Professional Documents

Culture Documents

Solvency Ratio - Overview, How To Compute, Limitations

Uploaded by

sunnyleoni.440Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solvency Ratio - Overview, How To Compute, Limitations

Uploaded by

sunnyleoni.440Copyright:

Available Formats

Home › Resources › Commercial Lending › Solvency Ratio

Solvency Ratio

A performance metric that helps us examine a company’s financial

health

Over 1.8 million professionals use CFI to learn accounting, financial analysis,

modeling and more. Start with a free account to explore 20+ always-free

courses and hundreds of finance templates and cheat sheets.

Start Free

Written by CFI Team

What is a Solvency Ratio?

A solvency ratio is a performance metric that helps us examine a

company’s financial health. In particular, it enables us to determine

whether the company can meet its financial obligations in the long term.

Give Your Banking Career a Boost

Use CFI’s free Career Booster to improve

key skills in commercial lending,

The metric is verycredit,

useful to lenders, potential investors, suppliers, and

capital markets,

any otherandentity

more!that would like to do business with a particular

company. It usually compares the entity’s profitability with its obligations

Register

to determine whether it is financially sound. In that regard, a higher or

strong solvency ratio is preferred, as it is an indicator of financial

strength. On the other hand, a low ratio exposes potential financial

hurdles in the future.

Summary

The solvency ratio helps us assess a company’s ability to meet

its long-term financial obligations.

To calculate the ratio, divide a company’s after-tax net income

– and add back depreciation– by the sum of its liabilities

(short-term and long-term).

A high solvency ratio shows that a company can remain

financially stable in the long term.

How to Calculate the Solvency Ratio

As explained later, there are a couple of other ways to determine a

company’s solvency, but the main formula for calculating the solvency

ratio is as follows:

Solvency Ratio = (Net Income + Depreciation) / All Liabilities (Short-term

+ Long-term Liabilities)

If you examine keenly, you will notice that the numerator comprises the

entity’s current cash flow, while the denominator is made up of its

liabilities. Thus, it is safe to conclude that the solvency ratio determines

whether a company’s cash flow is adequate to pay its total liabilities.

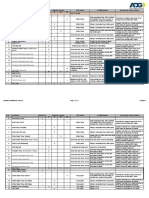

Practical Example

Let’s look at the case of SaleSmarts Co.:

SaleSmarts (USD in millions)

Give Your Banking Career a Boost

Net Income 45,000

Use CFI’s free Career Booster to improve

Depreciation 15,000

key skills in commercial lending, credit,

capital markets, and more!

Short-term Liabilities 83,000

Long-term Liabilities 160,000

Solvency Ratio = (45,000 + 15,000) / (83,000 + 160,000)

Solvency Ratio = 0.246 * 100 = 24.6%

Important to note is that a company is considered financially strong if it

achieves a solvency ratio exceeding 20%. So, from our example above, it

is clear that if SalesSmarts keeps up with the trend each year, it can

repay all its debts within four years (100% / 24.6% = Approximately four

years).

Limitation of the Solvency Ratio

Although the solvency ratio is a useful measure, there is one area where

it falls short. It does not factor in a company’s ability to acquire new

funding sources in the long term, such as funds from stock or bonds. For

such a reason, it should be used alongside other types of analysis to

provide a comprehensive overview of a business’ solvency.

Other Solvency Ratios

Financial ratios enable us to draw meaningful comparisons regarding an

organization’s long-term debt as it relates to its equity and assets. The

use of ratios allows interested parties to assess the stability of the

company’s capital structure. Here are a few more ratios used to evaluate

an organization’s capability to repay debts in the future.

1. Debt-to-Equity (D/E) Ratio

Often abbreviated as D/E, the debt-to-equity ratio establishes a

company’s total debts relative to its equity. To calculate the ratio, first,

get the sum of its debts. Divide the outcome by the company’s total

equity. This is used to measure the degree to which a company is using

debt to fund operations (leverage).

2. Interest Coverage Ratio

With the interest coverage ratio, we can determine the number of times

that a company’s profits can be used to pay interest charges on its debts.

To calculate the figure, divide the company’s profits (before subtracting

any interests and taxes) by its interest payments.

Give Your Banking Career a Boost

The higher the value, the more solvent the company. In other words, it

Use CFI’s free Career Booster to improve

means the day-to-day operations are yielding enough profit to meet its

key skills in commercial lending, credit,

interest payments.

capital markets, and more!

3. Debt-to-Capital Ratio

As implied in the name, the debt-to-capital ratio determines the

proportion of a business’ total capital that is financed using debt. For

example, if a company’s debt-to-capital ratio is 0.45, it means 45% of its

capital comes from debt. In such a case, a lower ratio is preferred, as it

implies that the company can pay for capital without relying so much on

debt.

