Professional Documents

Culture Documents

Coward Stub 2

Uploaded by

raheemtimo10 ratings0% found this document useful (0 votes)

6 views1 pageOriginal Title

Coward stub 2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageCoward Stub 2

Uploaded by

raheemtimo1Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

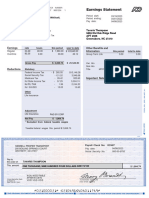

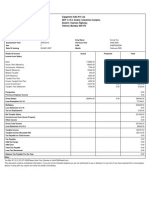

CO. FILE DEPT. CLOCK VCHR. NO.

10

K7/PDT24558337 01/795 USPOM 5565987 1of 1 Earnings Statement

AM OPAL MANAGEMENT Period Beginning: 03/31/2024

2082 MICHELSON BLVD Period Ending: 04/06/2024

IRVINE, CA 92612 Pay Date: 04/12/2024

Taxable Marital Status: Single

DARIUS COWARD

Exemptions / Allowances: 214 RUNNYMEADE DR,

Federal: Std W/HT CRESTVIEW, FL 32539

State: Std W/HT

SSN: XXX-XX-0634

rate hours this period year to date Other Benefits and

Regular 32.50 55.00 1,787.50 23,237.50 this period total to date

Gross Pay $1,787.50 23,237.50

Exemptions/Allowances:

Statutory

FICA-Medicare - 23.78 309.14

FICA-Social Security - 54.25 705.25

Federal Income Tax - 47.59 618.67

State Income Tax - 30.06 390.78

Net Pay $1,631.82

Checking - 1,631.82

Net Check $0.00

Excluded from federal taxable wages

Your federal taxable wages this period are $1,787.50

2024 ADP, LLC

AM OPAL MANAGEMENT Advice number: 00005565987

2082 MICHELSON BLVD Pay date: 04/12/2024

IRVINE, CA 92612

Deposited to the account of account number transit ABA amount

DARIUS COWARD xxxxxxx5780 xxxx xxxx $1,631.82

NON-NEGOTIABLE

You might also like

- Workday 1Document1 pageWorkday 1raheemtimo1No ratings yet

- Statement Dec:Jan 2024Document9 pagesStatement Dec:Jan 2024raheemtimo10% (2)

- Military Pay Stub TemplateDocument1 pageMilitary Pay Stub TemplateCasper HemingwayNo ratings yet

- Adp QUANIC MARTIN-converted (1st Try)Document12 pagesAdp QUANIC MARTIN-converted (1st Try)Quanic Martin100% (1)

- CVS Health Earnings Statement: SSN: Taxable Marital Status: Exemptions/Allowances: Yasmine Bastien 12818 Early Run LaneDocument2 pagesCVS Health Earnings Statement: SSN: Taxable Marital Status: Exemptions/Allowances: Yasmine Bastien 12818 Early Run LaneJeremy WhiteNo ratings yet

- FTF 2023-01-11 1673425648918Document12 pagesFTF 2023-01-11 1673425648918Charles Goodwin100% (1)

- 2 BXooo 006610620000 R 969253 A0 FFC521Document1 page2 BXooo 006610620000 R 969253 A0 FFC521Pily AguilarNo ratings yet

- DTC Example Question Stage 1Document3 pagesDTC Example Question Stage 1aqilah_abidin_1No ratings yet

- Direct Deposit Advice This Is Not A CheckDocument1 pageDirect Deposit Advice This Is Not A CheckAlex RoofNo ratings yet

- Introduction About Enrolled AgentDocument4 pagesIntroduction About Enrolled AgentAbinash100% (1)

- Kayila StubDocument1 pageKayila Stubraheemtimo1No ratings yet

- Paystub 02Document1 pagePaystub 02raheemtimo1No ratings yet

- Kines 2Document1 pageKines 2raheemtimo1No ratings yet

- Copy1 Paystub 1Document1 pageCopy1 Paystub 1raheemtimo1No ratings yet

- Paystub 01Document1 pagePaystub 01raheemtimo1No ratings yet

- ALBA PP 14 Paystub July 7 2017 PDFDocument1 pageALBA PP 14 Paystub July 7 2017 PDFayoubarade1No ratings yet

