, and CEO characteristics on the

number of years that the banks applied credit scoring and the rates of adoption. They

find that centralized organizational structure and geographic location, specifically

headquarters in New York City, are positively related to early adoption. They provide

weak evidence that size is also positively related. Prior profitability is negatively

related to quicker adoption. In other words, less profitable firms are more likely to

adopt innovations.

Lerner (2006) explores 651 financial innovations reported in the Wall Street Journal

during the period 1990-2002 to assess characteristics of firms introducing financial

product innovations. He finds size, geographic location, firm age, and financial lever

age to be positively related to the number of innovations. On the other hand, prior

profitability is negatively related.

Degree of Information Asymmetry Depending on Market

Empirical research on financial product innovation by investment banks involves

sophisticated, institutional buyers and sellers. In this study, we intensively examine

data for LTCI, which largely is sold by institutions to individuals either directly or

through cafeteria-style benefit plans offered by employers. The differences in these

two types of markets warrant further discussion.

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

Early Mover Advantages 1119

Informational asymmetry should be relatively small in investment banking markets

so adjustments should be rapid. Because market participants are generally well in

formed and relatively large volumes of securities are traded, sellers of new products

generally should not benefit from substantial informational advantages. Given the

experience of institutional sellers with other equities and/or debt instruments, the

underlying cost structure should be predictable in advance and prices, as proxied by

underwriting spreads, quickly and efficiently determined by the market.

In contrast, LTCI primarily is a retail product sold to individual consumers and

informational asymmetries are likely to be substantial in this market (Brown and

Finkelstein, 2008; Zhou-Richter, Browne, and Gründl, 2010; Pinquet, Guillen, and

Ayuso, 2011). The largest costs of LTCI consist of future claims, which are highly

uncertain because of limited actuarial experience (McShane and Cox, 2009). This

uncertainty is further exacerbated by new contractual options and new combinations

of options that were introduced into LTCI products during the innovation period.

These realities of the insurance marketplace are likely to generate proprietary learning

advantages for early movers.

We note that the cost of a LTCI policy necessarily rises with the purchaser's age, which

coupled with the informational barriers discussed previously is likely to produce

relatively high switching costs and consumer lock-in. Cox and Ge (2004) provide

empirical evidence to this effect for long-term care insurers. The logical conclusion is

that early movers should benefit in a market with these characteristics.

Insurance Product Innovation and Long-Term Care

Life-health insurers began developing LTCI, as we know it today, in the early 1980s

(Coronel, 2000) and approximately 130 insurers now offer the product. LTCI con

tractually obligates an insurer to pay benefits to an insured who is either unable

to perform certain activities of daily living without assistance or whose health and

safety is threatened because of cognitive impairment. LTCI quickly became the fastest

growing life-health insurance product during the period 1987-2002, with the num

ber of policies increasing by an average of 18 percent annually (Coronel, 2004). LTCI

premiums earned similarly grew at double-digit rates throughout the late 1990s and

early 2000s, but annual growth has fallen within the 6.5-7.5 percent range for the

period 2004-2007 (American Association for Long-Term Care Insurance, 2008).

Innovation in LTCI Product Options

A number of innovative contractual options and combinations of options have been

developed and now are offered in the typical LTCI policy. We next review some of the

more significant options in LTCI that were developed over the past two decades.1

Benefits Triggers. The primary contractual trigger for qualifying the insured to receive

benefits now generally specifies that the beneficiary cannot perform at least two of six

normal activities of daily living. These include bathing, continence, dressing, eating,

toileting, and transferring. The specific activities and the number required to trigger

1The extent to which many of these options are used is surveyed in a study by LifePlans Inc.

(2007).

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

1120 The Journal of Risk and Insurance

benefits have evolved gradually. Benefits also generally are triggered if the beneficiary

becomes cognitively impaired. This part of the trigger was virtually nonexistent in

the earlier LTCI contracts.

Services Provided. From simple nursing home indemnity policies, LTCI contracts

evolved to cover the costs of assisted living, nursing home care, adult day care, home

health care, caregiver training, homemaker services, hospice care, and, even, respite

care. The latter is for purposes of rejuvenating caregivers.

Benefit Limits. The basic benefit amount generally provides reimbursement for ex

penses up to a limit for assisted living or nursing home facilities. Lower limits on

adult day care, home health care, homemaker services, and hospice care often apply.

Alternatively, some contracts offer a flat indemnity payment without regard to actual

expenses incurred. For a substantial additional premium, cost-of-living adjustments

(COLAs) can be added. The most common COLA is 5 percent annually, but some

plans index the adjustment.

Policyholders may select from a menu of benefit durations including a specified

number of years or lifetime benefits. If lifetime benefits are selected, a maximum cap

on total benefits often is applied. A menu of elimination periods, essentially waiting

periods after the contractual trigger activates, also is offered. Additional options

that frequently are available include spousal discounts when both spouses purchase

policies and a shared care option. The latter provision allows a spouse who exhausts

her/his lifetime maximum benefits to receive further benefits under the spouse's

policy.

LTCI and Insurer Financial Performance

Exposure to the future expenses of long-term care can differentially affect insurers

depending upon their primary lines of business. McShane and Cox (2009) generate

empirical evidence that insurers primarily engaged in health care lines are likely to

benefit from strategic focus by adding the LTCI line. We further surmise that adding

the LTCI line should partially hedge the short-term loss profile inherent in medical

expense insurance issued by health insurers. To the extent that they participate in the

LTCI market, health insurers effectively diversify the durations of their portfolio of

contingent claims outstanding and lengthen the average duration.

For traditional life insurers, LTCI can be viewed as a potential hedge against actuarial

mortality risk. After all, policyholders dying relatively early are quite costly to life

insurers, but few, if any, claims will have been paid on LTCI held by these same

policyholders. The problem for life insurers is that, in contrast to the well-defined

actuarial experience for life insurance, LTCI claims experience is not very extensive

and traditional life insurers have little internal data on or experience with the costs of

health-care-related expenses for the more advanced age population. Indeed, McShane

and Cox (2009) find no evidence of incremental benefits for traditional life insurers

issuing LTCI.

