Professional Documents

Culture Documents

OM Retirement Annuity One Pager

OM Retirement Annuity One Pager

Uploaded by

Nessy ElagoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OM Retirement Annuity One Pager

OM Retirement Annuity One Pager

Uploaded by

Nessy ElagoCopyright:

Available Formats

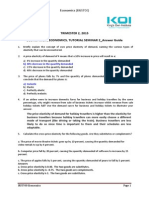

WHY INVEST IN A

RETIREMENT

ANNUITY?

? WHAT IS A RETIREMENT ANNUITY?

Simply put, a Retirement Annuity or also known as

an RA, is tax-effective retirement investment, that is WHY SAVE IN A RETIREMENT ANNUITY?

designed for individuals who want to save towards

their retirement. Once you reach retirement age which A retirement annuity is the perfect retirement savings

is 55 or the end of the contract term, 1/3rd gets paid to vehicle if you are self employed or as a top-up to your

you tax free as a lump sum and the 2/3rds is used to company’s pension or provident fund.

purchase a life or living annuity that provides you with

a taxable income.

MAX RETIREMENT ANNUITY BENEFITS

02 04 06

The You can add Job change

investment beneficiaries withdrawal

growth within to you RA benefits can be

v the plan is not investment. added tax-free

01 taxed. 03 05 to your annuity. 07

All contributions Your Retirement Access to a wide The more you

made towards your Annuity is range of underlying invest, the lower

RA may be tax protected against investment funds your plan charges

deductible. (Up to claims from on the MAX will be as your

N$150 000 pa) creditors. platform. investment grows.

WHEN SHOULD YOU START If you save N$1 000 towards your retirement in

2043 (20 years) and you start today, you’ll save

SAVING FOR RETIREMENT? N$1 235 258. If you delay by one year, you’ll save

N$1 075 108. And if you delay by three years,

The best time to start saving for retirement was you’ll save just N$807 000. So, a delay by just

20 years ago. The second-best time is now. three years will cost you N$428 258!

WITH A MONTHLY RETIREMENT

N$

HOW DO YOU ANNUITY POLICY CONTRIBUTION

N$300 000 – N$12 000 = N$288 000 (taxable income)

SAVE ON TAX? N$9000 + (25% for each N$ above N$100 000)

N$9000 + (25% of N$188 000) = N$56 000)

v Assumptions:

WITHOUT A MONTHLY RETIREMENT

ANNUITY POLICY CONTRIBUTION

SALARY N$25 000 N$300 000 (taxable income)

N$9000 + (25% for each N$ above N$100 000)

N$9000 + (25% of N$200 000) = N$59 000

ANNUAL SALARY N$300 000

MONTHLY CONTRIBUTION N$1 000

N$3 000

YOU SAVE

ANNUAL CONTRIBUTION N$12 000

TAX RATE 25%

A YEAR ON TAX

(*Invested in a Balanced Fund with a return of 8% per annum)

DO GREAT THINGS EVERY DAY

You might also like

- Sample Final Approval Letter: Reimbursement FormDocument1 pageSample Final Approval Letter: Reimbursement FormNLainie OmarNo ratings yet

- Windes 2021 Year End Year Round Tax Planning GuideDocument20 pagesWindes 2021 Year End Year Round Tax Planning GuideBrian SneeNo ratings yet

- Civil Engineering Manual Gcc2004Document185 pagesCivil Engineering Manual Gcc2004Paul Sony100% (1)

- PWC Captive InsuranceDocument13 pagesPWC Captive InsurancehvikashNo ratings yet

- ZapatoesDocument12 pagesZapatoesCheeze cake100% (6)

- Bus Math-Module 5.5 Standard DeductionsDocument67 pagesBus Math-Module 5.5 Standard Deductionsaibee patatagNo ratings yet

- CP575Notice 1641583471945Document2 pagesCP575Notice 1641583471945Dawson BanksNo ratings yet

