Professional Documents

Culture Documents

Boleta - Martin O.

Uploaded by

colegioVRHT0 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

boleta -Martin O.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageBoleta - Martin O.

Uploaded by

colegioVRHTCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

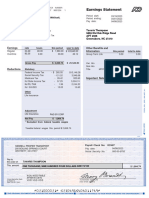

CO FILE DEPT CLOCK VCHH NO.

QX4 005702 000807 3563 0000490812 1 Earnings Statement

SEQ 014735 Period Befinning: 11/16/2023

FLAGSHIP FACILITY SERVICES, INC

405 S KIMBALL AVE Period Edning: 11/30/2023

SOUTHLAKE, TX 76092 Pay Date: 12/08/2023

PHONE # (972) 574-9702

MARTIN A ORTIZ LEON

Filing Status: Single, Married filing separately

Exemptiones/Allowances 779 EVERLYN

Federal: Standard Withholding Table APT 212

MOUNTAIN VIEW CA 94041

Earnings_____ _ rate hours this period year to day Other Benefitts and

Regular 25,9500 70.00 1,816.50 46,398.06 Informatión___________this period__ total to date

Sick 973,13 Sick Accrued 30.12

Vacation 1,855,43 Vacation Bal 92.66

Grosa Pay $2,281.01 51,720.68

Totl Hrs Worked 71.90

Deductions Statutory_______________________ Init Fee 876 106.40

Federal Income Tax -195.30 4,422.62

Social Security Tax -141.42 3,206.68 Employee ID 929503

Medicare Tax -33.07 749.95

CA State Income Tax -37.69 860.03

Important Notes______________________________________

CA SDI Tax -20.53 465.49

YOUR COMPANY’S ER PHONE NUMBER IS 408-977-0155

Other__________________________

Dues Local 19m -25.90 595.70 Additional Tax Withholding Information___________________

Cell Ph Stip - 97.06 Taxable Marital Status:

CA: Married

Adjustment_____________________ Exemptions/Allowances:

Cell Ph Stip +4.22

CA: 0

Net Pay $1,831.32

Checking -1,831.32

Net Check $0.00

Your Federal taxable wages this period are

$2,281.0

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Coward Stub 2Document1 pageCoward Stub 2raheemtimo1No ratings yet

- ALBA PP 14 Paystub July 7 2017 PDFDocument1 pageALBA PP 14 Paystub July 7 2017 PDFayoubarade1No ratings yet

- Ps 3Document1 pagePs 3Destiny SmithNo ratings yet

- Kayila StubDocument1 pageKayila Stubraheemtimo1No ratings yet

- PayStatement D0655147Document1 pagePayStatement D0655147Anonymous O61KvPgNo ratings yet

- Diokno 12.15.21Document1 pageDiokno 12.15.21MACN ASSROBNo ratings yet

- 9:30:22Document1 page9:30:22Rosa Medina AlbarránNo ratings yet

- Adp QUANIC MARTIN-converted (1st Try)Document12 pagesAdp QUANIC MARTIN-converted (1st Try)Quanic Martin100% (1)

- Gizmo Pay 2Document2 pagesGizmo Pay 2rafa perezNo ratings yet

- Adp Pay Stub TemplateDocument1 pageAdp Pay Stub Templatenurulamin00023No ratings yet

- Paystub-0202 DANEA MCLAURINDocument1 pagePaystub-0202 DANEA MCLAURINmarkchristory07No ratings yet

- CheckstubsDocument5 pagesCheckstubsAaron ThompsonNo ratings yet

- SSPOFADVDocument1 pageSSPOFADVKaren OHareNo ratings yet

- Check 1Document1 pageCheck 1luv meNo ratings yet

- Earnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Document1 pageEarnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Miquel JonesNo ratings yet

- E-Statement 20131018 00027Document1 pageE-Statement 20131018 00027Renee0430100% (1)

- Screenshot 2021-09-16 at 11.56.11 AMDocument1 pageScreenshot 2021-09-16 at 11.56.11 AMMartinez BryanNo ratings yet

- Paycheck 20201230 001387 Pravallika 202101241910Document1 pagePaycheck 20201230 001387 Pravallika 202101241910Prabhakar AenugaNo ratings yet

- 2020 MFJ Vs MFSDocument3 pages2020 MFJ Vs MFSenderjosNo ratings yet

- Paystub 1Document1 pagePaystub 1PeterJamesNo ratings yet

- Agosto 25Document1 pageAgosto 25dakpi479No ratings yet

- Nicole Hayward Paystub Feb 27 2024Document1 pageNicole Hayward Paystub Feb 27 2024Fake Documents of Simply Jodan's LLCNo ratings yet

- HMO Dependents Employment & Upgrading FormDocument2 pagesHMO Dependents Employment & Upgrading FormJim Kimberly TilapNo ratings yet