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

Early Mover Advantages 1121

Research Design

In this study, we explore data for virtually the universe of U.S. insurers underwriting

LTCI to empirically assess the impact of early entry on insurer shares of this mar

ket, product profitability, and product pricing. We also test other factors that financial

researchers have found to affect financial performance and product pricing. We specif

ically apply regression analysis to an unbalanced panel for the years 1994-2002. A

LaGrange multiplier (LM) test is used to determine whether pooled OLS is more

suitable than random or fixed effects methods. A Hausman test (1978) is applied,

as needed to determine whether random effects or fixed effects estimation is more

appropriate for our data.

Data

Our source of financial data for each insurer and for the LTCI line of business is the

InfoPro database, including data collected from LTCI Reporting Forms, compiled by

the National Association of Insurance Commissioners (NAIC). This data set encom

passes LTCI policies in force with virtually all U.S. insurers underwriting LTCI during

the period 1994-2002. Our study period begins in 1994 because it is the first year for

which the NAIC separately collected and reported LTCI data. It ends in 2002 because

the period of double-digit growth in this product market was complete by then (see,

e.g., Coronel, 2004; American Association for Long-Term Care Insurance, 2008).

We note that the LTCI database does not allow us to identify insurers that entered and

exited the LTCI market prior to 1994. If pre-1994 exits occurred and were the result

of poor performance in the LTCI business, survivorship bias could be introduced.

We consequently conduct a comprehensive search of ABI/Inform, LexisNexis, and

National Underwriter sources and find that three insurers exited the LTCI market

prior to 1994. Two seemingly were facing financial distress.2 The low number of early

exits from the LTCI business indicates to us that survivorship bias, if any exists at all,

is extremely limited.

We are able to examine the data reported for each policy form issued by each insurer

and omit those with missing or apparently outlying observations, such as negative

claims, negative premiums, or unrealistically high or low premiums per insured life,

based upon comprehensive surveys of LTCI pricing (Coronel, 2000,2004). The NAIC

states that a particular policy form is "issued to substantially similar risk classes and

... issued under similar underwriting standards" (NAIC, 2001, p. 374). Different LTCI

policy forms issued by the same insurer therefore should impound different levels of

underwriting risk depending upon the contractual options offered. Our consultations

with two LTCI actuaries and one insurance commissioner indicate that new policy

forms generally (1) limit or expand coverage, (2) offer alternative contractual triggers,

or (3) address new regulations, such as changes in tax law.

2United Equitable, one of the LTCI market pioneers, sold its entire block of 60,000 in-force

policies to Standard Life and Accident in 1986, before eventual liquidation of the firm. Re

liable Life and Casualty was liquidated in 1990, reportedly after LTCI underwriting losses.

Massachusetts Indemnity canceled all in-force LTCI policies in 1989, reportedly because of

large underwriting losses.

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

1122 The Journal of Risk and Insurance

Market Share Model

We use a multivariate approach to test the impact of early movement and other factors

on LTC insurers' market share, which we define as the ratio of LTCI premiums earned

by an insurer to total LTCI premiums earned by all insurers in our sample. We next

discuss the independent variables and applicable proxies that we test.

Early Mover. Our primary variable of interest measures the extent to which the

insurer is an early mover into the LTCI market. We use the number of years that

the insurer has been participating in the LTCI line as our proxy for early movement.

If early mover advantages exist and outweigh the advantages of later imitation, we

expect a positive relation with market share.

Product Differentiation. Insurers can differentiate their products by expanding the

product attributes offered to policyholders over time. They can do this by creating

new policy forms, which ostensibly have different risks and underwriting standards

according to the NAIC, and filing them with regulators. We can estimate this differ

entiation via the number of LTCI policy forms filed by an insurer. We therefore expect

insurers that offer more forms to acquire greater market shares.

Individual Business. Insurers typically implement extensive underwriting processes,

including paramedical examinations, to select and price LTCI for individual buy

ers. In contrast, applicants under group plans must respond only to a very limited

set of questions, a process known as "short-form underwriting." The underwriting

process consequently is less rigorous so group buyers should have relatively greater

information about their health compared to insurers. Kunreuther and Pauly (1985)

and Nilssen (2000) develop models in which such asymmetric information between

insurance buyers and sellers can result in monopolistic pricing practices and rising

profitability for insurers over time. They specifically suggest that insurers extract in

formation via their loss experience and this allows them to develop pricing schemes

that lock in existing policyholders. Schlesinger and von der Schulenburg (1991) show

that in insurance markets, search and switching costs also can produce consumer lock

in. Diamond (1994) posits that group buyers are better able to induce competition via

a bidding process that reduces these costs.

Cox and Ge (2004) find evidence of consumer lock-in in LTCI markets but no consistent

effect of group versus individual buying on LTC insurer profitability. They do find

that individuals are less susceptible to price increases than group buyers, which runs

counter to existing theory. They conjecture that group buyers extracted substantially

discounted premiums in the early years of LTCI and, as unfavorable claims experience

developed in subsequent years, relative price increases consequently were larger for

3 We note that in industrial studies spanning many decades, market tenure has been interpreted

as a survival measure and, therefore, as a measure of firm performance across a product life

cycle (see, e.g., Klepper and Simons, 2000; Klepper, 2002). Such an interpretation is not valid

for our data because only a few insurers exited the LTCI market prior to or during our period

of study, as discussed previously. We conclude that market tenure is not effectively a firm

performance measure at this early stage in the LTCI product life cycle.

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

Early Mover Advantages 1123

these buyers. To control for individual versus group buying, we apply the ratio of

premiums earned from individual LTCI policies to total LTCI premiums earned.

Firm Size. Schumpeter (1942) first suggested that larger firms are better able to inno

vate and a lengthy stream of literature was spawned.4 Akhavein, Frame, and White

(2005) report evidence of larger banks being more prone to innovate via credit scoring

in their lending processes. In a comprehensive examination of financial innovations

by investment banks, Lerner (2006) finds a positive relation between size and the

number of innovations. Most pertinent to our study, Doerpinghaus and Gustavson

(1999) argue that larger firm size produces greater name recognition and positive

reputation, which should be very important in attracting customers in the compara

tively new, long-tailed LTCI line of business. For these reasons, we expect firm size to

positively affect market share. The natural log of total assets serves as our measure of

insurer size.

