Professional Documents

Culture Documents

1 SFM - Questions

Uploaded by

Tarun AbichandaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 SFM - Questions

Uploaded by

Tarun AbichandaniCopyright:

Available Formats

Downloaded from castudyweb.

com

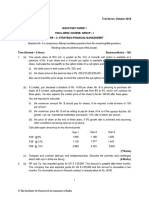

Test Series: September 2023

MOCK TEST PAPER 1

FINAL COURSE: GROUP – I

PAPER – 2: STRATEGIC FINANCIAL MANAGEMENT

Question No. 1 is compulsory. Attempt any four questions from the remaining five questions.

Working notes should form part of the answer.

Time Allowed – 3 Hours Maximum Marks – 100

1. (a) On 1st October 2021 Mr. P an exporter enters into a forward contract with a XYZ Bank to sell US$

5,00,000 on 31 December 2021 at ` 75.40/$. However, due to the request of the importer, Mr. P

received amount on 28 th November 2021. Mr. P requested the bank to take the delivery of the

remittance on 30 th November 2021 i.e. before due date. The inter-banking rates on

28th November 2021 were as follows:

Spot ` 75.22/75.27

One Month Premium 10/15

If bank agrees to take early delivery then what will be net inflow to Mr. P assuming that the

prevailing prime lending rate is 18%.

Note: 1. Consider 365 days a year

2. Round off final calculation in Rupees i.e. not in paisa (10 Marks)

(b) The risk free rate of return (Rf) is 8 percent and the expected rate of return on market portfolio

(Rm) is 12 percent. The expected rate of growth for the dividend of J Ltd. is 6 percent. The last

dividend paid on the equity stock was ` 5.00. The beta of J Ltd. equity stock is 1.5.

(i) What is the equilibrium price of the equity stock of J Ltd.?

(ii) Evaluate the impact of following factors jointly on the equilibrium price of equity stock of J

Ltd.

• the inflation premium increases by 2 percent;

• the expected growth rate increases by 2 percent in absolute terms;

• the beta of J Ltd. equity rises to 1.8 and

• market return remains the same. (6 Marks)

(c) Explain how financial risk can be evaluated from different point of views . (4 Marks)

2. (a) Compute EVA of X Ltd. with the following information:

Profit and Loss Statement Balance Sheet

Revenue 1500 PPE 1500

Direct Costs -585 Current Assets 450

Selling, General & Admin. Exp. (SGA) -300 1950

EBIT 615 Equity 1050

Interest -15 Reserves 150

EBT 600 Non-Current Borrowings 150

Tax Expense @30% -180 Current Liabilities & Provisions 600

EAT 420 1950

Downloaded from castudyweb.com

Downloaded from castudyweb.com

Assume Bad Debts provision of ` 30 Lac is included in the SGA, and same amount is reduced

from the trade receivables in current assets.

Also assume that the pre-tax Cost of Debt is 12% and Equity shareholder’s expected return is

10%.

Note: Make calculation in ` lac and round off up to 2 decimal points. (8 Marks)

(b) Calculate the justified price of 3 months ABC futures, if share of ABC (FV ` 10) quotes at ` 450

on NSE and the one month borrowing rate is given as 12 percent per annum and the expected

annual dividend is 20 percent, payable before expiry. Also demonstrate is there any arbitrage

opportunities if the three months Futures Price quotes at ` 470. (8 Marks)

(c) Not only Bundling and Unbundling is only feature of Securitisation, there are other features too of

the same. Explain. (4 Marks)

OR

Explain the key features of Alternative Investments that make them different from other

investment avenues. (4 Marks)

3. (a) The data given below relates to a convertible bond :

Face value ` 250

Coupon rate 12%

No. of shares per bond 20

Market price of share ` 12

Straight value of bond ` 235

Market price of convertible bond ` 265

Calculate:

(i) Stock value of bond.

(ii) The percentage of downside risk.