- Course Curriculum of MBA in Oil and Gas ManagementDocument31 pagesCourse Curriculum of MBA in Oil and Gas Managementantopaul2No ratings yet

- AP - A05 Audit of LiabilitiesDocument7 pagesAP - A05 Audit of LiabilitiesJane DizonNo ratings yet

- ﻣ ﺒ ﺴ ﻄ ﺔ ﺿ ﺮ ﻳ ﺒ ﻴ ﺔ ﻓ ﺎﺗ ﻮ ر ة Simplified Tax InvoiceDocument1 pageﻣ ﺒ ﺴ ﻄ ﺔ ﺿ ﺮ ﻳ ﺒ ﻴ ﺔ ﻓ ﺎﺗ ﻮ ر ة Simplified Tax Invoiceباجبع خلودNo ratings yet

- Depreciation Tax ShieldDocument23 pagesDepreciation Tax ShieldAmit SinghNo ratings yet

- 4.d CIR vs. Union Shipping (G.R. No. L-66160 May 21, 1990) - H DigestDocument1 page4.d CIR vs. Union Shipping (G.R. No. L-66160 May 21, 1990) - H DigestHarleneNo ratings yet

- Soal Kiesio Chapter 16Document4 pagesSoal Kiesio Chapter 16helfiani putri100% (1)

- Audit Report Real Property TaxDocument6 pagesAudit Report Real Property TaxJomar Villena0% (1)

- Standard DeductionDocument58 pagesStandard DeductionJoseph Gabriel EstrellaNo ratings yet

- Hospital de San Juan de Dios Vs Pasay CityDocument4 pagesHospital de San Juan de Dios Vs Pasay CityMoon BeamsNo ratings yet

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual DownloadDocument17 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual DownloadGregory Brown100% (21)

- Self Employed Tax ContributionDocument4 pagesSelf Employed Tax ContributionLe-Noi AndersonNo ratings yet

- Solar PowerDocument17 pagesSolar PowerPrathamesh KarandikarNo ratings yet

- Deloitte Namibian - Quick Tax Guide - 2022 - UpdatedDocument11 pagesDeloitte Namibian - Quick Tax Guide - 2022 - UpdatedVez HindjouNo ratings yet

- Accrual Accounting and Income DeterminationDocument47 pagesAccrual Accounting and Income DeterminationDylan AdrianNo ratings yet

- Full Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full ChapterDocument36 pagesFull Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full Chapterurocelespinningnuyu100% (21)

- Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111Document36 pagesSolutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111epha.thialol.lqoc100% (51)

- Financial Reporting and Analysis 13th Edition Gibson Solutions ManualDocument30 pagesFinancial Reporting and Analysis 13th Edition Gibson Solutions Manualgarrotewrongerzxxo100% (23)

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1Document23 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1donna100% (46)

- South Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFDocument36 pagesSouth Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFemma.ingram210100% (12)

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1Document32 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1markcamachoyrpbjxgeft100% (22)

- PIT09 Tax ReducersDocument8 pagesPIT09 Tax ReducersAlellie Khay D JordanNo ratings yet

- Good InformationDocument3 pagesGood InformationHoshen MollaNo ratings yet

- Full Solution Manual For Financial Management Theory and Practice Third Canadian Edition PDF Docx Full Chapter ChapterDocument36 pagesFull Solution Manual For Financial Management Theory and Practice Third Canadian Edition PDF Docx Full Chapter Chapterzanycofferswubjt100% (11)

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsNo ratings yet

- Retirement Plan 2Document11 pagesRetirement Plan 2Reign Ashley RamizaresNo ratings yet

- Net Present Value (NPV)Document4 pagesNet Present Value (NPV)faeeezNo ratings yet

- Latihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Document7 pagesLatihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Yoga Cipta NugrahaNo ratings yet

