Professional Documents

Culture Documents

10 Joint and by Product Costing

Uploaded by

202010461Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 Joint and by Product Costing

Uploaded by

202010461Copyright:

Available Formats

INTEGRATION: ADVANCED FINANCIAL ACCOUNTING AND REPORTING

JOINT AND BY-PRODUCT COSTING

PROBLEM 1

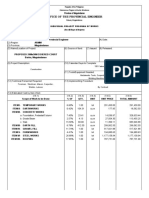

MIX Inc. is conducting a joint process which results to three products. The following production data were provided by MIX

Inc. for the current period:

Sales per unit at split off

Product Name Units Produced

point

Ace 10,000 P40

Bat 15,000 P20

Can 25,000 P12

Additional data for the period were provided:

All the Ace items were sold for a gross profit of P100,000.

The joint costs were allocated using physical method.

1. What is the gross profit/(loss) if all the Bat items are sold in current year?

2. Assuming the joint costs are fixed, what is the joint cost allocated to Can items using the relative sales

method?

PROBLEM 2

COMBI Inc. manufactures three joint products. The following production data were provided by COMBI Inc. for the current

period:

Additional Processing

Product Name Units Produced Final Selling Price

Costs after Split off

Xen 1,000 P20,000 P50

Yen 2,000 P10,000 P10

Zen 3,000 P30,000 P30

Joint product costs for the current period were as follows:

Raw materials P10,000

Direct Labor P15,000

Factory Overhead P25,000

The company uses the net realizable value method for allocating joint costs.

1. What is the gross profit/(loss) on the sale of all Xen products?

2. What is the total gross profit/(loss) on the sale of all joint products?

PROBLEM 3

CONSO Inc. manufactures joint products ALT and TAB, and a by-product DEL. Cost are assigned to the joint products by

the net realizable value or final market value method which considers further processing costs in subsequent operations. It

is the policy of CONSO Inc. to account for its by-product by market value or reversal cost method or deduction of net

realizable value of by-product from joint manufacturing costs of main products. The total manufacturing costs for 100,000

units were P1,520,000 during the year. Production and costs data follow:

ALT TAB DEL

Units produced 60,000 30,000 10,000

Sales price per unit 70 25 10

Further processing cost per unit 20 5 3

Selling and admin expense per unit 5

1. What is the value of DEL to be deducted from joint manufacturing costs?

2. What is the gross profit of ALT for the year?

3. What is the gross profit of TAB for the year?

INTEGRATION: ADVANCED FINANCIAL ACCOUNTING AND REPORTING

JOINT AND BY-PRODUCT COSTING

PROBLEM 4

MERGE Inc., manufactures ZEN products from a process that yields by a by-product called YAN. The by-product requires

additional processing costs of P30,000. The by-product will require selling and administrative expenses totaling P20,000. It

is MERGE’s accounting policy to charge the joint costs to the main product only. Information concerning a batch produced

during the year ended Dec 31, 2022 follows:

Product Units Market Value at

Units Sold

Name Produced Split off

ZEN 100,000 P50 60,000

YAN 8,000 P10 8,000

The joint costs incurred up to split-off point are:

Direct Materials P2,000,000

Direct Labor P800,000

Factory Overhead P200,000

The selling and administrative expense of MERGE Inc. for the year ended Dec 31, 2022 is P1,000,000 exclusive of that for

the by-product.

1. What is the gross profit for the year if the net revenue from by-product is presented as other income?

2. What is the gross profit for the year if the net revenue from by-product is presented as additional sales

revenue?

3. What is the net income for the year of the net revenue from by-product is presented as deduction from

cost of goods sold?

4. What is the net income for the year if the net revenue from by-product is presented as deduction from

the total manufacturing cost of the main product?

