Professional Documents

Culture Documents

Messa Adi Saputra

Uploaded by

Messa Adi SaputraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Messa Adi Saputra

Uploaded by

Messa Adi SaputraCopyright:

Available Formats

Cooke Bank has a fiscal year ending on September 30.

Selected data from the September 30 work sheet are presented below.

Instructions:

(a) Prepare a complete work sheet.

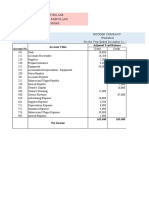

COOKE BANK

Work Sheet

For The Year Ended September 30, 2010

Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet

Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

Cash 37,400 37,400

Supplies 18,600 4,200

Prepaid Insurance 31,900 3,900

Land 80,000 80,000

Equipment 120,000 120,000

Accumulated Depreciation - Equip 36,200 42,000

Accounts Payable 14,600 14,600

Unearned Bank Service Revenue 2,700 700

Mortgage Payable 50,000 50,000

Cooke, Capital 109,700 109,700

Cooke, Drawing 14,000 14,000

Bank Service Revenue 278,500 280,500

Salaries Expense 109,000 109,000

Repair Expense 30,500 30,500

Advertising Expense 9,400 9,400

Utilities Expense 16,900 16,900

Property Taxes Expense 18,000 21,000

Interest Expense 6,000 12,000

Totals 491,700 491,700

Insurance Expense 28,000

Supplies Expense 14,400

Interest Payable 6,000

Depreciation Expense 5,800

Property Taxes Payable 3,000

Totals Formula Formula 506,500 506,500 Formula Formula Formula Formula

Net income or loss Formula Formula

Totals Formula Formula Formula Formula

Problem 1, Page 1 of 3, 04/24/2024, 13:49:52

(b) Prepare a classified statement of financial position. $10,000 of the mortgage payable is due for payment in the next fiscal year.)

(Note:

COOKE BANK

Statement of Financial Position

September 30, 2017

Assets Liabilities and Owner’s Equity

Noncurrent Assets Equity

Title Cooke, Capital Formula

Account Title Amount Liabilities

Account Title Amount Account Title Formula

Account Title Amount Formula Formula Current liabilities

Current assets Account Title Amount

Account Title Amount Account Title Amount

Account Title Amount Account Title Amount

Account Title Amount Account Title Amount

Total current assets Formula Account Title Amount

Total assets Formula Total current liabilities Formula

Total liabilities Formula

Total liabilities and owner’s equity Formula

(c) Journalize the adjusting entries using the worksheet as a basis.

Sep 30 Account Title Amount

Account Title Amount

Sep 30 Account Title Amount

Account Title Amount

Sep 30 Account Title Amount

Account Title Amount

Sep 30 Account Title Amount

Account Title Amount

Sep 30 Account Title Amount

Account Title Amount

Sep 30 Account Title Amount

Account Title Amount

Problem 1, Page 2 of 3, 04/24/2024, 13:49:52

(d) Journalize the closing entries using the worksheet as a basis. (e) Prepare a post-closing trial balance.

Sep 30 Account Title Amount COOKE BANK

Account Title Amount Post Closing Trial Balance

September 30, 2017

Sep 30 Account Title Formula Debit Credit

Account Title Amount Account Title Amount

Account Title Amount Account Title Amount

Account Title Amount Account Title Amount

Account Title Amount Account Title Amount

Account Title Amount Account Title Amount

Account Title Amount Account Title Amount

Account Title Amount Account Title Amount

Account Title Amount Account Title Amount

Account Title Amount Account Title Amount

Account Title Amount

Sep 30 Account Title Amount Account Title Amount

Account Title Amount Account Title Amount

Totals Formula Formula

Sep 30 Account Title Amount

Account Title Amount

Problem 1, Page 3 of 3, 04/24/2024, 13:49:52

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- A E E T: Nnual Mployee Valuation EmplateDocument9 pagesA E E T: Nnual Mployee Valuation EmplateYAMID MUÑOZ RIVERANo ratings yet

- Agency DraftDocument3 pagesAgency DraftMuskan TandonNo ratings yet

- Corporation Law ReviewerDocument3 pagesCorporation Law ReviewerJada WilliamsNo ratings yet

- Feu Fundact 2 Reviewer 2Document40 pagesFeu Fundact 2 Reviewer 2anneNo ratings yet

- Food Products Manufacturing Using Microsoft Dynamics AX 2012Document84 pagesFood Products Manufacturing Using Microsoft Dynamics AX 2012Reshu SrivastavaNo ratings yet

- Z - General Provisions FY 2023 GAADocument24 pagesZ - General Provisions FY 2023 GAAJVB 1029No ratings yet

- 4.3.2.5 Elaborate - Determining AdjustmentsDocument4 pages4.3.2.5 Elaborate - Determining AdjustmentsMa Fe Tabasa0% (1)

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTINGDocument92 pagesAnswer Key - Chapter 6 - ACCOUNTINGIL MareNo ratings yet

