Professional Documents

Culture Documents

Municipal Corporation Gurugram: Property Tax Notice Cum Bill

Uploaded by

uttamcse2021Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Municipal Corporation Gurugram: Property Tax Notice Cum Bill

Uploaded by

uttamcse2021Copyright:

Available Formats

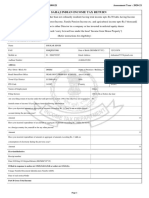

MUNICIPAL CORPORATION GURUGRAM

Property Tax Notice Cum Bill

Property Id: 1CAQHDU9 Old Property Id: 184C18U21CP111 Financial Year: 2022-2023

Ward No: Mobile No: 9910004359 Colony Name: Sector 74A

Plot Address: 603,DLF Limited, DLF Corporate green ,Sector 74A, Near Bill Print Date : 28 January 2023

Particulars of Owner(s) / Occupiers(s): Jaipur Express Way, Near Jaipur Express Way, 122004

Owner Name: Ravi Singhal Permanent Address:

Property And FireTax Detail

Total Area : 3757.530 SqYard

Floor Property Property Property Carpet Calculated Calculated Tax Rate Usage Property Floor Fire Tax(F) After Floor Building Rebate

Category Type SubCatego Area Area (Unit) Tax Rate Formula Tax(H) Rs Rebate(R) Rs Rebate Type Remark

ry (Sq.Feet) Rs (P)=(H+F)- Rebate

(R) Rs

6F Commercial Commercial Commercial 1496.00 1496 SqYard 15 15 Self 22440.00 0.00 2244.00 24684.00 No Rebate

Space Office Occupied

Total : 22440.00 0.00 2244.00 24684.00

Total Property & Fire Tax Outstanding(PO): 0

Property Tax Arrear(A)= Fire Tax Arrear(FA)= Interest on Arrear(I)= 11108.00/- Garbage Collection Charges(S1)= 0.00/- Garbage Collection Total Tax(P+A+FA+I+S1+S2)= 79019.00/-

39300.00/- 3927.00/- Arrear(S2)= 0.00/-

Outstanding as on date(IO)= 0/- Total Outstanding as on

Outstanding as on Outstanding as on Outstanding as on date(SO1)= 0/- Outstanding as on date(PO+AO+FO+IO+SO1+SO2)= 30.00/-

date(AO)= 30.00/- date(FO)= 0/- date(SO2)= 0/-

This bill pertain to current financial year only. This bill is for Property Tax collection purpose only. In case of Payment made up to 31st July of Current Financial year,

Tax Payer will get 10 % rebate on Current Demand of Property Tax.

If paid before 31/12/2022, interest on arrear will not be charged

You might also like

- Pulak Chandan PrasadDocument6 pagesPulak Chandan PrasadferozamedNo ratings yet

- National Association of Retail Collection Attorneys (Narca) Comments For Federal Trade Commission Debt Collection WorkshopDocument17 pagesNational Association of Retail Collection Attorneys (Narca) Comments For Federal Trade Commission Debt Collection WorkshopJillian SheridanNo ratings yet

- Bar Exams Questions in Mercantile LawDocument7 pagesBar Exams Questions in Mercantile LawNatura ManilaNo ratings yet

- Forex MarketDocument13 pagesForex MarketnikitaNo ratings yet

- Debt Management by Small Scale and Medium EnterprisesDocument59 pagesDebt Management by Small Scale and Medium EnterprisesGerald Villarta MangananNo ratings yet

- 7.banco Do Brazil-M.securities-Bank Confirm LetterDocument1 page7.banco Do Brazil-M.securities-Bank Confirm LetterPennyNo ratings yet

- Role of RBI in Economic Development of India PDFDocument18 pagesRole of RBI in Economic Development of India PDFTanmay Baranwal100% (7)

- ShoeDocument1 pageShoePRASHANT PRIYADARSHINo ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Un Cyberpark TC-16TH FLR 1603Document1 pageUn Cyberpark TC-16TH FLR 1603uttamcse2021No ratings yet

- Un Cyberpark TB-7TH FloorDocument1 pageUn Cyberpark TB-7TH Flooruttamcse2021No ratings yet

- Un Cyberpark Ta-1st FLR 103-BDocument1 pageUn Cyberpark Ta-1st FLR 103-Buttamcse2021No ratings yet