- Nicole Hayward Paystub Feb 27 2024Document1 pageNicole Hayward Paystub Feb 27 2024Fake Documents of Simply Jodan's LLCNo ratings yet

- Screenshot 2021-09-16 at 11.56.11 AMDocument1 pageScreenshot 2021-09-16 at 11.56.11 AMMartinez BryanNo ratings yet

- Paystub-0202 DANEA MCLAURINDocument1 pagePaystub-0202 DANEA MCLAURINmarkchristory07No ratings yet

- B3Uooo002511540000r031517F4FB66621 01 - 19Document1 pageB3Uooo002511540000r031517F4FB66621 01 - 19markchristory07No ratings yet

- Creighton PaystubDocument1 pageCreighton Paystubraheemtimo1No ratings yet

- 2020-06-09wyndham Hotels and Resorts 2Document1 page2020-06-09wyndham Hotels and Resorts 2Diana MartinezNo ratings yet

- Screenshot 2024-02-18 at 3.12.37 AMDocument1 pageScreenshot 2024-02-18 at 3.12.37 AMraheemtimo1No ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableChris LeeNo ratings yet

- 12:29 GW PaystubDocument1 page12:29 GW Paystubdonbabich8No ratings yet

- Savanah Stub 1Document1 pageSavanah Stub 1raheemtimo1No ratings yet

- Statement 2022Document1 pageStatement 2022Alexander Barno AlexNo ratings yet

- Jayvion Stub 2Document1 pageJayvion Stub 2raheemtimo1No ratings yet

- Monica 2Document1 pageMonica 2raheemtimo1No ratings yet

- Boleta - Martin O.Document1 pageBoleta - Martin O.colegioVRHTNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableChris LeeNo ratings yet

- Second PaystubDocument1 pageSecond Paystubjohnathan greyNo ratings yet

- 2020-05-22wyndham Hotels and ResortsDocument1 page2020-05-22wyndham Hotels and ResortsDiana MartinezNo ratings yet

- Sonny Holden Paystub 10-28-2022Document1 pageSonny Holden Paystub 10-28-2022Fake Documents of Simply Jodan's LLCNo ratings yet

- Tamyah 12:30 PDFDocument1 pageTamyah 12:30 PDFChris LeeNo ratings yet

- Earnings Statement Earnings Statement Earnings Statement Earnings StatementDocument1 pageEarnings Statement Earnings Statement Earnings Statement Earnings StatementDana HamiltonNo ratings yet

- Diamond 3:10 PDFDocument1 pageDiamond 3:10 PDFChris LeeNo ratings yet

- Tierra Frasier Biweekly Stub 1Document1 pageTierra Frasier Biweekly Stub 1Lillian AwtNo ratings yet

- File 1831Document1 pageFile 183176xzv4kk5vNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiableanali torresNo ratings yet

- Statement For Feb 9, 2024Document1 pageStatement For Feb 9, 2024craziedapNo ratings yet

- CheckstubsDocument5 pagesCheckstubsAaron ThompsonNo ratings yet

- 04 17 2022 Paystub - 1Document1 page04 17 2022 Paystub - 1Destiny SmithNo ratings yet

- Scan 23 Mar 24 18 41Document13 pagesScan 23 Mar 24 18 41atemple116No ratings yet

- Natalie's Paystub 1Document1 pageNatalie's Paystub 1Lay ConNo ratings yet

- Pay - 3 16 18Document1 pagePay - 3 16 18henri e ewaneNo ratings yet

- Akilah 1:13Document1 pageAkilah 1:13Chris LeeNo ratings yet

- 1st CheckDocument1 page1st CheckMoeez MaalikNo ratings yet

- Kanza Bey 01Document1 pageKanza Bey 01ahmadsabeh727No ratings yet

- Statement 44280 69598 1Document1 pageStatement 44280 69598 1Isaac OlagbemisoyeNo ratings yet

