Professional Documents

Culture Documents

GST Model Paper 3

Uploaded by

Joshua StarkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST Model Paper 3

Uploaded by

Joshua StarkCopyright:

Available Formats

BAPU DEGREE COLLEGE

(Affiliated to Bengaluru City University & Recognized by Government of Karnataka)

Triveni Road, Yeshwanthpur, Bengaluru – 560022.

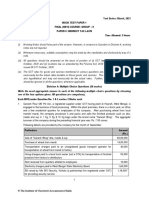

Class : V B.Com SUBJECT :GST LAW & PRACTICE

Time : 2 ½ Hours MODEL PAPER -3 Max. Marks:60

SECTION – A

Answer any five of the following questions. Each question carries two marks. (5x2=10)

1. a. What is Taxable event under GST?

b. What is meant by place of business?

c. Define Goods?

d. What is mixed supply?

e. Give any 2 advantage of registering under GST.

f. Expand HSN and SAC code?

g. State any four types of Indirect tax?

SECTION – B

Answer any four of the following questions. Each question carries five marks. (4x5=20)

2. In accordance with the provision of Section 12 of CGST Act, 2017 determine the time of supply of the following

independent cases.

Goods Made Available to Receipt of

SL No Date of Removal Date of Invoice

recipient Payment

1 01-07-2022 02-07-2022 03-07-2022 15-07-2022

2 03-07-2022 01-07-2022 04-07-2022 25-08-2022

3 04-08-2022 04-08-2022 06-08-2022 01-07-2022

4 - 02-10-2022 03-10-2022 15-11-2022

5 - 04-10-2022 01-10-2022 25-11-2022

6 - 04-11-2022 06-11-2022 01-10-2022

3. Explain composite supply and mixed supply?

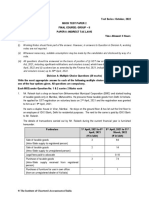

4. Compute the transaction value of taxable goods and GST payable from the following information of a registered

dealer in karnataka.

Selling price (including GST) 43,000

Following transaction are not included in the above price:

Freight charges paid by supplier charged separately 1,000

Normal secondary packaging cost 1,500

Cost of durable and returnable packing 1,500

Insurance on freight charges paid by supplier charged separately 500

Trade Discount (normal practice) 1,000

Rate of GST 18%

5. Kamath Hotel Group of companies provided the following services within the State of Karnataka from its various

establishments. Compute the amount of GST payable for the month of November 2020.

a) Supply of food or drink in restaurant not having facilities in air conditioning at 12% GST Rs. 40,000.

b) Supply of food or drink in restaurant in having licence to serve liquor at 18% GST Rs. 1,20,000.

c) Supply of food or drink in outdoor catering at 18% GST Rs. 2,00,000.

d) Renting of Hotel Rooms at 18% GST Rs. 3,00,000.

e) Supply of food or drink in air condition restaurant in 5 Star or above rated hotel at 28% GST Rs. 2,00,000.

6. Write a not on GST council?

SECTION – C

Answer any two of the following questions. Each question carries twelve marks. (2x12=24)

7. The following are the details of purchases, sales etc. of M/s Ramu and Co. a registered dealer in Karnataka for the

year ending 31-03-2019. Compute the GST liability of the dealer for the month of March 2019.

Particulars Amount(Rs.)

Details of purchases:

a) Purchase of raw materials from Bangalore - 5000 units at Rs. 10/unit (GST @ 5%) 50,000

b) Purchase of raw materials from a SEZ, Kerala 2000 units at Rs. 20/unit

(Inclusive of GST @ 12%) 44,800

c) Purchase of raw materials from a dealer who is registered under composition scheme

10,000 units @ Rs. 2/unit. Rate of GST 2.5% 20,000

d) Purchase of raw materials within the State from an unregistered person - 10,000 units at Rs. 3/unit 30,000

e) Import of raw materials from Canada - 50,000 units @ Rs. 10/unit.

(Inclusive of BCD and Exclusive of IGST at 18%) 5,00,000

Details of sales :

a) Sale of the taxable goods within the State @ 12% GST 50,000

b) Sale of goods to a dealer in Pondicherry exempt from levy of GST

(Goods were manufactured from the raw materials purchased from Bangalore) 1,00,000

c) Sale of goods to a dealer in Pune (Maharashtra) at 18% GST

(Goods were manufactured from raw materials purchased from SEZ, Kerala) 80,000

d) Export of finished goods to Srilanka

(Goods were manufactured from raw materials imported from Canada) 6,00,000

e) Sale of goods to a unit situated in SEZ Karwar (Karnataka)

(Goods were manufactured from raw material purchased from unregistered person) 2,00,000