Stock Form. Equity capital increases the incentives of stock firm managers to engage

in risky projects because of the greater potential for wealth transfers to equity holders

(Jensen and Meckling, 1976). The managerial discretion hypothesis first proposed by

Mayers and Smith (1981) specifically suggests that mutual managers will focus on

lines of insurance for which actuarial experience is well defined. Because stock man

agers generally should be more proactive in exploiting markets for which actuarial

experience is not well defined, such as that for LTCI, we anticipate a positive relation

between stock ownership and market share. Our proxy for a stock organizational

form is a binary variable with a value of one for stock insurers and zero otherwise.

Firm Age. Holmstrom (1989) suggests that older firms primarily focus on produc

tion and marketing, which compromises incentives to innovate. Klepper and Simons

(2000) suggest that older and larger firms are more likely than their younger and

smaller competitors to emerge as dominant firms, however. McShane and Cox (2009)

maintain that older firms have more actuarial experience in general, which can give

them a comparative advantage when entering a new market. We define our age vari

able as the attained age of the insurer when it first underwrites a long-term care

policy.

Capital Adequacy. Doerpinghaus and Gustavson (1999) suggest that financially

stronger insurers should command premium prices for LTCI products. McShane and

Cox (2009) find evidence that insurers perceived as more able to meet their long-term

contractual commitments because of financial strength are more likely to enter the

LTCI market. We ideally would use financial strength ratings issued by independent

rating agencies, but availability of these for the entire sample and time period is

problematic, so we use the risk-based capital (RBC) ratio, a measure of insurer capital

adequacy, to estimate perceived financial strength.5

4See, for example, Lerner (2006) for a review of this literature.

5See Klein and Wang (2009) for a full discussion of the strengths and weaknesses of the RBC

ratio to assess capital adequacy of U.S. insurers.

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

1124 The Journal of Risk and Insurance

Affiliation. Grace and Klein (2000) state that insurers with a larger group affiliation

are likely to reap cost advantages because of economies of scope, but their empirical

results are contraindicative. Cummins and Sommer (1996) alternatively argue that

policyholders may demand a risk premium from a group-affiliated insurer because

group managers can have incentives to let the affiliated insurer fail while protecting

other assets. In their study of LTCI markets, McShane and Cox (2009) find virtually no

relation between participation in LTCI lines and group affiliation, however. To control

for affiliation, we incorporate a binary variable with one indicating affiliation.

Health Insurer. McShane and Cox (2009) argue that insurers with prior experience

in health insurance lines should have informational advantages over other insurers

emanating from more extensive actuarial loss data pertaining to policyholder health

across the age spectrum. They find a very significant, positive relation between health

insurance experience and activity in LTCI markets. We consequently include the ratio

of health insurance premiums written, excluding LTCI premiums, to total insurance

premiums written by each insurer to control for possible differences in core compe

tence.

Our basic model for estimating the effects of product innovation and other variables

on LTCI market share follows:

MSjt = aiEarlyit + a2ProdDiffit + a^Indiit + a^Sizen + a^Stockit + oi(,Ageit

+ ayCapAdeqit + a%Affilit + a9Healthlt + Tt+ Ci + su, (1)

where it means the value for the zth insurer in period t, Tt is the time-specific effect

for years 1994-2002, a is the individual effect, and en is the time-varying error.

Market share (MS) is the individual insurer's relative market share in the LTCI line

and the independent variables are as defined earlier. Specifically, Early is our proxy

for early movement into LTCI, ProdDiff is our proxy for product differentiation, Indi

measures relative activity in individual lines, Size is firm size, Stock indicates stock

organization form, Age is insurer age at the time of LTCI market entry, CapAdeq

signifies the capital adequacy of the insurer, Ajfil indicates whether the insurer has

a group affiliation, and Health is the relative activity in health insurance lines other

than LTCI.

Profit Model

In a meta-analysis of previous work on first mover advantages, Vanderwerf and

Mahon (1997) posit that studies using market share as the dependent variable are

prone to finding first mover advantages. Lieberman and Montgomery (1988, 1998)

also express concerns about possible bias when testing market share, arguing that

profitability is the most appropriate and direct measure of first-mover advantages.

They note that market share often is a poor proxy for profits. For example, a firm can

increase market share by cutting prices to such an extent that an innovative product

becomes unprofitable. Researchers continue to use market share as a surrogate for

profitability because profit data for a particular new product or line of business is

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

Early Mover Advantages 1125

rarely available. The unique data for LTCI do allow direct observation of product

specific profits, however.

An argument for greater profits for early movers in a new product line is that earlier

movers can achieve lower costs (Tufano, 1989). LTCI is a long-tailed line and the

largest costs consist of largely distant, future claims, for which projections are highly

uncertain because of limited actuarial experience. Early movers conceivably can ben

efit from proprietary learning advantages by gaining actuarial experience that leads

to superior underwriting decisions, hence ultimately lower claims relative to later

entrants.

Our profit model is defined as

Profitit = (i\Earlylt + ci2ProdDiffit + a^ExpLoss^ + aniridia

+ a^Sizen + a^Stockn + ajAgeit + agCapAdeqit + + aioHealthn

+ ßPolAgeit + Tj + Cj + en, (2)

where it means the value for the z'th insurer in perio

for years 1994-2002, c, is the individual effect, and su

Because of data issues, we necessarily test two prox

unadjusted profit margin simply is gross LTCI pr

losses, divided by gross LTCI premiums earned. Th

itability because LTCI losses are expected to be quit

the expected, long-tailed loss distribution. Specific

chased by pre-retirees and most losses are unlikely

reach age 80 and beyond. We therefore follow Cox

ond estimate of profit margin, referenced as adjusted

all current-period changes in policy reserves into t

estimate, which is likely to be very conservative if

our only alternative because the data do not revea

attributable only to the current year's profit. We con

estimate that is excessively liberal, considering the

that is likely to be excessively conservative becau

into the current year's profits.

