Professional Documents

Culture Documents

Topic 2

Uploaded by

eddyyowCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 2

Uploaded by

eddyyowCopyright:

Available Formats

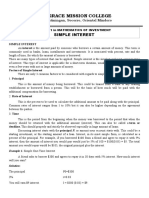

LESSON 2 Topic: Simple, Compound Interest and • To calculate Principal, CLO1

Annuity interest rate, time Test 1(15%)

• To calculate Future value

• Simple Interest & Simple Discount Note and present value

• Compound Interest • To calculate Future value

• Annuity annuity, Present value

annuity & sinking fund

• To calculate periodic

payment of the loan

Why This Topic

In this topic, students will learn the different types of interest that are available along with the applications. Topics

include simple interest, simple discount notes and compound interest. How compound interest is applicable to

annuities will also be explored.

Simple Interest & Simple Discount Note

Simple Interest is interest charged on the entire principal for the entire length of the loan. Principal is the loan

amount. Rate is the annual interest rate. Time is the length of the loan in years.

Simple interest = Principal × Rate × Time

I = P × R × T

Simple Interest Formula I = PRT

1. Rate (R) must first be changed to a decimal or fraction.

2. Time (T) must first be converted to years.

Example:

Jessica Hernandez needs to borrow $85,000 for 9 months. Her bank would not lend her the money since she has

no experience or assets. She found an individual who would lend her the money at 18.5%. However, her uncle

agreed to go to the bank and cosign a loan to her, which means he will have to repay the loan if Jessica fails to

do so. On this basis, the bank agreed to lend her the money at 10% simple interest. Find the interest at (a) 18.5%

and (b) 10%. (c) Then find the amount saved using the lower interest rate.

(a) First, convert 18.5% to 0.185 and 9 months to 9/12 year. Then substitute values into I = PRT to find the interest.

The principal (P) is the amount of the loan.

I = PRT

I = $85,000 × .185 × 9/12

I = $11,793.75

(b) First, convert 10% to .10 and proceed as in (a).

I = PRT

I = $85,000 × .10 × 9/12

I = $6375

© UNITAR International University Page 1 of 24

(c) Difference = $11,793.75 – $6375

= $5418.75

Hernandez quickly learned an important lesson: Interest costs can be very high. She was delighted that her uncle

had agreed to cosign for her. It saved her nearly $5500 in interest charges in only 9 months.

Maturity Value is the amount that must be repaid when the loan is due

Found by adding principal and interest

Maturity value = Principal + Interest

M = P + I

Example:

Tom Swift needs to borrow $28,300 to remodel his bookstore so that he can serve coffee to customers as they

browse or sit at their computers. He borrows the funds for 10 months at an interest rate of 9.25%. Find the interest

due on the loan and the maturity value at the end of 10 months.

Interest due is found using I = PRT, where T must be in years (10 months = 10/12 yr.)

Interest = PRT

I = $28,300 × 0.0925 × 10/12

I = $2181.46

Maturity value = P + I

M = $28,300 + $2181.46

M = $30,481.46

Loan may be given in days.

Loan may be due at a fixed date.

So we may have to figure out the number of days until the loan must be paid off.

One way to do this is to use a table as seen on the next slide and the back cover of the text.

Use the table to find the number of days from:

(a) March 24 to July 22

(b) April 4 to October 10

(c) November 8 to February 17 of the following year

© UNITAR International University Page 2 of 24

(d) December 2 to January 17 of the following year

Assume that it is not a leap year.

(a) July 22 is day 203

March 24 is day – 83

120

120 days from March 24 to July 22.

(b) October 10 is day 283

April 4 is day – 94

189

189 days from April 4 to October 10.

(b) November 8 is day 312, so there are 365 – 312 = 53 days from November 8 to the end of the year. Add

days until the end of the year plus days into the next year to find the total.

November 8 to end of year 53

February 17 is day + 48

101

101 days from November 8 to February 17 of the next year.

(c) December 2 is day 336, so there are 365 – 336 = 29 days from December 2 to the end of the year. Add

days until the end of the year plus days into the next year to find the total.

December 2 to end of year 29

January 17 is day + 17

46

46 days from December 2 to January 17 of the next year.

Use the Actual Number of Days in a Month to Find the Number of Days from One Date to Another

The number of days between specific dates can be found using the number of days in each month of the year

as shown in the table.

Example:

Find the number of days from:

(a) June 3 to August 14 and

(b) November 4 to February 21.

© UNITAR International University Page 3 of 24

(a) June has 30 days, so there are 30 – 3 = 27 days from June 3 to the end of June.

June 3 to the end of June 27

31 days in July 31

14 days in August + 14

72

72 days from June 3 to August 14.

(b) November has 30 days, so there are 30 – 4 = 26 days from November 4 to the end of November.

Nov 4 to end of November 26

31 days in December 31

31 days in January 31

21 days in February + 21

109

109 days from November 4 to February 21.

Finding Exact and Ordinary Interest

Exact Interest calculations require the use of the exact number of days in the year, 365 or 366 if a leap year.

Ordinary Interest, or banker’s interest, calculations require the use of 360 days.

When using I = PRT, since the rate (R) is given in years, time (T) must also be given in years, so you may have to

convert the given time.

Number of days in the loan period

T=

Number of days in a year

For exact interest: Use 365 days (or 366)

Number of days in the loan period

T=

365

For ordinary, or banker’s interest: Use 360 days

Number of days in the loan period

T=

360

Example:

Radio station KOMA borrowed $148,500 on May 12 with interest due on August 27. If the interest rate is 10%, find

the interest on the loan using the:

(a) exact interest

(b) ordinary interest

Either the table method or the method of the number of days in a month can be used to find that there are 107

days from May 12 to August 27.

© UNITAR International University Page 4 of 24

(a) Exact interest is found from I = PRT with P = $148,500, R = 0.10 and T = 107/365

I = PRT

I = $148,500 × 0.1 × 107/365

I = $4353.29

(b) Find ordinary interest with the same formula and values, except T = 107/360

I = PRT

I = $148,500 × .1 × 107/360

I = $4413.75

In this example, the ordinary interest is $4413.75 – $4353.29 = $60.46 more than the exact interest.

Promissory Note

A promissory note is a legal document in which one person or firm agrees to pay a certain amount of money, on

a specific day in the future, to another person or firm.

Maker or payer: The person borrowing the money. (Madeline Sullivan)

Payee: The person who loaned the money and who will receive the payment (Charles D. Miller)

Term: The length of time until the note is due (90 days)

Face value or principal: The amount being borrowed ($27,500)

Maturity value: The face value plus interest, also the amount due at maturity

Maturity date or due date: The date the loan must be paid off with interest (June 4)

Interest = Face Value × Rate × Time

Interest = $27,500 × 0.09 × 90/360 = $618.75

Maturity Value = Face Value + Interest

Maturity Value = $27,500 + $618.75 = $28,118.75

Finding the Due Date of a Note

Time in months. The loan is due after a given number of months has passed on the same day of the month as the

original loan was made.