Wrap Up

Before an individual or organization invests or lends money to a

company, they need to be sure that the entity in question can remain

solvent over time. Thus, interested stakeholders utilize solvency ratios to

assess a company’s capacity to pay off its debts in the long term.

A high solvency ratio is an indication of stability, while a low ratio signals

financial weakness. To get a clear picture of the company’s liquidity and

solvency, potential investors use the metric alongside others, such as the

debt-to-equity ratio, the debt-to-capital ratio, and more.

More Resources

Thank you for reading CFI’s guide to Solvency Ratio. To keep advancing

your career, the additional CFI resources below will be useful:

Common Size Ratio

Financial Ratios

Insolvency

Shareholder Equity Ratio

See all commercial lending resources

Share this article

Give Your Banking Career a Boost

Use CFI’s free Career Booster to improve

Get Certified for Financial Modeling

key skills in commercial lending, credit,

capital markets, and more!

(FMVA)®

Gain in-demand industry knowledge and hands-on practice that

will help you stand out from the competition and become a

world-class financial analyst.

Learn More

Company

Certifications

CFI For Teams

Support

Community

Trustpilot

Give Your Banking Career a Boost

Use CFI’s free Career Booster to improve

key skills in commercial lending, credit,

capital markets, and more!

© 2015 to 2024 CFI Education Inc.

Privacy Policy Terms of Use Terms of Service Legal

Give Your Banking Career a Boost

Use CFI’s free Career Booster to improve

key skills in commercial lending, credit,

capital markets, and more!

You might also like

- Cas Ii Assignment ON Importance of Liquidity Ratios in The IndustryDocument7 pagesCas Ii Assignment ON Importance of Liquidity Ratios in The IndustrySanchali GoraiNo ratings yet

- What Is A Good or Bad Gearing Ratio? PDFDocument8 pagesWhat Is A Good or Bad Gearing Ratio? PDFKainos MuradzikwaNo ratings yet

- AssignmentDocument5 pagesAssignmentpankajjaiswal60No ratings yet

- Ratio Analysis DefinitionDocument10 pagesRatio Analysis Definitionwubishet wondimuNo ratings yet

- What Is Ratio AnalysisDocument19 pagesWhat Is Ratio AnalysisMarie Frances Sayson100% (1)

- Financial Statement Analysis-IIDocument45 pagesFinancial Statement Analysis-IINeelisetty Satya SaiNo ratings yet

- Mba5002 Discussion 4Document2 pagesMba5002 Discussion 4Rabia BhardwajNo ratings yet

- MGT - Accounting - Imp (1 Unit 3 and 1Document12 pagesMGT - Accounting - Imp (1 Unit 3 and 1Vansh TharejaNo ratings yet

- Cap StructureDocument4 pagesCap StructureInvisible CionNo ratings yet

- Ratio AnalysisDocument9 pagesRatio Analysisbharti gupta100% (1)

- Financial Ratio AnalysisDocument6 pagesFinancial Ratio Analysis5555-899341No ratings yet

- Walt Disney Fa Sem3Document29 pagesWalt Disney Fa Sem3Ami PatelNo ratings yet

- Financial Statements Analysis - Q&aDocument6 pagesFinancial Statements Analysis - Q&aNaga NagendraNo ratings yet

- Strategic Audit NotesDocument6 pagesStrategic Audit NotesMaeve AguerroNo ratings yet

- Cash Flows RatiosDocument12 pagesCash Flows RatiosSaifiNo ratings yet

- Financial Analysis Tools - HandoutsDocument2 pagesFinancial Analysis Tools - HandoutsJohna Mae Dolar EtangNo ratings yet

- Assignment On: Financial Statement Analysis FIN 4218Document28 pagesAssignment On: Financial Statement Analysis FIN 4218নাফিস ইকবাল আকিলNo ratings yet

- Financial Ratios Are Mathematical Comparisons of Financial Statement Accounts or CategoriesDocument5 pagesFinancial Ratios Are Mathematical Comparisons of Financial Statement Accounts or Categoriesalfred benedict bayanNo ratings yet

- E10Block2FINAL 09 11 2009Document44 pagesE10Block2FINAL 09 11 2009ashfaqchauhanNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- How To Test Solvency With Cash Flow RatiosDocument6 pagesHow To Test Solvency With Cash Flow RatiospiasoleNo ratings yet

- Theoretical PerspectiveDocument12 pagesTheoretical PerspectivepopliyogeshanilNo ratings yet

- Liquidity Ratio: What Are Liquidity Ratios?Document11 pagesLiquidity Ratio: What Are Liquidity Ratios?Ritesh KumarNo ratings yet

- Solvency AnalysisDocument4 pagesSolvency Analysissonam agrawalNo ratings yet

- Asia Metroolitan University Taman Kemachaya, Batu 9, 43200 CHERAS SelangorDocument7 pagesAsia Metroolitan University Taman Kemachaya, Batu 9, 43200 CHERAS SelangorMehedi TanvirNo ratings yet