We use some of the same control variables as in our market share model but add two

new ones to proxy expected loss ratio and policy age, which we discuss next.

Expected Loss Ratio. The NAIC requires LTC insurers to estimate expected loss ratios.

Cox and Ge (2004) use both current-year loss ratios and reserve-adjusted loss ratios as

their LTCI profitability dependent variable and find that expected loss ratios have a

positive and significant relation with both these profitability ratios. For our dependent

variable profit measure, a higher value means greater profitability, so we expect a

negative relation to expected loss ratio. LTC insurers report a premium-weighted

anticipated loss ratio, which we use as our proxy for expected loss ratio.

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

1126 The Journal of Risk and Insurance

Policy Age. Most LTCI claims are expected during policyholders' more advanced

years, so the LTCI loss distribution is necessarily long tailed. Furthermore, the positive

impact of the initial underwriting and selection process should dissipate rapidly over

the term of the policy. Insurers with relatively older policies outstanding are likely to

incur greater claims, which necessarily reduce profitability. We consequently expect

insurer profitability to be positively related to the more newly issued policies in force

and negatively related to older policies in force.

Insurers report their LTCI premiums earned on policies that have been in force for

seven duration categories, that is, 1, 2, 3, 4, 5, 6 through 9, and 10 or more years.

We therefore apply the ratio of premiums earned in each time-in-force category, with

the exception of the 10+ category,6 to total premiums earned. Our policy age factor

therefore is a vector of the ratio of premiums for the policy age category to total

premiums for LTCI policies in the six categories discussed previously.

Pricing Model

As we discussed previously, researchers of investment banking have examined fi

nancial innovators to determine whether they realize pricing advantages because

of such barriers as proprietary learning and economies of scale. Carow (1999b) and

Charupat and Prisman (2004) report evidence of higher spreads charged by early

movers into certain investment banking products, but most researchers find no such

pricing premium. We earlier analyze how the characteristics of the LTCI market can

lead to potential informational advantages related to proprietary claims experience

and relatively high switching costs that allow insurers to extract price premiums, al

though potential pricing advantages for product innovators in the insurance industry

are heretofore unexplored.

Part of the empirical research problem is that pricing data for a broad group of

insurance policies simply are not available. In contrast to most insurance pricing

studies that are only able to examine average prices for broadly defined insurance

lines (see, e.g., Weiss and Chung, 2004), LTCI data allow development of average

price proxies for each specific policy form within this single line. We consequently

exploit these unique data to assess potential pricing advantages of early movers into

LTCI markets.

6The Policy Age variables are not binary (dummy) variables. Each is defined as the ratio of

LTCI premiums earned for the policy age category to total LTCI premiums earned by the

insurer. However, the sum of the all the Policy Age ratios for each insurer is 1, so if we include

all Policy Age variables in the regression, perfect multicollinearity blows up our results, so

we omit one of the ratios (10+ years). The results are not interpreted like dummy variables

would be but are directly interpreted as the relation to profitability, not relative to the omitted

variable. We confirmed this by alternately omitting other Policy Age variables and including

the 10+ Policy Age variable. This did not significantly change the results for the other Policy

Age variables and the 10+ variable is negatively and significantly related to profitability when

included.

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

Early Mover Advantages 1127

Our pricing model is

Pricejit = aiEarlyit + a2PolYr j rit + a^Cover j rit + a^MktShru + a^ExpLosSjf

+ aslndijjt + a^Sizeit + agStockit + agAgeit + a\o CapAdeqit + u\\Af)"ilit

+ a^Healthit + Tt+ Cj + £j,it, (3)

where Price is a policy level variable defined as the natural lo

premiums earned by insurer i in year t for policy form; to the nu

under policy form j in year t. PolYr, Cover, and Indi are also

whereas Size, Stock, Age, CapAdeq, Affil, and Health are insur

the time-specific effect for years 1994-2002, a is the individu

time-varying error.

We specifically use the average premium earned for first-year

form issued by each insurer as our price proxy. By focusing

we are able to eliminate unobservable and potentially confoun

justments over the duration of existing policies. Our early m

variables are as defined in our profit model, but we add a ne

and a coverage variable to control for differences between LTC

Policy Year. We define policy year as the calendar year in wh

policy form was first issued. Earlier generations of LTCI pro

narrower coverage attributes, more stringent underwriting

limits on benefits (Black and Skipper, 2000; Coronel, 2000). Pol

should be positively related to price. On the other hand, one c

issued later in an emerging market will be priced lower as m

the market and products become more standardized. This is t

effect. Because Cox and Ge (2004) found evidence of price low

highballing, in the LTCI market, we expect policy year to be

price.

Coverage. LTCI policies with more comprehensive coverage attributes should com

mand higher prices. Because we cannot observe the contractual features of each LTCI

policy form to directly assess coverage, we use the total policy reserve for the cohort

of new policyholders under each policy form divided by the number of lives insured

under each form. The total policy reserve is the insurer's approximation of the present

value of all claims anticipated on a particular policy form. To our knowledge, LTCI

is the only insurance product for which such comprehensive information is available

for each policy form offered.