-END-

You might also like

- p2 - Guerrero Ch15Document27 pagesp2 - Guerrero Ch15JerichoPedragosa83% (12)

- Local CHAPTER 14 COST ACCOUNTING (Answer)Document4 pagesLocal CHAPTER 14 COST ACCOUNTING (Answer)MA ValdezNo ratings yet

- Elaborate Activity: Evaluate: Straight Problems (Show Solutions in Good Accounting Form)Document2 pagesElaborate Activity: Evaluate: Straight Problems (Show Solutions in Good Accounting Form)Meghan Kaye LiwenNo ratings yet

- Case Analysis - Executive Shirt Company, IncDocument6 pagesCase Analysis - Executive Shirt Company, IncSaptarshee ChatterjeeNo ratings yet

- Joint and by Products Practice IllustrationsDocument2 pagesJoint and by Products Practice IllustrationsNCTNo ratings yet

- Additional Data For The Period Were ProvidedDocument3 pagesAdditional Data For The Period Were Providedmoncarla lagon100% (1)

- Equired Answer Each of The Following Questions IndependentlyDocument2 pagesEquired Answer Each of The Following Questions IndependentlyJan Christopher CabadingNo ratings yet

- 3 - Discussion - Joint Products and ByproductsDocument2 pages3 - Discussion - Joint Products and ByproductsCharles TuazonNo ratings yet

- Quiz 2Document4 pagesQuiz 2Kathleen CusipagNo ratings yet

- Quiz-3 Cost2 BSA4Document7 pagesQuiz-3 Cost2 BSA4Jessa HerreraNo ratings yet

- Activity Chapter 5 1Document11 pagesActivity Chapter 5 1Rocelle MalinaoNo ratings yet

- Joint Cost - Set A - QuestionDocument3 pagesJoint Cost - Set A - QuestionCheliah Mae ImperialNo ratings yet

- Problem ADocument5 pagesProblem AKim TaehyungNo ratings yet

- Quiz-3 Cost2 BSA4Document10 pagesQuiz-3 Cost2 BSA4Jessa HerreraNo ratings yet

- 1Document13 pages1Mikasa MikasaNo ratings yet

- MAS Product Costing Part IDocument2 pagesMAS Product Costing Part IMary Dale Joie BocalaNo ratings yet

- Cost 2 - Quiz5 PDFDocument7 pagesCost 2 - Quiz5 PDFshengNo ratings yet

- Exercises Absorption and Variable CostingPAUL ANTHONY DE JESUSDocument4 pagesExercises Absorption and Variable CostingPAUL ANTHONY DE JESUSMeng DanNo ratings yet

- Managerial AccountingMid Term ExaminationDocument3 pagesManagerial AccountingMid Term ExaminationMay RamosNo ratings yet

- Quiz-3 Cost2 BSA4Document6 pagesQuiz-3 Cost2 BSA4Kathlyn Postre0% (1)

- Strategic Cost Management Midterm Examination SY 2021-2022 FIRST SEMESTERDocument4 pagesStrategic Cost Management Midterm Examination SY 2021-2022 FIRST SEMESTERMixx MineNo ratings yet

- For Print Exercises Variable and Absorption CostingDocument2 pagesFor Print Exercises Variable and Absorption CostingAngelica Sumatra0% (1)

- Activity No. 7 Variable CostingDocument2 pagesActivity No. 7 Variable CostingYvonne Joy Mondano TehNo ratings yet

- MS02 Relevant Costs Special Order and Sell or Process FurtherDocument5 pagesMS02 Relevant Costs Special Order and Sell or Process FurtherIohc NedmiNo ratings yet

- Midterm Exam - BSAIS 2ADocument6 pagesMidterm Exam - BSAIS 2AMarilou DomingoNo ratings yet

- Bacc 103 QuestionsDocument4 pagesBacc 103 QuestionsPaul PeneroNo ratings yet

- Assignment 3 Relevant CostingDocument3 pagesAssignment 3 Relevant CostingMallet S. GacadNo ratings yet

- Relevant Costing: 1. Total Analysis vs. Differential AnalysisDocument4 pagesRelevant Costing: 1. Total Analysis vs. Differential AnalysisNone SenseNo ratings yet

- General Instructions: Read Carefully Each Questions. The Answers For The Questions Are To Be Submitted in Google ClassroomDocument3 pagesGeneral Instructions: Read Carefully Each Questions. The Answers For The Questions Are To Be Submitted in Google ClassroomRuby Amor DoligosaNo ratings yet

- Cost 2 - Quiz5 PDFDocument7 pagesCost 2 - Quiz5 PDFshengNo ratings yet

- Chapter 11 Relevant Costing ExercisesDocument3 pagesChapter 11 Relevant Costing ExercisesNCT100% (1)

- Variable Costingbatch2013Document5 pagesVariable Costingbatch2013JAY AUBREY PINEDANo ratings yet