- Municipal Cooperative Development Council: Hon. Jimmy S. Gamazon JRDocument19 pagesMunicipal Cooperative Development Council: Hon. Jimmy S. Gamazon JRjaeson mariano100% (1)

- Worksheet Complete Exercise ns3Document8 pagesWorksheet Complete Exercise ns3Steven consueloNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRDocument3 pagesTrial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRMaharani SinuratNo ratings yet

- Accountancy Auditing 2016Document7 pagesAccountancy Auditing 2016Abdul basitNo ratings yet

- Lab Komputer Akuntansi KeuanganDocument8 pagesLab Komputer Akuntansi KeuanganlistianiNo ratings yet

- Accountancy and Auditing-2016 PDFDocument6 pagesAccountancy and Auditing-2016 PDFMian Abdullah YaseenNo ratings yet

- Accountancy I 2016 PDFDocument4 pagesAccountancy I 2016 PDFShahid RazwanNo ratings yet

- Accounting 10 ColumnsDocument2 pagesAccounting 10 ColumnsTRIXIEJOY INIONNo ratings yet

- Illustration KK Co. Perpetual ClosingDocument9 pagesIllustration KK Co. Perpetual ClosingNAOL BIFTUNo ratings yet

- 7 SynthesisDocument5 pages7 SynthesisCristine Jane Granaderos OppusNo ratings yet

- FA1 Financial StatementsDocument5 pagesFA1 Financial StatementsamirNo ratings yet

- Uas Komp AkuntansiDocument3 pagesUas Komp AkuntansiDesy manurungNo ratings yet

- Homework P4 4ADocument8 pagesHomework P4 4AFrizky Triputra CahyahanaNo ratings yet

- Quijonez Fashionables Comprehensive Prob Merchandising Solution - XLSX Direct Extension MethodDocument4 pagesQuijonez Fashionables Comprehensive Prob Merchandising Solution - XLSX Direct Extension MethodzairahNo ratings yet

- Bali Company Worksheet For The Year Ended December 31, 2020: InstructionsDocument4 pagesBali Company Worksheet For The Year Ended December 31, 2020: Instructionsshera haniNo ratings yet

- 8625adjusting Entries PracticeDocument4 pages8625adjusting Entries PracticeNajia SalmanNo ratings yet

- Practise For MidDocument3 pagesPractise For MidIftekhar AhmedNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- Accounting 02182021Document4 pagesAccounting 02182021badNo ratings yet

- Adjusting FS ServiceDocument17 pagesAdjusting FS ServiceJasmine Acta100% (1)

- Lecture Discussion - Service Concern - Worksheet To Post Closing Trial BalanceDocument8 pagesLecture Discussion - Service Concern - Worksheet To Post Closing Trial BalanceGarpt KudasaiNo ratings yet

- Income Statement (T-Format)Document15 pagesIncome Statement (T-Format)Apryl TaiNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Problem Sheet 4 Summer 22Document4 pagesProblem Sheet 4 Summer 22Md Tanvir AhmedNo ratings yet

- Corrected TB CH 2Document1 pageCorrected TB CH 2Birhanu DesalegnNo ratings yet

- Jawab-Latihan - Siklus AkuntansiDocument26 pagesJawab-Latihan - Siklus AkuntansiSumarsono Booming FotocopyNo ratings yet

- Make Up Exercises ACCTG1 Sept20Document10 pagesMake Up Exercises ACCTG1 Sept20keith niduelan100% (1)

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Name: Rowma Danielle Lactao Date Submitted: 1-28-22 Grade & Section: 10-Peace Teacher: Ms. Lizz DelosoDocument2 pagesName: Rowma Danielle Lactao Date Submitted: 1-28-22 Grade & Section: 10-Peace Teacher: Ms. Lizz DelosoRowma Danielle LactaoNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Group Assignment - Questions - RevisedDocument6 pagesGroup Assignment - Questions - Revised31231023949No ratings yet

- AnsweredASS16 AccountingDocument6 pagesAnsweredASS16 Accountingvomawew647No ratings yet

- Assignment Week 4 Hal 205Document1 pageAssignment Week 4 Hal 205Pinarasrayan HaqueNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- Problem 2 - AccountingcyleDocument13 pagesProblem 2 - AccountingcyleGio BurburanNo ratings yet

- Adjusting Entries From The Desk F JASDocument3 pagesAdjusting Entries From The Desk F JASMalik of ChakwalNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Prepare Financial Report AssignmentDocument7 pagesPrepare Financial Report AssignmentBiruk HabtamuNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A SolutionsDocument17 pagesChapter 4 - Complete The Accounting Cycle Practice Set A SolutionsNguyễn Minh ĐứcNo ratings yet

- Siklus AkuntansiDocument15 pagesSiklus AkuntansiBachrul AlamNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 04 Handout 1Document6 pages04 Handout 1Nhov CabralNo ratings yet

- Unit 2 WorksheetDocument13 pagesUnit 2 WorksheetHhvvgg BbbbNo ratings yet

- Fabm2 QuizDocument2 pagesFabm2 QuizXin LouNo ratings yet

- FABM1 11 Quarter 4 Week 2 Las 2Document1 pageFABM1 11 Quarter 4 Week 2 Las 2Janna PleteNo ratings yet