© UNITAR International University Page 5 of 24

Example:

Find the due date, interest, and maturity value for a $600,000 loan made to Benson Automotive on July 31 for 7

months at 7.5% interest.

Interest and principal are due 7 months from July 31 or February 31, which does not exist. Since February has only

28 days (unless it is a leap year), interest and principal are due on the last day of February, or February 28

(February 29, if it were a leap year).

I = PRT = $600,000 × 0.075 × 7/12 = $26,250

M + I = $600,000 + $26,500 = $626,250

A total of $626,250 must be repaid on February 28.

Finding the Principal

Principal (P) is found by dividing both sides of the simple interest equation I = PRT by RT

I = PRT

I P RT

=

RT RT

I

=P

RT

Interest

Principal =

Rate Time (in years)

I

or P=

RT

Note: Use banker’s interest with 360 days for all problems in this section.

Gilbert Construction Company borrows funds at 10% for 54 days to finish building a home. Find the principal that

results in interest of $1560.

Write the rate as 0.10, the time as 54/360, and then use the formula for principal.

The principal is $104,000.

I

P=

RT

© UNITAR International University Page 6 of 24

$1560 $1560

P= = = $104,000

54 0.15

.10

360

The principal is $104,000

Example:

On February 2, Ebony Johnson took out a short-term loan to pay her college tuition. The loan is due to be repaid

on April 15, when Johnson expects to receive an income tax refund. The interest on the loan is $93.60 at a rate

of 6.5%. Find the principal, i.e. the amount borrowed.

First, find the number of days:

26

31

+ 15

72 so T = 72/360

Find the principal.

I $93.60 $93.60

P= = = = $7200

RT .065 72 .013

360

Finding the Rate

Rate (R) is found by dividing both sides of the simple interest equation I = PRT by PT

I = PRT

I PRT

=

PT PT

I

=R

PT

Interest

Rate =

Principal Time (in years)

I

or R=

PT

An exchange student from the United States living in Paris deposits $10,000 in U.S. currency in a French bank for

45 days. Find the rate if the interest is $18.13 in U.S. currency.

I

R=

PT

© UNITAR International University Page 7 of 24

$18.13 $18.13

R= = = .014504 or 1.45%

45 $1250

$10,000

360

Example:

Blaine Plumbing kept extra cash of $86,500 in an account from June 1 to August 16. Find the rate if the company

earned $365.22 in interest during this period of time. Round to the nearest tenth of a percent. Find the number of

days using the table.

August 16 is day 228

June 1 is day –152

76 so, T = 76/360

I $365.22

Rate = = = .02

PT $86, 500 76

360

The rate of interest is 2%.

Finding the Time

Time (T) is found by dividing both sides of the simple interest equation I = PRT by PR

I = PRT

I P RT

=

PR P R

I

=T

PR

Interest

Time (in years) =

Principal Rate

I

or T=

PR

I

Time in days = 360

PR

I

Time in months = 12

PR

Example:

© UNITAR International University Page 8 of 24

Roberta Sanchez deposited $18,600 in an account, paying 3% and she earned $217 in interest. Find the number

of days that the deposit earned interest.

I

Time in days = 360

PR

$217

T= 360 = 140

$18,600 .03

The money was on deposit for 140 days.

SIMPLE DISCOUNT NOTES

Simple Interest: Face Value + Interest = Maturity Value

(Principal)

Simple Discount: Proceeds + Discount = Face Value

(Interest) (Maturity Value)

Bank discount = Face value × Discount Rate × Time

or

B = MDT

where

B = Bank Discount D = Discount Rate

M = Face value (maturity) T = Time (in yrs)

Then, if P is the proceeds,

Proceeds (loan amount)

= Face value – Bank discount

or P = M – B

Stated another way,

Face value = Proceeds (loan amount) + Bank discounts

or M = P + B

Example:

Jim Peterson signs a simple discount note with a face or maturity value of $35,000 so that he can purchase a

truck with a plow for his snow removal business. The banker discounts the 10-month note at 9%. Find the amount

of the discount and the proceeds.

Peterson does not receive $35,000 from the bank, that is, the amount he must repay when the loan matures.

Use M = $35,000, D = 9%, and T = 10/12

© UNITAR International University Page 9 of 24

in the formula

B = MDT

to find the discount, which is the interest that must be paid at maturity.

Bank Discount = M × D × T

B = $35,000 × .09 × 10/12 = $2625

The discount of $2625 is the interest.

Proceeds are found using

P= M–B

P = $35,000 – $2625 = $32,375

Peterson signs the discount note with a face value of $35,000 but receives $32,375. Ten months later he must pay

$35,000 to the bank.

Calculating Face Value to Achieve Desired Proceeds

P

M=

1− DT

where

M = Face value of the simple discount note

P = Proceeds received by the borrower

D = Discount rate used by the bank

T = Time of the loan (in years)

Example:

Tina Watson purchased a classic 1961 Corvette and plans to rebuild it. She estimates that she will need to borrow

$18,000 for 180 days. Find the face value of the 10% simple discount note that would result in the proceeds of

$18,000 to Watson.

Use the formula:

P

M=

1− DT

Replace P = $18,000, D = .10, T = 180/360.

$18, 000

M= = $18, 947.37

180

1− .10

360

The face value is $18,947.37. Watson receives $18,000 and must repay $18,947.37 in 180 days.

Example:

© UNITAR International University Page 10 of 24

The owner of a medical supplies store has been offered loans from two different banks. Each note has a face

value of $75,000 and a time of 90 days. One note has a simple interest rate of 10%, and the other has a simple

discount rate of 10%. Identify the better deal.

Find the interest owed on each.

Simple Interest I = PRT

90

I = $75, 000 .10

360

I = $1875

Simple Discount Note B = MDT

90

B = $75, 000 .10

360

B = $1875

Find the amount the borrower would receive.

Simple Interest

Face Value = $75,000

Simple Discount Note

Proceeds = M – B

= $75,000 – $1875

= $73,125

The borrower has use of $75,000 with the simple interest note, but only $73,125 with the simple discount note.

Interest is the same.

So, the simple interest note is the better deal in this situation. However, simple interest notes are not necessarily

better than simple discount notes. You must examine the terms and find the maturity value of each.

Finding the Effective Interest Rate

Effective Rate of Interest – also called Annual Percentage Rate, APR, True Rate

The interest rate is calculated based on the actual amount received by the borrower.