(iii) The conversion premium

(iv) The conversion parity price of the stock. (8 Marks)

(b) Mr. A is having 500 units of a Mutual Fund which has shown its per unit NAV of ` 9.75 and

` 12.35 at the beginning and at the end of the year respectively. The Mutual Fund has given two

options:

(i) Receive a payment of ` 1.25 per unit as dividend and ` 0.80 per unit as a capital gain, or

(ii) Reinvestment of these distributions at an average NAV of ` 11.05 per unit.

Evaluate the difference it would make in terms of return available and which option is preferable?

(8 Marks)

(c) Explain the term Corporate Level Strategy and what are the three basic questions it answers?

(4 Marks)

4. (a) MN Limited is engaged in large retail business in India. It is contemplating for expansion into a

country of Africa by acquiring a group of stores having the same line of operation as that of India.

The exchange rate for the currency of the proposed African country is extremely volatile. Rate of

inflation is presently 30% a year. Inflation in India is currently 10% a year. Management of MN

Limited expects these rates likely to continue for the foreseeable future.

Estimated projected cash flows, in real terms, in India as well as African country for the first three

years of the project are as follows:

2

Downloaded from castudyweb.com

Downloaded from castudyweb.com

Year – 0 Year – 1 Year – 2 Year - 3

Cash flows in Indian ` (000) -100,000 -3,000 -4,000 -5,000

Cash flows in African Rands (000) -4,00,000 +1,00,000 +1,40,000 +1,80,000

MN Ltd. assumes the year 3 nominal cash flows will continue to be earned each year indefinitely.

It evaluates all investments using nominal cash flows and a nominal discounting rate. Th e

present exchange rate is African Rand 6 to ` 1.

You are required to calculate the net present value of the proposed investment considering the

following:

(i) African Rand cash flows are converted into rupees and discounted at a risk adjusted rate.

(ii) All cash flows for these projects will be discounted at a rate of 20% to reflect its high risk.

(iii) Ignore taxation.

Year - 1 Year - 2 Year - 3

PVIF @ 20% 0.833 0.694 0.579 (8 Marks)

(b) A mutual fund made an issue of 5,00,000 units of ` 10 each on January 01, 2020. No entry load

was charged. It made the following investments:

Particulars `

25,000 Equity shares of ` 100 each @ ` 160 40,00,000

7% Government Securities 4,00,000

9% Debentures (Unlisted) 2,50,000

10% Debentures (Listed) 2,50,000

49,00,000

During the year, dividends of ` 6,00,000 were received on equity shares. Interest on all types of

debt securities was received as and when due. At the end of the year equity shares and 10%

debentures are quoted at 175% and 90% respectively of face value. Other investments are

valued at par.

Find out the Net Asset Value (NAV) per unit given that operating expenses paid during the year

amounted to ` 2,50,000. Also find out the NAV, if the Mutual fund had distributed a dividend of

` 0.80 per unit during the year to the unit holders. (8 Marks)

(c) “Though in recent period of time the concept of securitisation has become popular in India as a

source of Off Balance Sheet source of financing but its level of growth is still far behind ” Explain.

(4 Marks)

5. (a) Expected returns on two stocks for particular market returns are given in the following table:

Market Return Aggressive Defensive

10.50% 6% 13.50%

37.50% 60% 27%

You are required to calculate:

(1) The Betas of the two stocks.

(2) Expected return of each stock, if the market return is equally likely to be 10.50% or 37.50%.

(3) The Security Market Line (SML), if the risk free rate is 11.25% and market return is equally

likely to be 10.50% or 37.50%.

(4) The Alphas of the two stocks. (8 Marks)

3

Downloaded from castudyweb.com

Downloaded from castudyweb.com

(b) A textile manufacturer has taken floating interest rate loan of ` 40,00,000 on 1 st April, 2012. The

rate of interest at the inception of loan is 8.5% p.a. interest is to be paid every year on

31st March, and the duration of loan is four years. In the month of October 2012, the Central bank

of the country releases following projections about the interest rates likely to prevail in future.

Dates Interest Rate

31st March, 2013 8.75%

31st March, 2014 10.00%

31st March, 2015 10.50%

31st March, 2016 7.75%.

(i) Advise how borrower can hedge the risk arising out of expected rise in the rate of interest

when he is interested in pegging his interest cost at 8.50% p.a. and if option on Interest

Rate is available at 0.75% p.a.