- Capital StructureDocument17 pagesCapital StructureVinit Mathur100% (1)

- 4 Reasons Why Ratios and Proportions Are So ImportantDocument8 pages4 Reasons Why Ratios and Proportions Are So ImportantShaheer MehkariNo ratings yet

- Financial Ratio AnalysisDocument4 pagesFinancial Ratio AnalysisJennineNo ratings yet

- Burget Paints Financial Report Summary and InsightsDocument5 pagesBurget Paints Financial Report Summary and InsightscoolNo ratings yet

- LOVISA V PANDORA FINANCIAL ANALYSIS RATIODocument30 pagesLOVISA V PANDORA FINANCIAL ANALYSIS RATIOpipahNo ratings yet

- Ratio Analysis - Tata and M Amp MDocument38 pagesRatio Analysis - Tata and M Amp MNani BhupalamNo ratings yet

- Solvency and Its RatiosDocument12 pagesSolvency and Its Ratiosnetra14520No ratings yet

- Ratio Analysis - InvestopediaDocument43 pagesRatio Analysis - InvestopediaEftinoiu Catalin100% (1)

- LiquidityDocument5 pagesLiquidityMobin ShaleeNo ratings yet

- Capital StructuringDocument6 pagesCapital StructuringLourene Jauod- GuanzonNo ratings yet

- What Is A Coverage RatioDocument2 pagesWhat Is A Coverage RatioDarlene SarcinoNo ratings yet

- Sustainable Growth Rate - Definition, Example, How To CalculateDocument3 pagesSustainable Growth Rate - Definition, Example, How To Calculateabubakar mohammad saniNo ratings yet

- Accounting Ratios - BW ClassDocument8 pagesAccounting Ratios - BW ClassDananjaya RajapakshaNo ratings yet

- Lecture 5 Financial Statement AnalysisDocument42 pagesLecture 5 Financial Statement Analysismainul04029No ratings yet

- Leverage RatioDocument5 pagesLeverage RatiopeptideNo ratings yet

- Ratio Analysis of Life Insurance - IBADocument116 pagesRatio Analysis of Life Insurance - IBANusrat Saragin NovaNo ratings yet

- FPT Group's Seperate Financial of 2020 and Consolidated Financial Statements of 2020Document17 pagesFPT Group's Seperate Financial of 2020 and Consolidated Financial Statements of 2020Phạm Tuấn HùngNo ratings yet

- Empirical Use of Financial LeverageDocument3 pagesEmpirical Use of Financial Leveragesam abbasNo ratings yet

- Current RatioDocument22 pagesCurrent RatioAsawarNo ratings yet

- Analyzing The Solvency Ratio A Comprehensive PPT PresentationDocument11 pagesAnalyzing The Solvency Ratio A Comprehensive PPT Presentationspoken.21212618No ratings yet

- Solvency Ratios: Solvency Ratios Come in A Variety of FormsDocument3 pagesSolvency Ratios: Solvency Ratios Come in A Variety of FormssanskritiNo ratings yet

- Importance of Financial StatementDocument11 pagesImportance of Financial StatementJAY SHUKLANo ratings yet

- Ratio AnalysisDocument3 pagesRatio Analysisk prasanthiNo ratings yet

- 203Document10 pages203monthlyreportcharhiNo ratings yet

- Ratio Analysis Notes and Practice Questions With SolutionsDocument23 pagesRatio Analysis Notes and Practice Questions With SolutionsAnkith Poojary67% (6)

- Asodl Accounts Sol 1st SemDocument17 pagesAsodl Accounts Sol 1st SemIm__NehaThakurNo ratings yet

- Business Accounting RatiosDocument18 pagesBusiness Accounting RatiosAhmed AdelNo ratings yet

- A STUDY ON LIQUIDITY - Docx (2) - 1Document111 pagesA STUDY ON LIQUIDITY - Docx (2) - 1Nirmal Raj100% (1)

- Accounts Isc Final ProjectDocument13 pagesAccounts Isc Final ProjectRahit MitraNo ratings yet

- Summative Assessment 2 Project 2Document2 pagesSummative Assessment 2 Project 2Parvesh SahotraNo ratings yet

- ADL 03 Accounting For Managers V3Document21 pagesADL 03 Accounting For Managers V3Amit RaoNo ratings yet

- What Is Ratio AnalysisDocument2 pagesWhat Is Ratio AnalysisDarlene SarcinoNo ratings yet

- Financial Ratio Cheatsheet PDFDocument33 pagesFinancial Ratio Cheatsheet PDFJanlenn GepayaNo ratings yet