- AYB320 0122 TrustsTutorialDocument20 pagesAYB320 0122 TrustsTutorialLinh ĐanNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- Tax Planning Guide: 1800 3000 6070 Buyonline@iciciprulifeDocument14 pagesTax Planning Guide: 1800 3000 6070 Buyonline@iciciprulifeRohitNo ratings yet

- Ch4-Recordedlecture-Fall2023 17 5166787619170306Document38 pagesCh4-Recordedlecture-Fall2023 17 5166787619170306ronny nyagakaNo ratings yet

- 09 - The Concepts of Depriciation and TaxesDocument44 pages09 - The Concepts of Depriciation and Taxesengineeringhydrologyfa23No ratings yet

- South-Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions Manual 1Document36 pagesSouth-Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions Manual 1briancrosbyqfakzcndys100% (28)

- South Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19Th Edition Raabe Solutions Manual Full Chapter PDFDocument35 pagesSouth Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19Th Edition Raabe Solutions Manual Full Chapter PDFfred.henderson352100% (13)

- IASSS16e Ch16.Ab - AzDocument33 pagesIASSS16e Ch16.Ab - AzLovely DungcaNo ratings yet

- Solution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDocument14 pagesSolution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDevender SharmaNo ratings yet

- Fundamentals of Corporate Finance: Using Discounted Cash Flow Analysis To Make Investment DecisionsDocument29 pagesFundamentals of Corporate Finance: Using Discounted Cash Flow Analysis To Make Investment DecisionsErez DavidovNo ratings yet

- Interest Rates..Document13 pagesInterest Rates..arkobagchi32No ratings yet

- SIPP Tax Relief GuideDocument4 pagesSIPP Tax Relief GuideMartin McDermottNo ratings yet

- CPA Question - CHPT 16 AnswersDocument22 pagesCPA Question - CHPT 16 Answersrohaanali222No ratings yet

- Answer 1: Introduction:: Particulars RsDocument10 pagesAnswer 1: Introduction:: Particulars RsRupesh SinghNo ratings yet

- How To Save Tax For Salary Above 20 LakhsDocument12 pagesHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNo ratings yet

- Liabilities Part 2Document43 pagesLiabilities Part 2Luisa Janelle BoquirenNo ratings yet

- Chapter 15 & 17 Q & SDocument7 pagesChapter 15 & 17 Q & Sgabie stgNo ratings yet

- CH 13 NotesDocument19 pagesCH 13 NotesBec barron100% (1)

- Gonzales CompanyDocument1 pageGonzales CompanyLako Lako FindsNo ratings yet

- Taxation Exam Part IIDocument14 pagesTaxation Exam Part IIGabriel Christopher MembrilloNo ratings yet

- Return On InvestmentDocument3 pagesReturn On InvestmentTirupal Puli0% (1)

- Financial Leverage One DriveDocument30 pagesFinancial Leverage One DrivemeraheNo ratings yet

- Practice Problems Ch12 PDFDocument57 pagesPractice Problems Ch12 PDFzoeyNo ratings yet

- Retirement PlanDocument11 pagesRetirement PlanReign Ashley RamizaresNo ratings yet

- Capital Budgeting-Different Techniques With Exercise: Dr. Md. Mosharref HossainDocument9 pagesCapital Budgeting-Different Techniques With Exercise: Dr. Md. Mosharref HossainPiyush NNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument14 pagesSolutions To End-Of-Chapter ProblemsTushar MalhotraNo ratings yet

- Roth Vs - Traditional InvestmentDocument1 pageRoth Vs - Traditional InvestmentShivam MishraNo ratings yet

- Solution Manual For Essentials of Corporate Finance 10th by RossDocument38 pagesSolution Manual For Essentials of Corporate Finance 10th by Rossjohnniewalshhtlw100% (26)