Stated Rate, or Nominal Rate – is the rate written on the note (it is NOT the effective rate)

Example:

Find the effective rate of interest (APR) for the simple discount note of the previous example.

Recall that I = $1875 (the discount), P = $73,125 (the proceeds), and T = 90/360.

Use the formula

© UNITAR International University Page 11 of 24

I

R=

PT

I = $1875, P = $73,125, T = 90/360.

$1875

R= = .1026 = 10.26%

90

$73,125

360

Federal regulations require that rates be rounded to the nearest quarter of a percent. So the effective rate is

10.25%.

Compound Interest

Present Value & Future Value

Present Value – the value of an investment today, right now

Future Value, Future Amount, Compound Amount – amount in an investment at a specific future date

Depends on:

1. Compound interest—Compound interest results in a greater future value than simple interest.

2. Interest rate—A higher rate results in a greater future value.

3. Length of investment—An investment held longer usually results in a greater future value.

Compound Interest – calculated on previously credited interest in addition to the original principal

Finding Future Value

1. Use I = PRT to find simple interest for the period.

2. Add the principal at the end of the previous period to the interest for the current period to find the principal at

the end of the current period.

Example:

Regina Foster wants to compare simple interest to compound interest on a $2000 investment.

(a) Find the interest if funds earn 6% simple interest for 1 year.

(b) Find the interest if funds earn 6% interest compounded every 6 months for 1 year.

(c) Find the difference between the two.

(d) Find the effective rate for both.

(a) Simple interest on $2000 at 6% for 1 year is found as follows.

I = PRT = $2000 × .06 × 1 = $120

(b) Interest for first 6 months

= PRT = $2000 × .06 × 1/2 = $60

Principal at end of first 6 months

= Original principal + Interest

= $2000 + $60 = $2060

© UNITAR International University Page 12 of 24

Interest for second 6 months

= PRT = $2060 × .06 × 1/2 = $61.80

Principal at end of 1 year

= $2060 + $61.80 = $2121.80

Interest earned in the second 6 months ($61.80) is greater than that earned in the first 6 months ($60) because

the interest earned becomes part of the principal, and therefore earns interest.

Total Compound Interest

= $60 + $61.80 = $121.80

(c) Difference in interest

= $121.80 – $120 = $1.80

Compound interest results in more interest. The difference here of $1.80 seems trivial, but compound interest

results in huge differences over time as you will see shortly!

(d) The effective interest rate is the interest for the year divided by the original investment.

6% simple interest

$120

= 6%

$2000

6% compounded

$121.80

= 6.1%

$2000

Although they have the same nominal rate (6%), the compound interest investment has a larger effective interest

rate due to compounding.

Example:

The Simpsons want to pay $5000 down in 4 years on a new car. Today they invest $3800 in an investment that

pays 6% interest compounded annually. (a) Find the excess of compound interest over simple interest at the end

of 4 years. (b) Will they have enough money to meet their goal?

First, calculate interest using I = PRT. Find the new principal by adding the interest earned to the preceding

principal.

𝑹 𝟎. 𝟎𝟔

Compound 𝒊= = = 𝟎. 𝟎𝟔

𝒌 𝟏

(b) FV = PV (1+i)n

=$3800(1+0.06)4 𝒏 = 𝒌 × 𝑻 = 𝟏 × 𝟒 𝒚𝒆𝒂𝒓𝒔 = 𝟒

= $4797.41

Compound Interest

= $4797.41 – $3800 = $997.41

© UNITAR International University Page 13 of 24

Simple Interest

= $3800 × 0.06 × 4 = $912

Difference = $997.41 – $912 = $85.41

(b) No, but almost! They will be short of their goal by $5000 – $4797.41 = $202.59.

Compounding Period

The compounding period is the time over which interest is calculated and added to the principal. The number of

compounding periods is the number of compounding periods, either in each year or in the life of a loan or

investment.

Identify Interest Rate Per Compounding Period

The interest rate per compounding period is the interest rate applied to each compounding period. It is found by

dividing the annual interest rate by the number of compounding periods in a year.

𝑹

𝒊=

𝒌

Identify Number of Compounding Periods

The total number of compounding periods in the investment is the product of the number of years in the term of

the investment and the number of compounding periods per year.

𝒏=𝒌 ×𝑻

Example:

Find the interest rate per compounding period and the number of compounding periods for each.

(a) 5% compounded semiannually, 3 years

(b) 6% per year, compounded monthly, 2 1/2 years

(c) 2% per year, compounded quarterly, 5 years

(a) 5% compounded semiannually is 5% ÷ 2 = 2.5% credited at the end of each 6 months. 3 years × 2

periods per year = 6 compounding periods in 3 years.

© UNITAR International University Page 14 of 24

(b) 6% compounded monthly results in 6% ÷ 12 = .5% credited at the end of each month. 2.5 years × 12 periods

per year = 30 compounding periods in 2.5 years

(c) 2% compounded quarterly results in 2% ÷ 4 = .5% credited at the end of each quarter. 5 years × 4 periods

per year = 20 compounding periods in 5 years.

Use M = P(1 + i)n to Find Compound Amount

The formula for compound interest uses exponents, which is a short way of writing repeated products.

For example,

Maturity Value = M = P(1 + i)n or FV = PV (1+i)n

Interest = I = M – P or I=FV - PV

Where

P = initial investment

n = total number of compounding periods

i = interest rate per compounding period

Example:

An investment at Bank of America pays 7% interest per year compounded semiannually. Given an initial deposit

of $4500, (a) use the formula to find the compound amount after 5 years, and (b) find the compound interest.

(a) Interest is compounded at 7% ÷ 2 = 3.5% every 6 months for 5 years × 2 periods per year = 10 periods

Therefore, 3.5% is the interest rate per compounding period (i) and 10 is the number of compounding periods (n).

M = P(1 + i)n

= $4500 × (1 + .035)10

= $4500 × (1.035)10 = $6347.69

The compound amount is $6347.69.

(b) I=M–P

= $6347.69 – $4500 = $1847.69

The interest is $1847.69.

Example:

In each case, find the interest earned on a $2000 deposit.