- Adp Pay Stub TemplateDocument1 pageAdp Pay Stub Templatenurulamin00023No ratings yet

- PayStatement D0655147Document1 pagePayStatement D0655147Anonymous O61KvPgNo ratings yet

- Britgo AdpDocument1 pageBritgo Adpesteysi775No ratings yet

- Soones12 31 23Document1 pageSoones12 31 23Arianna GarciaNo ratings yet

- Tranzact Insurance 7-06Document1 pageTranzact Insurance 7-06julissaNo ratings yet

- Pay Statement DataDocument1 pagePay Statement Datadwomohrobert939No ratings yet

- PaystubbtittanyDocument1 pagePaystubbtittanyesteysi775No ratings yet

- E19 Ooo 000570120000 R 064 BC9409 FC521 Paystubformay 29Document1 pageE19 Ooo 000570120000 R 064 BC9409 FC521 Paystubformay 29celiesNo ratings yet

- Non-Negotiable: Nvidia CorporationDocument1 pageNon-Negotiable: Nvidia CorporationSteven LinNo ratings yet

- Ap 3Document1 pageAp 3Moeez MaalikNo ratings yet

- Velez Paystub 103123Document1 pageVelez Paystub 103123andrewdallas948No ratings yet

- Tamara Shelton Paystub Apr 08 2024Document1 pageTamara Shelton Paystub Apr 08 2024ellamaekitchensNo ratings yet

- Earnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590Document1 pageEarnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590mellishagrant11No ratings yet

- Gil Rental Payroll - 105 - 022019Document1 pageGil Rental Payroll - 105 - 022019Steven LinNo ratings yet

- US Check Writer ReportDocument2 pagesUS Check Writer ReportDhanaraaj DevelopersNo ratings yet

- Kahlil-Jefferson-Report IDDocument1 pageKahlil-Jefferson-Report IDraheemtimo1No ratings yet

- Stine StubDocument1 pageStine Stubraheemtimo1No ratings yet

- Stepfon Report ID 03 1Document1 pageStepfon Report ID 03 1raheemtimo1No ratings yet

- Milan-NavyFedCU-02-2024Document5 pagesMilan-NavyFedCU-02-2024raheemtimo1No ratings yet

- Stub Weekly 3Document1 pageStub Weekly 3raheemtimo1No ratings yet

- Nelson March Statement 3Document4 pagesNelson March Statement 3raheemtimo1No ratings yet

- GlennDocument9 pagesGlennraheemtimo1No ratings yet

- Glam Hair Statement FebDocument1 pageGlam Hair Statement Febraheemtimo1No ratings yet

- Isaac Parker-report-IDDocument1 pageIsaac Parker-report-IDraheemtimo1No ratings yet

- Rina Henry Report IDDocument1 pageRina Henry Report IDraheemtimo1No ratings yet

- Chase MarchDocument4 pagesChase Marchraheemtimo1No ratings yet

- 45ed440f346733e59e7abfe2a96775f0Document2 pages45ed440f346733e59e7abfe2a96775f0raheemtimo1No ratings yet

- Palace ReportIDDocument1 pagePalace ReportIDraheemtimo1No ratings yet

- Creighton PaystubDocument1 pageCreighton Paystubraheemtimo1No ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusraheemtimo1No ratings yet

- TATIYANA-Stub 2Document1 pageTATIYANA-Stub 2raheemtimo1No ratings yet

- Mphokgo Report ID 1Document1 pageMphokgo Report ID 1raheemtimo1No ratings yet

- Copy-Michael-ReportID 1 1 1 1Document1 pageCopy-Michael-ReportID 1 1 1 1raheemtimo1No ratings yet

