Professional Documents

Culture Documents

Fin Man Reviewer

Uploaded by

Charimaine GumaracCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin Man Reviewer

Uploaded by

Charimaine GumaracCopyright:

Available Formats

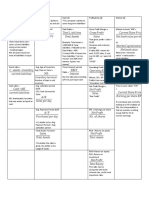

FINANCIAL MANAGEMENT (CH4) Net Incone

Profit Margin =

Sales

Ratios Net Income

ROA =

1. Liquidity Ratios - firm’s ability to pay off debts Total Assets

that are maturing within one year. Net Incone

ROE =

2. Asset Management Ratios - how efficiently the Common Equity

firm is using the asset. EBIT (1 −T )

ROIC =

3. Debt Management Ratios - how the firm has Total Invested Capital

financed its asset as well as the firm’s ability to EBIT

Basic Earning Power =

repay its long-term debt. Total Assets

4. Profitability Ratios - how profitably the firm is

operating and utilizing its asset. Market Value Ratios

5. Market Value Ratios - what investors think about Price Per Sℎare

Price/ Earning =

the firm and its future prospects. Earnings Per Sℎare

Market price per sℎare

Market/Book =

Liquidity Ratios Book value per sℎare

Liquid Asset - An asset that can be converted to Common Equity

Book Value =

cash quickly without having to reduce the asset’s Sℎares outstanding

price very much. Enterprise Value/ EBITDA

Liquidity Ratios - Ratios that shows the relationship = MV of Equity + MV of Total Debt + MV of Other

of a firm’s cash and other current assets to its Financial Claims - Cash and Equivalents

current liabilities. = EV / EVITDA

Current Assets ROE = ¿ + ¿ = ¿ x Assets =

Current Ratio =

Current Liabilities ROA Equity Assets Equity ¿

Quick, or Acid Test Ratio = Assets = Equity Multiplier

Current Assets − Invetories Equity

Current Liabilities

DuPont = Profit Margin x Total Assets Turnover x

Asset Management Ratios Equity Multiplier

Cost of Goods Sold

Inventory Turnover =

Inventories - it shows the relationship among asset

Receivables Receivables management, debt management, and profitability

DSO = =

Ave . Sales per day Annual Sales/365 ratios.

Sales

Fixed Assets Turnover = Assets ¿

Net ¿

Sales

Total Assets Turnover =

Total Assets

Debt Management Ratios

Total Debt

Total debt - Total Capital =

Total Debt + Equity

EBIT

Time Interest Earned =

Interest Cℎarges

Profitability Ratios

EBIT

Operating Margin =

Sales

You might also like

- Financial Ratios FormulaDocument4 pagesFinancial Ratios FormulaKamlesh SinghNo ratings yet

- Formula Sheet-FinalDocument3 pagesFormula Sheet-FinalSales ExecutiveNo ratings yet

- Financial Ratio FormulasDocument2 pagesFinancial Ratio FormulasSyed Shariq AliNo ratings yet

- Financial Ratios at A GlanceDocument8 pagesFinancial Ratios at A Glance365 Financial AnalystNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- Financial Ratios: Analysis of Financial StatementsDocument16 pagesFinancial Ratios: Analysis of Financial StatementsRiz NBNo ratings yet

- Notes On Ratio AnalysisDocument12 pagesNotes On Ratio AnalysisVaishal90% (21)

- Methods of Estimating The Amount of Inventory:: Sales DiscountDocument4 pagesMethods of Estimating The Amount of Inventory:: Sales Discountellaine villafaniaNo ratings yet

- Financial Analysis Cheat Sheet: by ViaDocument2 pagesFinancial Analysis Cheat Sheet: by Viaheehan6No ratings yet

- Financial Analysis and Reporting 1Document4 pagesFinancial Analysis and Reporting 1Anonymous ryxSr2No ratings yet

- Chapter 3Document8 pagesChapter 3NHƯ NGUYỄN LÂM TÂMNo ratings yet

- MA 3103 - Valuation Methods (Financial Analysis)Document9 pagesMA 3103 - Valuation Methods (Financial Analysis)Jacinta Fatima ChingNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisdavewagNo ratings yet

- Financial Analysis (Chapter 3)Document18 pagesFinancial Analysis (Chapter 3)kazamNo ratings yet

- MidtermDocument11 pagesMidtermDeseree De RamosNo ratings yet

- Midterm ReviewerDocument19 pagesMidterm ReviewerDeseree De RamosNo ratings yet

- FBF 10103 - LECT2 Financial AnalysisDocument20 pagesFBF 10103 - LECT2 Financial AnalysisNurul AsikinNo ratings yet

- Formulas FTDocument6 pagesFormulas FTAnkita JaiswalNo ratings yet

- Formula Sheet - Finance - VTDocument11 pagesFormula Sheet - Finance - VTmariaajudamariaNo ratings yet

- Financial Ratios TableDocument2 pagesFinancial Ratios TableWiSeVirGoNo ratings yet