(a) For 3 years, compounded annually at 4%

(b) For 5 years, compounded semiannually at 6%

(c) For 6 years, compounded quarterly at 8%

(d) For 2 years, compounded monthly at 6%

© UNITAR International University Page 15 of 24

𝑹 𝟎. 𝟎𝟒

𝒊= = = 𝟎. 𝟎𝟒

𝒌 𝟏

𝒏 = 𝒌 × 𝑻 = 𝟏 × 𝟑 𝒚𝒆𝒂𝒓𝒔 =3

(a) Compound amount =

M = $2000 × (1+0.04)3 = $2249.73

Interest earned =

I= $2249.73 – $2000 = $249.73

𝑹 𝟎. 𝟎𝟔

𝒊= = = 𝟎. 𝟎𝟑

𝒌 𝟐

𝒏 = 𝒌 × 𝑻 = 𝟐 × 𝟓 𝒚𝒆𝒂𝒓𝒔 = 𝟏𝟎

(b) Compound amount =

M = $2000 × (1+0.03)10 = $2687.83

Interest earned =

I= $2687.83 – $2000 = $687.83

𝑹 𝟎. 𝟎𝟖

𝒊= = = 𝟎. 𝟎𝟐

𝒌 𝟒

𝒏 = 𝒌 × 𝑻 = 𝟒 × 𝟔 𝒚𝒆𝒂𝒓𝒔 = 𝟐𝟒

(c ) Compound amount =

M = $2000 × (1+0.02)24 = $3216.87

Interest earned =

I= $3216.87 – $2000 = $1216.87

𝑹 𝟎. 𝟎𝟔

𝒊= = = 𝟎. 𝟎𝟎𝟓

𝒌 𝟏𝟐

𝒏 = 𝒌 × 𝑻 = 𝟏𝟐 × 𝟐 𝒚𝒆𝒂𝒓𝒔 = 𝟐𝟒

(d) Compound amount =

M = $2000 × (1+0.005)24 = $2254.32

Interest earned =

I = $2254.32 – $2000 = $254.32

=$121.80

© UNITAR International University Page 16 of 24

Present Value

Future value – amount available at a specific time in the future; amount available after an investment has earned

interest.

Present value – amount needed today so the desired amount will be available when needed.

Present value (PV)

PV = Future value / ( 1 + i )n

Example:

The local Harley-Davidson shop has seen the business grow rapidly. The owners plan to remodel the shop in one

year at a cost of $280,000. How much should be invested in an investment earning of 6% compounded

semiannually to have the funds needed?

The interest rate per compounding period is 6% divided by 2 = 3%, and the number of compounding periods is 1

year × 2 periods per year = 2.

𝑹 𝟎. 𝟎𝟔

𝒊= = = 𝟎. 𝟎𝟑

𝒌 𝟐

𝒏 = 𝒌 × 𝑻 = 𝟐 × 𝟏 𝒚𝒆𝒂𝒓𝒔 = 𝟐

Present value = $280,000 / ( 1 +0.03)2 = $263,926.85

Example:

Radiux Inc. wishes to partner with a Korean company to purchase a satellite in 3 years. Radiux plans to make a

cash down payment of 40% of its anticipated $8,000,000 cost and borrow the remaining funds from a bank. Find

the amount Radiux should invest today in an account earning 6% compounded annually to have the down

payment needed in 3 years.

𝑹 𝟎. 𝟎𝟔

𝒊= = = 𝟎. 𝟎𝟔

𝒌 𝟏

𝒏 = 𝒌 × 𝑻 = 𝟏 × 𝟑 𝒚𝒆𝒂𝒓𝒔 = 𝟑

Find the down payment to be paid in 3 years.

Down payment

= 0.40 × $8,000,000 = $3,200,000

Present value

= $3,200,000 / ( 1 +0.06)3 = $2,686,781.71

Radiux must invest $2,686,781.71 today at 6% interest compounded annually to have the required down payment

of $3,200,000 in 3 years.

Use Future Value and Present Value to Estimate the Value of a Business. Businesses with strong growth

opportunities valued at more than normal growth.

© UNITAR International University Page 17 of 24

Estimate future value of business in 2 to 5 years.

Find the present value of this amount using the appropriate discount rate.

Example:

Brianna McGruder and Tanya Zoban own Extreme Sports, Inc., whose value is $120,000 today assuming normal

growth. However, the partners believe the value will grow at 15% per year for the next four years. They want to

take this rapid growth into consideration when valuing the business for a potential sale.

(a) Find the future value of the business in 4 years.

(b) Estimate the value of the retail store by finding the present value of the amount found in part (a) at 6%

compounded quarterly.

𝑹 𝟎. 𝟏𝟓

𝒊= = = 𝟎. 𝟏𝟓

𝒌 𝟏

𝒏 = 𝒌 × 𝑻 = 𝟏 × 𝟒 𝒚𝒆𝒂𝒓𝒔 = 𝟒

(a) There is no 15% column in table, so use formula (1 + i)n with 15% for 4 years

Future value

= $120,000 × (1 + 0.15)4 = $209,881

This is an estimate of the value of the store in 4 years.

𝑹 𝟎. 𝟎𝟔

𝒊= = = 𝟎. 𝟎𝟏𝟓

𝒌 𝟒

𝒏 = 𝒌 × 𝑻 = 𝟒 × 𝟒 𝒚𝒆𝒂𝒓𝒔 = 𝟏𝟔

(b) Find present value of $209,881 assuming 6% compounded quarterly for 4 years.

6% ÷ 4 = 1.5% per quarter, 4 × 4 = 16 compounding periods

Present value

= $209,881 / ( 1 +0.015)16 = $165,393 (rounded)

Thus, the partners should ask $165,400 for their business. The rapid growth rate adds about $165,400 – $120,000 =

$45,400 to the value of the business.

Annuity

Annuity– series of equal payments made at regular intervals

Ordinary annuity– payments are made at the end of each period

Payment period– the time between payments

Term of the annuity– time needed for all payments to be made

Amount, compound amount, or future value of the annuity – total amount in an annuity on a future date

© UNITAR International University Page 18 of 24

Formula:

(𝟏 + 𝒊)𝒏 − 𝟏

𝑨𝒏𝒏𝒖𝒊𝒕𝒚 𝑨𝒎𝒐𝒖𝒏𝒕 = 𝑷𝒎𝒕 × ( )

𝒊

or

(𝟏 + 𝒊)𝒏 − 𝟏

𝑭𝒖𝒕𝒖𝒓𝒆 𝑽𝒂𝒍𝒖𝒆 𝒐𝒇𝑨𝒏𝒏𝒖𝒊𝒕𝒚 = 𝑷𝒎𝒕 × ( )

𝒊

Example:

Darnell Johnson’s employer contributes 4% of Darnell’s $38,400 salary into his retirement plan. Additionally, the

hospital matches the 1% of his salary that Darnell himself puts into his own plan. Find the future value in 10 years

assuming (a) funds earn 5% compounded semiannually and (b) funds earn 8% compounded semiannually. (c)

Then find the difference between the two. (Hint: Assume all contributions into the plan occur at the end of

semiannual periods.)