- Marissa Report IDDocument1 pageMarissa Report IDraheemtimo1No ratings yet

- Eviction NoticesDocument2 pagesEviction Noticesraheemtimo1No ratings yet

- Sept BOADocument7 pagesSept BOAraheemtimo1No ratings yet

- Savanah Stub 1Document1 pageSavanah Stub 1raheemtimo1No ratings yet

- Open BOA-01Document7 pagesOpen BOA-01raheemtimo1No ratings yet

- Savannah Henderson February StatementDocument6 pagesSavannah Henderson February Statementraheemtimo1No ratings yet

- Income Taxation-Assignment 3Document2 pagesIncome Taxation-Assignment 3Rica Mae BorjalNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrank LamNo ratings yet

- Retirement Decisions Guide Download Promotion 2013-08-19Document15 pagesRetirement Decisions Guide Download Promotion 2013-08-19n0nt0nNo ratings yet

- VN 1Document1 pageVN 1YA HABIBINo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document1 pageVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- Payslip For The Month of Aug 2022Document1 pagePayslip For The Month of Aug 2022Natural HealthCare IdeasNo ratings yet

- FILING STATUS (Check One)Document3 pagesFILING STATUS (Check One)hypnotix-2000No ratings yet

- Meerut Qe Mar2020Document23 pagesMeerut Qe Mar2020cubadesignstudNo ratings yet

- Schedule 2Document2 pagesSchedule 2Myreddy VijayaNo ratings yet

- Quiz 3 Chapter 8: Income From Property 50 Marks Name: SectionDocument4 pagesQuiz 3 Chapter 8: Income From Property 50 Marks Name: SectionHadiNo ratings yet

- Module 1 Internal Revenue TaxesDocument11 pagesModule 1 Internal Revenue TaxesSophia De GuzmanNo ratings yet

- LTA Claim FormDocument1 pageLTA Claim FormSupratikNo ratings yet

- Tax Invoice/Bill of Supply: Shreyash Retail Private LimitedDocument1 pageTax Invoice/Bill of Supply: Shreyash Retail Private LimitedRealme 2 proNo ratings yet

- MALELANG - Narrative Report TaxDocument4 pagesMALELANG - Narrative Report TaxRoseanneNo ratings yet

- Tammy PayrollDocument20 pagesTammy Payrollapi-274046647No ratings yet

- Provisional Tax - SlidesDocument17 pagesProvisional Tax - SlidesZwivhuya MaimelaNo ratings yet

- Employment Slips T4 / RL 1Document35 pagesEmployment Slips T4 / RL 1kanika019No ratings yet

- Print Patna JN (Pnbe) Lokmanyatilak T (LTT) 6622658965Document1 pagePrint Patna JN (Pnbe) Lokmanyatilak T (LTT) 6622658965Nirbhay SinghNo ratings yet

- Course OL TaxationDocument3 pagesCourse OL TaxationSayed Mukhtar HedayatNo ratings yet

- Certification of Foreign Status EntitiesDocument1 pageCertification of Foreign Status EntitiesALamin SarkerNo ratings yet

- Incometaxstatement2009 2010Document2 pagesIncometaxstatement2009 2010api-3725541No ratings yet

- 1 InvoiceDocument1 page1 InvoiceMohit GargNo ratings yet

- Range of State Corporate Income Tax RatesDocument2 pagesRange of State Corporate Income Tax Ratesgrishma14No ratings yet

- ATP Digest - Gatchalian Vs CIRDocument1 pageATP Digest - Gatchalian Vs CIRLawrence RiodequeNo ratings yet

- Income Tax 2008-09Document10 pagesIncome Tax 2008-09mohan9813032985@yahoo.com100% (16)

- Invoice: Deepnayan Scale CompanyDocument1 pageInvoice: Deepnayan Scale CompanyDssp StmpNo ratings yet

- Classification of TaxesDocument2 pagesClassification of TaxesJoliza CalingacionNo ratings yet