- Protect Your Assets: Strategically Oriented, Metrics-Centered Credit ManagementFrom EverandProtect Your Assets: Strategically Oriented, Metrics-Centered Credit ManagementNo ratings yet

- Credentials Evaluation Service Applicant HandbookDocument26 pagesCredentials Evaluation Service Applicant HandbookdramachicNo ratings yet

- Comparison of Time Domain Flutter Analysis Using A Reduced Order ModelDocument25 pagesComparison of Time Domain Flutter Analysis Using A Reduced Order ModelTheNo ratings yet

- Soda Ash MsdsDocument4 pagesSoda Ash MsdsDave ToExtremeNo ratings yet

- Analytical Model For Predicting Shear Strengths of Exterior Reinforced Concrete Beam-Column Joints For Seismic ResistanceDocument14 pagesAnalytical Model For Predicting Shear Strengths of Exterior Reinforced Concrete Beam-Column Joints For Seismic ResistanceAndres NaranjoNo ratings yet

- Journal 81Document33 pagesJournal 81ANURAG JOSEPHNo ratings yet

- Bulletin For August 28-2010Document2 pagesBulletin For August 28-2010Twin Peaks SDA FellowshipNo ratings yet

- Ductile Iron Pipe vs. HDPE Pipe: Strength and ForDocument15 pagesDuctile Iron Pipe vs. HDPE Pipe: Strength and ForZahid JiwaNo ratings yet

- Walls Sbu of UnileverDocument25 pagesWalls Sbu of Unilevermaham azizNo ratings yet

- Integrated Design and Construction of Tall Buildings (Moon 2010)Document8 pagesIntegrated Design and Construction of Tall Buildings (Moon 2010)Jose Antoni LasdNo ratings yet

- Applied Geography: Marco VizzariDocument11 pagesApplied Geography: Marco Vizzarialexandra mp100% (1)

- UNIT-5 FullDocument99 pagesUNIT-5 Fullsyedali24779No ratings yet

- Treatment of LeprosyDocument11 pagesTreatment of LeprosyFajar YuniftiadiNo ratings yet

- Bombardier CRJ 200-Communications PDFDocument48 pagesBombardier CRJ 200-Communications PDFmamon113No ratings yet

- Black - Skin - and - Blood DocUmeNtary PhotograPhy PDFDocument7 pagesBlack - Skin - and - Blood DocUmeNtary PhotograPhy PDFVinit GuptaNo ratings yet

- Thesis Paper Revised 123.01 2Document58 pagesThesis Paper Revised 123.01 2Dianne Mae DagaNo ratings yet

- Call Flow Comparison GSM UMTSDocument5 pagesCall Flow Comparison GSM UMTSSyed Zahid Shah100% (1)

- Wireless Cellular and LTE 4G Broadband 1Document76 pagesWireless Cellular and LTE 4G Broadband 1PRANEETH DpvNo ratings yet

- Creativity TechniquesDocument220 pagesCreativity Techniquesjcabbud100% (3)

- Website MockupDocument1 pageWebsite MockupRehan ShahNo ratings yet

- Review - An Invitation To Cognitive Science Methods, Models, and Conceptual IssuesDocument2 pagesReview - An Invitation To Cognitive Science Methods, Models, and Conceptual IssuesTaisei ChujoNo ratings yet

- Ktunotes - In: Lecture Notes On Power Generation, Transmission, and DistributionDocument11 pagesKtunotes - In: Lecture Notes On Power Generation, Transmission, and Distributionlakshmi dileepNo ratings yet

- Kuiz Minggu ICT Kelab Briged BestariDocument9 pagesKuiz Minggu ICT Kelab Briged Bestaribubblelicious_0701No ratings yet

- Ee3101 Lab Report ExpDocument16 pagesEe3101 Lab Report ExpyucesNo ratings yet

- ASPIRO TechnologyDocument19 pagesASPIRO Technologysehyong0419No ratings yet

- 984-800 GuideDocument123 pages984-800 GuideGerardo BaltaNo ratings yet

- Construction Issue: Qty. (Nos) AI DI AO DO Hvac System I Water Chilling Units 3Document11 pagesConstruction Issue: Qty. (Nos) AI DI AO DO Hvac System I Water Chilling Units 3Al Amin Hossain Srabon100% (1)

- Driver Safety ChecklistDocument1 pageDriver Safety ChecklistAkhtar QuddusNo ratings yet

- Textbook of Interventional Cardiology 8Th Edition Eric J Topol Full ChapterDocument67 pagesTextbook of Interventional Cardiology 8Th Edition Eric J Topol Full Chapterora.bowman920100% (9)

- Carbonation of Steel SlagDocument12 pagesCarbonation of Steel SlagTania Dealina SariNo ratings yet

- MobilenetV2 (Quantization)Document4 pagesMobilenetV2 (Quantization)Akash BhogarNo ratings yet