Salary per period = $38,400 ÷ 2 = $19,200

Total contributions = Darnell + Employer

= (.01 × $19,200) + (.05 × $19,200)

= $1152 invested every six-months

Interest: 5% ÷ 2 = 2 ½% per semiannual, for 10(2) = 20 six-month periods.

𝑹 𝟎. 𝟎𝟓

𝒊= = = 𝟎. 𝟎𝟐𝟓

𝒌 𝟐

𝒏 = 𝒌 × 𝑻 = 𝟐 × 𝟏𝟎 𝒚𝒆𝒂𝒓𝒔 = 𝟐𝟎

(𝟏+𝒊)𝒏 −𝟏

(a) 𝑨𝒏𝒏𝒖𝒊𝒕𝒚 𝑨𝒎𝒐𝒖𝒏𝒕 = 𝑷𝒎𝒕 × ( )

𝒊

(𝟏+𝟎.𝟎𝟐𝟓)𝟐𝟎 −𝟏

=$1152 × ( 𝟎.𝟎𝟐𝟓

)

=$29427.45

(𝟏+𝒊)𝒏 −𝟏

(b) 𝑨𝒏𝒏𝒖𝒊𝒕𝒚 𝑨𝒎𝒐𝒖𝒏𝒕 = 𝑷𝒎𝒕 × ( 𝒊

)

(𝟏+𝟎.𝟎𝟒)𝟐𝟎 −𝟏

=$1152 × ( 𝟎.𝟎𝟒

)

=$34304.35

(b) Interest: 8% ÷ 2 = 4% per semiannual, for 20 periods

Amount = $1152 × 29.77808 = $34,304.35

(c) Difference = $34,304.35 – $29,427.45

= $4876.90

© UNITAR International University Page 19 of 24

Calculate Amount of an Annuity Due

An annuity in which payments are made at the beginning of each time period is called an annuity due.

(𝟏+𝒊)𝒏 −𝟏

𝑨𝒏𝒏𝒖𝒊𝒕𝒚𝑫𝒖𝒆 𝑨𝒎𝒐𝒖𝒏𝒕 = 𝑷𝒎𝒕 × ( 𝒊

) × (𝟏 + 𝒊)

or

(𝟏+𝒊)𝒏 −𝟏

𝑭𝒖𝒕𝒖𝒓𝒆 𝑽𝒂𝒍𝒖𝒆 𝒐𝒇𝑨𝒏𝒏𝒖𝒊𝒕𝒚 𝑫𝒖𝒆 = 𝑷𝒎𝒕 × ( 𝒊

) × (𝟏 + 𝒊)

Mr. and Mrs. Thompson set up an investment program using an annuity due with payments of $500 at the

beginning of each quarter. Find (a) the amount of the annuity and (b) the interest if they make payments for 7

years into an investment account expected to pay 8% compounded quarterly.

𝑹 𝟎. 𝟎𝟖

𝒊= = = 𝟎. 𝟎𝟐

𝒌 𝟒

𝒏 = 𝒌 × 𝑻 = 𝟒 × 𝟕 𝒚𝒆𝒂𝒓𝒔 = 𝟐𝟖

(𝟏+𝒊)𝒏 −𝟏

𝑨𝒏𝒏𝒖𝒊𝒕𝒚 𝑫𝒖𝒆 𝑨𝒎𝒐𝒖𝒏𝒕 = 𝑷𝒎𝒕 × ( 𝒊

) × (𝟏 + 𝒊)

(𝟏+𝟎.𝟎𝟐)𝟐𝟖 −𝟏

= $𝟓𝟎𝟎 × ( 𝟎.𝟎𝟐

) × (𝟏 + 𝟎. 𝟎𝟐)

=$18896.12

Interest = Annuity Due Amount – Total deposit

= $18,896.12 – (28 × $500)

= $4896.12

Present Value of an Ordinary Annuity

Present Value of Annuity– thought of in two ways:

Annuity that accumulates funds.

Annuity that uses up funds that have already been accumulated to make a series of payments.

𝟏 − (𝟏 + 𝒊)−𝒏

𝑷𝒓𝒆𝒔𝒆𝒏𝒕 𝑽𝒂𝒍𝒖𝒆 𝒐𝒇𝑨𝒏𝒏𝒖𝒊𝒕𝒚(𝑷𝑽𝑨) = 𝑷𝒎𝒕 × ( )

𝒊

1. A single lump-sum deposit that results in the same future value as making regular payments for a specific

amount of time.

For example, say a firm needs $100,000 in 5 years. It can achieve that goal either by making a single, lump-

sum deposit (the present value) or by making regular payments. (See Example 1.)

© UNITAR International University Page 20 of 24

2. The lump sum needed today to fund all regular payments that need to be made.

For example, a judge requires a divorced man to make a $1500 child support payment at the end of each

quarter until his son turns 18. This can be achieved by depositing a lump sum today (the present value) that

will generate the necessary payments. (See Example 2.)

Example 1

The Daily News plans to accumulate funds ahead of time to purchase a computer network. It deposits $4325 into

an account at the end of each quarter for 5 years. The account pays 6% compounded quarterly. (a) Find the

lump sum that must be deposited today to accumulate the funds needed (the present value). (b) Find the future

value of the annuity.

(a) Interest: 6% ÷ 4 = 1.5% per quarter, for 5 × 4 = 20 quarters.

𝑹 𝟎. 𝟎𝟔

𝒊= = = 𝟎. 𝟎𝟏𝟓

𝒌 𝟒

𝒏 = 𝒌 × 𝑻 = 𝟒 × 𝟓 𝒚𝒆𝒂𝒓𝒔 = 𝟐𝟎

𝟏 − (𝟏 + 𝟎. 𝟎𝟏𝟓)−𝟐𝟎

𝑷𝒓𝒆𝒔𝒆𝒏𝒕 𝑽𝒂𝒍𝒖𝒆 𝒐𝒇𝑨𝒏𝒏𝒖𝒊𝒕𝒚(𝑷𝑽𝑨) = $𝟒𝟑𝟐𝟓 × ( )

𝟎. 𝟎𝟏𝟓

=$74254.36

(b) To find the future value, use the amount of an annuity table with a payment of $4325 for 20

𝑹 𝟎. 𝟎𝟔

𝒊= = = 𝟎. 𝟎𝟏𝟓

𝒌 𝟒

𝒏 = 𝒌 × 𝑻 = 𝟒 × 𝟓 𝒚𝒆𝒂𝒓𝒔 = 𝟐𝟎

𝑨𝒏𝒏𝒖𝒊𝒕𝒚 𝑨𝒎𝒐𝒖𝒏𝒕 (Future Value Annuity)

(𝟏+𝒊)𝒏 −𝟏

FVA= 𝑷𝒎𝒕 × ( 𝒊

)

(𝟏+𝟎.𝟎𝟏𝟓)𝟐𝟎 −𝟏

= $𝟒𝟑𝟐𝟓 × ( 𝟎.𝟎𝟏𝟓

)

=$100009.86

© UNITAR International University Page 21 of 24

The future value of $100,009.86 can be achieved with a single lump-sum deposit of $74,254.37 today, OR by

making 20 end-of-quarter payments of $4325 into a fund. In both cases, we assume funds grow at 6%

compounded quarterly.

