Professional Documents

Culture Documents

Ashkenazi Companies

Uploaded by

Abd AL Rahman Shah Bin Azlan ShahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ashkenazi Companies

Uploaded by

Abd AL Rahman Shah Bin Azlan ShahCopyright:

Available Formats

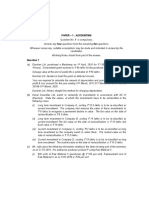

م8:07 2023/5/25 HW4-Dividend-Abd'Al-Rahman Shah

Instructor: Nor Azizan Che Imbi

Student: Abd'Al-Rahman Shah

Course: FINC2302 SECT 6, SEM2, Assignment: HW4-Dividend

Date: 5/25/23

2022/2023

Ashkenazi Companies has the followingstockholders' equityaccount:

Common stock (180,000 shares at$3 par) $540,000

Paid-in capital in excess of par 900,000

Retained earnings 360,000

Totalstockholders' equity $1,800,000

Assuming that state laws define legal capital as the par value of commonstock, what dividendper-share can Ashkenazipay? If legal capital

were more broadly defined to include allpaid-in capital, what dividend could Ashkenazipay?

Most states prohibit corporations from paying out as cash dividends any portion of thefirm's "legalcapital," which is typically defined as the par

value of common stock. This capital impairment restriction is generally established to provide a sufficient equity base to protectcreditors'

claims.

If legal capital is defined as the par value of commonstock, the amount of dividend Ashkenazi can pay is computed asfollows:

paid-in capital in excess of par + retained earnings

Dividend = ,

number of outstanding shares

$900,000 + $360,000

= = $7.00.

180,000

Ashkenazi Companies could pay a dividendper-share of $7.00 when legal capital is defined as the par value of common stock.

"Legal capital" can be more broadly defined as the par value of common stock andpaid-in capital. If legal capital is broadly defined as the par

value of common stock andpaid-in capital, the amount of dividend Ashkenazi could pay is computed asfollows:

retained earnings

Dividend = ,

number of outstanding shares

$360,000

= = $2.00.

180,000

Ashkenazi Companies could only pay a dividendper-share of $2.00 when legal capital is more broadly defined to include both the par value of

common stock andpaid-in capital.

https://xlitemprod.pearsoncmg.com/api/v1/print/en-us/highered 1/1

You might also like

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- 12 2 11Document2 pages12 2 11AshleyNo ratings yet

- Accounting for Notes Payable, Contingent Liabilities, and Stock IssuancesDocument5 pagesAccounting for Notes Payable, Contingent Liabilities, and Stock IssuancesEzy Tri TANo ratings yet

- Corporations Issuance of StocksDocument8 pagesCorporations Issuance of StocksYoussef NabilNo ratings yet

- Corporation Part 1Document9 pagesCorporation Part 11701791No ratings yet

- PARTNERHIPDocument2 pagesPARTNERHIProsojanice08No ratings yet

- General Questions: Pal SipDocument9 pagesGeneral Questions: Pal SipAura DewaNo ratings yet

- 1 - Week Partnership FormationDocument24 pages1 - Week Partnership FormationAlrac Garcia100% (1)

- Partnerships Formation OperationDocument7 pagesPartnerships Formation OperationJason CabreraNo ratings yet

- Chapter 11Document4 pagesChapter 11RBNo ratings yet

- Warren SM ch.13 FinalDocument38 pagesWarren SM ch.13 FinalDipra DewNo ratings yet

- Soal AKL21bDocument5 pagesSoal AKL21bIzzatul kamilaNo ratings yet

- The Following Stockholders Equity Accounts Arranged Alphabetically Are in TheDocument1 pageThe Following Stockholders Equity Accounts Arranged Alphabetically Are in TheM Bilal SaleemNo ratings yet

- Studymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1Document19 pagesStudymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1SukhmnNo ratings yet

- PARCOR Pretest POperationsDocument1 pagePARCOR Pretest POperationsAngelo VilladoresNo ratings yet

- Chapter 13Document13 pagesChapter 13Mondy MondyNo ratings yet

- Chapter 15 Advanced SolutionsDocument33 pagesChapter 15 Advanced SolutionsPremium Meditation MusicNo ratings yet

- ACCOUNTING FOR SPECIAL TRANSACTIONS - (PROBLEMS)Document44 pagesACCOUNTING FOR SPECIAL TRANSACTIONS - (PROBLEMS)Liz RegaladoNo ratings yet

- Chapter 3 ExaminationDocument4 pagesChapter 3 ExaminationSurameto HariyadiNo ratings yet

- Accounting For Business CombinationsDocument39 pagesAccounting For Business CombinationsRaisaNo ratings yet

- Precision Tool CompanYDocument6 pagesPrecision Tool CompanYMelissa Rosemond100% (1)