- Scan 23 Mar 24 18 41Document13 pagesScan 23 Mar 24 18 41atemple116No ratings yet

- E19 Ooo 000570120000 R 064 BC9409 FC521 Paystubformay 29Document1 pageE19 Ooo 000570120000 R 064 BC9409 FC521 Paystubformay 29celiesNo ratings yet

- Paystub For Oct 2020Document1 pagePaystub For Oct 2020bahadarkhan591No ratings yet

- Oscar O. Bolorin Candelario S 1048 Samuel DR Lot 25 Eunice, LA 70535-2009Document1 pageOscar O. Bolorin Candelario S 1048 Samuel DR Lot 25 Eunice, LA 70535-2009Agr AgrNo ratings yet

- Octubre 20Document1 pageOctubre 20dakpi479No ratings yet

- Johannah Stub 1Document1 pageJohannah Stub 176xzv4kk5vNo ratings yet

- File 1831Document1 pageFile 183176xzv4kk5vNo ratings yet

- 04 17 2022 Paystub - 1Document1 page04 17 2022 Paystub - 1Destiny SmithNo ratings yet

- Septiembre 8Document1 pageSeptiembre 8dakpi479No ratings yet

- Earnings Statement: Netjets Aviation, Inc. 4111 Bridgeway Ave Columbus Oh 43219Document1 pageEarnings Statement: Netjets Aviation, Inc. 4111 Bridgeway Ave Columbus Oh 43219sch44029No ratings yet

- IYYSCP007870400100 R 19125 DA6 E1 E3621Document1 pageIYYSCP007870400100 R 19125 DA6 E1 E3621Genesis De La Rosa SibajaNo ratings yet

- 1208payweek (1) JerryDocument1 page1208payweek (1) Jerryesteysi775No ratings yet

- 3.31 Paystub 1Document1 page3.31 Paystub 1disipiw20No ratings yet

- Downloaded PaycheckDocument3 pagesDownloaded Paycheckcrystalgeronimo0No ratings yet

- Payslip-03 10 2023Document1 pagePayslip-03 10 2023wireNo ratings yet

- Kanza Bey 01Document1 pageKanza Bey 01ahmadsabeh727No ratings yet

- Monica 2Document1 pageMonica 2raheemtimo1No ratings yet

- Diana Ogerio PayslipDocument2 pagesDiana Ogerio PayslipAimee DavidNo ratings yet

- Anore April 30 Payslip Previous Self 2309Document1 pageAnore April 30 Payslip Previous Self 2309Cherie Magne AnoreNo ratings yet

- PS01 Terrel MccrearyDocument1 pagePS01 Terrel Mccrearybahadarkhan591No ratings yet

- Hours Wages Rate This Check Year-To-Date Year-To-Date This Check Deductions and Taxes Amount Amount Amount AmountDocument1 pageHours Wages Rate This Check Year-To-Date Year-To-Date This Check Deductions and Taxes Amount Amount Amount AmountjgfNo ratings yet

- Global Cash Card - Paystub Detail PDFDocument1 pageGlobal Cash Card - Paystub Detail PDFVerónica Del RioNo ratings yet

- Adp Pay Stub Template 1Document1 pageAdp Pay Stub Template 1Candy ValentineNo ratings yet

- File 0624Document4 pagesFile 0624Anderson FrancoNo ratings yet

- Myrna Keith - Employer Package PDFDocument24 pagesMyrna Keith - Employer Package PDFJoey KeithNo ratings yet

- ITDECDocument2 pagesITDECDipak SahaNo ratings yet

- Order Execution Only GRSP Statement (CDN$) APR. 30 2020: Local CallsDocument4 pagesOrder Execution Only GRSP Statement (CDN$) APR. 30 2020: Local CallsAndy HuffNo ratings yet

- Pay - 3 16 18Document1 pagePay - 3 16 18henri e ewaneNo ratings yet

- Tristan Borders Pay Stub 09.17Document1 pageTristan Borders Pay Stub 09.17Alex NeziNo ratings yet

- Payslips 00437165 20230816Document2 pagesPayslips 00437165 20230816Nathaniel MasonNo ratings yet

- The Yuppy Puppy, LLC 9511 N Newport Highway Spokane, WA 99218Document1 pageThe Yuppy Puppy, LLC 9511 N Newport Highway Spokane, WA 99218Dr. GigglesproutNo ratings yet

- Sspofadv 4Document1 pageSspofadv 4Antoni Zelaya0% (1)

- B12 451Document1 pageB12 451ASAP CHAKINo ratings yet

- Paystub Auto 2209Document4 pagesPaystub Auto 2209DjibzlaeNo ratings yet

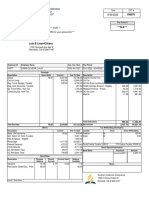

- Torch and Shield Security Agency: Cost DistributionDocument1 pageTorch and Shield Security Agency: Cost DistributionJomar Del BarrioNo ratings yet