(ii) Assume that the premium negotiated by both the parties at the above-mentioned rate which

is to be paid on upfront basis and the actual rate of interest on the respective due dates

happens to be as follows:

Dates Interest Rate

31st March, 2013 10.20%

31st March, 2014 11.50%

31st March, 2015 9.25%

31st March, 2016 8.25%.

(8 Marks)

(c) During Pitch Presentation to convince the investors to put money into the proposed business how

promoters deal with following points:

(i) Problem (ii) Solution (iii) Marketing/Sales (iv) Business Model (4 Marks)

6. (a) Following information is provided relating to the acquiring company M Ltd. and the target

company R Ltd:

M Ltd. R Ltd.

Earnings after tax (` lakhs) 4,000 8,000

No. of shares outstanding (lakhs) 400 2,000

P/E ratio (No. of times) 5 2.50

Required:

(i) What is the Swap ratio based on current market prices?

(ii) What is the EPS of M Ltd. after the acquisition?

(iii) What is the expected market price per share of M Ltd. after the acquisition, assuming its P/E

ratio is adversely affected by 10%?

(iv) Determine the market value of the merged Co.

(v) Calculate gain/loss for the shareholders of the two independent entities, due to the merger.

(8 Marks)

(b) Your bank’s London office has surplus funds to the extent of USD 10,00,000/- for a period of 3

months. The cost of the funds to the bank is 4% p.a. It proposes to invest these funds in London,

New York or Frankfurt and obtain the best yield, without any exchange risk to the bank. The

Downloaded from castudyweb.com

Downloaded from castudyweb.com

following rates of interest are available at the three centres for investment of domestic funds

there at for a period of 3 months.

London 5 % p.a.

New York 8% p.a.

Frankfurt 3% p.a.

The market rates in London for US dollars and Euro are as under:

London on New York

Spot 1.5350/90

1 month 15/18

2 months 30/35

3 months 80/85

London on Frankfurt

Spot 1.8260/90

1 month 60/55

2 months 95/90

3 months 145/140

At which centre, investment will be made & what will be the net gain (to the nearest pound) to the

bank on the invested funds? (8 Marks)

(c) “Investors can use Stock Index Futures to perform myriad tasks”. Explain. (4 Marks)

Downloaded from castudyweb.com

You might also like

- Amazon AWSDocument27 pagesAmazon AWSMIHIR ETHAN AWALENo ratings yet

- R26 Mergers Acquisitions Q Bank PDFDocument11 pagesR26 Mergers Acquisitions Q Bank PDFZidane KhanNo ratings yet

- Financial Statement Analysis and Security Valuation Solutions Chapter 6Document6 pagesFinancial Statement Analysis and Security Valuation Solutions Chapter 6Mia Greene100% (1)

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- Capital Returns 2 PDFDocument12 pagesCapital Returns 2 PDFNivesh Pande100% (1)

- Jan 06Document23 pagesJan 06Joshua ElkingtonNo ratings yet

- Internship ReportDocument66 pagesInternship ReportUmer JafarNo ratings yet

- Cesim Bank Guide BookDocument56 pagesCesim Bank Guide Bookrashad666No ratings yet

- Equity Analysis of SBI Bank-1Document69 pagesEquity Analysis of SBI Bank-1mustafe ABDULLAHINo ratings yet

- Debenhams Analyst ReportDocument108 pagesDebenhams Analyst ReportFisher Black75% (4)

- Sep23 Ques-1Document5 pagesSep23 Ques-1absankey770No ratings yet

- Oct19 Ques-1Document5 pagesOct19 Ques-1absankey770No ratings yet

- f9 2018 Marjun QDocument6 pagesf9 2018 Marjun QDilawar HayatNo ratings yet

- MTP1 May2022 - Paper 8 FM EcoDocument19 pagesMTP1 May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- RTP May2022 - Paper 8 FM EcoDocument30 pagesRTP May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- Chapter 5: Cost of Capital Dec 2014: TK 000 TK 000Document4 pagesChapter 5: Cost of Capital Dec 2014: TK 000 TK 000swarna dasNo ratings yet

