Professional Documents

Culture Documents

17 13

17 13

Uploaded by

Khánh LinhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

17 13

17 13

Uploaded by

Khánh LinhCopyright:

Available Formats

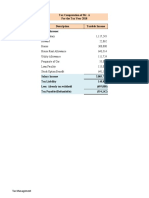

2018

Sales 3,600,000

Operating costs 3,279,720

EBIT 320,280

Less Interest expense 20,280

EBT 300,000

Taxes (40%) 120,000

Net Income 180,000

Dividends 108,000

Add to RE 72,000

Balance Sheets

2018

Assets

Cash 180,000

Account receivable 360,000

Inventories 720,000

Fixed assets (grow with sales) 1,440,000

Total assets 2,700,000

Liabilities and Equity

Payables + accruals (both grow with sales) 540,000

Short-term bank loans 56,000

Total current liabilities 596,000

Long-term bonds 100,000

Total liabilities 696,000

Common stock 1,800,000

Retained earnings 204,000

Total common equity 2,004,000

Total liabilities and equity 2,700,000

b. AFN = $2,700,000/$3,600,000(DSales) – ($360,0

– (0.05)($3,600,000 + DSales)0.4

$0 = 0.75(DSales) – 0.15(DSales) – 0.02(DSale

$0 = 0.58(DSales) – $72,000

$72,000 = 0.58(DSales)

DSales = $124,138.

Growth rate in sales =

Sales $124,138

= = 3.45%.

$3,600,000 $3,600,000

2019

3,960,000

3,465,000

495,000

37,125

457,875

183,150

274,725

164,835

109,890

2019

198,000

396,000

792,000

1,584,000

2,970,000

594,000

89,100

683,100

207,900

891,000

1,765,110

313,890

2,079,000

2,970,000

700,000/$3,600,000(DSales) – ($360,000 + $180,000)/$3,600,000(DSales)

(0.05)($3,600,000 + DSales)0.4

5(DSales) – 0.15(DSales) – 0.02(DSales) – $72,000

8(DSales) – $72,000

3.45%.

Assets in 2019 will change to this amount, from the balance sheet:

Target total liabilities-to-assets ratio

Resulting total liabilities: (Target total liabilities-to-assets ratio)(2019 assets)

Less: Payables and accruals

Bank loans and bonds (= Interest-bearing debt)

Allocated to bank loans 30.00%

Allocated to bonds 70.00%

Interest expense: (Interest rate)(2019 Bank loans plus bonds)

Target equity ratio = 1 – Target total liabilities-to-assets ratio

Required total equity: (2019 assets)(Target equity ratio)

Retained earnings, from 2019 balance sheet

Required common stock = Required total equity – Retained earnings

Old shares outstanding 100,000

Increase in common stock = 2019 Common stock – 2018 Common stock (34,890)

Initial price per share 45.00

Change in shares = Change in equity/Initial price per share (775.33)

New shares outstanding = Old shares + D Shares 99,224.67

Old EPS = 2018 Net income/Old shares outstanding 1.80

New EPS = 2019 Net income/New shares outstanding 2.75

2,970,000

30%

891,000

(594,000)

297,000

89,100

207,900

37,125

70%

2,079,000

313,890

1,765,110

You might also like

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Quantic MBA Accounting Project - Class of Sept 2024 Group 58Document7 pagesQuantic MBA Accounting Project - Class of Sept 2024 Group 58Eng Chee Liang100% (1)

- Mini CaseDocument7 pagesMini CaseHarrisha Arumugam0% (1)

- M3 Activity 1Document6 pagesM3 Activity 1Ruffa May GonzalesNo ratings yet

- More Vino Projected EarningsDocument4 pagesMore Vino Projected EarningsTERESANo ratings yet

- AMSA Mariners Handbook For Australian Waters 5th Edition 2019 10Document324 pagesAMSA Mariners Handbook For Australian Waters 5th Edition 2019 10Maksim Zaritskii100% (1)

- Minnesota Work Zone Speed Management Study 2022Document72 pagesMinnesota Work Zone Speed Management Study 2022Patch MinnesotaNo ratings yet

- Mid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121Document10 pagesMid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121rabab balochNo ratings yet

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- Annual Income Statemen1 Mcdonalds KFCDocument6 pagesAnnual Income Statemen1 Mcdonalds KFCAnwar Ul HaqNo ratings yet

- Financial Management ExercisesDocument6 pagesFinancial Management ExercisesLeanne Quinto100% (1)

- FM II Assignment 3 SolutionDocument2 pagesFM II Assignment 3 SolutionSheryar NaeemNo ratings yet

- Manual Solution 6-14Document5 pagesManual Solution 6-14Sohmono HendraiosNo ratings yet

- Lagrimas, Sarah Nicole S. - PC&OL PART 2Document3 pagesLagrimas, Sarah Nicole S. - PC&OL PART 2Sarah Nicole S. LagrimasNo ratings yet