- Acc213 Reviewer Final QuizDocument9 pagesAcc213 Reviewer Final QuizNelson BernoloNo ratings yet

- MA REV 1 Finals Dec 2017Document33 pagesMA REV 1 Finals Dec 2017Dale PonceNo ratings yet

- Managerial AccountingMid Term ExaminationDocument3 pagesManagerial AccountingMid Term ExaminationjaeNo ratings yet

- Exercises Differential Cost Analysis Relevant CostingDocument5 pagesExercises Differential Cost Analysis Relevant CostingBSIT 1A Yancy CaliganNo ratings yet

- Strategic Management: Topic 3 Variable Costing Versus Absorption CostingDocument20 pagesStrategic Management: Topic 3 Variable Costing Versus Absorption CostingKemerutNo ratings yet

- 673 Quirino Highway, San Bartolome, Novaliches, Quezon CityDocument4 pages673 Quirino Highway, San Bartolome, Novaliches, Quezon CityRodolfo ManalacNo ratings yet

- Quiz For Finals For PrintingDocument4 pagesQuiz For Finals For PrintingPopol KupaNo ratings yet

- PM Revision Questions 2021Document8 pagesPM Revision Questions 2021Ivy NjorogeNo ratings yet

- Relevant CostingDocument3 pagesRelevant CostingRuby RomeroNo ratings yet

- Joint and By-Product CostingDocument13 pagesJoint and By-Product CostingErlinda NavalloNo ratings yet

- F2 Past Paper - Question12-2005Document13 pagesF2 Past Paper - Question12-2005ArsalanACCA100% (1)

- Hetutua, Therese Janine D. Oct. 3, 2020 Bsac 2B: Problem 1Document7 pagesHetutua, Therese Janine D. Oct. 3, 2020 Bsac 2B: Problem 1Tristan Arthur BernalesNo ratings yet

- p2 Guerrero Ch15Document27 pagesp2 Guerrero Ch15Michael Brian TorresNo ratings yet

- COS 103 - Variable Costing ExercisesDocument2 pagesCOS 103 - Variable Costing ExercisesAivie Pangilinan100% (1)

- Classroom Code: 3A/: A. B. Smaller Than The Operating Income Reported Under The Absorption Costing ConceptDocument4 pagesClassroom Code: 3A/: A. B. Smaller Than The Operating Income Reported Under The Absorption Costing ConceptRochelle MartirezNo ratings yet

- MCQ SCM FinalsDocument17 pagesMCQ SCM Finalsbaltazarjosh806No ratings yet

- Takehome - Quiz - Manac - Docx Filename - UTF-8''Takehome Quiz Manac-1Document3 pagesTakehome - Quiz - Manac - Docx Filename - UTF-8''Takehome Quiz Manac-1Sharmaine SurNo ratings yet

- StratDocument20 pagesStratDhea MaligayaNo ratings yet

- Chapter 1&2 Seminar QN 2023Document5 pagesChapter 1&2 Seminar QN 2023fbicia218No ratings yet

- Cordillera Career Development College College of Accountancy Buyagan, Poblacion, La Trinidad, Benguet Acctg 154-Strategic Cost Management Final ExamsDocument3 pagesCordillera Career Development College College of Accountancy Buyagan, Poblacion, La Trinidad, Benguet Acctg 154-Strategic Cost Management Final ExamsMichelle BayacsanNo ratings yet

- Relevant - AssignmentDocument2 pagesRelevant - AssignmentSendo AkiraNo ratings yet

- Lecture Notes: Afar G/N/E de Leon 2813-Joint and by Product Costing MAY 2020Document4 pagesLecture Notes: Afar G/N/E de Leon 2813-Joint and by Product Costing MAY 2020May Grethel Joy PeranteNo ratings yet

- Problem A. PORT HYIR Manufacturing Company Using Process Costing To Account For ItsDocument3 pagesProblem A. PORT HYIR Manufacturing Company Using Process Costing To Account For ItsMay RamosNo ratings yet

- SEATWORKDocument4 pagesSEATWORKMarc MagbalonNo ratings yet

- Toaz - Info Midterm PRDocument9 pagesToaz - Info Midterm PRXyrene Keith MedranoNo ratings yet