- MTP 12 25 Questions 1696939932Document5 pagesMTP 12 25 Questions 1696939932harshallahotNo ratings yet

- Nov 2018 RTP PDFDocument21 pagesNov 2018 RTP PDFManasa SureshNo ratings yet

- 73535bos59345 Final p2qDocument6 pages73535bos59345 Final p2qSakshi vermaNo ratings yet

- Vidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document9 pagesVidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54shrenik bhuratNo ratings yet

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalNo ratings yet

- Question June - 2010Document8 pagesQuestion June - 2010pawan kumar MaheshwariNo ratings yet

- RM 3Document6 pagesRM 3Harsh KumarNo ratings yet

- FAC 320 Test 1 2022F With MemoDocument10 pagesFAC 320 Test 1 2022F With MemoNolan TitusNo ratings yet

- SFM New Sums AddedDocument78 pagesSFM New Sums AddedRohit KhatriNo ratings yet

- Section A: Compulsory: Question 1 (25 Marks)Document10 pagesSection A: Compulsory: Question 1 (25 Marks)mis gunNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationItikaa TiwariNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument120 pagesPaper - 2: Strategic Financial Management Questions Security ValuationKeshav SethiNo ratings yet

- Internal Examination: Nandkunvarba Mahila BBA CollegeDocument3 pagesInternal Examination: Nandkunvarba Mahila BBA CollegeShivani JoshiNo ratings yet

- Section 3 Modified - Ch5+Ch6Document8 pagesSection 3 Modified - Ch5+Ch6Dina AlfawalNo ratings yet

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- Cost of Capital QuestionDocument9 pagesCost of Capital QuestionMahesh KalyankarNo ratings yet

- 71888bos57845 Inter p8qDocument6 pages71888bos57845 Inter p8qMayank RajputNo ratings yet

- NBS Corporate Finance 2022 Assignment 2-Due-20220916Document7 pagesNBS Corporate Finance 2022 Assignment 2-Due-20220916SoblessedNo ratings yet

- 588c69bdc763b - Sample Paper Accountancy - 230102 - 185610Document7 pages588c69bdc763b - Sample Paper Accountancy - 230102 - 185610sanchitchaudhary431No ratings yet

- Fall 2012 - Old SFMDocument4 pagesFall 2012 - Old SFMAbdulAzeemNo ratings yet

- Financial Management: Thursday 9 December 2010Document8 pagesFinancial Management: Thursday 9 December 2010Chamara MadushankaNo ratings yet

- Bos 47907Document21 pagesBos 47907Raghunath ChoudharyNo ratings yet

- MTP 11 1 Questions 1696062519Document6 pagesMTP 11 1 Questions 1696062519kabeeramitbarot96No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerAyushi GuptaNo ratings yet

- Consolidation Q61 PDFDocument5 pagesConsolidation Q61 PDFAmrita TamangNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answeradarsh agrawalNo ratings yet

- Department of Commerce, Bahauddin Zakariya University, Multan Instructions For The ExamDocument1 pageDepartment of Commerce, Bahauddin Zakariya University, Multan Instructions For The ExamTHIND TAXLAWNo ratings yet

- P8 FM ECO Q MTP 1 Nov 23Document5 pagesP8 FM ECO Q MTP 1 Nov 23spyverse01No ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument27 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementSakshi KhandelwalNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswercdNo ratings yet

- Dividend DecisionDocument6 pagesDividend DecisionYasin Misvari T MNo ratings yet

- Çağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamDocument4 pagesÇağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamKinNo ratings yet

- FM & Eco Grand Test 2Document8 pagesFM & Eco Grand Test 2moniNo ratings yet

- CF WInter 2021Document2 pagesCF WInter 2021Ziya ShahNo ratings yet

- Week 11 12 ExerciseDocument4 pagesWeek 11 12 ExerciseNur AqilahNo ratings yet

- FFTFMDocument5 pagesFFTFMKaran NewatiaNo ratings yet

- 73153bos58999 p8Document27 pages73153bos58999 p8Sagar GuptaNo ratings yet

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NNo ratings yet

- SFM Q 2Document5 pagesSFM Q 2riyaNo ratings yet

- SFM Q MTP 1 Final May22Document5 pagesSFM Q MTP 1 Final May22Divya AggarwalNo ratings yet

