Professional Documents

Culture Documents

Print Bill

Uploaded by

Sumit Nandal0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

PrintBill

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pagePrint Bill

Uploaded by

Sumit NandalCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

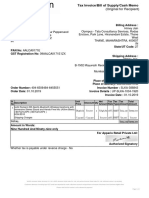

MUNICIPAL CORPORATION ROHTAK BillSrNo.

: 32

Property Tax Notice Cum Bill

Property Id: 1HBM2N31 Old Property Id: 144C71U33 Financial Year: 2023-2024 Print Date : 29 March 2024

Property Location: 28.8885180000000 : 76.6253240000000 Mobile No: 98XXXXX287 Colony Name: Tilak Nagar

Particulars of Owner(s) / Occupiers(s): Plot Address: 336/12, Tilak Nagar, 124001, , 124001 Linked OLD PID Owner Name : Dharamvir

Owner Name: Dharambeer Singh Permanent Address: Nandal / S/o Jagat Nandal

Total Area : 237.000 SqYard Category : Residential AuthorizedStatus : Authorized

Property And FireTax Detail

Floor Property Property Property Carpet Area used Applicable Calculation Usage Property Floor Fire Tax(F) After Floor Building Rebate

Category Type SubCatego Area for taxrate Formula / Tax(H) Rs Rebate(R) Rs Rebate Type Remark

ry (Sq.Feet) calculation after Rebate(if Rs (P)=(H+F)- Rebate

of tax rebate(if any) (R) Rs

any)

Ground Residential House Independent 0.00 237 SqYard 0.75 0.75 Self 177.75 0.00 0.00 177.75 No Rebate 0% - Ground

Floor House Occupied Floor

Total : 177.75 0.00 0.00 177.75

Total Property & Fire Tax Outstanding(PO): 178.00

Property Tax Arrear(A)= Fire Tax Arrear(FA)= 0.00/- Interest on Arrear(I)= 1424.60/- Garbage Collection Charges(S1)= Garbage Collection Total Tax(P+A+FA+I+S1+S2)= 3439.66/-

1557.31/- 280.00/- Arrear(S2)= 0.00/-

Outstanding as on Outstanding as on date(IO)= 1424.60/- Total Outstanding as on

Outstanding as on date(FO)= 0/- Outstanding as on date(PO+AO+FO+IO+SO1+SO2)=

date(AO)= 1557.31/- Outstanding as on date(SO1)= 280.00/- date(SO2)= 0/- 3439.91/-

•This bill pertain to current financial year only. This bill is for Property Tax collection purpose only. In case of Payment made up to 31st July of Current Financial year,Tax Payer will get 10 % rebate on Current

Demand of Property Tax.

•15% Rebate on the principal amount of property tax arrears for the years 2010-11 to 2022-23 to those property owners who clear all the property tax arrears for the year 2010-11 to 2022-23 and also self-certify

their property information on Property Tax Dues Payment and No Dues Certificate Management System Portal by the 31st March, 2024.

•100 % Rebate on Interest on the arrears of property tax pending since year 2010 - 11 to 2022 - 23 shall be allowed to all tax payers, if their arrears are paid and also self-certify their property information on

Property Tax Dues Payment and No Dues Certificate Management System Portal by the 31st March, 2024.

•15 % Rebate on the property tax for the assessment year 2023 - 24 shall be admissible to those assesses who self - certify their property information on “property Tax Payment and No Dues Certificate

Management System Portal” and pay their total property tax dues up to the assessment year 2023 - 24 by the 31st March, 2024

You might also like

- Bir 1701Document2 pagesBir 1701RAYNAN MARCELO100% (1)

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- PrintBill 109Document1 pagePrintBill 109gauravNo ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Print BillDocument1 pagePrint Billvkr4035No ratings yet

- Print BillDocument1 pagePrint BillThe sukhmani AutomobileNo ratings yet

- Seran MamaDocument1 pageSeran MamachauhantonyNo ratings yet

- Httpsproperty Ulbharyana Gov InBillReportPrintBillPID 1KD14OO0&UlbID 61Document1 pageHttpsproperty Ulbharyana Gov InBillReportPrintBillPID 1KD14OO0&UlbID 61roopumgautam95No ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Un Cyberpark TC-16TH FLR 1603Document1 pageUn Cyberpark TC-16TH FLR 1603uttamcse2021No ratings yet

- PrintBill 95Document1 pagePrintBill 95gauravNo ratings yet

- Un Cyberpark TB-7TH FloorDocument1 pageUn Cyberpark TB-7TH Flooruttamcse2021No ratings yet

- Print Bill 343Document1 pagePrint Bill 343modi jiNo ratings yet

- Un Cyberpark Ta-1st FLR 103-BDocument1 pageUn Cyberpark Ta-1st FLR 103-Buttamcse2021No ratings yet