- Module 2 ARS PCC - CVP, Absorption and VariableDocument3 pagesModule 2 ARS PCC - CVP, Absorption and VariableVia Jean LacsieNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryFrom EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Clay Refractory Products World Summary: Market Sector Values & Financials by CountryFrom EverandClay Refractory Products World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Franchise Financials - 7th HeavenDocument9 pagesFranchise Financials - 7th HeavenNtw MoviesNo ratings yet

- Project Management 220611Document25 pagesProject Management 220611Shri SmoNo ratings yet

- Platform BPO White Paper Transaction Based Pricing in BPO 05 2010Document14 pagesPlatform BPO White Paper Transaction Based Pricing in BPO 05 2010biswasrNo ratings yet

- Citric AcidDocument23 pagesCitric AcidLali SalcedoNo ratings yet

- Audit of Item of FS Notes by CA Kapil GoyalDocument9 pagesAudit of Item of FS Notes by CA Kapil GoyalAbhimanyu Kumar ranaNo ratings yet

- Marginal CostingDocument17 pagesMarginal CostingGarima Singh ChandelNo ratings yet

- Core 10Document194 pagesCore 10Ashutosh Patro100% (1)

- Pricing of Transmission Network Usage and Loss AllocationDocument40 pagesPricing of Transmission Network Usage and Loss AllocationSSSRGI TURNITINNo ratings yet

- CH 05Document68 pagesCH 05Lê JerryNo ratings yet

- 1 Financial Statements Other Than SCFDocument15 pages1 Financial Statements Other Than SCFYassin DyabNo ratings yet

- Chapter 67 01 InvDocument45 pagesChapter 67 01 Invhaymanotandualem2015No ratings yet

- Faculty - Accountancy - 2022 - Session 2 - Diploma - Maf251Document7 pagesFaculty - Accountancy - 2022 - Session 2 - Diploma - Maf251NUR FARISHA MOHD AZHARNo ratings yet

- The Grey Box ConceptDocument6 pagesThe Grey Box ConceptRichard ButcherNo ratings yet

- Econmics Concepts With Formula or and UseDocument6 pagesEconmics Concepts With Formula or and UseLuis QuinonesNo ratings yet

- Far160 - Jul 2021 - QDocument9 pagesFar160 - Jul 2021 - QNur ain Natasha ShaharudinNo ratings yet

- Chapter 2 - Cost Terminology and Cost Behaviors: True/FalseDocument24 pagesChapter 2 - Cost Terminology and Cost Behaviors: True/FalseJasmine Araniego0% (1)

- Problem Set 01 - Honeydukes Co - Influence and Blackbox DiagramsDocument8 pagesProblem Set 01 - Honeydukes Co - Influence and Blackbox DiagramskngkjbgbNo ratings yet

- Barira CCourt 20x30Document11 pagesBarira CCourt 20x30peejayNo ratings yet

- Types of Budgets - The Four Most Common Budgeting MethodsDocument8 pagesTypes of Budgets - The Four Most Common Budgeting MethodsPAK & CANADA TRADING LLC.No ratings yet

- Note The Key Components of The Following Types of BudgetsDocument2 pagesNote The Key Components of The Following Types of Budgetssajana kunwarNo ratings yet

- Ias 16Document21 pagesIas 16Arshad BhuttaNo ratings yet

- Complain From The The Northrop-Grumman Whistleblower LawsuitDocument34 pagesComplain From The The Northrop-Grumman Whistleblower LawsuitBehn and Wyetzner, CharteredNo ratings yet

- Manufacturing of AgarbattiDocument2 pagesManufacturing of AgarbattiSudhakarrao VuppalaNo ratings yet

- Cost Accounting Ch07Document41 pagesCost Accounting Ch07Erika AgnesNo ratings yet

- IAS 41 AgricutureDocument18 pagesIAS 41 AgricutureShimimana MayenjeNo ratings yet

- Absorption and Variable CostingDocument1 pageAbsorption and Variable CostingAngelica PatagNo ratings yet

- 01-PPT-Week 2-Concepts of ValueDocument48 pages01-PPT-Week 2-Concepts of ValueVan listerNo ratings yet

- Audit of Expenditures and Disbursements CycleDocument15 pagesAudit of Expenditures and Disbursements CycleiceeabaigarNo ratings yet

- Accomplishment Report AGIADocument20 pagesAccomplishment Report AGIAAbrien Zenitram100% (1)