- Chapter 3Document61 pagesChapter 3Shrief MohiNo ratings yet

- Exam 1 Formula Sheet (1) - 2Document2 pagesExam 1 Formula Sheet (1) - 2haleeNo ratings yet

- Financial Management FormulasDocument5 pagesFinancial Management FormulasDaniel Kahn GillamacNo ratings yet

- Financial Ratios at A Glance PDFDocument8 pagesFinancial Ratios at A Glance PDFmohit PathakNo ratings yet

- 6 - Financial StrategyDocument14 pages6 - Financial StrategyHUY NGUYỄN ĐÌNHNo ratings yet

- The Use of Financial Ratios Analyzing Liquidity Analyzing Activity Analyzing Debt Analyzing Profitability A Complete Ratio AnalysisDocument19 pagesThe Use of Financial Ratios Analyzing Liquidity Analyzing Activity Analyzing Debt Analyzing Profitability A Complete Ratio Analysiskowsalya18No ratings yet

- Notes On Financial Statement AnalysisDocument4 pagesNotes On Financial Statement AnalysisiRonieNo ratings yet

- Finance BasicsDocument4 pagesFinance BasicsCole HollandNo ratings yet

- Ratios Notes and ProblemDocument6 pagesRatios Notes and ProblemAniket WaneNo ratings yet

- SOURCES (Inflows of Cash) USES (Outflows of Cash) : TranslateDocument2 pagesSOURCES (Inflows of Cash) USES (Outflows of Cash) : TranslateRahul KapurNo ratings yet

- Ratio FormulasDocument3 pagesRatio Formulasakk59No ratings yet

- Ratio Analysis: ROA (Profit Margin Asset Turnover)Document5 pagesRatio Analysis: ROA (Profit Margin Asset Turnover)Shahinul KabirNo ratings yet

- Acctg 14 NotesDocument22 pagesAcctg 14 NotesJeciel Mae M. CalubaNo ratings yet

- Republic of The Philippines Department of Education: Gen. Pantaleon Garcia Senior High SchoolDocument6 pagesRepublic of The Philippines Department of Education: Gen. Pantaleon Garcia Senior High SchoolPaulo Amposta CarpioNo ratings yet

- Financial Statement Analysis and Performance MeasurementDocument6 pagesFinancial Statement Analysis and Performance MeasurementBijaya DhakalNo ratings yet

- Finman FormulasDocument11 pagesFinman FormulasArnelli GregorioNo ratings yet

- FINN 117 Ch. 6 - Financial Ratios Formula GuideDocument3 pagesFINN 117 Ch. 6 - Financial Ratios Formula GuidePatrick MendozaNo ratings yet

- Financial Statement Analysis (Ch.2)Document14 pagesFinancial Statement Analysis (Ch.2)TianyiNo ratings yet

- Fa Cheat Sheet MM MLDocument8 pagesFa Cheat Sheet MM MLIrina StrizhkovaNo ratings yet

- Financial Statements Analysis: Presented byDocument40 pagesFinancial Statements Analysis: Presented bykakolalamamaNo ratings yet

- Chapter 4: Analysis of Financial StatementsDocument8 pagesChapter 4: Analysis of Financial StatementsMuhammad ImranNo ratings yet

- Final Cheat Sheet FA ML X MM UpdatedDocument8 pagesFinal Cheat Sheet FA ML X MM UpdatedIrina StrizhkovaNo ratings yet

- The Use of Financial Ratios Analyzing Liquidity Analyzing Activity Analyzing Debt Analyzing Profitability A Complete Ratio AnalysisDocument19 pagesThe Use of Financial Ratios Analyzing Liquidity Analyzing Activity Analyzing Debt Analyzing Profitability A Complete Ratio AnalysispureabbasiNo ratings yet

- Current Assets Current Liabilities Ca CL: Tratio Analysis FormulaeDocument3 pagesCurrent Assets Current Liabilities Ca CL: Tratio Analysis FormulaealshaNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- Practice Questions (L3)Document3 pagesPractice Questions (L3)simraNo ratings yet

- Finman, FormulasDocument6 pagesFinman, FormulasSHAZNEI ALIAH NAGA SANGCAANNo ratings yet

- Formula Sheet-FinalDocument3 pagesFormula Sheet-FinalMuhammad MussayabNo ratings yet

- Ratio Analysis ch-6Document11 pagesRatio Analysis ch-6IP MAXNo ratings yet

- Financial Analysis (Chapter 3)Document18 pagesFinancial Analysis (Chapter 3)AsifMughalNo ratings yet

- TIFA CheatSheet MM X MLDocument10 pagesTIFA CheatSheet MM X MLCorina Ioana BurceaNo ratings yet

- Finance BBS3rd (Autosaved) 12Document29 pagesFinance BBS3rd (Autosaved) 12Ramesh GyawaliNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosMAURICIO CONTRERAS CABALLERONo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosyohan_phillipsNo ratings yet