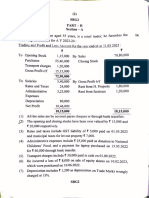

8. Mr Ram a registered dealer submits the following information for the month of October 2019

Particulars Amount (Rs.) Rate of GST

Details of Purchase:

Raw-material 'A' purchased from another state 18,00,000 28%

Raw-material 'B' purchased within state 25,00,000 18%

Raw-material 'C' purchased from USA costing Rs. 20,00,000

(including BCD @ 10% i.e. 2,00,000 and including of IGST) 22,40,000 12%

Raw-material 'D' purchased within the

State from a dealer who opted for composition scheme 7,00,000 5%

Raw-material 'E' purchased from a SEZ in Bangalore 15,00,000 0%

Details of Sales:

Sale of goods purchased from interstate purchase

and imported raw-materials to a person of Hyderabad

who opted for composition scheme 60,00,000 5%

Goods sold to an unregistered dealer of Mangalore 50,00,000 12%

Sale of goods to a dealer in union territory of Chandigarh,

produced from raw-material 'B' 20,00,000 18%

Sale of goods purchased from raw-material 'D' to a

registered dealer in Belagavi 20,00,000 28%

Sale of goods purchased from raw-material 'E' to

SEZ in Bangalore 7,00,000 0%

Note: The purchases and Sales figures given above do not include GST. Compute the amount of GST Payable.

9. Miss Swagatha a registered dealer submits the following information for the month of December 2023

Particulars Amount Rate of GST

Details of Purchase:

Raw- Material “A” purchased from other state 10,00,000 28%

Raw- Material “B” purchased from within state 20,00,000 18%

Raw- Material “C” purchased from USA costing rs 20,00,000 22,40,000 12%

(Including BCD @10% i.e 2,00,000 and including of IGST)

Raw- Material “D” purchased within the state from a dealer who 5,00,000 5%

opted for composition scheme

Raw- Material “E” purchased from SEZ in Bangalore 10,00,000 0%

Details of Sales:

Sale of goods purchased from interstate person who opted for 50,00,000 5%

composition scheme

Goods sold to an unregistered dealer of mangalore 75,00,000 12%

Sale of goods to a dealer in UT, produced from raw-material B 15,00,000 18%

Sale of goods purchased from a registered dealer in Belagavi 20,00,000 28%

Sale of good to SEZ in Bangalore 2,00,000 0%

SECTION – D

Answer any one of the following questions. Question carries six marks. (1x6=6)

10. Prepare tax invoice under GST Act?

11. Compute taxable value and tax liability with imaginary figures under CGST, SGST and IGST.

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- GST Model Paper - 1Document3 pagesGST Model Paper - 1Joshua StarkNo ratings yet

- GST Model Paper 2Document3 pagesGST Model Paper 2Joshua StarkNo ratings yet

- 4 GSTDocument4 pages4 GSTafsiya.mjNo ratings yet

- GST - Ch. 6, 8 - 13 - NS - Dec. 23Document2 pagesGST - Ch. 6, 8 - 13 - NS - Dec. 23Madhav TailorNo ratings yet

- GST - Ch. 3,4,5,7 - NS - Dec. 23Document3 pagesGST - Ch. 3,4,5,7 - NS - Dec. 23Madhav TailorNo ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- GST Practical Questions Vol - 1 (New) by CA Vivek GabaDocument13 pagesGST Practical Questions Vol - 1 (New) by CA Vivek Gabavamshi9686No ratings yet

- Answer Sheet of Mock Test Paper 31.3.2020Document19 pagesAnswer Sheet of Mock Test Paper 31.3.2020Babu GupthaNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument15 pagesFinal Examination: Suggested Answers To Questionsamit jangraNo ratings yet

- GST-II Problems and SolutionDocument112 pagesGST-II Problems and SolutionSukruth SNo ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- Class Notes, Tax Online - ITCDocument29 pagesClass Notes, Tax Online - ITCMuskaan MusthafaNo ratings yet

- MTP May 2021 QDocument10 pagesMTP May 2021 QÑïkêţ BäûðhåNo ratings yet

- Cfa Mock 3Document9 pagesCfa Mock 3jayNo ratings yet

- Payment of Tax @icmaifamilyDocument9 pagesPayment of Tax @icmaifamilypriyababu4701No ratings yet

- Class Notes, Tax Online - ITCDocument62 pagesClass Notes, Tax Online - ITCMANSI MANOJ 1923061No ratings yet

- Income Tax Question Note 1Document6 pagesIncome Tax Question Note 1Vishal Kumar 5504No ratings yet