- Accounting and Finance Tugas Kelompok #3 Chapter 6 Financial Planning and ForecastingDocument10 pagesAccounting and Finance Tugas Kelompok #3 Chapter 6 Financial Planning and Forecastingbudiman100% (1)

- Gross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsDocument85 pagesGross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsMaria Dana BrillantesNo ratings yet

- Template 2 Task 3 Calculation Worksheet - BSBFIM601Document17 pagesTemplate 2 Task 3 Calculation Worksheet - BSBFIM601Writing Experts0% (1)

- Excel 1 - Common Sized Financial Statements - IrvinDocument2 pagesExcel 1 - Common Sized Financial Statements - Irvinapi-581024555No ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- Integ Case 1 FsDocument7 pagesInteg Case 1 FsIra BenitoNo ratings yet

- Tugas AKM III - Week 3Document6 pagesTugas AKM III - Week 3Rifda AmaliaNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet

- I. Sources of Fund A. EquityDocument20 pagesI. Sources of Fund A. EquityJoshell Roz RamasNo ratings yet

- AssignmentDocument11 pagesAssignmentkireeti415No ratings yet

- WEEK 4 FINANCIAL STATEMENT ANALYSIS Part 2Document42 pagesWEEK 4 FINANCIAL STATEMENT ANALYSIS Part 2GIRLNo ratings yet

- Assets: Café Richard Balance Sheet As at 31 December 2019 & 2020Document3 pagesAssets: Café Richard Balance Sheet As at 31 December 2019 & 2020Jannatul Ferdousi PrïtyNo ratings yet

- Calculation of NPV: WorkingsDocument3 pagesCalculation of NPV: WorkingsTapiwa Kurungamakwashe NgungunyaniNo ratings yet

- Homework Chapter 13 Case From Text BookDocument23 pagesHomework Chapter 13 Case From Text Bookjhanzab0% (1)

- Horizonatal & Vertical Analysis and RatiosDocument6 pagesHorizonatal & Vertical Analysis and RatiosNicole AlexandraNo ratings yet

- Mayes 8e CH07 SolutionsDocument32 pagesMayes 8e CH07 SolutionsRamez AhmedNo ratings yet

- 5-Year Financial Plan - Manufacturing 1Document8 pages5-Year Financial Plan - Manufacturing 1tulalit008No ratings yet

- Panther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)Document7 pagesPanther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)HussainNo ratings yet

- Quiz FMDocument3 pagesQuiz FMMarcos Jose AveNo ratings yet

- Statement AnalysisDocument4 pagesStatement AnalysisrameelNo ratings yet

- Assigned Problems FinmarDocument8 pagesAssigned Problems FinmarTABUADA, Jenny Rose V.No ratings yet

- Untitled DocumentDocument6 pagesUntitled DocumentAman SinghNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Group Assignment 2Document2 pagesGroup Assignment 2sebsibeboki01No ratings yet

- Solutions - Formation-LumpSum LiquidationDocument14 pagesSolutions - Formation-LumpSum LiquidationLuna SanNo ratings yet

- Assignment#2Document5 pagesAssignment#2Kristine Esplana ToraldeNo ratings yet

- ASSIGNMENT#2Document5 pagesASSIGNMENT#2Kristine Esplana ToraldeNo ratings yet

- Chapter 7 Workbook SolutionsDocument26 pagesChapter 7 Workbook SolutionsdonnyNo ratings yet

- Horizontal and Vertical AnalysisDocument5 pagesHorizontal and Vertical AnalysisAshley Rouge Capati QuirozNo ratings yet

- AACONAPPS2 A433 - Audit of ReceivablesDocument23 pagesAACONAPPS2 A433 - Audit of ReceivablesDawson Dela CruzNo ratings yet

- Advanced Accounting 2DDocument5 pagesAdvanced Accounting 2DHarusiNo ratings yet

- Afar-Chapter 3 AssignmentDocument38 pagesAfar-Chapter 3 AssignmentJeane Mae BooNo ratings yet

- Short Term Credit Line ExampleDocument1 pageShort Term Credit Line ExampleNhư Hoài ThươngNo ratings yet

- Peanut FinancialsDocument4 pagesPeanut FinancialsTertius Du ToitNo ratings yet

- 1 Partnership SolutionsDocument34 pages1 Partnership SolutionsLuna SanNo ratings yet

- Module 3 Exercises 1. Pro Forma Income Statements: Scenario AnalysisDocument7 pagesModule 3 Exercises 1. Pro Forma Income Statements: Scenario AnalysisJARED DARREN ONGNo ratings yet