Results

We first examine statistics that provide an overview of market structure and the over

all market tenure and profitability of the LTCI insurers in our sample. After this, we

discuss the results produced by our market share, profit, and pricing models. For

all three models, LM test results show that fixed and random effects regressions are

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

1128 The Journal of Risk and Insurance

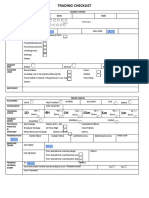

Table 1

Top Underwriters in the LTCI Market

Top Five Insurers Market Share Market Entry

Panel A: 1994

1. AMEX Life 16.5% 1978

2. Continental Casualty 8.28% 1979

3. Bankers Life & Casualty 6.31% 1985

4. John Hancock Mutual 6.02% 1985

5. Conseco Senior Health 5.85% 1978

5-firm concentration ratio 42.96%

10-firm concentration ratio 63.15%

Aggregate LTCI premiums written $1.779 billion

Panel B: 1999

1. GE Capital Assurance 15.98% 1978

2. Conseco Senior Health 13.46% 1978

3. Continental Casualty 10.12% 1979

4. John Hancock Mutual 9.43% 1985

5. Bankers Life & Casualty 7.74% 1985

5-firm concentration ratio 56.64%

10-firm concentration ratio 77.94%

Aggregate LTCI premiums written $4,063 billion

Panel C: 2002

1. GE Capital Assurance 14.18% 1978

2. John Hancock Life 9.77% 1985

3. Continental Casualty 9.15% 1979

4. Conseco Senior Health 8.09% 1978

5. Bankers Life & Casualty 7.61% 1985

5-firm concentration ratio 48.81%

10-firm concentration ratio 72.38%

Aggregate LTCI premiums written $6,481 billion

more suitable than the pooled ordinary least squares (OLS) method, while subse

quent Hausman tests indicate that fixed effects regressions are more appropriate than

random effects estimations. Consequently, only the fixed effects results are shown in

the subsequent tables. Standard errors are corrected using White heteroskedasticity

consistent covariance estimators (Greene, 2003, p. 314).

Descriptive Statistics and Analysis

To gain a better understanding of LTCI market structure, we provide an analysis of

market concentration in Table 1. Both the 5- and 10-firm concentration ratios rose

substantially between 1994 and 1999, but then dropped somewhat by 2002. With the

5- and 10-firm ratios slightly under 50 percent and 75 percent, respectively, by 2002

the prima facie evidence indicates a reasonably competitive market. We further find

that the top five LTC insurers entered the market by 1985, compared to 1989 for the

typical insurer in our sample.

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

Early Mover Advantages

Table 2

Descriptive Statistics for the Sample of Long-Term Care Insurers

Correlation With

Insurer Characteristics Mean (S.D.) Median Early Mover

Early Mover 9.63 9.00 1.000

Market Share (%) 0.68 0.07 0.374

(0.20)

Unadjusted Profit Margin (%) 52.26 68.35 0.334

(41.77)

Adjusted Profit Margin (%) 13.89 14.01 0.362

(4.19)

Product Differentiation 5.66 3.00 0.436

(6.80)

Firm Size 20.85 20.64 0.088

(2.31)

Firm Age 52.63 43.00 0.023

(37.27)

Stock Form 0.86 1.00 0.032

(0.35)

Capital Adequacy 7.78 5.630 -0.023

(8.76)

Notes: The sample consists of 1,139 annual observations for the period 1994-2002. Early Mover

is the number of years since the insurer issued its first LTCI policy. Market Share is the ratio of

LTCI premiums earned by each insurer to total LTCI premiums earned by all insurers in the

sample. Unadjusted Profit is defined as the gross LTCI premiums earned less underwriting losses,

divided by gross LTCI premiums earned. Adjusted Profit is defined as the gross LTCI premiums

earned less underwriting losses and policy reserves, divided by gross LTCI premiums earned.

Product Differentiation is the count of different policy forms issued by the insurer in the current

year. Firm Size is the natural log of total admitted assets. Firm Age is the age of an insurer at the

time it entered the LTCI market. Stock Form equals one if the insurer is a stock firm and zero

otherwise. Capital Adequacy is the risk-based capital ratio, which equals total adjusted capital

divided by minimum risk-based capital as defined by the National Association of Insurance

Commissioners. Values in parentheses are standard deviations.

As shown in Table 2, the mean and median for tenure in the LTCI market, our early

mover variable, fall between 9 and 10 years, with a standard deviation of 5.47 years.

Despite the substantial market shares of the larger LTC insurers apparent in Table 1,

the typical LTC insurer controls less than 1 percent of the market. The data also reveal

that the average LTC insurer issues between five and six policy forms, although the

median is only 3. In results not contained in the tables, we observe some correlation

between our early mover variable and market share, profit margin, and product

differentiation, but the correlation coefficients never exceed 0.45. We compute the

variance inflation factors (VIFs) developed by Belsley, Kuh, and Welsch (1980) and

find that all are below 3.5, so collinearity is unlikely to be a problem.

Table 2 also contains two estimates of underwriting profitability described earlier.

The very large, unadjusted profit margins reported in Table 2 indeed are indicative

of a young insurance market with mostly long-tailed losses that are not yet realized.

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

1130 The Journal of Risk and Insurance

Table 3

Market Share Results

Dependent Var: Market Share

Independent Variables Coefficients p-value

Early Mover 0.004 0.058*

Product Differentiation 0.009 <0.001***

Individual Business 0.001 0.580

Firm Size 0.003 <0.001***

Stock Form 0.008 <0.001***

Firm Age <0.001 0.013**

Capital Adequacy <0.001 0.534

Group Affiliation -0.002 0.459

Health Insurer 0.006 <0.001***

R2 0.245

Number of observations 1,139

Notes: Fixed-effects regression is applied to unbalanced panel data for individual insurers

issuing long-term care insurance (LTCI) from 1994 through 2002. The unbalanced panel contains

1,139 observations. Market Share is the ratio of LTCI premiums earned by the insurer to total

LTCI premiums earned by all sample insurers in the current year. Early Mover is the number of

years since the insurer first issued an LTCI policy. Product Differentiation is the count of different

LTCI policy forms issued by the insurer and outstanding in the current year. Individual Business

is the percentage of total LTCI premiums earned on individual, as opposed to group, policies.

Firm Size is the natural log of total assets. Stock Form equals one if the insurer is a stock firm and

zero otherwise. Firm Age is the attained age of the insurer at the time of market entry. Capital

Adequacy is the risk-based capital ratio, which equals total adjusted capital divided by minimum

risk-based capital as defined by the National Association of Insurance Commissioners. Group

Affiliation equals one if the insurer is a member of a group and zero if the insurer is unaffiliated.

Standard errors are corrected for heteroskedasticity using White's estimators. Health Insurer is

the ratio of health insurance premiums written, excluding LTCI premiums, to total insurance

premiums written by each insurer. ***, **, and * indicate significance at the 1%, 5%, and 10%

levels, respectively.