- PrintBillDocument1 pagePrintBillSumit NandalNo ratings yet

- PrintBill 95Document1 pagePrintBill 95gauravNo ratings yet

- BillDocument1 pageBillRAVINDER PANJETANo ratings yet

- PrintBill 109Document1 pagePrintBill 109gauravNo ratings yet

- Print BillDocument1 pagePrint Billvkr4035No ratings yet

- MUNICIPAL CORPORATION HISAR Property Tax NoticeDocument1 pageMUNICIPAL CORPORATION HISAR Property Tax NoticevikramNo ratings yet

- Print BillDocument1 pagePrint BillThe sukhmani AutomobileNo ratings yet

- Print Bill 343Document1 pagePrint Bill 343modi jiNo ratings yet

- Seran MamaDocument1 pageSeran MamachauhantonyNo ratings yet

- Httpsproperty.ulbharyana.gov.InBillReportPrintBillPID=1KD14OO0&UlbID=61Document1 pageHttpsproperty.ulbharyana.gov.InBillReportPrintBillPID=1KD14OO0&UlbID=61roopumgautam95No ratings yet

- P16_S16Document8 pagesP16_S16santosh palNo ratings yet

- Form PDF 927814290281220Document8 pagesForm PDF 927814290281220Project EngineerNo ratings yet

- Statement of Assets, Liabilities and Expenses: (DD-MM-YYYY)Document3 pagesStatement of Assets, Liabilities and Expenses: (DD-MM-YYYY)Md. Abdullah ShaimoonNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check ListVARUNNo ratings yet

- GSTR9 23apjps3159l1zg 032022Document8 pagesGSTR9 23apjps3159l1zg 032022sales candoNo ratings yet

- GSTR9 33dgwpp5135e1z4 032021Document8 pagesGSTR9 33dgwpp5135e1z4 032021newquper2022No ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 183499300100121 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 183499300100121 Assessment Year: 2020-21SONU SNo ratings yet

- Punjab builder files sales tax returnDocument4 pagesPunjab builder files sales tax returnHaroon ButtNo ratings yet

- 114(1) (Return of Income filed voluntarily for complete year)_2023 (7)Document7 pages114(1) (Return of Income filed voluntarily for complete year)_2023 (7)Bm ShopNo ratings yet

- Ztaxsheet AdobeDocument2 pagesZtaxsheet AdobeGarima ChughNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Paramjeet KontNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061No ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- North Delhi Municipal Corporation Tax Payment Checklist For The Year (2020-2021)Document2 pagesNorth Delhi Municipal Corporation Tax Payment Checklist For The Year (2020-2021)Gautam BhallaNo ratings yet

- Submitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxDocument4 pagesSubmitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxaizazbarkiNo ratings yet

- Submitted Status:: Tax Period KNTN Name Submission Date Normal AmendedDocument2 pagesSubmitted Status:: Tax Period KNTN Name Submission Date Normal AmendedEntertaining VideosNo ratings yet

- Form PDF 927448140281220Document7 pagesForm PDF 927448140281220Arvind KumarNo ratings yet

- Form PDF 927448140281220Document7 pagesForm PDF 927448140281220Arvind KumarNo ratings yet

- GSTR9 29aahcv2115k1z5 032021Document8 pagesGSTR9 29aahcv2115k1z5 032021MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9mani samiNo ratings yet

- Form PDF 710378520091120Document7 pagesForm PDF 710378520091120asmita196No ratings yet

- GSTR9 29aahcv2115k1z5 032020Document8 pagesGSTR9 29aahcv2115k1z5 032020MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- GSTR9 27aahcb1010d1zg 032023Document8 pagesGSTR9 27aahcb1010d1zg 032023arpindlavNo ratings yet

- Consumer Decision MakingDocument7 pagesConsumer Decision MakingUtkarsh GurjarNo ratings yet

- IT-2023-2024-7Document2 pagesIT-2023-2024-7luciferangellordNo ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- Veridian at Emerald Isle 2BHK Flat 1502 Payment ScheduleDocument1 pageVeridian at Emerald Isle 2BHK Flat 1502 Payment SchedulesachinNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 760683270291120 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 760683270291120 Assessment Year: 2020-21Chinmay BhattNo ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- ITR FormDocument9 pagesITR FormSuman jhaNo ratings yet

- ITR-1 Acknowledgement for Salaried IndividualDocument7 pagesITR-1 Acknowledgement for Salaried IndividualSaurya KumarNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Prérńã K K ŚhãhNo ratings yet