- Ch-4 Ratios TheoryDocument3 pagesCh-4 Ratios TheoryShubham PhophaliaNo ratings yet

- Business Is FUN! - Financial RatioDocument2 pagesBusiness Is FUN! - Financial RatioHardina AliNo ratings yet

- Ratio Analysis ParticipantsDocument17 pagesRatio Analysis ParticipantsDeepu MannatilNo ratings yet

- RatiosDocument2 pagesRatiosMina EskandarNo ratings yet

- CheatSheet Midterm v2Document10 pagesCheatSheet Midterm v2besteNo ratings yet

- Reviewer ContempDocument4 pagesReviewer ContempCharimaine GumaracNo ratings yet

- VolleyballDocument4 pagesVolleyballCharimaine GumaracNo ratings yet

- Summary of Chapter 7 Noli Me TangereDocument4 pagesSummary of Chapter 7 Noli Me TangereCharimaine GumaracNo ratings yet

- 2 Chapter 1 D. Climate Change Adaptation and MitigationDocument63 pages2 Chapter 1 D. Climate Change Adaptation and MitigationCharimaine GumaracNo ratings yet

- SM - 10 21eDocument33 pagesSM - 10 21eMonica Maharani100% (1)

- Case 8-32 Breakeven Time For New Product DevelopmentDocument3 pagesCase 8-32 Breakeven Time For New Product DevelopmentNicholas AlexanderNo ratings yet

- Recommendation On The Acquisation of VitasoyDocument8 pagesRecommendation On The Acquisation of Vitasoyapi-237162505No ratings yet

- Trial BalanceDocument2 pagesTrial BalanceVochariNo ratings yet

- PNBAnualReport2012 13 PDFDocument232 pagesPNBAnualReport2012 13 PDFAyan PodderNo ratings yet

- Advanced Financial Accounting Under IFRSDocument57 pagesAdvanced Financial Accounting Under IFRSAlexandra Mihaela TanaseNo ratings yet

- Chapter 6: MEASUREMENT: Conceptual Framework in Financial ReportingDocument24 pagesChapter 6: MEASUREMENT: Conceptual Framework in Financial ReportingHarel LeeNo ratings yet

- 3rd Examination Test in AccountingDocument23 pages3rd Examination Test in AccountingNanya BisnestNo ratings yet

- Serasa Experian Credit RatingDocument8 pagesSerasa Experian Credit Ratingsrmfilho123No ratings yet

- Answers and Solutions To Exercises PDFDocument22 pagesAnswers and Solutions To Exercises PDFshaira aimee diolata100% (1)

- BuyBack of SharesDocument18 pagesBuyBack of SharesVasu JainNo ratings yet

- M3 Exe SolDocument6 pagesM3 Exe SolJay Ann DomeNo ratings yet

- 1Document8 pages1Snehak KadamNo ratings yet

- Kuis 1 CH 1 &2Document3 pagesKuis 1 CH 1 &2Renny NNo ratings yet

- Module 4 Key Vocabulary - English For Business and Entrepreneurship Summer 2023Document7 pagesModule 4 Key Vocabulary - English For Business and Entrepreneurship Summer 2023Yamir VelazcoNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDhruv NarangNo ratings yet

- Project MadhuDocument132 pagesProject MadhushirleyNo ratings yet

- Exercise 4 ACGA General Accounting and ReportingDocument4 pagesExercise 4 ACGA General Accounting and ReportingEliza BethNo ratings yet

- Mock Quiz 1 PDFDocument6 pagesMock Quiz 1 PDFCarl Dhaniel Garcia SalenNo ratings yet

- MarketLineIC - Rallis India LTD - Profile - 240721Document22 pagesMarketLineIC - Rallis India LTD - Profile - 240721Anurag JainNo ratings yet

- Exercise Receivables 1Document8 pagesExercise Receivables 1Asyraf AzharNo ratings yet

- Management Accounting PDFDocument264 pagesManagement Accounting PDFAbhishek TodiwalNo ratings yet

- CVP Analysis F5 NotesDocument7 pagesCVP Analysis F5 NotesSiddiqua Kashif100% (1)

- II PUC ACC REVISED POQs FOR 2022-23Document3 pagesII PUC ACC REVISED POQs FOR 2022-23Shree Lakshmi vNo ratings yet

- Managerial Accounting Assignment 1Document20 pagesManagerial Accounting Assignment 1Eagle eye ጌታ-ሁን ተስፋዬNo ratings yet

- Basics of Valuation: Unit Two-6 HoursDocument12 pagesBasics of Valuation: Unit Two-6 HoursAjay ShahNo ratings yet

- Adjusting Journal Entries ExampleDocument3 pagesAdjusting Journal Entries ExampleLei khrizia MatampaleNo ratings yet

- LeveragesDocument9 pagesLeveragesShrinivasan IyengarNo ratings yet

- 18 HomeworkDocument4 pages18 HomeworkAbdullah MajeedNo ratings yet