- Case Study - BCVE and Preacquistion EntriesDocument3 pagesCase Study - BCVE and Preacquistion EntriesHuỳnh Minh Gia HàoNo ratings yet

- Hyper Star Traders Income Statement As of Dec 31, 2009: Net SalesDocument6 pagesHyper Star Traders Income Statement As of Dec 31, 2009: Net SalesomairpkNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- January 31: Birendra Mahato Adjusting Entries and WorksheetDocument17 pagesJanuary 31: Birendra Mahato Adjusting Entries and WorksheetAjit UpretyNo ratings yet

- Book 1Document6 pagesBook 1chrstncstlljNo ratings yet

- Far - Module 1 (Apol)Document10 pagesFar - Module 1 (Apol)Patricia may RiveraNo ratings yet

- Mahmudin Saepullah - Assignment 5BDocument10 pagesMahmudin Saepullah - Assignment 5BRomi Prabowo De jongNo ratings yet

- Module - WorksheetDocument2 pagesModule - WorksheetKae Abegail GarciaNo ratings yet

- Step 5: Compute Net Income or Net LossDocument29 pagesStep 5: Compute Net Income or Net LossTanvir Islam100% (1)

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- Operations Management: The Input/output Transformation ModelDocument2 pagesOperations Management: The Input/output Transformation ModelJUAN DIEGO QUINONES VENTESNo ratings yet

- (Update) Chapter 10 - Inheritance and PolymorphismDocument4 pages(Update) Chapter 10 - Inheritance and PolymorphismEng SayidNo ratings yet

- 2022 John Deere Annual ReportDocument75 pages2022 John Deere Annual ReportLiora Vanessa DopacioNo ratings yet

- MCC INDUSTRIAL SALES CORPORATION, Petitioner, VsDocument2 pagesMCC INDUSTRIAL SALES CORPORATION, Petitioner, VsLyka PascuaNo ratings yet

- Biological Assets: Full PFRS, Pfrs For Smes, and Pfrs For Se ComparisonDocument11 pagesBiological Assets: Full PFRS, Pfrs For Smes, and Pfrs For Se ComparisonReshyl HicaleNo ratings yet

- Supply Chain Risk Mitigation: Modeling The EnablersDocument18 pagesSupply Chain Risk Mitigation: Modeling The EnablersFadoua LahnaNo ratings yet

- Presentation EET 401 LAST PART TOPIC ONEDocument4 pagesPresentation EET 401 LAST PART TOPIC ONEAnn OkothNo ratings yet

- Excel To MySQL PDFDocument12 pagesExcel To MySQL PDFsendano 0No ratings yet

- Sustainable Supply Chain Maturity ModelDocument11 pagesSustainable Supply Chain Maturity ModelbusinellicNo ratings yet

- Soft Corperate Offer of Neftagazpromtekh LLC To Rajmoni Apparels PVT LTDDocument3 pagesSoft Corperate Offer of Neftagazpromtekh LLC To Rajmoni Apparels PVT LTDhqanlacNo ratings yet

- Pakistan International Airlines, Pia: Strategic ReportDocument21 pagesPakistan International Airlines, Pia: Strategic ReportMuhammad AwaisNo ratings yet

- 26 Spruit DragonairDocument2 pages26 Spruit DragonairW.J. ZondagNo ratings yet

- Chapter 3 AssignmentDocument9 pagesChapter 3 AssignmentAnas Omar MuffarrejNo ratings yet

- Banking LawDocument16 pagesBanking LawmadhuNo ratings yet

- Mekane Yesus Bulcha Area Local Church Business PlanDocument11 pagesMekane Yesus Bulcha Area Local Church Business Planpenna belewNo ratings yet

- Correctness by ConstructionDocument3 pagesCorrectness by ConstructionAmnaNo ratings yet

- Apostila UK: Personal InformationDocument1 pageApostila UK: Personal InformationElena GrigoritaNo ratings yet

- Application Form UniSea PDFDocument2 pagesApplication Form UniSea PDFJackNo ratings yet

- Rds Py CC Erp607 06 Solution Scope en XXDocument22 pagesRds Py CC Erp607 06 Solution Scope en XXagarwalyatish36No ratings yet

- Report: Mean (Expected Value) of A Discrete Random Variable 100%Document2 pagesReport: Mean (Expected Value) of A Discrete Random Variable 100%abel mahendraNo ratings yet

- Acco 20163 Activity 3Document9 pagesAcco 20163 Activity 3Marielle UyNo ratings yet

- Upwork Profile - Job Experience ProfileDocument4 pagesUpwork Profile - Job Experience ProfileKim NatividadNo ratings yet

- LNG Projects - Gravity Platforms Make Many Things Possible Exploration ProducDocument3 pagesLNG Projects - Gravity Platforms Make Many Things Possible Exploration ProducVijay K SinghNo ratings yet

- The Impact of The CovidDocument17 pagesThe Impact of The Covidkeshyam59No ratings yet