- 2020-06-09wyndham Hotels and Resorts 2Document1 page2020-06-09wyndham Hotels and Resorts 2Diana MartinezNo ratings yet

- College Accounting Chapters 1-27-22nd Edition Heintz Solutions ManualDocument22 pagesCollege Accounting Chapters 1-27-22nd Edition Heintz Solutions Manualmelrosecontrastbtjv1w100% (18)

- Financial and Managerial Accounting 9th Edition Needles Solutions ManualDocument14 pagesFinancial and Managerial Accounting 9th Edition Needles Solutions Manualdonnamargareta2g5100% (26)

- Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Document2 pagesSebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Deborah Beth DarlingNo ratings yet

- W2 Hyatt PLaceDocument5 pagesW2 Hyatt PLaceJuan Diego Velandia DuarteNo ratings yet

- Solution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverDocument39 pagesSolution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverPatriciaCooleyMDkrws100% (34)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableTJ JanssenNo ratings yet

- 1610747465.1724823 CLB Investments D B A Mcdonald S Hourly Employee General Handbook 102017Document37 pages1610747465.1724823 CLB Investments D B A Mcdonald S Hourly Employee General Handbook 102017Lucia SortoNo ratings yet

- 2021 W2 Marcus RobertsDocument1 page2021 W2 Marcus RobertsDAISY CRAINNo ratings yet

- Payroll Accounting 2013 23rd Edition Bieg Solutions Manual DownloadDocument31 pagesPayroll Accounting 2013 23rd Edition Bieg Solutions Manual DownloadTommie Clemens100% (22)

- Original PDF Payroll Accounting 2017 27th Edition PDFDocument41 pagesOriginal PDF Payroll Accounting 2017 27th Edition PDFwilliams.allen717100% (34)

- Ebook Corporate Financial Accounting 12Th Edition Warren Test Bank Full Chapter PDFDocument67 pagesEbook Corporate Financial Accounting 12Th Edition Warren Test Bank Full Chapter PDFdextrermachete4amgqg100% (11)

- Chapter 08 FINDocument32 pagesChapter 08 FINUnoNo ratings yet

- Solution Manual For Accounting 26th EditionDocument41 pagesSolution Manual For Accounting 26th EditionToddNovakmekfw100% (36)

- Accounting For Liability Categories Payable, Accrued and Estimated Liabilities - WrittenReportDocument18 pagesAccounting For Liability Categories Payable, Accrued and Estimated Liabilities - WrittenReportCaren ReasNo ratings yet

- Sample Budget Justification FY23Document2 pagesSample Budget Justification FY23NikitaHNo ratings yet

- Computer Application ExcelDocument1 pageComputer Application ExcelAmirah NatasyaNo ratings yet

- 04 17 2022 Paystub - 1Document1 page04 17 2022 Paystub - 1Destiny SmithNo ratings yet

- Non Negotiable: 142 GeneralDocument1 pageNon Negotiable: 142 General9wvsbwngcrNo ratings yet

- Full Solution Manual For Accounting Tools For Business Decision Making Kimmel Weygandt Kieso 5Th Edition PDF Docx Full Chapter ChapterDocument36 pagesFull Solution Manual For Accounting Tools For Business Decision Making Kimmel Weygandt Kieso 5Th Edition PDF Docx Full Chapter Chapterbraidscanty8unib100% (19)

- General Instructions For Forms W-2 and W-3: (Including Forms W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2c, and W-3c)Document34 pagesGeneral Instructions For Forms W-2 and W-3: (Including Forms W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2c, and W-3c)DrewNo ratings yet

- Document 1510 4516Document54 pagesDocument 1510 4516rubyhien46tasNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document3 pagesWage and Tax Statement: OMB No. 1545-0008h6bnyrr9mrNo ratings yet

- Payroll Fundamentals Practice TestDocument10 pagesPayroll Fundamentals Practice Testmohitkashap869No ratings yet

- Acctg11e SM CH11Document52 pagesAcctg11e SM CH11titirNo ratings yet

- En 05 10022Document2 pagesEn 05 10022Jeremy WebbNo ratings yet

- Philip D. Harvey - Government Creep - What The Government Is Doing That You Don't Know About-Loompanics Unlimited (2003)Document171 pagesPhilip D. Harvey - Government Creep - What The Government Is Doing That You Don't Know About-Loompanics Unlimited (2003)steved_43No ratings yet

- Peregrine CNC Decision CaseDocument6 pagesPeregrine CNC Decision CaseAsadMughalNo ratings yet

- The Case Against TippingDocument29 pagesThe Case Against TippingYm MNo ratings yet

- Statement For Aug 18, 2023Document1 pageStatement For Aug 18, 2023Hawa KabiaNo ratings yet

- TN TLDocument21 pagesTN TL2121013027No ratings yet