- Tax Test 1 QPDocument4 pagesTax Test 1 QPmshivam617No ratings yet

- GST ModulusTutorialDocument2 pagesGST ModulusTutorialmodulus tutorialNo ratings yet

- Idt l2 CombinedDocument21 pagesIdt l2 CombinedMilan NayaniNo ratings yet

- Idt QDocument10 pagesIdt QriyaNo ratings yet

- 1613200874GST Question Bank - May 2021 (With Solutions) PDFDocument157 pages1613200874GST Question Bank - May 2021 (With Solutions) PDFKhusboo ChowdhuryNo ratings yet

- Taxation Test 6 CH 4 Unit 3 Unscheduled Nov 2023 Test Paper 1689754347Document11 pagesTaxation Test 6 CH 4 Unit 3 Unscheduled Nov 2023 Test Paper 1689754347ashishchafle007No ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- Case ScenarioDocument11 pagesCase Scenariopujitha vegesnaNo ratings yet

- Taxguru - in-MCQs On GST For CACMACSDocument14 pagesTaxguru - in-MCQs On GST For CACMACSOm KambleNo ratings yet

- Goods and Services Tax (MCQ) Grade 10: Answer: BDocument10 pagesGoods and Services Tax (MCQ) Grade 10: Answer: BsMNo ratings yet

- Value of SupplyDocument8 pagesValue of SupplyPratham 5hettyNo ratings yet

- Tally Remedial Class Question - Feb 2023Document3 pagesTally Remedial Class Question - Feb 2023farkojeydiNo ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- QuesDocument3 pagesQuesSiya GuptaNo ratings yet

- CTPMDocument13 pagesCTPMYogeesh LNNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- GSTDocument11 pagesGSTvamshi9686No ratings yet

- Itctp 2022Document4 pagesItctp 2022Muskaan ShawNo ratings yet

- Sy Tax P.set - 2022-23 New Section - IIDocument4 pagesSy Tax P.set - 2022-23 New Section - IICupid FriendNo ratings yet

- Answer Key (IDT Model Paper)Document12 pagesAnswer Key (IDT Model Paper)RKSiranjeeviRamanNo ratings yet

- GST MCQDocument22 pagesGST MCQG Prasana KumarNo ratings yet

- Sy Idt Obj U-3&4Document16 pagesSy Idt Obj U-3&4SNEH MEHTANo ratings yet

- 73253bos59102 Final p8Document18 pages73253bos59102 Final p8Vishal AgarwalNo ratings yet

- CA - FINAL NOV 22 Suggested AnswerDocument17 pagesCA - FINAL NOV 22 Suggested AnswerVeena reddyNo ratings yet

- CA Final IDT RTP For May 2023Document19 pagesCA Final IDT RTP For May 2023Nick VincikNo ratings yet

- Dec 18 Cma SuggDocument13 pagesDec 18 Cma Suggamit jangraNo ratings yet

- Final New Indirect Tax Laws Test 4 Test 1617180304Document7 pagesFinal New Indirect Tax Laws Test 4 Test 1617180304CAtestseriesNo ratings yet

- GST Pracital Class 2Document7 pagesGST Pracital Class 2Nayan JhaNo ratings yet

- Imp Que GST by CA Manoj Batra For Nov 20 AttemptDocument261 pagesImp Que GST by CA Manoj Batra For Nov 20 Attemptshri jeetNo ratings yet

- Chpter 1, Scope & Levy, Nat & POS, AllDocument14 pagesChpter 1, Scope & Levy, Nat & POS, AllBhavika KhetleNo ratings yet

- Test 10Document4 pagesTest 10ls786580302No ratings yet

- GST Ca Interg9 QuestionDocument6 pagesGST Ca Interg9 QuestionVishal Kumar 5504No ratings yet

- 6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Document21 pages6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Mighty SinghNo ratings yet

- Input Tax CreditDocument8 pagesInput Tax Creditloey xafNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- Audit Ca Inter QuestionDocument5 pagesAudit Ca Inter QuestionVishal Kumar 5504No ratings yet

- Roll No. ..................................... : New SyllabusDocument12 pagesRoll No. ..................................... : New Syllabuskevin12345555No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- GST Skill DeveDocument7 pagesGST Skill DeveJoshua StarkNo ratings yet

- GST Expected Theory QuestionsDocument2 pagesGST Expected Theory QuestionsJoshua StarkNo ratings yet

- Advanced Corporate Accounting - TheoryDocument13 pagesAdvanced Corporate Accounting - TheoryJoshua StarkNo ratings yet

- CMT Section A&b Question Answers-1Document8 pagesCMT Section A&b Question Answers-1Joshua StarkNo ratings yet