Example:

Tish Baker plans to retire from nursing at age 65 and hopes to withdraw $25,000 per year until she is 90.

(a) If money earns 8% per year compounded annually, how much will she need at age 65?

(b) If she deposits $2000 per year into her retirement plan beginning at age 32, and if the retirement plan earns

8% per year compounded annually, will her retirement account have enough for her to meet her goals?

Solution:

(a) Find the present value of an annuity of $25,000 per year for 90 – 65 = 25 years at 8% compounded annually

𝑹 𝟎. 𝟎𝟖

𝒊= = = 𝟎. 𝟎𝟖

𝒌 𝟏

𝒏 = 𝒌 × 𝑻 = 𝟏 × 𝟐𝟓 𝒚𝒆𝒂𝒓𝒔 = 𝟐𝟓

𝑷𝒓𝒆𝒔𝒆𝒏𝒕 𝑽𝒂𝒍𝒖𝒆 𝒐𝒇𝑨𝒏𝒏𝒖𝒊𝒕𝒚

𝟏 − (𝟏 + 𝟎. 𝟎𝟖)−𝟐𝟓

(𝑷𝑽𝑨) = $𝟐𝟓𝟎𝟎𝟎 × ( )

𝟎. 𝟎𝟖

=$266869.40

Baker will need $266,869.40 at age 65. This sum, at 8% compounded annually, will permit withdrawals of $25,000

per year until age 90.

(b) Payments of $2000 at the end of each year for 65 – 32 = 33 years at 8% compounded annually

𝑹 𝟎. 𝟎𝟖

𝒊= = = 𝟎. 𝟎𝟖

𝒌 𝟏

𝒏 = 𝒌 × 𝑻 = 𝟏 × 𝟑𝟑 𝒚𝒆𝒂𝒓𝒔 = 𝟑𝟑

𝑨𝒏𝒏𝒖𝒊𝒕𝒚 𝑨𝒎𝒐𝒖𝒏𝒕 (Future Value Annuity)

(𝟏+𝒊)𝒏 −𝟏

FVA= 𝑷𝒎𝒕 × ( 𝒊

)

(𝟏+𝟎.𝟎𝟖)𝟑𝟑 −𝟏

= $𝟐𝟎𝟎𝟎 × ( )

𝟎.𝟎𝟖

=$291,901.24

She will have enough since $291,901.24 exceeds the needed $266,869.50. She is unlikely to earn 8% at a bank,

she will need to invest in stocks and bonds.

© UNITAR International University Page 22 of 24

Sinking Funds (Finding Annuity Payments)

Sinking fund – a fund set up to receive periodic payments

Sinking funds are used to provide money to pay off a loan in one lump sum or to accumulate money to build

new factories, buy equipment, and so on. The payment needed at the end of each period to accumulate a

fixed amount in a sinking fund at a specific future date is found as follows.

𝒊

𝑺𝒊𝒏𝒌𝒊𝒏𝒈 𝑭𝒖𝒏𝒅(Payment) = 𝑭𝒖𝒕𝒖𝒓𝒆𝑽𝒂𝒍𝒖𝒆 × ((𝟏+𝒊)𝒏 −𝟏)

Example:

In 5 years, hospital administrators plan to erect a building that includes a gym and swimming pool that can be

used for therapy, at a cost of $16,500,000. To prepare for the expense, they decide to make end-of-quarter

deposits into a sinking fund expected to earn 6% compounded quarterly. Find (a) the amount of each quarterly

payment and (b) the interest earned.

(a) Use: 6% ÷ 4 = 1.5% per compounding period,

for 4 × 5 years = 20 compounding periods

𝑹 𝟎. 𝟎𝟔

𝒊= = = 𝟎. 𝟎𝟏𝟓

𝒌 𝟒

𝒏 = 𝒌 × 𝑻 = 𝟒 × 𝟓 𝒚𝒆𝒂𝒓𝒔 = 𝟐𝟎

𝒊

𝑺𝒊𝒏𝒌𝒊𝒏𝒈 𝑭𝒖𝒏𝒅(Payment) = 𝑭𝒖𝒕𝒖𝒓𝒆𝑽𝒂𝒍𝒖𝒆 × ((𝟏+𝒊)𝒏 −𝟏)

𝟎. 𝟎𝟏𝟓

= $16,500,000 × ( )

(𝟏 + 𝟎. 𝟎𝟏𝟓)𝟐𝟎 − 𝟏

=$713554.64

(b) Interest is future value minus payments

Interest = $16,500,000 – (20 × $713,554)

= $2,228,920

Example:

First Chong sold $100,000 worth of bonds that must be paid off in 8 years. It sets up a sinking fund to accumulate

the necessary $100,000 to pay off the debt. Find the amount of each payment into a sinking fund if the payments

are made at the end of each year and the fund earns 10% compounded annually. Find the amount of interest

earned.

𝑹 𝟎. 𝟏𝟎

𝒊= = = 𝟎. 𝟏

𝒌 𝟏

𝒏 = 𝒌 × 𝑻 = 𝟏 × 𝟖 𝒚𝒆𝒂𝒓𝒔 = 𝟖

© UNITAR International University Page 23 of 24

𝒊

𝑺𝒊𝒏𝒌𝒊𝒏𝒈 𝑭𝒖𝒏𝒅(Payment) = 𝑭𝒖𝒕𝒖𝒓𝒆𝑽𝒂𝒍𝒖𝒆 × ((𝟏+𝒊)𝒏 −𝟏)

𝟎. 𝟏𝟎

= $100000 × ( )

(𝟏 + 𝟎. 𝟏𝟎)𝟖 − 𝟏

=$8744.40

Chong must deposit $8744 at the end of each year into an account earning 10% compounded annually to

accumulate $100,000. Interest is future value less payments.

Interest = $100,000 – (8 × $8744) = $30,048

Example:

Managers at Baton Chemicals frequently travel between the corporate offices in the United States and

manufacturing plants and mines in South America. They plan to purchase a private jet in 4 years. The jet costs

$14,800,000 today, and its cost is expected to grow at 5% per year. Find the quarterly payments needed to

accumulate the necessary funds in a sinking fund in 4 years if the firm earns 6% compounded quarterly.