- S S S - (3) A S S V S y I S S Tion Wi S C S V S.: 534 Module 35 Taxes: PartnershipsDocument1 pageS S S - (3) A S S V S y I S S Tion Wi S C S V S.: 534 Module 35 Taxes: PartnershipsEl Sayed AbdelgawwadNo ratings yet

- Tutorial 2Document6 pagesTutorial 2杰克 l孙No ratings yet

- Partnership Formation and Capital AccountsDocument13 pagesPartnership Formation and Capital AccountsKristine BlancaNo ratings yet

- Contract IisDocument7 pagesContract IisEmily ButlerNo ratings yet

- Introduction To Accounting 2 Organization and Capital Stock TransactionsDocument17 pagesIntroduction To Accounting 2 Organization and Capital Stock Transactionsalice horanNo ratings yet

- OU - Coe OU - Coe: Faculty of CommerceDocument10 pagesOU - Coe OU - Coe: Faculty of CommerceAMRITHANo ratings yet

- PARTNERSHIP ACCOUNTING SOLUTIONSDocument12 pagesPARTNERSHIP ACCOUNTING SOLUTIONSNhajNo ratings yet

- AFAR 1. PartnershipDocument8 pagesAFAR 1. PartnershipKristine May PeraltaNo ratings yet

- Accounting for Dividends and Stock RightsDocument3 pagesAccounting for Dividends and Stock RightsCamille GarciaNo ratings yet

- Partnership FormationDocument16 pagesPartnership FormationKian BarredoNo ratings yet

- ST Chapter 1 2Document3 pagesST Chapter 1 2Joresol AlorroNo ratings yet

- Far Pet Class - Mock Quiz CorporationDocument11 pagesFar Pet Class - Mock Quiz CorporationNia BranzuelaNo ratings yet

- Carried Interests: Technical and Tax Analysis: - Russell J.PinilisDocument8 pagesCarried Interests: Technical and Tax Analysis: - Russell J.PinilisHui XianNo ratings yet

- Stock KKDocument7 pagesStock KKamir rabieNo ratings yet

- Beams Aa13e SM 01Document14 pagesBeams Aa13e SM 01jiajiaNo ratings yet

- Chapter 13 Exercise Demonstration PowerPoint PresentationDocument68 pagesChapter 13 Exercise Demonstration PowerPoint PresentationCinema RecappedNo ratings yet

- CH 02 PDFDocument24 pagesCH 02 PDFAurcus JumskieNo ratings yet

- Chapter 09 - Partnerships - Formation, Operatios, And Changes in Ownership InterestsDocument53 pagesChapter 09 - Partnerships - Formation, Operatios, And Changes in Ownership Interestsgracerich20No ratings yet

- Test Bank 27.1Document4 pagesTest Bank 27.1Perbielyn BasinilloNo ratings yet

- Partnership Accounting PDFDocument4 pagesPartnership Accounting PDFTrisha Mae BoholNo ratings yet

- SHE JeromeDocument3 pagesSHE Jeromemark_somNo ratings yet

- Accounting Capital+Stock+TransactionsDocument17 pagesAccounting Capital+Stock+TransactionsOckouri BarnesNo ratings yet

- 1 When Recording The Issuance of Preferred Stock What AmountDocument1 page1 When Recording The Issuance of Preferred Stock What Amounthassan taimourNo ratings yet

- Partnership FormationDocument5 pagesPartnership FormationAra AlcantaraNo ratings yet

- Introduction of Partnership FormationDocument16 pagesIntroduction of Partnership FormationRamon AlpitcheNo ratings yet

- Partnership Testbank Part 2Document19 pagesPartnership Testbank Part 2Klay LuisNo ratings yet

- Chjapter 1-Partnership FinalDocument14 pagesChjapter 1-Partnership Finalkefyalew TNo ratings yet

- Materi Lab 2 - Business CombinationDocument4 pagesMateri Lab 2 - Business CombinationMuhamad Rizki PratamaNo ratings yet

- Advanced Accounting Exam 1AADocument20 pagesAdvanced Accounting Exam 1AASehoon OhNo ratings yet

- Accounting for Partnership FormationDocument20 pagesAccounting for Partnership FormationMathewos Woldemariam BirruNo ratings yet

- Special Accounting Topics For Business CombinationDocument4 pagesSpecial Accounting Topics For Business CombinationMixx MineNo ratings yet

- AFAR TestbanksDocument165 pagesAFAR TestbanksbognadonhazelNo ratings yet

- Chapter 14. Tool Kit For Distributions To Shareholders: Dividends and RepurchasesDocument9 pagesChapter 14. Tool Kit For Distributions To Shareholders: Dividends and RepurchasesHenry RizqyNo ratings yet