- 2826295699001Document4 pages2826295699001Yen TsangNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument6 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerKrishna Rama Theertha KoritalaNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument6 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshNo ratings yet

- SFM Old MTP Dec 21Document6 pagesSFM Old MTP Dec 21Kanchana SubbaramNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Fr342. Afr (Al-I) Solution Cma May-2023 Exam.Document6 pagesFr342. Afr (Al-I) Solution Cma May-2023 Exam.practice78222No ratings yet

- Question paper-TYBMS-SSF-Oct10Document2 pagesQuestion paper-TYBMS-SSF-Oct10Sneha Parab100% (1)

- Reading 13 Integration of Financial Statement Analysis Techniques - AnswersDocument21 pagesReading 13 Integration of Financial Statement Analysis Techniques - Answerstristan.riolsNo ratings yet

- StudentDocument79 pagesStudentSmartunblurrNo ratings yet

- Chapter 3 - Financial Statement AnalysisDocument22 pagesChapter 3 - Financial Statement AnalysisReyes JonahNo ratings yet

- Tata Consultancy Services IPO AnalysisDocument13 pagesTata Consultancy Services IPO AnalysisAmartya Dey0% (1)

- JSC Bank For Investment and Development of Vietnam (HOSE: BID)Document7 pagesJSC Bank For Investment and Development of Vietnam (HOSE: BID)Thu Huong PhamNo ratings yet

- Mda CibcDocument12 pagesMda CibcAlexandertheviNo ratings yet

- Balance Sheet As Per Schedule VI Indian Companies Act, 1956: Liabilities AssetsDocument50 pagesBalance Sheet As Per Schedule VI Indian Companies Act, 1956: Liabilities AssetsSreekumar NarayanaNo ratings yet

- ACC2052t2: Multiple ChoiceDocument22 pagesACC2052t2: Multiple ChoiceYandy YuenNo ratings yet

- Mirae Asset Sekuritas Indonesia INDF 2 Q23 Review A86140c7a2Document8 pagesMirae Asset Sekuritas Indonesia INDF 2 Q23 Review A86140c7a2Dhanny NuvriyantoNo ratings yet

- Corpuz, Aily F-Fm2-2-Midterm Practice ProblemDocument5 pagesCorpuz, Aily F-Fm2-2-Midterm Practice ProblemAily CorpuzNo ratings yet

- Financial Markets Final ExamDocument6 pagesFinancial Markets Final ExamGilner PomarNo ratings yet

- Assignment - 2: Akshita Shekhawat Division: E Roll No.: 05 PRN: 20020441032Document15 pagesAssignment - 2: Akshita Shekhawat Division: E Roll No.: 05 PRN: 20020441032Mandira PantNo ratings yet

- Ratio Analysis of Top 5 Banks in PakistanDocument324 pagesRatio Analysis of Top 5 Banks in PakistanDavid VillarrealNo ratings yet

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocument78 pagesInvestment Analysis and Portfolio Management: Lecture Presentation Softwarerayhan555No ratings yet

- ISFM Mutual Fund Mock TestDocument37 pagesISFM Mutual Fund Mock TestHrishikesh kateNo ratings yet

- 23014Document114 pages23014Anshul MishraNo ratings yet

- Nestle (Malaysia) BHD - Financial AnalysisDocument20 pagesNestle (Malaysia) BHD - Financial AnalysisDavis MaxNo ratings yet

- Invesco QQQ Trust: Growth of $10,000Document2 pagesInvesco QQQ Trust: Growth of $10,000TotoNo ratings yet

- Paper 1 2023Document16 pagesPaper 1 2023Salman ArshadNo ratings yet

- Vanguard Global Stock Index FundDocument4 pagesVanguard Global Stock Index FundjorgeperezsidecarshotmailomNo ratings yet

- 05 Market-Based Valuation - P... Nterprise Value MultiplesDocument53 pages05 Market-Based Valuation - P... Nterprise Value MultiplesMo HarouniNo ratings yet