Our much more conservative adjusted profit estimate, with a mean and median of

approximately 14 percent, better reflects profit expectations in a relatively new, long

tailed insurance line. We note that our measures of LTCI underwriting profits do not

impound investment profits earned by insurers because we cannot directly link the

portion of the each insurer's general investment portfolio attributable to premiums

generated by the sale of LTCI products.

Market Share Results

Table 3 reveals that the early mover variable is positively related to market share,

with a p-value of 0.058. Our results support the hypothesis that early movers gain

market share advantages, which is consistent with evidence from previous studies.

Even though insurers cannot patent products, barriers to entry are low, and product

information is relatively transparent, early movers gain greater market shares. Fol

lowing Ziliak and McCloskey (2004), we also consider the economic significance of

early movement on LTC insurers' market share. We find that if the typical insurer in

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

Early Mover Advantages 1131

our sample had moved into the LTCI market 5.5 years earlier, which is one standard

deviation from the norm, it would have gained over 2 percent in market share. This

would represent a quadrupling of the typical market share, which we regard as highly

significant in economic terms.

Product differentiation is positively related to market share at the 1 percent sig

nificance level, which is consistent with Schroth's (2006) findings. Firm size is also

positive and significantly related to market share, which is consistent with evidence

from Doerpinghaus and Gustavson (1999), who argue that larger insurers have an

advantage in attracting customers in a relatively new, long-tailed insurance line such

as LTCI. A positive and significant coefficient for stock form supports the managerial

discretion hypothesis, which posits that managers of stock insurers are more aggres

sive in exploiting new markets for which actuarial experience is not well defined.

Firm age is also positive and significant, consistent with prior hypotheses that older

firms with lengthier actuarial experience have advantages in building market share

in a new line of business.

A positive and significant relation between prior health insurer experience and market

share is consistent with the McShane and Cox (2009) evidence that insurers with more

experience in traditional health insurance lines have informational advantages that

are beneficial in competing in the newer LTCI line. We find no relation between

the relative amount of individual business, capital adequacy, or group affiliation with

market share. The first result impresses us as particularly interesting because it implies

that insurers are not leveraging potential superior information to lock in individual

consumers and build market share.

A possible criticism of using the number of years since the insurer entered the LTCI

market as our early mover measure could be a mechanical relation with market share.

In other words, one could argue that an insurer participating in the LTCI market more

years logically should have a larger market share. We therefore perform an additional

regression to compare market shares after insurers have been in the LTCI market the

same number of years, which is similar to how Berger and Dick (2007) handled this

issue in their market share model. Our data set limits the extent to which we can do

this but does allow the following.

As described in the Data section, our data are from 1994 through 2002. We start with

1994 because it is the first year that the NAIC separately collected and reported the

LTCI data. The LTC insurers with the longest tenure in our data set entered the LTCI

market in 1978, and thus have tenure of 17 years by 1994.

The additional regression uses market share data for all insurers that had been in

the market for at least 17 years by 2002. For example, if an insurer entered the LTCI

market in 1978, we use the market share and other firm characteristic data for that

firm in 1994. If an insurer entered the LTCI market in 1986, we use the market share

and other firm characteristic data for that firm in 2002. The insurers in our data set

will be all insurers that entered the LTCI market between 1978 and 1986. The Early

variable will be the number years the insurer has been in the market as of 1986.

This regression allows us to investigate whether earlier entrants have larger market

shares relative to later entrants, after being in the LTCI market for the same number of

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

1132 The Journal of Risk and Insurance

Table 4

Market Share Results Controlling for Years in LTCI Market

Dependent Var: Market Share

Independent Variables Coefficients p-value

Early Mover 0.001 0.008"*

Product Differentiation 0.001 0.035**

Individual Business 0.006 0.210

Firm Size 0.003 0.003***

Stock Form 0.007 0.126

Firm Age <0.001 0.219

Capital Adequacy <0.001 0.433

Group Affiliation -0.002 0.767

Health Insurer 0.013 0.012**

R2 0.131

Number of observations 41

Notes: Early Mover is the number of years the insurer has been offering LTCI as of 1986. For other

variables, the values are for the firm in the 17th year since it first offered LTCI. The regression

uses data from a certain year for each insurer (the 17th year after the insurer entered the LTCI

market), so will be a simple regression not a panel data regression. See Table 3 for a general

description of the variables. ***, **, and * indicate significance at the 1%, 5%, and 10% levels,

respectively.

years (17 years). In this regression, the results for the Early variable can be interpreted

as evidence of whether being an early mover results in a market share advantage:

MS, i7 = a\ Early^ + oi2ProdDiff^y + a^Indiny + a^Sizeny + a^Stockny + a^Age^y

+ ayCapAdeqil7 + ot$Affilil7 + a9Healthuy+ eu, (4)

where Early$6 is the number of years the insurer has been offering LTCI as of 1986.

For example, for insurers that first offered LTCI from 1978, the value would be 9; from

1982, value would be 5; and from 1986, value would be 1. For other variables, the

values are for the firm in the 17th year after it first offered LTCI.

Note that the regression uses data from a certain year for each insurer (the 17th year

after the insurer entered the LTCI market), so will be a simple regression not a panel

data regression. Accordingly, the size of our data set is reduced because we can only

include insurers that entered the LTCI market between 1978 and 1986. In our data

set, 41 insurers were offering LTCI by 1986 and had been offering LTCI for at least 17

years by 2002. Table 4 shows the results of this regression. Early mover is still positive

and significantly related to market share, which offers additional support for Early

Mover advantage in gaining and maintaining market share.

An argument that favors later movers is that they may be able to co-opt information

on industry actuarial experience at low cost to gain market share advantage over

earlier movers. Our results do not support this view. We surmise that since early

movers have fewer competitors, they can gain market share more easily than later

imitators who face more competitors, including the entrenched early movers. The

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

Early Mover Advantages 1133

early movers could, for example, maintain their market share lead over later movers

by aggressively pricing when competitors enter the market.