- Advanced Accounting Chapter 1 PDF FreeDocument11 pagesAdvanced Accounting Chapter 1 PDF FreeSitiNo ratings yet

- MCQ Ch13Document4 pagesMCQ Ch13YAHIA ADELNo ratings yet

- Partnership Testbank Part 1Document17 pagesPartnership Testbank Part 1Klay LuisNo ratings yet

- Accounting for Depreciation, Investments and Foreign ExchangeDocument25 pagesAccounting for Depreciation, Investments and Foreign ExchangeAditya PrajapatiNo ratings yet

- Resolution of The Board of Directors ofDocument2 pagesResolution of The Board of Directors ofEdy GunawanNo ratings yet

- Lesson 5: Corporate Social Responsibility Ethics and Social Responsibility Enlightened Self InterestDocument35 pagesLesson 5: Corporate Social Responsibility Ethics and Social Responsibility Enlightened Self InterestLily DaniaNo ratings yet

- CPA REVIEW FBTDocument8 pagesCPA REVIEW FBTKendrew Sujide100% (1)

- H.B. Fuller Investor Day 2018 - Leading The Way PDFDocument141 pagesH.B. Fuller Investor Day 2018 - Leading The Way PDFHồng Ân TrầnNo ratings yet

- Strategic Analysis On SonyDocument37 pagesStrategic Analysis On Sonylavkush_khannaNo ratings yet

- Application Form for AccreditationDocument2 pagesApplication Form for AccreditationMary Jane Dultra100% (1)

- GST Returns NotesDocument5 pagesGST Returns NotesvishnureachmeNo ratings yet

- Faber ReportDocument43 pagesFaber ReportgrneNo ratings yet

- Supply Chain Drivers and Metrics: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocument25 pagesSupply Chain Drivers and Metrics: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanysynwithgNo ratings yet

- Formation of A Sale of Goods ContractDocument2 pagesFormation of A Sale of Goods ContractSwastik GroverNo ratings yet

- Bangalore UniversityDocument2 pagesBangalore UniversitySourav ChowdhuryNo ratings yet

- 112380-237973 20190331 PDFDocument5 pages112380-237973 20190331 PDFKutty KausyNo ratings yet

- 18-10-05 - Loan Procedure 2015Document198 pages18-10-05 - Loan Procedure 2015molla fentayeNo ratings yet

- NFL Stars Score in Real Estate: Thousands Flee Syrian OffensiveDocument56 pagesNFL Stars Score in Real Estate: Thousands Flee Syrian OffensivestefanoNo ratings yet

- College List For Stock Mock CompetitionDocument143 pagesCollege List For Stock Mock CompetitionRajatNo ratings yet

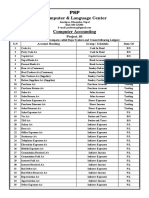

- Computer Accounting Project WorkDocument7 pagesComputer Accounting Project Workapi-319474134No ratings yet

- Question Revision A182Document5 pagesQuestion Revision A182Ke TingNo ratings yet

- 03 - AM4B - Terjemahan 3Document3 pages03 - AM4B - Terjemahan 3muhammad syaifuddinNo ratings yet

- Elements of Cost and Cost Sheet - FYBBA-IBDocument25 pagesElements of Cost and Cost Sheet - FYBBA-IBSakuraNo ratings yet

- Strategic Marketing Environmental AnalysisDocument35 pagesStrategic Marketing Environmental Analysissamithamadhushan_767No ratings yet

- 23-350001 Merit - Warba InvoiceDocument4 pages23-350001 Merit - Warba InvoicerameeshaNo ratings yet

- Pyidawtha - The New BurmaDocument7 pagesPyidawtha - The New BurmaZarni Maw WinNo ratings yet

- The Influence of Innovation Strategy and Organizational Innovation On Innovation Quality and Performance PDFDocument38 pagesThe Influence of Innovation Strategy and Organizational Innovation On Innovation Quality and Performance PDFEdward LumentaNo ratings yet

- MTD638Document20 pagesMTD638Ayla KowNo ratings yet

- Project Proposal Format GuideDocument4 pagesProject Proposal Format GuideRishi ChaudharyNo ratings yet

- Bank Tariff Guide For Hang Seng Wealth and Personal Banking CustomersDocument45 pagesBank Tariff Guide For Hang Seng Wealth and Personal Banking CustomersIsaacNo ratings yet

- Report - Id-40036Document35 pagesReport - Id-40036Mohammad Sayad ArmanNo ratings yet

- Jansport Backpack Thesis Utility Consumer Behaviour PDFDocument1 pageJansport Backpack Thesis Utility Consumer Behaviour PDFJefferson TanNo ratings yet

- SolutionDocument3 pagesSolutionmaiaaaaNo ratings yet

- FX MarketsDocument59 pagesFX MarketsAndreea ZamfirNo ratings yet