- Unit 1 - Contract Costing - ProblemsDocument8 pagesUnit 1 - Contract Costing - ProblemsJoshua StarkNo ratings yet

- Wa0022.Document10 pagesWa0022.Joshua StarkNo ratings yet

- Aca Skill DevelopmentDocument3 pagesAca Skill DevelopmentJoshua StarkNo ratings yet

- Nature & Significance of ManagementDocument19 pagesNature & Significance of ManagementJoshua StarkNo ratings yet

- 9045 Key ContactsDocument2 pages9045 Key ContactsAyo RosemaryNo ratings yet

- Important Bin For CCDocument2 pagesImportant Bin For CCRozanawati Shanty100% (4)

- Chap 2 - The Purchasing Management Process - SVDocument2 pagesChap 2 - The Purchasing Management Process - SVNhi NguyễnNo ratings yet

- Hotel Budget Excel TemplateDocument36 pagesHotel Budget Excel TemplateGhaouti ZidaniNo ratings yet

- 3.retirement and Death of A PartnerDocument23 pages3.retirement and Death of A PartnerTinku100% (1)

- International Marketing International Marketing: Final Project Final ProjectDocument15 pagesInternational Marketing International Marketing: Final Project Final ProjectsaeedNo ratings yet

- Group Planning Document Template For Viking - v1 ScribdDocument3 pagesGroup Planning Document Template For Viking - v1 ScribdDharna KachrooNo ratings yet

- Template Siklus AkuntansiDocument14 pagesTemplate Siklus AkuntansiSena Ilham NursandyNo ratings yet

- Duke Fuqua Casebook 2017 - 2018Document361 pagesDuke Fuqua Casebook 2017 - 2018Rinakira FuijeNo ratings yet

- Career Guide Connecting Executive SearchDocument14 pagesCareer Guide Connecting Executive SearchUs UssawitNo ratings yet

- Creative Writing Skillis .... Class 12Document15 pagesCreative Writing Skillis .... Class 12Akshat ShishodiaNo ratings yet

- Reviewer Pfrs 3 Business CombinationsDocument4 pagesReviewer Pfrs 3 Business CombinationsKryzzel Anne JonNo ratings yet

- Viva Presentation: Ruchi Vinay ChavanDocument54 pagesViva Presentation: Ruchi Vinay ChavanPravin SarafNo ratings yet

- Test Bank For Supply Chain Management 5th Edition by Chopra MeindlDocument13 pagesTest Bank For Supply Chain Management 5th Edition by Chopra MeindlBrenda Wilcox100% (28)

- Vancouver Economic Commission Delegates ListDocument10 pagesVancouver Economic Commission Delegates ListBob MackinNo ratings yet

- "The Conversion Cycle": Two Subsystems: - Ends With Completed Product Sent To The Finished Goods WarehouseDocument2 pages"The Conversion Cycle": Two Subsystems: - Ends With Completed Product Sent To The Finished Goods WarehouseKaren CaelNo ratings yet

- ABC Costing More Practise QuestionsDocument3 pagesABC Costing More Practise QuestionsJahanzaib ButtNo ratings yet

- Daraz PK PDFDocument21 pagesDaraz PK PDFRana Usama100% (1)

- Factors Affecting The Demand and Supply of SunsilkDocument2 pagesFactors Affecting The Demand and Supply of Sunsilkthomas100% (1)

- Saman HabibianDocument24 pagesSaman HabibiansarmadfunsolNo ratings yet

- 11 Task Performance 1Document1 page11 Task Performance 1Febe Anne AglangaoNo ratings yet

- Budget Preparation Forms and Instructions (Updates)Document41 pagesBudget Preparation Forms and Instructions (Updates)mgallegoNo ratings yet

- of Inplant Training NewDocument58 pagesof Inplant Training NewSafwana JasminNo ratings yet

- Burberry Group PLC: Company ProfileDocument35 pagesBurberry Group PLC: Company ProfileNaresh RamratanNo ratings yet

- IGC Controlling Prozessmodell PDFDocument21 pagesIGC Controlling Prozessmodell PDFmatthewNo ratings yet

- BSC K BeekmanDocument56 pagesBSC K BeekmanBONU SAI VENKATA DEEPAK NAIDUNo ratings yet

- Theories of International InvestmentDocument4 pagesTheories of International Investmentgayathrisuba67% (3)

- Resume - Karthikeyan P.T.R PDFDocument1 pageResume - Karthikeyan P.T.R PDFdev2025No ratings yet

- CPM - StrategyDocument6 pagesCPM - Strategyhoopyfrood24No ratings yet

- The Logistics and Management of Distribution ChannDocument12 pagesThe Logistics and Management of Distribution ChannLubna WaheedNo ratings yet