- Module 5Document10 pagesModule 5Rainielle Sy DulatreNo ratings yet

- TM PQsDocument9 pagesTM PQsAnooshayNo ratings yet

- Intermediate Accounting 3: PROBLEM 1-11Document3 pagesIntermediate Accounting 3: PROBLEM 1-11Gemmalyn JulatonNo ratings yet

- Analysis of Financial Statements - VICO Foods CorporationDocument19 pagesAnalysis of Financial Statements - VICO Foods CorporationHannah Bea LindoNo ratings yet

- Tugas Minggu Ke 5Document4 pagesTugas Minggu Ke 5Devenda Kartika RoffandiNo ratings yet

- ALEJAGA FM Project Week 4Document5 pagesALEJAGA FM Project Week 4Andrea Monique AlejagaNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- August TIF Ch12Document19 pagesAugust TIF Ch12Ömer DoganNo ratings yet

- FIN111 Tutorial 4QDocument2 pagesFIN111 Tutorial 4QKai YinNo ratings yet

- Research Proposal EnglishDocument3 pagesResearch Proposal Englishapi-295811065No ratings yet

- POPCOM: Review of Its Mandate and Policy ShiftsDocument18 pagesPOPCOM: Review of Its Mandate and Policy ShiftsJay LacsamanaNo ratings yet

- Union 101Document1 pageUnion 101csea_unionNo ratings yet

- Registration Specialist: Job SummaryDocument2 pagesRegistration Specialist: Job SummaryMona Abouzied IbrahimNo ratings yet

- Boracay Foundation v. Province of AklanDocument3 pagesBoracay Foundation v. Province of AklanGabrielle Adine Santos100% (1)

- Judgment: SCZ Appeal No. 145/2011Document21 pagesJudgment: SCZ Appeal No. 145/2011HanzelNo ratings yet

- Alan Scott - New Critical Writings in Political Sociology Volume Three - Globalization and Contemporary Challenges To The Nation-State (2009, Ashgate - Routledge) PDFDocument469 pagesAlan Scott - New Critical Writings in Political Sociology Volume Three - Globalization and Contemporary Challenges To The Nation-State (2009, Ashgate - Routledge) PDFkaranNo ratings yet

- Cytochrome P450 3A Inhibitors and Inducers - UpToDateDocument2 pagesCytochrome P450 3A Inhibitors and Inducers - UpToDatemehrin.mahbodNo ratings yet

- 09 Javier vs. COMELEC GR No. 215847 January 12, 2016Document11 pages09 Javier vs. COMELEC GR No. 215847 January 12, 2016Patrick Dag-um MacalolotNo ratings yet

- Chapter 10 GearsDocument77 pagesChapter 10 GearsBoy SeyNo ratings yet

- United States v. Roberts, 1st Cir. (1994)Document21 pagesUnited States v. Roberts, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- 2023 Carryover Budget - Administration RecommendationsDocument3 pages2023 Carryover Budget - Administration RecommendationsWVXU NewsNo ratings yet

- Ramos vs. Ramos DigestDocument1 pageRamos vs. Ramos DigestJoseph Macalintal100% (1)

- Daily Attendance Sheet MAPEHDocument3 pagesDaily Attendance Sheet MAPEHJEFFREYNALD FRANCISCONo ratings yet

- BiographiesDocument9 pagesBiographiesEaP CSFNo ratings yet

- Anuj Jain Vs Axis Bank Limited DefendantDocument12 pagesAnuj Jain Vs Axis Bank Limited DefendantCAAniketGangwalNo ratings yet

- Basic Non Disclosure AgreementDocument2 pagesBasic Non Disclosure AgreementKim Pecenio MoralidadNo ratings yet

- BBC ISM Agreement 2011 SignedDocument17 pagesBBC ISM Agreement 2011 SignedMu ZhangNo ratings yet

- Fixed Asset Accounting SOP PDFDocument5 pagesFixed Asset Accounting SOP PDFMahabubnubNo ratings yet

- Committee Report 1155Document17 pagesCommittee Report 1155bubblingbrookNo ratings yet

- The World of JesusDocument22 pagesThe World of JesusBethany House Publishers100% (2)

- ProblemsDocument2 pagesProblemsNah HamzaNo ratings yet

- Principles in Intestate SuccessionDocument3 pagesPrinciples in Intestate SuccessionHermay BanarioNo ratings yet

- Class 8 Sample Questions: The Actual Question Paper Contains 35 Questions. The Duration of The Test Paper Is 40 MinutesDocument1 pageClass 8 Sample Questions: The Actual Question Paper Contains 35 Questions. The Duration of The Test Paper Is 40 MinutesNihal ParasharNo ratings yet

- Module II - Corporate Governance Responsibilities and AccountabilitiesDocument7 pagesModule II - Corporate Governance Responsibilities and AccountabilitiesMae Richelle D. DacaraNo ratings yet

- Acams 1 PDFDocument18 pagesAcams 1 PDFMarko MihajlovicNo ratings yet