- Prem NagarDocument1 pagePrem NagarvikramNo ratings yet

- BillDocument1 pageBillRAVINDER PANJETANo ratings yet

- Property TAX 7707 2024 Due 2025Document1 pageProperty TAX 7707 2024 Due 2025decemberrealtygurgaonNo ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- North Delhi Municipal Corporation Tax Payment Checklist For The Year (2020-2021)Document2 pagesNorth Delhi Municipal Corporation Tax Payment Checklist For The Year (2020-2021)Gautam BhallaNo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check ListVARUNNo ratings yet

- GSTR9 23apjps3159l1zg 032022Document8 pagesGSTR9 23apjps3159l1zg 032022sales candoNo ratings yet

- GSTR9 33dgwpp5135e1z4 032021Document8 pagesGSTR9 33dgwpp5135e1z4 032021newquper2022No ratings yet

- SDMC Property Tax Delhi 2016-17Document2 pagesSDMC Property Tax Delhi 2016-17Bhuvanesh KohliNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument2 pages1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsrj aNo ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- GSTR9 27aahcb1010d1zg 032023Document8 pagesGSTR9 27aahcb1010d1zg 032023arpindlavNo ratings yet

- GSTR9 29aahcv2115k1z5 032021Document8 pagesGSTR9 29aahcv2115k1z5 032021MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- GSTR9 09abepk8302l1zh 032018Document8 pagesGSTR9 09abepk8302l1zh 032018Capraful PrabhakaranNo ratings yet

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061No ratings yet

- Page 4 ItrDocument1 pagePage 4 ItrariannemungcalcpaNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9mani samiNo ratings yet

- GSTR9 29aaqfm8617b1zz 032022Document8 pagesGSTR9 29aaqfm8617b1zz 032022helloNo ratings yet

- GSTR9 29aahcv2115k1z5 032020Document8 pagesGSTR9 29aahcv2115k1z5 032020MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsRyan VillamorNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9RM PlusNo ratings yet

- GSTR9 08aaafu3205h1zh 032022Document8 pagesGSTR9 08aaafu3205h1zh 032022Deepanshu AgarwalNo ratings yet

- GSTR9 19anypg3791m1zy 032022 PDFDocument8 pagesGSTR9 19anypg3791m1zy 032022 PDFManprit MahalNo ratings yet

- RPT VATMonthly ReturnnewDocument1 pageRPT VATMonthly ReturnnewchandhiranNo ratings yet

- GSTR9 07balps3408q1z0 032023Document4 pagesGSTR9 07balps3408q1z0 032023RINKOO SHARMANo ratings yet

- GSTR9 10JHBPS7007C1ZR 032019Document8 pagesGSTR9 10JHBPS7007C1ZR 032019karanNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check ListdeepakraNo ratings yet

- Vijayawada Municipal Corporation: OriginalDocument4 pagesVijayawada Municipal Corporation: Originallakshmiteja105_18319No ratings yet

- Ztaxsheet AdobeDocument2 pagesZtaxsheet AdobeGarima ChughNo ratings yet

- Submitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxDocument4 pagesSubmitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxaizazbarkiNo ratings yet

- GSTR9 09aaact9363l1zq 032023Document8 pagesGSTR9 09aaact9363l1zq 032023sachinkumar.rkcjNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check Listrxy8964No ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check ListANKIT VERMA CLCNo ratings yet

- (I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)Document8 pages(I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)santosh palNo ratings yet

- 1701 Doc FabianDocument2 pages1701 Doc FabianCristopher NacinoNo ratings yet

- 1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Document5 pages1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Jennylyn TagubaNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 183499300100121 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 183499300100121 Assessment Year: 2020-21SONU SNo ratings yet

- 2551Q Miflores 1st QuarterDocument3 pages2551Q Miflores 1st Quartercatherine aleluyaNo ratings yet

- RPT VATMonthly ReturnnewDocument1 pageRPT VATMonthly ReturnnewvrsapthagiriNo ratings yet

- SPD Contributions Calculator April 2013 Excel 2003-07 VersionDocument5 pagesSPD Contributions Calculator April 2013 Excel 2003-07 VersionmarkomarkomarkomarkoNo ratings yet

- AC2101 Sem GP 9 Presentation 7: Team 7 Lin Yilin, Wang Qian, Xia FanDocument21 pagesAC2101 Sem GP 9 Presentation 7: Team 7 Lin Yilin, Wang Qian, Xia FanLingNo ratings yet

- BGP IP RoutingDocument12 pagesBGP IP RoutingSumit NandalNo ratings yet

- SDWAN Viptela GuideDocument57 pagesSDWAN Viptela GuideSumit NandalNo ratings yet