Profitability Results

Table 5 shows regression results for both of our profitability measures.

The early mover variable is positive and significant for both profitability measures,

with a p-value of 0.018 for unadjusted profit and 0.052 for adjusted profit. In terms

of economic significance, an increase of one standard deviation in the early mover

variable would increase unadjusted profit for the typical insurer by 9.8 percent and

adjusted profit by 2.2 percent. In other words, if the typical insurer had entered the

LTCI market about 5.5 years earlier, relative increases in unadjusted and adjusted

profits above the means shown in Table 2 would have been 18.8 percent and 15.8

percent, respectively. Such increases again impress us as economically significant.

Considering these findings and our earlier results, we can see that early movers are

gaining market share, but not at the expense of profitability. The higher profitability

of early movers may be attributable to higher prices, lower costs, or a combination of

the two. Our exploration of pricing relations in the next section sheds further light on

these relations.

The product differentiation coefficient is positive and significant, once again show

ing that insurers offering greater LTCI policy choices gain a competitive advantage.

Expected loss ratio is negatively related to profitability, consistent with previous em

pirical evidence and our expectation. The individual business effect is highly positive

and significant at the 1 percent level, consistent with our expectation that individual

LTCI markets are less competitive than group markets and that relatively greater

switching costs can produce some consumer lock-in. Firm size also is positively re

lated to profitability, a result consistent with the suggestion by Doerpinghaus and

Gustavson (1999) that greater name recognition and positive reputation favor larger

firms entering the new and innovative LTCI market. The relative degree of prior

health insurance experience has a positive and significant relation to profitability,

which supports the McShane and Cox (2009) conclusion that insurers in traditional

health lines benefit from strategic focus when entering the relatively new LTCI line.

Results for the policy age variables provide explicit evidence of initial underwriting

effects on the profitability of LTCI. Our evidence reveals that first- and second-year

policies are relatively profitable. By the third year, the initially favorable underwriting

effect disappears. The policy age coefficients actually are significantly negative for the

fourth-year coefficients and beyond. These results imply an early underwriting effect

that disappears rapidly. Older policies in force generate significantly lower profits,

which probably reflect generally anticipated greater losses as policyholders' age.

Finally, our results suggest that general insurer characteristics such as organizational

structure, firm age, capital adequacy, and group affiliation do not significantly affect

LTCI profitability.

We also ran unreported regressions that interact the early mover variable with other

variables in the market share and profitability regressions, and describe significant

results here. We find that the early mover, product differentiation interaction term

is insignificant in the market share regression but positive and significant in the

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

1134 The Journal of Risk and Insurance

Table 5

Profitability Results

Dependent Variable

Unadjusted Profit Adjusted Profit

Independent Variables Coefficients p-value Coefficients p-value

Early Mover 0.012 0.018** 0.009 0.052*

Product Differentiation 0.027 0.014** 0.005 0.005***

Expected Loss Ratio -0.154 0.073* -0.019 0.088*

Individual Business 0.337 0.004*** 0.245 <0.001***

Firm Size 0.054 <0.001*** 0.051 <0.001***

Stock Form 0.125 0.162 0.194 0.111

Firm Age 0.007 0.129 0.014 0.143

Capital Adequacy -0.002 0.385 -0.001 0.331

Group Affiliation 0.006 0.776 0.004 0.706

Health Insurer 0.254 0.021** 0.154 0.037**

Policy Age: 1 year 1.005 <0.001*** 0.923 <0.001***

Policy Age: 2 years 0.211 0.062* 0.156 0.038**

Policy Age: 3 years -0.126 0.531 -0.138 0.713

Policy Age: 4 years -1.030 0.015** -1.409 0.008***

Policy Age: 5 years -1.763 <0.001*** -2.034 <0.001***

Policy Age: 6-9 years -0.877 <0.001*** -1.432 <0.001***

Adjusted R2 0.342 0.321

Number of observations 1,139 1,139

Notes: Fixed-effects regression is applied to unbalanced panel data for individual insurers issu

ing long-term care insurance (LTCI) from 1994 through 2002. The unbalanced panel contains

1,139 observations. Unadjusted Profit is defined as the gross LTCI premiums earned less under

writing losses, divided by gross LTCI premiums earned. Adjusted Profit is defined as the gross

LTCI premiums earned less underwriting losses and changes in policy reserves, divided by

gross LTCI premiums earned. Early Mover is the number of years since the insurer first issued

an LTCI policy. Product Differentiation is the count of different LTCI policy forms issued by the

insurer and outstanding in the current year. Expected Loss Ratio is the aggregated anticipated

loss ratio for all LTCI policies the insurer has in force calculated using the data provided by

insurers for each LTC policy form for each year. Individual Business is the percentage of total

LTCI premiums earned on individual, as opposed to group, policies. Firm Size is the natural log

of total assets. Stock Form equals one if the insurer is a stock firm and zero otherwise. Firm Age

is the attained age of the insurer at the time of market entry. Capital Adequacy is the risk-based

capital ratio, which equals total adjusted capital divided by minimum risk-based capital as

defined by the National Association of Insurance Commissioners. Group Affiliation equals one

if the insurer is a member of a group and zero if the insurer is unaffiliated. Health Insurer is

the ratio of health insurance premiums written, excluding LTCI premiums, to total insurance

premiums written by each insurer. The Policy Age variables (first-year business, second-year

business, etc.) are the ratios of LTCI premiums earned for the policy age category to total LTCI

premiums earned by the insurer. ***, **, and * indicate significance at the 1%, 5%, and 10%

levels, respectively.

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

Early Mover Advantages 1135

profitability regression. In both regressions, early mover and product differentiation

remain significant even when the interaction term is included. These results suggest

that the relation between product differentiation and market share is relatively simple.

Firms offering more types of policies attract more types of customers, resulting in

greater market share, all else equal. The results in the profitability model imply a more

complex relationship. Early movers in general have advantages that lead to higher

profitability, but early movers offering more products have even greater profitability.