First, find the cost (future value) of the jet in 4 years:

5% per year, 4 compounding periods:

𝑹 𝟎. 𝟎𝟓

𝒊= = = 𝟎. 𝟎𝟏𝟐𝟓

𝒌 𝟒

𝒏 = 𝒌 × 𝑻 = 𝟒 × 𝟒 𝒚𝒆𝒂𝒓𝒔 = 𝟏𝟔

Future Value :

n

FV= 𝑷𝒎𝒕 × (𝟏 + 𝒊) 𝟏𝟔

= $𝟏𝟒𝟖𝟎𝟎𝟎𝟎𝟎 × (𝟏 + 𝟎. 𝟎𝟏𝟐𝟓)

=$18054365

Next, find the quarterly payment needed to accumulate $18,054,365 in 4 years.

- end of content –

© UNITAR International University Page 24 of 24

You might also like

- BU111 TVM Practice1Document14 pagesBU111 TVM Practice1john100% (1)

- 1-1 Simple Interest DiscountDocument9 pages1-1 Simple Interest Discounthadukenryu9761100% (1)

- Loan Agreement PDFDocument8 pagesLoan Agreement PDFWilletta KincaidNo ratings yet

- Module 1 Simple Interest Bank Discount and Promissiory NotesDocument97 pagesModule 1 Simple Interest Bank Discount and Promissiory NotesMaria Theresa0% (1)

- Simple Interest and MoreDocument35 pagesSimple Interest and MoreSnow WhiteNo ratings yet

- Chapter 5 Simple Interest NewDocument21 pagesChapter 5 Simple Interest NewAlmira BonifacioNo ratings yet

- Module 1Document49 pagesModule 1Jonathan Miergas CayabyabNo ratings yet

- Simple Interest and Simple DiscountsDocument5 pagesSimple Interest and Simple DiscountsGinafe LegaspiNo ratings yet

- Lec 4 Simple Interest 2024Document65 pagesLec 4 Simple Interest 2024Pinky RoseNo ratings yet

- Simple Interest 2Document12 pagesSimple Interest 2JORENCE PHILIPP ENCARNACION100% (1)

- Lesson 1 NotesDocument9 pagesLesson 1 NotesLouie Jay Remojo KilatonNo ratings yet

- Gen Math Q2 - Week1 - Simple and Compound InterestDocument27 pagesGen Math Q2 - Week1 - Simple and Compound InterestJohn Nicholas TabadaNo ratings yet

- Simple InterestDocument27 pagesSimple Interestleslie0% (1)

- Simple Interest 2019Document52 pagesSimple Interest 2019Edessa DimaguilaNo ratings yet

- Simple InterestDocument6 pagesSimple Interestmistica.baronninoNo ratings yet

- Umak PPT Template Invemath Module 1.simple Interest - Module 2Document111 pagesUmak PPT Template Invemath Module 1.simple Interest - Module 2Jandrei Ezekiel LausNo ratings yet

- Lesson 5 (Business Math)Document15 pagesLesson 5 (Business Math)wilhelmina roman100% (1)

- Simple InterestsDocument23 pagesSimple InterestsaaaaNo ratings yet

- Week2 - AMORTIZATION, MORTGAGE, AND INTEREST (Modular)Document59 pagesWeek2 - AMORTIZATION, MORTGAGE, AND INTEREST (Modular)angel annNo ratings yet

- Chapter 2-Part 1Document7 pagesChapter 2-Part 1Puji dyukeNo ratings yet

- Topic 1 (Simple Interest)Document28 pagesTopic 1 (Simple Interest)Nanteni Ganesan100% (1)

- FDNBUSMDocument33 pagesFDNBUSMMarielle Nicole BritaniaNo ratings yet

- Chapter 2Document28 pagesChapter 2irenep banhan21No ratings yet

- Simple Interest and Simple Discount PDFDocument29 pagesSimple Interest and Simple Discount PDFandisetiawan90100% (5)

- (SANTOS) Part 1 Unit 5 FINANCIAL MANAGEMENTDocument34 pages(SANTOS) Part 1 Unit 5 FINANCIAL MANAGEMENTGrace HernandezNo ratings yet

- CHAPTER 1 - Simple InterestDocument38 pagesCHAPTER 1 - Simple InterestPrincess Mae AgbonesNo ratings yet

- GM Final LP 2023 2024Document17 pagesGM Final LP 2023 2024paulandrepidelo423No ratings yet

- Mathematics of Investment Module 1Document6 pagesMathematics of Investment Module 1Kim JayNo ratings yet

- Simple Interest-Simple DiscountDocument55 pagesSimple Interest-Simple DiscountSharmaine BeranNo ratings yet

- Business Maths 1 Interest-1Document24 pagesBusiness Maths 1 Interest-1emmanuelifende1234No ratings yet

- Genmath11 q2 Mod1and 2 Week1Document42 pagesGenmath11 q2 Mod1and 2 Week1Aaron LacasandileNo ratings yet

- General Mathematics: Quarter 2 - Module 1: Simple Interest and Compound InterestDocument42 pagesGeneral Mathematics: Quarter 2 - Module 1: Simple Interest and Compound InterestCarl Stephen SoloNo ratings yet

- General Mathematics: I.2 Learning ActivitiesDocument6 pagesGeneral Mathematics: I.2 Learning ActivitiesAndrea InocNo ratings yet

- Simple InterestDocument25 pagesSimple InterestSamuel Bruce RocksonNo ratings yet

- Exact N Apprx Discussion.Document7 pagesExact N Apprx Discussion.Grace Delos Santos RollonNo ratings yet

- Mathematics in The Modern World Simple InterestDocument18 pagesMathematics in The Modern World Simple InterestMarwin BartolomeNo ratings yet

- INTERESTDocument35 pagesINTERESTKylee NathanielNo ratings yet

- Math2 OdtDocument10 pagesMath2 OdtLesly Ann De GuzmanNo ratings yet

- 09 - Handout - 1 - Business FinanceDocument3 pages09 - Handout - 1 - Business FinanceChandria FordNo ratings yet

- Learning Packet 1 - Math 16 Mathematics of Investment (Student's Copy)Document14 pagesLearning Packet 1 - Math 16 Mathematics of Investment (Student's Copy)Armando Dacuma AndoqueNo ratings yet

- Week OnedDocument33 pagesWeek OneddaweiliNo ratings yet

- Topic 4 Mathematics of FinanceDocument66 pagesTopic 4 Mathematics of FinanceAndrew PillayNo ratings yet

- Simple InterestDocument18 pagesSimple InterestAaron Joy Dominguez Putian100% (1)