- Route Leaking Between VPNsDocument16 pagesRoute Leaking Between VPNsSumit NandalNo ratings yet

- Sumit Nandal ResumeDocument3 pagesSumit Nandal ResumeSumit NandalNo ratings yet

- Capital Gains Tax - AnswersDocument10 pagesCapital Gains Tax - AnswersRai Ali WafaNo ratings yet

- B 88 Tulsi Bunglows Radhanpur Road Mahesana Mahesana - 384002 Gujarat, IndiaDocument2 pagesB 88 Tulsi Bunglows Radhanpur Road Mahesana Mahesana - 384002 Gujarat, IndiaJigs PatelNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)shountyNo ratings yet

- GST May2023 V1Document213 pagesGST May2023 V1FhfhhNo ratings yet

- PO of LRPC Wire For Ghazipur Pkg-1Document2 pagesPO of LRPC Wire For Ghazipur Pkg-1SM AreaNo ratings yet

- Terminal Cash FlowDocument9 pagesTerminal Cash FlowKazzandraEngallaPaduaNo ratings yet

- MGBS To Hyderabad AirportDocument3 pagesMGBS To Hyderabad AirportSaiDheerajPachipulusuNo ratings yet

- Trashed-1684049848-Cprs - Payslip1 JSP PDFDocument1 pageTrashed-1684049848-Cprs - Payslip1 JSP PDFPrashant SinghNo ratings yet

- Statement of Change in EquityDocument1 pageStatement of Change in EquityYagika JagnaniNo ratings yet

- InvoiceDocument1 pageInvoiceSudipta DeNo ratings yet

- Motor Winding & BearingDocument1 pageMotor Winding & Bearingsatyaprakash yadavNo ratings yet

- Chapter 9 Part 2 Input VatDocument24 pagesChapter 9 Part 2 Input VatChristian PelimcoNo ratings yet

- Texas Property Tax ExemptionsDocument23 pagesTexas Property Tax ExemptionsBruce WayneNo ratings yet

- LAW 323-Tax Law-Asim Zulfiqar-Akhtar AliDocument7 pagesLAW 323-Tax Law-Asim Zulfiqar-Akhtar AliWajahat GhafoorNo ratings yet

- FESCO N Type Nov 2023Document1 pageFESCO N Type Nov 2023tanveerNo ratings yet

- الفروقات المؤقتة ومحاسبة الضريبة المؤجلة في الشركات الفردية وفق النظام المحاسبي الماليDocument18 pagesالفروقات المؤقتة ومحاسبة الضريبة المؤجلة في الشركات الفردية وفق النظام المحاسبي الماليRime KessiraNo ratings yet

- Soriano vs. Sec. of Finance G.R. No. 184550 Jan. 24, 2017Document3 pagesSoriano vs. Sec. of Finance G.R. No. 184550 Jan. 24, 2017Xavier BataanNo ratings yet

- Mandanas vs. OchoaDocument2 pagesMandanas vs. OchoaShaine ArellanoNo ratings yet

- 13 - Paymentwall Inc. v. CIRDocument29 pages13 - Paymentwall Inc. v. CIRCarlota VillaromanNo ratings yet

- Accounting Entries Under GSTDocument7 pagesAccounting Entries Under GSTPiousPatialaNo ratings yet

- 68907955577019582Document4 pages68907955577019582jeelp625No ratings yet

- Statement of Cash FlowsDocument14 pagesStatement of Cash FlowsNiña Gloria Acuin ZaspaNo ratings yet

- Bill Qayoom SB PDFDocument1 pageBill Qayoom SB PDFMuhammad AsifNo ratings yet

- Ajwpr6707nsd002 06 05 2011 PDFDocument1 pageAjwpr6707nsd002 06 05 2011 PDFGlobal Law FirmNo ratings yet

- AprilDocument6 pagesAprilcindy pecañaNo ratings yet

- Solved DR Quinn DR Rose and DR Tanner Are Dentists WhoDocument1 pageSolved DR Quinn DR Rose and DR Tanner Are Dentists WhoAnbu jaromiaNo ratings yet

- Cfs 9268 MDocument1 pageCfs 9268 Mdavidigoro26No ratings yet

- Step 1: Bir Form 2551QDocument7 pagesStep 1: Bir Form 2551QAce MarjorieNo ratings yet

- An Annotated Bibliography of Tax Compliance and Tax Compliance CostsDocument145 pagesAn Annotated Bibliography of Tax Compliance and Tax Compliance CostsDinartika HukamawatiNo ratings yet

- Lesson 1 Tax Administration Tutorial NotesDocument8 pagesLesson 1 Tax Administration Tutorial Notes4mggxj68cyNo ratings yet