We find that the early mover, health insurance interaction term is significant and

positive in both the market share and profitability regressions. In both regressions,

early mover and health insurance remain significant even when the interaction term

is included. As described earlier, McShane and Cox (2009) argue that insurers with

more experience in health insurance lines should have informational advantages in

the LTCI market. These results suggest that an early mover advantage exists for the

LTCI market regardless of health insurance experience, but that the advantage is even

greater for early movers that have more health insurance experience.

Pricing Results

Table 6 displays our regression estimates for the pricing model. We observe no signif

icant relation between our early mover variable and the average prices for different

policy forms. Our pricing results support the argument made previously that early

movers maintain market share by pricing aggressively as new insurers enter the LTCI

market. Considering our previous observation of greater market share and profits for

early movers, the paucity of pricing advantages implies that early movers into LTCI

products most likely benefit from cost advantages. Economies of scale are unlikely

because of the insignificant results for our market share and firm size variables. We

suggest that a more likely explanation is that early movers generate proprietary learn

ing advantages. Because LTCI is a long-tailed line for which actuarial experience is

limited and full loss development takes years, earlier movers should be able to gain

actuarial experience that can give them informational advantages over later imitators.

Such an argument also is consistent with our earlier evidence that traditional health

insurers gain profit advantages, probably because of greater focus in a line for which

their prior experience with the health expenses of aging policyholders is useful.

We find a highly significant, negative relation between policy year and prices. This

suggests that standardization of LTCI over time and the emergence of imitators domi

nate the effects of limited benefits and allegedly stringent underwriting for early LTCI

policies. Our coverage variable is significant and positively related to average price,

as expected, indicating that policy forms with more comprehensive coverage have

higher premiums. As noted earlier, market share is not significant, which suggests

that monopolistic pricing practices are not possible in the relatively dispersed LTCI

market.

Individual policy status7 is positive and significantly related to average price, as

expected, reinforcing our profit results. Firm age is positively related to price,

7At the policy form level, the individual versus group data are available for only about one

third of the observations. We ran regressions that included and omitted the Individual Business

variable. The regression that omitted the variable had many more observations. The results

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

1136 The Journal of Risk and Insurance

Table 6

Pricing Results

Dependent Var: Price

Independent Variables Coefficients p-value

Early Mover 0.009 0.127

Policy Year -0.012 0.008"*

Coverage <0.001 0.034"

Market Share -0.253 0.526

Expected Loss Ratio -0.159 0.183

Individual Business 0.434 <0.001"*

Firm Size -0.029 0.173

Stock Form 0.109 0.118

Firm Age <0.001 0.041"

Capital Adequacy -0.006 0.053*

Group Affiliation -0.203 0.132

Health Insurer 0.082 0.456

R2 0.153

Number of observations 2,073

Notes: Fixed-effects regression is applied to unbalanced panel data for first-year, LTCI policy

forms issued by insurers from 1994 through 2002. Price is defined as the natural log of the ratio

of LTCI premiums earned by an insurer for a particular policy form in a certain year to the

number of lives insured under that form. Early Mover is the number of years since the insurer

first issued an LTCI policy. Policy Year is the calendar year in which a particular LTCI policy

form was first issued. Coverage is the total policy reserves for each policy form divided by the

number of lives insured under that form. Market Share is the ratio of LTCI premiums earned by

the insurer to total LTCI premiums earned by all sample insurers in the current year. Expected

Loss Ratio is the anticipated loss percentage provided by insurers for each LTC policy form for

each year. Individual Business is the percentage of total LTCI premiums earned on individual,

as opposed to group, policies. Firm Size is the natural log of total assets. Stock Form equals one

if the insurer is a stock firm and zero otherwise. Firm Age is the attained age of the insurer

at the time of market entry. Capital Adequacy is the risk-based capital ratio, which equals total

adjusted capital divided by minimum risk-based capital as defined by the National Association

of Insurance Commissioners. Group Affiliation equals one if the insurer is a member of a group

and zero if the insurer is unaffiliated. Health Insurer is the ratio of health insurance premiums

written, excluding LTCI premiums, to total insurance premiums written by each insurer. ***,

**, and * indicate significance at the 1%, 5%, and 10% levels, respectively.

supporting the argument that older firms are likely to have actuarial experience

in other lines that give them advantages in new markets. The significant inverse

relation between capital adequacy and pricing is consistent with the results of Doerp

inghaus and Gustavson (1999). Their explanation for these results was more selective

underwriting by less capitalized insurers.

were not significantly different between the two regressions and since the Individual Business

variable is significant, we provide only the regression results that include the Individual Business

variable.

This content downloaded from

5.151.174.163 on Sun, 17 Mar 2024 05:32:14 +00:00

All use subject to https://about.jstor.org/terms

Early Mover Advantages 1137

Our results imply that insurers with traditional health insurance experience do not

have any pricing advantage in LTCI. As described previously, McShane and Cox

(2009) find evidence that insurers with prior experience in health insurance lines

when entering the LTCI market have informational advantages over insurers who do

not have this experience. The health variable is not significant in our price regression

but is significant in the profitability regression, providing evidence that the advantage

of prior health insurance experience is related to costs, not prices.

Firm size, stock form, and group affiliation also are not significantly related to policy

prices in our tests.

Summary and Conclusions

We use a unique and comprehensive data set to explore a relatively new and rapidly

growing financial market: the market for LTCI. We focus on the relation between early

movement into this new market and financial performance and pricing. Research on

financial innovation has been characterized by sparse data and correspondingly weak

empirical tests that have frequently produced conflicting results.

Our results support a positive relation between earlier movers and LTCI market share.

In this respect, our results are consistent with those generated via univariate tests by

other researchers. Product differentiation, firm size, stock organizational form, firm

age, and health insurance experience are also positively related to LTCI market share.

As described previously, studies using market share as the dependent variable are

prone to finding early mover advantages because early movers can cut prices to gain

market share at the expense of profitability. Our subsequent analysis suggests this is

not the case for LTCI, by revealing evidence of early mover effects on book measures

of LTCI underwriting profitability. These findings suggest that for a product such as

LTCI, with substantial informational asymmetries, proprietary learning can lead to a