- Satish Kumar JiDocument7 pagesSatish Kumar JiANIL GIRDHARNo ratings yet

- S. No Date 1Document16 pagesS. No Date 1pragya pathakNo ratings yet

- GSTR9 10JHBPS7007C1ZR 032019Document8 pagesGSTR9 10JHBPS7007C1ZR 032019karanNo ratings yet

- GSTR9 09abepk8302l1zh 032018Document8 pagesGSTR9 09abepk8302l1zh 032018Capraful PrabhakaranNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check Listrxy8964No ratings yet

- Form PDF 712550240101120Document7 pagesForm PDF 712550240101120Animesh JainNo ratings yet

- Sales Tax Return Sept 10Document6 pagesSales Tax Return Sept 10Raheel BaigNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21రాకేష్ బాబు చట్టిNo ratings yet

- Setting Up and Management of Merchant BankingDocument8 pagesSetting Up and Management of Merchant BankingRajeswari Kuttimalu100% (1)

- Internship Report On MCB Bank Limited: Introduction of Banking Industry What Is Bank?Document55 pagesInternship Report On MCB Bank Limited: Introduction of Banking Industry What Is Bank?Muhammad BurhanNo ratings yet

- To Study On Customer Satisfaction Toward Vodafone Mobile ServiceDocument62 pagesTo Study On Customer Satisfaction Toward Vodafone Mobile ServiceVITS 17-4I6No ratings yet

- Credit Risk Grading Score SheetDocument3 pagesCredit Risk Grading Score Sheetmr9_apeceNo ratings yet

- What Is A Financial System How Does An International Financial System WorkDocument6 pagesWhat Is A Financial System How Does An International Financial System WorkSamar MalikNo ratings yet

- Financial Literacy Brochure FinalDocument2 pagesFinancial Literacy Brochure Finalapi-469875744No ratings yet

- ICICIdirect DividendYieldStocks May2011Document2 pagesICICIdirect DividendYieldStocks May2011maitre6669No ratings yet

- OBJECTIVE QUESTION BANK FOR LEVERAGE ANALYSISDocument2 pagesOBJECTIVE QUESTION BANK FOR LEVERAGE ANALYSISadhishcaNo ratings yet

- Customer Satisfaction UAE ExchangeDocument108 pagesCustomer Satisfaction UAE ExchangeRenjith Raj100% (8)

- Financial Management Coursework Cash Flow AnalysisDocument3 pagesFinancial Management Coursework Cash Flow AnalysisA.A LastNo ratings yet

- Ciruclar On UV Lamp For CTS Cheques 370 - 2014 - 31052014Document2 pagesCiruclar On UV Lamp For CTS Cheques 370 - 2014 - 31052014Puli BaskarNo ratings yet

- 08 Bond InvestmentDocument3 pages08 Bond InvestmentAllegria Alamo100% (1)

- Quiz 3032Document4 pagesQuiz 3032PG93No ratings yet

- Ashkenazi CompaniesDocument1 pageAshkenazi CompaniesAbd AL Rahman Shah Bin Azlan ShahNo ratings yet

- HBC 2101: INTRODUCTION TO ACCOUNTING exam questionsDocument5 pagesHBC 2101: INTRODUCTION TO ACCOUNTING exam questionsmimiNo ratings yet

- Bank of IndiaDocument4 pagesBank of Indiavivek75% (8)

- Banking Sustainability For Economic Growth and Socio-Economic Development - Case in VietnamDocument10 pagesBanking Sustainability For Economic Growth and Socio-Economic Development - Case in Vietnamثقتي بك ياربNo ratings yet

- NICL - Information Finance ModuleDocument3 pagesNICL - Information Finance ModulearqumcNo ratings yet

- Notice of Revocation of Licences of Insolvent Microcredit CompaniesDocument4 pagesNotice of Revocation of Licences of Insolvent Microcredit CompaniesAnonymous BfJxK4b1No ratings yet

- Business Taxation QuizDocument5 pagesBusiness Taxation QuizWerpa PetmaluNo ratings yet

- Protecting Electronic Money From Money Laundering in AlgeriaDocument17 pagesProtecting Electronic Money From Money Laundering in Algeriajournal of legal and economic research100% (1)

- KCB Kenya Tariff Guide 2019Document1 pageKCB Kenya Tariff Guide 2019clement muriithiNo ratings yet