- CH 6 Case 4Document3 pagesCH 6 Case 4Hazem HalabiNo ratings yet

- Afif Juwandira-1162003016-Jawaban UTS Semester GenapDocument10 pagesAfif Juwandira-1162003016-Jawaban UTS Semester GenapYusuf AssegafNo ratings yet

- Lagrimas, Sarah Nicole S. - PC&OL PART 2Document3 pagesLagrimas, Sarah Nicole S. - PC&OL PART 2Sarah Nicole S. LagrimasNo ratings yet

- CB ProblemsDocument8 pagesCB ProblemsabhinaymarupakulaNo ratings yet

- Annual Compensation and Business TaxesDocument21 pagesAnnual Compensation and Business TaxesRyDNo ratings yet

- TABL2751 Tax Rates 2021 - UpdatedDocument4 pagesTABL2751 Tax Rates 2021 - UpdatedPeper12345No ratings yet

- Taxation Nyama AssignmentDocument14 pagesTaxation Nyama AssignmentTakudzwa BenjaminNo ratings yet

- DeductionDocument1 pageDeductionQueenie AndayaNo ratings yet

- Tax 56 Activity 2Document2 pagesTax 56 Activity 2Hannah Alvarado BandolaNo ratings yet

- Receipt Voucher: Xiaomi Technology India Private LimitedDocument1 pageReceipt Voucher: Xiaomi Technology India Private LimitedRubhan kumarNo ratings yet

- Sitta Von Reden - Money in Classical Antiquity (2010, Cambridge University Press)Document272 pagesSitta Von Reden - Money in Classical Antiquity (2010, Cambridge University Press)Felipe_Guma100% (1)

- 2018 Tax CalculatorDocument45 pages2018 Tax Calculatoracctg2012No ratings yet

- Syllabus-Advanced Financial AccountingDocument8 pagesSyllabus-Advanced Financial AccountingAndualem ZenebeNo ratings yet

- Shree Lekshmy Herbal and Cosmetic Products LLP Chennai India Super Stockist Oredr FormDocument3 pagesShree Lekshmy Herbal and Cosmetic Products LLP Chennai India Super Stockist Oredr Formk.madhuNo ratings yet

- SS Line 1Document3 pagesSS Line 1marlenemartinez119No ratings yet

- Advanced Taxation Cpa PDFDocument292 pagesAdvanced Taxation Cpa PDFJustin MUNYAMAHORONo ratings yet

- NMIMS Marketing of Financial Services - Assignment Answers (Sem-III)Document6 pagesNMIMS Marketing of Financial Services - Assignment Answers (Sem-III)Udit JoshiNo ratings yet

- (DIT) NotesDocument97 pages(DIT) NotesArjun SharmaNo ratings yet

- Department of Labor: ChoosingDocument8 pagesDepartment of Labor: ChoosingUSA_DepartmentOfLaborNo ratings yet

- Market Research Develop Ad CampaignDocument94 pagesMarket Research Develop Ad CampaignSheila SheilaNo ratings yet

- India Interstate Regulatory RequirementsDocument18 pagesIndia Interstate Regulatory RequirementsRohit CharpeNo ratings yet

- Cta 1D CV 08425 D 2014nov17 AssDocument43 pagesCta 1D CV 08425 D 2014nov17 AssbiklatNo ratings yet

- International EcommerceDocument41 pagesInternational EcommerceAnuj Kumar GuptaNo ratings yet

- 2019 Water Rate Increase Letter To The City of OceansideDocument9 pages2019 Water Rate Increase Letter To The City of OceansideANNAMARIE760No ratings yet

- SBD Works (NCB) EditedDocument33 pagesSBD Works (NCB) EditedKiyaNo ratings yet

- Business Communication ProjectDocument25 pagesBusiness Communication ProjectMuhammad Rauf Ali100% (1)

- Micro Tutorial Seminar 2 Answer GuideDocument3 pagesMicro Tutorial Seminar 2 Answer GuideHashma KhanNo ratings yet