- Financial MathematicsDocument44 pagesFinancial MathematicsJhon Albert RobledoNo ratings yet

- Economics 5Document2 pagesEconomics 5JacelMaeNo ratings yet

- Simple InterestDocument16 pagesSimple InterestTeree ZuNo ratings yet

- Simple InterestDocument19 pagesSimple InterestHJNo ratings yet

- Simple InterestDocument43 pagesSimple InterestPrimcess BanuaNo ratings yet

- Simple InterestDocument8 pagesSimple InterestConchito Galan Jr IINo ratings yet

- Business MathematicsDocument29 pagesBusiness MathematicsBrent Ivan D.60% (5)

- Simple Interest - 2021-2022Document23 pagesSimple Interest - 2021-2022racquel bagaNo ratings yet

- MODULE 2 - EEConDocument27 pagesMODULE 2 - EEConMark Anthony GarciaNo ratings yet

- The Mathematics of FinanceDocument13 pagesThe Mathematics of Financeflo sisonNo ratings yet

- Business Math G12 - Week8 Simple Interest Mortgages Commissions and OverridesDocument24 pagesBusiness Math G12 - Week8 Simple Interest Mortgages Commissions and OverridesKeiNo ratings yet

- Lesson 1 Simple InterestDocument2 pagesLesson 1 Simple InterestSERALDYN SAMSONNo ratings yet

- MODULE4Document23 pagesMODULE4Registrar CpacNo ratings yet

- Chapter 4 - Simple InterestDocument18 pagesChapter 4 - Simple InterestKPRobin0% (1)

- 09 02Document11 pages09 02Lara Lewis AchillesNo ratings yet

- General Mathematics: Quarter 2 - Module 1 Simple and Compound InterestsDocument21 pagesGeneral Mathematics: Quarter 2 - Module 1 Simple and Compound InterestsThegame1991ususus100% (1)

- Simple Interest and Simple DiscountDocument29 pagesSimple Interest and Simple Discountabhii101100% (4)

- Simple and Compound InterestDocument3 pagesSimple and Compound InterestLouise DefiñoNo ratings yet

- Topic 1 Part BDocument9 pagesTopic 1 Part BeddyyowNo ratings yet

- Topic 1 Part ADocument4 pagesTopic 1 Part AeddyyowNo ratings yet

- Topic 2Document6 pagesTopic 2eddyyowNo ratings yet

- BADB1014 QM Hypothesis Testing Examples of Comparing 2 Means 2Document4 pagesBADB1014 QM Hypothesis Testing Examples of Comparing 2 Means 2eddyyowNo ratings yet

- Standard Normal Distribution TableDocument3 pagesStandard Normal Distribution TableeddyyowNo ratings yet

- Pintec Technology Holdings LimitedDocument353 pagesPintec Technology Holdings Limitedvicr100No ratings yet

- 4-CONSUMER CREDIT (PART 2) (Choosing A Source of Credit, The Cost of Credit Alternatives)Document19 pages4-CONSUMER CREDIT (PART 2) (Choosing A Source of Credit, The Cost of Credit Alternatives)Nur DinieNo ratings yet

- 0 APR Credit Card BenefitsDocument2 pages0 APR Credit Card BenefitsAhmed BelalNo ratings yet

- Midterm Without AnswersDocument30 pagesMidterm Without AnswersLe Tran Duy Khanh (K17 HCM)No ratings yet

- P.V Number: 125268 Buyer Code: 6600005040293: Canal Side Campus Girls, Lahore NTN 22-13-0786158-3 BCRDocument1 pageP.V Number: 125268 Buyer Code: 6600005040293: Canal Side Campus Girls, Lahore NTN 22-13-0786158-3 BCRAmbreen ZainebNo ratings yet

- Banking Industry Interview QuestionsDocument11 pagesBanking Industry Interview QuestionsShubhangi Kesharwani100% (1)

- Strategic+Financial+Planning+Over+the+Lifecycle +a+Conceptual+Approach+to+PersonDocument384 pagesStrategic+Financial+Planning+Over+the+Lifecycle +a+Conceptual+Approach+to+Person蓝国文No ratings yet

- Common Questions in Finance and BankingDocument16 pagesCommon Questions in Finance and BankingParth GakharNo ratings yet

- PHFA CZBDocument129 pagesPHFA CZBaweinberg90No ratings yet

- Telus Mobile 605887849 2023 06 15Document4 pagesTelus Mobile 605887849 2023 06 15JamieNo ratings yet

- Wills ToyotaDocument1 pageWills ToyotaAmplified LocalNo ratings yet

- Assignment#2Document3 pagesAssignment#2Wuhao KoNo ratings yet

- Assignee Liability - Through The MinefieldDocument11 pagesAssignee Liability - Through The MinefieldArnstein & Lehr LLP100% (1)

- The Questions Marked WithDocument36 pagesThe Questions Marked WithMark Smith100% (1)

- 5 6302925808948215942Document11 pages5 6302925808948215942ana kamariahNo ratings yet

- Test Bank For Personal Finance 4th Edition MaduraDocument18 pagesTest Bank For Personal Finance 4th Edition Madurathomasburgessptrsoigxdk100% (23)

- Finance Applications and Theory 3rd Edition Cornett Test Bank 1Document120 pagesFinance Applications and Theory 3rd Edition Cornett Test Bank 1kyle100% (40)

- Core Chapter 04 Excel Master 4th Edition StudentDocument150 pagesCore Chapter 04 Excel Master 4th Edition StudentDarryl WallaceNo ratings yet

- StatementDocument3 pagesStatementChristina FisherNo ratings yet

- College Stud Budget MiniDocument19 pagesCollege Stud Budget MiniAlejandro Jose OletianoNo ratings yet

- Care Credit AppDocument7 pagesCare Credit AppwvhvetNo ratings yet

- Brea ch05 BMM 7e SGDocument91 pagesBrea ch05 BMM 7e SGAshish BhallaNo ratings yet

- Statement 20230707130713Document8 pagesStatement 20230707130713Hitesh BossNo ratings yet

- Assignment # 3: Chapter 3-The Time Value of MoneyDocument9 pagesAssignment # 3: Chapter 3-The Time Value of MoneyGenesis E. CarlosNo ratings yet

- Cash BudgetDocument11 pagesCash BudgetDarshan JoshiNo ratings yet

- The Abington Journal 08-31-2011Document28 pagesThe Abington Journal 08-31-2011The Times LeaderNo ratings yet

- Agregate Planning: Fauziah Amalia DeviDocument22 pagesAgregate Planning: Fauziah Amalia Devifauziah deviNo ratings yet

- FIN343 Assignment 1Document6 pagesFIN343 Assignment 1drhugh3891No ratings yet